Showing results for tags 'mbna'.

-

Hi, Sent a CCA request to MBNA who i have been paying on a DMP with Stepchange 10 days ago, have just found my original welcome letter and it is with Bank Of America / Amazon. I have not had a reply as yet. Account opened in 2012. Wondering if i should have sent the request to BOA rather than MBNA Cheers

-

Hi There, Been playing games with MBNA for months now on CCA etc and they passed onto PRA Group to chase, they have come back now and said the application was done digitally! Not sure where I stand now or what I can do? Thank you in advance for your help. Regards Steve H

- 1 reply

-

- application

- digital

- (and 4 more)

-

Hi, I'm new to the forum, but have been a long time lurker. First of all apologies for how long winded this is, but I hope I include all the relevant information. Alleged card debt from card taken out in 1998. Alleged debt approx £5k. Card sold to IDEM Capital Securities August 2012 Alleged Card default August 2013. Idem Capital Securities assigned alleged debt to Arrow Global November 2015 About three years ago I received multiple claims for alleged credit card debts, and with the help of this forum managed to get one claim dropped and ended, one victory in court and a few claims stayed, so thanks for the help there! Anyway, one of them doesn't appear to have gone away, and Shoosmiths appear to be applying to Northampton County Court to get a stay lifted and have my previous defence struck out pursuant to CPR 3.4 and obtain summary judgement pursuant to CPR 24.2 they claim I have no grounds for defending the claim. This was my original defence: So my defence was submitted, along with two other defences on the same date. Nothing further was received from Shoosmiths or the courts, and the claims were stayed. I should have asked to have them struck out, but I wasn't fully aware of the procedures, and couldn't afford to pay anything to the courts. So roll on two years and three months, and Shoosmiths start writing to me again, saying they did not receive my original CCA request or CPR18 letter in 2016 (funny how two more were received, and returned, and they were all sent in the same recorded delivery envelope!) They now claim they have provided all of the relevant information, and I still dispute this. Their alleged agreement is an application form for a card around the time I had allegedly taken out a few credit cards. Their "terms and conditions" is a reconstituted partial list, it even says for items X,Y,Z refer to your terms and conditions! They then have another set of terms including MBNA web address details, the web address didn't exist in 1998! Their letters also refer to one credit card number, then it changes to a new card number that they have assigned, which to me just points to multiple pieces of incorrect or fabricated information. I chose to ignore all of this further correspondence, as the claim was stayed. Then earlier this week, they have sent a further copy of this "information" along with a covering letter to me as follows: This covering letter includes a copy of their N244 Application Notice to lift the stay and all previously submitted information. Again, apologies for the long winded post, but I ask, how should I either try to stop this dead, or again defend? I am actually happy to attend court if it comes to that. I read on one of the other threads that this could be submitted. Would I be able to use it as a reply, as it has taken them over two years to get incorrect information that they think they can use in court? If anyone can reply, I'd like to say thanks now, and I will be extremely grateful. Will come back with the results.

