Showing results for tags 'claimant'.

-

Hi All I let out some rooms last year and had a tenant move out with out any notice and the tenant requested the deposit returned, this went to the Tenancy dispute service who had registered the deposit and they found in my favour and advised the tenant that this was legally binding as they had agreed to arbitration. The tenant went and filed a county court claim which i responded to straight away and within the given time, send by recorded delivery and heard nothing more, around six months later (this week) i received a letter advising judgment for the claimant as " no acknowledgement of service had been filed" with an advice that costs will be determined in due course . The case has no merit and they haven't acknowledged receipt of my defence and AOS , so is N244 the only way? Any help will be most appreciated.

-

My daughter has moved to Spain in March 2018. She has notified PIP of her new address, will this affect her entitlement at present as we are still in the EU until next March, as I understand it when the beginings of leaving the EU begins?

-

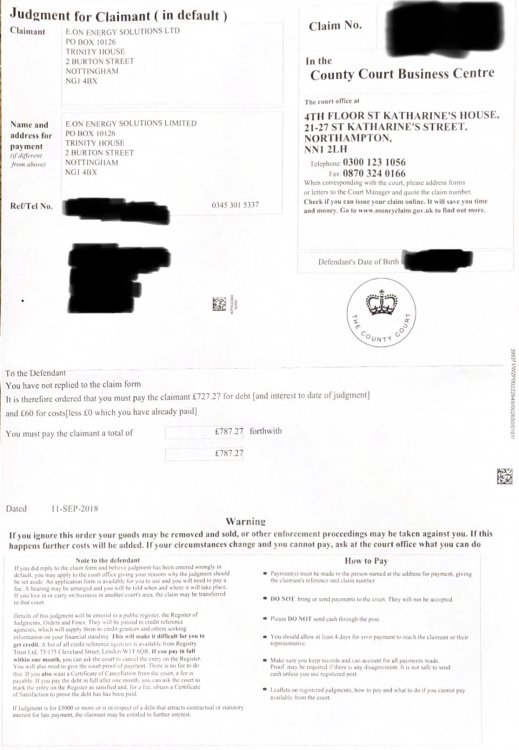

Hi everyone My brother has received a letter today from the county court business centre that was headed Judgement for Claimant (in default) It says you have not replied to the claim form (never received anything from the claimantt E-On) It is therefore ordered that you must pay the claimant £727.27 for debt and interest to date of judgement and £60 for costs. My brother has never received any court papers or even letters threatening court. But now he’s had this in the post. I’ll upload a scan of it but I’m not sure how to respond to the court document. Any help would be greatly appreciated Thanks Andrew

-

Hi, the answer I need is on the jsa claimant commitment of " most hours I can work each week". The reason is I have a long term disability, 2 years ago on my claim I had this on 24 hours. I started work and claimed working tax credits on 24 hours. but my employer was pushing my hours in a very demanding job for my disability up to 50 plus hours per week. I complained to head office and got no where so resigned from the position. I made a claim for jsa today and the "work coach" said that as I had done 50 hours then 40 hours full time would be on my claim for "hours I can work". I wondered if there was a set amount of hours like working tax credits if you are disabled that is accepted by them to put on the form. thank you.

-

I have just received claim form for a CC debt of about £4,400 from 2009 and they have claimed interest for 6 months + upto the date of judgement, but no mention of going forward. I don't mind paying them original amount in instalments but I am worried that if I accept the claim as it is then they may ask the judge for 8% interest until the debt clears, which may mean the payments I make will just pay off interest. Someone has told me that if I defend the case by asking them to prove the debt then they are likely to concentrate on proving the debt and not ask for interest going forward. But if I accept debt at the first stage then they are most likely to ask the judge to add 8% interest. Is this correct assumption? But I know that if I defend then I will be slapped about a £1,000 in further legal costs. What could be the best course of action in this case? Is there an argument against paying interest of 8%, which I may be able to use? I will be grateful for your comments.

-

hi all im new to all of this I have recieved a letter of judgement for claimant before this i recieved a letter that supposedly acknowledges a debt with studio but it doesnt have my signature on it and in less than a week i have had a judgement for claimant letter and i dont know what to do.

