Showing results for tags 'restons'.

-

Hi, hope someone can help. This is in regards of a 'stayed' case from August 2016 Via the County Court Business Centre. Cabot/Restons At the time I requested documents those being: 1. Agreement/Contract 2. Default Notice 3. Assignment These never arrived within the period of 12 days, then a further 30 days. I went on to deliver my defence and ultimately the case was 'Stayed' Present day: I have just received a photocopy of a credit agreement with spreadsheet statements from Cabot who now which to 'discuss the options available for this account.' My initial concern is the photocopy of the agreement, in that it has clearly had something stuck over part of the section 'YOUR SIGNATURE REQUIRED' with what clearly looks like a faxed signature of who ever was signing off on the agreement, although I am unsure if this is normal practice? Also the spreadsheet is very basic with no opening balance/closing balance or written indication to the amount of initial credit and whether this was increased/decreased over time during the period of the agreement? Per my original request during court proceedings they have not supplied 'Default Notice', 'Assignment', although I'm sure this would be a request I would make again should the 'Stay' get lifted and it goes back to court. Any help in this matter would be most appreciated. Thank you.

-

Hello, As seems to be the case with a few people on here and other forums, I have recently received court papers from Arrow Global on what I assumed was a written off (or statute barred) debt. I am now aware of the standard template and answers I need to give - but I did just have a quick "pre question" - it would appear that I made a "rogue" payment on this account (not to Arrow - but to a different DCA) in 2012 - I had a Standing Order set up on an old bank account - forgot about it - and happened to have enough money in account to pay it - other than that - the previous payments were made in 2010 - I know this is still within the 6 year period - however, it does seem a bit confusing as to "last payment/contact" concerning a debt - I thought I'd read somewhere it was more a case of when a payment was "due" rather than when an actual payment was made? Also - I'm assuming if I made an agreement to repay in instalments with a DCA, then new "due dates" would have been set. I really haven't had any correspondence about this debt for several years - it has not (and is still not) showed up on my noddle credit report. The claim is for a hefty sum of money (more than £10k!) - and I really am in no position to pay it off - even over 5 years. I would appreciate some advice to come to my best case scenario. I will post up the answers to the questions in the next day or so when I get a chance. Many thanks in advance for any help. thanks b799

- 149 replies

-

- arrow

- attachment

-

(and 3 more)

Tagged with:

-

Hi, here I am again... .6 years ago I had a breakdown, got into about 35K of debt, 3 CCJs which 1 is a charging order and this has just popped up. I am DESPERATE not to get another charging order so want to negotiate with them. I don't have the original CCJ nor any of the paperwork from Debenhams. .this debt has been passed round various DC over the years, all of which I've ignored.. but this I think Restons will take further.. I am on ESA in the support group with no chance of returning to work. My dad will help me, so I want to offer then 10% but since this forum has helped me on others, I've come here first for advice! this is the letter Re: Arrow Global Management Limited Account number xxx Original creditor and Product type : Santander – Debenhams Store Card We act on behalf of Arrow Global Management limited who has instructed us to write to you concerning an outstanding debt due to them. Our client has obtained a CCJ against you. The balance outstanding to our client is £1492.77 Our client would prefer t reach an affordable repayment arrangement with you to avoid further legal action. Please contact us on 000000 to discuss the various repayment options available. To help us understand your overall financial position and to determine how much you are able to afford, we enclose a financial statement for you to complete and return to this office. Alternatively please visit our website at www… .to complete a financial statement online. We would like to discuss your financial position with you to establish how you can repay this debt. Alternatively you can also seek free independent advice from one of the organisations detailed on the reverse of this letter. It is extremely important that you contact us to discuss your situation. We can only assist you in resolving this matter if you get in touch. Please contact us no later than Wednesday, May 24, 2017, failing which we have instructions to enforce the outstanding Judgement debt. Please note that there may be an opportunity for you to discharge your liability through a short term settlement payment. If you think your financial circumstances do allow you to pay a lump sum, please telephone us on 0000to discuss this. We must forewarn you that you will be asked to provide full details of your financial circumstances when speaking to us on the telephone. Without that information our Client cannot accept a short term settlement as it is important that any such payment does not have an adverse impact on your financial circumstances. If a settlement is reached and subsequently paid, our Client will update your credit file at the credit reference agencies within 35 working days. Your credit file will show that the account has been partially satisfied. The record will remain on your credit file for 6 years from the date of default. Yours Restons… any advice on my best way forward? thanks

