Showing results for tags 'pra'.

-

hello everyone. just started this thread for a colleague, who needs some advice and is not very good with computers. history of debt Barclaycard credit card 01/2008 debt management 08/2009 arranged with Barclays a reduced payment plan which was accepted while on the debt management plan. PRA GROUP was assigned the debt from Barclaycard 08/2015 Last payment made 02/2018 Name of the Claimant ? PRA Group Date of issue 17/01/2019 What is the claim for – 1.The claimant claims the sum of £1834.29 for an outstanding debt owed. 2.On 22.01.2008 the defendant entered into a an agreement with Barclays Bank PLC for a credit card under reference ….. 3.On the 06/2018 the defendant defaulted on the agreement with an outstanding balance of £2019.29. 4.On 17/08/2015 the debt of £2301.02 was assigned to PRA Group(UK) Ltd. Notices of assignment were sent to the defendant in accordance with S136 law of property act 1925. Payments of £434.52 were received up to 06/06/2018 and adjustments have been applied in the sum of £32.21. 5.AND THE CLAIMANT CLAIMS 1. The sum of £1834.29 A Barclaycard CC debt £1834.29 + court costs Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (pre action protocol) ?Yes What is the total value of the claim? £2019.29 what is the claim for:Barclaycard credit card When did you enter into the original agreement before or after April 2007 ? 01/2008 Is the debt showing on your credit reference files (Experian/Equifax /Etc...) ?NO Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim.Debt purchaser PRA Were you aware the account had been assigned – did you receive a Notice of Assignment? I don't remember receiving this information Did you receive a Default Notice from the original creditor? No, after ringing Barclaycard they claim that the account was never defaulted. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Just letters from PRA stating you are behind with your payments Why did you cease payments? Got into financial difficulties What was the date of your last payment?06/02/2018 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes I was on a debt management plan He has done the AOS on MCOL. CCA request ready to send to claimants CPR.31.14 ready to send to claimants solicitors Any help and advice appreciated. Donation will be made thank you

- 43 replies

-

- barclaycard

- county court

-

(and 1 more)

Tagged with:

-

Hi There, Been playing games with MBNA for months now on CCA etc and they passed onto PRA Group to chase, they have come back now and said the application was done digitally! Not sure where I stand now or what I can do? Thank you in advance for your help. Regards Steve H

- 1 reply

-

- application

- digital

- (and 4 more)

-

Hi there, Looking to see if someone can give this CCA and accompanying letters a look over, I sent a CCA Request to PRA Group and got the attached back from them is it all there and legit? This is in regard to a recent agreement. Thanks in advance. Barclaycard Letter Redacted.pdf Barclaycard Base CCA Redacted.pdf Barclaycard CCA Redacted.pdf PRA Reply Redacted.pdf

- 21 replies

-

- barclaycard

- cca

-

(and 2 more)

Tagged with:

-

I was out of work 4 years ago and agreed a 5 year payment plan with MBNA for a credit card debt (14,000), they stopped the interest , I have been paying this for 4 years +3months never defaulted , I have now received a letter saying they have now sold my debt (1900.00) to The PRA Group … .yesterday I received 3 calls from them which i have not responded to....what happens now? the letter from MBNA says I don't need to do anything and PRA group will carry on the agreement so why are they calling me? any advice appreciated!

-

Hi All I have been in an ongoing tennis game with letters going back and fourth with regards to an old debt i had with the bank of scotland (Credit Card) I have sent the usual CCA request to the PRA Group and have received the following A signed credit agreement A notification of assignment - (showing PRA Group as holders of the debt from July 2014) A statement of account up to March 2011 However the statement of account is where I have the issue, they only provided me with a credit card statement up to March 2011, the total they are chasing is lower than the one issued on the statement. I know this should the case as I was using a debt management company (Compass) to handle the account, and they issued payment of £6.49 a month, Compass ironically went under in April 2014, taking my debt savings and no more payments were made to PRA Group. My point is PRA group have only produced a official statement up to 2011, and only provided a spreadsheet on business paper showing payment of £6.49 made a month. There is no official statement showing these payments were made by Compass and especially nothing to indicate compass was acting on my behalf. I am assuming that if PRA group cannot prove the £6.49 payments are made on my behalf, the debt can be classed as Statute Barred as officially my last payment to Bank of scotland would of been in 2011 I have attached the last letter from PRA which includes a sample of the statement they provided (which anyone could knock up on excel). Am I ok to challenge this statement and ask for proof of who paid the £6.49 and confirm documents stating on who's behalf the payments were made? Any help on this is appreciated Thanks

