Showing results for tags 'plan'.

-

Good evening, I'll try to summarize briefly : - 10 day ago washing machine stopped to work at the end of the program, door locked... - I notified to the landlord the issue sending him an email with all details and a quick video where he can see what is the actual problem - After a couple of days I received a reply from him where he'll put me in contact with the guy who manage the house in his name so he can arrange the repair - This guy send me an email (landlord was in cc) saying and he requested a repair and he already arranged the payment. - This tuesday I received the visit of the engineer who made the work in about one hour This morning I found a letter in my letter box from the UK's leading specialist warranty provider about a "Repair and care plan" signed in my name (t's mentioning my name and surname as Customer Name) with a duration of 6 months. The payment has be arranged with Landlord's bank account, a Direct Debit Payment Schedule with a 6 Monthly payments. I'm pretty nervous cause he never agreed with me to arrange for a care plan and I never authorized him to do it in my name... I wrote him after a couple of hour I found the letter asking some explanation cause we never talked about care plan, he replied saying when he was doing the payment there was no different in price between the one-off repair and the care plan and due to the care plan is covering 6 months he decided (according with the landlord) to proceed with that. I replied him saying i'm fine with anything the landlord wants, but the contract needs to be signed in my of the lanlord... All email conversations contains the landlord as cc, at now they stop not replying ... How should I proceed?

-

https://www.nhs.uk/live-well/healthy-weight/start-the-nhs-weight-loss-plan/

-

Action plan to accelerate remediation of private high-rise residential buildings with ACM cladding READ MORE HERE: https://www.gov.uk/government/news/action-plan-to-accelerate-remediation-of-private-high-rise-residential-buildings-with-acm-cladding

- 1 reply

-

- accelerate

- acm

-

(and 8 more)

Tagged with:

-

I was stupid enough to sign up with utility warehouse who gave us low quotes for gas and leccy bills then upped them after 3 months....then when we got fed up and left sent us a final bill for £788 because we were on their bill protection scheme....no warning about this other than the small print. i want to setup a payment plan with them but as they've already dipped into my account to take £200 out without notifying me via a card payment. i do not want to pay via card or direct debit. They're saying that i can only setup a payment plan if i pay via card or direct debit. I want to pay via standing order as i do not trust this company. are they allowed to do this? If i'm making regular payments are they allowed to used a debt collection agency?

-

I asked Marbles to close my account, because the interest rate was going to be increased. They agreed to "close" which means let me repay at the old APR rate, not allow new transactions. The rules say I'm allowed to do this, and I can repay, at the old rate within a "reasonable time" Then I called up, few months later, saying lost employment, need to freeze interest completely, went thru income/expenditure and had it frozen. They agreed to reduce the monthly payments for 6 to 12 months. I kept up with the reduced payments, as agreed, and now they've sent a default notice. It's not even been 3 months yet. I think this default notice, is a system generated one. They've done this before. They issued a £12 penalty fine, even though I paid the correct amount, due for that month, and I then cancelled direct debit. They cancelled the £12 fine previously, and apologised as it was wrongly issued on their end. Was planning on calling on Monday, saying I had an agreement to pay reduced payments, put in place only a couple of months ago etc, why you defaulting me. Just curious to know, what I should do. We had an agreement, they agreed to, very recently, and I stuck to it. Pretty sure it's the automated system taking over. If I complain, could rock the boat, and Not sure if them issuing a default, whilst I'm in a payment plan, counts as treating customers fairly? I can't afford to pay the amount in the default notice. Thanks in advance

-

Afternoon Everyone. I've been reading other peoples threads regarding Vanquis and have come up with good information but have decided to make my own thread to be able to keep track of this and to add to the information hopefully, I also have questions. This is my only debt apart from my student loan it is large and I am worried it will ruin my credit score, I would like to get a debt plan for something that I can afford and then maybe make them an offer when I can to have the debt wiped with no CCJ. I owe £2993 with a limit of £3000 as of yet I havent missed a payment since the account was opened in late 2014, I have up until 2 August 2018 to make a minimum payment of £151 but that will be dificult.. I would like to get the account frozen and then work out an affordable way to pay. One thing I have read on another thread about dealing with Vanquis that it is wise to pay for a Subject Access Request for all my statements, I think that would be a good idea because my account has always been paperless and the online ones only go back for 12 months.. I have also noticed that while browsing a couple of them that there are lots of charges every month like; Purchase Interest, Cash Interest (But I have never ever borrowed cash against my card), Promotional Purchase Interest, Cash Advance Fee (Again, Never taken cash) I have also seen PPI being discussed but I'm not sure whether that applies to me. What should my steps be to solve this mess, Learn from it and eventually move on? My printer is at the ready, Thanks in advance everyone, L.

