Showing results for tags 'defaulted'.

-

Lowell's Solicitors are chasing an old debt (6yrs old) - as mentioned in post #1 old catalogue debt for JDWilliams & Oxendales Never seen a letter like this from them before Tactics or can they go further with this? Thanks LowellSolicitors.pdf

-

MBNA sold debts that belonged to both me and my husband. Idem bought mine, Moorcroft bought my husbands. I emailed Idem regarding reduced payments that I would make, and eventually they responded agreeing to my reduced amount. However, Moorcroft ignore emails (sent day after day) and they will not reply despite my husband requesting that they not call, but put in writing instead. They call anyway, and to whomever called, I asked them not to call, but to respond to my husband's emails - however, the chap then called my husband's mobile immediately! I got a statement from Idem, and in exactly the same marked envelope (same return address, same statement format) my husband had one from Moorcroft. Does anyone know if this is the same company??? It's really cheesing me off that Moorcroft ignore all the emails. Also, they're sneaky so-and-so's: they are based hundreds of miles away from us, and yet they call the landline using a local number that they must buy to use, to look like they're someone local calling us - idiots! It doesn't take long for me to recognise the number and ignore it. But, they're making me so mad!!! I think I'm wasting my time re-sending the same emails but at least it proves the point that they're ignoring us, dispite contacting them on a daily basis!

-

I'd seen recently on my Equifax file that an old BT debt was being recorded by Lowell This was chased by and already paid to Credit Resolve in 2017 I emailed Lowell last week along with proof of payment asking them to remove the entry They've said: Good Morning, Thank you for your email, I have noted your comments and would be happy to assist you. Account Number Original Client Current Balance xxxxxxxxxx BT PLC £72.84 I appreciate the comments you have made and I can see from the screenshot provided this shows the balance due was paid on the 31st of May 2017. Your query We’re investigating this matter with BT PLC and will let you know of the outcome. What happens next? You don’t need to do anything. The account is on hold and we will contact you again as soon as we hear back from BT PLC. If you require any further assistance please don’t hesitate to let me know. Kind Regards, Hakim Lowell Financial, part of Lowell I've paid, I don't owe them, would I have to wait for them to investigate or should they be removing the entry straight away? Can I go back with the 'remove in 14days or I'll start legal action line'? Thanks

-

Hi ..Just been reading this thread...and it's almost a mirror image to my nightmare. http://www.consumeractiongroup.co.uk/forum/showthread.php?370805-Lombard-Direct-Arden-Credit-Management-Query-PPI-reclaim-now&p=4062117#post4062117 The same players as well ..LOMBARD ...THEN IDEM ..THEN ARDEN CREDIT.... .Who are really turning up the gas on me constantly reviewing my payments to them every few months and constantly pressurizing me . I had the original loan with Lombard taken out september 2000. for £13,300 & PPI upfront payment of £2431.87 .plus total charge for credit £4081.33 total amount to be paid = £19813.20. Via 60 x monthly payments of £330.22 @ 9.90% APR. In 2001 November. I had a nervous breakdown and used the PPI to pay the load for a year. After which time the cover expired. As I have been disabled with mental health issues these past eleven or so years I have just been paying reduced payments to the various people Lombard seem to flog my debt too. They (Arden Credit ) are always asking me for more money (which I have been doing but have now reached my maximum of £120 per month) as I am on DLA . They know I have mental health issues, but when I tell them I cannot afford any increase to my monthly payments they send out a income & expenditure form . (even though I e mailed them one two weeks ago.after seeking help from the National debt helpline). What annoys me is I never ever fail to respond to them in any letters, but when I e mail my responses they say they have no record of the e mails until I challenge them ...then they say ..oh yes here it is. ..its making my health worse and I need to know if there is anything I can do to get the people off my back .. ..how much power do these people actually have ..given that this debt was taken out in 2001 , And I have never ever missed a (reduced ) payment to whoever was handling the loan. And do I have any thing to go on with regard to this PPI Payment which I originally paid out for...... Thanks Eddy