-

Hi I received some excellent advice from CAG after I had some major employment and debt issues between 2008 and 2011 which resulted in a number of my accounts defaulting, once again I am in need of assistance please. One of the alleged debts I defaulted on was in respect of a BOS Credit Card, under duress I continued paying £1 per month until August 2016 when it was sold to Cabot Financial. The balance claimed is around £4k. Cabot quickly passed the account to Restons who wrote in February 17 threatening legal action to which I issued an unsigned CCA request together with a £1 postal order. Restons rejected the CCA request as it was unsigned, therefore I signed it and resent it with a letter as follows; ___________________________________________________________________________________________________ Further to your letter dated XXXX in response to my second formal request for a copy of the original credit agreement for your reference shown above. I am somewhat surprised at your request considering you have happily sent personal information to my address if you are now uncertain that I am the correct person. For the avoidance of doubt there is no requirement under the Consumer Credit Act 1974 nor the Data Protection Act 1998 for my request to you to be signed. Never the less, I return to you now signed my original letters dated 23 March 2017 and 28 March, together with Postal Order: for £1. This postal order represents the fee payable under the Consumer Credit Act 1974 in respect of my request for a copy of this credit agreement and a full breakdown of the account including any interest or charges applied and must not be used for any other purpose. I understand that under the Consumer Credit Act 1974 (sections 77-79), I am entitled to receive a copy of any credit agreement and a statement of account on request. I understand that, under the Consumer Credit Act 1974, creditors are unable to enforce an agreement if they fail to comply with the request for a copy of the agreement and statement of account under these sections of the Act. For the avoidance of doubt, an original signed Consumer Credit Agreement is just that; not an application for credit and not a reconstructed or micro-fiche document from other sources but indeed the original signed document purporting to be signed by myself. Please note that until such times as a legally enforceable, original Consumer Credit Agreement can be produced and a copy sent to me by return, then this letter is not an acknowledgement of debt and this account will remain in an unenforceable state in line with s.127 (CCA1974). I look forward to receiving the documents requested within the next 12 days. ___________________________________________________________________________________________________ I have also sent an unsigned CCA request to Cabot which has been acknowledged and is in process. I have today received the attached letter from Restons advising legal action is commencing, although they have stated the Postal Order and letter has been returned this was not included in the envelope. I have contacted Royal mail to obtain confirmation the Postal Order has been cashed. I would really appreciate guidance as to how I should respond as Restons appear to have no inclination to provide a copy of the CCA and appear happy to proceed to court on this basis. Many thanks Bozalt IMG_1942JPG.pdf

-

Dear CAG Restons have written to me: That they have been instructed to review my payment plan. That I should provide my financial information and breakdown again. That they want to determine if the payment arrangement I have with them is affordable. Please advise, if I am correct in understanding: a. I am required to remain compliant to the actual order by the court. (in the court order it states, "the claimant had objected to the rate of payment you have offered. The court has therefore decided at the rate which you should pay.") This is via monthly instalments of £5/month until the debt is settled. b. That I do not have an "arrangement" so to speak, with Restons. I have an order from the court. The background information is self-explanatory in the reply I have sent to them, as copied below. Dear Sir/ Madam Your ref: xxxxx Amount claimed: £15541.85 Letter dated xx March 2017 by Miss H xxx Further to your letter as attached: 1. Please note that my understanding is that you had obtained a CCJ and the court had ordered, directing me to pay £5 a month until this debt is settled. 2. This was ordered at CC Business Centre, Northampton on the x of Feb 2016, for a total sum of £15541.85 including interest and court costs, owed to your clients. 3. I have attached the copy of the order for ease of reference. The claim no. is xxxxxx 4. Yourselves had further obtained a charging order against my home which I had not contested. This is dated x April 2016. (I do not have or own any other properties.) 5. I have remained compliant to, as directed by the court and I understand, that the onus is on me to continue to make the payments at £5 per month. 6. Please explain, why the outstanding balance is shown to be greater than that on the court order. I have made payments to cover the payment due date, of the 28 of Feb 2017 (13 payments x £5 = £65), prior to when you have written to me, with £15709.41 as the balance amount in your letter dated the 10th of March 2017. I am not in agreement with the outstanding sum you state. 7. Please also note this as a formal complaint. In your letter dated 10 March 2017, you have stated and informing me about legal/recovery actions, even though I have remained compliant with the court order. This has caused me a lot of distress and is now affecting my health to an extent, that I am having sleepless nights. I have experienced extreme anxiety. I have tried to call Miss H xxxxx who is named on this letter, numerous times on the telephone number 01925426100 and have also left a message to return my call, but to no avail. 8. I will continue to make the monthly payments of £5. 9. Ref offer of a discounted settlement: a. Further to your second letter dated the 13th of March, 2017, with a discount of 20% available to me, against the outstanding sum, via three equal monthly instalments of £4089.30, please be advised, that I am unable to take up this offer. b. However, if you were to accept a sum of £1555 to settle and close this account, I may be able to get some help from a relative abroad. I may be able to make this payment before the end of April 2017. I shall await your confirmation on this. c. Another debt collection agency had offered to me a discounted settlement, in February 2017 for £400 against an actual balance of £4000. I did manage to settle this account with a plea to reduce my associated stress and burden, to a relative abroad. I can attempt to do the same, for a sum of £1555 to settle the account with MFS portfolio, if you were to advise so. Please note that there will not be a time limit for I to repay such a cash advance to me. Therefore, it will not add to my current level of stress. Your Sincerely

