Showing results for tags 'costs'.

-

Hi everyone Hopefully I am in the right place but couldn't find a section to suit this .... I am really annoyed. My Hive heating set up is broken. After 3 or 4 calls to Hive including 2 resets of the system etc etc (an hour on the phone each time), they have conluded over the phone that my hardware is broken. Now for a start, no engineer has seen it to confirm something is broken - I don't think it is, I think it is on the blink due to an update they did of the system over Christmas. There is no signal between all three components at the same time. Initially the Hub was offline and would not go online and the thermostat lost signal with the receiver. I called Hive and after about 50 mins on the phone and much fiddling, she concluded that my Hub was broken and quoted me £40 for a new one. Fair nuff I thought but was reluctant to buy anew one so I didn't. 2 days later it all went wrong again and the thermostat/room controller would not connect to the receiver so no heating or hot water at all. On the phone to Hive they guided me through another reset of the system and she concluded that the Thermostat/controller was not working - odd eh? Oh and no I can't buy a new thermostat as they are factory paired so the whole kit for £250 plus installation (hard wiring) = £400. Great, not. After yet more fiddling (by now I know how to do almost as much as the call centre staff) and hey presto the thermostat now talks to the receiver but not the Hub. This means that I have only the temperature and ON/OFF functions but no schedule or timer. It is now costing me a fortune as it is all on either 24/7 or nothing. My question/issue is this: How long are they meant to last? I would say that 4.5 years for a cost of £250 is not long enough considering this came with my new boiler installation (from British Gas) and thats guaranteed for 10 yrs minimum. Should I or anyone be expecting to buy new controller for the heating every 5 years at £400? I see their guarantee is for 1 year only. They obviously don't really know why my system has failed and are grasping at straws, should they be telling consumers to shell out again for a new system when the fault is not actually properly diagnosed? How could I prove it has been caused by their update recently where many people I see online have complained about their system going down and losing signal afterwards. Of course Hive deny it's anything to do with them. I think all this needs exploring. If they are selling this product, people need to know that it will all be useless in 5 years and that maybe the system is designed to fail after a period of time. You cannot repair or replace parts of it, you can only get a whole new set up. Also I want to say that for the elderly, young children, ill people, I would definately not trust this system to deliver consistent heating/ hot water reliably, I have woken up with no heating or hot water in the freezing cold because it has dropped signal in the night, even before these recent problems. What are my rights here? These systems are starting to fail (the early ones) and for £400 initial cost, I never expected that after the 1 year warranty was up, I'd be on my own with non-working junk and a cold or boiling hot house 24/7 expecting to shell out again. I feel like I've been had. Help!

-

Hi Needing some advice and guidance, will keep this to the point and hopefully someone can help, It was a 40th treat for myself which makes it even worse for me. Viewed a vehicle on 04/11/18, at a Lookers dealer in Carlisle, 70+ miles from our home address, Paid full screen price, £12,500, paid £8000 on debit card and £4500 on finance, asked for a few cosmetic repair's to carried out as well as serviced, mot'd and fully valeted. Got train back to dealer on 17/11/18 with wife and kids to collect vehicle, only thing was it hadn't been cleaned at all well apart from that happy with vehicle and service received. Drove home, on returning home (82miles covered) not even 3 hours into ownership the vehicle has smoking badly from under the vehicle, the transfer box on the transmission had been leaking all over the exhaust and underside of vehicle causing the burning smell and smoke when arriving home. So at this time on a Saturday night the dealership was closed so emailed the salesman. The workshop manager contacted us Monday to arrange vehicle collection as they wanted the option to repair the vehicle at the purchasing dealership (which turned into a joke), the vehicle was collected on a trailer (20/11/18) and took back to Carlisle. The oil leak was rectified and the vehicle returned to my place of work on 23/11/18. I took delivery of the vehicle as the leak seemed to be rectified, when I left for work I tested the 4wd system which displayed a fault, contacted the general manager as it had been passed to him to deal with and verbally agreed he knew the 4wd was working prior to repair as he drove the vehicle when it was traded in, as I also knew it was working as I tested it before purchase. He contacted me to let me know he had booked it into the Lookers Ford dealer nearer to my home, great, dropped it Monday 26/11/18 to be inspected Tuesday, this didn't happen, the inspection took place on Wednesday, they condemned the transfer box, the General manager from Carlisle contacted me to state a new one would be fitted and he had authorised the repairs. Collect the vehicle 03/12/18 far dirtier than when I dropped it off and to discover a second-hand unit had been fitted not new, which has now shown a fault 1 day after the replacement transfer box. I'm at the end of my tether. Now this is where my problem starts...…. and for my post needing help!! (sorry for the long post) I don't think for one second they will challenge my rejection as he has already made this a evident to me over the phone. We have been more than reasonable and in turn they have been fine with us. But.. Its a 63 reg vehicle and only had 44K miles recorded and had a very high spec. if I'm just to simply take my money back and finance cancelled there is not another vehicle on the market to replace this one for the same value, some are £2000 plus more, I may be being stupid but I don't see why I should now be without a vehicle because of Lookers incompetence or having to be another £2k plus deeper into a vehicle. Not including all the cost to collect the vehicle etc. Is there any advice on how to progress with this? I want the vehicle that was described to me at initial purchase, however I have lost all faith in the one I have. Are they obliged to find me one either from group stock or from an alternative source? and if they are and it is at a higher price - do I have any rights with them to ask them to price match for the one I bought? I don't see why I should be out of pocket and back to square one, after viewing a few vehicles before purchasing this one. Thanks

