Showing results for tags 'interest'.

-

I ended up with 3 debts to Barclays bank - Premier Card / Overdraft and Select loan.I challenged Barclays on the way that they had been charging interest on my Overdraft and Select Loan. Very good news they did not challenge me back but simply sent me letters saying they would be writing them off. I have written to Robinson Way who now hold the Barclays Premier Card debt asking for my terms and conditions / interest rates/ how Barclaycard applied them to my account. Barclaycard have supplied a copy of the original agreement but have said " WE ARE UNABLE TO SUPPLY THE HISTORIC AND VARIED TERMS AND CONDITIONS " My question is whether they can refuse to supply these details ? Many thanks in advance for your kind help

- 11 replies

-

- barclaycard

- condtions

- (and 4 more)

-

Hi I'm after a bit of advice. I am currently interest only on my mortgage and owe approx 63000. This ends in 7 years. I am in no position to remortgage. Because of my poor credit rating and type of house I'm in. As I know this 63000 needs to be paid. What is the best way. Do I up my monthly payment to my mortgage company or save up over the 7 years. (I actually thought I had longer) Thank you

-

My mum has had a mortgage for 45 years. It represents 17% of it's value. They don't want to continue it, once it reached the end of it's term, even after agreeing to continue it in May of this year. We only get to know a repossession court date is due on 30th of this month, 10 days ago. Barclays know she was staying with me over summer and it was only a neighbour checking post, that alerted us. (Barclays has made it very difficult for me to assist my mum on the issue) They wanted a message from the doctor, which they got, now they changed their mind and want a more formal letter via the post. Before 'possibly' reconsidering. Her rate was/is a minimum of 5% and went higher when rates increased recently. So they are earning well from her. Plus she paid off two loans they sold her, to pay off overdrafts, they kept letting her fill up! Until we asked them to stop. Both stink of miss selling. The impact of this will worry her, cause her to fear leaving her home and disrupt her recuperation with us. An effort that took her from being skin and bones, close to death (even with carers/social workers visiting), to eating and being more healthy.

-

Having read this forum and had a pretty good solicitor in a recent case, I have cobbled together what I perceive quite a nice defence, if anyone is interested. Obviously people would need to tailor to their own needs. Just really mentioning this to give something back to an excelllent forum and Dx100 help. shall I post it up? It does not include which I have read here recently.: 1) Unfair Terms in Consumer Contracts Regulations 1999 The Office of Fair Trading v Abbeyicon National PLC and others (2009) 2) Show how they have complied with sections III & IV of Practice Direction - Pre-action Conduct. The only issue I have is that I have used a few times and I dont want a judge to think I just copied a template off the internet. I would be happier to give it to MODS for them to give it to trusted / known posters? Am happy to PM someone if they wanted to "disguise" it.

- 55 replies

-

- agreements

- cards

-

(and 2 more)

Tagged with:

-

Interest rate increases without informing the customer CONC rules i.e customer not informed:- ? surely there is a time limit before they introduce increase, and the customer given a chance to disagree and state no further use will be made of the facility and just pay off outstanding under original interest Rate????

-

Hi All, I have a mortgage with Santander. I have just received a letter saying that my payment will increase due to the increase in BOE rate. That's fine but it's just arrived today for the payment that's due tomorrow! I pay by Standing order and already paid this month. Don't they have to give a little bit more notice than that? the letter is only dated Sept 2018 (no actual date!) I know it's not a massive increase at the moment, but if it was the notice given wouldn't be enough. Is there some rule about this?

-

Hi i recently made a PPI claim to Car Giant. First of all they said they could find no record of me taking out PPI. But i found the documentation so they had to admit i had it. I filled in the complaint form and received a letter within days. However they are saying they wont admit i was mis sold it as the manager in charge at the time has since left. But they will refund the full amount but will not pay the interest. The total amount i paid is about £1800.00 over ten years ago. Surely by offering me this they are admitting responsibility. And surely i should receive the interest on top. I would be grateful if anyone can advise me if i should dispute this.

