Showing results for tags 'any'.

-

can someone please confirm to me how far back i can claim for being overcharged by my landlord, on the annual insurance premium on my leasehold flat? I have discovered that they have been overcharging me 4% of the premium since 1994. this equates to almost 5k Thanks.

- 14 replies

-

Hello everyone Unfortunately, my husband has gone and got himself another PCN. This time it's one that was stuck on his car I haven't seen any photos of the situation yet - I think they will be uploaded tomorrow at the earliest as he only received the PCN today. I was trying to upload the pdf but this website says that I have the incorrect file extension Is anyone able to help me understand what I've done wrong? I tried following the instructions about uploading files. Thanks

-

Any Builders or Decorators out there?

andrew1 posted a topic in The Bear Garden – for off-topic chat

Hi, On a low budget so wondered if anyone could recommend any kind of product which might help my lad cover the surface of this outside wall of his? To remove all the plaster and have it redone will be expensive so he's hoping to DIY and try and get a decent finish which hides up most of the crass mess made by the people he bought his place from. Any idea's of any product which he can paint onto this surface which might hold for a year or two? Thoughts appreciated. -

Hi all, after 3 attempts, GE Money have FINALLY sent me a working SAR. First disc wouldnt recognise the password, second disc was completely blank! Anyway, Ive spent most of the morning going through this stuff and it doesnt look like they hit me for any insurances. But going right back to the beginning of the mortgage there is a list of charges that Im not sure about so could anyone advise if any of these might be reclaimable? Purple Loans Arrangement Fee £352.00 Lenders Legal Fee £170.38 First National Completion Fee £100.00 Insurance Fee £25 ( for processing documents relating to my own insurance) HLC (Higher Lending Charge) £236.19 Thanks all.

- 1 reply

-

- any

- reclaiming

-

(and 2 more)

Tagged with:

-

Could someone please advise on the “6-years and it lapses” rule, I want to know if it still is in place, and also if it then has relevance for the following. 5 years ago I acted on advice from the wonderful people on this forum. I had previously retired at 65 after a business collapse, and was facing constant letters/calls from debt collectors regarding some related debts amounting to £36K across 5 business credit cards, 1 personal card, and a small-business loan. As a result of great advice I was able to hold my ground and even go on the attack, and after a year or so 4 of the debts were wiped out and a 5th “will not be pursued until we can furnish a copy of the original agreement”. That DCA was a total shambles, so that seems extremely unlikely 4+ years later still. My query today relates to the personal credit card, which was being dealt with by DCA 1st Credit. I offered a token payment of £5/mth because at that time I had not discovered this forum and had no idea that the financial sector worked in such heavily self-serving ways, nor that I had options. The offer was accepted and I made 3 payments, though by that point I had found this forum which opened my eyes wide! I wrote to 1st Credit notifying them that the credit card issuer had not dealt acceptably/completely with previous concerns (long story!), that I would not be making any more payments, that they should return the case, and that I would be contacting their client seeking proper action and that they would be included in any subsequent formal complaint themselves if they continued collection processes in the meantime. Other than asking for details once, which I ignored, I never heard from them again. I have now received two letters a few weeks apart advising “1st Credit has now become Intrum UK Ltd”, requesting a payment arrangement for that debt. I don’t know whether 1st Credit just changed their name, or Intrum Justitia (one of ‘my’ earlier DCAs) has bought their book, but either way it seems 1st Credit just shoved it to the back of the shelf 5 yrs ago, not returned it nor done anything with it themselves. My knee-jerk is that if the 6-year rule still applies, they are now trying to resurrect the case before it lapses. Part of me says to ignore them and see where it goes, though another part of me wants to snap-back setting a line of defence advising Intrum to return the case to the card issuer who I am contacting requiring them to deal properly with already-notified matters that they have yet to complete, with a warning of a formal complaint should they continue to chase. I’d greatly prefer getting to a 6 year cutoff however and just washing my hands of the whole stressful matter, than opening a level of formalities all over again and having all the stress for a year at least and most likely on in to our mid-70s. I’d just like to get on with living, as all was extremely upsetting to my wife who was/is not a strong woman after losing all our assets, our house and a second property, and living hand-to-mouth on just our state pension in rented accommodation and not the comfortable retirement we had expected. So regarding the “6-years” rule, is it still in force? If so, would contacting fresh-face Intrum with a stand-down notification letter end the 5 year lack of any contact just a year before it could help close the door? Or maybe has that already been ended with the appearance of Intrum asking for an arrangement, beginning a fresh 6-year requirement? So … should I ignore Intrum’s contact for a while longer, or get in quickly with a defence by going in to attack mode which no doubt would drag out for at least a year … by which time the 6 year rule would apply anyway if it is still in place as a potential backstop as long as I don’t break the silence? I would welcome some focus so I can see more clearly what makes the best sense … and also any pointers to new or changed legislation/codes-of-conduct /proper forms-of-words/etc that may be keeping me unknowingly out of step with things these 5 years later. Many thanks if you can guide me at all.