-

Hi Could someone please help as I'm very new to this. I've just received a letter dated 3rd July from what looks like it's from County Court Business Centre. It says the claimant is JC International Acquisition LLC and the name for payment is Moriarty Law. It says I haven't replied to the claim form and am ordered to pay £1655.2 or £50 a month? It doesn't show what I owe it for but from looking at other posts, looks like it may be Talk Talk. Any help or how to respond will be much appreciated. Thanks in advance!

- 14 replies

-

- acquisiton

- claimant

-

(and 5 more)

Tagged with:

-

Hello Everyone I hope that someone could help with the following legal situation: Someone took me to the County Court to have enforcement of an Employment Tribunal granted as the original ET decision was 11 years old. YES 11 Years Old! At the first hearing the DJ struck out the judgment and listed a date for the matter to be heard again (the claimant did not attend). At the second hearing, I was stuck in traffic and did not get to the court in time and judgment was awarded to the claimant in default. At the third hearing where we both attended, the DJ heard submissions from both parties and struck out the claimant's request to enforce the judgement as it was substantially out of time. The claimant has appealed that decision, again not within 21 days, but 55 days, and was refused on paper as being "totally without merit" and with no excuse for being ouside the 21 day time limit. The claimant is entitled to have that decision reviewed at a hearing, I am just wondering the following: a) Do I even need to attend? b) What will be the courts view on his constant flouting of the time limits? c) Is 55 days anyway acceptable if he has no reason? d) Do I need to present counter arguments to his alleged evidence? even if they do not touch on his delay outside the time limits. e) Do I need to make a skeleton argument? f) At the last hearing, I was asked by the DJ if I wanted to make an application for costs, I said that as long as the matter was at an end, then no. My question is what costs can I apply for, can I apply for the previous hearing if I declined to seek costs then? Thanks everyone for any advice

-

Hello i have a pending action through small claims track (hearing) and have just found out that the defendant's partner sent a text to my witness asking if he had spoken to me recently! this was followed by a few phone calls asking same witness to "just pop up and sign something". All declined by witness. Should I inform the hearing about this?

-

Had to email the court to see where a claim against me was as hadnt received anything. Received an email from them today stating that due to me not filling out the questionnaire my defence was struck out, further down the email stated that the claim has also been struck out as the claimant did not file a directions questionnaire. I can pay money to have my defence considered, but its seems to be a standard email sent out as as the case has been struck out it is pretty irrelevant. My real questions are Can the claimant pay £XXX amount to reopen the case? If YES do I need to pay to have my questionnaire submitted or does it reset the clock? If they can do this will I be informed of this and my defence accepted? Full email below. Unfortunately we cannot process your Directions Questionnaire as it has been received outside of the time allowed. The defence has now been struck out. If you would still like to contest the claim you will need to apply to re-instate the defence. This application should be made using an N244 Application Notice and should be accompanied by a completed Directions Questionnaire. You will need to explain why you did not file your Directions Questionnaire within the deadline provided and why you feel you should still be allowed to contest the claim. All forms can be downloaded from www.justice.gov.uk/forms. If the claim against you was for over £10,000 please attach an N181 Directions Questionnaire; for claims of £10,000 or under please attach an N180 Directions Questionnaire. You will need to provide one copy of the application for each defendant, one copy for the claimant and one copy for the court. There is a £100 court fee to process the application without a hearing or a £255 court fee to process the application with a hearing, payable by cheque or postal order to HMCTS or by card by calling the Helpdesk between 9am and 3:15pm. If you are applying as an individual rather than on behalf of a company and you cannot afford to pay this fee you can check if you are eligible for help with fees by downloading the EX160A booklet. Please note that the claim has also been struck out as the claimant did not file a directions questionnaire. Please note, applications are not automatically granted. The outcome of your application is at the discretion of the District Judge or court appointed Legal Advisor. If you require any further information please contact our helpdesk on the number below. Alternatively you can email us at [email protected]; Please ensure that you state the above case number in the subject heading of your email

-

Had a blue form sent a month or so ago which was issued by the court, filled it out offering repayments today had a letter saying I didnt send it back and I now have to pay in full the 3000 pound... which of course I can't. No I didnt send it recorded which was stupid but I did send it what can I do please? I didnt send the form back to the court I sent it to the claimant was this wrong ? I sent the blue forms to Shulmans Ltd

-

Hello I received a Judgment for claimant (in default) from Gladstones and I am unsure what to do. I was advised by a member of the forum to seek help here. An outline of the issue: Around the 10th of October 2015 I received a letter entitled postal notification parking charge from parking management control uk. The charge was for 100.00 but would be reduced to 60.0 if paid within 14 days. I ignored it and not happened after. Now I have received the Judgement of Claim from County court business centre in Northampton, saying that I have defaulted and I owe them 258.21. What do you advice I do now? Since October 2015 I did not get any letters of paper work from Gladstones or PCN, so how can the court send me this judgement. Thank you.