-

Older home-owners are being given more borrowing options, as a building society launches a new range of retirement interest-only mortgages. Leeds Building Society said it is entering the market, with the new deals initially being made available through brokers. Interest-only mortgages allow people to make regular interest payments on a loan, without paying off the loan itself – but the capital must be eventually paid off. Leeds’ new mortgages are being offered to borrowers aged 55 to 80. https://uk.yahoo.com/finance/news/interest-only-mortgages-lasting-retirement-230100829.html

-

I have only just discovered this site since having 8 properties taken over by LPA Receivers. I am desparately trying to find out what to do next. I read that I can make an Application to Court to get control of sales. Please is there an expert who can tell me how to word tha application? I am scared of making an awful situation even worse if that is possible!!!

-

Hi all I made a mistake and tried a ppi agent to deal with Cap1. they paid them and the agent deducted their commission and sent me the balance together with Cap1 letter calculations. Cap1 determined that since i was aware of PPI in 2005 when i cancelled the ppi then i was not entitled to receive interest since it was over 5 years ago. I wrote back asking them to pay the interest since i cancelled the ppi because i could not afford it... NOT THAT PPI HAD BEEN MISSOLD... DIDNT AWARE OF THAT UNTIL MY CLAIM WAS SUBMITTED. They will not budge their offer was final. Questions: do I have a reasonable case for interest? should I lodge complaint with FOS or go to court?? thanks

-

There are many people who find themselves in my position . Interest only mortgage coming to the end and there are either insufficient funds or no funds to repay the capital sum. In my case I took out a 10 year Interest Only Mortgage ( Idon't know why it is only 10 years) I have contacted Santander a few times over the last 2 years to see if they would extend the term but they just refer you to customer services to start a whole new loan . I no longer fit any criteria to get a loan . I have never missed a payment even though I am on a very high rate compared to other lenders or teaser rates . I am now retired with a younger wife and four-year old son . I got until February 2017 to find an answer to my problem. I have read the FCA guidelines 2013 but its just guidelines and Santander doesn't wish to play ball. Anybody got any ideas?

-

Afternoon All, I hope everyone has having a lovely bank holiday. When someone has a moment, I would very much appreciate some advice and direction with a credit card complaint. I've genuinely looked for a similar thread/question, as to not to waste anyone's time, but there doesn't appear to be anything (which is surprising). at a high-level, over the course of 2 years or so, I raised a couple of Section 75 claims with my credit card company; both for the same issue. On the first occasion, I submitted my claim via e-mail as per their direction of the CC, I got a confirmation response and they sent a declaration form in the post, which I signed and returned accordingly. Weeks and months went by and I hear nothing. I made several phone calls where they promised to investigate but did nothing. A YEAR goes by and still they fail to act. I submit another claim for the same issue. I get another e-mail confirmation but no declaration form to sign. Again weeks and months go past but I hear nothing. On this I refused to pay any further monthly minimum charges as they weren't looking into my dispute. Long story short, my account is in default (however they didn't raise the default correctly). Can they do that when he account is in dispute? The FCA handbook page is down but I'm certain it says that whilst there is a dispute a debt should be set aside? Thank you in advance for any help or advice.

-

I'm being pestered by the Lloyds Mortgage department to prove how I will repay my Interest Only mortgage in 5 years' time. There is nothing in the original agreement which says I have to provide proof during the currency of the agreement ( I am aware that nowadays they want the proof before even giving an interest only mortgage but that certainly wasn't the case 10 years ago ) Any thoughts on the legal position ?

-

Hello! I went to court with my neighbour over a land dispute. I had to withdraw from the trial because I am deaf and the audio loop wasn't working, but the Judge refused to adjourn... This is probably a whole other area, however, the neighbour was awarded costs of £23k and has now placed an Interim Charging Order on our jointly mortgaged house. My husband is not the debtor. I want to know if I can argue that the Award is unfair, not just because of what happened in court, but also because it includes a 100% success fee, which I feel they are not entitled to because I did not receive the Part 36 Offer which the neighbour's lawyers said they sent to me prior to trial. They are unable to prove I received it as they only sent by first class post. The hearing to decide whether the Charging Order is to be made final is in August, and I wonder if anyone can advise what I should do if I wish to object to the award for costs. My husband will object to the Charging Order. What argument should he provide, please? There is little equity in the property, as there is a lot of work which needs doing, including subsidence. The Judge was biased and failed to adjourn when it was discovered that the Audio Loop necessary for me to participate in the Trial, was not working. He instructed the room to shout and speak slowly for my benefit. None did as they were all the opponents witnesses. All of what they said under cross examination was of no consequence. I entered into litigation after much studying, and was confident of success. What went wrong? I am now being taken to court by my opponent for his costs.. £23k.. He is trying for a Charging Order, too.

