Showing results for tags 'attachment'.

-

Hello, As seems to be the case with a few people on here and other forums, I have recently received court papers from Arrow Global on what I assumed was a written off (or statute barred) debt. I am now aware of the standard template and answers I need to give - but I did just have a quick "pre question" - it would appear that I made a "rogue" payment on this account (not to Arrow - but to a different DCA) in 2012 - I had a Standing Order set up on an old bank account - forgot about it - and happened to have enough money in account to pay it - other than that - the previous payments were made in 2010 - I know this is still within the 6 year period - however, it does seem a bit confusing as to "last payment/contact" concerning a debt - I thought I'd read somewhere it was more a case of when a payment was "due" rather than when an actual payment was made? Also - I'm assuming if I made an agreement to repay in instalments with a DCA, then new "due dates" would have been set. I really haven't had any correspondence about this debt for several years - it has not (and is still not) showed up on my noddle credit report. The claim is for a hefty sum of money (more than £10k!) - and I really am in no position to pay it off - even over 5 years. I would appreciate some advice to come to my best case scenario. I will post up the answers to the questions in the next day or so when I get a chance. Many thanks in advance for any help. thanks b799

- 149 replies

-

- arrow

- attachment

-

(and 3 more)

Tagged with:

-

Hi I've been getting a number of letters from different debt companies and i stupidly ignored and even stopped opening them. I now have a letter from Northampton county court ordering a payment of over £8,000 for a certain credit card bill. I however suspect that this debt might be over 6 years as i remember getting into financial difficulties and defaulting when i was on maternity leave six years ago. I have read a few threads on here that mention doing a set aside and am guessing this is the route i need take, but am not sure who to contact regarding how old this date is. It was originally with Lloyds bank and has been passed to different companies. They are demanding for payments to start on the 5th April and another 2 companies are issuing their demands too but not gone to court yet. Any advice on what to do is very much appreciated.

-

Hi all, When I got my payslip for October, there was an Attachment Order on it which took a significant amount of money from my wage. I knew nothing about this attachment order prior to receiving my payslip. I spoke to our payroll provider who told me it was put on by the County Magistrates. The payroll eventually provided me with the paperwork sent to them by the court. This appertains to a person with the same name, D.O.B and had my N.I. number and payroll number on it - the only thing that didn't match was the address which is in a town some 20 miles away that I have never had any association with. I have spoken to the Court in question, who are currently looking into it although they were very sure they had the right person. The court say the attachment order letter was sent to the address in question and was returned as 'not know at this address'. I have been told the matter is for a court case in 2017 which was for 'Failure to Comply With an Environmental Order'. This is something I have definitely not been involved in. I'm being made to feel like I have to prove my own innocence but am struggling at how I can do that as they seem to have all my details. EIther somebody has been completely brazen and gone to court pretending to be me or somewhere in the court system, there has been an enormous clerical error... I'm going to consult a Solicitor on Monday morning to discuss my options as this is definately nothing to do with me and because of this, I have been unable to meet my monthly financial obligations. Does anybody have any ideas where I can go with this?? I'm at my wits end...

- 5 replies

-

- attachment

- earnings

-

(and 2 more)

Tagged with:

-

Afternoon all ! Need a little advice on a creditor applying to court for an attachment of earnings from a CCJ. How will a court assess this if I am contracting on short term three month contracts ? How will the court perceive this if I contacted the creditor to pay missed payments but they refused to accept them pending court response ? Thanks...

- 18 replies

-

- attachment

- earnings

-

(and 1 more)

Tagged with:

-

Today my other half received a rather strange letter titled Notice of Transfer Of Proceedings from Cabot Financial UK Ltd that states this claim has been transferred to the county court at _____________ for enforcement. This was done apparently because she did not reply to N56 (form for replying to attachment of earnings application) within the specified time. She did not receive this form. The receiving court will arrange for the bailiff to serve N61(order for statement of means) The only CCJ she had was over 10 years ago and is now definitely statute barred. Is there anything I can do to prevent any further action on this? Surely Cabot are taking the mickey??

