Showing results for tags 'judgement'.

-

Today I checked my credit file for the sheer hell of it. Personally I'm not bothered what it says as I don't borrow money. Made those mistakes years ago and now my file is at zero. However what I did find was a CCJ for £280 issued last October. Whoever the claimant was didn't write to me at my current address despite being on the electoral register and not at my previous one. They sneakily wrote to the old address so as to win by default. I have a very good idea who this, but it doesn't show on my credit file, just a claim number. I am guessing here but I think it may be a debt collector who has been harassing me for years over this alleged debt It was to Orange for a mobile contract which I had never has. ( I was the victim of ID fraud and they did other things too ). Despite many, many letters asking them for proof like the Deed of Assignment, Deed of Novation and a contract that proves I am the debtor and responsible, they have ignored me. To then sue me using an old address when they only wrote again only yesterday to my current one, I find this extremely bad practice that flies in the face of all the guidelines on debt collections. This is just spite of their behalf, nothing more. Today I wrote to that Mickey Mouse court called Northampton business centre where no judge ever sets foot and asked for the judgement to be set aside as I have not been notified and I have been denied my right to defend myself. Also I issued a counterclaim for a considerable sum as set down by a judge in a similar situation where PC World sued a man over a computer and filed an inaccurate and untruth report on his credit file. Now what will happen? Will my set aside be successful as it really is a bit cheeky to sue somebody deliberately using an old address so that you win by default. This smacks of a certain debt collector who we are all familiar with on this forum.

- 11 replies

-

- county court

- judgement

-

(and 2 more)

Tagged with:

-

Good evening and thank you for this amazing forum It is a case for 5k where i am not sure whether to try and point out something or not in the hearing for setting aside judgement I am the claimant. the defendant replied their defence to an incorrect email address and therefore i was awarded default judgment as the court did not recieve their defence in time. the defendant sent an email to one of the ccbaq email addresses which was not the correct email address for filing a defence. in the atutomatic reply it said not to duplicate the email as it wastes court time, so they did not send through their defence through any other avenues. now the other side wish to set aside judgment. there is a hearing soon to set aside judgment their defence is totally wrong as they have gotten totally muddled up. in the past I had had a seperate issue with the defendant which was resolved and their current defence basically says that i had resolved the current case and therefore cannot claim again. so the defendant has muddled up the two cases as it is clear as it is a seperate case which was resolved. my question / dilema is should i try (option 1) stop the defendant setting default judgment aside and show why the defence is totally flawed. if i win the hearing to set aside judgement on the grounds that the defendant has no prospect for success in their defence, then that would be great... but i will probably loose as they have got quite a good excuse that they sent the defence to a mistaken email address. they will claim that there was a valid reason in missing the deadline for submitting a defence. in this scenario where they will win the hearing for setting aside judgement, they will fix their defence for the proper hearing later on. as they will realise that in their defence they had muddled up the two issues. or my second option (option 2) should i allow them to set aside judgement without disclosing why their defence makes no sense and save it for the final hearing where i will prove that their defence is flawed. but i may be accused of obstruction of justice by not pointing out that the defendant has made a simple mistake of muddling up the two issues. I am very grateful in advance for replies kind regards

-

A company has been contacting me on and off for the past year claiming that I owe them money, to which I repeatedly informed them that I disagree. I heard nothing of it for several months, but today received an email from the company stating that they have a CCJ against me. I have not received a court letter nor a letter informing me of the county court judgement. At the start of September, I moved house, and informed the company of my new address. At the end of October and the start of December, my landlord informed me on both occasions that two letters had been attempted to be delivered (signature required), but my landlord was not in on either occasion and so they went back to the post office and presumably were returned to the sender. Although I thought nothing of it at the time, I now suspect these letters may have been from the court. It appears to me that the company (despite being informed of my new address) deliberately issued a claim against my old address so that they could win the judgement by default, when I inevitably did not respond to the claim I knew nothing about. I have been trying to get details of the claim all afternoon (reference number, etc), so that I can sort this out. I have tried phoning and emailing the company for the reference number, but they have not responded. I have also tried to contact the court, but they cannot confirm whether there is a CCJ against me without me providing a reference number (which I do not have). The last option would be to pay to complete a search on the online registry, which apparently should provide a reference number. I am quite concerned, not so much about the possibility of paying this money, but more about the effect that this judgement will have on my ability to obtain credit and pass pre-employment checks in the financial services industry. I would appreciate any advice on how I should proceed.