-

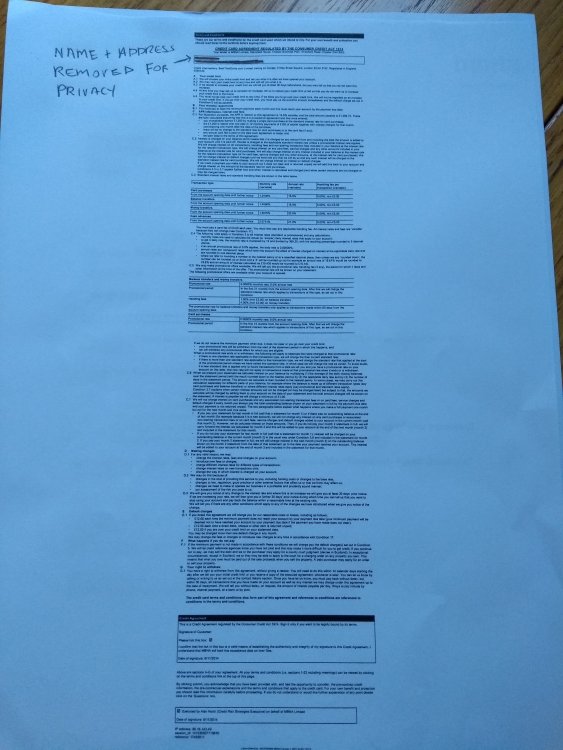

Had the following back from MBNA in response to a CCA request. 2 sets of T&C's, one current, and one supposedly from the time they card was taken out (not sure how I'd actually verify that) A summary statement showing current balance And a "copy executed agreement" Have uploaded the covering letter and the redacted "copy executed agreement". Basically, is this valid? This card was taken out in late 2014, and from what I've read it seems like it probably is a valid an enforceable response to my request, but would like to be sure before taking next step (MBNA bluntly rejected a recent full and final offer of around 60% of balance, claiming they never accept such offers. I should also mention that the debt is still with MBNA and no payments have been made for 3 months now. Current balance is a around £10.5k. Borrowing from family and selling a few things I reckon I could raise £8k tops. It doesn't seem like MBNA would accept this as a full and final, and all the while the interest mounts up.

-

Hi, Im trying to unravel my late father's very complicated finances, as I'm his executor. I found a letter from Hoist Finance dated from last year stating they own the account, with an outstanding balance of £2131.92. When I phoned to say he'd died they told me it would be passed to 'Philips and Cohen' - this was mid-January and I've heard nothing (luckily). Having read these forums I then wrote to MBNA requesting all his account data but they replied stating the 'GDPR only applies to personal data relating to a living individual'. is this true?There's also a letter relating to another MBNA debt from Link Financial, so they have sold the two on. I need to know how old these are etc. Letters scanned and attached. The reason I'm confused is I've also written to Santander (using the same template letter) and have received all the loan info so they obviously have different rules! - I'm not willing to settle anything unless I know how old these debts are and what they relate to. We couldn't find any paperwork at my Father's house. Any advice as what to do next - I did send certified copy of probate certificate with my requests. Many thanks for reading! scan0041.pdf scan0040.pdf

-

I was out of work 4 years ago and agreed a 5 year payment plan with MBNA for a credit card debt (14,000), they stopped the interest , I have been paying this for 4 years +3months never defaulted , I have now received a letter saying they have now sold my debt (1900.00) to The PRA Group … .yesterday I received 3 calls from them which i have not responded to....what happens now? the letter from MBNA says I don't need to do anything and PRA group will carry on the agreement so why are they calling me? any advice appreciated!

-

Good evening, When i was a lot younger i ran up quite a bit of debt which became unmanageable once i had children and cost of living increased. paid into a DMP for a few months and then defaulted this was in April 2013. I have pretty much ignored all contact as no one was taking legal action. I have had some discussions with Restons over the phone about this debt as i tired to agree a repayment plan. but could not stick to it as it was un affordable to me. Today i have received a CCJ claim from the for a total of £5131.05. The debt is from an MNBA credit card which i took out sometime around 2005/06 i think. The POC on state that the original debt is from MBNA "dated on or about Feb 2007 and assigned to claimant on Dec 2011. It then list the following two items: 19/07/28 Default balance 5151.05 19/09/2018 Pos Refrl CR -20 That is all that is on there. I have done a lot of reading around and am thinking of defending this claim but my head is spinning a bit with all the different threads i've read. Am i right in thinking that they probably dont have the CCA? I don;t believe that they have followed pre-court protocols as i have not received a letter stating they were due to start legal proceedings. Do i need to now request this information under CPRs and then defend the case accordingly? Am i right that if they can not produce the cca they can't enforce the debt? Thank you in advance.

-

gI have also recently received a letter from MBNA regarding the same thing.g In this letter they say,.. " You could now receive some money back if we took a high level of commission on your PPI policy but did not tell you this when you bought it. A high level of commission typically means it was over half what you paid for the policy. Generally we do not tell PPI customers about our commission at the point of sale, as we were not required to ". Interestingly the reply address they give begins with........MBNA Plevin Proactive. Unlike Welcome they include a form to be completed.

