Showing results for tags 'direct'.

-

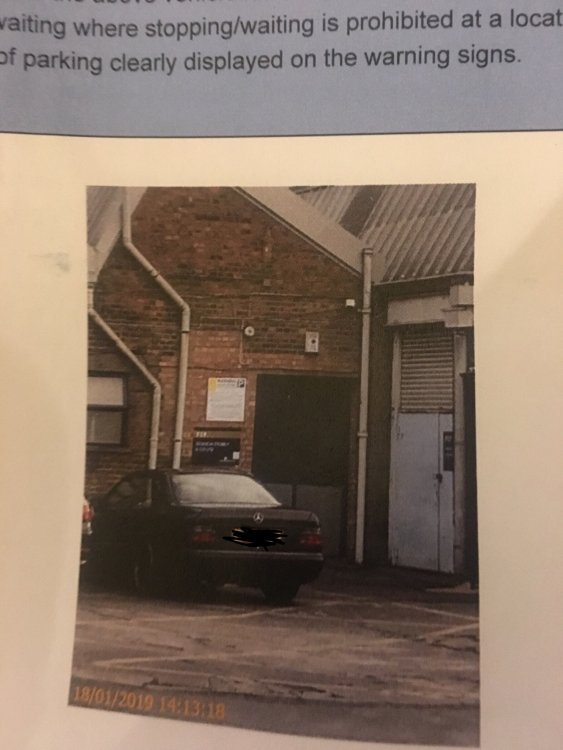

Hi, Sorry but this is my first time doing this so bare with me. I work for a catering company in which I load and unload stuff everytime with my own personal car. There is one sign that mentions of a 30 min loading time and there is also a parking sign in the exact same area. On the Parking sign it mentions that you can park up to 1 hour. I have been given a ticket by ParkDirectUK within the period of 10 minutes so this does not make any sense to me. At the time I was loading and unloading taking things to and from the car. I think I have been provided this ticket unfairly and I think it is ridiculous, I also spoke to another person who works within the same units me saying that he had also been provided a ticket 7 days ago for the exact same thing. I will provide pictures which I hope will give you a better understanding. If you need anymore information please let me know. Should I pay? Should I ignore it? Should I contest it? Any help would be appreciated. Regards, Ridoftickets

-

Good morning all Have been an avid reader of CAG for some time. I currently have an alleged debt with shop direct which is being dealt with by Lowells. The debt is for £2k+ I have read the guides and templates available and sent a CCA request to Lowell's in November. I finally received 2 signed documents. You can see on one document the key financial info is set at £36. The other document Is signed and the account number is the same as the first document. Note that the dates are different so the documents were not signed together. Any help or pointers would be greatly appreciated. Many Thanks

-

Hi I was made redundant last year followed up with a difficult time with depression which I am now over with. I had a good pay off and made regular payments to my direct debits but noticed that I had a letter from one Credit Card saying I was five months in arrears. When I complained they said they had cancelled my direct debit as I had missed a couple of earlier payments. I looked through all the terms and conditions of the card and no where is this process mentioned - I can't find any reference to this or the law surrounding it nor can I find a lawyer who will advise me on this. The only thing I can find about cancelling direct debits is when it's a consumer cancelling it and the direct debit guarantee. They also tell me they wrote to tell me about this earlier last year but I didn't receive the letter - I have a process of scanning every letter I have when I receive it so would not have missed it. What rights do I have - I've exhausted their complaints process and am a bit wary of the Financial Ombudsman. Thanks

-

The company we all can not forget, for their poor quality customer service and who cares attitude which landed yes BUST I had a letter in december from them at my new address, the property was built in 2013 so would of been impossible for them to obtain from me. I checked all of my credit files and no searches, Direct Auto finance claim they got it from equifax... so I ask equifax they say no they have not. Direct Auto finance claims that they have the right to trace my address for legitimate business reasons, and they also have to right to still keep 12 years after the end of my agreement all of my data, drivers license, passport, bank statements etc. ICO says not but 3 month backlog, has anyone else had a letter from them? I have also seeked to reclaim gap using the Plevin case as an example, as they failed to advice what commisions were been paid normal brick wall response from them. Now my agreement was late 2005 so not sure if ombudsman or fca with it but they dont seem to like giving deadlock letters etc. Any advice, also if you have recieved this letter about data SAR them it will cost them todo also.