- 12 replies

-

- claimant

- gladstones

-

(and 1 more)

Tagged with:

-

Hi CG In Civil procedure rules if the Defendant is an individual, the case is automatically transferred to his home court. what if the defendant is a limited company? Can a claimant (another limited company) select a court at his home court? pls can some one advise me on this thank you all the best BF

-

Hi Forum! Am hoping someone may be able to offer some advice. Following period of very difficult times late 90's/early 00's - I negotiated (and, over many years, completed) payment arrangements with most of my creditors to clear substantial accumulated debts over £40k - fortunately avoiding bankruptcy/IVA's etc. However, whilst moving house in 2007, I got issued with a CCJ - and slightly unsure who the creditor was!! Sounds stupid, I know - sorry! I have a sneaky feeling it was Yorkshire Bank - who had given up chasing me to clear £10k card debt. The CCj suggested that the 'particulars of the agreement and debt had previously been provided to me' - which they hadn't. In the turmoil of house move - I foolishly just accepted the debt and returned the court forms offering to pay £20 per month etc which was accepted and CCJ issued. Claimant : CL Finance Ltd. (not aware of them and had no previous dealings - but assumed they assigned the debt from someone!) Pay to: Howard Cohen & Co. No 'account numbers or references' I could recognise. The years have passed and I have religiously paid the £20 per month for the last 10 years. (Mug I hear you say!) I have never received any statement or progress report - amount outstanding etc etc. I have moved a couple of times in last 12 years - but always on Electoral Roll/Experian etc - so definitely traceable? However, I have recently become curious as to what the debt was - and why my DD changed few years ago to 'Lewis Group' but now shows me paying 'Robinson Way'? I am reluctant to write to Robinson Way and ask what this debt is - and to whom (!) - or was the CCJ obtained correctly - was there PPI on the account (blimey - that would be a result!) as they could re-assess my circumstances and try to increase payments substantially - or my greatest fear - get a charge order against my home - or screw my credit rating (which is now clear and very good) But equally - should I carry on paying £20 for the rest of my life (and beyond) and not know who the heck to - or what for! Thoughts/advice appreciated? Best, Phil