-

Hi there, I've sifted through a few threads trying to get a jist of what to do. Quite a bit of info, I'm hoping someone can help me with my issues Done a credit report and I've currently 5 defaulted accounts and 1 arrangement NatWest credit card - defaulted balance £984 with a current balance of £785. This debt is paid DD £20p/m directly to Natwest, I've ignored ALL letters from Wescot who manage my account on behalf of NatWest. NW have just written to me this week informing that my account has been assigned to Cabot Financial, to cease my payments to NW and make future payments to Wescot for the foreseeable - Thoughts/ advice on what to do at all? Aquacard - Account in arrangement with CapQuest to pay £5p/m, current balance is £1,200. This doesn't show as a default on my credit file. Notes that its in arrangement Vanquis - account is defaulted with Hoist Portfolio Ltd - this was forwarded to Robinson Way and I currently pay £10p/m with them Current balance £320 defaulted balance was £859 (Dec 2018 6yrs expires) JD Williams - Held with Lowell managed with Fredrickson paying £5p/m. £919 defaulted balance, current balance £504 (Nov 2017 6yrs expires) BT - Debt was passed to Past Due, then Capital Resolve, then Freds. I paid Capital Resolve the debt of £91.05 Freds have this as balance owing when I checked online with them Lowell have a default recorded with the account type being Communications Supplier, default balance £72, august 2015 which I think is the original BT debt Oxendales - Default recorded with Lowell, managed and arranged payment with Freds of £5p/m I have just at the moment cancelled all standing orders & DD's, just want to get some clarity on what to do with them Thanks Shelly

-

Hi I'm so glad to have found this forum. I hold 5 student loans from years 1996 - 2000. The 1996 & 1997 loans are with Thesis The 1998, 1999 and 2000 loan are with Erudio I have never received a DAF from Erudio or signed any document with them. My loans have always been deferred thorugh the Student Loans Company, who now seem to have rebranded as SLC. Historially I've occasionally been late submitting deferment but it's never been an issue. I did not receive a DAF from anyone in 2017. Erudio have sent me a default notice letter saying I had to pay my arrears of £1254 to "remedy the breach of Agreement" by 21st Oct. For personal reasons I didn't open this letter until after that date. I rang them (sorry! - I won't make that mistake again, it was before I found this forum) to see what could be done. I've been told that I'm no longer eligible for deferment. I was explicitly told that the agreement has been cancelled and that I'm no longer entitleld to have the loan written off in 2025 and that I need to enter into a repayment plan. When I started receiving letters I spoke with SLC (last month) and they have sent me a replacement DAF, however it only lists the 2 Thesis loan account numbers, not the 3 Erudio ones. I'd greatly appreciate advice on where I stand legally and what my next step should be. Thesis are also now calling, emailing and texting but I haven't yet responded to them. Many thanks DJ

-

Hello I have a few pdl's listed below taken out 2016 which i have not paid. I would like to try and get these sorted out and would like advice on the best way forward. I also have credit card debt listed on a seperate thread here. https://www.consumeractiongroup.co.uk/forum/showthread.php?489391-Debts-of-Credit-Cards-amp-PDL-s-advice-required(1-Viewing)-nbsp Thanks in advance Drafty PDL- now being chased by Asset Collections £746.55 wage day advance PDL £492.71 - Moorcroft The money shop PDL £768.84 - BW Legal Piggybank - £700 - Assett Collections Safetynet credit £503.89 PDL - Opos satsuma PDL £738.00 no dca activity western circle/cashfloat - £607.37 no dca activity

-

Hello All, I'm not sure where to ask this question so move it if it's in the wrong place. I have a defaulted account with Capital One (last payment 1/10/10) it has now been bough by Cabot and the have re defaulted it from 1/11/15. Is the correct and ok to do? I know Cabot are diddley so want to be sure? Surely if it was already default, they can't re default it?? Thank you for your help

- 20 replies

-

Hi How do I get rid of a closed account on my credit account which was a default from 2012? Thanks in advance.

