cfs_too

Registered UsersChange your profile picture

-

Posts

196 -

Joined

-

Last visited

-

IDEM Claimform - HSBC Loan or was it?***Claim Discontinued***

cfs_too replied to Tbirdo's topic in Legal Successes

Hi, Maybe one of the more experienced members might know more details, but as I remember.... HSBC / First Direct for a period of time from 2007 onwards, combined loans and CC's into Current accounts so that it appeared the current account was £1000's overdrawn instead of having a current account & loan/cc account separate. There was much discussion on here about the errors of doing so as it removed some of the consumer rights under CCA 1975. I'm my experience they bundled a £8000 CC into a £300 o/d current account. At the time I challenged them, they told me to clear off! I think I remember some contributors saying this could cause issues if taken to court? -

Hi, Thanks for the info and links, I've also read a slightly different version....which may cover other ESA people too, to do with ESA 'income related top up'. I'll put a link here (hope it's allowed). The first part is a quote from the linked article. "There are two forms of ESA: income-related ESA and contribution-based ESA. The DWP error related to claimants who were placed on the latter form of the benefit only, when they may also have been entitled to the former. As a result they may have missed out on premium payments." https://samedifference1.com/2018/03/21/three-hundred-thousand-esa-claims-to-be-reviewed-after-latest-dwp-error/

-

Hi dx, It's a bit complicated but I'll try to explain as simply as I can.... Several CC companies (to whom I owe money & am unable to pay due to disability), continue to contact me still, 10 years after I got into financial difficulty. They refuse to write off balance, and will not accept I do not have the funds to pay them. I was making token payments, but after many years of continued harassment did the CCA route, and decided not to pay the unenforceables. So, every now and again the CC 'recoveries' departments trigger the account to be sent to DCA's. The one account which I currently have a problem with, has been sent back n forth to 1st credit 2-3 times, also sold to 1st and purchased back by OC. (1st credit have purchased several other debts which they have given up on) I am unable to communicate on the telephone, and have requested numerous times, quoting EqAct etc to remove all telephone numbers from accounts. The CC companies and 1st credit oblige, until the account is passed to them again (or a new CC tries to use 1st credit as the others have failed to get anywhere). And so here is where the problem begins...... Each time an account is sent or (resent) to 1st credit they perform a check on a 'general database', attaining a telephone number which I have not been contactable on for over 12 years, but which is used by a family member. They then continue to bombard the telephone number with calls at all hours. Each time I have to raise formal complaints to get the calls stopped, but it takes a few weeks each time, and I really don't have the time or energy to keep writing formal complaints on the same problem. Each time they remove the number.....until the next time!! We have a true call on the number, but there are times when they slip through, before I can block the numbers. I have written to 1st credit requesting details of this 'general database'. They signed for, but ignored my letters (plural!) I wrote to the ICO, who have advised to request this information under a DSAR, and until 1st credit refuse to provide this information under a DSAR then the ICO can't do anything. It's so frustrating, all I want to do is find this central database and get the information corrected. I really don't know how the incorrect telephone number is against my name in the first instance - as for over 20 years, I have not put this telephone number on to any forms, and have also ensured I ticked 'no third party contact' etc. I hope that's explained it, so in summary I need 1st credit to name the external database / company from where they attained an inaccurate telephone number. Thanks Me_too

