Showing results for tags 'action'.

-

Sent a debt collection agency the letter with regard to "a formal request pursuant to s.77/78 of the Consumer Credit Act 1974 etc". They have written back asking for my last three addresses to confirm who I am. Any suggestions what to do next. Thanks.

-

I've received the following letter from Lowell solicitors regarding a default from 2012 for about £1700. I've previously tried to negotiate a settlement figure but got very little response. Although I have found a letter they sent last year offering a 60% reduction in the debt. Any suggestions on my next course of action? PAP LOC (1).pdf

- 114 replies

-

Thanks. I have previously SAR'd Vanquis. I'll dig it out and post here Here's the SAR response jpg2pdf.pdf

- 23 replies

-

Hi I received some excellent advice from CAG after I had some major employment and debt issues between 2008 and 2011 which resulted in a number of my accounts defaulting, once again I am in need of assistance please. One of the alleged debts I defaulted on was in respect of a BOS Credit Card, under duress I continued paying £1 per month until August 2016 when it was sold to Cabot Financial. The balance claimed is around £4k. Cabot quickly passed the account to Restons who wrote in February 17 threatening legal action to which I issued an unsigned CCA request together with a £1 postal order. Restons rejected the CCA request as it was unsigned, therefore I signed it and resent it with a letter as follows; ___________________________________________________________________________________________________ Further to your letter dated XXXX in response to my second formal request for a copy of the original credit agreement for your reference shown above. I am somewhat surprised at your request considering you have happily sent personal information to my address if you are now uncertain that I am the correct person. For the avoidance of doubt there is no requirement under the Consumer Credit Act 1974 nor the Data Protection Act 1998 for my request to you to be signed. Never the less, I return to you now signed my original letters dated 23 March 2017 and 28 March, together with Postal Order: for £1. This postal order represents the fee payable under the Consumer Credit Act 1974 in respect of my request for a copy of this credit agreement and a full breakdown of the account including any interest or charges applied and must not be used for any other purpose. I understand that under the Consumer Credit Act 1974 (sections 77-79), I am entitled to receive a copy of any credit agreement and a statement of account on request. I understand that, under the Consumer Credit Act 1974, creditors are unable to enforce an agreement if they fail to comply with the request for a copy of the agreement and statement of account under these sections of the Act. For the avoidance of doubt, an original signed Consumer Credit Agreement is just that; not an application for credit and not a reconstructed or micro-fiche document from other sources but indeed the original signed document purporting to be signed by myself. Please note that until such times as a legally enforceable, original Consumer Credit Agreement can be produced and a copy sent to me by return, then this letter is not an acknowledgement of debt and this account will remain in an unenforceable state in line with s.127 (CCA1974). I look forward to receiving the documents requested within the next 12 days. ___________________________________________________________________________________________________ I have also sent an unsigned CCA request to Cabot which has been acknowledged and is in process. I have today received the attached letter from Restons advising legal action is commencing, although they have stated the Postal Order and letter has been returned this was not included in the envelope. I have contacted Royal mail to obtain confirmation the Postal Order has been cashed. I would really appreciate guidance as to how I should respond as Restons appear to have no inclination to provide a copy of the CCA and appear happy to proceed to court on this basis. Many thanks Bozalt IMG_1942JPG.pdf