-

Hi, My mum sadly passed away in August in Hospital, aged only 52. I have taken on the responsibility of arranging her funeral. She left no will nor did she have any assets, at the time of her death she was claiming ESA and living in a hostel. I have filled in the post office form to close her account but I doubt very much that there was much if anything in there as I went to her accommodation after she passed and she had been counting coppers before she was taken to hospital. I have spoken to the DWP bereavement service this morning about help with funeral costs, they told me it is unlikely I will get any help as I have a working sister and mum had 3 siblings too. My sister hasn't spoken to my mum in 10 years after she left to live with our dad at 14, their relationship broke down after mums mental health and alcohol issues rendered her unable to care for my sister. The same goes for mums brother and sisters, they haven't spoken in many years, due to my mums issues and how difficult she was to maintain a relationship with. I have stood by her, supported and helped her as much as possible and remained in regular contact with her, going on days out and spending quality time together, I was with her the whole week leading to her passing and held her hand in her last moments. I am a lone parent, working 18 hours a week, I get a working and child tax credit and housing benefit reduction, so I believe because of that I am eligible to claim for help, I have asked them to send me the form to complete but is there really any point in me doing that now that they have said there are other adults who could pay? They wont! They also told me I would be responsible for any over-payment of benefit mum might of received, but if the way they see it is all close relatives should be responsible for the funeral, why not hold them all responsible for over-payments too? I have not gone all out on her funeral, no cars or masses of flowers or over priced coffin, just a basic graveside humanist ceremony in the same cemetery as her parents, although costs are slightly higher as she is being transported from the south of England to the north of England. Sorry, waffling. So my question is, should I bother applying for funeral expenses or just focus on getting the funds and making an arrangement with the funeral directors? Thank you.

-

A fitter came to my house on the 20th of June. Unfortunately, when he came to my house he did not have the LVT samples that I had requested from the Carpetright Ipswich store, in order to do colour matching. I thought that was not professional of the store, but nevertheless, I decided to let this go. On the 30th of June I made an order for a Carpet, LVT and fitting on a finance agreement. At that time I did not realise that the carpet in question is out of stock and the customer advisor did not inform me of this. Otherwise, I definitely wouldn't have made the order as I would like to have flooring in my new house sooner. I wish I had been informed of the 4 weeks turn around. I had been hoping for a two-week turnaround (max). On the date of my order I had been told by the person who did the paperwork that he would give me a ring the next day to arrange fitting dates. I did not get the promised call on 1st July. Monday 2nd July I followed up to try and get a fitting date and the person on the other line told me that it wouldn't be until the end of the month. At which point I expressed my dissatisfaction as I had not known it would take so long, neither had I been told this at time of order. The person on the other line said he would see what he can do to expedite the fitting. He gave me a call the following day, but unfortunately, due to work commitments I missed the call and was not able to get back to the store until Friday 6th July. On Friday 6th July I rang the store back and managed to secure a fitting date for the 19th of July. However, I've been reviewing my Carpetright account online and I noticed that the carpet order is on hold because the carpet is (no stock). The store did not make this clear to me at the time of order that the carpet was not in stock. My experience and cumulation of disappointments do not inspire confidence and I am concerned about further letdowns, which has led me to the decision to cancel my order . I have a credit agreement with a cool of period of 14 days, which expires in 6 days. This is a huge agreement to get into and a very big deal, as a result, I want to make sure that the service delivered is also to a good standard that I'm not going to regret. Carpetright have point blank refused to cancel the order and yet attached is a term/condition that I feel they are in breach of. I wonder what rights I have?

- 23 replies

-

- any

- carpetright

-

(and 1 more)

Tagged with:

-

Greetings All. First post (hopefully of not too many, but think there may be a few in the pipe). If a Dealer's Website says: "Complaint Procedure" - Awaiting Content" of course there's nothing about any trade bodies or ADR channels. is this a breach of law and if so which legislation/ASA code etc? Is it worthy of an additional 'complaint' ? Thanks for your time.