-

Hi, I appreciate any help on this one. My mum received a letter before claim from bw legal acting on behalf of pra group so we sent a cca request to pra group. This morning she got a response from pra group saying that they were unable to fulfil her request as they have not yet completed the required security checks in order to verify her identity and sent the postal order back. They want her to write or phone to tell them her name, date of birth and previous addresses even though we put her name and adress at the top of the cca request along with the reference no. from bw legals letter. If anyone could give me some advice on how to respond that would be great. I've sent cca request to other dca's in the past but I've never received that response.

-

Hi, Had a letter today from PRA Group for a 16 year old debt had back in 2002 and they're offering a discounted payment i believe the debt would be statute barred? nothing on my credit file is it worth sending a letter under the Limitation Act? Thanks

-

Good Morning, Today i received a letter from PRA group in relation to a quick quid loan taken out in March 2011, they are offering around a 70% discount, The letter is titled "Could you settle your account?" I did query this loan in 2015 so i have a statement of the account. I was just wondering what my next steps would be to get them to stop hassling me and would this be statue barred as the last payment was made in May 2011. Thanks DC

-

Hi there, My wife and I have unfortunately gotten ourselves into around £20,000 of debt. I recently wrote to the agencies sending out letters using the template to ask for the signed credit agreement. We have received this back from PRA GROUP. Could someone possibly give us some advice on what we need to do next Thank you Here

