Showing results for tags 'against'.

-

Hi Can I get taken to court over the same debt twice? Have several debts, 2 with CCJ's but 6 years old early next year, paid monthly agreed amount but still balance will remain outstanding. With regard other debts, again 6 years and older, they have now dropped off my credit report and all bar one have been sold to collection agencies....can they make defaulted again or take me to court to obtain CCJ? I paid monthly a small amount but have stopped since dropping off credit report. Cheers in advance.

-

Hello I hope I can get advice. I took out a secured loan in January 2002 for 8000. I obtained the loan through dial4aloan. The loan was arranged and the lender was endeavour. It appears I also was sold ppi of 1200 added to the loan. Well I am trying to reclaim the ppi. However all organisations are blaming each other for selling it. Dial 4 a loan state they only recommended ppi. Yet the ppi policy is on endeavour paper. Aviva say they have no responsibility either. So what happens when no one will accept responsibility? Thank you

- 45 replies

-

Looking for help with claim against Royal Mail in small claims. They admitted to losing my 'signed for' package, but then failed to reply further or compensate me. Four months afterwards, I issued Small Claims writ and they sent me standard letter and standard cheque for compensation two weeks later. They have put through their defence which from reading other threads is the same they always use, ie: 1. No contract was entered into between parties for the delivery of the parcel (they mention Harold Stephen & Co V's RM 1978 as reference). 2. The defendant has immunity to a claim in tort in respect of the transmission or delivery of post. Saying they cannot be sued in contract or tort. I know of one case on here that they lost in the County Court. However County Court proceedings are not recorded as far as I know. What I am looking for is any evidence of similar proceedings, a letter explaining the court's reasoning or similar. If anyone had anything they could redact and post I would be very grateful.

-

CMA secures court order against viagogo READ MORE HERE: https://www.gov.uk/government/news/cma-secures-court-order-against-viagogo

-

Not sure if this is the right sub-forum, but would appreciate some advice regarding the following. My wife and I purchased some lighting from a specialist online/high street retailer a few months ago...which was done as follows. The company sell lights/lamps from various Manufacturers on their website, which are not bespoke in any way (they are not custom made/made to our specification...they are simply lamps/lights like any other customer could buy). After receiving an initial quote from the company via email for some items we were interested in, we changed the items a few times before settling on the final requirement list (but never received a final quote to order from...we were simply emailed an invoice to be used to order). Note all conversations/engagements with the retailer were conducted via email/telephone/their website. We then sent the money via bank transfer to place the order (a total of around £1,800, of which the 2 lamps came to roughly £850)...and had to wait a few weeks whilst the lamps were shipped from the Manufacturers in Italy to the UK retailer...and then shipped on to ourselves. Upon receipt, we didn't like the quality of a couple of the lamps...and contacted the Online shop asking to return the items on the same day they were received. We were advised we had no right to a return, as the lamps had been made especially for us...and it was noted on the first quote we received that they could not be returned once ordered (which I then checked, and it was a small clause at the bottom of the original quote). From speaking to Citizens Advice, they confirmed that as the lamps were not bespoke in any way, that we hadn't provided specifications to which the lamps had to be made...and had essentially bought a product that could simply be ordered by any other customer...that the retailer had to comply with the 14 day returns period. So we started an MCOL Claim against the retailer from that point...and also returned the lamps via Parcelforce (which the retailer confirmed they had received). We are now at the stage were the retailer has launched a defence against our claim, but they have yet to return the DQ form and have had a General Sanctions Order raised against them a week ago (we can enforce judgement in 1 week now if they don't respond). Hopefully all of the above is clear...my question is, have we been correctly advised by Citizens Advice that the 14 days return period is our legal right, or has the retailer covered themselves by adding the 'no returns on this product' note on their original quotation? I have a feeling the retailer is dragging it out as long as possible, and will file the DQ form right before the 2 weeks are up, which will mean a visit to court...so I want to make sure we do have the law on our side before that point!

