Showing results for tags 'cca'.

-

.. I sent off a CCA request six months ago which has not been provided, the account is in dispute, i have been receiving 'arrears' letters since. My question is, would it help to send back the latest arrears letter with a "No contract. Return to sender" label, or sit on my hands? Thanks Pencil.

-

Sent a debt collection agency the letter with regard to "a formal request pursuant to s.77/78 of the Consumer Credit Act 1974 etc". They have written back asking for my last three addresses to confirm who I am. Any suggestions what to do next. Thanks.

-

Hi All, Was on here some time ago (7 odd years) and received some incredible help. Sadly 2 years ago i fell into some issues and couldnt work at the time. Thus accumulating some debts. One of them is a credit card with Halifax , approx £5500, that had been passed to Moorcroft. I have sent them a 'prove it' style letter They have replied to me with 1 page which is a personal details page and 1 page which is the signed CCA, from Halifax (photocopies) I am happy to settle this debt but want to know peoples advice, opinions and the best way about it. i do remember a fair bit and have been reading up. Seen the settlement letters, but also conscious the debt seems no longer with Halifax or is do Moorcroft just act on the clients behalf as opposed to buying the debt? I aslso have 4 others than are with Capquest, but rather than making this post complicated, i'll post a new thread. Thanking you all in advance again

-

Hi All, I have just finished writing the CCA request and I thought I'd start a thread where I can request help once they respond. Fingers crossed!

-

Hi all I have debts with Littlewoods, Next and hubby has one with Very (along with other debts such as credit cards and a store card but these are the 'catalogue' debts). We are struggling to pay any of our debt and need to make some payment arrangements. I have noted that there is a CCA request which is often used by people to see if the debt is enforceable, I am not sure when these ONLINE accounts were set up but believe it was 2007/08. Can anyone advise if we are able to take any steps in regards to CCA... Also, would you advise to CCA them anyway and see what happens?...... In either instance can we claim back all the late payment fees etc from these debts?... .I understand I would need to SAR them but after that not sure how to actually request the fees back so a little advice would be lovely please. Thanks guys

- 245 replies

-

- cca

- littlewoods

-

(and 2 more)

Tagged with:

-

Hi there, Looking to see if someone can give this CCA and accompanying letters a look over, I sent a CCA Request to PRA Group and got the attached back from them is it all there and legit? This is in regard to a recent agreement. Thanks in advance. Barclaycard Letter Redacted.pdf Barclaycard Base CCA Redacted.pdf Barclaycard CCA Redacted.pdf PRA Reply Redacted.pdf

- 21 replies

-

- barclaycard

- cca

-

(and 2 more)

Tagged with:

-

MBNA sold debts that belonged to both me and my husband. Idem bought mine, Moorcroft bought my husbands. I emailed Idem regarding reduced payments that I would make, and eventually they responded agreeing to my reduced amount. However, Moorcroft ignore emails (sent day after day) and they will not reply despite my husband requesting that they not call, but put in writing instead. They call anyway, and to whomever called, I asked them not to call, but to respond to my husband's emails - however, the chap then called my husband's mobile immediately! I got a statement from Idem, and in exactly the same marked envelope (same return address, same statement format) my husband had one from Moorcroft. Does anyone know if this is the same company??? It's really cheesing me off that Moorcroft ignore all the emails. Also, they're sneaky so-and-so's: they are based hundreds of miles away from us, and yet they call the landline using a local number that they must buy to use, to look like they're someone local calling us - idiots! It doesn't take long for me to recognise the number and ignore it. But, they're making me so mad!!! I think I'm wasting my time re-sending the same emails but at least it proves the point that they're ignoring us, dispite contacting them on a daily basis!