-

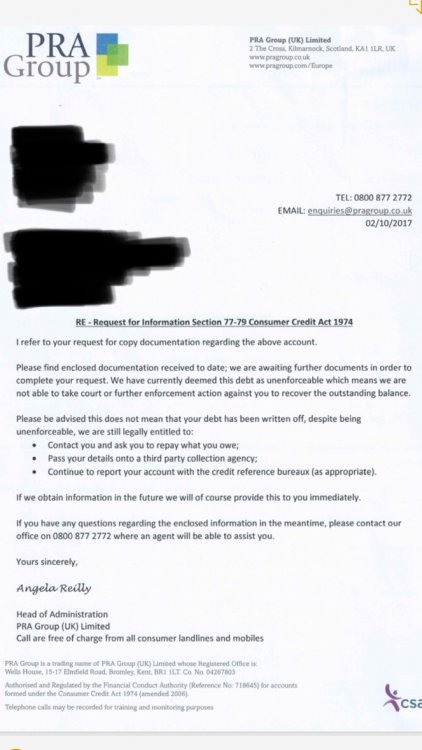

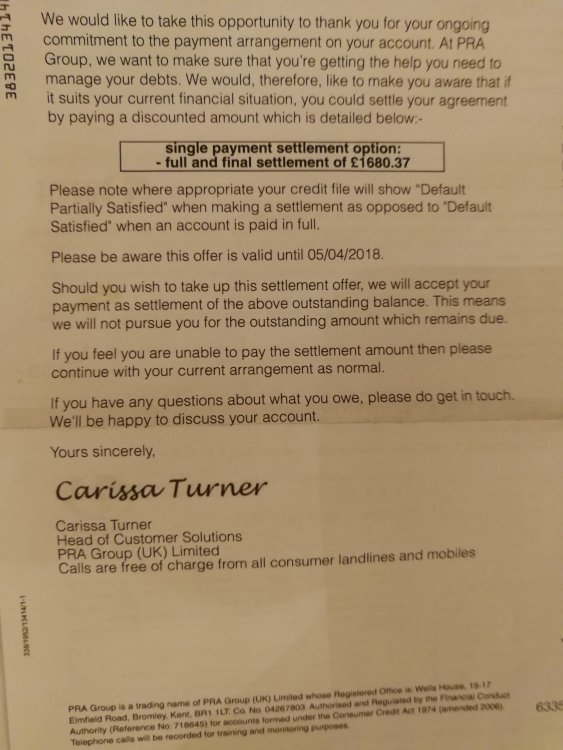

Name of the Claimant ? PRA Group Date of issue 19/12/2018 What is the claim for – 1.The claimant claims the sum of £4793.79 for an outstanding debt owed. 2.On 20.01.2005 the defendant entered into a an agreement with Barclays Bank PLC for a credit card under reference ….. 3.On the 06/05/2011 the defendant defaulted on the agreement with an outstanding balance of £5041.31. 4.On 17/08/2015 the debt of £5041.31 was assigned to PRA Group(UK) Ltd. Notices of assignment were sent to the defendant in accordance with S136 law of property act 1925. Payments of £232.96 were received up to 20/03/20108 and adjustments have been applied in the sum of £14.56. 5.AND THE CLAIMANT CLAIMS 1. The sum of £4793.79 An Egg CC debt £4793.79 + court costs Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ?Yes What is the total value of the claim? £5058.79 what is the claim for: egg credit card When did you enter into the original agreement before or after April 2007 ? 2005 should I request the CCA I believe they won't have a problem proofing I owe this debt? Is the debt showing on your credit reference files (Experian/Equifax /Etc...) ?No it came off about a year ago Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim.Debt purchaser PRA Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes sure I did ! Did you receive a Default Notice from the original creditor? Yes Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Not sure Why did you cease payments? Had a brain injury What was the date of your last payment?19/12/2018 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes How shall I defend / respond to this they seem to be using bully tactics and fishing for me to pay up the full amount which I don't have. in March last year they sent me a full and final settlement letter asking for £1680.37 I counter offered £1200 they refused it and said they would only take £1945 which is bizarre. PLEASE SEE ATTACHMENT, I questioned this on another forum and was told the wording is not right and the balance should be zero. If you have not already done so – send a CCA Request to the claimant for a copy of your agreement (except for Overdraft/ Mobile/Telephone accounts) Will Do ! Particulars of Claim An Egg CC debt £4793.79 + court costs I went into arrears in 2010 after a head injury and have been making monthly payments. Egg was bought by Barclaycard since then and then they assigned/sold the debt to the PRA group 17/08/2015. I have been paying without missing a payment but have not done their constant requests for income and expenditure. I got a letter November 13th say my account had been transferred to the investigations and litigation department which I ignored. Thanks for your help I don't have long to respond to this claim

- 68 replies

-

- county court

- group

-

(and 1 more)

Tagged with:

-

Hello all !, I received a letter from PRA Group a couple of days ago. Letter opens with "in order to comply with our obligations under the Consumer Credit Act 1974, We are providing you with this statement of your account. Opening bal: £545.40 Total payments recieved £0.00 Balance adjustments £0.00" Letter also gives a ref number and says I owed Lloyds TSB Bank PLc, the agreement date was 30 May 2002. And offers a settlement payment amount of £54.54. I have never had an account with Lloyds TSB. I panicked thinking someone may have stolen my details, as I've never had a letter of this nature before. Have checked credit files from the usual three and there's nothing. My name is a common name (G Jones), I work with two others with the same first and sir name so had thought it could be for a different G Jones but that doesn't account for the letter having my address on it. Do I contact PRA Group ? Do I ignore ? I'm not sure what to do, not slept the last two days. Thanks in advance and apologies if I've posted in the wrong place or duplicated a thread. G

-

Hi everyone, Received a letter from The PRA Group this morning, kindly complying with their "Legal obligations" by sending me a statement of my account with them for the year. This is an old Barclays Bank debt which defaulted back in 1991! Unfortunately I was made redundant at the time, fell into debt and lost my home. To be brutally honest, I'd completely put this period behind me and eventually got back into shape. I even have my mortgage and bank account with Barclays now. What concerns me a bit is a line in the letter threatening a black mark with the CRA's. Is this just a threat as the original debt defaulted and was on my credit report for over 6 years. I understand it's well past the Statute Barred period. Should I keep the home warm by throwing this letter on the fire?

