Showing results for tags 'dsar'.

-

Firstly a bit of background. I have a secured loan with blemain finance (we all make mistakes:-x) It was taken out in may 2007 and is for £10K also it is cca regulated. They have added over £4K in charges in just 2 years, I have requested the charges back and after lots of letters i have they're final bog of letter. so i am now debating whether to take then to court for unfair credit agreement or go to the fos, i have phoned the fos and they have taken details and sent me out the forms to carry on with my complaint,but as yet i have not sent them back.so i have all options open to me and some advice in which way to go would be appreciated. Also i have a suspended possession order after they went for repossession, now the thing is i think when they took me to court they first sent out a default notice, but i think that it is non compliant and would like a second opinion,and some advice on how to deal with a suspended position order that they got on the back of a dodgy default notice. my issues with the default notice are a]That they didn't give me 14 clear days to rectify. b] No specific date to remedy (they say 14 days from date of letter) c]The paragraph saying that if you dint understand this then seek advice from CAB is missing the following is word for word what it says on the default notice and the only date on the notice is at the top of the page. 1] To remedy the breach you must pay the total arrears of £xxx within days of the date of this letter. 2] If the action required by this notice is taken before the 14 days, no further action will be taken in respect of the breach. 3] if you don't take the action required by this notice before this date then the further action set out below may be taken against you. 4] FURTHER ACTION: on or after the date shown above we shall apply to the court for an order for possession and sale of the mortgaged property. so any advice on how to proceed with this would be greatly appreciated and thanks for looking. welshperson (from bridgend:-))

-

Hello I SAR'd VODAFONE for a debt that is on my credit file that i believe is not mine. I asked for SAR but they are asking for proof of my ID and address etc. I have only ever lived at one address, i told them that the credit file and the information they have put on the CRA's is the same as the address they are sending the SAR, but now the time has elapsed for them sending this to me. I don't want to send them any ID as I know they don't have my ID and won't send me any contract or nothing. There also sent it to a DCA, and I SAR'd them, they said its taking longer than expected, outwit the time limit and said will get back to me in a month or so - probably because they don't have any information from vodafone cos the contract and debt is not mine. Can anyone help me out?

-

I also obtained this from them regarding a JD Williams account. It does not makes sense. Debt written off. No copy of contract, can't remove default as information was correct at the time but they can't send or have copies of nothing..? letter below including the reply from Exuifax, which tells me that the dca can't leave a default if it buys the debt? so something really wrong here.

-

Well here's another company failing to adhere to the GDPR I requested a DSAR from Opos on 23/06/18 and have just received the following email - Dear XXXXX I am in receipt of your below email and I have noted the contents accordingly. In order for us to proceed with your request, please complete the attached form and return this, along with the requested documentation, to this email address. Once the completed form and requested documentation is received, we will progress with your request. Regards, Rob Sands Data Protection Officer So they are failing by asking me to fill out their form and asking for ID even though they have previously contacted me by email and I have raised complaints with them by email. ( its an email address I only use for this sort of stuff so don't care if they have it) Ive let them know that if they continue to ask me to fill out their form and request ID I shall be reporting them to the ICO and if they fail to send me the required info within the 30 Days then I reserve the right to issue proceedings against them

-

HSBC UK have not complied with my Data Subject Access Request (SAR), submitted under the new General Data Protection Regulation (GDPR). The DSAR was requested on 16/06/2018 and should have been disclosed by 17/07/2018. 16/06/2018 - Request sent to HSBC UK for DSAR under new GDPR 18/06/2018 - Acknowledgement email received from HSBC UK Customer Care Team 22/06/2018 - Acknowledgement letter received from HSBC UK Data Protection Office 17/07/2018 - Data not received, so contacted HSBC UK who stated that they were not aware of this request and have not even started to gather data for the disclosure 17/07/2018 - Internal complaint made to HSBC UK Customer Complaints Team 18/07/2018 - Complaint made to Data Protection Office and Letter Before Action sent to HSBC UK. Telephoned Data Protection Office and confirmed that they have received both email and LBA. When asked for timescales in relation to compliance for my DSAR, a team manager has advised they don't know and cannot give any timescales. I have made them aware I will be reporting the non-compliance to the ICO, but they didn't seem at all bothered. 18/07/2018 - Information Compliant Handling Form submitted to ICO 18/07/2018 - Complaint acknowledgement received from ICO Next steps: Now waiting for the Data Protection Office to make contact with me to progress DSAR and also waiting for HSBC UK complaints team to pick up the complaint. No doubt this will be towards the end of the 8 FCA timescales! Also, waiting to see if HSBC UK will comply within the 5 working days afforded to them in my LBA. I very much doubt they will, due to the large amount of data they will need to gather, redact and securely send on to me. Will potentially need to look at submission of a POC for a County Court claim if not. Submitting a GDPR POC is unchartered territory for me, so if it comes to that point, could really do with some help. Hints/Tips: Some may already be aware of this, but I was not. None of the calls received at the HSBC UK Data Protection Office are recorded. So when I asked for copies of all recordings to their department, they advised me of the above. Also, HSBC UK Data Protection Office don't advertise or easily give up there email address. So if you do need to email that team, you can do so here [email protected]. It definitely works, as I have emailed them my LBA and complaint letter and they have received it the next day.