-

Hi All, Looking for some advice and guidance please. I had two accounts littlewoods and very, both had payment protection on them. I run the accounts fine for years and then got into a bad patch financially and couldn't afford to pay them, it didn't help that I was being paid monthly and the statements were 4 weekly. Shop Direct sold the debt to Lowell, I now have a CCJ for the one account. But they piled on a load of charges and interest before they sold the debt to Lowell, and what was a £2k debt between two accounts is now a £3.7k debt. Any advice with this? Or should I just accept it is what it is and continue paying the amount agreed with Lowell. Thanks in advance Sarah

- 1 reply

-

- direct

- littlewoods

-

(and 1 more)

Tagged with:

-

Morning everyone Received letter from Shop Direct on 28th March to say they sold my Very account to them. Shop Direct is still showing on my credit file. Could anyone advise who I should SAR? Thanks so much

-

So I need some advice. Long story short, I was working for a small lettings agent. I was given a company car however the owner told me to take out personal car insurance, stating that he would pay the monthly direct debit. This was the case and I was working their for a couple of months until unforntualy I had an accident in the car making it a write off. I then had to claim on the insurance, the car was paid out, after that the owner decided he didn't want me to work their anymore. I then lost my job, the owner canceled the direct debit for the insurance which then, in turn, caused Direct Line to cancel the insurance. I then, however, started receiving letters from Direct line insurance stating that I owed the £1809.71 for the rest of the insurance premium as per the terms and conditions. I ignored these letters for months, however, I am now receiving letters from Moorcroft Debt recovery LTD who have been instructed by Direct Line insurance to collect this £1809.71. I need some advice asap, I am currently not in a situation where I can pay off this debt and to be honest I don't really want to.

-

Can't find a sar template for shop direct can anyone help? i intend it to send it via email, dont want to post or have facilities to print etc. email only. Basically I just want all statements including charges, how much i paid etc as i want to reclaim unfair charges eventually once i know all the facts its for littlewoods and very and the accounts were started in 2010/11 i believe, will they provide for the entire 7 or 8 years?

-

Hi all, A query regarding very online shopping, hopefully someone can confirm my question. I purchased an item from very on the 18th of october 2017 on a 12 months buy now pay later basis. According to very the full balance was due on the 21st september 2018, i have missed this by 2 days (paid on the 23rd sept) and i have been charged the bnpl interest,very are not willing to refund the interest. I was just wondering whether very have the correct payment due date? It doesnt seem right to me, very work on 28 day statement basis. Can someone who has been in a similar situation clarify if the payment due date is correct please.

-

Hello, I currently get £8K PA from the government's self directed support and I am not happy with their service and I wish to change to direct payments for more choice and control. It's done through the social care direct service. They want to establish a meeting with them to do what best for me? Do i have to go to this meeting or else I will be rejected direct payments of non attendance and non communication? When the service changed from day care centre which closed down to privatised care they forced me to go to private care rather than give me a choice of direct payments. Why can't social care stop payments to them and provide direct payments? Its sounding like a pip assessment.

-

Hi there, Recently i had an accident that wasn't my fault when i veered out the way of an oncoming car that came over onto my side of the road. The cars did not collide and i went into a raised curb, the other driver did not stop and drove away. Major damage to passenger side front wheel, and passenger side suspension with body damage. i have a £3000 excess, with XS direct. They claim the car is a right off and their engineer valued the car at £24,000 when brand new in March 18 it was £37,000 value. They are now claiming it is not economically viable to repair. Car was sent to BMW approve garage as in BMW dealership, estimate of £16,000 all in. They class it as Salvage: S? Please help, is there anyway to convince them to repair the car? Thanks,