- 24 replies

-

- county court

- mfs

-

(and 1 more)

Tagged with:

-

Good evening, When i was a lot younger i ran up quite a bit of debt which became unmanageable once i had children and cost of living increased. paid into a DMP for a few months and then defaulted this was in April 2013. I have pretty much ignored all contact as no one was taking legal action. I have had some discussions with Restons over the phone about this debt as i tired to agree a repayment plan. but could not stick to it as it was un affordable to me. Today i have received a CCJ claim from the for a total of £5131.05. The debt is from an MNBA credit card which i took out sometime around 2005/06 i think. The POC on state that the original debt is from MBNA "dated on or about Feb 2007 and assigned to claimant on Dec 2011. It then list the following two items: 19/07/28 Default balance 5151.05 19/09/2018 Pos Refrl CR -20 That is all that is on there. I have done a lot of reading around and am thinking of defending this claim but my head is spinning a bit with all the different threads i've read. Am i right in thinking that they probably dont have the CCA? I don;t believe that they have followed pre-court protocols as i have not received a letter stating they were due to start legal proceedings. Do i need to now request this information under CPRs and then defend the case accordingly? Am i right that if they can not produce the cca they can't enforce the debt? Thank you in advance.

-

Arrow/Restons Claimforn - old M&S credit card 'debt'

molly2 posted a topic in Financial Legal Issues

Name of the Claimant ? Arrow Global Limited Date of issue – 15/09/2016 What is the claim for – The Claimant claims payment of the overdue balance due from the Defendant under a contract between the Defendant and Marks and Spencer Financial Services PLC dated on or about Jan 27 2005 and assigned to the Claimant on Feb 12 2013 PARTICULARS a/c no - xxxx xxxx xxxx xxxx DATE ITEM VALUE 29/01/2016 Default Balance 6000.00 Post Refrl Cr NIL TOTAL 6000.00 What is the value of the claim? £6600 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? Before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Account assigned to Arrow Global who issued claim Were you aware the account had been assigned – did you receive a Notice of Assignment? I believe so Did you receive a Default Notice from the original creditor? I do not know Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Received an Annual Statement in 2016. Not ever received a Notice of Default sums Why did you cease payments? Ran out of money so stopped Debt Management Plan What was the date of your last payment? June 2014 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes I was in a debt management plan from 2008 to 2014 I submitted a CCA request earlier this year, when Arrow transferred the account to Restons, and received the following back : '&More' Credit Card Application form - dated January 2005 (see attachments) Credit Card Agreement - dated October 2013 Credit Card Agreement Terms - dated May 2015 Statement of Transactions - October 2012 to November 2012 I have acknowledged service and said I would like to defend all. I will send a CPR31.14 to Restons. Is there anything else I need to do prior to preparing a defence ? JAN2005 S78Page1.pdf JAN2005 S78Page2.pdf- 25 replies

-

- arrow

- claim form

-

(and 2 more)

Tagged with:

