Showing results for tags 'response'.

-

Hello Last year, me and my girlfriend joined an X4L gym on a monthly contract basis. We paid the first month on the spot when joining (28th Oct) and shortly after had a bad experience. I went online and saw how bad this place is and we decided to cancel. I wrote down all the things I had to do and when, hoping to avoid this. I sent the cancellation request on 9th Nov online as instructed, saved the 'receipt' and also have the confirmation email that came through a few days later. I allowed the final payment to come out on the 27th Nov and then cancelled the DD on the 28th Nov. That's 48 days before the following payment would have been. I've stuck to the terms, yet here we are. As I mentioned, we both joined. I did everything for us both at the same time. I haven't heard a thing from them, but they are chasing my girlfriend. So far, their demands are 2 months membership plus x2 £25 penalties (sorry, 'admin fees'). Most threads around here are people cancelling DD without letting them know, etc. I can't be bothered to write a letter and post it, considering it's obvious they don't care and will just continue. I just wanted to check, am I OK to bounce their emails and forget about it? I know they have no powers... Or, shall I send a letter with the dates in, anything else?

-

i raised a complaint to peachy for IRL (due to my gambling addiction at the time) they left no credit footprint at the time of applying on the 19th April (however they did on the 9th April when i didnt apply there) i admit i lied about my expenditure to fuel my habit not sure how to respond to them here.

-

Charity Commission response to report on freedom of speech in universities READ MORE HERE: https://www.gov.uk/government/news/commission-response-to-report-on-freedom-of-speech-in-universities

- 1 reply

-

- charity

- commission

-

(and 5 more)

Tagged with:

-

Hello i filed an IRL complaint to these due to the fact when they offered me the loan at the time my credit file littered with defaults and accounts in arrears they responded with the below, i never asked for a reduce payment plan. whats the best thing to respond with? i find it strange they are asking proof of income and everything now when they never asked for it when i first took out the loan. when i first took out the loan they never once asked for bank statements wage slips. Dear We acknowledge receipt of your recent communication the contents of which have been noted. In order that we may consider a reduced repayment plan please provide us with the following: ** Proof of your current income (a wage slip if you are employed or evidence of benefits) ** Details of your expenditure to include any balances owed to creditors and any repayments currently being made to them ** Your offer of repayment NB this must be a pro rata offer taking into consideration all your credit commitments ** The date you intend to make your first repayment We require the above information to be received at this office within 7 days from date of this email. If you would like to phone us to discuss your account please call 0113 887 3434 and one of our agents will be able to help you. We are open 9.30am to 5.30pm Monday to Friday. We look forward to hearing from you. Regards Cash4UNow Cash4unow.co.uk is a trading name of Novaloans Ltd, Company Number 07639288, Registered Office 7 Limewood Way, Seacroft, Leeds, LS14 1AB. Novaloans Ltd is authorised and regulated by the Financial Conduct Authority FRN 672320. Authorisations can be checked on the Financial Services Register at http://www.fca.org.uk/ or by contacting the Financial Conduct Authority on 0800 111 6768. Regards Cash4UNow cash4unow.co.uk

-

Hi all, After more great advice on top of what I have already received from here. First issue: I sent a bog standard prove it letter to BPO Collections this month (using template from either here or National debt line). Apparently they now own a debt from Motormile Finance/Lantern. I think I took a payday loan out in 2011/12 with CFO, who went bust, debts purchased by Motormile, who changed names to Lantern, who have assigned this to BPO. It becomes very confusing to keep track of name changes and who owns who. The letter I received back states (amongst the usual twaddle): What should be my next step? they are refusing the prove anything if I'm reading that right. I've checked my credit file (3 different agencies) and if there was anything on there from CFO/Motormile/Lantern/BPO it isn't on there anymore. I don't ever recall paying anything to any of these companies or speaking to them. Second issue: I sent a Statue Barred letter to BW Legal in regards to a PRAC/PayDayLoans debt. Again it was from a template from either here or the National Debt Line. They have replied back with the following: Followed by the usual how to pay stuff. Firstly, they have the dates wrong as my credit file states that it was started on 10/01/2012 and the default registered 1/7/2012. Secondly they already sent a letter of claim for court action in November last year but never followed it up (I foolishly didn't reply at the time due to ignorance on my behalf). I haven't paid a bean or acknowledged debt. So this is statue barred right? How should I respond or should I even bother? I'd like to put something to them that draws the matter to a close, but I thought the SB letter was meant to do that? Thanking you in advance.