-

Hi guys would like some advice please and will try to make this post as short as possible. 1. In may this year the EPS light came on my Kia cee'd 09 plate. Took it to the Kia garage and was told the steering rack needed replacing which they did at a cost of £800. 2. On Monday the EPS light came back on again and on Tuesday I took it back to the Kia garage. Wednesday I got a phone call to say the steering column now needed replacing at a cost of £1800 plus vat. I told them to not do anything and I would collect the car. 3. When I got there I asked if the problem in may was actually fixed and was told that the steering column and steering rack are totally unrelated issues and it was a different problem. I asked for a copy of the fault codes and was told they are not allowed to give it out. As a compromise after much arguing I was allowed to take a picture. 4. I contacted them later that day asking for a copy of the diagnostic report and fault codes from the repair in may and was told they would get back to me on Thursday. Nothing on Thursday so today I asked the Kia customer services to contact the dealer to get the report. Was told they don't keep them and if they did it would be archived and the person is not in. I feel the original fault was not fixed in may and now they are trying to fleece me again. What is the best course of action to take regarding this?

-

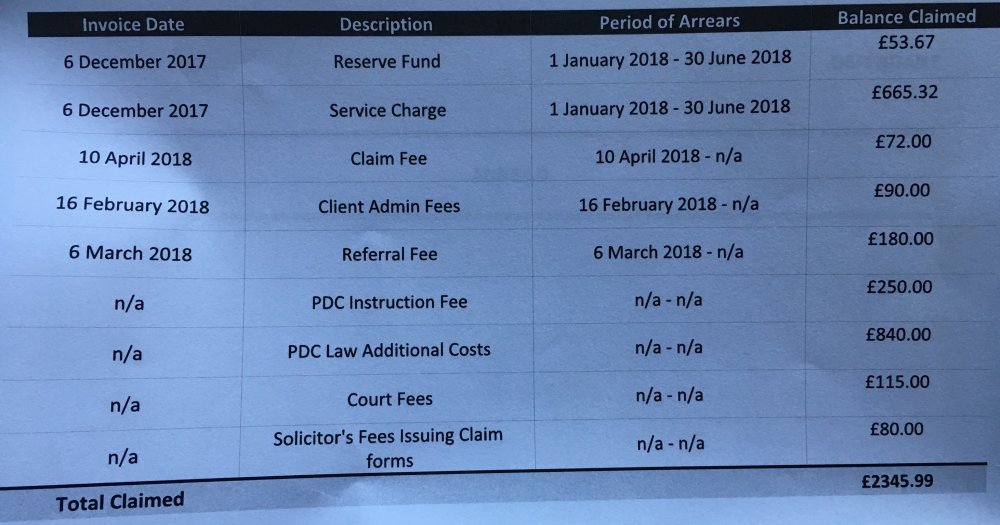

Hi to everyone, this is my first post here but I have been reading this forum for years and up till now have got most of what I needed by reading but this time I could do with a bit of help. Hi and sorry if this is in the wrong thread, I tried to look where to place it but this seemed the closest I could find. I own a freehold flat that was originally leasehold but I purchased the freehold several years ago. I pay a service charge to Warwick estates every 6 months A few years back I moved to live with my partner but still kept the flat and because of this I ended up forgetting to pay the service charge of £665.32 + reserve fund of £53.67. I was issued with a £90 admins fee and £72 claim fee. This I also missed because I was absent from the property. It was then sent to PDC and they slapped on an additional £180 referral fee. eThis I also missed as it escalated quite quickly and they put on another £250 instruction fee. At this point I did some reading on CAG and decided to pay Warwick estates directly via bank transfer which is my normal means of paying them. And paid everything apart from the £250 PDC instruction fee as I have no issue with paying my service charge and understand that by not doing so in time had incurred costs. This was in April 2018. I heard nothing and thought it done with until today I received a court claim of £2345 for the full amount including what I had already paid. This now includes an extra £840 PDC law additional costs £115 court fees and £80 solicitors fees issuing claim forms. I intend to challenge it and say I didn’t receive the last letter they sent me regarding the £250 PDC instruction fee and that I paid everything else to that date. But I am getting worried now. I hate these debt companies with their massively inflated costs and am seeking help with how I should proceed and whether I will be able to defend myself. Regards Leo