-

Hi, Im desperately hoping someone can advise... To cut a really long story short, i took a career break from my bank job to care for my sick husband in 2012. It left us with minimum income other than disability allowance and carers allowance as because i was still classed as employed we were told we couldnt claim any other benefit, not that we wanted to. We never have had any state benefits. My husband passed away in 2013 and i had to pay his funeral costs, half of which i paid upfront. His family were meant to pay the other half but never did. Subsequently the co-op billed me. I had gotten in to a mess financially since still being off work, entitled to no benefits and trying to deal with my own grief aswell as supporting my 9 year old daughter with hers. Falling behind with mortgage payments and council tax i had to agree to pay almost double on them both to avoid reposession of the house and removal of goods for bailiffs. I counted these as my priority debts and put everything else to the bottom of the list including the coop bill. They issued a ccj against me which unfortunately then meant i couldnt go back to my old job (i work for a bank and policy is no ccjs). I have since started up my own business and draw £100 a week wages when there is enough money to take of course. I also now get working tax credits so a tiny bit better off. The solicitors dealing with the case sent me an enforcement notification. I rang straight away to see if i could make some kind of arrangement but they said no. The original outstanding was £2200. The ccj had £2900 and now ive had a letter through the door telling me its £3900!! The bailiff has said in the letter he will come back and take my car. And other goods within 7 days, i have tried to speak to the solicitors but they've said its pay the lot or nothing. Ive submitted for n245 to the court with a copy if my income and expenditure but i really need a bit of advice. Will the bailiff allow me to make payments by instalments or will they just keep coming back and taking my things regardless of the fact i can prove i dont have the means to pay. If they take everything i have and its still not enough what will they do then?? I feel totally helpless Hoping for some/any kind of advice... Shelley

-

Hello everyone, I wonder if people can help here. I have got a CCJ against someone for 18K recently. I am looking at getting a charging order against this individual on their beneficial interest which i believe they hold in a property. Now they are not a legal owner (ie not on the title deeds) I know it is possible to get a charge against the beneficial interest,but i believe the court sets the evidence bar very high to prove beneficial interest. Before i embark down this path can anyone advise what evidence the court would require to prove the beneficial interest as i dont believe i would automatically get an interim charging order without a hearing or providing substantial evidence

- 39 replies

-

- beneficial

- interest

-

(and 1 more)

Tagged with:

-

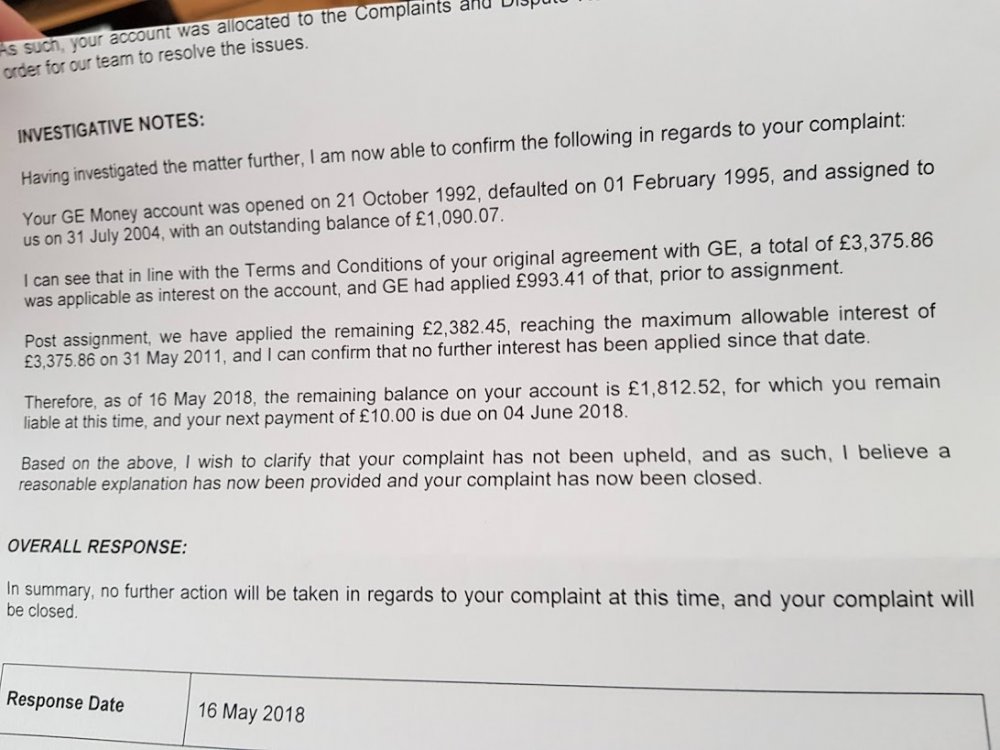

I defended the case and they had to discontinue the claim, but now they sent me a letter, with all the court fees and interest added on a periodic statement, almost £600 added to debt. Can the buyer of defaulted debt keep on adding fees and interest where the default debt was less than £5,000? Or could it be a ploy to get me to make contact with them (to prevent it from becoming time barred) as I never made contact with them since default some 4 years ago?

-

A company called Oakham have been in touch regarding a loan i took out several years ago, although i thought it had been paid they claim i still owe them a small amount of money. I asked them for a statement which seems to say they are correct. The issue i have is the large amount of interest charged each month, they call it 'Contractual Interest' and i am wondering if this is the same as PPI? Would be grateful for any help on this.

-

Hi, My partner has got herself into 9k's worth of debt with a credit card company. She kept it secret for years and has been paying £300-£350 minimum amount per month, but the interest keeps coming and she's missed payments because of other debts and outgoings. We don't have any joint savings to throw at it, I'm disabled and not working and we have a child of 4. She works full time. I'm not sure what further details are required, so please let me know and I'll add them. I would really appreciate some guidance as to what our options are. My first thought was to get a consolidation loan to bring down the payments to manageable levels, but I doubt she'd be able to get a loan because of the missed payments. CC firm don't seem interested in helping and the interest is mounting up. She hasn't spent anything on the card for many months since she first defaulted. Thank you. P.S. apologies if this is in the wrong section.

-

Same old story I'm afraid..... We had a loan via GE Money/Home lending for £5500 and had only managed to make a few payments on the account when i lost my job. We spoke to GE and advised them of the situation, that the problems were only temporary and that we would make arrangements for the arrears to be cleared as soon as possible. The call taker insisted we make a payment arrangement but as we were living off thin air I was unable to do this. I offered £5 a month token payment which was refused and advised i couldnt do anymore at the present time. The debt was subsequently sold to Link Financial and shortly after recieving a letter from them we received a very rude call from someone at link who advised me "We own the debt, you owe us £6600 (or thereabouts) can you make full payment now?" I advised that I didnt have £6600 knocking about and that we would be able to make a payment offer but was just advised "we'll be sending you court forms" and the call was ended by them. Duly the court forms arrived and unfortunately due to fighting repossession we did not attend the hearing. CCJ granted and now they are going for charging order THIS FRIDAY 12th (in a court 60 miles from our nearest court!) . How can i avoid a charging order? Postpone the hearing?? It is in our mortgage terms that if someone applies for second charge they can cancel the mortgage/sell our house!!! I have just started a new job and could not get the time off to attend. Any payment would have to be small due to arrears on water/elec/gas etc and we do not currently have the money to pay court fees to have set aside???

- 36 replies

-

- bankrupt

- discharged

-

(and 8 more)

Tagged with:

-

They used to be Blemain, now are 'Together'. I am always behind with my mortgage. I am on a very low self employed income and it is erratic. So always end up having to pay three or four months arrears when they threaten me with an eviction. They have an court order due to persistent late payments. My circumstances have changed since I lived at the house...my gf who is also on the Deeds split up. She pays the mortgage, I pay the second mortgage with Together which is about £500 a month. I can never do one of those things with income and outgoings because is so erratic and I dont even live there. But I pay it every few months when I can so she doesn't lose her home, and at some point maybe we can sell it. But, because of all the charges and extra interest etc the amount I owe after paying it for about 10 years is about £10k more than I borrowed! Yet am Paying £6k a year! Total amount is about £60k and its a high interest rate because that is all I could get at the time. So virtually everything I earn bar about £100 a week pays that. And as I only get money erratically and then £2-3k every three months or so on average, I can never get in front just keep paying off the arrears and my living and some debts. So I am very depressed about it and cant see a way forward, except that one day we may be able to sell it. But there is no equity in it atm, and I am losing £6k a year really while the market is stagnant and yet actually reducing nothing its gone up over £10k. Problems started when the banks called my business o/d and loan in as then I had no way of budgeting to cope with the erratic income. I am effectively homeless, and cant even get tax credits because of my circumstances, and living between a few sets of friends and a new girlfriend. She has a tiny flat so I cant store anything there, and cant stay at all when her son is there...no room to swing a cat. All my stuff is with friends in my 'rooms' there, and I have nowhere to sit and do my books which are a few years behind and no doubt I am being chased for that too on money I haven't earned but fines for late books. I am in a total mess and cant see what to do. What can I do? Are these charges even legal? I am told they are not? I want to sort this out first as it will be one thing off my mind if I can stop them doing that. Then I have to face the HMRC and explain why I haven't done my books for several years afterwards.