-

Hi there, Is there anyone out there who can help me? We have a former GMAC mortgage that went over to mortgage Express. We were keeping up with the mortgage until I finally succumbed to my illness and disability. We are currently five months in arrears which works out to be £4250. I was working part time and my wife was working full time and up to earlier in the year keeping up with our mortgage. We thought we had sorted ourselves out with my working part time and my wife getting a full time job a while ago. I had an operation several years ago, that resulted in damage to my spine, this means I take 35 tablets a day, and have fentanyl (type of morphine) patches, oramorph (another type of morphine). I am stuck in a wheelchair now, I am typing from a special bed installed in our bedroom that is like a hospital bed. All this means I cannot really work a lot now. I am waiting for the first of five operations at the start of August so will be out of any sort of working fulltime loop for a few years. I will be able to work part time and an employer is willing to let me do this fitting around all my issues. My wife works fulltime, but had to take a few months off without pay due my being in and out of hospital. overall a loss of income. We have managed to stabilise our position, but need to sort out the mortgage arrears. We were in arrears a few years ago with MX and it was hell. Four of five phone calls a day, refusal to accept a deal, threats of a home visit etc. we changed our phone number, managed to pay off the debt and were debt free for three years. How can I write a letter offering an extra £150.00 a month, which we can pay and try to forestall any action? We had a knock at the door which was out of the blue. It was an advisor and valuer from them. We told him to go away, we were only going to deal with Mortgage Express in writing as our last experience told us they bullied on the phone, never agreed a deal, and kept on phoning us. Despite our telling him to go away, he came back four times, each time was when our neighbours were coming home from work. He would stand outside the house and with a raised voice tell us he was there to deal with our mortgage arrears. our neighbours know our business. Can someone point me towards a letter template our help me out with one to send them as soon as possible? I just want to stop and action which the valuer told us they would do, that being taking us to court for repossession. I know the court might end up giving possession and then stay it, but it is a worry I could do without. I get full DLA, I am as previously stated in a wheelchair. I have four outpatient’s appointments a week, which I know is not MX’s fault, but being thrown out of the house will result in my ending up in hospital. Please help.

-

Hi everyone, following on from extremely similar cases, i requested documentation for service charges of a flat i own. Accordingly to regulations (Landlord and Tenant Act 1985 Section 21, as amended by the Commonhold and Leasehold Reform Act 2002 Section 152) they should have provided evidence within 21 days. 25 days later they sent me some receipts making up 25% of the charges. I asked them if that was all they had for that financial year and they confirmed this. So I had these checked and found usual irregularities like wrong calculations for shares and of course all the missing receipts and invoices for many of the services allegedly offered. For example, lift maintenance is £1000, divided by 10 flats they make it £15. Clearly wrong to me and you, but of course their calculators seem to consider maths an opinion. They don't dispute that these calculations are wrong, but they simply avoid addressing the problem. I asked for a refund of all undocumented charges and overcharged, same as I did with other financial years which they refunded. As soon as they received this request they sent another 3 receipts totalling £20 approx; this was well after the statutory 21 days. I rejected these receipt and told them that I was not in a position to accept any further documents because they had already confirmed that they didn't have anymore and the 21 days had passed long time ago. So they're now playing the ignore game and, as the 14 days I gave them are up tomorrow, I am drafting a lba. If you are still reading I thank you, I know it's a bit long but I wanted you to have a good picture. I have a feeling that this time I will end up taking them to court, so I don't want to make any mistake. My question is: Accordingly to the pre action protocol I should suggest an alternative dispute resolution service, however I don't want to give them an opportunity to get the Ombudsman involved, knowing that they are useless. Can I avoid mentioning ADR in my lba? If I do, could they claim that I haven't complied to the letter of the pre action protocol? Or by ticking yes to mediation on mcol I should be ok? Thanks for your help.

- 36 replies

-

- action

- county court

-

(and 3 more)

Tagged with:

-

Hi All. I was going to resurrect the old thread just for the latest judgement, this is an appeal which confirms the view that the coa emanates from the default notice date of course. I know this is an old thread, but there has recently been a test case which proves the point that a COA is in fact the date of the 87DN. Therefore it should be considered as such when calculating the COA and the subsequent barr date. It ties up the large thread nicely https://www.bailii.org/ew/cases/EWCA/Civ/2019/12.html Critically, section 87(1) does not provide merely that a default notice is necessary before the commencement of proceedings to recover everything outstanding under the regulated agreement. It provides that there is no right to treat the agreement as at an end or to make a demand for accelerated payment of outstanding amounts. That is not a "procedural" precondition. It qualifies the substantive legal rights of the creditor. The contractual precondition in clause 8f of the Agreement ("Subject to us sending any notice required … by law) must have the same meaning and legal effect. His Honour Judge Madge, on the other hand, held that the effect of CCA s.87 was that the cause of action only arose after the time specified in the default notice for remedying the default. As said this is the first date that enforcement can start, All. or most points are covered on the judgement and agree with what Sequency or I said at the time. I shall not be discussing this further, it has all been said, unless I see someone being mis-advised.