-

Hi guys just wondering if I can get some help. I have issue a claim against amazon and their solicitors have emailed me stating the following: However I am sure I sent them what should be counted as a separate detailed particulars. First I sent amazon my money claim online form in pdf format within the post along with a separate detailed particulars detailing why I have raised the claim against them by first class post stating the following: Would this count as a separate detailed particulars as I sent this to the solicitors who are dealing on behalf on amazon via email as they sent out a letter well before 14 days since the claim was issued and I responded immediately via email with the details they wanted me to send. On the MCOL form I just briefly said I ordered some goods from amazon, were not as described, also claiming for gift certificate balance and a Iphone that was not delivered, nothing like the above that I sent to amazon via post with my pdf MCOL form along with what I've quoted I sent them above - Would this count as a separate detailed particulars as they sent me an email today asking for this stating I should of done within 14 days.. Thanks for everyone's help in advance.

-

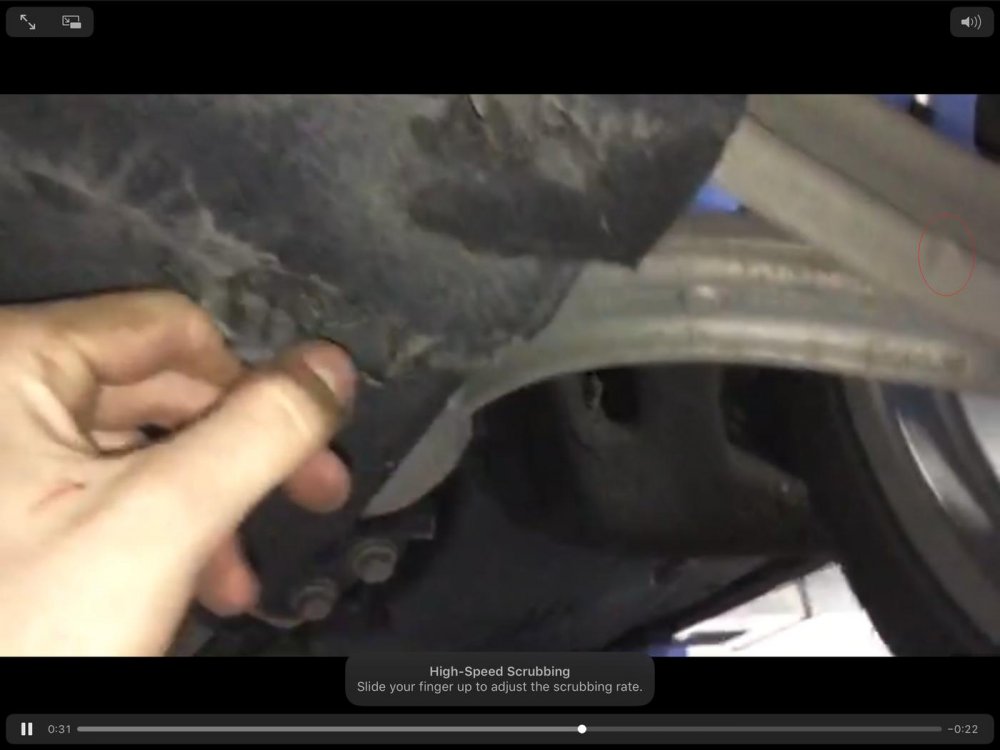

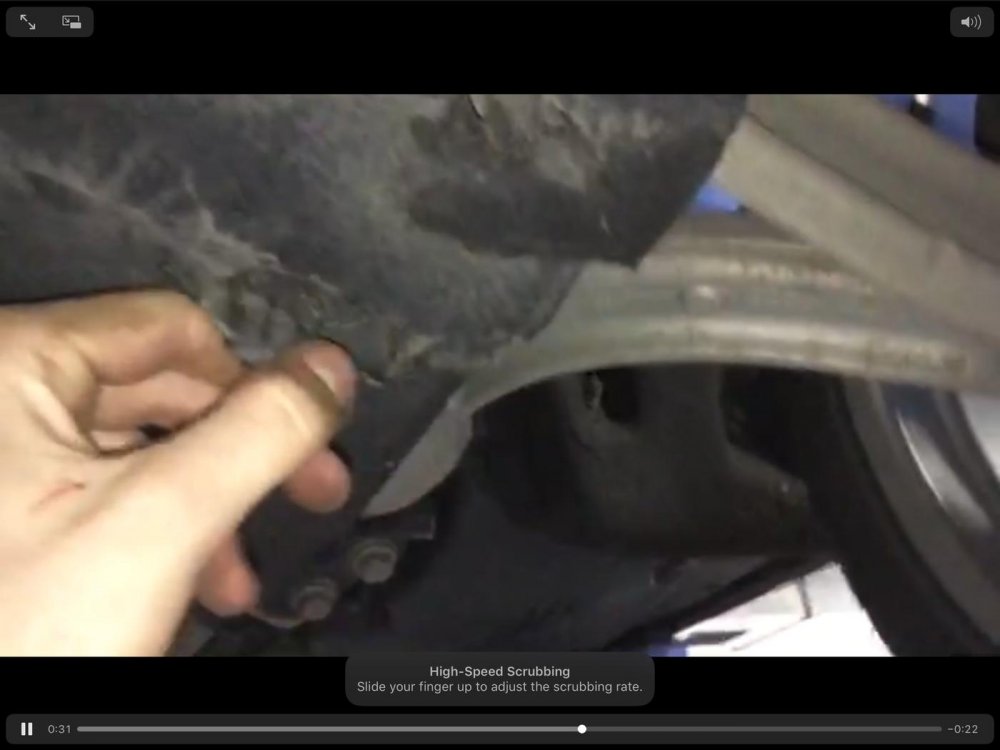

Hi, new user here but long time browser. I am after some advice on a situation I am currently involved in... On 30/04/2018, I was driving home with my wife and 22 month child in my 2016 Audi A4 which has done 19,500 on the clock. Whilst driving, I lose control as if I had burst my tyre and upon regaining control and parking, I inspect the car to find the front passenger wishbone snapped off. The car was towed back to Audi in Coventry to be inspected and I was informed that I must have hit something as there was under tray damage as well as to the gear box liner. The issue is that on 18/04/2018 I took the car to Listers Audi Solihull for its service and health check. Audi actually record any issues in a video called Audi Cam which they provide to customers. Within said footage, you can actually see the thumbnail sized dent in the wishbone where the fracture and eventual crack occurred. I have provided images of the video still that shows the dent; the technicians