-

There is a very real risk those who are owed money by Wonga in compensation for having been lent money irresponsibly may be chased by creditors for this money, whilst losing access to the compensation to which they are entitled. https://www.msn.com/en-gb/money/news/wonga-compensation-claimants-may-lose-out-due-to-automation-plan/ar-BBPkdZX?ocid=spartandhp

- 1 reply

-

- automation

- claimants

-

(and 5 more)

Tagged with:

-

Hi All, It's a quick question. I took a credit card out with Lloyds Bank, then unfortunately I was made redundant. I went though their income and expenditure document to inform Lloyds and they put a hold on the card. About 5months later they put a repayment plan in place and according to them, they sent a letter. I did not receive this letter and they made no other contact to me about this. The bank said that because I had failed to pay the repayment plan, the account will be sent to another company. My point is, if I receive nothing about a repayment plan, and the bank don't contact me about it, how can I be held liable for not paying a repayment plan I knew nothing about? It's incredibly frustrating dealing with Lloyds Bank, they've been nothing but difficult all the way through. Soon as I got another job I contacted them to make repayments and they told me I no longer have an account with Lloyds so I can't pay anything right now and no-one would speak to me about the account. I went through with the complaints manager who in his final letter he stated that he will uphold my complaint but then and the end of the letter he stated nothing will be done. Anyway... My question was about the repayment plan, if the bank are using that against me to say that I didn't pay, surely they have to actually tell me about the plan so I can pay it, right? Thanks

-

A few days ago I completed a few transaction over LocalBitcoins.com to a buyer named Muumbis (currently blocked) who seemed to be a trusted user, had good feedback and 2 months of multiple transactions. The buyer sent me the funds through a PayPal transfer, and then I proceeded to send/release the bitcoins to his account once the money hit my account. These transactions were very profitable to me, amounting to about 40% of profit over the then exchange price of bitcoin. Only after 6 PayPal transactions amounting to a total of around £11000, I noticed that the person’s details included in the PayPal account used to forward all these payments differed greatly from the personal information of this LocalBitcoins.com user. For comparison sake, the owner of the PayPal account is a Canadian, while this person seems to be based in Netherlands (Proxy, likely) and has a verified phone number from Kenya, as well as, beginning of a different gender. As of now PayPal as yet to contact me about any irregularities in these transactions and I made sure I transferred all my PayPal balance to my savings account. However I’m confident I got [problem]med and it’s just a matter of time until these payments are flagged as unauthorized transactions and the owner of the PayPal account files a chargeback against me leaving me empty of bitcoins and about 5000£ of negative PayPal balance, which I have no means to payback as I’m student and I already have some debt going. Summary, I sold some bitcoins at 40-50% in profit to a guy who used a hijacked PayPal account to pay me. It’s just a matter of time until the victim of the hijacked account files a PayPal unauthorised transaction/ chargeback against me. PayPal then reverses the transaction and the [problem]mer gets the bitcoins while I’m left to pay around 5000£ of debt due to the profit margin. I’m divested by this, as I’m a victim too just like the affect PayPal account owner, plus I have no means to payback if these transactions are found to be unauthorized. Perhaps, in the end, all I could do is payback the some of the money to the victim excluding the profit/debt margin that was employed in this [problem]. God, I can’t believe a fell for it, I’m aware of this sort of thing yet due to my own stupidity or being a student with no income I just went for it….Never felt so dumb. I know I’m making assumptions on what if…however, I just need to a little guidance on what to do next or who to turn to, basically a course of action to reduce all the possible damage. Thank you all