-

hi i sent the alliance and leicester an LBA, ive had the usual reply, ie sorry we do not accept .... blah blah- before i issue a court claim is it ok to add another charge ive incurred since i sent my letter ? just want to get my facts right before i add another £100 pounds or so to their total thanks gaz

-

Hi all, I started a previous thread to share my general issues, but am posting in this section for specific advise relating to First Direct. Previous forum address here if anyone is interested: http://www.consumeractiongroup.co.uk/forum/showthread.php?458839-Low-income-6-year-old-debts-and-worrying-about-the-possibility-of-future-court-action I had an account with an overdraft, credit card and loan with First Direct (all pre Apr 2007). I defaulted on payments for the credit card and loan back in 2009, at which point, they closed my account, merging the credit card and overdraft together as one debt, and the remaining loan as another. Since the default in 2009, I have been making token £1 monthly payments to Metropolitan Collection Services; I have since moved house a few times and hence had no contact with them. Aiming to sort things out once and for all, I joined this site, and under some much appreciated advice, sent out a CCA request to Metropolitan last week. First Direct have responded, sending back my CCA letter (but keeping the postal order???), saying: The letter is not signed (didn't think I needed to) - they want me to provide a specimen signature My current address does not match their records (it wouldn't as I have moved, but my credit file address is up-to-date) - they want me to provide the old address to match their records. From this, I gather that FD still own the debt as Metropolitan did not write to me. As mentioned, my credit file is up to date with all addresses. Does anyone have any advice on how I should proceed? Are they trying to delay and does the time limit of 12+2 days still apply? Or, are they valid in their requests? Any help much appreciated Thanks AM

-

Hi all again, I owe a fair bit of debt and I need to workout the best way to manage it. I've only been on this website a few days reading a few posts on debt and I've found that I might not only be about to manage it myself for free, I could write off a fair bit of the debt because of the way it was sold to me. What & Who I owe:- Name Balance Payday Express £661.43 NCO Europe (Shop Direct) £294.95 Quick Quid £167.52 Certegy Ltd (FIS) £501.12 Retail Credit Management Ltd £501.12 NatWest £314.18 Total £2,440.32 Bit of background information when theses where taken out:- All the payday loans EG: (Payday Express, Quick Quid) where taken out when I was working cash in hand, they couldn’t have done a proper background-check to make sure I could pay them back. Also the Certegy Ltd and Retail Credit Management are chasing the same debt. I took credit of some-sort to pay for a photo-shoot. I still have the contract for it and once again can’t have been a background check because I was on JSA (Dole) when taking it out. The NCO Europe is Littlewoods credit that’s been passed on. There couldn’t have been a background-check on this either because I wasn’t even working when taking it out. And finally the NatWest is an overdraft that keeps charging me because of an unarranged transfer but they know I’m currently out of work. My question is, have a lot of these debts been miss-sold? Because I’ve read on here to send a letter like this to the payday lenders. (Dear Sir/Madam I have a payday loan agreement with your company and wish to make a complaint in relation to the product you sold me. Your product has resulted in me suffering serious financial hardship and becoming unfairly indebted. In particular, my ability to pay rent, mobile phone contract, overdraft, food, clothes and basic essentials. I would not have suffered such detriment had your company complied with the relevant consumer credit laws in relation to my individual circumstances; in particular I believe: When I took out my payday loan the Representative APR and true costs of the borrowing was not made clear to me on your website and advertising. This was unfair and contrary to the Advertising Regulations and the Consumer Protection from Unfair Trading Regulations. Your company also failed to provide me with the proper statutory pre-contractual information before I entered into the loan – including a clear explanation of the consequences of missing a payment, default and rollover charge. Had I known this, I would not have taken out the payday loan. Your company again failed to provide me with adequate pre-contractual explanations on the suitability of payday loans in relation to particular types of use, and how much I would really have to pay and what would happen to me if I was unable to do so. Because of this failure, I have been significantly prejudiced and have suffered loss & hardship. Your company also failed to properly assess my creditworthiness when you first lent me money contrary to section 55B of the Consumer Credit Act 1974, had you undertook a sufficient assessment I would not have incurred additional interest and default charges. I would ask you to write-off the interest and charges you have applied to my loan. If you are not prepared to do so please explain why, within the statutory 8-week period, so I can take my complaint to the Financial Ombudsman Service. In the meantime as this debt is in dispute please desist from debt collection or contacting me until this dispute is concluded. Yours Sincerely, ,,,,,,) And to the rest I should send a CCA Request like this. (template removed please do not post templates in the open forum - dx]