-

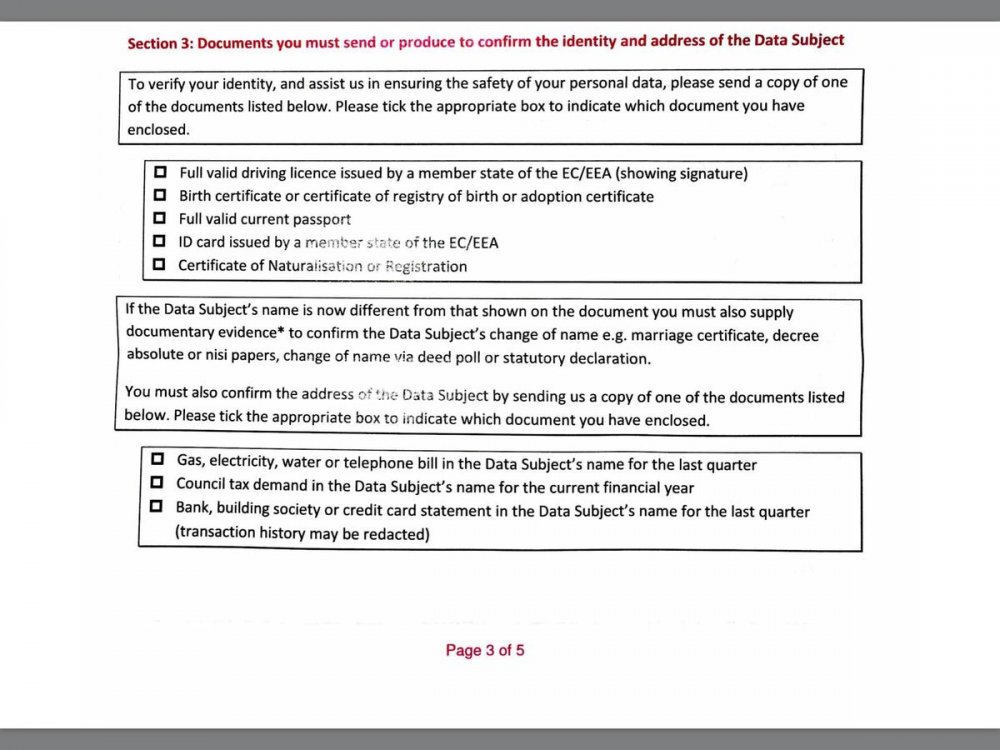

I've just sent off (with the £10 postal order) a Formal DSAR request to 1st Crud. All info required to be supplied, including a signature was provided in my formal and detailed letter. I've just received one of their 'please fill out this 5 page form' before we are obliged to do anything, however I'm not happy with what they are requesting I provide. There is no way I am ever going to provide them a copy of my driving licence, or bank statements and I'm back on here for some advice. I've been completing DSAR requests for approx 10 years, and apart from (almost) starting legal action with BC whilst some have been a struggle to get all info from and in a timely manner most have been compliant and not made me jump through too many hoops. (Oh apart from the DWP completely ignoring me for over 2 months! Still ongoing - but I class them in a different category to the CC companies and DCAs etc). Have the rules changed? I am now legally obliged to provide any of the following on the attached picture? Considering I've lived at the same address for over 10 years, and they've contacted me for 3-4 different companies at this same address, and threatened legal action to me at the same address, and supplied alleged CCA agreements, I would think that they should be fairly confident of my identity? Can I take this route, or will they likely play up and delay provision even though I don't (I think) have to legally provide the documents they have requested I send? Thanks ME_TOO

-

Barclaycard charging interest after closing account as per T&C ?

cfs_too replied to cfs_too's topic in Barclaycard

Hi dx, Oops, thanks dx, yes now I can see it is the 'card protection' and not PPI. Coincidently, PPI was also stopped around this time (when the account was effectively 'defaulted'), but not registered as such on the BC systems. I'm not sure if its actually BC IT systems which are at fault, as the account was clearly closed, as documented in the DSAR notes, the account was 'cancelled' as per the card protection letter, PPI stopped etc so it indicates the account was defaulted properly but not updated accurately on the BC IT systems. Im sure I read somewhere on here a few years ago that there was an issue in 2011 (I think), whereby BC didn't update the CRA's correctly with the default and then added them retrospectively. Which again must have been an IT issue. thanks MT- 4 replies

-

- account

- barclaycard

- (and 4 more)

-

Barclaycard charging interest after closing account as per T&C ?