-

My line manager recently resigned, a new director has taken over the team in my first conversation I have with the new director he tells me "You are going onto a PIP". I was pretty shocked as had no warning from anyone, written or verbal, that this was coming. I was already feeling stressed prior to this and this tipped me over so I have been on sick leave for past 2 weeks and just been signed off for another 2 weeks. (I have had virtually no sick days in 12 years prior with my employer). The PIP objectives themselves have not yet been discussed or agreed / signed by me. My questions are 1) Has correct process been followed for the PIP? (i.e no warning is required?) 2) I learnt yesterday that because I am on a PIP my boss has option to only pay me Statutory sick pay and that's what he has instigated for next 2 weeks. Is this legal even if PIP has not been signed / formally agreed with me? 3) Linked to 2) as this was unexpected (it places potential financial stress on me when I am already off with stress). Is that fair or does impact on me not matter? Thanks in advance for responses p:s - Background is below if this helps with responses to the above I have been with my financial services employer for 12 years and have always had ok to very good performance reviews over the years. I moved roles about 10 months ago (Having been in a very stressful role previously) The new role is very much spreadsheet reviews of very complex datasets (not my strength) although certain aspects of the role I did well. When I did get feedback I only got 2 pieces (one from a peer who has a "coordinating role") and one from my line manager. My line manager didn't give written feedback just answered some questions which require a "Always, often, sometimes, seldom, never" type response. His responses were "sometimes". When I arranged a meeting to go through his responses, he explained that sometimes I do something well and sometimes I don't (how enlightening!).

-

Glorified saving plan - not Pension

ccridersuz posted a topic in Pensions - including Pensions Fraud

Hi all, been a while since I've posted on here, but we need help. Just traced an old Pension of hubbies and it amount's to just over £13,000, but having phoned to find out further details, have been informed that it's just that a lump sum!!, nothing else. No income, no pension nothing! just a Lump Sum of £13,069. Seem's like someone gave him bad information over 40 years ago. We are waiting on a CETV, but our plan's on buying a little holiday retreat have gone. However, we would like advise as to whether this minimal sum is worth doing anything with Pension wise, as hubby is 62 this year or should he just spend it? (thank goodness for the state pension(eventually). Any well meaning advise welcome. Cheers -

Hi there, I purchased a car from Arnold Clark around 3 months ago which included a service and MOT plan. I had no end of issues when purchasing the car. I signed 3 different order forms because the sales person entered incorrect info, I travelled 3 hours each way to collect the car to be told the car was not ready to go, as well as various other problems that complicated and confused the buying process. I feel that this service plan was not explained to me properly and if I had understood I would be paying interest for a service plan over 3 years I wouldnt have bothered . I contacted Arnold Clark customer services who have quite clearly stated i will not be getting a refund if I cancel the plan because I signed the order form and it clearly states it on there. I understand I have signed for this but they have not taken into account how confusing the sales person made the buying process. I actually received a good will gesture of £200 from the sales manager because of all the complications. my question is, do i have a right to request a refund for the service/MOT plan and if I do what are my next steps? Thanks a lot NB: apologies for any grammatical errors, I have typed from my phone. Tony

-

I’m looking for some advice on a recent issue I have had with Halfords with regards to a road bike. This had started with a dispute over the quality of work done as part of a service plan, eventually resolved by taking to an independent bike repair shop. Ultimately, I accepted a refund of the cost of the additional work required, but informed them that I was still unhappy with various other issues they were unwilling to resolve. I was informed that a manager would call 4 times, which never transpired, though I believe the whole issue would have been resolved if they had taken the time to talk. The advice I’m now after is with regards to the service plan as some of the documented responses from Halfords have quoted that certain work is not covered by the Service Plan – none of the exclusions were ever outlined to me as the plan was provided as an apology for the pedal falling off when first purchased in 2014 and was renewed as a “3 year service plan” in 2015. Checking in-store, there is no clear advertising of inclusions by means of leaflets or boards. my first query is was the plan I was given ever fit for purpose for my bike and as such has it been mis-sold? Secondly, as part of the independent service I required the headset to be replaced. Checking the service document for my 2016 check, the headset was included. On the latest 2017 outline (eventually located online) the headset is only covered on a Gold Service. the second query is should I have been informed by Halfords of what seems like a change in terms and conditions of what is covered under the service plan? All advice greatly appreciated