-

I defended the case and they had to discontinue the claim, but now they sent me a letter, with all the court fees and interest added on a periodic statement, almost £600 added to debt. Can the buyer of defaulted debt keep on adding fees and interest where the default debt was less than £5,000? Or could it be a ploy to get me to make contact with them (to prevent it from becoming time barred) as I never made contact with them since default some 4 years ago?

-

Looking for a quick bit of advice. Capquest purchased a defaulted Marbles credit card debt and are reporting it as a current credit card account with themselves. They have been doing this for about a year or so and I only noticed when I checked my credit reports with both Noddle and Clearscore. I have written to Capquest requesting they either prove I have a current credit card account with them or remove the entry from my files with the credit reference agencies. They have replied with a copy of the notice of assignment showing they purchased the debt. Now I have no argument they now own the debt - my argument is they are telling porky pies reporting I have a current credit card account with them and that the marbles account defaulted about seven years ago. As they are giving me the run around who do I report them to for entering false information with the credit reference agencies?

-

Hi, I have finally checked my credit file and I have 2 defaults from PD loans and 1 from Lloyds. Cash on Go ( I think may be Satsuma) - £410 ( Initially borrowed £200) Provident ( I think may be Peachy) - £755 ( Initially borrowed £400) and Lloyds £410 ( 100% unplanned overdraft charges that have accumulated.My account was a basic account with no OD facility.) United Kash have been contacting me for the Satsuma loan but from reading on here, I have not replied or answered the phone. As they are defaulted what can I do now? Just ignore them? There is a very slim chance that I could possibly borrow the money from a family member to pay them all off but I don't know how to start as they are now in default? Any help appreciated! Thank you!

-

Hi all, new to the sight, and indeed, to debt. Had a look around here this morning, and I'm quite frankly overwhelmed by all that is concerned with debt and debt resolution, so please, bear with my ignorance! I'll try to keep this as concise as possible also. Full time employed home owner/mortgage, one active credit card with my bank which I over pay on religiously (£2k balance) so no issues there. No HP/credit, and no defaulted utilities. Wife left Dec 2015 (not divorced yet), I remain in the house and the mortgage is in my name. I'm also a lone parent to 2 boys, 6yrs and 9yrs. In Jan 2016 I got a letter from PRA stating 'my' account had defaulted on 'my' debt (from MBNA credit card) of £10278.34 and advising me I had previously to that point been paying £80pm against the amount. I had no knowledge of this until the letter landed on my mat. As you can imagine... It's come to light that my estranged wife had, over a number of years, been using one of my cards without my knowledge. The first I knew of this debt was the letter from PRA. At the time I was left financially devastated, and have spent the past 20 odd months getting back on an even keel (hence the £2k balance on my current credit card). As such, during this time, I kicked this £10278 debt 'into the long grass' as it was not my priority. Wife also owes other debt held by PRA and a number of other debt companies, and has 'bumped' many of these payday loan companies. I get regular mail in her name from people chasing her for debt. Quite the girl. I have received several more letters from PRA (last one Aug 17th 2017) advising me the matter is with their litigation/investigation/collections team, and an offer of a 'one off' discount allowing me to pay only £9250.51. They've also predictably been phoning me (assuming estranged wife gave them my number...), and also phoned daily by what has been described to me as a 'hunter' for PRA to establish if I am resident at my address. None of these calls I have answered. I am expecting a doorstep knock, as this 'hunter' is only 20 miles away. I was at the point last week of phoning them and saying, "I can give you £100pm...." but thought better of it. As I am seething that the debt I did not accrue is in my name, but yes technically it is my debt. I have no way of disproving this. I spoke to a solicitor last year who advised they could likely establish the debt was not accrued by me, but it would probably cost me £10k in their fees. As it stands then, wife had been paying £80pm to Activ Kapitol (the only thing she did concede), and stopped paying when she left in Dec 2015 (they should have knowledge her paying it over the years as it would have to come out of her account). Obviously, the status of the debt is 'defaulted'. I've paid nothing to it as I wasn't able to during this period. The only thing I have done (last week) was fill in the assessment form on PRA's website. Gin has a lot to answer for... What's my situation? What's likely to happen next? Will I end up in court/CCJ? Do I have to pay this? Should I just pay this and get on with my life? Again, please appreciate I'm all new to this. And yeah, I know, ignorance of the debt is no defence. Many thanks, Jason.