-

Hi I received some excellent advice from CAG after I had some major employment and debt issues between 2008 and 2011 which resulted in a number of my accounts defaulting, once again I am in need of assistance please. One of the alleged debts I defaulted on was in respect of a BOS Credit Card, under duress I continued paying £1 per month until August 2016 when it was sold to Cabot Financial. The balance claimed is around £4k. Cabot quickly passed the account to Restons who wrote in February 17 threatening legal action to which I issued an unsigned CCA request together with a £1 postal order. Restons rejected the CCA request as it was unsigned, therefore I signed it and resent it with a letter as follows; ___________________________________________________________________________________________________ Further to your letter dated XXXX in response to my second formal request for a copy of the original credit agreement for your reference shown above. I am somewhat surprised at your request considering you have happily sent personal information to my address if you are now uncertain that I am the correct person. For the avoidance of doubt there is no requirement under the Consumer Credit Act 1974 nor the Data Protection Act 1998 for my request to you to be signed. Never the less, I return to you now signed my original letters dated 23 March 2017 and 28 March, together with Postal Order: for £1. This postal order represents the fee payable under the Consumer Credit Act 1974 in respect of my request for a copy of this credit agreement and a full breakdown of the account including any interest or charges applied and must not be used for any other purpose. I understand that under the Consumer Credit Act 1974 (sections 77-79), I am entitled to receive a copy of any credit agreement and a statement of account on request. I understand that, under the Consumer Credit Act 1974, creditors are unable to enforce an agreement if they fail to comply with the request for a copy of the agreement and statement of account under these sections of the Act. For the avoidance of doubt, an original signed Consumer Credit Agreement is just that; not an application for credit and not a reconstructed or micro-fiche document from other sources but indeed the original signed document purporting to be signed by myself. Please note that until such times as a legally enforceable, original Consumer Credit Agreement can be produced and a copy sent to me by return, then this letter is not an acknowledgement of debt and this account will remain in an unenforceable state in line with s.127 (CCA1974). I look forward to receiving the documents requested within the next 12 days. ___________________________________________________________________________________________________ I have also sent an unsigned CCA request to Cabot which has been acknowledged and is in process. I have today received the attached letter from Restons advising legal action is commencing, although they have stated the Postal Order and letter has been returned this was not included in the envelope. I have contacted Royal mail to obtain confirmation the Postal Order has been cashed. I would really appreciate guidance as to how I should respond as Restons appear to have no inclination to provide a copy of the CCA and appear happy to proceed to court on this basis. Many thanks Bozalt IMG_1942JPG.pdf

-

Hi all, I recently CCAed all my creditors in order to try and sort out my finances finally. I have been paying £1 token payments to each, having defaulted on all over 6 years ago. I have moved house a few times since and have lost track of what has happened to them all. having sent a CCA request to Robinson Way, who I originally dealt with for a Halifax debt, I received a strange reply, returning my £1 PO, and saying that "the account is closed on our files, please contact our principal". This was written on a very unprofessional piece of paper that looked more like a memo than a letter! Has anyone got any advise as to how I should proceed with this? The 12+2 days are definitely over. As Robinson Way were dealing with this, is it still their responsibility to respond to my CCA request? Thanks AM

-

Can someone kindly advise how to calculate possible PPI reclaim amount ? I have calculated my monthly PPI interest amount figure using forum details located in which I have already paid over120 months but still have 60 months to expiry. Any assistance would be appreciated as I would like to know a possible figure in order to compare with Welcome's offer if successful.

