Showing results for tags 'sent'.

-

Good evening, I have received a letter from MET Parking Services starting that a fine is now overdue, the problem is, no initial letter was sent. They are demanding payment within 14 days, what is the best way forward. I go to Stansted a lot and I'm not 100% sure the charge is genuine as it was from a few months ago. Date of incident is the first week of November and this is the first letter I have received regarding this (today).

-

Hi, I'm currently waiting to be assessed by Maximus - I've sent my ESA50 back and am waiting for them to decide if I can have a home assessment. I've been sent a P60U today - is this normal? It shows how much I've received in ESA, but nothing under "taxable income" - presumably because I'm on Income Related ESA? Just wondering why I've been sent this. Is it normal?

-

Sent a SAR to Barclays bank on behalf of my father who signed the letter. He has been with the bank for over 60 years. They send his cards and statements to his address. Got a letter to say that they will only send him his details until they phone him up to prove his identity. It's been over thirty days and we have received no phone call. Why should he have to phone them. We thought it would be straightforward. Had mortgages and credit card with them for years. What should we do now?

-

Hi, would appreciate any advice regarding the situation of a relative who is a single Mother. She had an outstanding housing benefit overpayment which was being repaid monthly over a payment plan for the last few years. At the beginning of this year the council got in touch to say that they needed to increase the amount paid each month; following a review of her income and expenditure a significantly higher amount was agreed to be paid which she has paid without fail. The council also stated that they would review the payment plan after 3 months, however they sent a letter 4 months later with a means statement saying she needed to respond within 10 days. She was out of town and didn't see the letter until she returned 11 days after it was dated; she called the council who said that they have now passed the debt onto a debt recovery agency and she has to deal directly with them and that there is nothing they can do now. She is now very worried and has been sent letters by the debt collection agency. I think the councils behaviour is unfair and unacceptable, she has always made the payments agreed and was compliant with the agreed payment plan, they sent the means review later than they had indicated but are punishing her by handing her over to debt collectors because she did not respond to their late letter within 10 days. Does any one have any advice as to how she should deal with the council and the debt collectors? She is willing to repay the debt within her means and doesn't think it is fair to have to deal with bailiffs and risk losing her possessions or work to their aggressive repayment plans.

-

First post so Hi and thanks for any advice offered. Had some windows/doors installed by a local firm in a self build property. There’s been issues since the start, leaking sliding doors, bay window out of square, no keys for window locks, runners corroded. The company haven’t been the most helpful in rectifying anything. I moved into the house I was building in March 2016 and I’ve had visits from the companies employees whilst I was living there, the last one about April/may. I still owed 10% of the £15k for the full job which I told them I would pay when my concerns were sorted. 2 weeks ago I settled the outstanding amount as I am going to take it to the small claims court. The guy I sold the house to works away and he dropped a handful of letters off last week from solicitors, ccj and bailiff visits with extra charges, all dating back to July/August. This was the first knowledge I had of a ccj and a writ. Thanks in advance.

-

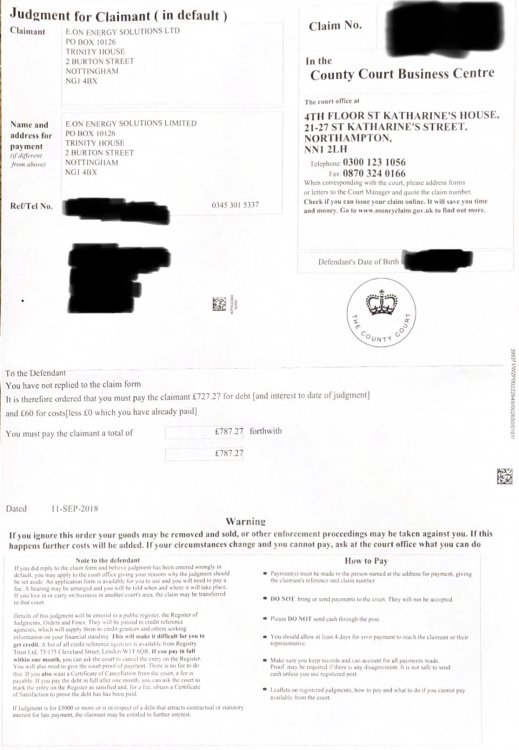

Hi everyone My brother has received a letter today from the county court business centre that was headed Judgement for Claimant (in default) It says you have not replied to the claim form (never received anything from the claimantt E-On) It is therefore ordered that you must pay the claimant £727.27 for debt and interest to date of judgement and £60 for costs. My brother has never received any court papers or even letters threatening court. But now he’s had this in the post. I’ll upload a scan of it but I’m not sure how to respond to the court document. Any help would be greatly appreciated Thanks Andrew