-

Hi I wonder if you can help... I have an outstanding debt of £798.22 which was an MBNA CC from 2011 - this has been passed round collection agencies since then and I haven't made any payment or acknowledged the debt till Nov last year. I am currently not working, been on ESA for years and have very little prospect of returning to work. My dad offered to help me clear my debts so I can move into an adapted rented property . I wrote to Restons and offered them 10% of the outstanding debt and explained I had a chronic health condition. They replied a month later rejecting the 10% but asking for supporting documents . I replied on 31/12 sending letters from the hospital and haven't heard anything. Meanwhile other creditors have been accepting 10% full and final settlement offers.. my post has just arrived which included a Claimform from Restons - I'm livid as I had been trying to resolve this. The debt collectors before Reston were dlc who offered me a settlement of £199.56 but sold the debt on Can I appeal? I have tried to call Restons, even with a named case manager, I can't get through I am so so frustrated and upset by this thanks for your help

-

My wife has been getting calls and texts from Cabot for weeks telling her to call them about a matter they wish to discuss, but they ask for her grown-up daughter's name. She has happily ignored the calls and texts, nothing to do with her of course. A letter arrived recently advising that Restons were going to make a claim in court for over three and a half thousand pounds, not a trivial amount so they may actually try. BUT, the HFC Bank account was started in 2006 and defaulted soon after when my step-daughter lost her job. The letter states the account was terminated in January 2008. I think she made some movement to pay via CCCS but that fell through long ago. As far as she is aware, nothing has been paid on this account for the last 7-8 years and she's not contacted anyone about it in that time. The letter says the debt was assigned to Cabot in October 2017, no mention of where it was up until then. She does not have any paperwork relating to the account but that's beside the point, she has had no default notice that she is aware of and does not know when the last payment was made either, it's that long ago. Does she just write to them and say 'statute barred' and see where it goes from there or is there some way she can get the info she needs to prove that? I don't think she's ever asked for a credit report but the concern is that will just give the DCA her up to date address, phone number and so on. I've read dx100uk 's defence note in https://www.consumeractiongroup.co.uk/forum/showthread.php?477307-Arrow-restons-claimform-old-Vanquis-Card-debt-statute-barred&p=5031789&viewfull=1#post5031789 amongst other threads, got to admit a lot of it goes over my head these days, I'm well out of the loop since I used to be active on here. The letter says she has to pay in full by July 26th 'or else'... They also sent a statement of earnings form.

-

I have been reading this forum for advice so think I know what to do but I have a few questions. Yesterday I received a 'Notice of Warrant of Control', from my local county court (Chester) asking for £536 or the bailiffs will call 4th Feb. It is for not paying a CCJ judgement from Restons (originally Next). I emailed them in May last year when they got the CCJ asking to pay £15 a month and asking for bank details, no reply and now this. I have other CCJs/debts so never chased up at the time, tbh head is a mess and I forgot. My questions; 1 - Is the debt now owed to bailiffs and not Restons, so I can't speak to them? or should I ring them and ask for a hold too? 2 - Is N245 the best option? 3 - Is the Notice or warrant of control the same as a notice of enforcement? Panicking over a visit, I have kids that I don't need to see baillifs.

-

I have a debt with citi financial going back to about 2008, for around £3k on a credit card, i have been paying £1pm stopped when i moved house, the debt company Cabot have instructed Restons to issue court proceedings against me in order to get a charge put on my house which i now own outright. I have asked if they will accept payments of £40pm to prevent court action but they have replied saying that unless i repay the full amount before the 8th December they will issue proceedings. Is it worth getting a CCA request asking for a copy of the agreement to see if it is unenforceable in any way? Or is there any other strategy people know about to prevent them getting a charge on my house and a CCJ. regards Zaggacom

-

Hi Everyone Back again as Caboot are back. They appointed Marrlin who wrote to me asking for payment in full on a debt that I believe to be Statute Barred. Last contact from Arrgos Card Svces was in 2006 when they sent a notice of assigment. Payments continued to Moorcroft, unfortunately I cannot find the paperwork regarding this issue, it may be in attic. which I will need to access later today. I received letter from Reestons yesterday, the letter was dated 7 days prior to me recieving it. I have to contact them by next Tuesday, if I do not they submit a claim to the county court. This now leaves me less than 5 days to deal with this issue. Do I advise Reestons that I believe this debt is statute barred? Or that that I dispute the debt? or should i ask them to provide a CCA? I have asked a debt collector in past to provide a CCA which they could not do. I beleive I should now send a SAR to ARrgoos card svcs, is that correct? I think that I should also ask Caboot to provide a CCA? is that correct? As this is such an old issue I am not sure where to start with it, and as I have very little time to respond really need to know what to send to REsstons. Whatever i need to send will have to be sent Monday at the latest. Poppay