-

Hi, Does anyone know what Nationwide is likely to do in our situation please? Wife is 16 years older than me so we had a 10 year self cert mortgage taking her to age 65 originally through Derbyshire/Salt and now taken over with Nationwide. About 12 months ago we rang Nationwide after receiving a standard letter re repaying the loan at the end of the mortgage term. The friendly but extremely unhelpful call center guide was only interested in referring us to an independent mortgage advisor when asking about options and whether we could extend the term as they couldn't give advice and there were NO options on Nationwide doing some sort of deal or changing the mortgage. There wasn't much point in talking to a broker as my business went south in 2009 and we have wobbly credit, can't prove income to service the loan now although have no arrears or ever been in arrears. Instead we have been trying to sell the property - £255000 mortgage and 2 local estate agents started us at £395,000 now down to £340,000 and only 3 viewings in a year! I have been trying to understand 'Forebearance' but can't find any examples of any lenders being helpful to customers when they can't afford repayment. All we want to do is to continue actively trying to sell it while paying interest only rather than have it repossessed and forced sold. Does anyone know what is 'likely' to happen - particulalrly where Nationwide are involved? Any thoughts or advice would be really appreciated. Wife was just going to leave today she is getting so upset. We have until Feb for the mortgage term to end although haven't received any notices about the mortgage since last year. Thanks

-

Hi, The managing agent of my leasehold property has passed my details to SLC solicitors to pursue payment, I was about £4400 in arrears. I have paid the amount along with around £400 added for interest and legal charges, I want to know how I can recover the same. The backstory, from the managing agent I was receiving postal and email communication until Dec 2016 for payments due, but from Jan 2017 I did not receive postal communication anymore. Apparently, they were emailing me the information, but as my email hasn't be working reliably I didn't receive the service charge notices. Significant to note that from Jan 2017, i have been charged interest on dues, this was never charged in the past for any overdue amount (also I'm the only overdue leaseholder who is being charged interest on overdue payments). Also, I was passed to SLC solicitors who have since charged me another £180 in fees for sending 2 letters. The first letter was sent to the wrong address and I didn't receive it until much later, the second letter was sent to my address but was receiving by me after I had made the payment. The managing agent did not send me any letter before starting legal action. I feel that the way this whole thing has been done is really unfair to me and i haven't been properly informed at upcoming action at any point. Please could I know how to proceed to recover the interest and legal charges? I wrote to my managing agent (RICS registered) asking for a refund, but they said that all the charges were paid to the solicitors ( i think it would be unlawful for solicitors to charge interest on top of legal fees?), i think my managing agent is lying. How do i proceed?

-

Hello, I owe service charge backpayment to my management agent for my leasehold property. They took it to county court, then fast tracked to high court without informing me. I only knew when I received a demand for £2100 from the Sheriff's office. I offered to pay in instalments but they said their client wanted full payment, which I could not do. I sent them a copy of my Debt and Mental Health Evidence Form, they said their client rejected it. A Baliff visited my property when I was not in. I submitted an income and expenditure form (both mine and my wife's)to the sheriff's office, which clearly shows a minus. Even so I offered to pay £50 a month. I have now had an email saying they will forward this to their client and if it is rejected I will receive a visit from the Baliff without any prior notice. The amount has risen from £2100 to £3700 in just over 6 weeks, with interest at 41p a day. There is also a charge for a Baliff visit that never happened. I am worried sick. Please, if you can, please advise. I feel due process was not followed regarding the secrecy in taking this to court. I suffer from depression due to my debt issues and this is really affecting me

- 11 replies

-

- astronomical

- charge

- (and 8 more)

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.