-

21st Jul 17, 7:14 PM Hello All POPLA refused my Appeal Hello All. I am newbie here. Trying to find a solution to my frustration. The gist of my appeal to POPLA was as follows -------------------------------------------------- *That I paid for the parking fee, which avoided loss to the parking company. *The Dashboard on the Rangerover is sloped/curved and the parking ticket could have slipped on to the steering, due to the air gush when the door was closed. *The parking ticket had no self adhesive to stick it to the dashboard. *I have shown the ticket to the parking attendant on my return to the car, while he was still there and he asked me to appeal. *My intentions were not to breach the terms and conditions of parking site, hence bought a ticket and should not be penalised with unreasonable amount. PEA( PARKING AND ENFORCEMENT AGENCY LIMITED) nor POPLA could consider my appeal, and reply was as below.... ------------------------------------------------------------------------------ ASSESMENT DECISION was on 30/03/2017 on their website Unsuccessful Assessor summary of operator case The operator’s case is that the appellant failed to display a pay and display ticket. Assessor summary of your case The appellant’s case is that they purchased a pay and display ticket but it slipped down the dashboard, as the ticket did not have any self-adhesive. Assessor supporting rational for decision The operator has provided photographic evidence of the signage located around the site in question. The signage states, “Not displaying valid permit/ticket clearly on the dashboard…Parking Charge Notice is £100”. The operator has provided photographs of the appellant’s vehicle parked at the site in question. The photographs provided show the appellant’s vehicle without clearly display a pay and display ticket. The operator has issued the Parking Charge Notice (PCN) as the appellant failed to display a pay and display ticket. I acknowledge the appellant purchased a pay and display ticket but it slipped down the dashboard as the ticket did not have any self-adhesive. However, from the operator’s photographic evidence of the appellant’s vehicle I cannot see a pay and display ticket displayed on the dashboard. In order for the warden to assess that the vehicle was authorised to park at the site, a pay and display ticket would need to be clearly visible in the vehicle. As it was not, the warden has issued the PCN, as they would have been unaware whether the vehicle is authorised to park at the site. POPLA’s remit is to assess whether or not the appellant has adhered to the terms and conditions of the site in question. Therefore as the appellant failed to display the ticket correctly, I am satisfied the appellant has not adhered to the terms and conditions of the site. Ultimately, it is the responsibility of the motorist to ensure that when they enter a car park, they have understood the terms and conditions of parking. By remaining parked on site, the appellant accepted the terms and conditions. On this occasion, the appellant has failed to follow the terms and conditions of the signage at the site and as such, I conclude that the operator issued the Parking Charge Notice correctly. ------------------------------------------------------------------------------------------------- On not replying to their letters, regret PEA have given it to a debt collection as expected received debt collection letters from CSB SOLICITORS LIMITED followed by county court claim form dt 14/07/2017, for £265/- ( Claim £165/-, Court Fee: £25/-, Legal Reps cost : £50/- Total £240.31 further interest to accumulate on daily basis. I would like to defend and change the court to my local area. Any suggestions as to how to pinpoint the defence, so that the judge would see my side of the argument that there was no loss to the company and the penalty is disproportionate and unfair. Further as the said parking site is cordoned off currently for flats development, i cannot prove the terms and conditions on the signage as it existed, if at all . There are no signs boards currently. Any help is greatly appreciated in advance. Please could anyone be kind to advise as time is ticking . Appreciate your help in advance. Thanks

-

I was in dispute with Private Parking Company about a PCN. The last I heard from them was in February after a Letter Before County Court Claim was sent on 31 December 2014. I was away during August this year upon return from Holidays received a Judgement for Claimant (in default) which the Parking Company had filed during my absence and thus I could not file my defence within the 14 days statutory period. I can apply to get the Judgement set aside but there is a filing fee of £155. My first question is if I do so and get the subsequent judgement of the case by the Court in my favour can I claim back the application fee for setting the initial judgement aside? If not, there would be little point as the fee and the claim they won are similar amounts and I will end up out of pocket in any case. I intend to write to the site owner and complain about the underhand tactics of this firm that they employ but am not sure if they can force the Claimant to to withdraw their clam at this late stage and thus avoid any further costs? Is there a procedure for withdrawing a claim once a judgement (in default) has been issued by the Court?

-

Good evening, I wondered if you could help me. I have received a county court claim form for a credit card debt. The credit card was capital one and the debt was passed to various solicitors over the years. The debt is now with Capquest and they have instructed Drydens Fairfax to manage the matter. This credit card was taken out over 6 years ago, however I believe the last payment made could be around the 5 or 6 year mark which if over 6 could make the debt statute barred. I have tried to find old paperwork to try and see when I last made payment but can't and I no longer bank with the particular bank from which the payments will have been made. I know I haven't made any payment since May 2010 and could be earlier. The issue date on the Claim a Form is 03 December 2015 and I know I have to comply with timescales. I cannot afford to have a CCJ registered against me as I am looking to purchase a house next year. I haven't received anything from anyone about this debt for around 4 years until a week or so ago when I got a letter from Drydens. They threatened legal action if I didn't contact them within 14 days. I contacted them within this period and emailed for more information. They emailed back to request a paragraph from me to confirm that I was happy to correspond via email I did this, received no further response apart from the Claim Form. I don't know what to do for the best. The debt is in excess of £2500. I also cannot find out when my last payment was. I don't know where to start. Do I acknowledge regardless? Do I attempt to defend with no evidence unless they can prove otherwise? I look forward to receiving your help Thank you