-

I bought an item on Ebay, which the seller claimed had only been used 1 time and was in excellent condition, the only reason why i bought the item. The item arrived damaged, i requested a return as item not as decribed and arrived damaged. Seller refused to accept a return, instead she blamed me for the damage, saying i had caused the damaged and had swapped item and the pictures I had shown of the damage were fake. Seller claimed she has a witness who saw her send the item in mint condition, but i told her it arrived damaged with a dent/chipped, with scratches etc and obviously not used the 1 time as seller claimed. Anway the seller then made a threat take me to smalls court (when she had my money and sent me a damaged item) and is still refusing to take the item back and still blaming me and now claims she can get a witness statement to say she sent the item in mint condition - if thats the case as seller claims, why it did arrived damaged!! In the email exchange with the seller, she is trying to make herself look the victim in all of this. The item is of over £250 Raised return request on Ebay, but seller is blaming me for the damage, how crazy is that, she sent an item not as described, anway time to escalate to Ebay and get Ebay involved because the seller is not admitting the item i received is damaged, even after showing pictures and still blaming me, what do I tell Ebay when I escalate item not as decribed, arrived damaged, seller not accepting responsibility, blaming me for the damage? As for the sellers witness statement to say she sent the item in mint condition, that doesn't count because my pictures show the damage, please please help

-

Hello, Long time lurker here looking for some help please. Thanks to the advice to others I have read here I have learned sooooo much! I defaulted on three credit cards in 2008 and have been paying £1 per month to each since then. They have all been sold on multiple times. Current situation: MBNA £17000 now with Capquest HSBC £3000 now with Robinson Way MORGAN STANLEY £8000 now with Cabot. I know I've been an idiot and it's all my own doing. I sent all three Cca requests on monday, unsigned with POs. What happens now? My token payments are due on 17th - do I keep paying? Thanks so much for any advice. This site is brilliant! Gettingmyselftogether (I'm giving it a shot anyway!)

-

Hi there, heres the story, I paid for an early upgrade online with ee. the cost was £251 including the early upgrade fee to buy out the rest of my contract and the upfront cost of the new handset. Now I ordered this the same day my new bill was generated, however my payment date for this bill is the 10th of each month, it was not due for another week so I didnt see a problem. in the after morning after ordering I checked the ee tracker to find news of my delivery only to find it `timed out` it couldnt find any record of the order number in other words. I phoned ee to find out what was going on, the rep told me for some reason the system had taken my upgrade fee but then straight away refunded it and it was on its way back to my account, she apologised and said if I wanted it back quicker I could get an indemnity on the direct debit with my bank asking them to cancel it and I should recieve payment that same day. Since then I found a better deal with another provider on the same handset (vodafones 32gb of data v 8gb ee were offering for the same price as I was paying now monthly!) I decided id use the refund to pay off my contract with EE and go with that one instead of upgrading. I contacted the livesupport on the ee website just to ensure the upgrade hadnt been put through again and to make sure it was indeed cancelled before going with the other network. I was then told that I was not being issued with a refund, the funds instead had been put towards my account balance and it was now in credit (this was presented as something I was apparently meant to be happen with) Now I wanted the refund, my bills not due till the next week and I didnt want to pay it till my next payday which falls before my payment date anyway. I was told I couldnt be refunded as the payment had already been put towards my bill and id just have to get a refund of the credit after paying my bill the next week. My issue is I never authorised this, the payment was sent as part of the early upgrade service it was payment for the early upgrade fee and the handset it was never authorised by me to be used as payment for my bill. EE have just gone ahead and done this without my permission then used that as a reason for not refunding me, I dont see how this is legal to use a payment in a way it wasnt intended without asking esp when the payment is taken as payment for a specific. product and service such as an upgrade. Not happy as not only was my payment used for something not intended by me and without my permission but the woman on the phone in the morning was obviously utterly using me. What I think has happened is ee have sneakily used the fact I made a payment for this upgrade as a way to have me pay my bill off early and just cancelled the upgrade so they can use the payment for this. Obviously very dodgy practise if so! Im just wondering if my misusing my payment in this way ee may have broken any part of their contract, id love to get a bit of revenge by using it as a reason to tear it up. Latest update got in touch with my bank, they say I cant get an indemnity anyway as the payment was by card (so the ee rep was totally using me this morning it appears!) but that the payment is still pending so it shouldnt take any time at all for EE to refund as they can just cancel it.....lets see if they choose to or see if they choose to `keep the money` on my account balance against my will......what they do will decide if I take further action im guessing, EE rep claiming they dont have the ability to cancel a pending payment......utter rubbish! I will be taking this further! luckly ive saved the chat transcripts. anyone else experienced this kind of thing?