- 6 replies

-

- attachment

- cabot

-

(and 3 more)

Tagged with:

-

I am in desperate need of some advice please. Up until Christmas my debt was in control but over Christmas I split with my husband and things have become hard. Today I received 2 attachment of earnings orders from the council applied to my estranged husband. This is going to cause me a whole load of issues with him and none pleasant. Can I appeal this or even have this attached to my earnings. He gets paid in 3 weeks so I don't have long to sort this out. I am petrified as the relationship ended on bad terms.

- 4 replies

-

- attachment

- earnings

-

(and 2 more)

Tagged with:

-

Hi All Received a letter from Mortimer Clarke today regarding a debt to Cabot Financial. Letter claims their client obtained a judgement against me on 04/02/2016. First paragraph says "Because you have failed to pay the judgement debt in accordance with the terms of the judgement our client is now entitled to take action to enforce the judgement order against you. Our client has instructed us to apply to the County Court for an Attachment to Earnings order to be made against you." Final paragraph says "If you do not contact us within 7 days , then our client has instructed us to apply for an Attachment of Earnings Order against you." Notes: 1. I have checked Trust Online for my current and previous 3 addresses and there are no ccjs registered against me. 2. I did not receive any correspondence threatening to take me to court, advising I was being taken to court or asking if I wished to defend and finally I did not receive a judgement. 3. The letter makes no mention which court they obtained the judgement from or any judgement reference number. 4. The debt is from 2007 and I believe it may well be statute barred now. Can anyone provide any thoughts or advice on how I should proceed at this point? kind regards

- 57 replies

-

- application

- aside

-

(and 7 more)

Tagged with:

-

Hopefully this is on the right board. Any advice or thoughts appreciated. A long story behind this but to keep it as brief and to the point as possible, the issue is this. My business closed in 2007 with lots of debt (sole trader - lesson learned). I did not go bankrupt as I was served with several statutory demands (took debt advice was told to wait for one of them to bankrupt you) no one carried through with it so got through the 6 years apart from the below which is still hanging over me.(all another story) One of the Credit card debts Lloyds Bank about 11K did the rounds with debt purchasing companies in 2012 was brought by one of the Companies who shall remain nameless at this stage. They took out a CCJ against me at Northampton CC bulk clearing - with interest fees and costs this came to Circa 15K. I am not sure if they could roll up interest and costs once the debt defaulted with the original lender, but as I was not aware of this to contest it the CCJ was rubber stamped in the bulk centre. I did not receive this summons (moved several times after 2007) so was not aware of the CCJ until I received a form to fill in for an attachment of earnings from the local court. Which I was obliged to do. Since 2012 I have had 20 pounds per week deducted at source from my earnings and this is paid to the debt purchasing company. The outstanding debt now is in the 8k region. Earlier this year I saw on here that Credit card agreements prior to 2007 had to have certain things on them to be legally enforceable. As my original agreement with Lloyds was prior to 2007 I thought it may be worth looking in to. Last February I wrote to the debt purchasing company (enclosing a pound) requesting a copy of the original credit card agreement. (As as they took me to court I presumed they would have this to prove they legally owned the debt). They wrote back to me and said they would contact Lloyds Bank and I would have this within 6 - 8 weeks. Nothing received by May Via email I chased this and the reply was they will do their best to obtain the agreement from Lloyds bank but as they held a CCJ they were under no obligation to let me have the agreement - I don't think that is strictly true but have it in writing (email) from them. My thought is that if they have never held the credit card agreement (which may not be legal) or have not produced it do I have grounds to request the CCJ be set aside and the money paid to them to be refunded with interest. Is it down to me to contact Lloyds bank to obtain a copy of the original agreement to make sure the wording is legal or should the debt purchasing company produce it ? If the wording of the agreement is correct then I don't think I have an argument. However I should be able to see this to check that it is legal. The other issue here is rolling and adding up the interest and costs to the debt correct after it was defaulted by the original lender ? Thanks