- 7 replies

-

- county court

- judgement

-

(and 1 more)

Tagged with:

-

This relates to a case against my daughter by a builder. She put in a defence and counterclaim. The builders claim against her was not valid and he did not abide by the Civli Procedure rules when initiating the claim. He did not respond to her counterclaim. The judge ordered a allocations hearing. My daughter was unable to attend and the reasons were accepted by the judge. She has received a General Form of Judgement Order and it states: The Particulars of Claim are struck out for non compliance. The judge further ordered that the Claimant must by a certain date file a new claim correctly other wise the claim will remain struck out. He further ordered that the defence and counter claim are stuck out unless the claimant submits a new claim and then she must submit a defence, and if advised my daughter should submit a new counter claim . The claimant has not submitted a new claim. Upon ringing the court, I was told that the claimant has not submitted a new claim and therefore the claim is definitely struck out, however I was told that she can and should submit a new counterclaim as she paid for the counterclaim and although it was submitted at the same time as the defence, it is in effect a separate claim against the claimant. She is not sure if this is correct? She is out of pocket considerably because of this builders negligence. It cost her a lot more to put right the work. If this is correct and she submits a new counterclaim, does this mean that the claimant can answer the counterclaim and start once again claiming against her? Not sure what to do, as time is running out. Thanks if anyone can clarify and help.

-

Good morning everyone, I have been asked by my ex-wife to help her after she got a letter threatening her with bailiffs, She got herself into debt with EE and of course because she was dealing with depression she started to "bury her head in the sand" The consequence is that The lovely Leeds Losers (aka Lowell) have got involved, I only became aware of this situation after she got a letter from the county court, saying that they were about to get the bailiffs after her. My question is, why have they only chosen to partially enforce the judgement, this is something I have never heard of before? because of her depression etc she is not sure she received a letter of assignment etc, would it be worth having a go at getting the judgement set aside(however I have paid the amount they enforced, just to stop her having to deal with bailiffs) Many thanks in advance

-

Hi CSA, I received a letter from drysdens solicitors dated 29 Nov 2018 stating the a County Court Judgement was being entered against me on behalf of Erudio Student Loans. On the 30th of November i receive a letter from the county court staing that the CCJ was entered. Both of these were sent to an old address and I received them a day after the deadline to pay it off was set- 12th December. I didnt receive any prior communication from Drysdens. I took the loan out in 1993 wiyh SLC. I deferred some years ago, cant remember exaactly how many at this point. Please could you advise and help. Many Thanks.

- 7 replies

-

- county court

- erudio

-

(and 1 more)

Tagged with:

-

Hi everyone I use a courier company, i will call "TPC", who in turn use DPD. I have to say on the whole the past few years has been event free but a few months ago we sent a 3D printer to someone to use and it was smashed up really badly. The recipient took photos and has emailed us stating the damage was beyond dropping in his view and we have loads of photos of the box damaged etc. I reported the issue immediately and TPC were originally very sympathetic etc. I have to say I was shocked at the damage, you would have had to try really hard to do what they did. As the client needed to get printing urgently, I resent a new identical printer out, only this time this one had a glass build plate, so about 30x20, super tough, heat resistant glass plate that the plastic is printed onto. This was in fact a bespoke upgrade I did to this one but the plastic plate was also sent. This printer was also sent insured fully. This 2nd delivery went horribly wrong yet again, with a tonne of damage done. We sent both printers in the original boxes, designed for transporting them. They are thick boxes, with the original polystyrene inserts. Loads of space etc. we also used an outer box with more packaging to be safe. The packaging has never been challenged, in fact DPD stated that it was fine. long story short. I know DPD have accepted both claims (although irrelevant as the contract was with the 3rd party we use, TPC). I am still waiting for any decision, I have emailed multiple times and so we logged a small claims track. Unfortunately the printers are no longer made, so I have asked for the replacement cost of the latest available model for both printers. The defence is that they will not pay as there was glass in the box (even though only the 2nd item had glass in it) There is no consideration about the first delivery that had no glass in it at all. I have sent the court questionnaire off, have stated I am willing to mediate and I am waiting. No solicitors seem to be involved at this point, certainly no legal sounding stuff has come back from the defendant at this point. Just want some help and advice really. I have basically lost a part of my little business due to these printers being damaged beyond repair. Questions: 1. I have no doubt that I will get the compensation for the 1st Printer as there was no glass and it was clearly in breach of the Sale of goods and services act 1982, (reasonable care and skill clause). however What about where there is a piece of glass in an item? I have never actually claimed for this extra add on, I feel that if they had delivered properly in the first place I would not have had to send the 2nd printer out and also the glass did not cause the damage, it was just "also" damaged, but again I am not claiming for this. 2. I would normally claim for the cost of the item if damaged. However in the case of the model being superseded and no longer being available. Is it OK to claim a little more for the latest available model? I have averaged the price from 5 retailers and would genuinely be buying these to simply replace my lost printers. In my defence it is a real pain in terms of retraining and new software to learn a new machine. Any help would be appreciated on the best course of action and of course I will post everything up here so others can learn from my mistakes and hopefully successes!! I am about to go through mediation, but can't find much on the process here. Has anyone gone through this process as a claimant and is there any advice anyone can give. I have been told by the CAB that it's a chance to "negotiate" but Ii'm not sure if negotiation is what I want to do, i'd really like the defendant to try and see the light. Also can the defendant deny wanting to use mediation? Any help appreciated.