-

Hi, I'm hoping someone can give me some advice. I have an old MBNA debt which I defaulted on in 2010. Since then I have religiously been making pro-rata payments up to and including this month. MBNA sold the debt to Aktiv Kapital who in turn sold it to PRA in 2014. I know that PRA have been receiving my payments because they sent me a letter towards the end of last year saying "...thank you for your ongoing commitment to the payment arrangement on your account". It goes on to say "....We would therefore like to make you aware that if it suits your current financial situation, you could settle your agreement by paying a discounted amount which is detailed below" The letter ends with " If you feel you are unable to pay the settlement amount then please continue with your arrangement as normal." Which I have done! However, on the claim form they state "..Payments of £307 received up to 16/6/16" and are now claiming sum owed plus 8% interest + court fee + legal costs. I know I have not missed any payments because my bank statements tell me so I know they have been receiving them because they wrote and thanked me for my continued commitment 4 months after the date that they claim they received last payment. To say I was shocked and confused to receive the claim form from the court is an understatement. What's going on? and how to tackle this? Any help would be appreciated.

-

I'll begin with thanking any one who can help and advise me with this. I had a Bank of Scotland credit card from1995 until 2006 when employment and marital issues took their toll and I was unable to meet payments required but did continue to make minimal payments. They subsequently passed the debt to Moorcroft Debt recovery and I continued to make monthly £20 payments more when I could The debt has reduced from £13700 to £9640 (oct 2016) Other than a few reminder letters MDL seemed ok to receive monies. On 24/10/2016 i received a letter from PRA group advising they had purchased debt (no confirmation of this received from MDL) I did not contact either company at this point and ceased my monthly payments. Their letter also stated debt was with Lloyds TSB bank letter who I understand took over BoS in the financial crash of 2008 On 17/11/2016 i received letter before claim notice as required for pre action protocols In response to this I sent s78 request signed for with £1 PO Reply recd 3/12/16 returning the £1 PO saying it was not required and case on hold until they sent me the requested info together with their 'fact sheet 'saying it may take longer than the 12 working days. 26/1/17 PRA letter received with copy credit card statements only from 2003 to 2006 and advising debt marked as currently unenforceable. 1/2/17 PRA letter received with copy of original signed credit agreement and letter still advising debt currently deemed unenforceable. 20/2/17 PRA letter received chasing debt again and asking for contact which I have not done. 6/3/17 PRA claim letter received before pre action protocols wanting response before 22/3 constituting a formal demand for payment before court proceedings are started. It also states the creditor assigned this to PRA on 6/11/2014 but they did not have this case until October 2016 it was previously assigned to Moorcroft debt recovery I am not sure what to do now and any help /advice would be greatly appreciated Again thanks in advance