-

Hi All My partner no longer lives in the UK, but has received a few emails from an old (believe pdl) debt over the last few months relating to a CCJ which was granted after she left the country. The DCA are called TM LEGAL SERVICES They have now sent the following: Following our recent letter, you have failed to contact the office to set up a repayment on your County Court Judgment. We are now in the process of contacting your employer to verify your status of employment. Once we have confirmed the status of your employment, we will complete an N337 Form (Request for Attachment of Earnings Order) and present this to the court. We anticipate this form will be completed in the next few days. After this form has been completed and sent to the courts, we are unable to retract the application and your employer may be informed of your County Court Judgment. Once the Attachment of Earnings has been applied for, the courts will issue you an N56 Form (Form for Replying to an Attachment of Earnings Application Statement of Means). You must fill in this form, giving details of your financial circumstances. These include your employer's details. You are required to include your partner's financial circumstances also. You must return this to the court within eight days. It is an offence not to send back the N56 Form or to give false information within the form. If you do not send back the form, the county court bailiffs will serve you with an order to complete. If you still do not return the form then you will be sent a notice of summons to attend a court hearing. At this hearing you will be required to explain why you have not supplied information about your financial circumstances that you were requested to. You must attend this hearing. If you do not attend the hearing, the court can issue a warrant for your arrest and you may be brought to court or even jailed for up to 14 days. To stop our application, we require you to contact the office by 7.00pm today Friday 29th September 2017 on the number below to discuss the options avaliable to you.. Our contact number is 01253 523460 (option 2) and our opening hours are Monday to Thursday 8.00am to 7.00pm & Friday 8.00am to 7.00pm. Note, we are extending are opening hours to give you a final oppurtunity to avoid the Attachment of Earnings. Pretty scary sounding here, mentioning arrest etc. What is the best way to approach this. She does not live in the UK, is not employed in the UK, but we are willing to potentially set up a payment plan, but are wary of giving them much info. Any help would be appreciated.

- 19 replies

-

- attachment

- ccj

-

(and 3 more)

Tagged with:

-

Hi There. My wife has just received through the post an attachment of earnings form from the MCOL Business centre. A CCJ was awarded in default as was sent to a previous address. My wife only found out about it when she received a Noddle credit profile change notification. She spoke to Robinson Way who advised it was issued at a previous address. She gave them our new address and interestingly the attachment of earnings form has come through to our current address. Details of the debt: Original creditor was Egg (so suspect any CCA would be "interesting" to say the least) Default was issued in 2012 according to her credit report Original agreement was taken out we think in about 2006. Balance was about 1650 CCJ balance was just over 2.5k (plus now another £110 attachment of earnings fee added) We are convinced the debt is statute barred as my wife is convinced she hasn't paid anything towards this for a long time. I know we need to look at getting this set aside but unfortunately we cannot afford the fee to do so, and we don't fall into the category where we can have the fees waived. Is there any other way around this? Surely they would have records and would know when the last payment was made, so if so then is this not an abuse of court process by submitting the claim? Any advice on next steps would be greatly appreciated.

- 6 replies

-

- attachment

- barred

- (and 9 more)

-

Hi and thanks in advance for any time and help . Been meaning to post for a while , a letter that arrived yesterday (29/9/15) has spurred me on , My wife a number of years ago had run up a £10k Yorkshire bank visa card debt. When I looked into it earlier this year when she told me about the debt it seems (according to noddle) she received a CCJ dated on her credit report on the 1/10/09. The letter that arrived yesterday from the county court is titled a "general form of judgment or order" and goes on to say ," It is ordered that ME III limited be substituted as the claimant in this claim" , the letter is dated 28/9/15 . Am I right in believing this letters arrival has stopped the debt becoming statute barred by two days , also as far I am aware there hasnt been any PPI on the debt (not 100% sure) but I am sure there are some hefty charges . And so whats the best way to move forward in this sticky situation .She doesnt really earn that much to even attempt to clear the debt over a number of years so I would have to seriously help . It really affected her nerves hiding it from me for so long and the latest letters arrival may start her off again . Thanks for reading , Andy.