-

Apologies if this is a regular question ... I took out a series of PayDay loans in Apr-July 2012, rolling over each month with the same company. Eventually I got the bank to issue a new debit card (said I had lost old one) to break the CPA and default the loan. After several difficult phone calls I got them to agree to a DMP where I paid off the loan in £10 installments per month, which I have been doing ever since. Now my credit file lists these payments as against a regular loan - an 'Advance against Income' . The loan is dated as starting the day I failed to pay my rolled over loan, with a complete (though occasionally inaccurate) list of my monthly payments. Regarding the credit listing surely this is not legit and the loan should be marked as defaulted? I had not been concerned too much until recently when I found this is messing up my application for a mortgage (overall my circumstances are better now). I want to get this 'loan' taken off my credit file or at least marked as a default against the original, which would be far less toxic than the current situation. Can anyone comment on the legal situation here and can I quickly force them to mark this as defaulted (around Aug 2012). deed can I make a complaint against the PDL over the rolled over loans, no credit checks taken ( I was in arrears on my Mortgage at the time) even though this is all before the new FCA rules, and include this demand as well? Thanks in advance for any advice, I appreciate your efforts.

- 3 replies

-

- credit file

- defaulted

-

(and 2 more)

Tagged with:

-

Hi, I was living in France and had a French Mortgage for 200,000 Euros in 2009. Unfortunately I lost my job and I had to return to the UK, I paid what I could to the Bank over the next few years, but one day in 2012 the Bank informed me that the outstanding Mortgage was paid off by an insurance policy. I rented the house out to tenants after making enquiries and paying a Notaire to see if the house was actually mine, I was assured it was and assumed that I had taken a policy out at the time of purchase. Last year I agreed to sell the house to my tenant, it was then discovered that the insurance company Credit Logement had put a charge on the house in 2012 for the outstanding amount of the mortgage they paid off plus interest. I have been living in the UAE since 2010, and my tenant in my house in France since 2011. Neither of us had received any notification of any actions or judgements against me. I was totally unaware of any legal proceedings whatsoever as the papers were served to an address in the UK, I hadn't lived in since 2010. We are in a stalemate situation at the moment with the Insurance Company threatening to re-possess the house since May 2016 but have they have not made any moves to do so. The Paris High Court served a Judgement against me in March 2012 with the insurance Company putting a charge on the Property's Title in August 2012. Does anyone know if these outstanding debts have a Statute of Limitations? Any advice would be gratefully appreciated. Badhorsey

-

Good afternoon folks, I have been looking around for advice on the following as i am trying to clean up my credit files folowing completion of an IVA in August 2016. In summary, IVA started in June 2010, settled in August 2016. One of the creditors has finally updated the credit file at Equifax as below :- You can see that there is no default date on this entry, which should be the start date for the IVA. Is this entry going to stay on there for another 6 years from the settlement date, which should also be the date for te end of the IVA? If i have the default date corrected will the entry then disappear ? This creditor, Nationwide, seems to be reluctant to assist. Urkood.