-

Hi all Hope everyone is well. Had this back recently - after months on inactivity on all accounts. For a Lloyd’s credit card This is the one and only sheet sent back from Idem. Looks like an application form to me ? Any help much appreciated. Thanks for looking and Bon weekend ! Here is correct picture Lloyd’s scan 2.pdf

-

Good evening all, I've done a bit of research trying to close accounts which led me to requesting CCA's to Cabot. I sent two for two different accounts which they took off Halifax (1 x CC & 1 x Current Acc Overdraft). I posted the following to them: Dear Sir/Madam Account No: With reference to the above agreement, I require you to supply the following documentation before I will correspond with you further on this matter. 1. You must supply me with a true copy of the alleged agreement you refer to. This is my right under your obligation to supply a copy of the agreement, under the legislation contained within s.78 (1) Consumer Credit Act 1974. 2. A full statement of account. 3. A signed true copy of the deed of assignment of the above referenced agreement that you allege exists. 4. A copy of any other documents referred to in the agreement. I understand that under the Consumer Credit Act 1974 (sections 77-79) , I am entitled to receive a copy of any credit agreement and a statement of account when I request it. I enclose a payment of £1 which is the fee payable under the Consumer Credit Act 1974. I understand a copy of any credit agreement along with a statement of account should be supplied within 12 working days. I understand that, under the Consumer Credit Act 1974, creditors are unable to enforce an agreement if they fail to comply with the request for a copy of the agreement and statement of account. A speedy response would be appreciated to resolve the matter amicably. I look forward to hearing from you soon. Yours faithfully THE LETTERS WERE RECEIVED ON 17TH/18TH JULY AND TODAY I RECEIVED THE FOLLOWING LETTERS: Thank you for your CCA request etc etc... We currently do not have this information on file. However I have requested the relevant details, which include a copy of the credit agreement, statement of account and relevant terms and conditions from the original lender. You have requested a copy of the Deed of Assignment. Please be advised that the DOA is a confidential document between Cabot and the original lender. It does not contain any personal details relating to you or your account and is not available for disclosure. We sent you a Notice of Assignment for your account to your address, which is sufficient to confirm our ownership of this account. Only the courts can request this... Blah blah blah. A couple of things here... I asked for a true copy, they are referring to simply a copy. If they do obtain a copy, is this enforceable? Also is it acceptable what they are saying about disclosing the DOA to me? I don't ever recall being sent a Notice of Assignment, if I did, is this sufficient to confirm ownership and enforceable? I have been currently paying towards what they are claiming, on a monthly basis via DMP. The next payment is due in a couple of days. Should I continue paying or is it advisable to stop until they wholly action my request? Thanks in advance and any help/advice/feedback is much appreciated! I'm looking to get a mortgage by the end of the year so I can get my son into the school I/he wants. Many thanks.

-

I recently made a section 78 CCA request to Cabot who I have been paying a debt off to for 2 years. There was another 12 months left until I realised I could make a CCA request to them. I received a reply today saying that they could not get the info from the original lender, and the account is unenforceable. What data position does this place them in? Can they still request from me or use my data in any way? What about the default under their name on my credit file?

-

Hi, after CCA'ing my creditors as per advice here in an earlier thread back in October one of my main DCA's (Wescot has responded - took them a while!) They are saying they have sent me my original agreement as requested and have now passed the debt back to Lowell who they were collecting on behalf of? is the CCA a valid copy? The original creditor was HSPF (home shopping personal finance) Not sure if i should get back in touch with Lowell and start arranging payments again or not Any help appreciated as always, i have uploaded copy of what Wescot have sent me.. next steps for me? file_1_pdf.pdf

-

Good morning all Have been an avid reader of CAG for some time. I currently have an alleged debt with shop direct which is being dealt with by Lowells. The debt is for £2k+ I have read the guides and templates available and sent a CCA request to Lowell's in November. I finally received 2 signed documents. You can see on one document the key financial info is set at £36. The other document Is signed and the account number is the same as the first document. Note that the dates are different so the documents were not signed together. Any help or pointers would be greatly appreciated. Many Thanks