-

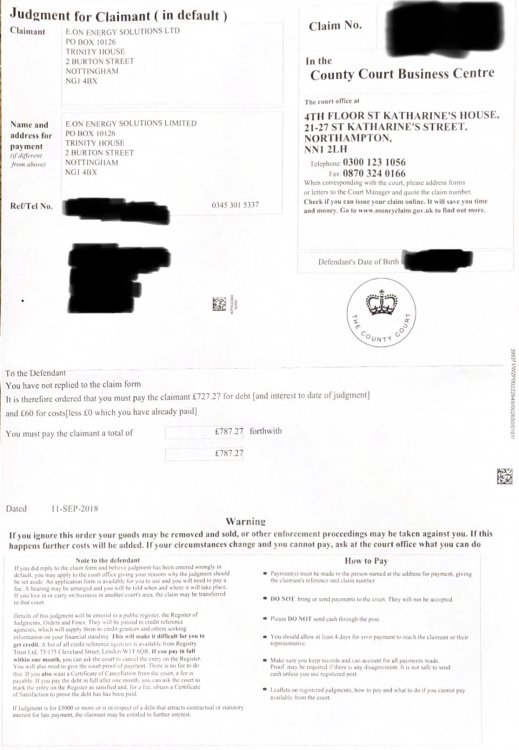

Hi everyone My brother has received a letter today from the county court business centre that was headed Judgement for Claimant (in default) It says you have not replied to the claim form (never received anything from the claimantt E-On) It is therefore ordered that you must pay the claimant £727.27 for debt and interest to date of judgement and £60 for costs. My brother has never received any court papers or even letters threatening court. But now he’s had this in the post. I’ll upload a scan of it but I’m not sure how to respond to the court document. Any help would be greatly appreciated Thanks Andrew

-

My first time, so hope I am posting this in the right place? I've got a judgement set-aside against (hey!) Hoist Portfolio regarding an old Barclaycard debt (last payment made August 2011). Judgement was yesterday afternoon (6/11/2017) and now I have to launch a defence regarding BC mishandling of my original offer to settle in first quarter 2012. they ignored all communication from my solicitor and sold the 'debt' on to MKDP without telling us anything about it. Being that BC owed my nearly £8k in PPI at the time, (this was pointed out by my solicitor) and they went on to sell the whole thing on as a bundle, I said in court yesterday that I felt they had mis-sold the debt to the DCA. Once the PPI was deducted it brought balance down to just over £5k - is that how it works? I'm not sure. Has anyone got as far as this, and what is your experience? The Judge told me to get in touch with the CAB. If I keep using my local solicitor I'm going to be out of pocket very quickly, even though she's been the most useful person so far! By the way, Hoist Portfolio were asking for over £20k when my research suggests they probably only paid £120 for buy the debt off Robinson Way/MKDP/Barclaycard. Your thoughts and experience welcome - are CAB the right people to deal with this? Fanx!