-

Hi, I have an old credit card debt dating back a few years - I was too ill at the time to deal with it and was taken to court and ended up with a CCJ. I wasn't able to make the payments the court told me to pay but Restons agreed an arrangement of a minimal payment each month to run alongside the Judgement. I have paid each month and never missed a payment. Today I received a letter from them with an 11-page questionnaire about my finances and other personal details - if I do not reply within 7 days they say the arrangement will be cancelled and they will advise the client to begin recovery options including legal enforcement without further notice. They have also stated that I could make a settlement payment and discharge my liability - no hope of that - I am penniless! I haven't defaulted on the agreement and my financial situation is unchanged - what should I do? I never agreed to the amount I was told I owed as much of that was fees and interest that had been added to the account for late payment, admin costs etc. The company knew I was ill and had to give up working but continued to add fees anyway until it was sent to a DCA.

-

Hello,this is my first post and I am seekng advice. I received a letter of claim from Restons. Following on from the advice given to others in the same circumstances as me, I sent a CCA request to Cabot and downloaded the PAP reply form, from here and filled it in. I followed the instructions on post 6 on the PAP thread. Well hubby did as I couldn't get to type in pdf format. I have receved a reply from Restons but don't understand why they are askng me to explain on a separate piece of paper. I thought I had? restons reply 13 04.pdf

-

Hello I am writing on behalf of a friend regarding an outstanding debt (overdraft) with Halifax Bank. Since 2015, this has gone through Wescot Credit Services, Cabot Financial and is now with Restons Solicitors. They were out of work for a time but are now employed and wondering how to handle the Letter of Claim sent from Restons on behalf of Cabot. They are asking for payment of the sum £1,261 by 18 May and this just isn't possible. They say if it's not paid they have instructions to issue a Claim in the County Court for the full balance plus fees and costs. They then say Cabot is prepared to accept payment by instalments and ask that a financial statement be filled-in and returned by 18 May - but they don't want to engage with Restons in this way. Is this likely to escalate to County Court any time soon (this is the first letter received from Restons) or will they likely come back with some sort of offer? Do you have any advice on how to proceed. Thank you to everyone who takes the time to reply

- 23 replies

-

Hi Guys I have received a letter of claim from Restons solicitors for a debt bought by Cabot financial. I have made a complaint to the financial ombudsman that the original creditor ‘ a credit card company ‘ refused to deal with several mistakes on my account over a year before Cabot bought the debt and simply told me to deal with the 3rd party debt collectors. The ombudsman said that as they were still the legal owners of the debt they had a duty to deal with me and not pass the buck to the debt collectors. The amount Cabot are claiming is for £1800 when the correct amount after deducting the disputed amount is £1150. My question now is, should I contact Restons who have sent me a letter of claim and say they will start proceedings on 18 05.2018 or Cabot or both and tell them its a disputed amount sold by the original owner of the debt and I have now made complaint to the FOS for which I have received relevant paperwork and a reference number. So would they like to put proceedings on hold whilst this matter is dealt with by the FOS as I see no point in starting court proceedings when they are trying to claim the wrong amount.I I don't dispute the lower figure. So far I have made no contact with either company.

-

I got a pre action protocol letter with a form, from Restons for a next account which has been passed to Debt Managers (Services). I ticked box I and requested a copy of the contract, statement of account, details of any administrative charges, copy of notice of assignment and a copy of the default notice. I received a reply from them providing with a few details; date account was opened, address used (which is incorrect btw), last order date, last items ordered, last payment date and amount. The letter says I have not provided any information as to why I don't know if I owe the debt, and asking me to confirm 'why you are unsure if you owe the debt so that our client can understand your position'. It reads like a template reply to me, but I am unsure how to word my response. Do I need to give a reason why I am unsure under the pre action protocol, or should I write back simply asking them for the information I originally requested?