hand is mere inches away from the dent yet he failed to inform me resulting in the car being driven for under two weeks for it to eventually fail. I have also attached the image of the wishbone snapped. My view is that the technician should have informed me of the dent as the wishbone is a vital part that undergoes stresses and any damage especially one that was visible would affect the performance of the wishbone causing it to eventually fail. The Listers Audi service manager stated in regards to the this "We carry out a vehicle inspection on all cars that we work on in the workshop, this inspection is part of our duty of care to our customers, and is an industry approved process. I have reviewed the inspection and Technicians report on your vehicle and I find that everything was done correctly. With specific regard to the suspension arm I can see that the indentation gives no suggestion that fatigue has taken place in the arm, therefore there is no reason the Technician, who has no knowledge of the vehicle history would suggest the arm be replaced. We could clearly see damage to the undertray and arch liner, but that is it. we were not aware that the vehicle has sustained a significant impact to the underside/suspension, and there was no mention of this on the Job Instruction from you. " I would have had no idea of any damage to the underside of the car as most do not have the equipment to lift the car spot high to inspect and I would argue that's why the car is taken in for a service in the first place. I contacted Audi UK for them to mediate however Listers would not budge to repair the car, therefore am looking to take this to small claims court. An independent assessor from The Institute of Automotive Engineer Assessors (IAEA) has also looked at the damage and confirmed the dent is the origin cause of the part to snap. His view is that it would be 50-50 for the court to award my claim which would be for my insurance excess of £650, The impact on my policy increasing due to the claim, expert fees and court fee to be awarded. I would be representing myself and the assessor would also attend. Do you guys think its worth pursuing through small claims court and any views of my chance on success would be most welcome. Thanks Yans