-

Today I received a white county courtclaim form from northampton for the MBNA Credit card 2008 – now with PRA GROUP - £2723 – defaulted 2012. On 12th Nov PRA Group wrote to me in response to my returned PAP form where I stated I dispute the debt because I need more documents or information Specifically I wrote: I need a copy of (1) the Default Notice, (2) the Notice of Assignment, (3) a complete set of statements detailing exactly how the debt has accrued detailing: (a) All Transactions, (b) Any additional charges, be them by the original creditor or you PRA Group (UK) Limited, the debt purchaser or any predecessor, © Details of all contractual interest added by whom and on what date, (d) List of ALL Payments made toward the Agreement. The PRA group letter on the 12th said, that in response to my query (PAP form) please find enclosed copy of statement of account from MBNA and a copy of the credit agreement (was an online application 2008) plus statements from the MBNA credit card (virgin). The letter goes on to say that they will put the account on hold for 30 days until 12th December to allow sufficient time to receive the letter and contact them. Today I received the county court claim form. I don't know what to do now? Please advise. Should I try to a negotiate an offer with PRA or will I have to pay in full somehow! I don't want a CCJ registered.

-

Hi My wife has received a Pre-Action Protocol for Debt Claims from Drydensfairfax, for an old debt from 1998 at an old address. Arrow recently started sending letters to our new address and continued despite being returned as not known at address. They now appear to be instigating court proceedings. Unfortunately I expect this is not outside the statute of limitations as I have been paying £1 per month by standing order since she defaulted in around 2000/2001 (from my account not hers). Whilst she is working, she is not in a position to pay it off as she is currently just managing to maintain her current credit. Naturally we do not want a CCJ, ideally she is hoping to consolidate her current debt soon to help manage and prevent her credit status worsening. I would really appreciate any advise you could offer, in particular could I ask: - should I send the suggested CPR 31.14 request (as this seems to mention a specific court that has not yet been advised)? - should I send the CCA request to Dydyenfairfax or Arrow? - I have seen a Debt Prove it letter, would this be appropriate? Also, I have listed below the details as suggested: Name of the Claimant ? Drydensfairfax Solicitors/Arrow Global Guernsey Ltd Date of issue – 04/02/2019 Date to acknowledge) - 09/03/2019 - We are instructed by our client, Arrow Global Guernsey Limited, in relation to the above debt. If you do not provide proposals to repay this debt, or respond as otherwise detailed in this letter and it's attachments, legal proceedings may be issued against you in the county court. If such proceedings do become necessary, further costs will be incurred for which you may be liable. The proceedings may then result in a county court judgement being entered against you which will be registered a the credit reference agencies and is therefore likely to affect your ability to obtain credit in the future. Full details of the debt are set out below: The amount owed is £702 and no charges/interest are being added at this stage A statement of account is attached ---(an account summary showing only start balance (£823), total debits (£17), total credits (£138) current balance (£702)--- The agreement this debt relates to was entered into between you and Shop Direct (Carval) on xx/xx/1998 and assigned to Arrow Global Guernsey Limited on xx/xx/2011. A copy of the agreement can be requested using the reply form. ---(should I do this also?---- Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ? Don't know Have you changed your address since the time at which the debt referred to in the claim was allegedly incurred? Yes Did you inform the claimant of your change of address? No What is the total value of the claim? 702 Is the claim for - catalogue When did you enter into the original agreement before or after April 2007 ? before, it was 1998. Is the debt showing on your credit reference files (Experian/Equifax /Etc...) ? Not on my copy, I don't know if deeper searches with linked addresses are any different, credit score is low but I thought this was due to current level of debts Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt purchaser, Arrow Were you aware the account had been assigned – did you receive a Notice of Assignment? probably but to a previous debt purchaser, it was back in 2011 when Arrow took over but we moved house in 2008 Did you receive a Default Notice from the original creditor? Yes, around 2000/2001 Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Don't know, possibly, but moved house in 2008 and only recently started receiving letters to new address Why did you cease payments? Husband has maintained £1 per month standing order throughout, still paying unless their bank payment details have changed What was the date of your last payment? Feb 2019 unless their bank payment details have changed Was there a dispute with the original creditor that remains unresolved? No, due to credit difficulties Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes and Yes Many thanks again in anticipation of any advice you can offer.