-

Hi, In Sept 2017 I enrolled on a course at University, at the induction day I signed an agreement for the course costs £2170 payable in 3 parts. I signed a Direct Debit form, and over the coming months all the money was taken from my bank successfully. Job done in my opinion. 8 weeks ago, I received a threatening letter, not far off a screaming banchee coming in the room and demanding £320. "You agreed to accept responsibility for your course fee's and if you don't pay immediately we will pass this to an external debt collection agency" I had no idea what this was about. I called them, and they didn't either, so I was told that something was wrong but they were not sure what, and would look into it. 4 weeks later, Another letter arrived, even more angry than before with more threats. I have, demanded an explanation of why I being asked for £320.00 I feel this is not an unreasonable thing to ask. They say, I was charged the wrong amount, and the correct amount is on the website, it's in the terms and conditions that they are allowed to charge for any mistakes they make, so pay up. "The 2017/18 Tuition Fee Regulations state ‘1.10 The University reserves the right to correct administrative errors identified during invoicing and take action to recover any shortfall in fees in accordance with the published tuition fee listing for the appropriate academic session.’ Our Regulations are published externally in advance of the application cycle" I think I have to pay them, even though its not the amount I agreed to pay, I just think their approach is awful, what if this was a more vulnerable person (as some students can be), they were very iron fist in their approach. Can I legally demand an invoice from them in advance of the £320 payment, as I have asked for them to issue an invoice and they say its only a correction. thanks

-

Hi All, Thanks in advance for any help ! We received a claim from from our builder because we have withheld payment of the final instalment as he as breached his contract with us. He sent a claim form asking for the money to be paid (approx 1667.00). We are now trying to work out the counterclaim and having serious difficulties in understanding what to do. Any help appreciated. problem outlined here. (ignoring court fees and interest at the moment) Final installment withheld by us is 1667.00 BUT this value is incorrect as he is trying to charge us for more expensive tiles than those he installed without our permission. He is claiming that money is owed on his claim form. What we have already paid him is £3865. What we paid Wickes for more tiles directly is £248 The new invoice from another builder who said that the entire bathroom will need re-fitting £6635 (this includes a tile allowance that are slightly higher than our original builders tile costs ). Should we be basing our claim on the difference between what we thought the original builder would have been owed if the job had been done well, subtracted from the higher cost of the new invoice. Then adding the amount we already paid him. OR should we be just saying pay us £6635. (despite the fact we have withheld the final invoice but we are not sure of the value of that final bill and he has breach contract so technically we dont owe him it anyway !) HELP !

-

Hi, Hope someone can help. Our daughter recently died.We have had the funeral but the matter of costs is worrying. She has no estate as such and only has around £800 in her account . She received an ESA payment of around £250 2 days after death and one weeks housing benefit of around £80. My main question is her funeral has cost around £2600 + , we paid the cremation fees and cost for a celebrant up front which was around £1000. There is a £1600 bill to be paid to the funeral directors which is due on the 10th April. My brother in law who used to be a bank manager is dealing with her money etc... on a sort of imformal basis as the estate/money is so small. Can my brother in law direct all the money in her account towards funeral costs or will the DWP or council demand repayment of any overpayments? My brother in law says they can chase after him for overpayments as we are aware the payments came into her account before we had a chance to freeze her account. My wife and i are on low income but don`t qualify for a funeral grant(as far as aware) as we are only on working tax credits (without child element) and a basic state pension (without pension credit). Any help or advice appreciated. We are preapred to pay the remainder of the £1600 due but need clarity on how much we can use from her account.