-

I cannot believe how useless FOS is: Investigator ruled against me because I must have accepted an online question that I wanted PPI: he sent me screenshots of questions re PPI but not my screenshots since i never seen them before. my gdpr did not contain them, my cca regulated agreement contained nothing about ppi… he says fos is not interested in cca agreement or what is in gdpr … cca is a matter for fca.. not fos disgraceful appalling service... i feel a need to complain about this investigator i have sent an email complaining about the fos guy essentially he has assumed that i saw an online form and replied i did want ppi… but he has not offered any evidence that i was offered or even accepted or declined

-

For anyone facing court action regarding this car park, be advised that Excel parking is deemed to be the Creditor .. the legal entity entitled to enforce parking charges and legal action. Excel have a contract with the landowner. Any legal action launched by VCS is not relevant in law as they have no contract with landowner and are not the Creditor. They are a separate legal entity. If you are facing court action from VCS use this as your defence.

-

Good evening CAG, I am new to this site but I must say that I have heard how fantastic you are at helping, so, I am hoping you could point me in the right direction. I have received a claim form from Northampton which has been issued by Cabot Financial. Now they say that I owe money to Moneyway (a loan) and give an account number but, it has been issued to me in my maiden name which I have not used since 2007. Now, I dont ever remember taking a loan with a company called Moneyway so I am pretty amazed at this, let alone using a name I havent been known by for a number of years. they say that the debt was assigned to them, so I am guessing they brought this supposed debt cheap, but I think they must have picked me off an old voters list or something as I have never done business with a Company called Moneyway. Now I dont really know much about rights as a consumer or anything but I thought that debts became statute barred after a certain time. I need to do something but I dont know what and I dont know how much time I have to do it before a judgement is registered against me for something I have not had. Could someone please point me in the right direction. I would be so grateful. Thank you LTB

-

Hello, Old user, new issue : Where do i post HMRC issues please? Its regrading old tax penalties from 200-2002 reclaimed against last 2 years accounts as a self employed person resulting in loss of approx 5k

-

Hi I posted a few months ago about chasing old PPI and this particular one is very long winded dating back over two years. Its particularly interesting because they admit PPI on a business overdraft but wont pay it back and more importantly they continued to take money from a totally unrelated separate personal joint account for two years without my permission(though they have paid me that back) Scores of letters but I have uploaded the relevant ones here for your help. I discovered PPI on a business account and asked them to repay me to which they refused saying I had signed for the product Letter tennis ensued for over two years whilst they sorted out other PPI but consistently refused to be drawn on this particular matter. docs .pdf