-

Hi there, firstly apologies if this is in the wrong section. Also I thought I'd keep things quite general so that this might help more people. 1) If I have a contract dispute (money claim) with a supplier and have given them a letter before action (LBA) which they have replied to (I am not satisfied with their answer). Do I still have to waste time going backwards and forwards with them until they stop replying or can I just start the proceedings and issue an N1? 2) In their response to my LBA they had provided some evidence (SMS) which I wish to respond to by providing the whole SMS thread (I didn't think it was necessary at the time of issuing the LBA). Do I have to provide all evidence in which I intend to rely on before sending N1 or can I send it along with the N1? It's been a while since I did a money claim and even though I have been successful doing LBA then N! with full docs (regardless of their negative response) I read conflicting things on the internet that would suggest things have changed a bit.

-

Hello I hope I can get advice. I took out a secured loan in January 2002 for 8000. I obtained the loan through dial4aloan. The loan was arranged and the lender was endeavour. It appears I also was sold ppi of 1200 added to the loan. Well I am trying to reclaim the ppi. However all organisations are blaming each other for selling it. Dial 4 a loan state they only recommended ppi. Yet the ppi policy is on endeavour paper. Aviva say they have no responsibility either. So what happens when no one will accept responsibility? Thank you

- 45 replies

-

Hi all, Today my wife received rather thick envelope containing letters from Lowell and BW Legal, containg a reply form, which after looking about online seems like a new thing (pre action Protocol?). My wife hasnt heard anything about this debt in a very long time, plus we moved home last year so that possibly hasnt helped matters. The debt is for Vanquis Bank (Credit Card) and was defaulted on 31/10/2012 - no payments have been made since before this date and its approaching being statute barred. Whats the best way to proceed WITHOUT acknowledging the debt? Do I tick boxes D to dispute the debt and tick box I and ask for more information? If so what information? Should I also sent a normal CCA letter with the reply form? Do I now just deal with BW Legal seen as all this has come from them as Lowel say it has been sent BW Legal? Many thanks Martyn

-

Hi Everyone Back again as Caboot are back. They appointed Marrlin who wrote to me asking for payment in full on a debt that I believe to be Statute Barred. Last contact from Arrgos Card Svces was in 2006 when they sent a notice of assigment. Payments continued to Moorcroft, unfortunately I cannot find the paperwork regarding this issue, it may be in attic. which I will need to access later today. I received letter from Reestons yesterday, the letter was dated 7 days prior to me recieving it. I have to contact them by next Tuesday, if I do not they submit a claim to the county court. This now leaves me less than 5 days to deal with this issue. Do I advise Reestons that I believe this debt is statute barred? Or that that I dispute the debt? or should i ask them to provide a CCA? I have asked a debt collector in past to provide a CCA which they could not do. I beleive I should now send a SAR to ARrgoos card svcs, is that correct? I think that I should also ask Caboot to provide a CCA? is that correct? As this is such an old issue I am not sure where to start with it, and as I have very little time to respond really need to know what to send to REsstons. Whatever i need to send will have to be sent Monday at the latest. Poppay

-

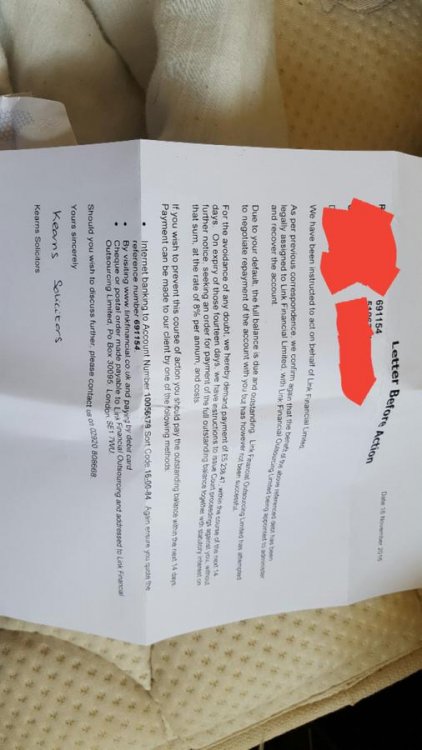

Hi all, Been a while since I've been on here. Have received a letter before action from Kearns on behalf of link financial for an old MBNA credit card debt. The debt is circa 2007. I haven't been chased on this or had any correspondence on this or made any payments on this for over 6 years for sure. I have attached a copy of the letter. Please advise course of action? If I am honest, I have moved address and Link have recently chased me for another one and I feel they are phishing on this one as I basically disappeared for 6 years. Letter attached for advice. Thanks!