-

Issue Date: 21/02/2017 Claimant: PRA Group Solicitor: Surjit Gida (Legal Rep) Original Creditor: MBNA Particulars of Claim: 1.On 11/06/02 the defendant entered into an agreement with NBNA for a credit card under reference: xxxxxxxxxxxxxxxx. 2.On 31/05/10 the defendant defaulted on the agreement with an outstanding balance of 6895.76. 3.On 29/02/2012 the debt of 6895.76 assigned the debt to PRA Group (UK) on 31/12/2014. Notices of assignment were sent to to the defendant in accordance with S136 Law of Property Act 1925. 4.Payments of 54.00 received up to 13/09/2016. 5.The claimant claims (1) the sum of 6838.76. (2) Statutory interest pursuant to Section 69 of the County Courts Act 1984 at a rate of 8% per annum from 13/09/2016 to 20/02/2017, 239.63 Daily rate of 1.50 until judgment or sooner payment. The Claimant claims the sum of 7078.00 for debt and interest. Is the debt Statute Barred: No Info: My mother over the phone registered for a credit card, there was no signing of an agreement. In 2009 her husband, my father developed cancer while working abroad. He carried two thirds of their house hold income. Finances grew increasingly as time went on. I assist as much as possible. All other banks when informed of the situation froze their accounts and worked on a solution. MBNA differed and instead raised interest rates. In May 2010 She defaulted once again. On 04/06/2010 MBNA sent her a letter stipulating her balance was 6905.76 and in order to remedy the breach she must pay £1082.13 by 22 June 2010 (I have this letter). On the 30th My father died at home with my mother, she had no ability to pay. On the 30th she also received a letter from Experto Credite stating Varde Investments (Ireland) has bought the interest of MBNA including the outstanding balance. Thus the legal owner of the account. Under the terms of this assignment Experto Credite had been appointed to recover any and all debt. (I have this letter). She replied after numerous calls and letters on the 14th august 2010 (I have this letter copy), apologising and stating the situation she is in, and her inability to pay the sums owed and how she was treated by MBNA. Eventually finances were looked on and a plea bargain was made whereby my mother and Credite Experto agreed she paid £1 per month (Amazing), from the 20/05/2011 via standing order to an assigned bank account. At the end it states "If your payments stop at any time without us agreeing, the full amount will become payable immediately. (I have this letter). She has paid this every month without fail. This never stopped them from harassing her with letters saying she has monies outstanding, but each time she referred to the agreement and never stopped paying. On the 26/04/2012 a letter was received by Aktiv Kapital stating they have purchased the account from Varde Investments. With an outstanding balance of £6,893.76. They have stated they have been advised of a payment arrangement set up with Experto Credite. And although they own the account, "you should still continue to make your payments to Experto Credite" "Experto Credite will advise us of all the payments you make so we can keep your account up to date" (I have this letter) On the 16/05/2012 Experto Credite sends a statement of account as required by the CCA 1974, stating the assigned balance is £6905.76 (This is the exact original amount stated by NBNA in 2010), paid £13... (£1 every month from since agreement) and the current balance is £6892.76. She continues to pay and receives letters of settlement offers she can't afford but no statements from Experto Credite ever again (I have several examples of offers). She next receives a letter of statement Undated for 13/01/2014-12/01/2015 as requires by CCA. Giving a opening balance on 13/01/2014 of 6873.76 and the closing balance on 12/01/2015 of £6860.76. On the letter it also states Aktiv Kapital (UK) limited changed its name to PRA Group (UK). Then saying they have been assigned the account from Aktiv Kapital. "You do not need to do anything as a result of this change. We will continue to accept payments in the name of Aktiv Kapital, So no changes of payment are needed". (I have this letter) On the 16/01/2015 a letter was received from PRA to inform that the account was assigned to them, re-stating that their name had changed. Also saying "Your existing payment arrangements are not affected by this transfer and do not need to make any changes" (I have this letter). Of course still letter are still sent saying an outstanding amount, offers which she still can't afford and calls about her balance. Her replies over the phone stay the same and she keeps paying. On the 25/01/2016 PRA sends another statement saying her opening balance on 26/01/2015 is £6860.76 payments received 12.00. Closing balance on 25/01/2016 is £6848.76. Of course the calls keep coming and she keeps to the same script. On the 03/01/2017 PRA Group sends a letter to inform her that her account has been transferred to the investigations and litigation department. Saying its a letter before claim as required by Practice Direction on Pre-Action Protocols, for intention of court proceedings. She calls them up and informs them of the agreement to which they say they haven't been sent payment.... She checks every month without fault and her last payments at the end of the year show payments go through... . She argues and yes calls them a liar. don't say why or give a reason for not getting payment. On the 05/01/2017 she gets another statement from PRA Group saying they have payments received of £11.00... . So she goes back to her last statement and sees payments are being made, to the agreed. Her statements come after the 9th of every month and is actually stated on her statements... . So she couldn't check her Dec-Jan Statement. She goes with the premise that as usual they are calling to force a new agreement or get something. She gets one more letter from PRA stating again its with the Investigations Department... . Then on the21 /02/2017 she is sent a County Court Claim Form. She still only has her house to her name and zero finance ability. So she contacts me and I look into what I can but I am no lawyer... I discover Experto Credite is now under Liquidation and her Dec-Jan Statement provides a refund of that £1.00 on ironically the 4th of Jan.... One day after???! Being informed its under a investigation and litigation department.... expert credite website shows their liquidation info. This has gone way over my legal knowledge but surely PRA was responsible for informing my mother that the company was under liquidation.. . Or that they weren't paying. .. To investigate this third party who was being paid.. .. The totals from the statements also don't match up to the statement in the claim.. .. 54 is not correct that's even less. She has only missed 1 payment because it was refunded; she wasn't informed at all of anything. This can't be fair or legal. And the Claimant in their statement has completely ignored the fact there is a payment plan in effect, that they have acknowledged this plan, stated nothing will change..... I am lost in how to put a defence down, as its unfair, even though there is no signed agreement which doesn't matter anyway apparently CCA 2006, she has always paid it. any help, identifying legislation, OFT guideline, code of practice or just how to act would be appreciated. I am getting in touch with a financial Ombudsman, Citizen Advice, then gaining statements for every single month to prove payments if it matters, I have copies of all these letters. But pretty sure in a defence you can only have like 200 characters??. And defence on what grounds.... I am truly thankful for any and all help, Wayne