-

Good evening all, I've done a bit of research trying to close accounts which led me to requesting CCA's to Cabot. I sent two for two different accounts which they took off Halifax (1 x CC & 1 x Current Acc Overdraft). I posted the following to them: Dear Sir/Madam Account No: With reference to the above agreement, I require you to supply the following documentation before I will correspond with you further on this matter. 1. You must supply me with a true copy of the alleged agreement you refer to. This is my right under your obligation to supply a copy of the agreement, under the legislation contained within s.78 (1) Consumer Credit Act 1974. 2. A full statement of account. 3. A signed true copy of the deed of assignment of the above referenced agreement that you allege exists. 4. A copy of any other documents referred to in the agreement. I understand that under the Consumer Credit Act 1974 (sections 77-79) , I am entitled to receive a copy of any credit agreement and a statement of account when I request it. I enclose a payment of £1 which is the fee payable under the Consumer Credit Act 1974. I understand a copy of any credit agreement along with a statement of account should be supplied within 12 working days. I understand that, under the Consumer Credit Act 1974, creditors are unable to enforce an agreement if they fail to comply with the request for a copy of the agreement and statement of account. A speedy response would be appreciated to resolve the matter amicably. I look forward to hearing from you soon. Yours faithfully THE LETTERS WERE RECEIVED ON 17TH/18TH JULY AND TODAY I RECEIVED THE FOLLOWING LETTERS: Thank you for your CCA request etc etc... We currently do not have this information on file. However I have requested the relevant details, which include a copy of the credit agreement, statement of account and relevant terms and conditions from the original lender. You have requested a copy of the Deed of Assignment. Please be advised that the DOA is a confidential document between Cabot and the original lender. It does not contain any personal details relating to you or your account and is not available for disclosure. We sent you a Notice of Assignment for your account to your address, which is sufficient to confirm our ownership of this account. Only the courts can request this... Blah blah blah. A couple of things here... I asked for a true copy, they are referring to simply a copy. If they do obtain a copy, is this enforceable? Also is it acceptable what they are saying about disclosing the DOA to me? I don't ever recall being sent a Notice of Assignment, if I did, is this sufficient to confirm ownership and enforceable? I have been currently paying towards what they are claiming, on a monthly basis via DMP. The next payment is due in a couple of days. Should I continue paying or is it advisable to stop until they wholly action my request? Thanks in advance and any help/advice/feedback is much appreciated! I'm looking to get a mortgage by the end of the year so I can get my son into the school I/he wants. Many thanks.

-

My 82 year old mum hasn't been too well recently and her local Nat West Branch has closed down and the new one is a nightmare for parking and she doesn't walk too well. She also got caught out by a phone holiday spoof to the tune of a few hundred quid and became paranoid about the company knowing her account details so we decided that maybe a change to a new bank was a good option. Barclays is my and my sisters bank as well and as difficult as it is to talk about if something happens to mum before it happens to me we theorised that if we are all at the same bank things would be easier to deal with, but it has all become a bit of a disaster!! We had a meeting with an advisor who looked into it and after doing her bit on computer stated that mum qualified for a basic account which would not include an overdraft or the option to loan. To be fair mum has plenty of money in her account and gets very good pension and investment returns so the need for an overdraft or loan is highly unlikely as her balance stays pretty much the same each month and it's far higher than my balance is!!! The one thing the advisor forgot to mention though was that mum wouldn't get a cheque book and I wouldn't have know that anyway being a Barclays Current Account holder since I was in my teens!! This was only brought to our attention over a week later when I rang Barclays to ask because mum mentioned she hadn't received one, which we obviously thought was the norm, but was told that she couldn't get a cheque book for a basic account. We then went back for a meeting because this was baffling. It then became clear that mum had been declined a current account (hence the basic) but the reason for why she has been declined is unclear and apparently the advisors do not get told the reason so obviously the customer cannot argue against it. The advisor to be fair did apologise profusely for not explaining clearly and for forgetting to mention the cheque book and said the reason could be something to do with a credit score. I've however checked mums credit score on Experian and it was 999. She has no debts, mortgage paid off years ago, no loans taken out for years if ever as far as I know, plenty of cash in the account and has never had an issue getting credit cards, of which she pays off in full...… Could this be the problem?! The annoyance is that mum relies on her cheque book and is in a muddle and is having to either get me to send cheques for her or she has to withdraw large amounts of cash. The bank suggested waiting a couple of months and when they have seen how the account is managed and that Barclaycards have been paid off etc then they can reapply for a current account. If it is still declined then the only option is to go back to Nat West who have already said she can have a current account with cheque book like she did before, but it will obviously be a pain switching once again and I suspect all of the Direct Debit companies will be baffled as to what is happening!! Barclays have also made a mess up with statements as well with mum not receiving one statement in the two months since the account opened so I am chasing up that as well mum called Barclays Head Office last week and the guy on the phone couldn't understand why she hadn't been given a cheque book so we will wait and see if he gets any joy, although I would say probably not!!! So any ideas as to why this happens? Especially as I as an 18 years old got a current account without an issue and with probably no job at the time albeit 35 odd years ago!! It seems bizarre especially as they hide the reason. I am wondering in part if it's because she is a retired widow so upon first check they may not have known what monthly income she would be receiving but they would have seen from the account surely? Help massively appreciated.