-

Major crackdown on abuse of 'debt' judgement by rogue parking and utility firms is announced Ministers will pledge action on abuse of county court judgments by rogue firms Anyone who has had a CCJ without their knowledge will have it removed The Govt plans to immediately set aside all backdoor CCJs for those who can prove to a judge that they did not know about it when it was passed. http://www.dailymail.co.uk/news/article-5214075/Action-debt-judgement-rogue-firms-abuse-announced.html

-

Hi I have sent my mobile phone to a shop in Nottingham to be repaired, and they have sent it back to the wrong address , the bloke is claiming that is address that i sent him, which is total .. as the address it was sent back to is 400 miles away, he has said theres nothing he can do, is this right ?

-

hello, I have a problem, how to sort it out.. Around half year ago, received response pack from county court. sent them back defence N9B form, but they haven't received and i lost a case. I know I should send registered mail..but unfortunately. Now received notice of debt recovery from DCBL £261 + £75 recovery fee for parking ticket. The thing is I have a proof that vehicle on date of issue been sold already. Should I go to nearest court or any other ways?

-

Hi, My partner has been paying off a nominal monthly amount to Link Financial since the card debt was sold to them by MBNA. Sent Link a CCA in June but have had no reply. Sent a SARN request to MBNA and had a reply with only the attached request form copy and a second page with the terms and conditions. From reading other posts I think that this is invalid and therefore unenforceable. Would one of you more experienced people be good enough to have a look at give me your opinion. It seems to refer to paragraphs that don't exist and there is no lending limit or interest rate shown. We have since (last week) written to Link re their failure to supply a valid CCA and await their response! What is our next move please? L CCA Request Load.pdf

- 3 replies

-

- application

- mbna

- (and 4 more)

-

From their website: "Charged to cover the administration of issuing an arrears chase letter." - Outgoing arrears letter I'm not condoning missing mortgage payments, but surely £27.50 is a lot for a one-page (presumably computerised) letter and envelope being sent out? I think this has been covered previously (in 2011) but I'm not sure of my best course of action. Or whether I have a claim at all? Can anyone help me? I have received 2 of these letters in the last fortnight alone. £55 is hard to take for 2 sheets of paper and 2 envelopes! This figure is clearly exceeding actual administrative costs, and I find them unfair and therefore unlawful. Are they well within their rights to charge such a figure? Sometimes I have had these letters without even a prior phone-call to chase/remind me to make payment.

-

Hi, Wifes parents recently moved house and a parcel was sent to them but the wrong house number, £50+ food hamper tracked by my hermes. it was signed for on the on the 20th but didn't find out till 2 days ago it was sent to the wrong house. He's been round to the house and they have denied all knowledge of having it. Just wondering where we stand legally on this as the parcel wasn't in the persons name who signed for it. is it a case of tuff luck or can the police be contacted for theft?

-

I have been in writing to Drydensfairfax Solicitors back in March 2016. They are acting on behalf of their client Max Recovery Limited who purchased a debt. I had previously asked them for a credit agreement and copy of the deed of assignment. Back in March 2016, they wrote to me in reply. They provided me with a basic office copy of a credit agreement. They claimed that their client, Max Recovery, had provided them with a copy deed of assignment, and that they had attached this to the document for my perusal. Upon checking the documentation, this assignment was not present as stated in the covering letter. For the past year, I have had no response from Drydensfairfax. Today, I checked my credit agreement, and I am horrified that they have placed a default on my credit file on the 30th May 2017. Under section 87(1) Consumer Credit Act 1974, I have NOT been provided with a written default notice prior to this default being placed. Can anyone please advise me what to do next as I feel that the default is illegal!? The other concern is that Drydens should not have put the default in their name as the debt belongs to their client Max Recovery Limited. Am I correct in thinking Drydens have done this default incorrectly it should be their client!?