- 26 replies

-

- attachment

- barred

- (and 5 more)

-

Hello, I was declared bankrupt on 19th May 2017. I had a CCJ from Capquest that predates this by a month or so. The other week I received a letter from the County Court stating Restons have applied for an attachment of earnings for Capquest. I returned the N56 and attached a cover letter explaining the debt was included in my Bankruptcy and included a copy of the bankruptcy order. I sent a letter to Restons with this detail also. Today I received a transfer of proceedings form moving it to my local county court. It states I never returned the N56, which I obviously did. I have spoke to the official receiver and they ahve stated that Capquest got sent the statement for creditors and should be aware of the bankruptcy. They however told me they will not intervene with the court and I should seek legal advice. How do I get this sorted? Do I need to apply for a change of order? The letter states a bailiff will attend to deliver a N61. Should I be concerned? Any help appreciated.

- 2 replies

-

- attachment

- bankrupt

-

(and 2 more)

Tagged with:

-

Hi To cut a long story short. I had a business that went bust. One supplier managed to gain a CCJ against me 4 years ago. The invoices were in my name and not the Ltd companies name, hence why i have the CCJ against me. My problem is how long can the HCE officers chase the debt for. I know that a CCJ lasts for 6 years after which it is removed from my credit file. But what about the debt. I have paid some monies towards it over the 4 year period, but havn't paid anything for the last 6 months. They don't know were i live as i moved from the property i was in. I have spoken to the solicitor for the supplier about the debt and explained that it wud b easier to go bankrupt than try and pay it back, as the interest and costs are adding more to the debt than what i can afford to pay back. The latest statement says they are charging me 29p per day for a walking possession, i find this hard to believe as they started this in August as this was the last visit. I wasnt even living at the property at the time. Quite happy to put the figures up as i do not trust what the costs are from the HCE firm. Any help would be appreciated.

- 23 replies

-

- attachment

- earnings

-

(and 1 more)

Tagged with:

-

Hi, I'm hoping somebody here may be able to advise me. I have recently become bankrupt at the end of May. The DWP have just sent me a letter claiming an attachment of earnings to cover an old social fund loan. I did include this in my list of debts on the bankruptcy application. Can they still go ahead with the attachment of earnings depsite my bankruptcy? Thanks

- 7 replies

-

- attachment

- bankrupt

-

(and 2 more)

Tagged with:

-

hi I received a ccj for a credit debt £450 I offered them £6 a month they have refused that I told them my only income is my state pension , they told me they will get attachment of my state pension can they do this thanks

- 2 replies

-

- attachment

- â£460

-

(and 2 more)

Tagged with:

-

Hello, this is my first time posting and I really hope someone can help me. I have got myself into a complete mess with my council tax over the last year or so. I have completely neglected payments as I have simply not had the money to pay. It have now got to the point where my employer has received an attachment of earnings order, I think maybe 2. At first I was OK with this as at least my arrears will now be paid. After thinking about how much will be deducted from my earnings I am very worried that I am going to be left with nothing to live on. If there are 2 orders, 7% of my net income (i assume the deduction will be off my net income after tax and national insurance?) will be deducted twice which would be 34%? This would add up to £520.00. This would leave me with around £1000.00 to live off. My rent is £525.00 i have car finance for £191 plus energy bills, water etc. Once everything has been paid I will have nothing. I am 8 weeks pregnant, I don't want to be so stressed and worried about this. I am worried that I will be unable to afford to put food on my table and put my unborn child's health and risk as well as my own. I am aware this is my own silly fault but I was wondering is there anything i can do about this? Can so much money be deducted at once? Thanks.

-

Hello I'm looking for advise. I live overseas for past 10 years. Yesterday at a friends address in UK where I receive my bank statements a letter arrived looking official. At my request my friend opened it. It is a Notice of Application for Attachments of Earnings Order. Judgement Creditor: Hoist Portfolio Holding 2 Limited. In the: Country Court Money Claims Centre. Amount 3,975.28 GB. The Judgement Debtor is under my maiden name and I've since been married, divorced and re-married. I have never heard of this company and no of no debt to them. They are not listed on companies house, but from research it seems they are linked to Robinson Way a DCA. There is no contact telephone number and only instruction to pay Howard Cohen & Co Solicitors, based in Leeds. Again they are not registered on Companies House. The form looks official with case number and reference number. The document is dated 17th May 2017 and says payment required in 8 days of notice or further action including a possible 14 days prison. I am very concerned especially as this is now logged at a friends address, where i have never lived but do get my UK bank statements sent to. Any advise gratefully received.