-

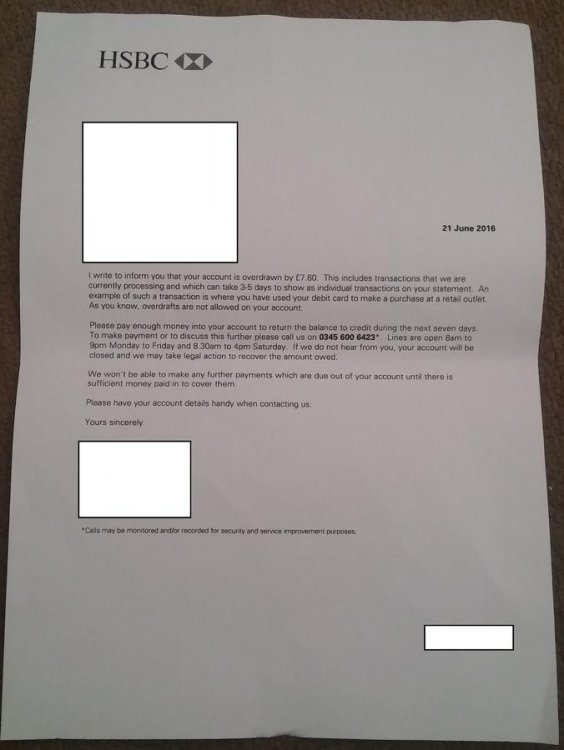

Hi, Really need some help. HSBC have closed my account without any notice. They state they sent me warning letters but I have not received anything, even though I was getting normal statements and a new debit card. The account is a basic account with no overdraft facilities just a debit card. Yet somehow netflix managed to take £7.49 and the acc went into a minus. I admit I should have kept a closer eye on this via internet banking. But now I'm worried that with the closing of this acc they have put another default on my credit file. I rang them regarding this and the lady told me that the money was "written" off? When I asked has the acc defaulted she gave me a hazy response and advised that if I wanted to I could go in the branch and pay this off? What would be the recommended path I should take? The only way I found out my acc was closed was when I tried to login to my acc it gave me an error message. Their communication has been poor from the beginning. How long would a default take to appear? Are they allowed to close an account without notice? If they have defaulted me, are they allowed to do so without notice? I have attached a letter I obtained from my branch which they apparently sent me. Is this sufficient enough to warn me of a default? I also found out from call centre that I was warned my acc could be closed on the 19th of Jan? But I was never overdrawn till July? All I care about is being illegally defaulted, I don't care about them closing my acc. I don't want to bank with them. Also the branch manager said I could open another acc?? Any help would be greatly appreciated.

-

Hi I have several defaults for various amounts totalling approx. £5000. For whatever reason I didn't pay my bills for several months and am now in a position to begin tackling this mess. I can probably pay off all of the debt in around nine months settling several smaller accounts within three months. Lots of the debts have been sold on to various debt collection agencies. They're offering me various discounts to write off part of the debt which I am open to for obvious reasons. However I am also keen to begin the process of rebuilding my credit rating ASAP and am wondering whether it is better to settle in full for this reason? I've also read that if you only settle partially, the remainder of the debt can be sold on which is concerning. If I decide to offer a partial settlement which is then accepted, how do I avoid that scenario? Thanks

-

Hi people I am at the end of my patience now with Vodafone. I cancelled two contracts with Vodafone one which I was havin data charge problems with. Getting texts saying you have 30 gb the day after I had been charged for going over. After numerous phone calls and visits to a store, I finally got the store manager to document my screen shots of the texts and he agreed yes it's not right. I explained I was likely to owe a small amount for my rental but I was not prepared to pay until I had an amended invoice. The manager passed it on and I heard nothing more then I kept getting bill texts to my now 3mobile number. Vodafone confirmed again some thing was a miss and they would as usual promise yet have no intention of calling you back. Then the debt collectors letter dropped on the mat. Long email explaining the above with screen shots. Reply comes back ok we will not take further action until we have heard back from Vodafone. Ten days after this without warning a default was placed on my account non payment. mrs cancels her phone and ports number. Final bill comes through in text and Mrs ring up to pay. "Sorry you're not in our system ". With no way to pay it was forgotten about until a letter came through. Ringing this number gets you through to a department you have never been to before where you do exist. Payment is made end of story. But no now her credit file is also knackered. We lost a £500.00 pound deposit on a caravan as we were refused finance. I am looking to seek compensation for the above and would welcome any pointers in the right direction.