-

I naively filled out some PPI claim online Pemberton Associates ages ago, gave all info I had to hand. “Electronically” signed all documents. Was sent something in the post which was lengthy, eventually completed & returned. Cut a long story short but I started getting A LOT of emails from this company. Regarding all sorts of things, claims against pay day loans, claims against all sorts of things, there was that much I lost track. I was only ever really interested in PPI and I assumed everything I filled in was to do with PPI. I got a final response saying once they’ve checked my credit history there’s only two companies I could claim against - one being a mail order company (which I owe a mere £80 and the other being my current account, which at the time was overdrawn) I replied saying I didn’t really see the point in perusing a claim against these for the reasons above. To which they agreed. I then started getting emails regarding some payday loan I took out a while back, asking me to send them a copy of some letter. I had no idea what they were talking about and told them this, on top of the fact my balance was zero I didn’t understand why they were looking into it. Fast forward a few weeks and they’re now saying I’ve breached the contract and that i’m Liable for cancellation fee’s if £360 for each company they originally persued (sure there’s about 12 all together) The guy who was emailing me was horrible, very threatening, making out like I was lying, saying they’ve now realised I’ve breached the contract for a second time as I’d not returned documents (this isn’t the case - I’ve returned everything I’ve received) I was getting no where with him, ended up leaving a lengthy yet honest review on trust pilot to which he replied saying if I didn’t remove it they’d sue me for damages. Cut a long story short he reckons he’s issuing court proceedings first thing tomorrow. He’s literally not left me alone all night, threatening all sorts, telling me I am liable for court costs on top of the damages and fee’s already mentioned. Apologies for any spelling errors, currently in the middle of something & frantically trying to explain myself on my phone! Any advice greatly appreciated!

- 11 replies

-

- action

- associates

-

(and 4 more)

Tagged with:

-

Noting the branding on a cinemas car park, I parked to watch a film. Not noticing any clear notifications to pay, they clearly are there. Naturally this is a Br2ttaN3a managed carpark. I now have two letters. 1. Letter before action from the dubious BW 2. A final 16 day demand before court. I have done the following but have had no response. 1. Recorded delivery letter to parking management company, asking for evidence, print outs, and offence. 2. Recorded delivery letter to BW asking for data restriction. ( they replied saying not applicable ) 3. Letter to my MP 4. Letter to the cinema asking for them to make their signs to the car park clearly state you have to pay - and to step in and make contact. I enclose the two letters. I have sent a follow up email to the cinema stating I will write to the board and the local press - and that my complaint is under unfair contracts. Shall I post the letters here, obviously edited?

-

Hi all. Brief background to my delimma; Opened up a vanquis account back in mid 2013, kept on top of it for a few years until I went through an extremely difficult time, they increased my credit limit to £2000 around the same time and I blew the lot and stopped paying because I didn’t care about anything. It was then sold to Lowell’s solicitors I ignored the first letters until I received the pre action protocol letter. I responded to that asking them to prove it. Today they replied stating they were waiting for response from creditor and my account is on hold in meantime. Total debt is £2396. But I also noticed some of the information on this letter is wrong. The last payment date and the amount is incorrect and also the default date. I checked through my bank statements and they’re a month out with the payment date. They have my last payment as November for £70 odd, but my last transaction was in the October for £30 odd. Then the default is recorded in May the following year. I’m wondering if it’s worth letting it go to court if they seem to have wrong information. Would be really grateful for any information or advice anyone has. Many thanks.