-

Sorry if this is long winded, will try to get all info here on 1st attempt 5 x creditors total outstanding approx. 46K Barclays loan with Cabot – debt purchased by Cabot Barclays overdraft with Barclays Recovery – debt still with Barclays Store card with Cabot – this one is clear, see below Mint card with Westcot – not sure if bought or just being collected Barclaycard with Mercers – not sure if bought or just being collected Store card with Lowell – not sure if bought or just being collected All were in default but now expired (2016) on credit report, which is going in right direction. Entered DMP with Financial Atlantic (FA) approx. 2008, paying £150 pm across all creditors, have been model client and paying regular. During this year’s DMP review, it was clear that FA would not entertain any CCA requests and would only negotiate F&F at rate of 40%, plus there 10% charge on savings made. After checking forums, I decided to go for CCA requests myself, letters sent 1 week ago, Cabot already replied for the store card debt and will no longer pursue the debt as cannot obtain CCA, £3.3K gone. I asked FA to hold all payments to creditors pending CCA replies, they have now advised my DMP account will be cancelled and to continue discussions myself with creditors, I guess they saw what I was doing and wanted no part of it. FA will write to creditors advising plan is cancelled. My option, as I see it, is await for CCA results, if no CCA, debt unenforceable, ignore, if CCA, then maybe go for F&F starting at very low figure, I am guessing for bought debt, I have paid more than the purchase price already, others were only on token payment, duration left for each as per my DMP between 8 and 15 years, one (Barclays loan has 38 years at current payment) I understand these debts cannot be put back onto credit file as once defaulted that’s it, am I correct here? Has anyone done similar, what was result and how should I play this now.

-

Hi all Going through some old paperwork I found I had a 3k loan over 18 months back in 1996 with RBS. It has a loanguard booklet and have before seen a letter I am fairly sure saying I had this. I also found two personal illustration letters from 1999 talking about a lifetime assurance plan and mortgage protection plan. Sounds crazy but RBS, or RSA? collect a £5.00 a month d/d from my account which I thought was something I had to have...but don't actually know what its for as no reference numbers attached :/ What is the best way forward on this please? I did a few with Lloyds for my Dad but had all the paperwork, however this is much older! Found some paperwork, the £5.00 per month is for Royal Scottish Assurance Life Protector, I am sure I was told this was compulsory when you have a mortgage though? Mortgage started 1997 £45k but has changed lots and not even with RBS anymore! It changed to Aviva, or they took over in 2011. My mortgage also isn't with RBS anymore so all their information would be wrong. How do I stand with this please? Many thanks E!

-

Hey everyone, At the start of last year (January and February) my wife and I took our kids in for two different photo shoots at the same place. It was one of those groupon deals where you pay £30 or so and you get a free print, but you have the option afterwards to either walk away with your one free print or buy some more of the photos. Both of these times we set up a payment plan for these two different sets of photos and signed a piece of paper to say we agree to pay that amount. The total amount was £310. We had a really rough year last year, my wife is severely disabled and I'm her carer, and my mum also passed away from cancer in October. I completely forgot about these photos and the payment plan. I had a letter at the end of January this year (which seems to be dated 19.01.16) that says a "recovery cost" of £100 has been added to the balance, and £24.80 of interest. The letter also states that he has tried numerous times to contact me by phone and has sent out several invoices, none of these I received. The letter states that if he doesn't receive the full payment in 7 days he would take court action. I emailed the photographer enquired about the added charges, he said right off the bat that he would waive those if I made a payment. I made a payment of £30 and said that £30 per month was all I could afford, we both agreed on that payment plan. I also asked him to send me copies of the letters I signed when we came to the agreement. He emailed me these recently and it says nothing about added charges and interest being added, nor does it say anything about a date that the balance had to be paid by. I asked him again what it was exactly that he did that cost him £100 pursuing the debt and he gave no specific details. He has now become very annoyed and has said that "if I still want the photos" I would need to pay in full because he's no longer willing to accept a payment plan. I'm quite confused, I was under the impression from his letter that i am legally obliged to pay him that money for the photos (which I dont have in my possession), if that's the case then how can there be any "if you still want them"? Is he able to charge interest and just think of a number to add on top of the money I owe? I know it may look a tad silly because he said he would waive the added £100, which seems a bit strange if he had actually spent that amount chasing me up. But I just can't help the feeling that he just stuck it on the letter as a threat to make me get in touch. Despite what the letter said I had no contact from him at all for the whole year beforehand. Any advice you can give would be great. I have the letters and signed documents if it helps Many thanks, Rich