-

A friend has received payment from MBNA for a miss-sold PPI policy. The advice slip attached to the cheque invites a telephone call to their offices, should there be any queries. This in spite of a notification letter, received some weeks earlier, stating that “This is our final response to the complaint” and referring the recipient to the Ombudsman Service, should the refund not be deemed satisfactory. If MBNA are granting telephone queries, would they not similarly accept written queries? Secondly, I have attached MBNA’s calculations by which they arrived at their refund and would be grateful if someone, with more experience than I, would be kind enough to examine those and give us the benefit of their advice. The credit card was provided circa ten years ago and has been steadily operating with a constant debt just shy of £3000, since then, with only minimum payments being made, each month (if that helps). Thank you. MBNA_PPI-Responce1of2_EDIT.pdf MBNA_PPI-ChequeAdviceEDIT.pdf MBNA_PPI-Responce2of2_EDIT.pdf

-

I have just had a reply from MBNA saying I am not eligible for any redress as I was declared bankrupt, this is not the case as I was in an I.V.A. which is now completed. Also the debt is now run by Max Recovery, what are the options?

-

Hi everyone My first post here. I’m seeking advice on being asked by Cabot for an MBNA credit card debt of £2300, opened in Dec 2005 and defaulting in May 2011. They have history of most of my addresses and I received a letter from them recently to my current address. They say they have no documentation to clarify the amount owed nor are they able to request any from MBNA. Apparently the account is on hold for 30 days and then they want a direct debit arranges for repayment. Any advice welcomed thanks

-

Hi I've received my sar back from MBNA but it never included my payment history I called them and they say they no longer have them I was hoping to check if I had any ppi to come back they also my sold account onto arrow global who then obtained a ccj how can they do this if they have no record of my last payment on the old MBNA credit card as it could of been statute barred

-

Hi all Had a credit card with MBNA since December 2001. Couple of months ago thought I would just check on the off chance that I had PPI - couldn't see anything when I looked online at my account. I went through the MBNA website and lo and behold it says that my account has had PPI from the minute the account was opened in 2001. Went through the claim and was given the 8 week deadline for a response. Had two letters from them confirming that they were still working on it. Got to the deadline day and decided to call them. Was told that indeed my claim had been upheld and that a payment was due of £576.48. I queried this amount and asked how they had made the calculation. The guy couldn't tell me but obviously had a script saying that with this amount my account would be back to normal. Not being satisfied with that I called again that day and spoke to another guy who again gave me no info. I asked if he could tell me how much each PPI premium was worth and what interest it had been rated at. Nothing. He said that he had no access to such info. Stewed on this and called again next day and spoke to a lady. All of a sudden she could supply me with all the info I needed, interest rates, actual premium amounts. On me remarking sarcastically that I couldn't understand why MBNA would bother sneakily cheating me out of less than £600 in 17 years. Didn't seem worth the bother. She then said that the PPI had been closed in March 2003 on this account, as per written request by me, the customer.?????? This was clearly a lie and alarm bells started ringing. The script kicked in perfectly again - "most people don't remember what they did some 17 years ago". I obviously asked for a copy of the letter to which I was told that we no longer have such a thing on file. Very convenient! I am alleged to have written cancelling an account that I still didn't know I had 17 years later. I told her that I smell a rat, based on the calculation she had presented me they could owe £15-£20k. Would make sense to try and blag me. She told me to send in a cheque for £10 and a request for "SAR" which she claims would show every single detail on the account from day 1. But now I don't trust them nor anything that they send me. Today I received the cheque which clearly I will not bank. Does this sound right to anyone? In two emails, two letters and then two conversations with their office nobody once mentioned that the PPI had only been for just over a year and that I had cancelled it in writing. Has anyone else had an experience like this? Feel like they have me over a barrel. Help!!! Thanks

-

Hi just went on MBNA website as i credit card back in the late 90s with them , i have had a response saying yes it did have PPI on it and then they want me to fill in their own questionnaire. Is their a templete letter on here which will do a better job of makinag a complaint and what is the best process to follow. I am also doing the same for PPI with A Morgan Stanley(now Barclays) card and a peoples bank now Citi bank. I believe that all these cards were obtained via pre filled in application forms and included the PPI on the filled in application forms. Thanks in advance for any help