-

The following is an extract of the news report published in the Guardian: https://www.theguardian.com/media/2018/feb/22/couple-filmed-evicted-channel-5-tv-show-win-damages-high-court

-

This is a long story, so I'll try and cut to the chase. Back in 2013 we moved into a property. The landlady who we were renting off asked if she could continue to be registered at the address. She agreed that she would cover all the council tax bills for the property. Two years later we received a letter from the council to "the occupiers" asking us when we moved into the property. We truthfully told them the date. Two months later, we received a massive bill from the council for two years worth of council tax, backdated to the date we moved in. We got in touch with the landlady who admitted she had not paid the council tax. We were now stuck with a £2300 debt when in fact it wasn't our debt. To add to our problem, the landlady admitted she had been illegally claiming benefits from the property whilst we were living there and she could not admit that she was due to pay the council tax as that would lay her wide open to prosecution. We contacted the council and explained the situation, but they wouldn't discuss it. As far as they ( capita ) were concerned, we were liable and they had passed the debt onto Ross and Roberts for collection. We rang Ross and Roberts, who were in fairness understanding, and they agreed a repayment plan which we stuck to like glue. In December 2015 I contacted them to make a payment and they gave us a figure which they said was the amount needed to clear off the debt. I then paid that amount and was told by the lady on the phone that the debt was now paid and we owed nothing more. They would cease any action against us. We didn't think any more about it We got a letter from the council saying we were in arrears with our council tax and they were taking us to court. I went into the offices to talk to them they told me that there was still £470 owing from the previous liability order and that they'd used my council tax payments for that year to clear this off. I explained everything about Ross and Roberts, how they said we'd paid it all off, but the woman insisted that they hadn't collected the full amount and had left £470 uncollected. That was why they were using 2016s council tax payments to clear off those arrears first. After much arguing, they agreed to cease the court action and use the money we had paid for the current years council tax. As for the £470 owing they would simply add it onto the bill and we could repay that on top of the current years council tax over the year. Owing to financial problems we fell into arrears with the council tax, and because as they put it "you have a bad history of paying" they just sent the matter to the courts and we were given another LO. When we contacted Ross and Roberts to sort out payments, they told us that there was still a LO for £470 owing which they were treating seperately, and had added £310 costs onto that bill. Not only that, they added £310 onto the amount for that current year as well. Had Ross and Roberts not told us that we had paid off the full bill, back in 2015, then we would have carried on making all the payments as planned and we wouldn't have been hit with a huge amount of fees, not only for the £470 that they incorrectly didn't collect, but also because that then had a knock on effect for the current year, and owing to us owing the grand sum of £110 for the current year, they whammed us with £310 charges for that. So if you can understand it, we ended up paying £620 in bailliff fees for two liability orders. One for £110 which I accept we owed, and £470 which Ross and Roberts had themselves told us we didn't owe it was their mistake when they didn't collect it as they should have done back when we were willingly making payments to clear off a debt that wasn't even ours in the first place as the landlady should have paid it.