-

Name of the Claimant ? Lowells Date of issue – . 06.05.16 Date to submit defence = 4pm Tuesday 7th june What is the claim for – 1) The Defendant entered into a consumer credit Act 1974 regulated agreement with Lloyds under account reference XXXXXXXXXXXXXX ('the Agreement'). 2) The Defendant failed to maintain the required payments and a default notice was served and not complied with. 3) The agreement was later assigned to the Claimant on 26/08/2014 and notice given to the Defendant. Despite repeated requests for payment, the sum of £1,600.00 remains due and outstanding. And the Claimant claims a) The said sum of £1,600.00 b) Interest pursuant to s69 County Courts Act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accruing at a daily rate of £0.326, but limited to one year, being £130.00) c) Costs What is the value of the claim? £1,900 (including court fees) Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Current account (overdraft) When did you enter into the original agreement before or after 2007? Before 2007 (2003) Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim.lowells Were you aware the account had been assigned – did you receive a Notice of Assignment? I do not recall receiving any notification Did you receive a Default Notice from the original creditor? I do not recall receiving a default notice Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? I do not recall receiving anything like this Why did you cease payments? As I had incurred excessive charges on the account and after my claim for the charges back was rejected due to the banks winning in the high courts I felt that I would never pay off the debt as when I was making monthly payments it did not seem to be decreasing. I felt they owed me money so stopped paying or responding to them. I believe I stopped in 2009 as that is when I sent my claim for the charges and they responded once they had won the case. What was the date of your last payment? I cannot recall but again I do not believe I made any payments after 2009 Was there a dispute with the original creditor that remains unresolved? As I above, I felt it was unresolved but they said it had been resolved in through the above mentioned case. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes, they agreed on a monthly amount I could pay = £30 and £50 per month Help needed please... How should I proceed with this? I wish to defend all of the claim. Thanks To add, the account was opened in 2003 and I believe it could be statute barred as I do not recall making any payments in the last 6 years or acknowledging the debt in that time.

- 14 replies

-

- county court

- defaulted

-

(and 3 more)

Tagged with:

-

Hi Would like some advice about 2 loans that I took out in 2005 with egg to consolidate credit cards, car purchase etc after getting a mortgage in 2004. Both loans were for just under £25k each and it was more or less implied that if I took out PPI that the loans would be easier to be accepted for and that I would be able to claim if I was not able to work for any reason even though I was self employed. Roll onto end of 2008 where my ex wife and I started having relationship problems and I started struggling to make the repayments but feeling that I had a duty to repay I struggled on trying to keep the repayments up to date even when I could not carry on working at the end of 2009 when I became a single parent. By March/April 2010 I could not make the payments so the loans went into default officially. I spent the next 6 years struggling to bring up my kids as a single parent and have been chased to repay the loans via lots of different debt collection companies but was never in the position to pay anything So now in 2016 the loans have both been removed from my credit report (such a relief as can start rebuilding my credit worthiness). I did receive a questionnaire for both loans from Canada Square Operations in 2013 about my PPI but because of my financial situation I just filed them as I was worried that it was a ploy to get me to pay money to them that I could not afford. It does state in the covering letter that they that the loans where now being administered by Britannica Recoveries but does not say the debt had been sold to them. It also lists the reasons that they think I would be entitled to a refund for and they are for it being implied that by taking PPI I would get the loans and that when self employed I could only claim if I could not work at all. My question is would it be worthwhile sending in the questionnaire now to apply for a refund. Many thanks in advance Allister

-

Hoping for some advice. After significant debt issues just over 6 years ago I am now in the year when various defaults and a CCJ hit their 6 year mark on my credit file. All payments being managed through stepchange (I have charge against my house connected to CCJ) If i understand correctly as the respective default dates pass these will drop off my credit file? Do the accounts completely disappear from the file or just show as accounts that are being paid? Are companies more likely to accept a full and final offer once the 6 years from default date has passed? (i understand the money is still owed but i'd like to pay them as little as possible!) The CCJ is managed by Marlin, who brought it from Virgin and Optima... they've not been the nicest company to deal with... I have claimed back all PPI etc so i can't reduce the debts any further that way. All help appreciated!