-

I received a letter dated 5/12/17 from MBNA offering £924.03 minus £184.81 UK Withholding Tax. This was for a PPI undisclosed high commission complaint (PLEVIN) on a very old credit card on which they had refused a PPI repayment as they claimed it was not mid-sold. I am a 70-year old female Pensioner who had a mild stroke last week and do not understand these things, but also do not trust Banks. Is the UK Withholding Tax being paid directly by them to my HMRC 'account' ? Can they be trusted to do this. How can I check that the calculations given are correct? They are: £816.89 Amount of applicable commission and profit share £ 0.00 Total amount of fees refunded £137.20 Amount of historic interest £924.03 Applicable 8% gross interest* -£184.81 Less UK withholding tax* The payment is being paid directly into my Bank Account within 28 days. Any advice will be most helpful.

- 2 replies

-

- calculations

- correct

-

(and 3 more)

Tagged with:

-

Hi all, I am new to this and I hope the good people out there can help me. I used to be in terrible debt problems in the second half of the 00's and beginning of the 10's - with many credit cards and unsecured loans. All of which I was paying large amounts of penalties and interest. This was with Lloyds, Natwest, Egg, Virgin and MBNA. A few weeks ago I received a letter from MBNA (relating to a Virgin credit card account) saying the when my credit card account was in arrears they should have sent me a notice of sums in arrears on 21st September 2009 but as a result of an error they didn't. Therefore they have refunded any interest and default fees that were added from the date and the date of this letter (9th Jan 2018). The total (to my amazement) was a £9k refund in the form of an attached cheque. I did not believe it until the cheque cleared which it now has. I have some questions: 1) Should MBNA pay me interest on top of this for keeping this money over the period of time. I think I am right in saying that if this was resolved in court then I would be due 8% straight interest on the refunded amounts. 2) How do I check if I am due refunds from Natwest, LLoyds, Egg? I did not receive anything regarding a sum of notice in arrears at the time as far as I am aware. - What criteria do they need to send the notices of sum in arrears? I have read on line that many of the top institutions failed to do this but could not get any real details. - Does this apply to credit cards and unsecured loans? - Can I do anything to chase this with them or is it a case of wait and see? I have found the odd article on this on line but am struggling to see if I have a case and if so what I need to do. I have rung Natwest and LLoyds and also went into the branch - but all useless and they had no information on NOSIA refunds or investigations. Anyway - it would be fantastic if anyone out there can help me on this. Many thanks and appreciation in advance Charles

- 5 replies

-

- arrears

- lloyds bank

-

(and 7 more)

Tagged with:

-

Hi everyone I hope I've posted this in the correct forum as I'm back again just looking for advise and general pointing in the right direction. I've received a letter (PDF attached) and presume at this stage all I can do is send a CCA request to Link? Do I send a SAR to Link and MBNA or just to MBNA as they were the original creditor? Regards Suss Link.pdf

-

Hi all, I've now received a copy of my agreement /statement from Arrow after 10 months of CCA request arrow are going to contact a third party to manage the account (letter uploaded). IF Enforceable what could I expect next? With my other account Capital One I make a payment every month and not heard a thing Thanks for any advise

-

Name of the Claimant - Arrow Global Guernsey Limited Date of issue – 13th October 2017 What is the claim for – 1.The Claim is for the sum of £5984.20 in respect of monies owing by the defendant on a credit agreement held by the defendant with MBNA under account number XXXXX under which the defendant failed to maintain payments. 2. A default notice was served upon the defendant and has not been complied with. 3 The balance owed was assigned from MBNA to the claimant and the defendant has been notified by letter of the assignment by letter. What is the value of the claim? - £6494.20 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? probably around 1999 and originally with Alliance & Leicester. Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. ARROWS Were you aware the account had been assigned – did you receive a Notice of Assignment? I may have done but don't remember for sure. Did you receive a Default Notice from the original creditor? Again possibly, but I don't remember clearly. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year went through a period at a different address and also had a lot of unopened mail...so as before, I can only say these may have been received. Why did you cease payments? The company I worked with at that time, went into Liquidation and my income was then drastically reduced and hence I could not keep up with the payments on my Cards and loan. The situation was impacted further, by a couple of heart attacks and another since. What was the date of your last payment? As far as I'm aware, not since around 2008. I had been making payments to some creditors in 2015, but I don't recall this being one of them. Was there a dispute with the original creditor that remains unresolved? No, I don't recall a dispute with the original creditor. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes, first in 2007 to Alliance & Leicester..... this in respect to the specific debt detailed here and also other debts/loans on cards and a bank. This is something I arranged myself with each of them - first stopping all the substantial PPI premiums I was paying on each; requesting the interest to be frozen [agreed] and then paying a percentage of the usual monthly payments, pro rata the size of each debt. Assuming MBNA took the card over from A. & L. at some point, I don't recall having had any communication with them at all. This is a new CC claim I've received from Arrow Global, regarding an old MBNA/Alliance & Leicester credit card. The questionnaire completed below.....as had be requested in another thread I was being helped with. The "claim for" details provided are as written on the claim form. Thank you.