-

This is a useful High Court judgment and one that should serve as a reminder to anyone considering litigation, that an error by an enforcement agent is not automatically trespass and most importantly, that any claims for loss/damages etc must be proved to arise directly from the agents misconduct -which very often will be difficult to prove. There is also the matter of the need to provide evidence to support any claims (something that was seriously lacking in this case). Background to claim: On 12th March 2015, a writ of control was issued against Mr Miller for £408,00. This related to a judgment from March 2010 for £330,000. I am assuming that the difference between both figures relates to interest on the debt. The Creditor passed the writ of control to a High Court enforcement company to enforce. Of significance, was that the address on the writ was ‘Sunnyview’. In 2014, Mr Miller had moved from that address to a rented property (called Yew Tree). On 26th March 2015, the enforcement agent visited an airfield*where Mr Miller had a business.The purpose of the visit had been to locate two small aircrafts (a Pitts and a De Havilland Chipmunk owned by Miller). The enforcement agent met with Mr Miller and took control of the vehicle that he had been driving (a Jeep), and one of the aircraft (the Pitt). The claimant made payment of £1,600 towards the judgment.Goods were not removed that day. Following the meeting, Mr Miller claimed that the enforcement agent went around the airfield ‘questioning everyone’before gaining peaceful entry into an airfield building where he looked for documents. He left, taking documents and keys to the aircrafts. The Enforcement Agent then went to an alternative address (xxxxx Mills) to make enquiries. Mr Miller had told the enforcement agent that this location was connected to his business. There he was allowed access to the property to search for the second plane; (the De Havilland Chipmunk). The plane was there, together with other aeronautical parts belonging to Mr Miller. A short while later, Mr Miller removed the plane to a friend’s barn in Cirencester. The following day, (27th March 2015) Mr Miller visited the High Court and made an application for a temporary 'stay’ of the writ. The stay was lifted 2 months later (on 27th May 2015) and re-imposed on 5th June 2015 (it was finally lifted on 24th July 2015 after he failed in an application to ‘set aside’ the judgment). Mr Miller's arrest and charge of ‘interfering with controlled goods. Despite a ‘stay’ being imposed, and despite his Jeep and one of the aircrafts being ‘taken into control’, Mr Miller removed the aircraft and aeronautical parts to various locations including his rented property (‘Yew Tree’). *He parked the PITTS on his driveway under a tarpaulin. The enforcement agent became aware that the seized items had been moved and accordingly, on 20th June 2015, he attended ‘Yew Tree’ . Nothing was removed on that day. Instead, the police were called and Mr Miller was arrested and charged with ‘inferring with controlled goods’. The court stay was finally lifted on 24th July 2015 and the following day, the enforcement agent removed goods. Further items were removed a couple of days later. According to Mr Miller, he had a number of hearings for the criminal charge, the final one being in January 2016 at Swindon Magistrates Court where he claimed that he had been acquitted. No details appeared to have been provided for the acquittal (more on this shortly). He claimed that the Magistrates Court had supposedly been satisfied that he had moved from ‘Sunnyview’ to ‘Yew Tree’ in April 2014. It would appear that he had been assisted in court by an internet sourced ‘Mc Kenzie Friend’. Removal of goods and sale. The goods were eventually removed by the enforcement agent at the end of July 2015 and sold at public auction for £34,000. The auction was advertised. (Continued in following post):

-

Would someone please kindly point me in direction of some recent schedule of costs examples for circumstances like this? Thanks

- 21 replies

-

- compliance

- costs

-

(and 3 more)

Tagged with:

-

Hi guys 1st post My mother has an outstanding debt with bailiffs for Council Tax. She had an agreement with bailiffs to pay it off and defaulted after 2 payments as she could not afford it. Now they want the amount in full. They say they have requested for 'Commital to prison' which scared my mother until i explained it to her. They do not have a 'Controlled Goods Agreement' at all I have today disputed the amount as the bailiffs starting balance doesn't match what is owed to the Council. To be clear this is before any alleged fee's from the bailiffs themselves. It is just the 'starting balance'. I intend to pay it for her in a couple of weeks when I have the money together BUT I do NOT intend to pay the bailiffs fee's. Instead, what I intend to do is pay the Council in one payment via online payment what my mother owes them. Leaving the fee's with the bailiff's!! If I pay the Council, then the debt can't be passed back to the Council as the fee's would be theirs and theirs only. My intention then is, on Common Law grounds, is that I get my mother to say she doesn't consent to these charges from the bailiffs. Which is a total of £310. They are only claiming this money under the 'Control of Goods Act 2014'. Now, when the bailiff's are only left with their fee's and no actual debt - would she able to refuse consent? As an Act is only governed by consent. The other option is to just leave them with their fee's and ignore them. As it is a Civil matter - and without proof of claim - they can't actually do anything. I reach out to you guy's for answer's on this. Am I right to think I can get one over on the Bailiff's this way? They have very naughty attitudes when she calls them BUT seem very polite to me when I call! I would LOVE to get away with this

-

In a nutshell. I had a business in Glasgow but now live in Manchester. A summons was raised for liability against me in Glagow and I attended the hearing. I was v close to having it struck out there but a request was made for a position statement from me and then a reply from the council. Before adjournment I asked about my costs as the travel alone was close to 200 miles each way plus time to get there. I mentioned this is court and the advisor did mention "Ex Parti costs" if I won but to be fair, I didnt understand but it sounded like I could claim this back if won. The council have emailed me and muttered this that and the other but said " "the Council will oppose an application and case law does allow public bodies to pursue legal proceedings “without fear of exposure to undue financial prejudice if the decision is successfully challenged.” So they are saying they can drag me 400 miles twice and theres nothing I can do about it. I was going to instruct a solicitor because I struggled to speak at the hearing but now they are saying even if I win, I wont get my costs. Is this true? Also on the day, they issued 600 summons at cost of £60. £36,000 for 1 morning s attendance. Thanks

-

I recently fell behind with some rent payments, which I'm now paying back. My Landlord issued a claim for possession through the courts and the hearing date is in April, however, today I received a form 6a from the Landlord and I'm really confused! Does this go hand in hand with the Court hearing? It appears tactics have changed. How do I stand with a 6a as it states 'no fault possession. The Court claim says it's due to rent arrears. Please could anyone shed some light on it for me?