-

Hi, new here, apologies if i have post in the wrong place. i need legal assistance to write up a claim against a high street bank. Never in my life have i met a company like it. Deny, delay, deceive and shift liability at all costs seems to be the tactics at play. Brief back ground. 2007 i re mortgage to a tracker mortgage 2009 i start getting letters stating my two year tracker mortgage is coming to an end alarmed at this news, i called bank to notify them of my own change in circumstances i was now on ESA DLA etc due to illness, and, to challenge the idea that i was on a two year tracker mortgage not a life time tracker which i asked for! a phone call to the bank informing them (call A) was had and i was not offered any help, no product change no offers nothing, all they would do upon request is put me on interest only holiday payments. i was seriously ill at the time and could not fight them there and then. around 2011 i decide to raise a complaint, a financial advisor for the mortgage broker insisted that the bank should have made me an offer or an affordable product as soon as i informed them i was ill and on the sick. the bank did no such thing and never has to this day! i requested to see the original signed documents to ascertain whether or not i did in fact sign for a two year tracker or if the bank was changing my terms and conditions because my payments on the tracker were very low due to the low interest rate.. the upshot was an ombudsman complaint, about the bank not showing me the original signed contract/agreement. the bank sent a copy of a direct debit agreement and an insurance agreement to prove i was in a contract with them, and the ombudsmen accepted that as evidence of contract. no where in contract law does that stand as a contract, its not even a confessionary judgement, just some circumstantial nonsense. i was naive to the ombudsman process(still am) and allowed the adjudicator to convince me she was the ombudsman and i thought that was it done. i moved onto try and get a copy of (call A) again, i asked for the call in writing, by phone, the citizens advice asked for it, the ombudsman asked for it, the bank refused access to the phone call, concealing the evidence that i had indeed informed them of my ill health. their complaint handler based his whole refusal of my complaint around computer notes and refused to listen to the phone call. demoralised and defeated, i made one last attempt to rectify the situation by calling the bank, got a great woman Spent 4 hours that day trying to get to the bottom of the problem in 2013. S she called me back in the afternoon, and said, you were right! the complaint manager had now listened to the calli i had informed them of my illness that i should never have been on interest only payments that they had set me up for payments of £235 per month That payment was to always remain the same. T Brilliant, i though, finally got to an agreeable solution. she also said the letters i was receiving informing me that my payments were going to go up was a banking error... two weeks later, the letters started to arrive on the door step again. i called the bank they refused to stand by their previous offer/arrangement and proceeded to set me up to fail in order to gain a false legal basis to repossess. i2014 the bank filed for possession , i filed a notice at first and gained an order for my complaints against the bank to be investigated at the next hearing! i filed a 67 page bundle two days before the hearing and the bank ran away, adjourned with an opportunity to restore but had to do so within 1 year or else they would be struck out! 2015, they relisted the hearing, i filed more paperwork they adjourned again for another year, 2016 i requested an adjournment myself, which pushed it into April 2017, when finally the bank failed to relist their claim and consequently were STRUCK OUT!. the bank have since added 6-7k worth of legal costs to my account, despite protest of course, they are now currently ramping up their threats whilst in all this time they have never made me one affordable offer! ive been bullied, threatened, lied to, deceived, misrepresented and set up to fail! the Judge said in 2014 that he agreed with my counter claim, the basis of which was unfair treatment and relationship had developed. Now i want to file a legal claim against the bank but feel i need someone with the legal head to help me write the claim and comprehend the procedures. at very least to bounce ideas off... whom in here want a crack at a major high street bank? one of the worst organisations i have ever dealt with, they will say and do anything to avoid liability, they even lied on their witness statement by claiming the arrears had not been capitalised only last week admitting that the arrears HAS been capitalised!.. im at my own wits end and need some support and help.. any forthcoming will be appreciated..

- 2 replies

-

- against

- assistance

-

(and 1 more)

Tagged with:

-

Hi all, Santander have made an offer based only on the PPI amount and associated interest and no interest because... 'On a rolling line of credit account 8% out of pocket interest is only applied if the loan would have had a credit balance had the PPI not been included. ... This is in line with the requirements of the FOS and FCA' I believe this to be complete nonsense: I take a restitution approach with unjust enrichment. Had I had the PPI amount then I could have invested it and gained at least 8% interest. Has anyone challenged this and been succesful? Do you agree with me? How do you challenge their full and final offer? A letter first stating the argument I assume then ... FOS seem to be under pressure and likely take a while??? or... direct to county court? I have exactly the same argument presented to me for no interest offered on my Credit Card PPI.... Any advice would be helpful... thanks

-

I filed a formal complaint with H and T yesterday, I was approved for a loan despite having 22 defaults on my credit file, all for high cost borrowing... I remember applying for the loan and an agent calling me back telling me to change my outgoings as they were too much. Claim filed yesterday.........received this reply today, Hello, Thank you for your email. I am unfortunately only able to find Pledge loans in your name. Regards and that was it basically

-

Firstly i will say hello and thank you for any help i obtain here the basics of what i had are a ppi policy for a car loan with welcome finance from march 1999 i have a copy of the loan agreement i have tried to claim against welcome but have been told to pursue the underwriter i have contacted the underwriter ( a bit confusing Lloyds say they weren't the underwriter but admitted the would pay out the policy if it had been claimed against and said jubilee group were the underwriter which have replied on behalf of lloyds i have had much correspondence from Lloyds mostly contradictory and i getting nowhere they told me to claim against welcome i asked the question why are Aviva paying out on policies as underwriters in the exact same circumstance yet Lloyds are not the response was they cannot comment on what another companies position is. im at the point of not really knowing how to go on any help would be appreciated thanks Kenny