-

I've been sorting through some old paperwork and have realised I had a Link MBNA debt that I defaulted on in 2008 for £8,000 ! Naturally this has long gone from my credit file, but Link still have my old address. Is there still a danger of a backdoor CCJ after this long? The last payment was made in 2008 so it is certainly statute barred. It's also a pre 2006 agreement. Should I ring Link Finance and give them my current address? or let sleeping dogs lie on this one. I'm about to buy a house and don't want someone knocking on my door with a charging order at some point in the future because I let a perfectly defendable CCJ happen.

-

Hi, My partner has been paying off a nominal monthly amount to Link Financial since the card debt was sold to them by MBNA. Sent Link a CCA in June but have had no reply. Sent a SARN request to MBNA and had a reply with only the attached request form copy and a second page with the terms and conditions. From reading other posts I think that this is invalid and therefore unenforceable. Would one of you more experienced people be good enough to have a look at give me your opinion. It seems to refer to paragraphs that don't exist and there is no lending limit or interest rate shown. We have since (last week) written to Link re their failure to supply a valid CCA and await their response! What is our next move please? L CCA Request Load.pdf

- 3 replies

-

- application

- mbna

- (and 4 more)

-

Today I received a white county courtclaim form from northampton for the MBNA Credit card 2008 – now with PRA GROUP - £2723 – defaulted 2012. On 12th Nov PRA Group wrote to me in response to my returned PAP form where I stated I dispute the debt because I need more documents or information Specifically I wrote: I need a copy of (1) the Default Notice, (2) the Notice of Assignment, (3) a complete set of statements detailing exactly how the debt has accrued detailing: (a) All Transactions, (b) Any additional charges, be them by the original creditor or you PRA Group (UK) Limited, the debt purchaser or any predecessor, © Details of all contractual interest added by whom and on what date, (d) List of ALL Payments made toward the Agreement. The PRA group letter on the 12th said, that in response to my query (PAP form) please find enclosed copy of statement of account from MBNA and a copy of the credit agreement (was an online application 2008) plus statements from the MBNA credit card (virgin). The letter goes on to say that they will put the account on hold for 30 days until 12th December to allow sufficient time to receive the letter and contact them. Today I received the county court claim form. I don't know what to do now? Please advise. Should I try to a negotiate an offer with PRA or will I have to pay in full somehow! I don't want a CCJ registered.

-

I have been in writing to Drydensfairfax Solicitors back in March 2016. They are acting on behalf of their client Max Recovery Limited who purchased a debt. I had previously asked them for a credit agreement and copy of the deed of assignment. Back in March 2016, they wrote to me in reply. They provided me with a basic office copy of a credit agreement. They claimed that their client, Max Recovery, had provided them with a copy deed of assignment, and that they had attached this to the document for my perusal. Upon checking the documentation, this assignment was not present as stated in the covering letter. For the past year, I have had no response from Drydensfairfax. Today, I checked my credit agreement, and I am horrified that they have placed a default on my credit file on the 30th May 2017. Under section 87(1) Consumer Credit Act 1974, I have NOT been provided with a written default notice prior to this default being placed. Can anyone please advise me what to do next as I feel that the default is illegal!? The other concern is that Drydens should not have put the default in their name as the debt belongs to their client Max Recovery Limited. Am I correct in thinking Drydens have done this default incorrectly it should be their client!?