-

Took delivery of a brand new E-Pace and initially all was good until 6th June was drive on a dual carriage way and the front collision detection system triggered incorrectly. The car was bought to a stand still, the hand brake applied, and engine switched off, no vehicles or obstruction in front of car. Luckily the lorry and car behind our realised there was a fault and avoided a collision, wife and daughter very shaken. Reported to dealership who were very concerned and asked to bring it into dealership, they inspected the car found errors or logs relating to the time of the incident. Dealership said we could not have our car back it was too dangerous hire car was provided. were hoping there was an identifiable fault that would be quickly fix but after a week still investigations were ongoing we therefore rejected the car as ‘no fit for purchase’ Initially dealership were onboard and told us to report the issue to Jaguar Finance stating we were going to reject the car. Dealership the found a replacement car but delays started to happen Main issues were the replacement car was £600 which I wasn’t prepared to pay but also I’d used Jaguar Privilege staff discount which caused problems I continued to chase and was told ‘we have to follow process’. By this stage I’d already escalated the issue to the Jaguar Executive team. 2nd June still no updates chased and was told still waiting for report from engineers at which point I expressed concern and threated legal action. Magically a few hours later I received a call from dealership, no Jaguar stating that no fault had been found and as a result they could not replace my car and I’d have to have my original car back. I have stressed that no fault found does not mean the incident did not happen, in theory it is now more serious as Jaguar are aware of an issue and have been unable to identify the cause. Weekly summary of the events below, I have a very detailed breakdown of events Is there anything I can do, my wife now does not want to drive the car, she did feel happier knowing the car was going to be replaced. Now she will be concerned if it happens again. 25/05/2018 1 Delivery and handover of E-Pace 01/06/2018 2 Identified faults, rear fog light wiring, alarm triggered, 3G Issues 06/06/2018. Collision detection system triggered incorrectly 08/06/2018 3 Car returned to Marshalls due to serious fault, refused to return car as logs found, too dangerous 15/06/2018 4 "Asked to call Finance company and inform them car is not fit for purpose and is being rejected. All ad-min good and complete and everyone had approved the replacement. Christian had identifed a suitable vehicle but due to additional cost it needed approval but shouldn't be an issue." 22/06/2018 5 Replacement vehicle hadn't been approved, must follow process. 29/06/2018 6 "Issue relating to Privilege voucher resolved Christian working to locate suitable replacement car. Additional £600 reguired for new car, unwilling to pay extra, Marshalls unable to cover costs. Potential issues with Q3 pricing in comparison to Q2, need to wait until next week." 06/07/2018 7 Q3 SE Specification changed, Drive Pack now an additional £700 cost option.

-

Hello, I used Resolver to find out if I had any PPI with Studio catalogue, I attach the response and although the sum would be very small if I were successful, I feel that it is a matter of principle as this response is, I think a fob off. Studio response1.pdf

-

Hello so i filed an IRL claim to peachy which then went to the ombudsman, i cited my gambling addiction at the time but it seems the adjudicator is siding with all the PDL companies saying they did sufficient checks. it says that they checked my credit file and it shows i was struggling to make payments towards loans i had defaulted 4/5 years ago and that Peachy wouldnt of taken this into account??? any advice on this?