-

Hi All New to forums, so please move if I have posted in the wrong place. Thank you in advance for any comments. Introduction My wife (38) and I (44) are currently in a joint ownership mortgaged property, in a debt management plan, with defaults on bank loans and credit cards. We both have good earning potential and hope to remortgage in approximately 2 years (after April 2019/20) to achieve full ownership. Current financial position Our current property is in my wife's name. It's a joint ownership (50%) 3 bed semi. Our 50% is valued at around £85k. We have £18k o/s on the mortgage and a further £6k charge on the property from Cabot re: an old CCJ that is no longer on the wife's credit history. Approximately £60k equity. Wife is in long term permanent employment earning £32k per annum. Husband is Director of own Ltd Company. Currently in year 1 with expected earnings of around £28k (£8k salary + £20 dividends). First year end is April 2018. Current debt position We currently have around £20k of debt under a debt management plan. Two years ago my wife was ill and I was made redundant. Rather than bury our heads in the sand, we tried to deal with our creditors, asking for payment holidays or help with interest payments. We tried to consolidate but none were helpful. Despite being pro-active, they all served us with defaults. Below are the debts showing as default on our credit check. The bottom two credit cards show as "up to date" but when you drill down it shows the payment with "DM" next to it for debt management. Type of debt Amount £ Default date 6 year date Bank o/d 742 28/08/2012 28/08/2018 Bank o/d 998 29/08/2012 29/08/2018 Bank Loan ,627 31/12/2012 31/12/2018 Credit Card 2,617 29/01/2013 29/01/2019 Credit Card 1,716 27/03/2013 27/03/2019 Credit Card 424 06/12/2013 06/12/2019 Credit Card 1,494 28/12/2016 28/12/2022 Credit Card 1,948 28/12/2016 28/12/2022 Bank o/d 325 22/02/2017 22/02/2023 Credit Card 1,819 up to date - DM Credit Card 4,013 up to date - DM 20,723 The default date is from our credit reports and I have added on 6 years as I believe/hope the debts will drop off our credit reports after this date (?). Plan A What we would like to do is buy a full ownership in approximately 2 years. My wife's earnings will be around £35k, and I expect my earnings to be around £45 (£8k salary + dividends). We hope to borrow in the region of £300k and use our equity to spend around £330k and pay off the rest of the debt. If my understanding is correct, debts older than 6 years won't show on our credit history, so we would spend the next two years paying off the more recent debts, so that our credit check is clear (ish). We would clear the old debts with the remortgage. Plan B Our current property is owned 50% and we could buy the other 50% at a good rate from the Housing Association. Because of the work we have done to the house, I hope we could buy the other 50% for around £75k and have full ownership of a house worth between £190 and £200k (at a cost to us of £160k). We would use this as a stepping stone to achieve PLAN A in roughly the same time frame. As the property is currently listed as 'affordable housing' I believe taking full ownership would allow us to potentially sell for more, and open up more options in terms of dealing with lenders, without the restrictions associated with joint ownership properties. Questions 1) Is the £6k debt to Cabot likely to affect future borrowing? It doesn't show on a credit check, but Cabot do have a charge against the property. 2) Husband is owner/Director of Ltd Company. Other than waiting for 2 year trading history and maximizing earnings from Company, is there anything else I should be doing over the next two years? 3) Will our defaults 'disappear' from our credit checks at 6 years old? Can they still affect our rating? 4) Is there any debts that should take priority over the others? 5) After April 2018, when I have been trading 1 year, would it be possible to buy the other 50% of our current property with the above credit history, equity and earnings? This could be an opportunity to clear off some of the debts to improve our position for the future. 6) Are their any considerations around 'help to buy' that we could take advantage of now and things we should/shouldn't do to jeopardize any opportunities? For example, I have never owned a house. Might this help me in getting 'help to buy'? 7) Do lenders ask for bank statements? Should we perhaps keep any unhealthy payments out of our main bank accounts? 8) Do we need to be concerned about our ages? 38 and 44? I would appreciate any thoughts, comments or suggestions. We are committed to paying off our debts and hopeful that we can achieve our goals. Thank you.