-

Hey folks, I took a small business to court because I believe there's strong evidence that their work damaged my car. At the initial hearing the court hadn't issued the letter telling us we needed to exchange evidence, so we were dismissed with a date to exchange evidence by (within a month) and told to return another day on a date set by a letter that would be sent out. That hearing cost me nothing because I was in a two week holiday. I receive a letter with the new hearing date on after a few weeks. Some time goes by and that month deadline for evidence arrives. I receive an email from their solicitor (I'm acting for myself) to request a one week extension, which I grant. A week later, on the deadline, I receive an email copy of the evidence. Hearing date arrives and they're a no-show at court. Neither them nor their solicitor arrive. I'm taken into the room half hour late, during which I offer to call the other party to ask where they are - the judge tells me it's their own responsibility to be there. He decides not to take oral evidence but makes judgement based on both written statements. I win. Almost a month goes by when the letter arrives that I've won and how much I'm owed. Two days later I get an email from their solicitor - they never got the letter with the court date on it. They want me to set aside judgement, presumably so we can go to court again. Now, I have several issues with this. Firstly, I'm self employed so my business lost a full day of income at that second hearing. A third hearing will cost me another full day. I can't claim anything for it as there's no evidence I lose personally - my business does. Secondly, there was a week shy of three months gap between that first and second hearing. Surely any solicitor would enquire after a month of the first hearing when the second one is going to be? Why would you wait three whole months when the second hearing is obviously going to have taken place? I don't mind that they want to face me in court. I mind they didn't turn up in the first place. Another day in court means my business income loss would equate to 39% of my claim, which I feel is getting a bit excessive. So before I say no or yes - what should I do?

-

Hi Just received a claim from Howard Cohen this morning. Just wanted to check what I need to do. 1st - Acknowledge claim. Can this be done online? 2nd - Send CPR18 to Howard Cohen, as belows [template removed - dx] 3. Wait for reply.

-

I am writing this on behalf of someone else. Where i use the words me i or us means the person involved. Not me. I was employed as a mobile with a well known security company. My main job was to respond to alarms and deal with them. When i started my job off i was told that i was on a gauranteed 24 hour contract (weekly). I was not given any paperwork apart from some paperwork to show how and what i should be doing. I was told be my manager that i would recieve my contract in the post during the next 4-6 weeks. I also emailed my manager and he confirmed that i had indeed signed upto a 24 hr gauranteed contract that gauranteed me work of at least 24 hours a week. This manager left and work was going on well until october when my vetting was complete and i was sent a 0 hours contract by Human resources. I immediately phoned up and was told to query this with my manager. 2 emails were sent and nothing happened. Again in january this year my manager changed and i raised this again with hr. The new manager said he would investigate this. He came back to me and told me that the email i had was worthless and that i was on a 0 hours contract. Worst bit my days have been cut where i was without any income for 6 weeks. Since august last year i have put in several uniform requests and have had 0 back as manager keeps on claiming he has lost paperwork. This is despite sending 2 emails to him. I now come to the part After having nearly 6 weeks without work i started back a few weeks ago. The first night back i was pulled by traffic police and asked why i was watching a video playing while driving. The mobile is on a stand. I told the officer i was not watching i was only listening to the music and mobile was facing other way. Officer gave me words of advice and then took my details and after a few minutes told me i could go. No probs so far. He then phoned my employers and told them he was concerned for my safety. I only found out when a fellow officer came looking for me. As far as i was concerned the matter was finished. I did not log it either. Fellow officer told me that a call had been recieved and that the matter had been escalated to the manager. No probs here. The manager phoned me the follwoing day and told me i was suspended pending a investigation and that suspension would be unpaid. I have been to the investigation meeting and i was shown a picture of me sitting in my van with the mibile facing me. I was told this was taken by the other officer and he was allowed to do this. I have now been told that a decision will be taken and if needed a disciplinary will be held. I have been told not to contact any of my fellow workers. What do i do ?