- 4 replies

-

- adjudicator

- peachy

-

(and 1 more)

Tagged with:

-

some may be familiar that i filed an IRL claim with payday loan companies due to my gambling addiction, is this worth pursuing with the ombudsman further after their response? even though mr Lender have agreed to waive all interest and fees it looks as though the ombudsman is saying that they didnt have to do thorough checks as it was my first loan with them

-

Hello some may remember my posts before where i have made IRL complaint with several companies as i recover from my gambling addiction, can someone give advice on how to respond to Oakam now? i have attached their response thank you i have referred this to ombudsman but now they are saying " The letter we have sent to you on 6 July 2018 did offer a resolution to your complaint. For clarity, your complaint was upheld. At this time, you have not yet paid back the principle sum you have received so we cannot offer you a refund. However, the interest due on the loan has been waived so the account can be closed after the £150 you have received has been repaid. As you have paid £11.98 towards the sum, you do have just £138.02 left to pay. This balance is frozen. We note that this resolution is in line with the guidelines set by the Financial Ombudsman Service. Did you receive our letter dated 6 July 2018 or do you have further comments regarding its content? "

- 3 replies

-

- irresponsible

- lending

-

(and 2 more)

Tagged with:

-

Hi Wondered - I recieved a parking ticket on 16th July and challenged it the same day. I had heard nothing from local authority so emailed them to check they had received it. I received a response 3 days later saying they had a backlog and challenge will nont be addressed for another 2/3 weeks. Is there a time limit for them to respond to a PCN challenge?

-

Hi all. Brief background to my delimma; Opened up a vanquis account back in mid 2013, kept on top of it for a few years until I went through an extremely difficult time, they increased my credit limit to £2000 around the same time and I blew the lot and stopped paying because I didn’t care about anything. It was then sold to Lowell’s solicitors I ignored the first letters until I received the pre action protocol letter. I responded to that asking them to prove it. Today they replied stating they were waiting for response from creditor and my account is on hold in meantime. Total debt is £2396. But I also noticed some of the information on this letter is wrong. The last payment date and the amount is incorrect and also the default date. I checked through my bank statements and they’re a month out with the payment date. They have my last payment as November for £70 odd, but my last transaction was in the October for £30 odd. Then the default is recorded in May the following year. I’m wondering if it’s worth letting it go to court if they seem to have wrong information. Would be really grateful for any information or advice anyone has. Many thanks.

-

hello, I have a problem, how to sort it out.. Around half year ago, received response pack from county court. sent them back defence N9B form, but they haven't received and i lost a case. I know I should send registered mail..but unfortunately. Now received notice of debt recovery from DCBL £261 + £75 recovery fee for parking ticket. The thing is I have a proof that vehicle on date of issue been sold already. Should I go to nearest court or any other ways?

-

Hi Ive CCA'd all my creditors. I have had a response from IDEM for some sofas I had from DFS. They have sent me the original credit agreement I signed in DFS on 24/11/07 with a copy of my driving liscence. They have also sent me a list of all payments made, apart from they have missed off the first year of payments made through payplan. So I am guessing that this debt is enforcable so where do I go from here shall I set up a repayment plan for this, do you think I could try and F&F. Should I enquire about the missing payments? The last payment made to them was recently on 04/12/17 which was the last payment I have made into my payment plan. Thanks in advance

-

Hurricane Irma: government response and advice READ MORE HERE: https://www.gov.uk/government/news/hurricane-irma-advice-for-british-nationals

-

- government

- hurricane

-

(and 2 more)

Tagged with:

-

Hurricane Irma: government response and advice READ MORE HERE: https://www.gov.uk/government/news/hurricane-irma-advice-for-british-nationals

- 1 reply

-

- government

- hurricane

-

(and 2 more)

Tagged with:

-

Hi, My partner has been paying off a nominal monthly amount to Link Financial since the card debt was sold to them by MBNA. Sent Link a CCA in June but have had no reply. Sent a SARN request to MBNA and had a reply with only the attached request form copy and a second page with the terms and conditions. From reading other posts I think that this is invalid and therefore unenforceable. Would one of you more experienced people be good enough to have a look at give me your opinion. It seems to refer to paragraphs that don't exist and there is no lending limit or interest rate shown. We have since (last week) written to Link re their failure to supply a valid CCA and await their response! What is our next move please? L CCA Request Load.pdf

- 3 replies

-

- application

- mbna

- (and 4 more)

