Showing results for tags 'lowells'.

-

Hello, I have had an ongoing problem with Lowell for the past few years for 3 three mobile debts. Now yes I had contracts for these but I left due to lack of service and the fact that the phones were practically useless as none of the 3 could ever get signal in the house. The debts are for the cancellation fees that Three applied to the account. I have written to Lowells asking them to prove it, only to be sent the statement form three of the charges that were applied, now it is my understanding that mobile phone contracts are not under the CCA and therefore I don't have many options other than to pay them? I tested the water with the one for £188 and offered to pay £100, but Lowell declined and instead offered 20% discount and a partially settled mark on my credit file, which is pretty much-ruined thanks to this nightmare. I am looking for some advice on what to do now as this is causing me a lot of upset and stress, and I'm not really sure where to turn. Thank you in advance

-

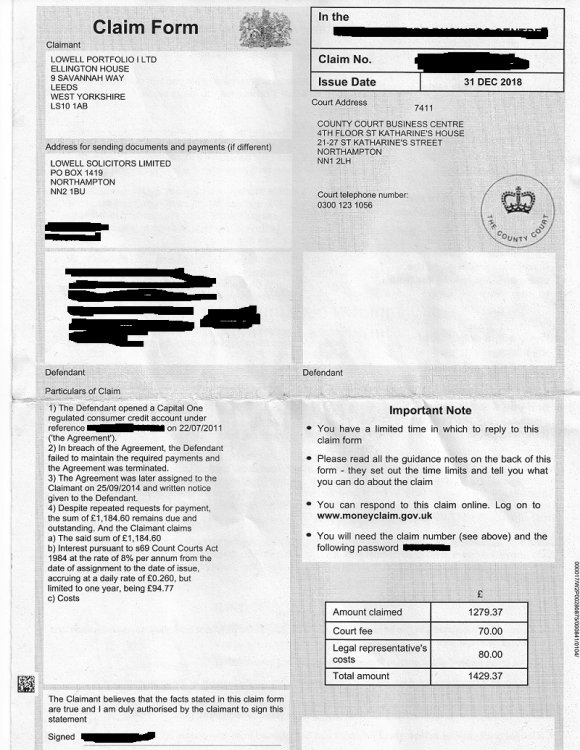

Hi I received County court claim back on Friday 4th January despite it states issue date 31 December 2018 it did not arrive in post until then but no matter what I assume date on paper work stands. I then received 15th January a warning from Lowell that they had sent it to court and I should receive something soon their letter was dated 7th January so that came very late. Okay I will get to the facts really hoping for your urgent help and assistance in this as I have suffered with sickness this month and also at same time struggled as had to keep work balance. I don’t want to use any excuses other then It was easier for me to hide this away and just wish for better things. But I did submit my AOS and full defence within the 2 weeks on Sunday 13th January and was received and noted by court on Monday 14th January. I did receive the proper letter regarding Lowell would submit to court and I had the 30 days before end of November 2018 so they followed rules for that. To try put facts about my debt down short basically was a credit card I took out with Capital One back in 2011. To be fair I am not 100% sure when my last payment was and if its statue barred. It was at a lower limit then years later was setup to £1000 limit. I fell into a dispute regarding some £12 charges etc and also had contact through phone and emails I then stopped payments and kept going up. I did not get proper response on my emails etc I was even trying to settle a solution. My fault for ignoring further letters with request for payments and debt was sold to solicitor Lowells in 2014. To cut to the chase I need to submit my defence tonight as I understand and I have not got CCA and CPR (31.14) letters sent off despite I have made them ready. Can I still get these sent off tomorrow morning with Royal mail 1st class recorded delivery and then attach £1 postal order for each? Also because of my dispute with Capital One I really wish to claim back all charges and the 8% interest etc but how do I deal with this now? Can I sent letter to them or does that has to go to Lowell? Hope for your assistance guys I would be so grateful. I have attached Claim Form and also I have done a draft Defence for me to submit tonight hope it looks okay? here is my defence draft Defence 1. The Defendant contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 2. Paragraph 1 is noted. I have had an agreement in the past with Capital One but any alleged balance is and remains in dispute for charges/services. 3. Paragraph 2 is denied I am unaware of any legal assignment or Notice of Assignment allegedly served over 1 year ago. 4. It is therefore denied with regards to the Defendant owing any monies to the Claimant, the Claimant has failed to provide any evidence of agreement/assignment/balance/breach requested by CPR 31. 14, therefore the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreement with the Claimant; and (b) show how the Defendant has reached the amount claimed for; and © show how the Claimant has the legal right, either under statute or equity to issue a claim; 5.As per Civil Procedure icon Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. 6. On the alternative, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer credit icon Act 1974. 7. By reasons of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief. Signed I am the Defendant - I believe that the facts stated in this form are true xxxxxxxxxx 27/01/2019 Defendant's date of birth x/x/19xx Address to which notices about this claim can be sent to you xxxxxxxxxxxx