-

Hope I can get a quick bit of advice/knowledge from you guys. Lowell have been sending my husband the usual series of threatograms over a Talk Talk account debt and have now sent us a county court claim form. What makes this especially fun is that this debt is absolutely not ours. We have never had an account with TalkTalk. Hubby has even phoned TalkTalk and verified that he has never had an account with them (and they actually confirmed to us that the debt is question is not and never has been registered at our address - but we can't really use that info because under data protection they shouldn't even have told us that much). Hubby has a very common name and I can only assume that Lowell, being unable to find the actual debtor, have just sent out speculative threatograms to everyone they could find with that name in the hope of bullying someone into paying. We haven't bothered replying to the threatograms because, quite frankly, why should we? It's not our debt and we are under no obligation to send them personal and/or financial information (also, in my past experience of DCAs chasing a debt for a previous resident of our address, these companies are extremely reluctant to remove a name/address from their records unless you can provide them with an alternative address at which to chase - they would rather continue to pursue payment at an address they know not to be that of the debtor than have nowhere to send threatograms to). I am submitting our defence to the claim on the website and it's fairly straightforward because it amounts to, Sorry mate, not our debt, sod off. But I would like to get Lowell in as much trouble with the courts as I possibly can for their unscrupulous shenanigans I would like to know what the regulations are (I know there are regulations DCAs are supposed to follow, not that they often do) about chasing debts/issuing court action etc when they haven't even ascertained that the person they are chasing is the actual debtor. Are they in breach of regulations here? Or are they actually allowed to send out threatening letters to everyone with the same name as the debtor they are seeking and take people to court just because they have the same name as a debtor? Any help/thoughts/guidance much appreciated.

- 38 replies

-

- action

- county court

-

(and 3 more)

Tagged with:

-

A couple of years ago, my ex-landlord agreed to settle a dispute out of court by paying me £10 a month by direct bank transfer, till he had paid £300 in total. I have just checked my old bank statements, and discovered that he made his first four £10 payments, and has not made a payment since. Knowing him as I do, I don't believe that this was an accident. Would I be within my rights to recommence the previous legal action, deducing £40 from the amount previously sought, and adding on the costs of the new legal action? Or would the court expect me to first contact my ex-landlord and give him the opportunity to settle the outstanding debt? I would far prefer the former, as my landlord is a rude and aggressive person who would probably mess me around further. Just a further thought - If I were to give him a non-negotiable deadline by which to pay the outstanding balance (say, a month), would that be likely to be deemed reasonable by the court, given that the entire debt should have been paid off by now?