- 18 replies

-

- application

- attachment

-

(and 4 more)

Tagged with:

-

Due to various bouts of unemployment, low wages and general lack of funds over a prolonged period my local council sneakily slapped an attachment of earnings order on me ( i was asked for a full breakdown of my income and outgoings , and they said they would use it to work out a manageable repayment schedule that would help me to pay off my quite considerable backlog of council tax debt ) .. Unfortunately for them, the company i worked for, as a van driver/courier ,for considerably less than the minimum wage regarded me as self employed .the AofE order couldn't be enforced , without further communication i have now found myself served with 6 onesource bailiffs notices running into thousands of pounds , plus 6 x £235-00 enforcement fees But the original AofE i was issue considerably less than the minimum wage was for only £256.14 . .. i also find it strange that the liability order date is given as 17th june 2010 ... . but the AofE is dated as 15/3/ 2016 ... Any help would be greatly appreciated as i'm now being threatened with schedule 12,section15 TCE 2007 enforcement , as yet i have not engaged with onesource as i am unfortunately out of work again, thanks

-

I have a charge order placed on my house by Bristol & Wessex Water for £1800. They recently sent me a letter stating that if I don't pay the full amount they will be taking legal action and apply for an order for sale. I then will be sent an order to vacate my property within 28 days. My house is owned outright with no mortgage and currently valued around £200K. I am living on a small private pension with no chance of paying back the debt. I went to the CAB who told me that I will end up homeless and living on the streets as there is no social housing available for single men. The Water company placed a CCJ on my credit record so it's impossible for me to borrow money to pay back the debt and keep my house. I could never understand why there were homeless people on the streets, but I do now. I will be joining them soon. What an idiot I was buying a house. If I had a council house I would have nothing to worry about and a safe roof over my head. I know a chap near here who lives in a housing association bungalow. He owes banks £73k and will not end up homeless. Comments welcome.

- 197 replies

-

- 6years

- attachment

- (and 19 more)