-

Hi there. My husband is trying to claim ppi from Littlewoods/shop direct. He has received a letter from then saying he did have ppi with cover plus. Start date was in 1994. It was fully paid. The thing is, they have enclosed a claim form from the FOS. Why would they do this? Many thanks

- 19 replies

-

- cheque

- compensation

-

(and 3 more)

Tagged with:

-

I have a bit of an awkward situation that I can't see anywhere else. I had amassed some debt and in November 2015. I contacted a debt charity at 4am by email and they locked into action immediately and helped me. By 14 December 2015 an IVA had been agreed between the financial company and creditors and now paying that without having missed any payments. However, in the November, whilst my IVA was being set up, I was advised to move my bank account from Santander as they would likely lock my account upon receiving this email IVA request notice. I moved my account in November 2015 to First Direct. The account they provided me with was a Credit Account with a £500 overdraft and I applied online with no prompt to read any T&C's that I can remember and no paperwork received with the exception of my bank card and it's pin. In the first couple of months I had planned with my financial advisor handling my IVA what debts to include. To help reduce the IVA amount, I used most of the £500 overdraft on the First Direct account to clear one of the debts and then I would work the overdraft down over time. Out of the blue, and with therefore no notice, I received a letter from First Direct in March 2016 stating that they would close my account because I was in an IVA and this breached their current account rules and that they would close it in May 2016, giving me 2 months notice. I rang First Direct immediately upon receiving the letter and was essentially told to pay back the overdraft before the account closed and that was my only choice. In May 2016 I rang First Direct again and explained I was still in IVA as they know so couldn't pay off my overdraft in one go like that and had planned to work it down over time that had now been taken away from me at their choice. I was told that they would send me a form once my account closes to complete to set up a repayment plan that would be affordable to me and take into consideration my IVA. This is where my problems began to escalate. I never received any form from First Direct. I emailed them to ask for it in June and July 2016. received responses stating they couldn't discuss my account unless I rung them, which I was suspicious about as surely they must contact on the method I request? I managed to go out of my way and visit a HSBC some miles away and ring them. They agreed to send me the form that they hadn't sent previously. I then waited some weeks and received no form again. Instead, some weeks later I received a letter with a debt collection agency header on it asking for £512 that I now owed. I replied by email, copying in First Direct, explaining that I was still awaiting the repayment form and then never received a response from First Direct nor the Debt Collection Agency. Some weeks later I again got a letter from the Debt Collection Agency, again replied by email copying in First Direct and attaching my previous email and again never got a reply. A couple of months later I then received a letter with a different Debt Collection Agency header. Again I replied with the same email, attaching previous emails and copying in First Direct, and again I received no reply from anyone. I then sent an email to First Direct a few times over the next few months asking for the form and kept getting the same response as before, that they cannot discuss my account. In mid April 2018 I received a letter from Cabot Financial asking for repayment of the £512 for the HSBC debt and that they had bought the debt in August 2017 but weirdly apologised for taking until now to write to me about it?! A day later I received a letter with HSBC header dated BEFORE the Cabot letter chasing repayment for £512 debt. a couple of days later I received another letter dated AFTER the Cabot letter from HSBC saying they had now sold the debt to Cabot and to now deal with Cabot on it. This all seemed very odd to receive these 3 letter within a few days, seemingly contradicting each other and confusing, one claiming Cabot had purchased the debt in August 2017 and one with HSBC dated before the Cabot letter asking me to repay them (and not Cabot). I have replied by email to Cabot and asked for no email or telephone contact and no visits to my home and that I would only correspond in writing and that I would write to them in time on this. I'm now in a position where I am looking for above on what to next. Any help would be much appreciated!

-

Good evening everyone! A friend of mine has just contacted me and told me a story of how she had just visited a Sports Direct store in East Ham, London. She was just looking around there in search of some clothes and when she tried to take a shirt from the hanger, huge insects started falling out of its folds. She began recording this with her smart phone camera and asked the manager to comment the situation. But the manager just told her to stop recording and "get out of the shop!" So she is not going to try and contact Sport Directs anymore and want to proceed with complaint straight to appropriate authorities. Please advise where should she write the complaint and how should she use that video as the evidence. Thank you in advance!