-

Not to be confused with another case I have ongoing at the moment. Been trawling my Credit Reports regularly for some time now (only because they are 'free') and the only outstanding issue showing on them is an older Natwest account that Defaulted in late 2010. The default came about as I bailed out of the account with an O/D of about £2200 and the monthly charges were something like £28 + Interest. This was taking a significant chunk of my monthly earnings at the time and the Unfair Charges thing was ongoing. Now, the account is still shown as being with Natwest and I was expecting it to go Statute Barred before the end of 2016. However, as a result of fighting Cabot/Restons/Black Horse on a Statute Barred case I have been paying some more attention to the details. What I have seen is that at some time on 2013 the outstanding balance of the account went down by £39. I know I didnt make a payment to them or anybody else and not did I authorise anybody to do so on my behalf so where has this come from and what does it mean? Could this be an internal adjustment/refund/correction or would this be the value of the account that they sold? I 1/2 expect that they sold the debt for £39 (1.5%). Question is though, do I SAR them for a full copy of their records on me now or not? They dont know my most recent address which is important because the other case I am fighting has an element of 'address discrepancy' in it but as I dont recall receiving much on the account once it defaulted I dont really know how this one is being played yet. Chances are it is with a DCA already but they havent adjusted the account details with the CRAs yet so I have no idea if anybody is actively searching for me or not. I know Hillesden and Cabot have been nosing in my files but thats related to my other claim. If they have this account as well though then they do know where I am. What really bothers me though is that reduction of £39 and is this another 'Phantom Payment' or not? I guess a SAR should show that but does it then wake NatWest up to take another look at this account bearing in mind it is close to going Statute Barred (subject to where this £39 came from). As Cabot/Restons have already got one CCJ against me by using knowingly incorrect address details I would like a chance to try and kill that path off from them. Mind you, I dont see too many Cabot/Reston cases coming from NatWest so do their debts go elsewhere?

-

First time posting. I want to thank this site and everyone on it! Beginning of August I received a notice from CCBC that Lowells (via BWLegal) were beginning court proceedings against me for ~£6500 (HFC Bank loan from mid 2007, defaulted 2008). Lowell bought the debt in 2012 and re-defaulted it! I had spoken to them shortly after explaining that I had tried to renegotiate my monthly repayments with HFC but they outright refused and ignored all letters I sent their way - loan was then defaulted June 2008. Lowells apparently ignored all this and just sent bailiff threats and endless phonecalls demanding payment in full. I ignored them. So this notice of court proceedings... obviously by August 2015 the debt was statute barred for over a year. I browsed these forums and found everything I needed to issue a full defence through mcol (deny claim/claim is statute barred). Sent my request to BWLegal for them to send copies of my of my credit agreement (never received). SAR sent to HFC for all account details (received 51 days later :/). Low and behold, Lowells had no legs to stand on and today I received a Notice of Discontinuance from BW . All I need to do now is see if I can get the default removed from my credit file! So again, big thanks to this site. Don't let them get you down! -Craig

-

Hi everyone I'm in the process of sorting out all my old debts, and I've just sent Natwest bank a SAR (well 2 actually) relating to two accounts that appear on my credit files shown in default state from 3-4 years back. I just had a call from a person within their data protection team asking me to clarufi what I was aslking for in my SAR. I told them everything they help about me at Natwest relating to those two accounts! He then said I need to go into a branch to ID myself, because the address on my correspondence they didn't have on any of their systems! Never had this before with a SAR! Are they meant to be calling me? Anyone else had this problem as above? Advice? Cheers

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.