- 26 replies

-

- capital

- county court

-

(and 1 more)

Tagged with:

-

Good morning all Have been an avid reader of CAG for some time. I currently have an alleged debt with shop direct which is being dealt with by Lowells. The debt is for £2k+ I have read the guides and templates available and sent a CCA request to Lowell's in November. I finally received 2 signed documents. You can see on one document the key financial info is set at £36. The other document Is signed and the account number is the same as the first document. Note that the dates are different so the documents were not signed together. Any help or pointers would be greatly appreciated. Many Thanks

-

I also obtained this from them regarding a JD Williams account. It does not makes sense. Debt written off. No copy of contract, can't remove default as information was correct at the time but they can't send or have copies of nothing..? letter below including the reply from Exuifax, which tells me that the dca can't leave a default if it buys the debt? so something really wrong here.

-

started a new thread as advised. my wife started to get letters about debts from lowells. all have had cca requests sent on 4th july this year, but they have all been acknowledged and all the accounts are on hold except capital one. the paperwork they have sent suggests the debt isnt as old as we thought. i have attached all the letters in pdf format. capitalone.pdf

-

Morning everyone Received letter from Shop Direct on 28th March to say they sold my Very account to them. Shop Direct is still showing on my credit file. Could anyone advise who I should SAR? Thanks so much

-

Hi, It’s currently 4:30am and haven’t been able to sleep tonight worrying about this situation I find myself in so apologies in advance for bad spelling/not making sense. I opened a littlewoods account around 2/3 years ago now when I’d lost everything and was immature and stupid I ended up maxing out the account to a total of £600...100s of letters/phone calls of being ignored I’ve finally been hit with a county court claim. Came on the 4th but had the date of 1/06/18 on it. I briefly read through it and started to panic on how real this could be getting. I haven’t filled anything in I was just going to ignore it and just let things plan out as I did do with quickquid years ago which just gave up but reading more into the forums here and the words county court are starting to seem more serious. I have no job and has been like that for 6 months now, No money at all and living with my mum. We’re set to move in a few months so If I just ignored what will happen? I’ve not once been in contact with them like most have on here it’s just been a straight case of me ignoring it whilst giving myself a slap everytime a letter came through the door asking myself why was I so stupid back then. if someone could help with advice I would really appreciate it, Also my credit rating is so bad and I really don’t expect to be looking for any credit related items in the next 5-8 years so would an CCJ really affect me? Lowell’s now ask for a sum of £860 odd in total Thanks and sorry for any ignorance in this message

- 34 replies

-

- county court

- littlewoods

-

(and 1 more)

Tagged with:

-

Hi all, Looking for some additional advice as I appreciate that this is a topic well covered on the CAG forums. I have had a look on the CAG forums at similar cases to get an idea of how to proceed with a claim that Lowells are making towards my girlfriend - I'll state at this point this is on behalf of my girlfriend as she isn't any good at this sort of thing. Please see below particulars of the case they are bringing. I hope everything is covered.. Name of the Claimant : Lowell Portfolio I LTD Date of issue – 19 Jul 2018 What is the claim for – the reason they have issued the claim? 1) The defendant entered into an agreement with O2 (UK) Ltd under account reference xxxxxxxxxx ('the agreement'). 2) the defendant failed to maintain the required payments and the service was terminated. 3) the Agreement was later assigned to the Claimant on 30/04/2013 and notice given to the defendant. 4) Despite repeated requests for payment the sum of £796.54 remains due and outstanding. And the Claiment claims a) The said sum of £796.54 b) Interest pursuant to s69 county courts Act 1984 at the rate of 8% per annum from the date of assignment to th date of issue, accruing at a daily rate of £0.175, but limited to one year, being £63.72 c) Costs What is the value of the claim? £990.26 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Mobile account When did you enter into the original agreement before or after 2007? I'm guessing after that date! The original account (according to her credit file) was opened 25/09/2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim? I believe the account was assigned to Lowells as they stated this was 30/4/2013. Were you aware the account had been assigned – did you receive a Notice of Assignment? Not to the best of our knowledge but we've only been together 6 years, and 4 years in our current property. It's possible something was sent to an old address. Did you receive a Default Notice from the original creditor? No idea. In all honesty a lot of these because of the age and the fact she's no longer an O2 customer go in the bin. There's also the fact we've moved three times, finally settling 4 years ago. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Again not sure, as above... Reading some other CAG threads would this not be applicable as mobile phone contracts are not covered by the CCA? Why did you cease payments? No idea. She had this account before I knew her, and I believe it may have possibly had something to do with her state of mind at the time. She split from her ex who she was with for 15 years and got a bit depressed. Working as a carer on basic minimum wage and living alone for a time, so probably got swept away. What was the date of your last payment? No idea on this. Have contacted O2 with a kind of altered SAR directly by E-mail requesting details they hold on her Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management planicon? No I'm going to fill out the AOS on-line on her behalf (praying that this doesn't get as far as court as neither of us will be up to that) However I would appreciate some advice on whether this would possibly be statute barred? I understand why they are bringing the claim now as it's just under a year before the 6 year period runs out. But surely the 6 year period runs from the last date a payment was made? Am I right to go down this route of defence? And am I right to hit O2 with a SAR. (I'm expecting them to have little information though on her as the account was opened 6 years ago, although assigned to Lowells just under 6 years ago) At this stage should I specify that I'm contesting the entire claim or just part of it? She had an account and it's likely the contractual term hadn't ended but it's hard to know exactly at this stage what terms she was under as the account was opened 5+ years before it was assigned to Lowells. Given all the uncertainty I'm leaning towards contesting part of the claim? Would that be the best course of action? and then hit them with a CPR 31.14? Many thanks in advance,

-

Hi I CCA'd Lowell as they held a Default against me for Morses Club for £329 which I do not recall owing back in 2009, which was defaulted in 2015. Lowell have come back to me sending me a printed statement, which to be honest, I could just type up on a few sheets of paper! The letter states "we note that you state that we have failed to comply with your request for information under sections 77-79 of the Consumer Credit Act 1974 and as such you feel that this account is unenforceable. The duty to supply documentation under Section 77-79 of the Act does not apply to an account under which no sum is, or will, or may become payable by the debtor. Therefore it would not apply where the balance has been written off, as is the case with this account". "In accordance with Schedule 2, paragraph 2(a) of the Act that deals with the exceptions to any request under Section 10, Lowell is not prepared to cease processing your data in respect of the debt claimed from Morses on the basis this is required for the performance of the said contract to which you are a party. At the point of application of this account with Morses a Fair Processing Notice was agreed to by you to share/pass personal data. Consequently, when Lowell purchased the rights to and benefits of the account, this included the Fair Processing Notice and the requisite permission". Section 136 of the Law of Property Act 1925 requires Lowell to give you notice of the assignment of the debt to them from Morses. Our records show that our letter of assignment sent to you on the 23rd June 2015 following the purchase of the debt from Morses which satisfies the relevant provision of the Law of Property Act 1925". "We are not prepared to remove any default registered with the credit reference agencies in respect of this account as we consider the data remains correct and accurate". It goes on but it's the same standard blah blah blah. Any help would be really appreciated in response to their letter, thanks

-

Vanquis CC debt + Lowells + ** WIN **

notodebt posted a topic in Provident and associated companies.

Hi.. Sent a SAR request last week to Lowell for a Vanquis CC debt and Halifax loan . Got a letter back today to say they have received and sending all paperwork from when they purchased the debts but if I require anything before that i need to SAR the OC. Surely as the supposed owner of the debt they should contact the OC or have all original paperwork such as statements etc sent to them once purchased ..or do I indeed have to contact OC ? Wanted to check before I send a curt reply letter back to Lowell -

Hi I have received a county court claim form from Lowells for an old catalogue debt of £186 and I dont know the first thing to do , can anyone help me please? I cant even remember having the catalogue they say its from December 2011