-

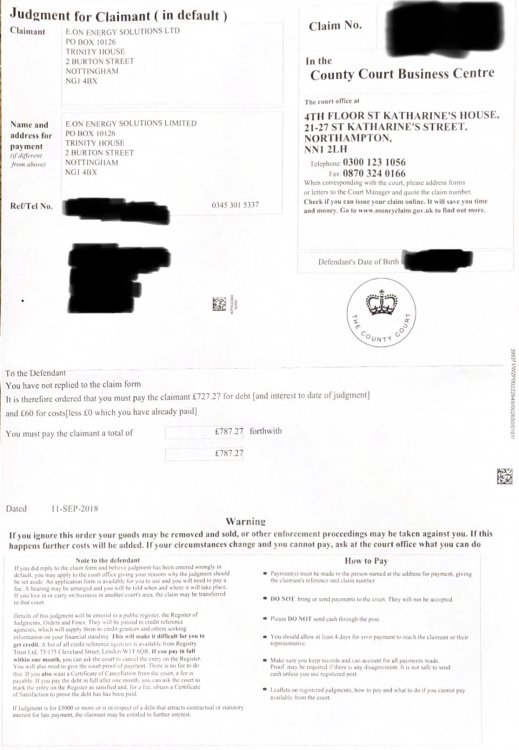

Hi everyone My brother has received a letter today from the county court business centre that was headed Judgement for Claimant (in default) It says you have not replied to the claim form (never received anything from the claimantt E-On) It is therefore ordered that you must pay the claimant £727.27 for debt and interest to date of judgement and £60 for costs. My brother has never received any court papers or even letters threatening court. But now he’s had this in the post. I’ll upload a scan of it but I’m not sure how to respond to the court document. Any help would be greatly appreciated Thanks Andrew

-

Hi All Really appreciate your help on this. I have googled and I don't think there is anything we can do, but thought I'd check here. My mother had a quote for £2700 for some building work. She Emailed the builder and he set a date to start work. She had a reply saying it was confirmed etc. They sent numerous communications. Then she had a reply from the builder on a fake Email address that looked just like his asking for £900 payment to secure the date. She checked his references etc and it all seemed okay. 2 weeks later the builder called her asking for payment to get the scaffolding started. Obviously she thought she had paid. She hadn't. The bank investigated and the fraudulent account now has no money in it so they say she has lost it and it she was at fault. I told her to ask the bank in writing how long the account was open, how many frauds occurred and when was the first one. I heard you can complain based on the bank not closing the fake account in a timely manner. Anything else you would recommend? Thanks D

-

Hi all, Brand new here so hi to everyone, I hope you are doing better than me right now. I am completely at fault doing 91 in a 70, I'm embarrassed and sincerely sorry but I doubt this will change anything. I have read that the fine is determined largely by my salary. I am currently on 85k and this is my first driving offence in over a decade, I've been driving for 15 years and am now 32. No criminal convictions. From a few other websites it appears I can be fined in the region of £2,000. For someone trying to save for a deposit on a house this is quite depressing. Should I expect the worst? Many thanks.