-

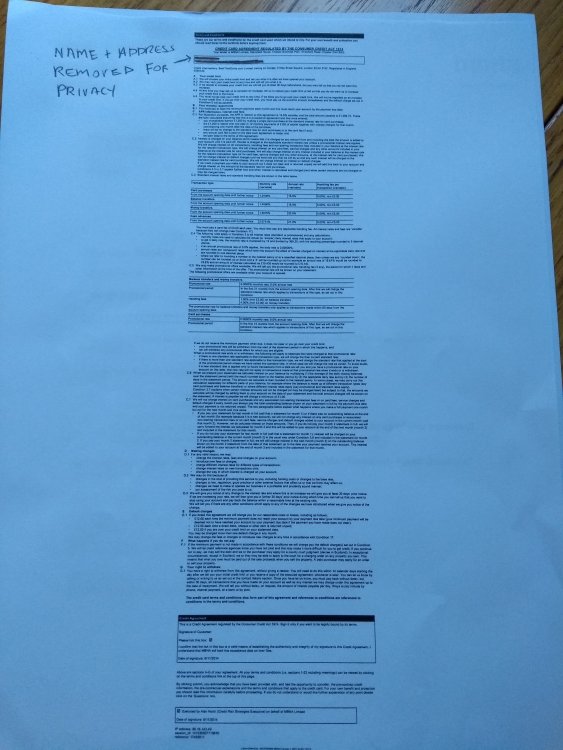

Had the following back from MBNA in response to a CCA request. 2 sets of T&C's, one current, and one supposedly from the time they card was taken out (not sure how I'd actually verify that) A summary statement showing current balance And a "copy executed agreement" Have uploaded the covering letter and the redacted "copy executed agreement". Basically, is this valid? This card was taken out in late 2014, and from what I've read it seems like it probably is a valid an enforceable response to my request, but would like to be sure before taking next step (MBNA bluntly rejected a recent full and final offer of around 60% of balance, claiming they never accept such offers. I should also mention that the debt is still with MBNA and no payments have been made for 3 months now. Current balance is a around £10.5k. Borrowing from family and selling a few things I reckon I could raise £8k tops. It doesn't seem like MBNA would accept this as a full and final, and all the while the interest mounts up.

-

Hello, I started a DMP with Stepchange about 6 years ago with £150k of credit card and personal loan debt. I have paid about £80k via Stepchange over the years and about £70k remaining balance (including personal loan interest). I have been paying £800 per month split pro rata via stepchange but due to change in circumstances can not pay much at all anymore! Have yet to contact Stepchange but have cancelled the DD with them just now. I need urgent help and advice!! Should I arrange to pay them £1 per month instead for now through stepchange and CCA them all in the meantime? – I have just read about CCAs here. I am terrified of getting CCJs from them all now – All help greatly appreciated! Debts are as follows: • NRAM personal loan pre 2007 – now with Cabot Financial (Marlin) - £12,933 - not on credit report • Bank of Scotland personal loan – post 2007 - now with ‘Wescot Credit Services – Bought Debts’ – £12,395 owing – not on credit report • Santander Personal loan – 2002 - £10,859 – Defaulted 2011 • MBNA Credit Card – 2005 - now with IDEM CAPITAL SECURITIES – £6,919 – Defaulted 2011 • Cahoot loan - £4499 – showing on credit report as settled 2015! – but stepchange still collecting and paying!? • Barclaycard credit card 2008 – now with LINK FINCANCIAL OUTSOURCING - £3337 – showing as up to date positive credit on my credit file! • MBNA Credit card 2008 – now with IDEM CAPITAL SECURITIES - £3233 – defaulted 2012 • Capital one credit card £3205 – not on credit report • MBNA Credit card 2008 – now with PRA GROUP - £2723 – defaulted 2012 • Co-operative bank credit card 2002 – now with LINK FINANCIAL OUTSOURCING - £2571 – defaulted 2012 • Co-operative bank credit card 2001 – now with LINK FINANCIAL OUTSOURCING - £2026 – defaulted 2015 • RBS MINT credit card – now with ‘WESCOT CREDIT SEREVICES – NON BOUGH DEBTS’ - £1624 – not on credit report • Tesco Bank credit card – now with ‘ROBINSON WAY LTD – TESCO’ – £1222 - not on credit report • Barclaycard credit card 2001 – now with ‘LINK FINANCIAL OUTSOURCING’ - £1087 - showing as up to date positive on credit report! • Bank of Scotland – now with FAIRFAX SOLICITORS - £750 – not on credit report • Cahoot credit card £713 – not on credit report • American Express credit card – now with ‘NCO – OTHER’ £387 – not on credit report • EGG Credit Card – now with PRA GROUP (UK) - £193 – not on credit report • Cahoot credit card £100 – not on credit report

-

Hi im new to the forum I have recently stopped paying my loan, I recall the loan company sending me out my loan agreement and making me hand sign it in late 2016. If I was to do a CCA will they need to show the signed agreement?