- 142 replies

-

- drydensfairfax

- legit

-

(and 7 more)

Tagged with:

-

Hi all, Im totally new to this forum and wanted some advice from you all. I've done the necessary searches for a case similar to mine but couldn't find anything. Here goes: Contravention happened on Bright Road in Purley, Surrey. There are 2 red route bays there that you can park in. One has the times of 7am-7pm and the other is 10am-4pm. I was unsure as to which was which and stopped in the 10-4 one at 09:55, got out of the car to check the board with the times on (as it faces the pavement as opposed to the road) and got back in my car to drive around the block a couple of times to make up the 5 mins. Received a PCN on September 2015. Wrote a letter requesting CCTV footage for the time period between 09:55 & 10:00. I heard nothing back from them until September 2016 (12 months later) requesting £190 as the time had apsed to pay the original £65. I immediately wrote a letter informing them that since I received no reply, I assumed this PCN was null and void. The responded saying that they had sent out CCTV footage and I had failed to pay. I wrote another letter explaining that I hadn't received any correspondence to which they then sent CCTV footage (signed for Royal Mail) They then raised this with the County Court. I've filled out a TE9 and received a letter today from the courts saying that the 'Order for the Charge has been Cancelled'. The CCTV footage is only for the minute of 09:55 where I drove into the bay and semi-parked to check the times. They haven't given me any more footage after 09:55 to show that I had in fact driven off. My questions are: Can they send a reminder out to pay a PCN exactly 12 months later? Can they select what parts of the CCTV footage they can send me? Im currently on maternity leave and really cant afford to pay £200 for a fine. Can I fight this and on what grounds? Many Thanks in Advance

-

@PANDORA_UK Hi there, I would like some advice please. Last week I purchased a 'Abundance Of Love' ring from Pandora UK on their online store for my daughters 16th birthday which is this coming Thursday. The cost in the sale was £19 plus £5 delivery. Today I received a parcel from Pandora. In the parcel is my invoice for the ring at £19 and delivery £5. However in the parcel there were two jewellery boxes. One had a necklace and pendant in. The other had 5 x Pandora charms in. After looking on the website I estimate the cost of this order around £300-£350. I like to think I am an honest person and although my dispatch note only said the ring I thought its only fair I ring and tell them about their error. I called and explained I ordered a £19 ring and have received over £300 of jewellery. They said once I send the jewellery back to them they will dispatch my ring. I said is there anyway around this as I would like the ring for my daughters birthday on Thursday. (ok its only £19 but should have been £45 - money is tight at the moment and this was going to be a special present for her) He put me on hold and said he spoke to his manager and no they couldnt do anything until I sent the parcel back. I said ok is a courier coming to collect it. He then said no you need to take it to the post office tomorrow and send it back to us recorded delivery! I kept very polite and said I rang you and was 100% honest when I could have just kept quiet and kept all this jewellery and now you are telling me that I have to take time out of work tomorrow to go into town to the postoffice and I have to pay to return it. He said yes or we cannot send out your original ring order. I asked to speak to management but suddenly no one was available. He said someone would call me right back but no one has. Am I right in being extremely angry that this is their mistake yet I have to pay for it? Can they make me? Am I within my rights to refuse to post it back at my expense? I am more then happy to have a courier come and collect it but I work from home and cannot easily get out to town for the postoffice during the week. I am so upset that I did the honest decent thing and now I am going to be out of pocket and my daughter will not have her birthday present. Any advice is appreciated. thank you

-

Hi Guys, I am new to website. But i have really big problem with hsbc. let me explain. I have small property investment business. Due to this when we pay some of builders they take out money without my authority each time i have to cancel my card and bank sent new one this things happen 7 to 8 times we told number of time banks about this and finally came to point when we thought its best to close a/c and all matters. At that time i have one credit card, bank a/c and personal loan on my name. Bank has closed current a/c and credit card straight way but loan they told me if i can not afford to pay they will keep open as it is and i have to keep paying them monthly arrangement. i have setup arrangement with them by direct debit and till date everything upto date i did not miss any payment. During december time my father passed away and i have to go out side country, during this period hsbc suddenly decided to close my loan a/c they sent out letter which i was not aware. After few days later another letter came for default notice and final demand. I came back last week and i have seen these letters. I been told by HSBC staff not to worry and they will sort out everything . I been given collection number which i called number of time but they have given one answer as my loan account is active and its up to date. Letter i received from hsbc clearly confirmed they will pass my details to credit reference agency and it will affect my credit rating. I have made full payment to HSBC but they refused to do anything. I have explained them as i was out side country and i did not received any phone call but they did not listen. As well they have notes on system march 2017 confirming person previously dealing in back office (customer relations manager) place note confirming account keep open and customer will maintain monthly payment as agreed when opened loan account. HSBC in march 2017 told me they will keep my loan a/c opened as far as i will keep paying my instalment but in december they have decided to close my a/c. Branch even give me wrong information as they told me nothing to worry my a/c is up to date and no action required. I really need serious help as my business on credit and if something goes against my credit file it will be end of my business. I need serious help as bank not helping me out at all neither branch already made complain to bank but i am not hoping any good response.