-

If you are going on Holiday Abroad always check if you need any Immunisation/Medication beforehand for the areas you may be visiting. NHS Choices Travel Vaccinations: https://www.nhs.uk/conditions/travel-vaccinations/ Travel Health Pro: https://travelhealthpro.org.uk/countries

-

Hi there, heres the story, I paid for an early upgrade online with ee. the cost was £251 including the early upgrade fee to buy out the rest of my contract and the upfront cost of the new handset. Now I ordered this the same day my new bill was generated, however my payment date for this bill is the 10th of each month, it was not due for another week so I didnt see a problem. in the after morning after ordering I checked the ee tracker to find news of my delivery only to find it `timed out` it couldnt find any record of the order number in other words. I phoned ee to find out what was going on, the rep told me for some reason the system had taken my upgrade fee but then straight away refunded it and it was on its way back to my account, she apologised and said if I wanted it back quicker I could get an indemnity on the direct debit with my bank asking them to cancel it and I should recieve payment that same day. Since then I found a better deal with another provider on the same handset (vodafones 32gb of data v 8gb ee were offering for the same price as I was paying now monthly!) I decided id use the refund to pay off my contract with EE and go with that one instead of upgrading. I contacted the livesupport on the ee website just to ensure the upgrade hadnt been put through again and to make sure it was indeed cancelled before going with the other network. I was then told that I was not being issued with a refund, the funds instead had been put towards my account balance and it was now in credit (this was presented as something I was apparently meant to be happen with) Now I wanted the refund, my bills not due till the next week and I didnt want to pay it till my next payday which falls before my payment date anyway. I was told I couldnt be refunded as the payment had already been put towards my bill and id just have to get a refund of the credit after paying my bill the next week. My issue is I never authorised this, the payment was sent as part of the early upgrade service it was payment for the early upgrade fee and the handset it was never authorised by me to be used as payment for my bill. EE have just gone ahead and done this without my permission then used that as a reason for not refunding me, I dont see how this is legal to use a payment in a way it wasnt intended without asking esp when the payment is taken as payment for a specific. product and service such as an upgrade. Not happy as not only was my payment used for something not intended by me and without my permission but the woman on the phone in the morning was obviously utterly using me. What I think has happened is ee have sneakily used the fact I made a payment for this upgrade as a way to have me pay my bill off early and just cancelled the upgrade so they can use the payment for this. Obviously very dodgy practise if so! Im just wondering if my misusing my payment in this way ee may have broken any part of their contract, id love to get a bit of revenge by using it as a reason to tear it up. Latest update got in touch with my bank, they say I cant get an indemnity anyway as the payment was by card (so the ee rep was totally using me this morning it appears!) but that the payment is still pending so it shouldnt take any time at all for EE to refund as they can just cancel it.....lets see if they choose to or see if they choose to `keep the money` on my account balance against my will......what they do will decide if I take further action im guessing, EE rep claiming they dont have the ability to cancel a pending payment......utter rubbish! I will be taking this further! luckly ive saved the chat transcripts. anyone else experienced this kind of thing?

-

I need serious advice please! I bought online a mattress for kids but wrong size, so had to return it at my cost to the seller. I used an online platform http://www.uship.com to advertise for the delivery job. I got a driver quote and paid deposit to uship. The driver came to pick up mattress i received him well, very likeable guy. After a few days, he cut off communication and so i had to approach uship. They tried to get in touch but no response. The whole project cost £300. I have texted him,emailed and phoned in vain. Yesterday, after 3 weeks of texting and emailing, i borrowed a phone from a friend and phoned him. He picked it 'unknowingly' then had to say he has been busy will call me later. He didn't and been calling again and text for past week, no response. Now, my dilemma, the guy runs a delivery business, I have all communication trail with him including his bank details and address. Why would he risks this for £300... in addition whom do i report to(never had deal with the police)? I have enough evidence including cctv footage from my house. He has a limited company which he runs the delivery business from and so have his trading address, and his other details like bank accounts and phone numbers... my other worry he might be using different names as the bank he gave to transfer money was under a different name. I appreciate I might probably spend more financially and on time - but I am interested to bring him to justice so that he doesnt do this to others. Advice much appreciated

- 16 replies

-

- any

- county court

-

(and 3 more)

Tagged with:

-

Hi, I have joined here after reading an exceptional amount of valuable information regarding Blemain Finance (or Blemain Group) now operating as Together. About myself: I am a law graduate and helping a friend with his mortgage taken from Blemain. About the friend: From what I can see he has taken a total of 5 "charges" over his property from Blemain over the course of 2013 to the present. It started with £15,000 and now he owes 4 times this amount. That is not to say he did not exercise his own will, but so much about their operation is incredibly DODGY (for want of a better word/phrase), that it has made me upset to see a family friend potentially abused. He suffers from brain damage and this house is his only asset which I can foresee him losing if something is not done about the way Blemain/Together are operating... At some point he spoke to Phone-A-Loan who are an associated company of Blemain. It is unclear to me what their role was, but I hope to establish this position as quickly as possible. Enterprise Finance Limited always appear to have acted as the broker. They seem to take a fee each time he redeems his mortgage then opens a new account with Blemain (as stated this is his 5th loan/charge/mortgage. My question at this point is has anyone else dealt with Enterprise Finance Limited? If so did they provide options of lenders (ie alternatives to Bleamin) or did they simply tell you to go to Blemain for the loan? From my limited research I can not discover any connection between Enterprise and Blemain but I suspect there must be some link (even if it is beneficial ownership which would be fairly difficult to establish or prove). From the initial loan of £15,000, the charges which have accumulated as he has re-mortgaged amount to £15,000 and he has been extended a further £30,000 in credit. He, nor I, have yet requested the SAR, will do soon I am interested to see if there have been any hidden/undeclared charges to his account. In all this practice seems deeply unfair and I have a feeling it may well be considered more than "unfair" in the eyes of the law, At this stage I do not want to throw around accusations without evidence. I would really like to hear from others, and particularly those who might have dealt with Enterprise Finance Limited as the brokers. Thank you,

-

Hi guys I will try to simply this A letter was sent to DVLA to try get unclaimed tax fine squashed. DVLA sent 3 letters to an address I've never been known at and my license was never registered at that address. No response means my license was revoked. After filling in a D1 and M1 forms and sending them off, they wrote to my doctor found out I had used diazepam illicitly for three weeks, I've never had a drug or alcohol I didn't even realise the word illicit existed. They are saying that I will not get my license back for a year, not only did they mess the paper work at the beginning their doctor is making false aligations about me stating I undertook a supervised drug withdrawal I was dependant on diazepam what is a lie, the whole statement and the way DVLA handled it from the start shows they have not delt with my matter properly My doctor wrote to them saying there's no concerns she's happy for me to drive my local mp agrees that I should have my license back Any reviews on this matter?

-

Hello, My sister has had a incident with my travel card. When she was exiting the station a travel officer caught her using my card. She admitted to the travel officer that she had used her husbands travel card as she did not know it was mine. She had also informed him that he did not know her taking it. She admitted to using it, and gave all her personal information. He informed her that she would recieve a letter and now we have recieved that letter. The letter states that she was reported 26th of October 2017 failing to produce a valid ticket, pass or photocard for the journey. The facts of the incident are being considered and they are advising that legal proceedings may be taken against her . In order for them to deal with our case correctly they want us to fill out the form on the reverse side. We do not wish for her to be prosecuted and she has never been convicted before regarding anything. I have not sent her appeal yet but I would like some advice before i send it This is what I wrote in her appeal: Dear Sir / Madam I would like to inform you that all these years I have been living in the UK, I have never been part of such an incident as well as I have never been a part of any criminal activity and most certainly never fare dodged. I feel so ashamed and depressed because of my ignorant decision. It was not something I neither planned nor did intentionally; rather it was more in the heat of the moment. It has been a very stressful period for me and my husband since he is working full time and I am on maternity leave alone with toddler and baby during the days. I literally have one free day a week when my husband has a rest day from his job, which lately I have been spending on gathering necessities for my children and relatives regarding our travel in November. Therefore when I was to enter the station I notice that I am not carrying my own pocket book and I had already reached the entrance. There was a long queue behind me stressing me so I panicked and used the card that was in the pocket book which I thought initially was my husbands. After this whole incident I feel even more stressed, distraught sad but mostly ashamed. I have had so much trouble sleeping and I barely have enough energy to take care of my kids. I am so afraid of what will happen to me. I will co-operate with you to the fullest and you have my guarantee that this will never be repeated. I would like to make you aware that there is no excuse for what I did and I am ready to pay the maximum fine for my mistake. I wish one day in the near future to return to work and continue my job search after starting a family, and a conviction would destroy my chances of finding a decent job to support and help provide for my family. I beg and wish for you to have some understanding of my current situation and we can find our way towards a settlement. If anyone can please read this through and advise me what I need to add and if there is someway we can settle this without her getting convicted? If there is someone out there with similar experience and can inform us what our next step should be and what we should be prepared for I would appericate it so much I would appericate it My sister is so stressed out right now. Thank you very much I have updated my appeal and added a few things: Dear Sir / Madam I would like to inform you that all these years I have been living in the UK, I have never been part of such an incident as well as I have never been a part of any criminal activity and most certainly never fare dodged. I feel so ashamed and depressed because of my ignorant decision. It was not something I neither planned nor did intentionally; rather it was more in the heat of the moment. It has been a very stressful period for me and my husband since he is working full time and I am on maternity leave alone with toddler and baby during the days. I literally have one free day a week when my husband has a rest day from his job, which lately I have been spending on gathering necessities for my children and relatives regarding our travel in November. I left my apartment in such a rush and quickly picked up my keys, my purse and what i thought was my pocket book from the kitchen table, since I was already late for my vaccine appointment, when I was to enter the station I notice that I am not carrying my own pocket book and I had already reached the entrance. Since I did not have my own card and I know that i could pay for my ticket due to that I did not have my bank card or any cash with me since they were in my pocket book. I was not thinking clearly and I was already so stressed since i left home so late and knew I had to be home so early. All I could think of was coming home to my children that I had left with my husband so he would babysit them while I am away for my appointment. I knew I had to be home early since he had a night shift the same day. There was a long queue behind me stressing me so I panicked and used the card that was in the pocket book which I thought initially was my husbands. After this whole incident I feel even more stressed, distraught sad but mostly ashamed. I have had so much trouble sleeping and I barely have enough energy to take care of my kids. I am so afraid of what will happen to me. I will co-operate with you to the fullest and you have my guarantee that this will never be repeated. I would like to make you aware that there is no excuse for what I did and I am ready to pay the maximum fine for my mistake. I wish one day in the near future to return to work and continue my job search after starting a family, and a conviction would destroy my chances of finding a decent job to support and help provide for my family. I beg and wish for you to have some understanding of my current situation and we can find our way towards a settlement.