-

Hi All, Looking for a some advice regarding the following situation, i've bullet pointed to make it easier to read: I recieved a claim form from County Court Business Centre, Northampton with an issue date 6th April 2018 and claimant was Shoosmiths LLP, amount being £657.02 Claims form stated day of service is taken as 5 days after issue date which would be 11th April and giving 14 days from then to respond (25th April). I agreed to debt and completed form N9A (admission form) and returned to Shoosmiths (as the County Court Form advised) with my offer of payment. I sent this form to them on 21st April first class and obtained proof of posting. On Saturday i recieved a Judgement for Claimant form dated 26th April. I contacted Shoosmiths who said they did not recieve my N9A form until 26th April and as such judgement was correct (it appears they are willing to accept offer of payment though). Spoke with Court and nice lady there did agree that she was surprised they are saying they did not recieve form until 26th April as it was sent first class but there was little to be done other that dispute judgement. This will cost £250 with no G'tee of success. So questions: Is it worth disputing for £250 and if i win can i claim that £250 back? Should i just role with judgement, contact Shoosmiths with offers of payment and then once paid get a certificate of satisfaction from court after that date? Look forward to thoughts on this.

- 7 replies

-

- challenge

- county court

-

(and 1 more)

Tagged with:

-

Hi, I have recently been to the small claims court to claim £200 from an individual who owed for services I supplied. The defendant failed to attend and after a hearing, I was given judgment with costs. After 14 days no payment has been received so I went to instruct the county court bailiffs but was told this costs £150. Now I thought this seems a lot especially if they are unsuccessful. I decided to call on the defendant and suggest he pay me to avoid adding bailiffs cost to his bill. His was not interested and said bailiffs or not he would not be paying. What if any are my options. Thanks in advance.

-

Hi Does anyone know the cost for summary judgement application. It's over 10k. The fee quoted says the amount if up to 5k. But I can't see one for the amount I will be claiming. Can anyone advise? If not I will ring the court and ask.

-

Hi There, I was hoping somebody might be able to help me out. I moved in 2016, moved again in 2017. Thought I had brought all of my debts with me but I guess I didn't. This will have been from a long time ago, Wageday advance payday loan and I must have assumed it was paid off as hadn't heard anything from them in a while I have just had a letter arrive via the postman from Moriarty Law It says; We have been instructed by our above named client to write to you with relation to the Judgement they have obtained against you. (I wasn't aware of this but have checked my credit report and have a CCJ registered against me as of August last year) The letter talks about getting a Warrant of control without further reference to myself unless I make an initial payment and an acceptable offer Should I upload the letter? I will pay it I just cannot afford it all in one go and I'm worried they will go ahead with the Warrant of Control I have severe anxiety and I'm not good on the phone I go to pieces so I really really do not want to ring them, sorry for sounding so pathetic, I have just had some terrible experiences on the phone to DCA's

-

Hi, first post here, please forgive me for it might be a long one - I've summarised at the end if you want to skip to the questions. I recently won a small claims case against a car dealer a few weeks back, however, I feel that they have no intention of paying and I have a number of questions. The judge gave a deadline for payment of next week but no paperwork has been received yet. I tried calling the courts today but it was late in the day and nobody answered, I'll try again tomorrow, hopefully they're not shut due to the weather. With that in mind, if the payment deadline day comes and goes, I'll ask for the judgement to be enforced. The problem here is that the dealer could say that they have not received the paperwork (despite being given the deadline on the hearing day) and ask for it to be set aside. I understand that time is of the essence in legal matters so I'm unsure whether I should wait for the paper work to come through? Then I'll ensure I forward it on to the various addresses I have as this'll give me evidence that the dealer has received it. Or should I apply for the judgement to be enforced regardless and get the HCEO on the case? I ask this because I know they have no intention of paying and I foresee that they plan to mess me around and I want to try to stay ahead of the game. Even then the above timing issue is resolved I think I'll have to get a HCEO on the case but I have a feeling the dealer has been through this process before so will undoubtedly make it such that there is nothing for them to take. So, my next question is regarding the best possible route to getting my money back. I'm aware that there are a number of possible options: 1)HCEO (Shall be the first port of call) 2)Freeze bank assets (unclear on this one as I see them swindling out of this by changing accounts, using joint accounts etc) 3)Order for information (I think he'll lie, and the same goes for attachment of earnings) 4)Charging order - this is the one I quite like the sound of, however, I'm unclear about what happens when this is applied in the case of a car that has to go back to the dealer. Should the person not sell their house for the next X years, what happens to the car? Will it just need to sit around? I can't imagine there is any other option and this is what I'd like advice on please. To summarise: 1) Should I wait for the court paperwork to come through before enforcing the judgement? 2) Is a charging order on property suitable when there is a two way transaction required - if the property isn't sold the car will have to sit around. Many thanks.