-

Hi, I have received a claim from northampton county court on 31st Jan 18. I have done the acknowledgement online as per the document (and help here) acknowledged on the 31st. I have read some posts about similar and sent a CCA to Lowell and CPR to Lowell Solicitors signed for. I had a Vanquis Card back in 2012 and came out of work and couldn't pay, stuck my head in the sand and ignored everything. Received some letters from Vanquis I think but just binned them. Got some letters from Lowell and they ended up in the bin too. I know it is not far off from being Statute Barred which is why I guess they have decided to try this now. I've now got a claim from Lowell via the court for £2660.50 The claim is broken down as; Amount Claimed £2660.50 Court Fee £105.00 Legal Fee £80.00 Total £2845.50 The Claim particulars are 1 - The defendant entered into a Consumer Credit Act 1974 regulated agreement with Vanquis under account reference xxxxxxxxxxxxxxxxxxxxx (the agreement) 2 - The defendant failed to maintain the required payments and arrears began to accrue. 3 - The agreement was later assigned to the claimant on 04/08/2013 and notice given to the defendant. 4 - Despite repeated requests for payment the sum of £2463.43 remains due and outstanding. And the claimant claims a - the said sum of £2463.43 b - interest pursuant to s69 county courts act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accruing at a daily rate of £0.540, but limited to one year, being £197.07 c - costs Since sending the CCA to lowell I have not heard anything from them at all (sent 1st Feb) Lowell Solicitors have sent a copied version of the notice of assignment which introduces them as the "debt purchaser". It is not an assignment or transfer from the original creditor which is what was asked for in the CPR. I have been working on my defence and this is what I have so far; "The Defendant accordingly sets out its case below and relies on CPR 16.5(3) in relation to any particular allegation to which a specific response has not been made. (1) The Defendant notes the opening sentence referring to an agreement between him and Vanquis. The Defendant has in the past had financial dealings with Vanquis. The Defendant is unaware of what alleged debt the Claimant refers, having failed to adequately particularise its claim. The Defendant has not entered into any contract with the Claimant. (2) The Claimant alleges that the Defendant failed to make the required payments due. This is denied. (3) The Claimant alleges the agreement was later assigned to them on 04/08/2013 and notice has been given to the Defendant. This is denied. The Defendant is unaware of any legal assignment or Notice of Assignment from assignor or assignee pursuant to the Law of Property Act 1925 s136. (4) The Claimant alleges “repeated requests for payment”. This is denied. The Defendant is unaware of what account or contract the Claimant refers to, nor having received any default notice pursuant to the Consumer Credit Act 1974. The Claimant has not complied with paragraph 3 of the Pre Action Protocol. Failed to serve a letter of claim, pre claim pursuant to PAPDC changes of the 1st October 2017. It is respectfully requested that the court take this into consideration pursuant to 7.1 PAPDC. The defendant denies owing any monies to the Claimant and the Claimant is put to strict proof to: (a) Show how the Defendant has entered into a legal signed agreement with the Claimant; and (b) Show absolute proof of how the Defendant has reached the amount claimed for with the Claimant by way of statements showing all amounts levied by the Defendant; and © Show how the Claimant has the legal right, either under statute or equity to issue a claim; (d) To provide an original assignment in writing signed by the assignor at time of alleged assignment pursuant to the Law of Property Act 1925. (e) On receipt of this claim the Defendant requested by way of CPR31.14 and a section 77 request for copies of any documents referred to within the Claimants particulars to establish what the claim is for. To date they have failed to comply to the section 77 request and remain in default with regards to the CPR31.14 request. As per Civil Procedure Rule 16.5(4), it is expected the Claimant prove the allegation the money is owed. On the alternative, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act 1925 and Section 82a of the Consumer Credit Agreement Act 1974. The Defendant feels that in the event the Claimant does not have a right to issue claim, pursuant to the Law of Property Act 1925 it may be a contempt of court in that the Claimant brings a claim that is misleading by representing they have ownership by assignment and making that representation in their particulars of claim before the court. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief." Any chance anyone can help me out with this? I'm trying to get everything in the right order and such but it is a little daunting on my own.

- 182 replies

-

- action

- county court

-

(and 1 more)

Tagged with:

-

I have just discovered this site and forums, and fear I have made a terrible hash of dealing with Erudio with regard to my own and my husband's old Student loans (My own: 1 from 1990 (unsigned by SLC) for £420 but due to 9.8% interest (!!!!) now over £800 and really should have been written off had Erudio not been involved; and my husband's: 4 from 1993, 1994, 1995 and 1996 respectively and over £5,000). We had been happily deferring re-payment of these loans over the years until Erudio took over. The first inkling that we had that they had been sold to a bunch of debt collectors were involved were the classic "you are in arrears letters". At this point in our lives we were both suffering from health conditions (I had had a nervous breakdown and have since been diagnosed with an autistic spectrum disorder and my husband has since been diagnosed with IBD) - whether this had an impact on our judgement I don't know. We did initially ignore these, and people were saying definitely not to fill in their deferment forms, so we didn't do that either. We have historically been a fairly low income household, and I have never made any re-payments on my loan , whilst my husband briefly made a couple of repayments.(I cannot remember in what year.) We were harassed on a daily basis by telephone calls- often several times a day. My husband's account was then transferred over to Capquest, which did freak us out a little, I have to admit, never having dealt with debt collectors before. The same situation occurred with the letters and phone calls with Capquest. They seemed to be not taking any action on my account. We sent CCA requests in June 2015, to Erudio and received the copies at the end of July 2015. I complained to Erudio in writing about their tactics, their harassment, and asked them to remove the arrears from the account and to consider back dating deferment . I even took this to the FOS - no joy. I complained to SLC and said my loan had been miss- sold - I think I also took this to FOS - also no joy - I was told that I would have been able to access commercial lending operators!! We wrote to the director of Erudio explaining our situation and please could we just defer!! I believe the response was : Capquest are dealing with your account now - talk to them... At this point I became tired and gave up - they just wanted all the money and there seemed no scope for returning to the good old days of deferment. And it seems our accounts would never be written off now as we had broken the terms and conditions - welcome to harassment for the rest of our lives!! Last year Capquest were still harassing my husband - his mental health has been badly affected by his physical health - and he did not work for several months - he works for himself but did not have the money in his businesses to pay himself whilst he was unwell. I wrote to them and told them to back off in no uncertain terms. Neither of us claim disability benefits, we claim tax credits, which has kept us afloat. It had all gone fairly quiet on the Erudio front until a few weeks ago when a "remedy of account" package arrived with statements dating back to 2015, for my husband's loans. Closely followed by default letters for each loan (1993, 4, 5 & 6). And then last week a letter from Drydensfairfax solicitors which appears to be a letter before action. What is interesting is this : ----------------------------------------------------------------- Full details of the debt are set out below: . The amount owed is £5341.45 and no charges/interest are being added at this stage. . A statement of account is attached. . The agreement this debt relates to was entered into between you and SLC on 9th Dec 1993 and assigned to Erudio on 22 Nov 2013. A copy of the agreement can be requested using the reply form. --------------------------------------------------------------- They have stated that the whole amount relates to the 1993 agreement - in which only £800 was borrowed. The reply form also includes boxes where you can dispute the debt. With regards to my account, I have received the same "remedy of account" statements that my husband has, and, yesterday the same default letter. I believe it to be going down the same route. We do not have the money to pay these loans and are still under the re-payment threshold. I do not know what move to make next - as I understand that now they will never be written off, and I don't know what strategy to employ to deal with this new development. Any advice would be hugely appreciated.