-

Name of the Claimant ? Cabot Financial UK Limited Date of issue – 17th January 2018 What is the claim for – 1.The claimant claims payment of the overdue balance due from the Defendant(s) under a contract between the Defendant(s) and Tesco Personal Finance Plc dated on or around Oct 20 2012 and assigned to the claimant on Aug 14 2017. Particulars are a/c no xxxxxxxxxxx DATE 11/12/2017 ITEM Default Balance Value Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ? I received a PAP and responded with a CCA (postal order etc) What is the value of the claim? Between 3 and 4 k Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? After Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Assigned to Cabot who are the claimant. Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes probably, didnt keep letters, was in a bad way. Did you receive a Default Notice from the original creditor? I believe I did. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? I do not recall getting these. Why did you cease payments? Financial hardship, Mortgage arrears accumulating What was the date of your last payment? Some time in 2014 Was there a dispute with the original creditor that remains unresolved? Not that I am aware of Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? NO unfortunately. Hi all, thanks for being here for those of us who are having a hard time.. ..Before Xmas (so that postal delays were at the maximum) I received a PAP from Restons/Cabot to which I responded with the CCA according to the forum guidelines. Within a day or two of this I received a Claim Letter from Restons I am trying to prepare the CPR31 but the particulars dont really amount to much so what should I request in respect of the evidence they may be presenting? The clock is ticking and I am yet to post the Acknowledgement of Service. The claim also doesnt give a court 'name' as such, just a county court business centre and a number. Is this correct? Thank you for any help/reassurance you could give me.

-

This is for an old overdraft that may or may not be statute barred but no one will reply to me to tell me! Court papers issued, filed defence asking for all paperwork etc and proof not statute barred, Northampton then asked for some kind of form to be filled out where Restons asked for a three month stay and its now been transferred to local court and I attach what the Judge has asked for. Need some advice on what I do as this arrived yesterday and dated 26th so I guess 5 days service plus 7... .Interesting to see that Judge has a) Referred to mediation and Restons have previously put on their form before transfer that they wont enter into mediation. b) Judge has asked for us to liase, but Restons wont enter into correspondence with me at all c) The court fee is nearly as much as the claim Hopefully this will help, perhaps a mod can delete the two above please as not to confuse issues

-

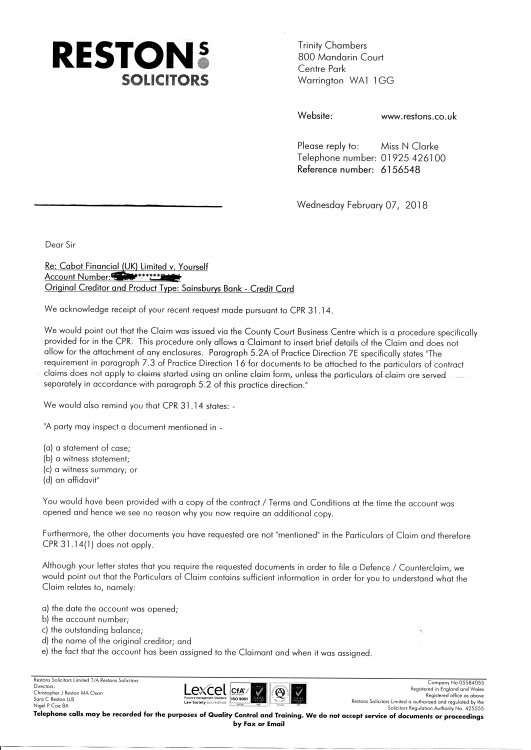

Cabot/Restons claimform - sainsbury credit card debt

andymr posted a topic in Financial Legal Issues

I've had a MoneyClain from the Northampton BC, Sainsbury's Credit Card/ Cabot - Restons Solicitors). I have acknowledged receipt through MCOL online and I'm filing a defence today. I sent a CPR 31.14 asking for the documents mentioned in the Particulars of Claim. I have this morning received a letter from Restons stating the reasons for not sending me the required documents. I did try to speak with Restons when I first got the claim but their position was pay up now in full or else. Pretty unhelpful and somewhat Cavalier. I must send my defence today but haven't got any documents from the Claimant.- 28 replies

-

- cabot

- cca ilegible

-

(and 3 more)

Tagged with:

-

Hi Ive just received a letter from Arrow stating that my debt with them (which i did not know i had) is now with Restons, I just called restons to find out what the debt was for and was told it was HSBC but passed to them from Arrow, i disputed the debt and was told that they would take legal action, I offered a settlement of £900 as the total of £1750, but it was declined Any advise please Thank You