- 10 replies

-

- improvement

- mortgage

-

(and 3 more)

Tagged with:

-

Hi I am trying to get clarification if the cardholder protection plan on my Tesco card in the years 2000 - 04 were in fact PPI. The amount changed each month depending on how much I had spent. I did not have a balance on the card as it was paid in full each month, many times overpaid. I think in the 4 years I only got charged interest a few times. Also on the same card we had a yearly Sentinel protection paid once per year. What I am confused about is if this was in case my card got stolen, why would the amount fluctuate? surely it would be a standard price per year or month. I have read the date for claiming CPP has ended but I have also read that only applied for CPP between 2005 - 2014. So before I go to Tesco I would like to know if it is worth it and also what I had been sold Any advice appreciated

- 5 replies

-

- cardholder

- plan

-

(and 2 more)

Tagged with:

-

Hi All, If this is not the right place could someone kindly move it or advise a better place? I moved to a Rural Village with my wife 2 years ago to be closer to her family so I could get some help and support looking after her. A month after I moved in First cut the bus service and then two months later all her family moved out(over an hours drive away) leaving us stuck in this horrible little village. Neither of us can drive nor can we afford a car. We have tried everything to get out, private rent, medical re-banding etc etc and been given the finger at every turn. Our only hope is getting a swap. This is a very small chance as apparently everyone round here knows how horrible this village is and won't live here. We have now found out from the housing association that in order to swap(over a year after we joined the register) that the other tenant must have a local connection as per the village plan(these houses were built two years ago specifically for people with a connection to the village). I have read the plan and nowhere does it state that swaps are to be enforced only new allocations, I have spoken to housing and planning at the local council and they have stated that swaps will be enforced. Any help here? Where can I go? A swap is the only chance we have of leaving and if I ever find anyone who actually wants to live here I cant have any barriers in the way. Thanks

-

I took out a Service Plan agreement less than 14 days ago and want to cancel. Essentially you pay £26.99 a month for 18 months and it covers a major and minor service, fair enough. However, Ive decided to cancel and simply pay for each service in lump sums as it will in fact be better for me if I want to change cars within the timeframe as if I did then the balance is due which again is fair enough. However, I have NOT claimed on the plan at all and speaking to VW financial services they are saying ok but that it takes up to 28 days to cancel (funny how it only took 20 minutes to set up) and that the first payment is due within that period and they will take it and its non refundable. Other than cancel the direct debit, have I any recourse and is it me, or does this sound like pretty dubious practice anyway?

- 2 replies

-

- agreement

- cancellation

- (and 4 more)

-

Hello all, I normally just look at these sites but after seeing the helpful replies I thought why not. In Nov 2014 I had missed two payments on a card, and I was aware by this time that hiding did no good, I called Capital One to explain I was starting a new job and it would be maybe 1-2 months until I could get the balance back within it limit (which I did). I was then sitting on £227.57 on a £200 limit due to charges and interest. The advisor said sure, we can setup a payment plan, but no mention of the different types. I got an expenditure form and filled it in. On the form there were two options longer and shorter (max six months) in section 8. The £10 per month I agreed to pay was double the interest on the account if within it's balance (I think 28%) I thought well, they are giving me the option I will take the longer one, not realizing it had consequences. Oh boy what a mistake. This option defaulted the account immediately. I never received the letter they said they sent about stating this so it went untoticed until around a few months ago when I did a credit check. I contacted the financial Ombudsman who said they decided in the companies favour. I have since replied stating a few facts they got wrong and are now reassessing. The thing I feel is wrong that nowhere on the form I filled in explains the two options or their consequences. I had a look on the consumer report and wondered if it applied? I had a look on the consumer act and seen the below which I don't feel applied to the agreement form I filled out. 55Disclosure of information. (1)Regulations may require specified information to be disclosed in the prescribed manner to the debtor or hirer before a regulated agreement is made. [F155APre-contractual explanations etc Before a regulated consumer credit agreement, other than an excluded agreement, is made, the creditor must— (a)provide the debtor with an adequate explanation of the matters referred to in subsection (2) in order to place him in a position enabling him to assess whether the agreement is adapted to his needs and his financial situation, (2)The matters referred to in subsection (1)(a) are— ©the features of the agreement which may operate in a manner which would have a significant adverse effect on the debtor in a way which the debtor is unlikely to foresee, Any advice? I seen a post somewhere else that said anything detailing to time and action should be more profound in size/bold/undlerlined. In the defult letter, i never got its all the same size. I think they also kept the older higher amount on the default notice. za1.pdf za2.pdf