- 18 replies

-

- any

- appericated

- (and 6 more)

-

After a long absence from benefits I'll be starting a new claim for Universal Credit in the next few days. Just a brief history: I was on the old Work Programme with Ingeus for the full 2 years - towards the end I was placed on the ESA assessment phase having been on JSA only and didn't have to attend the office anymore... Shortly after I ended the claim to pursue a new opportunity and that's where I've been for over a year and a bit. Now having to go back to relying on benefits is a difficult thought and I have no idea what's changed. I have no clue if my local office is still open, I know most claims are now dealt with by phone only... I think that's right? I've heard DWP offices are closing down all over the country so what does this mean for a claimant and how do they check your doing all you can to find work? Can anyone fill me in on what's changed and what'll happen when I sign up... very nervous about it as I never actually thought I'd go back into the system... I was on antidepressants before and looking for job didn't help much with my mental health. Having not worried about work strictly speaking for over a year I am quite anxious regarding all these changes and what it could mean for my family.

- 11 replies

-

- any

- appreciated

- (and 6 more)

-

Hi I'm representing a group of employees at my retail workplace some of which are part time and some are full time. The shifts we do vary between 4 and 12 hours a day. It is an individual business not part of a chain or anything. There is no union or HR department there are just the managers who own the business and about 20 staff who work for them. The problem is that we are not allowed to take any rest breaks even in 12 hour shifts. We have previously been allowed a few minutes to eat a meal at some point during the shift but we have to stay at our workplace and if the phone rings we have to leave our meal to answer it or if a customer needs serving we have to serve them. Often our food is left to go cold before we can get back to finish it. The new problem is that we have seen an email between the managers complaining about staff eating during their shift and it shouldnt be allowed as it looks bad to the customers (the email wasn't meant to be seen by us but one of the managers left it on screen on a computer in a public office. They dont know we have read it and ok maybe we shouldn't have if it wasn't addressed to us but we have and its about us anyway). So one of us contacted acas and all they said was there is nothing they can do as there is no way to enforce it. Then we contacted HSE who were very understanding and they passed it on to our local council. Although we have since contacted the council who have said they have been in to speak to one of the managers and they are not going to take any action because they pay us for the whole shift (like if we work from 7am to 7pm straight we get paid for 12 hours. they would only take action if they stopped our pay for a rest break but didn't allow us to take it). We don't think this is fair but we really don't know what to do about it so we are hoping someone on here can advise us on what to do. Other people have said just leave and work somewhere else but it's not as simple for that for some of us who can't find a different job. Thankyou