-

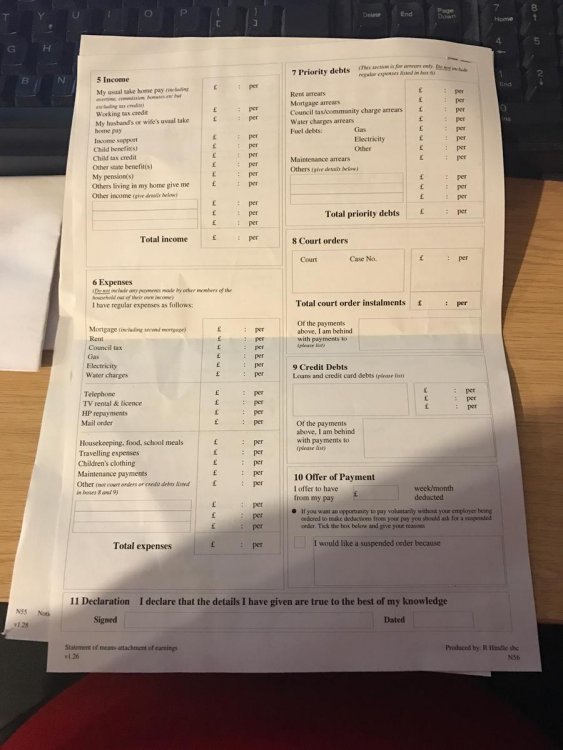

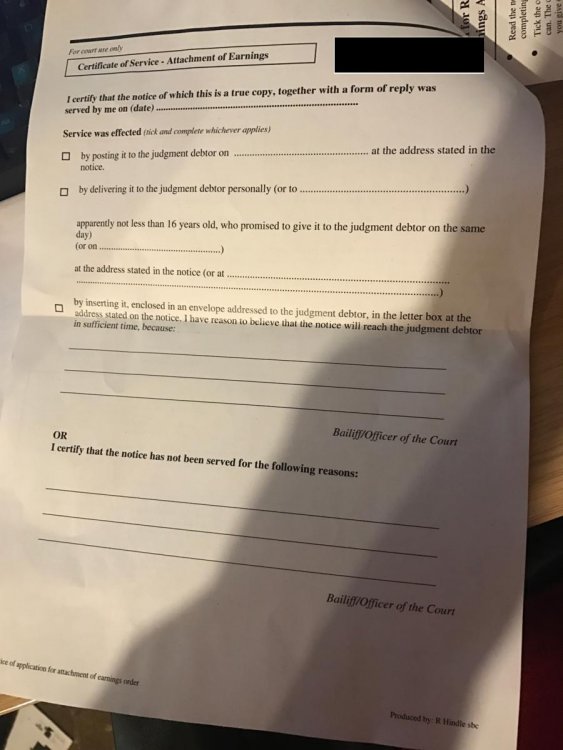

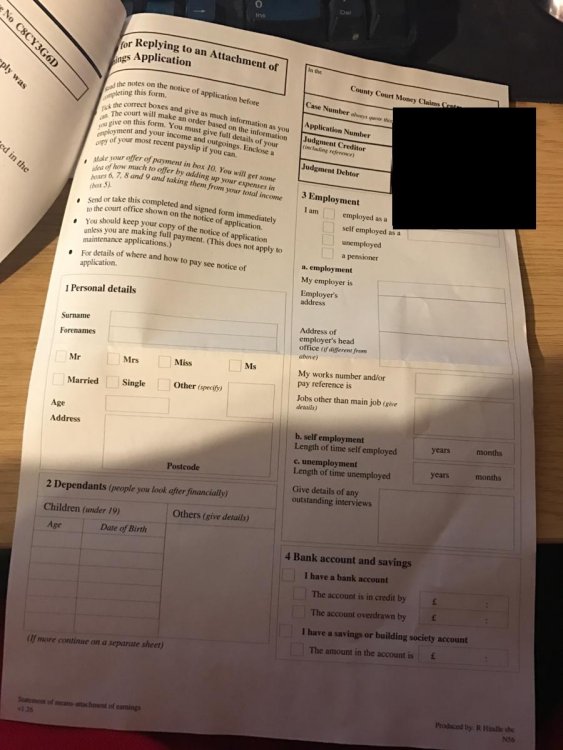

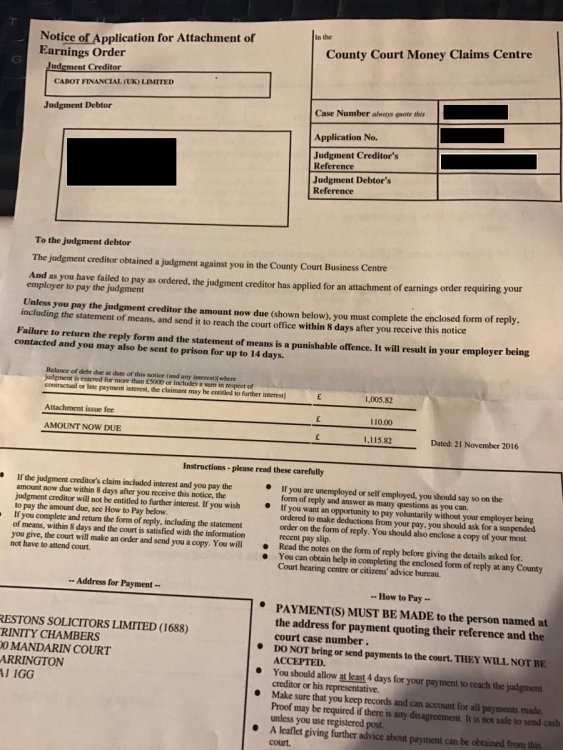

First I've heard of this, I haven't received anything else regarding this matter, isn't this something that I have to attend court for? if so why wasn't nothing stated nor issued to me? I have to pay £1005.82+£110 fee within 8 days to a company I don't even know about? or even know what money they are trying to get from me? Over the past few years I've been working hard to pay back things i genuinely do owe, and for this to pop up is just annoying.. I work a part time 30 hour a week job, any ideas? Obviously if the debt is true I'll pay, but from how long ago could it go back to?