-

Hiya all, Trying to help my brother out, He has been issued with a money claim alongside a section 8, They are for differing amounts but issued on the same day which is odd I am going to help him out with responding but a quick technical question should a letter before action have been sent to him beforehand? I know it is practice for companies but not sure if applicable to rent arrears? Also worth saying he wrote to LL on date it was issued asking for a rental breakdown as he disputes the amounts ( especially as different from the section 8 ) and it was signed for the day after ( 13 days ago ) he believes the LL has applied his own charges and then implemented them without a breakdown to him. I am assuming he defend it on the basis that the LL has not responded to his asking of a rental breakdown/ any charges applied?

-

Hello, I posted on Saturday a letter to Santander reclaiming over 2 k of bank fees (template from this site) . It contained a paragraph in which you say what has happened - lot of death in my family and lost biz too. It was a very painful letter to write. (I kept it just a paragraph). Today they texted me they had been trying to call me and to call back. I hadn't answered since I am avoiding calls from anyone (not in a good place). I feel sick. Do I have to talk to them? I don't think I am strong enough to hold it together on a call (now my keyboard is wet). Kicking myself.

-

HI I sent CCA to Lowells for 3 different accounts. I had no response this was in 2014. I have now received pre-legal assessment letters. I have kept the post office recipts as I sent recoreded with 1 pound postal order. I also sent to Bryan Carter as well. (he respoded was on hold until could get info) never heard back from any of the creditors until now??? How do I prove I sent CCA if it goes to court? and do I need to send another CCA as its been 2 years?? Any help thanks

-

RBS made me an offer of £2k for ppi from 2003 They said they would pay me by cheque. However, the other day I had a message saying "we have deposited the money into your current account. On checking this I found that they hadn't deposited into my account, but to their own holding account pending further investigations. I phoned the ppi office to be told that the loan on which I claimed the ppi had arrears and so they were investigating. However, I then phoned RBS credit management and they confirmed I had no outstanding debts, but then claimed they still need to investigate. If they suspected this, why did they agree that ppi was refundable and why can't they find any evidence. Really frustrating! I have to wait another 28 days now while they investigate. Anyone dealt with this before?

-

I feel so upset and frustrated. I got pip for a year, then after an assessment for renewal they did not award me enough points to carry on getting it. Before I was getting the standard care rate. I appealed and asked for the mandatory reconsideration but again the DWP refused to award me. Only after being sent out all the forms did I see where the missing points were. I am working with Harc and it was for preparing food and both the recent form, and previous form my answers were the same yet they did not award the 4 points the second time but gave me the same points for the same things as last time, bar that. So, I appealed and went to the tribunal and they awarded me more points which took me to enhanced care and lower mobility and I thought great, finally over. Got a letter through dated the 24th (my appeal was on the 18th) and it says we've applied to the tribunal or a statement of the reasons for the decision made on the 18th as we may wish to consider applying for permission to appeal against that decision. I'm sorry we won't be paying you the benefit awarded by the first-tier tribunal at the present time. We have one month to consider applying for permission to appeal. The period of one month starts from when they first=tier tribunal reasons has been issued. If we decide not to apply for permission to appeal we'll start paying you the benefit strait away and we'll pay money we owe you, if we apply for permission to appeal and it's not granted, we'll consider if we can start paying you (what do they mean they'll consider if they can start paying me???) I'm getting so upset and no idea what to do next. How do I find out when this month starts and ends and is it common for the DWP to be granted permission to appeal. What will they be appealing? the points I've been awarded? I thought the judge at the appeal I went to had the upper hand so to speak, why am I now being put through this. Please can someone help me understand what's happening here and what I should do. Much appreciated.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.