-

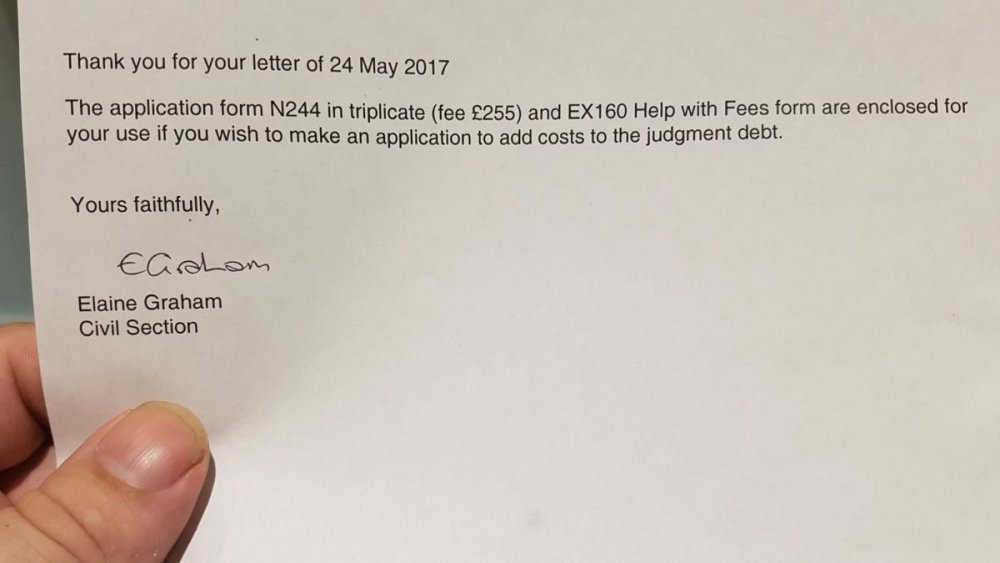

this has no connection to any other topic ive done before (and i say this because i know ive confused myself and messed things up previously) i have recently gained this letter and a copy of the fee application, however i havent been given the application they are referencing and was hoping somebody could tell me where this form is. i have emailed them but itll be about a month before i get a response.

-

I started an important thread earlier today concerning a recent court judgment where a debtor was ordered to pay £7,000 in costs after losing his claim against Harrow Council and their agent; Newlyn. The background and Judgment can be read by way of the following link: http://www.consumeractiongroup.co.uk/forum/showthread.php?477808-Paying-the-creditor-direct-to-avoid-paying-bailiff-fees-has-landed-a-debtor-with-a-%A37-000-cost-order.(32-Viewing)-nbsp To ensure that the original thread does not go 'off topic', discussions about the judgment can be posted here.

-

They used to be Blemain, now are 'Together'. I am always behind with my mortgage. I am on a very low self employed income and it is erratic. So always end up having to pay three or four months arrears when they threaten me with an eviction. They have an court order due to persistent late payments. My circumstances have changed since I lived at the house...my gf who is also on the Deeds split up. She pays the mortgage, I pay the second mortgage with Together which is about £500 a month. I can never do one of those things with income and outgoings because is so erratic and I dont even live there. But I pay it every few months when I can so she doesn't lose her home, and at some point maybe we can sell it. But, because of all the charges and extra interest etc the amount I owe after paying it for about 10 years is about £10k more than I borrowed! Yet am Paying £6k a year! Total amount is about £60k and its a high interest rate because that is all I could get at the time. So virtually everything I earn bar about £100 a week pays that. And as I only get money erratically and then £2-3k every three months or so on average, I can never get in front just keep paying off the arrears and my living and some debts. So I am very depressed about it and cant see a way forward, except that one day we may be able to sell it. But there is no equity in it atm, and I am losing £6k a year really while the market is stagnant and yet actually reducing nothing its gone up over £10k. Problems started when the banks called my business o/d and loan in as then I had no way of budgeting to cope with the erratic income. I am effectively homeless, and cant even get tax credits because of my circumstances, and living between a few sets of friends and a new girlfriend. She has a tiny flat so I cant store anything there, and cant stay at all when her son is there...no room to swing a cat. All my stuff is with friends in my 'rooms' there, and I have nowhere to sit and do my books which are a few years behind and no doubt I am being chased for that too on money I haven't earned but fines for late books. I am in a total mess and cant see what to do. What can I do? Are these charges even legal? I am told they are not? I want to sort this out first as it will be one thing off my mind if I can stop them doing that. Then I have to face the HMRC and explain why I haven't done my books for several years afterwards.