-

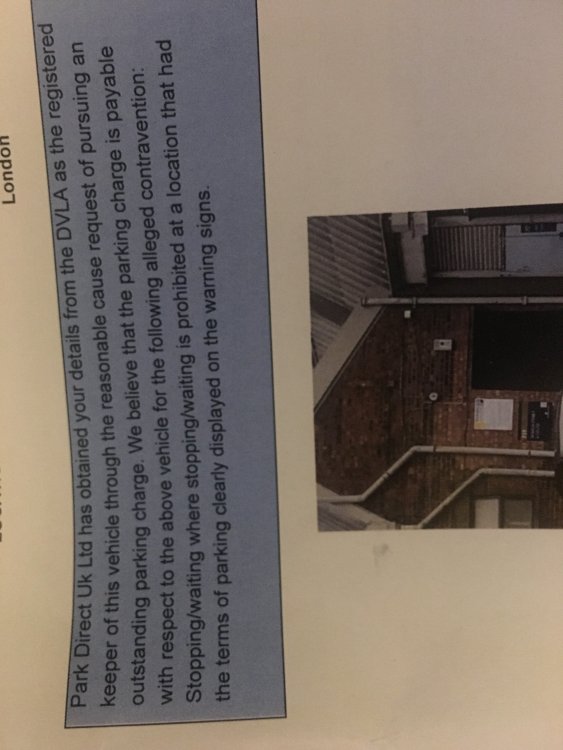

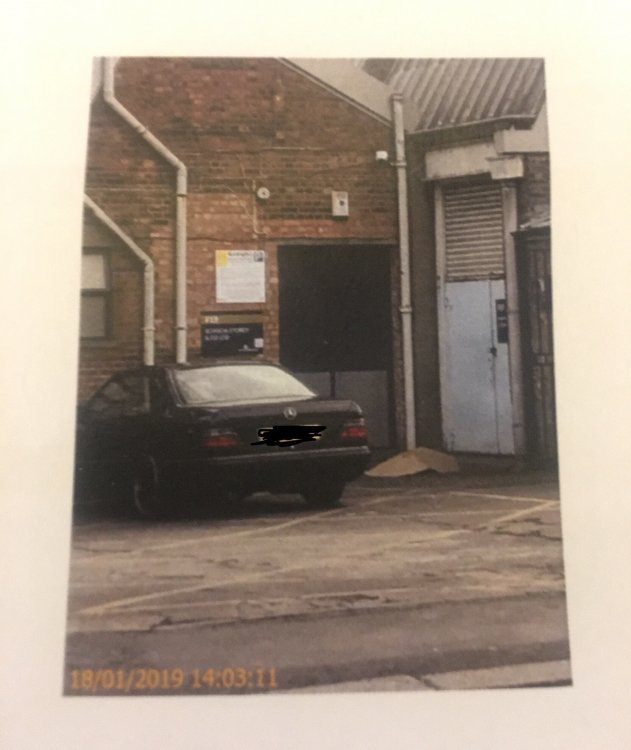

This company Park direct uk, issued me a PCN while i didnt have time to think to where to park, so i was feeling dizzy and i parked there, and I gave the reason to them, and I'm legally to do so if im in an emergency, and i sent them a appeal and they refused, and this is a private land, can someone help me out please? I attached all the posts that i received from them and what i appealed to them. Many thanks guys

-

Hi all, some advice required please. i used a ppi claim company to make various claims a couple of years ago, with some positive results,(apart from their charges). i had a couple of cars through YCC pre 2005 and ended december 2007. i claimed against YCC in 2011 but resulting in a letter from the claim company about 3yrs later saying the ombudsman rejected the claim as it was pre feb 2005. would it take that long firstly, and would it be worth making a claim against Direct auto finance??? Or have i been fobbed off by that claim company because they couldnt be bothered? thanks in advance also when i say the company couldnt be bothered, i was being flippant. as ive looked online many times (probably badly) and a lot of people had no joy or no reply from them. i certainly never seen any successful claims being mentioned.