-

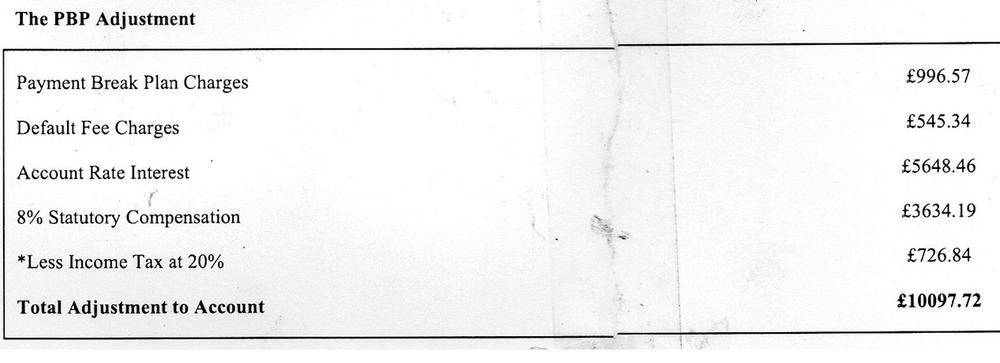

I have received a letter from monument about PBP. It was totally unsolicited, and I have not applied for anything (PPI or the like)or contacted Monument in any way for years. This letter came totally out of the blue and I dismissed it along with all the other letters I have received from them over the years. I ripped it up and put it in the bin. The Short Story My monument account was pulled many years ago , I can't even remember the dates it was so long ago, leaving an unpaid balance of around £3,600 which remained unpaid. The Long Story I have just fished this letter out of the bin as yesterday, I received a cheque in the amount of just over £6,800. The letter I received last week referred to PBP - Payment Break Plan and looks to be a letter of 'without admission of liability'. I have scanned part of this and attached it to this post. It would appear than an adjustment of just over £10,000 has been credited to my account, and the cheque I have received looks to be the difference between the amount of the adjusted credit, and the outstanding balance as mentioned above. I'm just wondering if this is legit or maybe a ruse on the part of Monument to track down their un-paying debtors. I have seen other posts here mentioning refunded PBP - which I never knew I had, but these are dating back to 2014/2015. Obviously we're now at the latter part of 2016, and they 'look' to be still paying out. The letter states they will apply the adjustment values to any outstanding debt from the account, and should this result in your account going into credit, we will issue you a cheque within 28 days - which looks to be the same as others have posted here. I'm not sure whether to put this cheque in the bank or leave it be as I really can't afford to be snared in this way. Any input would be greatly appreciated. Thanks.

-

http://www.lawgazette.co.uk/law/british-bill-of-rights-plan-to-be-unveiled-this-autumn/5050869.article?utm_source=dispatch&utm_medium=email&utm_campaign=GAZ080915 "The Ministry of Justice today confirmed that it will ‘bring forward’ proposals for a British bill of rights, to replace the Human Rights Act, this autumn."

-

I notice that there are quite a few Xercise4Less/Harlands threads here already so I'm sorry for adding yet another one! I took out an 11 month membership with Xercise4Less in February 2015 and fully intended to see the contract out. However, over the last few months I have been facing increasing financial difficulty and have now started a Debt Management Plan with Step Change. I need to make the first payment towards my plan of £488 today (2nd November) and having just switched my current account from NatWest to Halifax it has left me with virtually nothing once the payment has been made until I get paid on 18th November. From then on things should start to get easier now I am on the debt management plan and I can start budgeting and saving. There was no way that I could afford to make the October payment of £9.99 to Xercise4Less so I had no choice but to cancel my Direct Debit. I informed my local Xercise4Less branch of this straight away by post and enquired about cancelling my contract early because of the Debt Management Plan. A girl from the branch rang me and said that while they couldn't cancel my membership for that reason themselves, head office should be able to do so, so I have written to them this week and I am waiting for a response. In the meantime I received a letter from Harlands yesterday saying that I owe them £34.99. Octobers payment of £9.99 + a £25 administration charge. I have written back informing them that my contract is with Xercise4Less and not Harlands and that they they are dealing with my cancellation. I have told them that I will not be paying the £25 charge as it is unfair and unlawful. I agree that I owe October's payment and if Xercise4Less don't agree to cancel my contract early I will be happy to resume paying until January 2016, but I will not be reinstating the Direct Debit until the £25 administration charge is removed. Any advice is appreciated.

- 104 replies

-

- harlands

- management

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.