- 142 replies

-

- drydensfairfax

- legit

-

(and 7 more)

Tagged with:

-

Hi CAG Team, Name of Claimant: IDR Finance UK Ltd Claim Date: 07 June 2017 What is the claim for: 1.The claimant claims the whole of the outstanding Balance due and payable under an agreement referenced 412XXXXXXXX and opened effective from 12/12/2007. The agreement is regulated by the Consumer Credit Act 1974, was signed by the Defendant and from which credit was extended to the Defendant. 2.The Defendant failed to make payment as required and by 30/11/2011 a default was recorded. 3.As at 29/02/2012 the Defendant owed MBNA Limited the sum of £14,094.67 by an agreement in writing the benefit of debt has been legally assigned to the Claimant effective 29/02/2012 and made regular upon the Claimant serving Notice of Assignment up the Defendant shortly thereafter. 4. And the Claimant claims - 1.£14,194.67 2 .Interest pursuant to Section 69 County Court Act (1984) at a rate of 8% per Annum from 29/02/2012 to 06/06/2017 of £5720.54 and thereafter at a daily rat of £2.98 to date of judgment or sooner payment. Date 06/06/2017 What is the value of the claim: £20,806.89 Has the claimant included section 69 interest: Yes Is the claim for: Credit Card When did you enter into agreement: December 2007 Who has issued the claim: Debt purchaser Were you aware the account had been assigned: Yes Have you been receiving statutory notices: Yearly Statement of Account from Link Financial Why did you cease payments: Made redundant at the time, debts spiralled out of control What was the date of your last payment? July/August 2011 Was there a dispute with the original creditor that remains unresolved: Yes, charges and PPI Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan: Yes, cancelled card immediately and started the process to sell my debt. What I need to do: Requested CCA from Link in 2012, no response but credited fee to my account. Request CPR 31.14 from Kearns. Respond to claim online mark "I intend to defend all of this claim" Unfortunately I find myself calling on your services once again. A couple of years ago I had a fight and lost against MKDP LLP -BC. It was far from the end of the world and without going into detail has all but gone away now. I have today received a claim out of the blue from Kearns acting for Link on an old MBNA Credit Card that was fast approaching SB (8 months) Like most posts regarding Link I received a statement of account once a year which I chose to ignore. In the early days they used aggressive telephone tactics but that didn't phase me and it soon became this yearly statement and nothing more, until today. As always your assistance with defending this claim would be much appreciated. OMH Kearns MBNA Claim.pdf

-

Morning, folks. I'm in a particularly odd and confusing situation so any assistance in clarifying where exactly I stand would be greatly appreciated. In 2010 I took out a credit card with Virgin Money. In 2012 I defaulted on this due to financial difficulty and depression. I do not remember receiving a default notice from Virgin Money. It's possible I received a default notice from MBNA, but I closed an account with them in 2006 (I have the letter) so would have discounted it. In January of 2017 I found out a CCJ was registered against me with Hillesden Securities as the claimant. I did not receive any correspondence prior to it being registered, as I was not living at the address the CCJ is registered at. As soon as I found out about the CCJ (through a mortgage adviser telling me!) I attempted to contact Hillesden. This led me to DLC, which led me to Cabot, which led me to Mortimer Clarke. I spoke to a representative of theirs on the phone, explained the situation and asked if the judgement could be set aside. They said no, and that the best I could do was satisfy the CCJ. After some digging online I sent an N244 to my local court and received a hearing date. Mortimer Clarke did not show, the judge decided they hadn't been very helpful, and duly set aside the judgement. Happy days. This was earlier this month. Today I found a letter sent from Mortimer Clarke 4 days before the hearing, with the claimant now being ME III Ltd. The letter states they agree to the setting aside but that a full defense should be submitted within 21 days. They attached a draft order, assuming that the judge would made this order. She didn't. What happens now? Given that the draft order was not formalised, I'm assuming I do not have to submit any further defense (which I already submitted in full as part of the N244). And what are Mortimer Clarke likely to do when they receive the actual order from the court? Many thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.