-

Hi, I had an account with Natwest, which was shut down about 6 years ago. At the time, I had my Overdraft of £1800 (all owed), a loan for £1000 (£897 remaining), and one for £5000 (£3976 remaining). Due to my financial issues due to illness, I'd had to live off what little credit I had, and after a few months of being unable to keep above the maximum 1800 Overdraft (frequently going to £2000 when bills hit) my account was closed Following this, I was taken to court and something (I forget the technical term now, sorry) was put on my house so that when sold, my outstanding debt to Natwest would be paid out of any monies I received. We have since sold the house to a housing agency (again, lost it due to ill health and financial issues) and NAtwest received nothing because the mortgage was not fully paid off. Following this, Natwest sent debt collectors. MY wife was had by Shoosmiths (for similar level of debt) I think mine were Cabot financial (They currently take £2 a month from me, but I'm sure they said it was passed on however I've received no new paperwork) the debt is now with a debt collector. This morning I got a letter from RBS, regarding my Natwest loan, to tell me that I'm due over £800 in refunds Which will be paid into my account if it is still active, otherwise I will receive a cheque. MY account was closed, I do still get statements every 6 months about what is still outstanding. Will my refund get paid to these account, despite being closed, or will I get it? As if I receive it, I'm quite happy with my current £2/month arrangement and don't wish to just send them nearly a grand, when I've got other bills that are slightly behind now (council tax, water, TV, gas) that I would like to clear off, and I could do that with the payout, and still have a little bit over to help at christmas. As I paid these bills at a time when I owed them nothing, and I was not given a real option of not paying (I was flat out told I had to have it or I'd be refused). To me, they took money they should not have had. it should definitely all be paid back to me, for me to do with as I please. I realise they won't see it that way though, but just wondered if anyone else in a similar situation has had this happen, and received the cheque? As they only send me updates every 6 months, I wont find out now until March, as I got my update 3 weeks ago. :\ So I'm hoping someone here can help me a little sooner.

- 33 replies

-

- against

- autmatically

-

(and 11 more)

Tagged with:

-

HELP!!!!!! Please ....... My 16yr old son went through a bus lane back in November 2017 on his motorcycle, the first we knew about it was when we received an notice of enforcement totalling £175 through the post from Marston’s on 29th March 2018 but the letter was giving us until 25th March to get in touch for a payment arrangement. We rang them and explained that this had been received after the date to come to an arrangement and this is the first time we had known about the fine. They were most unhelpful saying that the full amount needed to be paid to stop further action. I asked for evidence of the offence and they did not have this and suggested I speak to SWindon Bpurough Council. This we did and also they were inhelpful saying this was now passed to marstons who were dealing with it now. We explained that had we received the PCN’s we would have paid the priginal fee of £30. They had no photographic evidence as there files were now closed on this and everything was with marstons. We filed an out of time order with the TEC had no response and now we have a removal notice today for £408. My son is on full time education does not work as he helps me at weekends as I e just been diagnosed with cancer. He has no way of paying this and marstons will not accept an arrangement they only want full payment. I’m happy to pay weekly to stop this action if only they’d listen. My son no longer has the motorcycle as he sold it to use for tools for his college. Can someone please help or advise. I know the usual keep doors and windows locked but I need a solution to the problem.

-

Hello, I wonder if anyone may be able to help me please. I bought a flight in Dec 16 from Citi Flights, flying from London to Thailand. I flew out on the outbound flight but the airline cancelled my flight home. They left me stranded in Thailand with no other option but to purchase a new ticket home. I have been battling with them ever since and they have said that Citi Flights had no authorisation to sell me the ticket in the first place and it was a fraudulent transaction. Citi Flights have said that the issue is with Turkish Airlines and not them and if they weren't allowed to sell me the ticket how could I have travelled on the outbound flight. I spoke to the CAB consumer helpline and I have issued a claim online for breach of contract and damages under common law against both parties (as I have no idea who is telling the truth). However I have just received a letter to say that Turkish Airlines intend to defend the claim. Does anyone have any knowledge or experience to offer me please? Lauren