cfs_too replied to cfs_too's topic in Barclaycard

Hi Slick & thanks for the quick response, Re: ‘cancelled PPI letter’ - this letter is the only communication received from BC which confirmed the account had been closed. I have attached (i hope) a copy of the letter which references the account is ‘cancelled’, which arrived two months after the ‘expiry’ of the default notice & a copy of their internal notes which state the account has been closed by the collections department (attained under DSAR). They also withdrew credit facilities at this time - in 2006. BC have declined to default the account. My partner started with PayPlan just over 1 month later, after the account was closed, prior to this BC were refusing to accept any offers directly from him. Unfair Treatment? Thanks for details on the lending code, I think I have made a mistake in the Formal complaint by referencing the wrong guidelines/practices BC are obliged to follow. The formal complaint included, (as this is what guidelines I thought covered them) quoted from my letter: “Barclaycard has failed to administer my account accurately and fairly, or to have taken ‘consideration as to my Financial Difficulties’ under the following: 2002 - 2007 : The Banking Code 2007 - 2012 : COBS 2006 - 2016 : Data Protection Act 1998 2006 - 2016 : The Consumer Credit Act 1974” Maybe I made a mistake not referencing the lending code? Does COBS cover the lending code? A little more history BC stopped interest for just over a year, then there were a couple of payments missed, interest was restarted and the DMP was renegotiated (as was initially too high) and thereafter since 2007-2016 made regular payments. Payplan made regular contact with BC, each time requesting interest was to be stopped. BC ignored every request, it was never acknowledged or interest stopped. My partner buried head in sand as he thought this was the ‘way it is’. Clearly in failing to default the account they have received £2500+ in interest, and in charging interest on his account, whilst reducing/stopping interest and/or defaulting other debtors accounts - this is unfair treatment. The best part of BC unfair treatment? They declined to respond to 3/4 of formal complaint, referencing my partner to contact the FOS and then have halted the FOS investigation immediately by stating the event occurred over 6 years ago and/or my partner should have been aware within the past 3 years - and therefore the FOS cant investigate! Even worse, the adjudicator didn’t even ask if this was relevant and has given their verdict. The adjudicator has also referenced me to T&C, (they forgot to include a copy in their letter) which I assume states BC are able to continue adding interest after an account has been closed. This part I wish to complain about also, and wanted clarification if BC can do this once an account is closed. This is why I am asking for the above information, as I didn’t want to solely reply on unfair treatment (however this is quite a large part of the formal complaint in many areas!) thanks MT BC_PPI_cancelled_JPG_jpg.pdf BC_systems_notes_closed_JPG_jpg.pdf- 4 replies

-

- account

- barclaycard

- (and 4 more)

-

Hi, It's a bit of a complicated issue, but I'll try to keep it concise. It's relating to my partners BC account, for which he put his head in the sand until 2014 as he assumed PayPlan had 'sorted it all out', since starting a DMP in mid 2006. I took over the issue in 2015, helping him, as we discovered BC failed to default the account in 2006 (and where still trashing his CRA files). The journey since has been frustrating to say the least.... ...I use 'I' in this context as I have been writing the letters etc on his behalf to try to get this sorted. I have a complaint with FOS, re Barclaycard failing to default a CC account in 2006 and adding interest between 2007-2016, at times as much as 17.9% whilst on a DMP. I raised complaint with BC in Early 2016, raising with FOS 6 months later (in time), BC refused to default account, and referred me to the FOS. FOS have now stated its both out of time, ie more than 6 years ago (only by BC using this as an excuse to stop the FOS investigation), and secondly the FOS adjudicator has stated it is fair, and in BC T&C that interest can be charged after the account is cancelled, as per T&C. ...my problem is that in 2 CCA requests no terms have ever been provided, the one copy I did receive with my DSAR does not reference interest under the section number the FOS states, oh and the FOS has actually failed to include a copy of the terms they are referencing! I intend to escalate to an Ombudsman, but need a little advice beforehand. My Q is: When a credit card is cancelled, by the creditor for the cause of 'my failure to meet minimum contractual repayments' (for 5 months), does this deem the contract to be terminated and thus no longer valid. Ie can BC legally charge interest if they have withdrawn credit facilities and 'cancelled' the account? (There are internal BC notes from DSAR which state account is closed in 2006) I always thought that when closing the account, withdrawing the card and stopping PPI etc then he contract was finished and interest could not be charged. (Oh and defaulted which is my main complaint to BC, the interest being charged is the second part of the complaint as I think this falls also under unfair treatment). History below: In summary, in 2006 default notice, not complied with (was in considerable financial difficulty), received a letter from BC stopping PPI as the account was cancelled. All credit facilities were revoked. DMP with Payplan started FIVE weeks after account cancelled. Then a 2nd default notice issued, after the first DMP payment, but before DMP accepted by BC . This too expired before BC accepted DMP. For one year interest was stopped, but then failed on 2 DMP payments , only managing a partial payment for both, in 2007. (DMP temporarily failed due to bullying from another creditor to make more payments to them outside of DMP!). Interest was restarted and never stopped despite numerous letters from PayPlan request that it is stopped - all letters were ignored. Between 2007 - 2016 made regular payments, and in Sept 2016 managed to pay off the remaining balance with a small PPI Claim received from another company. Between 2006-2014 buried head in the sand assuming PayPlan were working in best interests. Also assumed BC account was defaulted, all the others out of 13 creditors were defaulted between 2006-2009. In 2014/2015 realised both that BC was not defaulted and that wouldn't be getting the interest 'refunded' upon completion of DMP ( as promised by PayPlan - unfortunately only verbally!). This is when I intervened eventually leading to this Formal complaint to BC. any advice before I reject the ajudicators decision would be great. Me_too