-

Hello! I went to court with my neighbour over a land dispute. I had to withdraw from the trial because I am deaf and the audio loop wasn't working, but the Judge refused to adjourn... This is probably a whole other area, however, the neighbour was awarded costs of £23k and has now placed an Interim Charging Order on our jointly mortgaged house. My husband is not the debtor. I want to know if I can argue that the Award is unfair, not just because of what happened in court, but also because it includes a 100% success fee, which I feel they are not entitled to because I did not receive the Part 36 Offer which the neighbour's lawyers said they sent to me prior to trial. They are unable to prove I received it as they only sent by first class post. The hearing to decide whether the Charging Order is to be made final is in August, and I wonder if anyone can advise what I should do if I wish to object to the award for costs. My husband will object to the Charging Order. What argument should he provide, please? There is little equity in the property, as there is a lot of work which needs doing, including subsidence. The Judge was biased and failed to adjourn when it was discovered that the Audio Loop necessary for me to participate in the Trial, was not working. He instructed the room to shout and speak slowly for my benefit. None did as they were all the opponents witnesses. All of what they said under cross examination was of no consequence. I entered into litigation after much studying, and was confident of success. What went wrong? I am now being taken to court by my opponent for his costs.. £23k.. He is trying for a Charging Order, too.

-

Does lending money to a friend create a legal contract..

- 1,080 replies

-

- collection

- debtor

-

(and 4 more)

Tagged with:

-

Could anybody help by suggesting what reasons a bank as defendant could apply for Strike out and or summary judgement for a court claim issued by a depositor as follows. Claimant opens a fixed term savings account online and deposits by debit card. The bank adds interest and after the term ends, the claimant writes a letter of instruction as the T&Cs require asking for the money back by cheque as the bank can pay by cheque, FPS etc. This is refused, claiming fraud, signatures does not match (bond was opened online so didn't get a signature at the time) etc. What excuses do you think could the bank use to get the claim stopped before allocation to small claims track?

-

I signed a franchise aggreement (unfortunately) and I would like to know if the : personal guarantee`s that was included is legal, if it was not witnessed, at the time of signing, and their is no provision for a witnesses signature, is there a set format for this, and could it be deemed invalid and/or, not binding? when is a deed not a deed? Your advice would be welcome. Thanks!

- 75 replies

-

- application

- aside

- (and 21 more)

-

Recent High Court PIP Judgement Affecting those with Psychological Distress High Court. RF v Secretary of State for Work and Pensions: http://www.bailii.org/ew/cases/EWHC/Admin/2017/3375.html The High Court Judge: - quashed the new regulations because they discriminate against those with disabilities in breach of Human Rights Act 1998 obligations. - declared that the Secretary of State did not have lawful power to make the regulations (i.e. they were ‘ultra vires’) and should have consulted before making them. Yes the Government is going to appeal this Judgement at the Court of Appeal so we will have to wait and see the outcome of that Appeal.

- 2 replies

-

- affecting

- county court

-

(and 6 more)

Tagged with:

-

Hello, hope you can help?? My friend has been laid off work sick for 3 months had a series of problems and traumas leading up to that time which has resulted in being in debt. He has doctors notes and ambulance reports to confirm this. it got to a point where he was not opening his mail. He is now in a position to sort out the debts and pay them off in full. All of them can be sorted except for one which is an 'Egg' credit card that took him to court two days ago (without his knowledge) & he received has now got a County Court Judgement. Is there any way he can prevent that getting on his record if he pays the full amount immediately? thank you.

- 30 replies

-

- ccj

- county court

-

(and 1 more)

Tagged with:

-

posted on behalf of a friend after checking her credit file because she was turned down for credit. it showed she had a CCJ. and has applied to for courts for it to be set aside on the basis she knows nothing about it today she has received a letter off cabots solicitors confirming it was for a mobile phone and papers were sent to previous address. it states that the is no prospect of setting this aside and invites her to withdraw her action whats the next step https://www.photobox.co.uk/my/photo/full?photo_id=10030744201[/img]

- 9 replies

-

- application

- aside

-

(and 3 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.