- 7 replies

-

- compliance

- dsar

-

(and 3 more)

Tagged with:

-

Sent a DSAR to National Hunter. This DSAR was specific in that I was requesting copies of any and all data they might hold on me Response being in regards to any statements, screen shots, recordings, internal and external communiications etc. They have stated that they want me to be specific, that is date range and what context about myself, The obligation has to be on them to search for data Looking at drafting a sutible response and welcome guidance as to content before going in with the ICO if justified

-

Think this might be a quick issue to resolve but I would like your thoughts please. Is it possible to apply for Data Subject Access Request for information on a deceased person? I am the spouse of the deceased and there was a Power of Attorney in place prior to death so I was next of kin. I suspect that DSAR is only for living person but if that is the case how can I get access to information which involves me but was on his records? Thanks in advance Shelley

-

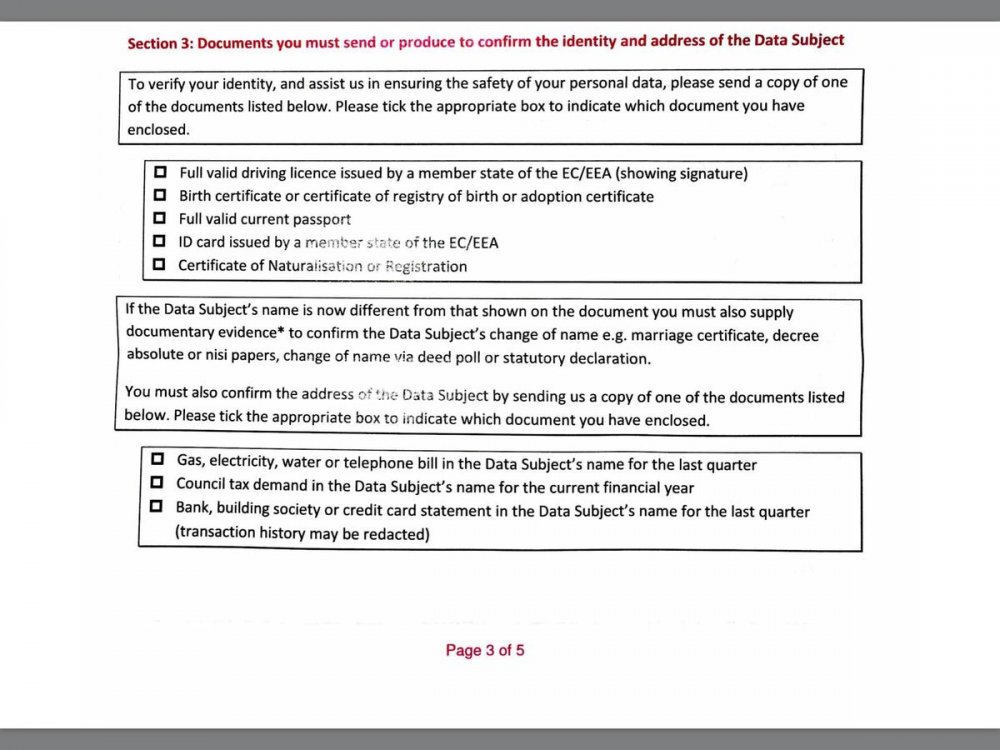

I've just sent off (with the £10 postal order) a Formal DSAR request to 1st Crud. All info required to be supplied, including a signature was provided in my formal and detailed letter. I've just received one of their 'please fill out this 5 page form' before we are obliged to do anything, however I'm not happy with what they are requesting I provide. There is no way I am ever going to provide them a copy of my driving licence, or bank statements and I'm back on here for some advice. I've been completing DSAR requests for approx 10 years, and apart from (almost) starting legal action with BC whilst some have been a struggle to get all info from and in a timely manner most have been compliant and not made me jump through too many hoops. (Oh apart from the DWP completely ignoring me for over 2 months! Still ongoing - but I class them in a different category to the CC companies and DCAs etc). Have the rules changed? I am now legally obliged to provide any of the following on the attached picture? Considering I've lived at the same address for over 10 years, and they've contacted me for 3-4 different companies at this same address, and threatened legal action to me at the same address, and supplied alleged CCA agreements, I would think that they should be fairly confident of my identity? Can I take this route, or will they likely play up and delay provision even though I don't (I think) have to legally provide the documents they have requested I send? Thanks ME_TOO