-

Can anyone help on this issue. About 3 years ago I put a cigarette out when unexpectedly being called into a shopping centre. I shouldn't have, and I got caught by council enforcer. At the time, I was going through a very difficult break up, and was homeless as a result effectively. I am self employed on a low income, and could not claim tax credits as the previous relationship I was in meant my name is still on the deeds effectively its my home to the tax credits people they said I was still living there, even though I wasn't. Hadn't for 7 years. I had spent my time travelling around , and staying with clients, friends, the new girlfriend I had, and my brother. My reasonable income and security was effectively taken when the Banks called my business loan and overdraft in when they got in trouble, as they did to a lot of self employed. Stupidly I remortgaged and that's a drag too. still have to pay it so my ex doesn't get evicted. And just surviving off the little I earned. Very difficult to do my books as its all a mess and I have nowhere I can do them properly atm despite being under the tax threshold I still have responsibility to do them but that is difficult in the circumstances. I had a big row with my brother 3 years ago as I was staying there. We don't speak. He just put return to sender on any of my mail that came there, which was mostly junk. But apparently he has discovered they have been chasing me for a fine as a bailiff company told him. He pointed out that it wasnt him and I haven't lived there and we don't speak. He is demanding to know where I am living so he can pass it on to me. I had completely forgotten about it and now its about £1500 as it went to court and everything. There is no way I can pay it, prove my very low income, or effective homelessness (I am staying with two lots of very kind friends free, and don't want the bailiffs knocking on their door). So what can I do? I am told I could even be arrested for it? This is terrifying me as I only have a subsistence living and cannot pay it and cant prove my income atm . I never received any notification of the court date three years ago and had forgotten all about it. They are looking for me but dont know where I am obviously and neither does my brother. I dont want to get him in trouble either, so can I approach the Court or what? If I had known re the court date obviously I would have paid when it was low.

-

I instructed a solicitor in a personal injury claim some time ago with myself and my son as claimants, my partner was a passenger in the car, but did not wish to make a claim. I have had favourable outcomes / settlements for both me and my son and I thought the matter was finished. Last week we discovered that a ccj has been registered against my partner for £4k+. On enquiry to the court it turns out that my solicitor included my partner in the original claim, completely unbeknown to her, and the judgement is for something called a default costs order, claimed by the original defendant. My solicitor has never had any contact with my partner, not one phone call, letter or email. He did however imply in a phone conversation I had with him earlier that he thinsk "we may have put her on the claim at the beginning", although he has to get the file out of storage to check exactly what has happenend. My questions are these. Is it possible for a solicitor to be instructed without ever having contact with the client? What is the best way to deal with the CCJ which theoretically could be enforced at any time? (It is now over 28 days old) Is there any way other than requsting it is set aside, which costs £275 and is by no means a certainty? Thanks for any help FF

-

Hi Not me but posting for a friend he received court papers for a business debt the debt was paid off on receiving the papers but they want the court costs i take it he has to pay these, he left this late now he has 1 day to acknowledge the debt via money claim online Thanks in advance

-

In May 2015, I started a thread on this forum regarding a debtor (Mr OR) who had followed advice from the internet and had issued an injunction against a local authority after his vehicle had been clamped by a bailiff. The debtor considered that his vehicle should have been exempt as it was subject to finance. Unfortunately, his injunction failed as the Judge ruled that there could be a ‘beneficial’ interest in the vehicle. Mr OR was ordered to pay the local authorities costs of £3,200. This was in addition to his own costs (the fee for the injunction alone was £395). A link to this popular thread is below. So far, it has received almost 13,000 views. http://www.consumeractiongroup.co.uk/forum/showthread.php?445251-Goods-on-HP-a-Judge-says-they-can-be-sold(1-Viewing )-nbsp In Sept 2015, I started a similar thread on here to warn members of the public that if they have a vehicle that is subject to finance, they need to ensure that they provide evidence that there is no ‘beneficial interest' in the vehicle. Even that thread has received almost 6,500 views !! http://www.consumeractiongroup.co.uk/forum/showthread.php?451273-Vehicles-on-HP-can-be-sold-by-a-bailiff.-Evidence-must-be-provided-that-there-is-no-beneficial-interest. Unfortunately, a couple of months ago, another debtor (Mr MH) also issued an injunction to prevent an enforcement company selling his vehicle (a mini cab). This vehicle was also subject to ‘hire purchase’. The difference with this case, was that the ‘value’ of the vehicle was approx £14,500, and the amount required to settle the obligation under the hire purchase contract was just £6,300 (leaving an ‘equitable interest’ of approx £8,200). The debtor lost his case in court on 16th August. He was also ordered to pay the local authorities legal costs of £3,400. He was refused permission to appeal. Neither the debtor or his legal representative have made an application to appeal and accordingly, given the importance of this subject, the enforcement company have given me permission to provide an outline of the case in the hope that it may help other debtors to avoid making the same mistake. PS: I will not be giving the name of the debtor, the local authority or the enforcement company. The facts of the case are all that is important.