- 7 replies

-

- application

- attachment

-

(and 1 more)

Tagged with:

-

I have received a letter this morning at my rented address for a notice of application for attachment of earnings order from Cabot Financial (UK) Ltd. I migrated to Australia in 2011 but had to return in Aug 2015 due to visa refusal but although this letter has a case number and application number as well as a judgement creditors reference I actually have no idea what this debt is supposed to be for as this is the first correspondence I have received at this address and I have been here since August 2015. It says unless I pay the judgement creditor within 8 days I must complete the enclosed form of reply including the statement of means and send it to the court office within 8 days after receiving this notice. I'm not sure what this debt is for which is my main concern as there is no reference to it nor what date this judgment was carried out. It says the address for payment is Restons Solicitors Limited Warrington and that's about as much as I know

- 6 replies

-

- application

- attachment

-

(and 4 more)

Tagged with:

-

Long story short I bought a car on finance had it for three months and life changed enough that I missed the next payment and would miss further payments. I agreed to them having the car back. the repo men turned up we had a cuppa and they went with the car no bad feeling. Due to family circumstances I moved house very quickly to another town to a farm yard hard to find. I stopped paying into a pension and months later thought they were still taking it to find out it was an ATE £100 they have taken me to court for payment including interest - almost £10,000 for nothing:-x Now my stupid bit: This has been going on for over four years (i have had depression etc and could not fight my way out a wet paper bag) I have called the court for an appeal but I had to do it within 21 days I wonder if I have any way out of this . .. i feel £10,000 for nothing is very unjust Looking forward to some replys ... I already know how stupid this seems:???:

- 28 replies

-

- advantage

- attachment

- (and 4 more)

-

not sure if am posting in the right place for this but here goes : my local council and myself have been in dispute for the pass 12 months over an over payment they made to me some years agoh the dispute has been about the amount of money i pay back each month to clear the debt, this morning i woke up to find they have enforced a direct earning attachment with my employer dispite the fact that i have made payments to them every month for the last year or 2 without missing a single payment to what i can afford, now they are taking a percentage of my earnings that i can not afford putting me further and further in to debt making it so i can no longer keep up with my other debts theres been no court order and dispite sending them a breakdown of my earning some months ago they have decided that my other debts or outgoings dont matter.

- 3 replies

-

- attachment

- direct

-

(and 2 more)

Tagged with:

-

My husband had a debt which was taken to court a CCJ given and an attachment of earnings put in force. The first payment has been taken from his salary BUT he cleared this debt 3 weeks ago in a full and final settlement with the solicitor. How do we get this money back as it is not owed and stop further payments being taken? Solicitors have said courts have been informed but not sent anything to us confirming any of this as of yet

- 1 reply

-

- attachment

- earnings

-

(and 1 more)

Tagged with:

-

Hi all, hope you can help me out. I am being chased from B&S for council tax for 3 property's (during myself and partners we where moved out due to landlords either selling property's or finding it troublesome, antisocial behaviour or violence, however we are now with the local housing trust as we have a child. Now during those 3 years we have occurred some council tax, some was billed for the entire year, some only for the months we where there. Even before B&S started chasing me, I went to the council and explained the situation, they told me to pay what i could across all the council taxes, so they gave me a bar code for the last few months would chip away at the debt, however the process of bailiffs was automatic and eventually the debt would be passed back to the council. They also told me they would apply for an earnings attachment where they would take a % directly out of my wages to cover council tax and back dated payments, and that has happend and has done for 4 months and it will continue until its paid off? Today b&s have visited with an enforcement notice.... Now I dont want to talk to b&s, infact i want to send some form of letter first calsss recorded giving them no right to access my property and also that the debt is being dealt with the council and their services are not required, from the research ive done their people have no power, and the only people with any say are high court enforcement offices? any help with letters or templates would be great!

- 21 replies

-

- attachment

- bristow

-

(and 3 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.