-

I received leather sofa from Sofology, financed with an Int. free loan from Barclays (Partner Finance) Hours after delivery, it became obvious that the sofa had manufacturing faults (different cushion front panel heights, and inadequate partly filled cushions to the seating area. Raised a complaint (!) and provided photo/video evidence....asked for correction or collection! Initially fobbed off, told there was nothing wrong. Persisted, and 3 weeks later, I appear to be dealing with a senior colleague, instead of the 11 or so 'Tom, Dick and Harriets' that I had encountered in a sequence of email/call centre 'one-off' contacts. I have informed Sofology that I wish to return the sofa, due to it's failings, and also that it fails to match the quality of the original in-store sofa observed at time of ordering. Q- Might this form a 'breach of contract'? I'm not a legal person and don't want the 'Perry Mason' in me to get completely carried away! FWIW I have complained to Barclays, and they have started a Sect 75 complaint....but I've no idea where that might go. However....after essentially ignoring me for over a fortnight....Sofology have perked up a bit when Barclays presented the complaint. Position I'm now in is: Either.....allow Homserve rep. (supposedly independent....really?) to visit, assess and provide an 'honest' report. Sofolgy's subsequent action, in terms of the 'refund' (to Barclays) and to end the finance agreement will depend on this 'report' OR....as the defects/faults are considered 'un'confirmed, (in spite of Video evidence) they will take back the Sofa, and charge me a 30% (£300+) cancellation fee. Is it correct to consider this as a cancellation.....the item is defective??! Haven't encountered this idea of being charged in order to return a defective item......is that legal? Would appreciate any help from members

-

I'm trying to find out if a business mobile contract is different for a Sole Trader (up to 10 employees) versus a limited company? I thought I'd read somewhere that a sole trader has similar rights to a consumer? Basically, it seems, companies have no automatic rights - it's assumed they have access to lawyers, I guess. I have been told because I have a business contract that consumer rights don't apply. Also that 36 month contracts are not banned for business customers? (Ofcom rules 24 month max).....and that a 14 day 'cooling off' period doesn't have to be offered to businesses??

-

On the week-end of 2-3 June 2017, I parked on Cowley Place. One of my friends gave me the visitors pass for MN, but I did not realise it had a different zone than I usually use.(EO). I did have visitor parking permits, which I displayed and validated. Clearly there was no intent to evade payment or gain any advantage and I indeed have used/invalidated two visitor passes. I therefore feel it is unfair to be fined, and lose the use of two visitors passes. I also question whether the correct contravention code was used on the PCN. (30 - Parked longer than permitted). Shouldn’t the correct code be 19 - Parked in a residents’ or shared use parking place or zone either displaying an invalid permit or voucher or pay & display ticket, or after the expiry of paid for time. In my case I was in a shared use zone, displaying an invalid permit. Guidelines say Code 19 is used when a driver has made some attempt to park correctly and is displaying something that could have been used. Additionally, The Civil Enforcement of Parking Contraventions (England) Representations and Appeals Regulations 2007 states that any PCN issued should legally contain the following information : (3)(2) (b)(ii)but that, if a notice to owner is served notwithstanding those representations, representations against the penalty charge must be made in the form and manner and at the time specified in the notice to owner. I cannot see any clear reference to point 3 (2) (ii) anywhere on the PCN. It is insufficient to say that the owner must follow the instructions on the NtO, it must be outlined on the PCN. This means that the council has not complied with the Regulations made under the Traffic Management Act 2004 (TMA) or the relevant regulations. Am I correct in these 3 points, which make a sucessful appeal likely ??

-

Hi Cabot /restons are taking me to court tomorrow for an unpaid credit card debt. Card was started in 2002. Debt was built up whilst receiving treatment for prostate cancer because I ran my own small limited company. Although the card was registered in my name, The card was used solely to pay business debt and that business folded some years ago. Lloyds TSB sold debt to apex management who in turn sold on to Cabot but I have no evidence of Cabot purchasing from apex. Restons tried taking me to court in Northampton last year but it was stayed because they could not provide my request for production. The law then was that they had to produce this in 12 days plus 2 days. Do you know if this still stands? Tho they have since sent me copy of one page of signed agreement with illegible writing. They have sent statement of account of duration of card use and also copies of limited pay plan where the company paid £5 pm for several as a gesture of goodwill. - this was not to Cabot who bought debt later In my defence tomorrow I have obtained doctors letter confirming the loss of my mother recently and that I am suffering from stress and anxiety - btw I am 66 years old. They have not produced original agreement under credit consumer act of '74 This is my defence I quote consumer credit act of 1974 they did not comply with statutory 12 days plus 2 to supply the signed credit agreement. Northampton court have already stayed this case previously because restons were unable to supply requested information. Any help and advice for tomorrow would be much appreciated thank you

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.