-

Hi all, I received a letter today from BWLegal in relation to a debt of £704.80 original debt was with The Money Shop, payday loan of just over £100.00. The debt is due to be made SB in March. The letter is threatening to take me to court and place a CCJ on my credit file. I have typed the below letter and would appreciate any feedback you could give. This will be the first letter they have received from me, I have not made any contact with them previously. I have also typed out the content of the letter I received from them today. 16th January 2019 CCA Request removed please do not post our template requests. The Below is a rough outline of the letter received today Dear MR XXXXXX We have been instructed by PRAC Financial Ltd to commence legal action in the form of issuing a claim against you in the county court, without further notice, in respect of the above debt. If payment or response is not received before the 14th February 2019. If you dispute this debt please tell us why so we can help resolve this matter. Estimated Claim Such legal action may result in you being liable for court fees, solicitors costs and statutory interest which are listed below: Principal Debt: £708.74 Estimated Interest: £118.37 Estimated Court Fees: £60.00 Estimated Solicitors cost: £70.00 Enclosures Enclosed with this letter are: Information Sheet Reply Form Income & Expenditure form Particulars of the debt On 20 February 2013 you entered into an agreement with Instant Csh Loans Ltd t/a The Money Shop to provide you with a fixed sum Loan agreement account. You failed to make payment in accordance with the terms of the agreement and it was later terminated and has since been assigned to our client on the 9th December 2016. Notice of this assignment has previously been given to you. Our client is not currently applying any interest, fees or charges to your account. Any help with my CCA Request letter is greatly appreciated, I want to make sure I have the correct sections quoted etc. Thanks in advance regards Veteran6224

-

Hi I am new to the site and just learning how to navigate the forums. Hoping I am now in the correct place to get some helpful advice. I have 4 very historic debts being managed for the past 6-7 years by CABOT and 1 with PRA. In the past few weeks, I requested a CAA and SARs from both which was a very revealing exercise. Low and behold:!: CABOT replied saying they could not find CAA for 3 historic debts so these are unenforceable but that I should continue with my monthly payments to my DMC. PRA replied very differently saying "current accounts do not require credit agreements and therefore no credit agreements have been set up when opening the account". How can these 2 Debt Companies behave and respond differently:?: I now plan to stop monthly payments to CABOT and would like your advice if there will be consequences! I am currently 70+ in poor health and want to be debt free in 2019:!: I have also sent GP medical and Cardio reports to both companies but did not receive any compassionate response:sad: Many Thanks for any advice and direction given. nacro:help:

-

Good evening...... I had the pleasure of a member of Resolve Calls team visit my home this evening with regard to an old debt of an unsecured loan taken out with Northern Rock in 2004 - last paid via debt management in 2014. Cabot took up this debt in 2015, I sent them a CCA request in Jan 16 but from memory only received a standard response. I have two questions i could really do with some advice on 1) Should I write to Cabot reminding them of the outstanding CCA request or resend the request? From memory i think they sent a generic response effectively saying they were 'looking for it' . I know i should have kept this info, however the original signed agreement was definitely never provided. 2) Is there a letter or anything I can communicate to prevent these people just turning up at my door? They wrote to me months ago informing me of Resolve Calls involvement but i assumed it was fairly generic. The guy was very polite and non-threatening, I gave him no more info than he could find from the electoral roll, his objective seemed to be to get me to call his office on my doorstep at 7.30pm in the dark. At this point i politely told him that wouldn't be happening so he gave me a card with details on to call. I work away fairly often and do not want these people turning up when my partner and young son are at home alone. Thanks in advance for any advice

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.157c55a57c1d03e42624bbf0c552576e.jpg)

.thumb.jpg.0a920372943b1ddd34b7a9e31a174b4f.jpg)