-

Hi everyone, So my good friends at Capquest have been nipping at my backside again, this time using the wrong account number, creditor, agreement and more. You would have to see it to believe it. That aside it the final account they decided upon has been proved statute barred and they have discontinued. In the meantime in an attempt to defend the ever moving claim I've paid for duplicate bank statements, made a court application and taken advice from a solicitor. A report to the FOS and FCA are probably in order, but does anyone know if a claimant in a "small" claim they are protected from the costs of discontinuance. I read CPR 38.6.(1) to mean I can claim those costs. Thanks! uteb

- 7 replies

-

- costs

- discontinued

-

(and 1 more)

Tagged with:

-

For many years I've religiously renewed my breakdown coverage because it's very cheap - £15. During that period I think I've used them only once before, but recently I punctured five miles from home. Ordinarily I would put the spare on myself but, Sod's Law, only that morning had lent someone my repair kit and didn't have it back yet. Rather than walk home, I decided to use breakdown. When I rang, they told me they couldn't find my details and said I hadn't renewed, but I was adamant that I had. They agreed to send someone in good faith providing my details could be clarified (I was also given the impression that if there had been a problem with the renewal, it could be rectified). As it was, it took them four hours to get to me (had I known it would be that long, I'd have walked home!). This prompted them to, the following day, ring me and offer £50 compensation. Now I've received a threatening letter saying I didn't renew and they want paying for everything. I'm assuming they mean the £50 and the cost of the (third party) breakdown guy. They haven't put a figure on this but I dread to think what it is. Having now checked, I found that I haven't a renewal policy. Further investigation shows that I sent them a cheque (which I have proof off) but, again Sod's Law kicking in, the £15 cheque that was subsequently cashed on my bank statement, and that I therefore assumed was for the renewal, was actually a late cheque that I'd written three months earlier, cashed late. So what now? I know that I sent them the cheque, so feel like I'm being punished because they lost the cheque. I know that I won't be able to afford whatever figure they come out with, and most certainly wouldn't have willy nilly rang for a breakdown guy to come out had I not thought I had coverage. Thanks in advance.

-

http://news.sky.com/story/car-insurance-costs-rising-five-times-faster-than-train-fares-10740471

-

If you are issued a section 21 notice, and there is no hearing, there is no way to contest costs. The judge has discretion to award costs or not. I was issued a section 21 because I would not accept a rent increase. No other issues with the tenancy. Costs were awarded. Whether a section 21 is issued or not is completely at the landlords discretion. Then forcing a tenant who is otherwise not in breach of the tenancy to bear that cost seems to be a violation of the consumer contracts act, 2015. I want to take that to small claims. Do I have a case? As I understand it, small claims will be loath to overturn costs orders, but section 21 is an "administrative procedure". Perhaps the costs are "administrative" also, and not strictly awarded court costs?

- 4 replies

-

- costs

- possession

-

(and 1 more)

Tagged with:

-

This is going to be a very long drawn out case, unless someone can offer some element of hope for us. We completed renovations to a derelict property about 2 ½ years ago. Our porch needed a new roof which was done with a trocol membrane. In a storm back in January 2016 we returned from a trip to find a metal pole on the flat roof which had a covering of gravel. My immediate suspicion was that it was the remnants of an old tv aerial, but as it was only the pole, I have since found it to be referred to as the mast, not the aerial itself. This is important as it was referred to as an aerial when I rang to make the claim. Because of the gravel I did not notice the membrane had been punctured, but removed the pole and lifted down a bracket/clamp that was on the main roof. In the August of 2016 we noticed a dry rot problem, which had previously been identified and treated during the renovations, had come back with vengeance. I notified the company that treated our house and they began stripping the property apart under warranty to determine the source. It was then that we found the porch roof was compromised which had allowed damp to enter the property. I notified MoreThan/RSA that the pole was suspected and they sent out Building Validation Solutions. Their "inspector" was quick to dismiss the case, suggesting we would get nothing from the insurance company as dry rot was not covered. It was explained that we were not claiming for the rot but for the porch roof, hall, stairs and landing decoration and vestibule door due to the leak, and that everything else was being covered by the rot company. BVS suggested to decline the claim due to rot, but yet some three weeks later, agreed inadequate costs and issued a scope of works for a patch job with inferior materials than what was listed on his first report to insurers. After rejecting this, RSA sent out their own senior loss adjuster, from a fraud unit??? who took a statement and agreed that BVS had not conducted themselves correctly, and asked for estimates for the repairs. These were for different aspects of work, building, plastering, decorating plaster moulding etc and as they were emailed to him, he agreed them individually by email. Over a couple of months, he was aware we had begun the works as it was nearing Christmas and we had a lot of work to do to rebuild our home. 5th December he sent an email giving his account of what he had agreed "as he saw it" and was going to transfer funds. This was an inaccurate figure as he had forgotten to include some aspects of work he had previously agreed to, but after a quick couple of emails he accepted. At this time I had asked him to consider the exterior rendering of the front of the house to match the new render of the porch at our builders request. This went over what he was authorised to pay and he referred it to in house specialists due to escalating costs. We have been fighting ever since. It is worth noting that this loss assessor was happy that we were being fair and reasonable with regards to the claim, considering we were only looking for the porch hall stairs and landing even though the rest of the house was in a mess. At this time, they decided to send out a forensic investigator and she would be accompanied by the same BVS inspector that had been proven to be incompetent in the first place and we have subsequently found out lied on his report, suggesting he used pole cameras outside to assess the origin of the metal pole we found, when he most certainly did not. During the forensic visit we provided some drone images which show that the old pole that was present when we bought the property had been since been removed during renovations unknown to me, and that it could not have originated from the chimney stack after all. My reasonable and logical suspicion of a pole that I was able to prove was on the property before works began from old footage was clearly incorrect. I found out a week or so later after a few anxious nights of no sleep worrying about the implications, that the pole was in fact something my son had used to extend his reach while cleaning gutters out with a trowel, which he had inadvertently left of the large chimney stack while he was cleaning up. This was explained to the insurers, so the forensics wanted to interview my son, which was facilitated and he explained what had happened. The forensic report has recently been forwarded by the ombudsman after I lodged a complaint due to the time that has been involved and their treatment of us throughout. I have found a significant amount of inconsistencies, and the report is heavily based on guess work, estimates and opinion rather than facts. With the porch being completely rebuilt and no pole available to inspect, it is hard to understand how the forensic investigation could have been anything other than an opportunity for the insurers to wash their hands of the case based on conjecture, yet the ombudsman has declined to side with us and given much weight to the forensic report considering it was independent, and have rejected the claim. The costs of these works has been in excess of £30K which was all agreed as the quotes went through, and emails can confirm this. What I would like to know is if the RSA loss adjuster by agreeing these costs and knowing we had begun works has accepted the claim on behalf of the insurers. They are claiming that because I didn't accept the original offer of just over £20K, on the 5th December, even though the loss adjuster accepted in reply emails he had calculated the figure incorrectly, and omitted some of the previously agreed costs, they are not obliged to pay anything. They were entitled to investigate further and a flimsy forensic report with steering by BVS to clear his name was the reason. The title of the report from forensics is "Damage caused by Rot" for instance, which stinks of BVS influence, considering that is not what we were claiming for, and she has not once referred to the RSA loss Adjuster nor has he been involved since the 5th December as he was "sick" and now no longer works for the company. Any guidance would be most appreciated. We are in financial difficulties after heavily loading credit cards, borrowing from family and from our business which is struggling to pay suppliers now, on the strength of this agreed fund coming to pay them all back, and the lack of sleep worrying and what feel like panic attacks, knots in the stomach and sweating are wearing me down. Perhaps RSA policy is to break my spirt but hope I can get a shred of help to fight this one last time. 11 months almost....and counting. Many thanks if you have got this far reading and in anticipation of you helping with advice.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

3053548.thumb.jpg.6ea05a752ac6bbf38ae4e7be9676053a.jpg)