- 49 replies

-

- action

- drydensfairfax

-

(and 4 more)

Tagged with:

-

Hello, Please can you help? Since July 2018 I have Marstons chasing a debt for Severn Trent which I was unaware of until they sent me a hand delivered letter, informing me they had a high court writ. I promptly filed a N224 form to Apply to stay the writ and Set Aside the judgment. However, I misread the instructions prior to the hearing and took my defence statement to the September hearing and presented it to the judge, the application was dismissed as I had not filed the defence statement prior to the hearing. The following day I applied again for a Apply to stay the writ and Set Aside the judgment using N224 and submitted it online. Now in November Marston have decided to chase the debt again and are visiting my home with hand delivered letters. As, I had not received anything from the court, I called them and I found out they had not received it. On the 9th of November, I submitted the N224 by hand to the court, I contacted the High Enforcement Officer and he told he will be executing the writ as there has been a stay order granted by the court? What can I do/ please help

- 9 replies

-

- action

- enforcement

-

(and 2 more)

Tagged with:

-

The lift in our apartment block has had some sort of major failure and is out of action. The management compnay say it will be at least 2 months before work can start, so potentially 3-4 months before it's complete. In the meantime I can't get in or out, so am effectively homeless. This delay is apparently down to the s20 procedures needed before they can even get estimates, is this true and is there no way around it? Surely they wouldn't have to do this if emergency repairs were needed to the roof, for example? Wouldn't me being homeless be an emergency? Any suggestions anyone?

-

Hi there, I'm currently struggling to pay off $AU 7k debt that is owed to an Australian bank, which has now been sold to a Debt Collection Agency in Oz. T hey tried to find out where I was living by contacting my ex partner and have tracked me down in the UK. They said they will forward this to their overseas affiliates Stevensdrake. I received a couple of letters from SD, the last one stating 'in the absence of any response we are instructed to commence legal proceedings against you. Court costs and interest will become payable (where applicable) in addition to the basic debt if those proceedings are successful.' Having studied most of the threads most people would recommend ignoring them. I have made no contact with them at all and this debt is pretty recent, only about 1 year. So I have about 5 years before going down the SB route. It looks like SD do bring people to court in relation to this...which is my fear. Unfortunately I have zero money or assets here. Just UK debts which I'm trying to pay off every month, I'm on min wage salary and I actually can only just about pay my bills, rent and food every month. My Mum isn't well so I had to move back within a year of being there. When I moved back to the UK from OZ I was unemployed for 6 months because I couldn't find work. I'm just not sure what the best way forward is as most people say to ignore them but I've seen some people recommending to make contact as to not let them think they will get an automatic judgement against me if they did bring proceedings forward. Any advice would be so appreciated.

- 36 replies

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.