-

I am writing this on behalf of someone else. Where i use the words me i or us means the person involved. Not me. I was employed as a mobile with a well known security company. My main job was to respond to alarms and deal with them. When i started my job off i was told that i was on a gauranteed 24 hour contract (weekly). I was not given any paperwork apart from some paperwork to show how and what i should be doing. I was told be my manager that i would recieve my contract in the post during the next 4-6 weeks. I also emailed my manager and he confirmed that i had indeed signed upto a 24 hr gauranteed contract that gauranteed me work of at least 24 hours a week. This manager left and work was going on well until october when my vetting was complete and i was sent a 0 hours contract by Human resources. I immediately phoned up and was told to query this with my manager. 2 emails were sent and nothing happened. Again in january this year my manager changed and i raised this again with hr. The new manager said he would investigate this. He came back to me and told me that the email i had was worthless and that i was on a 0 hours contract. Worst bit my days have been cut where i was without any income for 6 weeks. Since august last year i have put in several uniform requests and have had 0 back as manager keeps on claiming he has lost paperwork. This is despite sending 2 emails to him. I now come to the part After having nearly 6 weeks without work i started back a few weeks ago. The first night back i was pulled by traffic police and asked why i was watching a video playing while driving. The mobile is on a stand. I told the officer i was not watching i was only listening to the music and mobile was facing other way. Officer gave me words of advice and then took my details and after a few minutes told me i could go. No probs so far. He then phoned my employers and told them he was concerned for my safety. I only found out when a fellow officer came looking for me. As far as i was concerned the matter was finished. I did not log it either. Fellow officer told me that a call had been recieved and that the matter had been escalated to the manager. No probs here. The manager phoned me the follwoing day and told me i was suspended pending a investigation and that suspension would be unpaid. I have been to the investigation meeting and i was shown a picture of me sitting in my van with the mibile facing me. I was told this was taken by the other officer and he was allowed to do this. I have now been told that a decision will be taken and if needed a disciplinary will be held. I have been told not to contact any of my fellow workers. What do i do ?

-

If anyone could help I’d appreciate it, We went to Birmingham to collect a friend and driving down to the 30 minute free wait the car started to jerk and pull the engine management light came on. Which forced us to pull over as was not safe to continue. We clocked their sign saying no stopping to collect or drop off. We never did we in fact stopped for two minutes maximum. Enough time to switch the engine off an start it again. The engine management light stayed on but the car seemed a slight rough but wasnt pulling or jerking. We drove up an down for a while then entered the premium set down to collect as they had to wait around for us. We kept the ticket also took a picture clearly showing the enginee on with engine management light on and also a photo of their sign post. As we had not done any of what they said we couldn’t. A week later we received a parking charge notice to pay 50 within 14 days or 100 after. I myself appealed to APCOA never heard anything I got a demanded letter to say the 14 days had now gone and I needed to pay. I challenged them on the phone and was informed I had lost my appeal. But never got a letter I said to the man it was an emergency he said I’d have to appeal to POPLA I did an today I’ve lost. This was a genuine emergency an we literally stopped for 2 mins. To switch off an back on. Will we have to pay can anyone help???

-

Hi everyone out there. I am seeking a quick bit of advice; and will try to make this as short as possible. On 2/7/2017 I got a Parking charge in the form of a letter (relevant),from Parking Control Management (PCM). The claim was that I had not paid a PCN they'd issued and they want £100. Two initial issues: (1) I did not receive any prior notice - eg stuck to the car. (2) This was likely due to the fact that I had never been anywhere near the place they claimed I was wrongly parked. I googled the place and discovered that it is a block of flats some 5 miles away managed by the same people who manage my block (L&Q). And both blocks have PCM in attendance - so tat might be a possible cause of the mix-up. Maybe I could have obtained clarification if I'd phoned PCM - but the advice I've gleaned over the years from consumer websites is NEVER engage with these people. So I didn't. Over the following months I got the usual piles of letters from debt collectots and then Gladstones solicitors - all totally ignored. HOWEVER a couple of days ago I got a claim form from the Northampton County Court. PCM are now claiming I owe them £335.76 (not inc court and legal costs) I'm hoping to get my defence back to Northampton by 22nd March - Please is there anyone out there who would know how best to handle this. Obviously my defence is that 'I didn't do it' - BUT do I just enter this on the form and hope for the best? Should I/could I get a Statutory Declaration? Because ultimately it's going to come down to who the Court believes - Am I being naïve to think a Stat Dec looks more believable? I would welcome any advice or comments a.s.a.p. Thank you Sandra

- 37 replies

-

- against

- county court

-

(and 1 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.