-

Hi I received a letter in March 17 from Lowell chasing a Shop Direct debt for £179.73. I wrote back to them that I did not acknowledge this debt and requested a copy of the CCA so that I could see what this was for. Letter sent May 2017. I never heard back I chased in June 2017 saying they had exceeded the statutory time etc and to remove any detrimental evidence on my credit reports. I received a letter from them shortly after to say that they have been unable to obtain a copy of the CCA and put the balance at zero on the letter. "as we have been unable to provide the requested documents we have decided to not pursue the outstanding money at this time. We are required to record true and accurate information and the Default registered will stay on your account for a period of 6 years". I have no idea what this Default is for, and Lowells have now closed the account and are no longer chasing. The Default will not drop off my credit file January 2020 which I do not really want to wait another 2 years. I wrote back to them and again their letter showed a zero balance owing, BUT they state in their letter that there is sufficient evidence to prove that I owe this debt and they will not be removing the default? Please can someone give me some advice or point me in the right direction of my next course of action, I have no idea what this debt is for and feel that I have a chance here to possibly get this Default removed and want to do what I can to at least try. Thanks

-

Hi everyone - haven't been on this forum for ages which is probably a good thing as it means I have no problems that need solving, but need to use all your brilliant advice again. Got a letter from Direct Auto Finance saying I could claim for PPI, they sent a form and also asked for copy of my agreement (which I did have, think was from 2012) filled it all in as we were conned, I remember the sales guy saying we had to take out PPI otherwise we could not get the car without it even though it was over the amount we could afford and kindly left the room for us to "talk about it". Had no option so signed on the dotted line. The total amount of PPI on our finance agreement was £1018.97. Got the letter with breakdown from them today and they have agreed a final settlement of £219.75. What I would like to know is does this amount sound fair or should I appeal. The only reason I don't want them to get away with it as looking back the salesman had no right to say we could not get the car without it. My brother has bought me a ticket to go to New Zealand over Easter to see my nephew so would be brilliant to have some extra money to spoil him. I have attached a copy of the breakdown. PPI.pdf

-

I placed a order online for 2 electric scooters. One for my son and one for my sisters. Since placing the order I have tried emailing them at least 6 times with no response at all. My parcel has been stuck in customs for 6 days and there is no way to see why, which courier it is with or anything. Not sure what I can do usually companies reply or have a contact number they have nothing and no way of contacting them other then the emails and they are not replying to them. I am not having to give my sister the money for the one she bought to replace the birthday present which I am not to bothered about if I knew for sure I could find out what was happening with the scooters.

-

Hello I have received from Shop Direct for compensation on PPI added to account I had with Choice catalogue sounds correct? Have read elsewhere SD may typically offer refund of premiums but not correct amount for 8% interest - am unsure how to calculate myself to check PPI sold with account in March 2001. Account closed 2006. Have a couple of statements still but not full file - compensation letter states total premiums paid + £154.78. Additional interest paid due to premiums = 0 Refund of charges incurred as a direct result of the PPI being added = £15 Simple interest - at 8% per annum - for times balance would have been in credit if no PPI on account = £9.06 Total refund with £1.81 tax deducted = £177.03 Not sure this sounds correct as my understanding was 8% interest per annum should be added from date of PPI sale to today to compensate for not having the money - that would be 16 years & doesn't seem to have been included? Grateful for any advice as thinking of referring to FOS