-

Hi, Received two letters today: One from Mortimer Clarke Solicitors (dated 28/01/2016) Re: Cabot indicating that they have received no response to the claim form issued.( I was going to ignore it until I looked at the second letter...) Letter Two: Judgment for Claimant (in default), from the County Court, dated 28/02/2016 Claimant: Cabot Financial (UK) Ltd. I checked my credit file using Noddle: It shows one active credit card which is OK and currently active. Then .. Starting from Oct 2015 to Dec 2015 there is an entry for Cabot with a Default for each month. There is nothing else there, no balance history . The account details state that it is a credit card , defaulted 25/04/2010 - Balance: £680. Account start date 11/04/2008. On public information there is a CCJ from 28/02/2016. I had two credit cards back then , one I know was paid off, the other obviously was not. I think it may have been a Capital One credit card. I have never received a Claim form and have not had any dealings with Cabot. I have not had a Notice of Assignment . Should I contact to Court to apply for the Judgment to be set aside because I did not receive the Claim Form and have no proof that I owe Cabot anything? Can I get a copy of the Claim Form? (i feel disadvantaged because they seem to have all the information whereas I have none) Should then CCA Cabot and CPR 31:14 Mortimer Clarke? Any help or guidance greatly appreciated .... Thanks.

-

Hello all - I have an unusual situation with a CCJ. We paid in full using our deposit as part of the payment. The landlord is claiming that the deposit isn't whole anymore but also said she made no deductions on the deposit. Based on the lease, since she did not make any deductions, the deposit is whole and the CCJ is completely satisfied. SHe is trying to get extra money from us now and the court has been difficult in terms of providing a certificate of cancellation. What can we do now? We have proof of all payments in full well in advance of 30 days. Not sure how to proceed. We requested a certificate and the last response said we would need to petition to court for a formal a What pplication but I don;t know what that means as we already sent in the formal application for cancellation. So confusing! What are we meant to do??

- 4 replies

-

- acknowledging

- ccj

-

(and 1 more)

Tagged with:

-

Good morning all, I have a question if someone is able to help... If a defendant files a full defence via MCOL, stating that they don't beleive they owe the claimant money and the reasons why; how long does the Claimant have to instruct the court to proceed once this defence is received? Many thanks!

-

Hi, I have not been on here for quite some time. My daughter has just received a letter from the county court business centre saying that it is a Judgement for Claimant (in default) The debt was with O2 and the last payment was over 6 years ago (this is why my daughter did not reply to the claim form, she thought it was a [problem]). Any advice on how to handle this would be much appreciated. Kind Regards Bigandy

-

Hi, My landlord is wanting to send estate agents round to value the property because he wants to put it on the market. He has not yet served me with a Section 21 notice so I have no idea when he is expecting me to vacate but I would have thought a valuation would be more realistic once the house is empty and after he can do some redecorating, etc to get it ready for selling. At the moment, we have been too stressed over searching for a new home and we have been having a mad declutter and we have half packed boxes everywhere and the housework has become less of a priority, so all in all, the house no longer looks homely and I certainly wouldn't want any estate agents taking photos to use for selling purposes. Does my landlord have a right to getting a valuation, especially before he has issued a Section 21? I feel so uncomfortable about it and I really don't want anyone coming round while I still live here I have been looking through other tenants posts and came across this comment from one of CAGs members:- "Are you aware of this >> For example, a Section 21 notice cannot be served if there is no EPC or Landlord gas safety certificate in place for the property. Any non-compliance with this requirement will render the section 21 notice ineffective." Now my landlord has never done annual gas checks and the last one (for which I have a copy of the certificate) was about 2 years ago. Does the above CAG members comment mean that when I receive the Section 21 Notice it will not be legally enforceable? If so, what should I do and how do I respond to my landlord when I get the notice?

-

Hello, I have just checked my partner's credit report as we are applying for a new tenancy (our rented house has been sold, we have 6 weeks to get out). I was shocked to find 2 CCJ's that neither of us had a clue about. They were both registered at previous addresses long after we'd moved on, so no claims/summons were ever received. The credit report does not show who the claimants were, or what they were claiming for, and neither does the online register of judgements. How do we find out what the hell these are for? Thanks in advance.

-

Hi, I have received a claim from the small claims court. The claim relates to an Estate I was the administrator for. The claimant is not a beneficiary of the Estate but an agent for some of the beneficiaries. However, the name of a beneficiary is not stated on the claim form as I suspect the Agent has not been retained by any beneficiary to make this claim. Should I just reject this claim as it is not made by a beneficiary. The value of the claim is about £150 and I would be reasonably confident of winning the case but absolutely not 100% as it relates to expenses incurred in administering the Estate. It would be down to the court in their interpretation. Your comments would be much appreciated.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.