-

Hoping someone can give me some advice here. Arrow Global and Restons have issued me with Court papers for an HBoS debt which goes back to 1997! Over the past 10 years I have requested the CCA and have SAR'd other DCA's but the CCA has never been sent, only an Application Form with retyped up-to-date Terms and Conditions. Now, of course, Arrow Global have applied for a CCJ. I don't think I would be able to go to Court myself (as a pensioner I don't have the funds for the trip to Northampton for one thing) but do you think I should dispute it? And if so, how?? Regards Chickenlegs

-

Hi please can you help me, I have received a court claim from Arrow from Northampton Court, for the claim of £4900, issued 8 days ago was a bank loan issued opened up in 1998, , last know payment was 2008/9. I have not acknowledged this debt, or any comms from me to Arrow I have filed online that I will contest this claim, hopefully on Limitation Act 1980 can I now send off a CPR18 request to their solicitor ? what is should I be asking for in the CPR 18 ? All of the below 5 details ? 1.The agreement/contract, including the specific Terms at the point the alleged Agreement was made and any subsequent changes. 2.The deed of assignment 3.The notice of assignment 4.The default warning letter 5.The default notice (CPR 31.14 Request only worth doing if debt is over 10k. I may have this totally wrong..) I have read that some people think that a CC Agreement request letter is not really useful (sorry, I cannot remember their reasons for stating this) Is it worth it your opinion to request CCA from the DCA? shall I ring up my old bank and ask them for the last payment date ? thanks for all help in advance

- 90 replies

-

- application

- arrow

-

(and 7 more)

Tagged with:

-

Hello. I am new to the forum and need some advice/help. Received a letter from restons Re an old credit card debt seeking payment and issuing a county court claim against me. It should have been statue barred Dec 2017 but apparently I have made payments. It is possible as this card relates back to when I got divorced. I was advised to send a practice direction letter which I did and received a response from them. Can someone please advise what this means and is it worth defending in court. My friend has offered to pay it off for me as it is making me stressed. I have a mortgaged house and a car which I have been told they will put a charge on. Is it worth paying this off or defending and if I did what are the potential court costs, would it add a lot to the debt. Any advice would be appreciated. have until 5th Feb to respond. docs1.pdf

-

Help please. I have received a CCJ claim pack from Rentons solicitors in regards to a apparant debt linked to a overdraft I have no knowledge of. I have answered the default questions below. Can someone please offer advice / assistance on what I should do now please. I have completed the Acknowledgment of service on the money claim website so the clock is ticking now. Please help Name of the Claimant ? - Restons / Arrow Global re: Lloyds bank overdraft Date of issue – top right hand corner of the claim form – this in order to establish the time line you need to adhere to. Date of issue : 04/04/2017 What is the claim for – the reason they have issued the claim? - The claimant claims payment of the overdue balance due from the Defendant(s) under a contract between the Defendant(s) and Lloyds TSB dated on or about Dec 30 1994 and assigned to the Claimant on Nov 20 2013 PARTICULARS a/c no xxxxxxxxxxxxx DATE 10/02/2017 ITEM - Default Balance VALUE - 4500 Post Refrl Cr - NIL TOTAL - 4500 What is the value of the claim? £4500 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? - Appears to be a overdraft for a account I have not used since 2011. When did you enter into the original agreement before or after 2007? Yes - appears to be Dec 30 1994 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Appears to be debt purchaser - Arrow Global Limited. Were you aware the account had been assigned – did you receive a Notice of Assignment? No - I have not received any documentation in regards to the debt - didn't know it existed before receiving the CCJ claim pack as I was working out of the country since February 2011 Did you receive a Default Notice from the original creditor? No - Left the country in 2011 so have received no communication from Lloys of anyone in regards to this debt. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? - As above - Nothing received. Why did you cease payments? - Left the country - left account open but was completely unaware of any outstanding overdraft. What was the date of your last payment? - Nothing paid into account or account even used since Feb 2011 Was there a dispute with the original creditor that remains unresolved? No dispute. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan - No communication at all ever had. What you need to do now. If you have not already done so – send a CCA request to the claimant for a copy of your agreement (except for Overdraft/ Mobile/Telephone accounts) - This appears to be for a overdraft - shall I still send CCA ? Thanks in advance for any advice guidance given.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.