-

Hello people, Its been a long time since I've had to do this so I'm looking for guidance. My Partner has received a County Court Summons dated 22 March2018 for a Lloyds credit card. The card was taken out in 2000 and the last payment made was in 2014 - according to the particulars the agreement was assigned to Lowells in March2015. I am presuming there will have been letters from them but my partner WILL have ignored them, which is why I am guessing they have gone down this route - hoping this will be ignored and then gain judgement by default. The total claim is £2126.77 Obviously this is now time sensitive so I need to get moving with it - How do I reply to the summons and then how do I deal with Lowells? Sorry its so sporadic but I do a lot of travelling with my job so sometimes its difficult to get things achieved. Any advice, as always , gratefully received. regards OOT

- 52 replies

-

- lloyds bank

- lowells

-

(and 2 more)

Tagged with:

-

Claimant - Lowell Portfolio 1 Ltd Date of issue – 23 January 2018 What is the claim for – 1) The Defendant entered into a Consumer Credit Act 1974 regulated agreement with Vanquis under account reference XXXXXXXXXXXXXXXX ('the Agreement'). 2) The Defendant failed to maintain the required payments and arrears began to accrue. 3) The Agreement was later assigned to the Claimant on 31/03/2014 and notice given to the Defendant. 4) Despite repeated requests for payment the sum of £742 remains due and outstanding. And the Claimant claims a) The said sum of £742 b) Interest pursuant to s69 County Courts Act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accruing at a daily rate of £0.163, but limited to one year, being £59 c) Costs Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol)? Unsure What is the value of the claim? £931 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Credit card When did you enter into the original agreement before or after 2007? 2009 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? Unsure Did you receive a Default Notice from the original creditor? Unsure Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Unsure Why did you cease payments? Unemployment What was the date of your last payment? Unsure Was there a dispute with the original creditor that remains unresolved? Unsure Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Unsure ---------- Hi First of all, thank you to everyone who helps on here, you're amazing! I've been issued a Claim Form from the County Court Business Centre regarding a 2009 Vanquis credit card debt which is now with Lowells. I used MCOnline to register and Acknowledgement of Service 10 February 2018 and have a PDF showing this date (I think I just made it in time!) I ticked 'defend all of this claim' and 'I intend to contest jurisdiction' (advice from another thread before landing here). That same thread said to send a CPR18 Request for further information, which I am doing now from their template as well as a separate CCA Request letter. Looking for advice on whether this is the right course of action. Thank you all so much.

-

Received a letter today from Vanquis and also Lowells together stating my £1900 CC debt has been passed to them CCA Lowells and SAR Vanquis?

-

Hi guys/gals its been awhile since I posted and needed any help so bare with me. Lowell have bought an old Vanquis debt, I have had loads of letters and ignored them, I haven't had any contact with them on the phone either so I've not acknowledged any thing. On Saturday received court papers, I have registered with money claim AOS as I want to defend. I was told about a 3 letter process to send to Lowells solicitor but don't know what the letters are. Any help greatly appreciated, thanks.

- 20 replies

-

- county court

- lowells

-

(and 1 more)

Tagged with:

-

Hi there I am trying to find out if Lowells did buy the debt are they liable to pay the PPI or is it the Cap One as the Original creditor who is liable to pay this back. I have read it somewhere it is the original creditor who has the right to PPI. Any advice would be greatly appreciated. I have a Cap One card with a small balance which would be SBd in a few months. Lowells claimed that they bought the debt but I had a dispute with Cap One for a long while. I have some PPI on that card which I want to claim. Lowell had put a Default Note in my CRA and the account is in their name although I had a dispute with the original creditor. Are they allowed to do this? I am going to send them a letter so would be grateful if anyone has had similar experience and has got a letter so I can send Lowell's a similar letter. Many thanks

-

Hi, I will try to keep this brief, have received county court claim from Lowells for credit card, I have already acknowledged service with intention to defend, sent CPR18 and CCA request but not submitted defence yet still have 2 weeks for that, what I need advice on is regarding the letter I have had back from Lowells as this could affect the defence I put in. They have not as yet produced any documentation that has been asked for and have said I am not entitled to deed of assignment as this is confidential, but below is what they say regarding the account and I paraphrase. The account was opened in 2007. The address they give for where it was opened I did not actually live there until 2009!!, would this have any relevance for defence I can prove that point? The last payment on account was in 2012, however I know that the credit card company took the money out of my account and as I did not recognise the activity on my account because the d/d mandate was so old, my bank recalled the payment and put back in to my account, my question is and this is important, does this constitute a payment as if not it would be SB They also said a default was registered on my credit file in 2012, obviously I have my credit files from all agencies (yes I am that anal lol) but there is no default at all from that date, the only one on there is one put on by Lowells not the cc company in 2014. Any thoughts on this would be really appreciated