-

Hi All Is there a difference between a court hearing for Possession and / or Repossession its probs a silly question and I know the answer but I ask because I have just recieved some paperwork re my court appearence on Monday 6th Dec, hence the title O M G. Mr Very Worried at the momment however I am sure that will change in the next few hrs.

- 187 replies

-

- doorsteppers

- dsar

- (and 12 more)

-

Looking to send a DSAR to Npower after not being billed correctly for nearly 1.5 years after having a new electric meter installed in August 2014. Have made official complaints to Npower direct & the Ombudsman but still not any further forward with getting a correct bill as basic maths seems impossible for Npower staff. Am now dealing with Npower via letter/email only as fed up with being lied to/pasted from pillar to post/having the phone hung up on me. New development is that Npower haven't taken Jan 2016 direct debit payment, my bank states that Npower never put the request through! So now I want to view what records Npower has to compare them to mine, think should make for interesting reading. But am unsure which Npower department/address to I send the DSAR request & cheque to? Plus who do I make the cheque payable to? Planning on sending the request (using the fab template on this board) & the cheque recorded delivery but is there anything else I should do/be aware of?

- 14 replies

-

Hi all Been very quiet on here for quite a while, due to no DCA's trying to contact me about the usual. Today however, I have received a letter from a company called Drydens Fairfax. There is perhaps one debt I have that COULD still be enforceable - mortgage shortfall, sadly! All the others to the best of my knowledge, Statute barred. Any idea who the clients of this outfit could be?? The letter is the DCA's usual, "Are you XXX? Do you know where XXX is?? If you are not XXX, please accept our apologies........." and so on and so forth. Obviously I have no intention of contacting them unless they come up with something a little more convincing. Worrying thing is, the wife has one as well, which means if there is a debt, it's a joint one, and there's only two of I know of that could be - one being the shortfall, another being Wel**** Finance. It's a company based up north, which makes me think it may be from Cattles Group/Welcome finance, which is definitely SB. Any words of wisdom, folks?? Thanks.

-

I had an MBNA credit card approx. 17 yrs ago. I sent a standard letter asking for information on my original agreement including possible ppi, charges, fees and interest. they sent me a very brief letter stating " Payment protection cover has never been applied to this account, therefore no premium charges have been applied". are they trying to fob me off? and if this is true should I pursue this claim to reclaim my charges (im sure there are numerous for missed DDs and late payments) please advise

-

I have been trying to locate the correct address to send a Data Subject Access Request to the DWP and I am not having much success. I am after information from all departments from past 40years maybe so not sure how I would go about ensuring that the information covered every benefit etc. Has anyone had success with this and if so, what timeframe did they go back to? Was the information legible or are they like the banks in so much as provide some but not all? Appreciate any assistance or addresses please. Shelley

-

A friend of mine was prescribed with an overdose of a drug by a Private consultant in a Harley Street clinic. It has led to complications as one might imagine. Can anyone tell me if she would be able to get copies of ALL her medical notes and whatever they hold in the clinic by issuing a Subject Access Request or any other method as she's not getting straight answers from the clinic? She may have been having the consultation via her medical Insurance (not sure)although I know they pay the fee, but she does have Insurance I do know. She was not referred by her GP though. Thanks A1

- 7 replies

-

- consultant

- dsar

-

(and 2 more)

Tagged with:

-

Hi there everyone,.. I have found many threads on this DCA group and thought someone could possibly point me in the right direction? I have debts. .. Im currently using DMP by Gregory Pennington to pay off. .. thats all fine and dandy.. . have been using for 6 months but apparently they have to review every few months or so.. . so they have to re-negociate with creditors and so forth.. . fair enough... However, Halifax have recently sent one of my accounts to their in house team B.O.S, they have gone the whole way so far.. . text messages asking me to call them, 08456 numbers, which are obviously halifax, I am aware that B.O.S are just a subsidary of HBOS... Sorry im waffling now.. my issue is with a letter i recently received... "NOTICE OF INTENDED COURT ACTION" ... HFX vs.. ******me****** ... formal notice is hereby given that our client instructs us to commence court proceedings against u without delay... papers are now being PREPARED for commencment... -that old chesnut basically my issue is since i had their first letter last month, they have gone straight to this sort of letter.. . and I already have re-payment arrangements in place via DMP Gregory Pennington - so they are accepting payments... im just a bit confuzzled, i know not to ring them, as regardless of what I tell them IF i actually did ring them, they would only seek more money that I dont actually have... Im sorry If i have waffled on too much, but there must be someone out there who mite be in the same predicament as me?? BOTTOM LINE: i have arrangements already in place, all my other creditors are continuing and are acepting minimal payments which is great.. . AND the amazing thing, HAlifax have already accepted repayment plan for another account no problem.. .. but for some reason they have transferred this particular account (debit acount i believe) to B.O.S where they have jumped to this letter, even though payments are still being made. ARGHHHH, PLEASE HELP Much appreciated to those who can respond Regards, DaveTheRave xx

-

LLOYDS BUSINESS-PERSONAL Accounts SAR

kurvaface posted a topic in Business Bank accounts and charges

Hi there and thanks for having a look. I really appreciate any advice given. I have a few business accounts with lloyds and I do my personal banking with them too. Recently the bank has removed our very friendly personal manager and replaced him with some automaton from a call center in Birmingham because our turn over for each business isn't high enough to merit face to face contact with an individual manager. Since then, the bank has made cock-up after cock-up resulting in no end of inconvenience to us. I intend to do a subject access request to see what information the bank holds on me and to try and establish why they are providing such a very bad service. My personal account has always been linked to my business accounts in terms of decisions made about overdrafts, credit cards etc.... even the type of personal account I have is a consequence of my business accounts. In discussions with the bank about SARs, they have said they do not have to provide transcripts of calls to their call center because the calls are recorded against an employee's name for training purposes rather than my name. It is not unusual for us to ring the bank and discuss both business and personal matters in the same call. They do say they record all calls. They also said SARs are not applicable to LTD companies. My Questions are: 1) Are SAR s different for LTD company accounts compared to personal accounts? If so, what is the process by which I can establish what data the bank holds on me in relation to my businesses? 2) If I do a SAR in my name, will it throw up all the business information or will I have to do seperate requests for each of the businesses? 3) Will a SAR provide transcripts of phone calls? 4) Is there any information they do not have to provide for a SAR? 5) Can they get out of providing telephone transcripts? 6) If they fail to provide the information, what options do I have and what sanctions can I seek? Many thanks KURV- 13 replies

-

- dsar

- lloyds bank

-

(and 2 more)

Tagged with:

-

MARBLES Credit card DSAR Hi forum, I've sent a DSAR to Marbles. Enclosed with it was a copy statement (all I have) from Nov/Dec 2005. They have sent my request back stating: "We were unable to find information for the account you requested - Marbles cards from 2005 are dealt with at HSBC" I sent my request to the customer resolutions team at: Card Services Pitreavie Business Park DUNFERMLINE KY99 4BS So I'm a bit stumped now .. ??

-

What is the difference if any? i want information from my employer which one do i use to request it? thanks

-

Hi, I'm not sure if this is in the correct place? Anyway I recently sent a SAR on the 27/09/12 via signed recorded, which they apparently didn't receive it till the 01/10/12. More recently they have sent me one of their standard signature request letters dated the 12/10/12 , which I assume is a stalling technique, as the letter I originally sent was signed, dis-regarding this I decided to go with the flow and send them back the signed request to get things moving ASAP, they have then written back dated the 16/10/12, that they have received the signing mandate and will be processing it within 40 days from the 16/10/12, as they hadn't received all the documentation that they required at the original date. Could someone please help, I don't think I've ever been so frustrated with a bank, especially one that I've had no prior problems with. All the best John

-

Hi, I have tried to DSAR a firm of solicitors icw with a mortgaged property repossession, as I am trying to get hold of court papers from 1999 - I've been direct to the court, but they told me that they do not hold the paperwork for more than 5 years. I have written to the solicitors and sent them the cheque etc., but they have replied as follows: The request you have made to access any personal date that we may hold on you refers to personal data that we hold on behalf of our client ***. Therefore your request for a copy of the data should be addressed direct to *** as data controllers. Is this correct? When I DSARd the band direct a couple of years ago they did not provide any information from the solicitors, despite my asking them. If I can DSAR them direct - what arguement do I go back with? Jody

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.