- 4 replies

-

- account

- barclaycard

- (and 4 more)

-

Arrow/Restons Claimforn - old M&S credit card 'debt'

cfs_too replied to molly2's topic in Financial Legal Issues

post deleted - didn;t realise &more card to start with, not chargecard etc Sorry me_too- 25 replies

-

- arrow

- claim form

-

(and 2 more)

Tagged with:

-

Hi Silverfox, Thanks for your prompt response, I got a little side tracked with a PIP Medical I did write to Tesco (Data Controller) got a response from Customer services, the response : "Whilst I appreciate you are unhappy this information can be viewed, this would not be a breach of data protection". Yes its the letter heading showing through the window. This letter is the third or fourth time, each time the heading shows and the address is NEVER in the correct place. I think they have major problems with the formatting of the letters, as the address is clearly printing in the wrong location and in conjunction with the 'folding machine' they are always in the wrong place, but never consistently in the same wrong place. I am ex-IT programmer, so I know how easy it is to change the location of the address, however it appears it is not a problem to them. Not sure what to do next, maybe a letter to ICO (for what thats worth). Thanks Me_too Oh, and I forgot the best bit. I also sent a DSAR to Tesco. I received 2 parcels, on 2 separate days, in 'Royal Mail we're sorry your item was damaged' clear bags. The DSAR department placed approx. 100 sheets (each) into the thinest, poorest quality envelopes possible to put into the post. Needless to say the envelopes tore due to the poor quality and all of my personal financial documents scattered from the envelopes. Royal Mail kindly bundled them up, twice, and placed them into clear bags. I don't think that was acceptable from a DSAR department either!

- 3 replies

-

- dept

- displaying

-

(and 3 more)

Tagged with:

-

Hi, I have a strange question, and hope someone familiar with debt collection procedures / DPA 1998 are able to assist. I am disabled, living with elderly parents. My father has never been in debt, and would absolutely freak out of he knew I still owed Tesco Bank a considerable amount of money. I am in comms with them regarding token payment on debt, its been over 10 years of intermittent token payments, DCAs etc but recently I keep receiving letters from their recoveries department but with the fact it is the recoveries department clearly showing on the front of the envelope. A few years ago I thought I read that DCA's etc needed to be more discreet when addressing people who owe money. Luckily I have stopped my father seeing these envelopes but if he does see one my relationship with the family will suffer tremendously. How can I ask Tesco Bank to be more respectful in there posting of Debt letters? Are they breaking any Date Protection Issues by showing recoveries department on the letter? Thanks Me_too TESCO PRINT.pdf

- 3 replies

-

- dept

- displaying

-

(and 3 more)

Tagged with:

-

Hi Dx, Many thanks for prompt response. Me_too

-

Hi, Just wondering if the OP had any luck sending CTAX statement instead of passport details etc? I have the same issue with NRAM requesting photo Id. Thanks me_too

-

Hi, The more experienced members will be along with great advice later, however as I too had an RBS card from the 90's also converted to an MBNA card I've done some research on the credit agreements for these accounts I'm sure it's still applicable that pre 2007 a copy of original credit agreement is required for the owner if the debt to 'legally enforce' in court. (Can more experienced members confirm this). (That's IF they take you to court). I think MBNA didn't retain (or even attain when they purchased the accounts) copies of the credit agreements or terms & conditions at inception. There's more info on the internet if you look for it re: MBNA credit agreements etc. This might be useful to remember if a claim is made by the creditor. Others can advise what this means to a claim, and can advise you how to attain a copy etc. (In my experience no copy of agreement has been provided). Hope this helps, if not now in the future. Me_too

- 40 replies

-

Hi all, I thought I'd do a quick update, incase there's anyone out there in the same situation. Well, 1st crud was sent CCA s77/78 in Nov 14, usual response 'waiting for M&S to provide CCA' blah blah. As I was concerned about legal action from 1st Crud I made 2 formal complaints, the latest being late 2015, asking them to either provide CCA or confirm not available & to refund payment. I received a bog standard response, 'we do not uphold your complaint etc', stating that a year is not unacceptable to wait for provision of s77/78!!! Moving forward to March 2016, I now have a letter from 1st crud, the account has been 'assigned back to M&S'. Strange wording considering 1st Crud purchased the account! Now waiting for M&S to harass me again, even though I've complained many times that they have failed s77/78 they refuse to accept it and keep on contacting me! (Well they did until they sold it last time). Maybe they will sell to another DCA who needs to be reminded of Ms Mayhew? Me_too

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.