-

Hi , wonder if anyone can help, Lowells are threatening legal action , i.e having assessed our options, we intend to take legal action to recover this debt if you do not contact us to agree a repayment plan. Some background phone and iPads taken out on contract in early 2012, payments dropped off late dec 2012 due to losing job, then had a major accident in early 2013 , was off immobilised/unable to walk for 11 months, in the meantime I offered and was paying orange £10 per month, which by 2014 had stopped, no money, yep buried head in sand, just before christmas 2016 , had the letter that lowells had bought the debt ...they have sent various letters over the last 10 weeks , the last one being i.e having assessed our options, we intend to take legal action to recover this debt if you do not contact us to agree a repayment plan. Any ideas on how to move forward. ..also the sum is quite large around the 2k mark. ..I acknowledge i owe , but not that much... I do not have that kind of money. ..nowhere near.. .can anyone suggest best way forward... don't want a cjj , was thinking of offering a payment of £5 per month, but want a breakdown of charges...

- 99 replies

-

- debtlowells

- lowells

-

(and 1 more)

Tagged with:

-

Hi long time reader, first time poster. I requested a CCA from Lowells in October of last year relating to a Llyods/TSB credit card debt. The card in question was taken out in April 2004 and fell into default in late 2012. 4 months later they have sent me what appears to be a copy pasted set of terms and conditions and a copy of the last years worth payments to the account. The terms and conditions have an error in the address I was living at when the card was taken out, they've used the postcode for an address I was living at 10 years later, otherwise it's correct. There's also no date for when the agreement was taken out, nor is there a signature (I'm unsure if this is required or not). Would I be right in thinking that a reconstituted CCA is only valid for debts after a certain date? I would be grateful if someone could take a look at the attached PDF to see if what I received meets the requirements of a CCA request and if not, what do I do next? 2017-03-07_12-43.pdf

-

Just when I thought I am getting everything in order here comes Lowells with a Pre-legal assessment letter. How funny they are sending a letter for an account that was settled. It was an old account that I had with BT which is also SB'd as last payment was made in 2010 (disputed termination fees which was settled). I sent them a letter to say that I do not owe them or BT any money and they are trying obtain money by fraud.

-

Good afternoon everyone. This is going to sound pretty silly but I have been paying Lowells £5.00 per month for nearly 3 years now, but I have no idea what it is I am paying for. Some of you have been helping me with an actual claim, so know the state my life was in a few years ago, so I won't go into that all again. Anyway - I think (but am not certain) that the debt was an old littlewoods catalogue. I have not missed a payment ever in the nearly 3 years it's been going on for - but my credit file just shows default every single month, so I am getting no benefit by paying it back. I'm rambling (as always) sorry; I just wanted some information on how I can find out what this is for. I am loathe to call them as they've lately been writing to me about an old mobile phone contract, and I'm nervous that getting in touch with them may open another can of worms. My credit score page just says Lowell, and nobody else so I don't have a clue what this is for. I imagine most will think it insane that I've been paying them all this time without knowing what it's for - but I just agreed a small amount to get the off my back at the time, and being homeless I have lost any paperwork they might have sent me long ago. Many thanks people.

-

Hello, I have this morning received a Claim Form, it is from Lowells. i am confused, I am pretty sure I took this up with Shop Direct at the time and asked for documents etc but to no avail. This account was defaulted on 29/10/2013 and has been with lowell for a while. They have tried to ask me for the money back but I did not respond. The debt on the letter from solicitors 2 weeks ago states i owed 846.65 but this claim form says 914.38 then fees on top of that bringing it to 1044.38. My question is, do I fight this or do I offer them some payment scheme if they will allow at this point as I have had no communication with them. Any help would be greatly appreciated.