-

Hi all - this is a split off from a more general thread where following your Cash Cow advice I have sent off many CCA's This is a RBS CC taken out in early 2005 - Balance around £700 Currently paying £1 to Moorcroft They acknowledge receipt of CCA but request "in line of their clients procedures" a hand signed request... they returned the old one for a signature.. The also ask the the PO gets made out to the client ( atm it just says xxx) On hold 30 days blah blah I gather this is all rubbish so what is my next move? Thanks again

-

Hi all - this is a split off from a more general thread where following your Cash Cow advice I have sent off many CCA's This is a Natwest CC taken out in Mid 2004 - Balance around £2300 Currently paying £1 PCM Direct - Account in Default since 2010 The application was made online They have sent me 1) a covering letter telling me they can send me a copy agreement and "current" terms. 2) A current leaflet with the General Conditions 3) A letter regarding a replacement Credit card with no date 4) A signed credit agreement A6 size no mention of limits or APR's 5) A letter with a copy of the agreement with APR's on an Credit limit 6) A photocopy of some more terms with some minor variations in the Advances APR's 7) A copy of a current statement. I have no idea what most of this means and your guidance as to the next steps would be greatly appreciated.

-

Can some one please help. I have received a final response to the letter that I sent to GE regarding my PPI payments on the loan that I took with First National Tricity Finance in October 1999. I have the agreement and I know I paid £155.00 as a lump sum. Single premium. Santander was saying that I should have checked the PPI. However, in 1999 I did not know anything about PPI, and also I was told that this formed part of the deal. In order to continue with the loan I had to take this so I did. Has anyone able to claim an PPI from Santander please? Many thanks

-

Hi all I sent a SAR off to barclays on the 20th of May - I got a reply today from them saying they could not process the request as the "cheque is not valid" I had enclosed a blank postal order for £10 They have not returned it or told me why it was not valid What is my next move Thanks

-

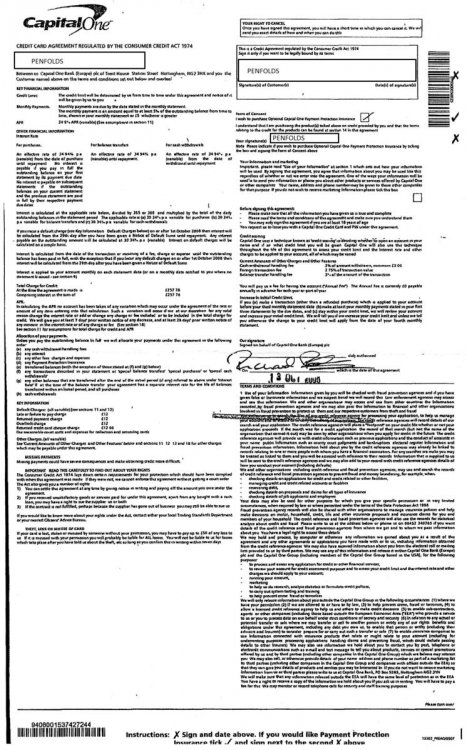

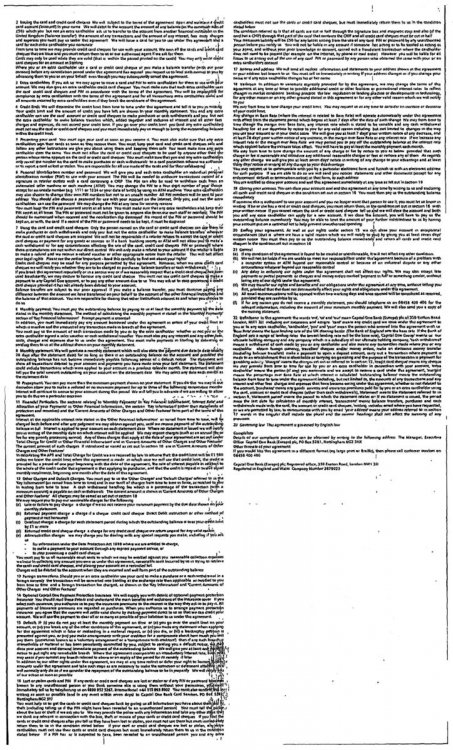

Hi All, I have recently defended a claim by Shoosmiths on behalf of Capquest for a Cpaital One credit card taken out in Oct 2008, the last payment made was in Jan 2012. The claim was stayed at the end of Jan 2017 after filing a defence. Before filing the defence Capquest was sent a CCA request, a copy was also sent to Shoosmiths with a CPR31.14 request, which Shoosmiths remain in breach of. However today Capquest has sent a response to the CCA request (attached). They have also sent somebody elses application for a Barclays Sky Card which includes their name, address, DOB, household income, home, mobile and work telephone numbers and applicants signature. Any advice greatly appreciated, please advise if defence or CPR 31.14 request needs uploading. Thanks Penfolds