-

Good afternoon. At the end of last month around the August bank holiday weekend (2017) I decided to cancel my direct debit to Fit4Less because of an upcoming medical condition. On the same day I sent a message to my local Fit4Less on their website contact page saying I would no longer be able to attend and so I have cancelled my direct debit. I had no response. on September the 4th i receive a letter from Harlands saying: Dear MR ***, re: Your membership to Fit4Less We are writing with regards to your membership for Fit4Less as we have been advised by your bank that your Direct Debit instruction has been cancelled and as a result we have been unable to collect your monthly installment of £44.99. Due to this payment being missed you have incurred a £20.00 administration charge. We would like to help you keep up to date with your membership payments and we understand this may have been a mistake so would kindly ask you to contact the Harlands Customer Service team on 01444449029* to pay the outstanding balance and reinstate your Direct Debit. Alternatively you have the ability to make a payment and reinstate your Direct Debit using our secure online payment service by following the link and using the details provided bellow. Go to *some url* You will need the following information to hand: - Ref Number -Credit/Debit card details -Arrears to be paid £44.99 Please note you will not be able to access the club until this balance has been cleared. We remind you that under the terms of your membership you need to provide 1 month's notice and therefore need to make another monthly payment. Failure to do so will result in further action so please contact us immediately to resolve and avoid this. If however you are having any problems with your membership or payments please contact the Harlands Customer Service team on 01444449029* or email us at *theire email* and we will be happy to discuss your account. We look forward to hearing from you soon. Telephone lines are open from 9am to 8pm, Monday to Friday and we look forward to receiving your call. Yours sincerely, Harlands " My monthly installments have been on a no contract Direct debit of £24.99. I understand I should have paid his final installment but do I have a leg to stand on if i refuse to pay the admin charge. I am also going to the hospital tomorrow for his condition so I am tempted to ask for a doctors note. Any thoughts? Many thanks!

- 11 replies

-

- cancellation

- debit

-

(and 3 more)

Tagged with:

-

Hi My son has recently applied for a mortgage and has been turned down due to a default on his file which originally was Shop Direct which then defaulted and was sold to Lowell. The amount was £371 and was paid off in full to Lowell in Oct 2013. It is due to drop off his file in August 18. I am trying to help him get this removed because I have read somewhere that usually if debts like these are passed to Lowell they are in some way unenforceable by the legal route. Can anyone tell me who would I SAR so I can start digging to see if I can find anything and what would I look for? Cant find any old paperwork even relating to this account but I have some emails relating to Lowell. I have had dealings myself with Lowells and they are currently chasing me for an old debt with Provident and I was wondering if I cant help my son with getting the default removed by finding something untoward, then do you think I could use my debt as a bargaining tool to either remove the default from his file or transfer it to my name. I would rather it be on my file for the next 9 months than his. I know this is underhand but I dont think they are exactly saintly themselves. Can anyone help with this please. Thankyou

-

I wonder how many people - outside the weekend - have had DD collected BEFORE the due date and landed them in the overdrawn gang! if so I wonder if any compensation could be claimed from the offenders.

-

Hi all Apologies if this isn't right as i'm new to the forum as i'm looking for some advice. I saw that others have had a similar experience to me and was hoping you could help me too. Last week I had a Sheriff Officer at my door who in the end put the form through in regards to the Simple Procedure Claim relating to a debt from 2012. This got me concerned which led me to do a bit of searching on the internet for advice. The debt came from a time when I took on far to much and in the end couldn't afford to make payments. Yep, it was a stupid decision and one i've regretted for the last few years and this particular one is from Isme for approx £614 I believe, would need to double check the form. I actually think that the debt is Statute Barred, based on when i made the last payment which i think was back in 2012 from what i have on my bank statement. Capquest are claiming that the last payment was in July 2013, however i also had a very account which i was making payment to and the account number on the form is for Isme, which was different. As the payments were to Shop Direct as a whole would this be counted as my last payment even though it's a different account? I do know that Isme is now essentially Very and doesn't exist anymore. When i signed into my account it was via the very website, although I had to choose the separate account number for Isme. When I get home i can post more information if required although any help/advice would be greatly appreciated. Thank you

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.157c55a57c1d03e42624bbf0c552576e.jpg)

.thumb.jpg.0a920372943b1ddd34b7a9e31a174b4f.jpg)