-

Name of the Claimant ? Lowell Potfolio 1 Ltd Date of issue – 11 May 2017 What is the claim for – 1.The Claimants Claim is for the sum of £564 being monies due from the Defendant to the Claimant under a Financial Services agreement regulated by the Consumer Credit Act 1974 between the Defendant and HFC Bank Limited under account reference XXXXXX and assigned to the Claimant on 23/12/2011 notice of which has been given to the Defendant. 2.The Defendant failed to maintain the contractual payment under the terms of the agreement and a default notice has been served and not complied with. 3.The claim also includes statutory interest persuant to section 69 of the County Courts Act 1984 at a rate of 8.00% per annum (a daily rate of £0.12 from the date of assignment to 22/12/2012 being an amount of £43.92. What is the value of the claim? £738 Is the claim for a current (Overdraft) or credit card /loan or catalogue or mobile phone account? Loan When did you enter into the original agreement before or after 2007? Before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Assigned - Lowell Portfolio Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes Did you receive a Default Notice from the original creditor? Unknown Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Don't think so. Why did you cease payments? Financial difficulties. What was the date of your last payment? Probably June 2006, but proven as before Nov 2009. Was there a dispute with the original creditor that remains unresolved? No. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No. Hi all. I have read several threads on the forum, and could probably work out how to do this on my own, but I would feel a lot better with some experienced guiding hands. I have received a court claim from Lowell Porfolio regarding a loan taken out originally in 2005 with HFC for goods purchased from a high street retailer. If I remember correctly, there was nothing to pay for 6 months, followed by 6 months interest free payments. Failing that it was to revert to 36 payments with interest. I believe that I only made one initial payment, before falling into difficulties. I have managed to find a statement from HFC stating the balance in Nov 2009, and that is the same balance that has appeared on all correspondence to date, so I can show that nothing has been paid since then at least. I do have a letter dated Nov 2012 stating that the loan had been assigned to Lowells. Any help on my best course of action would be gratefully received.

- 18 replies

-

- barred

- county court

-

(and 2 more)

Tagged with:

-

I received a Letter of Claim from Lowells today and now my heart is racing and a sense of panic is setting in. Particulars of debt: On 22/6/2009 you entered into an agreement for Lloyds account. You failed to make payment in accordance with the terms of the agreement and it was later terminated and subsequently assigned to our client by Lloyds Bank PLC on the 24/11/2015. Notice of the assignment has been previously been given to you and you may request a copy of the agreement on the enclosed reply form you are required to make payment of the of the sum outstanding £11931 within the next 30 days. Please advise as i certainly do not have that type of monies available.. Silly silly me for stopping my repayments

-

Hi all, I just received a County Court Business Centre Claim Form from the above mentioned companies and any help as to my course of action would be grateful... Name of the Claimant ? Lowell Portfolio I Ltd Date of issue – 20th April 2017 What is the claim for – 1.The claim is for the sum of £2093 (rounded off) due by the defendent under an agreement regulated by the Consumer Credit Act 1974 for a Provident Personal Credit Limited account with an account reference number of xxxxxxxx. 2.The defendant failed to maintain contractual payments required by the agreement and a Default Notice was served under s.87(1) of the Consumer Credit Act 1974 which has not been complied with. 3,The debt was legally assigned to the claimant on 29/Aug/2014, notice of which was given to the defendant. The claim includes statutory interest under S.69 of the County Courts Act 1984 at a rate of 8% per annum from the date of assignment to the date of these proceedings in the sum of £167 (rounded off) The claimant claims the sum of £2260 What is the value of the claim? £2445 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Personal Loan When did you enter into the original agreement before or after 2007? After 2007 - One 22/8/08, One 23/8/09 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Lowell Portfolio Were you aware the account had been assigned – did you receive a Notice of Assignment? Did you receive a Default Notice from the original creditor? Not sure Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Not that i'm aware of Why did you cease payments? Entered into a DMP with the CCCS (as it was then) and thought they'd paid the debt What was the date of your last payment? Roughly 2011 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? As stated - entered into a DMP which finished in 2012 Looking on my Noddle credit file, there are 2 Lowell accounts on there (neither corresponds with the account number stated in the claim), one for £1850 and the other for £250 - it appears they have 'lumped' them together - Can they do this? If I recall rightly, the larger amount is for a loan which included paying off the first loan which is still showing as £250 If i'm correct, my first step is to send a CCA request to Lowells and a CPR 31.14 request to Cohen Cramer which will be done in the morning.... I presume I need to acknowledge the claim prior to doing this via moneyclaim online? And then what are my next actions? I'm going to try and locate my old CCCS documentation which is on an old mothballed desktop computer in our attic! Any help would be gratefully received Swisstoni

- 101 replies

-

- cohen

- county court

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.157c55a57c1d03e42624bbf0c552576e.jpg)

.thumb.jpg.0a920372943b1ddd34b7a9e31a174b4f.jpg)