-

In 1996, I applied for the then student loan for as 2 years course. Once I finished my University, and for a long while, I didn't get any jobs where my earning reached the threshold necessary to start paying it back. I then moved to Australia and live there almost close to 4 years. I hadn't heard anything from the SLC (Student Loan Company) since 1997. When I got back from Australia, I suffered a stroke and since then I have completely forgotten about this loan. However, last week, I got a letter making demands to pay the loan back? Isn't this supposd to be statute barred? (No communcations since 1997?) Also I am going to be 51 and I was under the impression that the loan gets written off once you are that age? The long and the short of it is that my daughter needs to apply for a student loan and my wife has been able to fill-in her side and I am supposed to do mine, but it keep saying error and that I must contact them by phone. I am not sure what to do next? Is this statute barred or not? Thank you for your help

-

Hi All, Like many others on this forum, I've been having a lot of trouble with Harlands/CRS/X4L and wish for it to stop. I've been putting off posting here for a while and simply been following the advice given to everyone else by ignoring the threats from CRS and Harlands and replying in writing. I signed up for a 12-month contract on the 3rd November 2015, and after 12 months decided to cancel my direct debit on the 22nd November 2016 after fulfilling my 12-month obligation. Initially I ignored the letters from Harlands demanding payment, however after they threatened to pass my 'debt' of £171 onto CRS, I decided to reply with a letter to them explaining that I'd fulfilled my 12-month obligation but offered to pay the £9.99 to cover the cancellation period which I had missed, and to stop further demands otherwise they'd be reported to TS etc, etc. In the meantime, my 'debt' was passed onto CRS, and Harlands replied with a letter simply stating that they could not cancel the agreement as they were simply the direct debit company acting on their behalf and to get in touch with X4L directly. So I did just that, basically sending the same letter to X4L head offices, offering to pay the £9.99 but nothing more, and again to stop CRS/Harlands contacting my otherwise I'd report them to TS and the CMA. However, on Tuesday I received this response via email: I'm a bit confused by all of this as they just seem to be passing the buck onto one another, and I'm a bit confused as to what steps I should take next, as CRS have since begun Texting me and sending me Emails demanding I ring them. Anything I should say to X4L in response to this? Any advice would be GREATLY appreciated. Many thanks

-

Hi, my 19 year old son who has recently been diagnosed with depression got himself into a muddle with his banking due to inexperience and the ease of contactless payments. He was paying charges of £80 per month for the majority of a year and was unable to get himself out of the financial mess he had got himself in. Once I became aware I advised him to speak to the bank HSBC and ask them to give him an authorised overdraft so he could limit his charges and get himself out if the situation he found himself in. He contacted HSBC and as he failed a credit score (no surprise there, he has never had credit) they refused to give him an authorised overdraft. He buried his head the sand a little longer and then finally took my advice to contact the Financial Ombudsman. HSBC initially denied to the FOS that he had made a call to them explaining his financial situation and asking for help but after we supplied a telephone bill detailing the date and the fact that he was on the phone for in excess of an hour they agreed that he had made contact. The FOS requested the conversation. However HSBC did not submit a recording of the phone call they supplied hand written notes. These notes failed to mention that he was experiencing financial hardship. Therefore the FOS said that he had no case. He stressed that he did state this in the phone call but the FOS decided that as it was not mentioned in the notes submitted by HSBC then that was the end of the matter. My son has paid in excess of £800 in charges on a paultry income and it feels that he has no redress against HSBC. Can they not be forced to submit the original recording?

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.