- 16 replies

-

- 2017

- aktiv kapital

-

(and 7 more)

Tagged with:

-

Hi have had letter from PRA Group which says Settlement Offer - call now - valid until ....... We would like to advise you we may be able to offer you a repayment solution which could represent a significant saving on your balance. To discuss this repayment option, please a call a member of our team who will review your current financial circumstances to help come to the most appropriate solution for your account Single Payment option: Full and final settlement of £ (10%) Should you make the discounted settlement payment; your credit file will be updated to show as 'partially settled'. In order for your credit file to be marked as 'satisfied', the full outstanding balance must be cleared So this account is unenforceable and has fallen off my credit report and no payments have been made for a while but it is still some time to go before statutory barred and who knows whether things will change about its enforceability so I would like to go for the 10% payment but would like any advice - I am confused about the 2 paragraphs above - are they offering a full and final or does it depend on my contacting them Any help please - Thank You

-

I need some advice on how to proceed with PRA Group?, over the past years PRA have written to me regarding a debt going back over 7 - 8 years that is owed to Nationwide, just recently they have started writing to me again and their latest letter is not offering their usual hefty discount but instead 'Dear xxxx Could you settle your account?'. Also on their letter they state an agreement date of 13 January 2005, this was not an agreed overdraft but my bank account went overdrawn by a very small amount (just over £10 if I remember rightly) and I was hit with multiple bank charges which caused the account to go even further overdrawn which lead to even more bank charges being added on top, the amount owed according to PRA is £390. After researching the forums I sent the Statute Barred letter to PRA as I was 100% sure that no payments have ever been made by me on this account, today I received a e-mail from PRA stating 'Thank you for your query which we received on 19/05/2017 in which you advised your account has now exceeded the period specified in the “Limitations Act 1980”. Under the “Limitations Act 1980” we have six years to collect the outstanding balance and after this time the debt becomes unenforceable. This means that we are unable to pursue this through the courts. Our records indicate that the last payment made to the account was on 28/02/2017. Please be advised that this payment is deemed as acknowledgement of the debt and as such, would reset the limitations period for a further 6 years from this date. Whilst I appreciate that this may not be the response you were looking for, please be aware that we at PRA Group (UK) remain committed to working with you to come to an appropriate resolution. We have requested documentation from Nationwide. As PRA Group UK Limited do not hold the information internally, we have held your account until our client is able to provide the documentation applied for. During this time you will receive no further letters or calls.' I would like some advice regarding their e-mail as I HAVE NOT MADE ANY PAYMENTS against this debt so I would like to know where they got this date from, I have replied to their e-mail asking for details regarding this payment and I confirmed to them that I have absolutely no knowledge of this payment being made. Are they chancing their luck?

- 1 reply

-

- group

- nationwide

-

(and 1 more)

Tagged with:

-

Hello BWlegal has sent a letter dated 14th August 2017 requesting a final payment from me. I see that the debt they refer to is a closed account on my credit file and the last record on the credit file was from T/A Payday Express, (and recorded by them) showing as 'satisfied ' default assigned in January 2017. I have not paid any monies toward the debt which had a default registered from 2013 until January 2017. There have been no default notices recorded after January 2017. I have letters from Payday Express and Prac dated April 2017 saying the debt was assigned in December 2016 to Prac who use BWlegal. I hope the above is not too confusing, I do want to resolve the issue but is bwlegal entitled to be asking for payments from me? Look forward to your responses

-

Hi Name of the Claimant ? PRA Group Ltd Date of issue – 03.04.17 Date of to acknowledge - 21.04.17 Date to File Defence - by 4pm 05.05.17 What is the claim for – 1.The claimant claims the sum of £5,000 for debt and interest. 2.On X/X/02 the defendant entered into an agreement with MBNA for a Credit Card under ref XXXX. 3.On X/X/09 the defendant defaulted on the agreement with an outstanding balance of £5000. 4. On X/X/13 the debt was assigned to Aktiv Kapital who itself assigned the debt to PRA Group on X/X/14. Notices of assignment were sent to the defendant in accordance with S136 Law of Property Act 1925. 5.Payments of £600 received up to X/X/14 AND THE CLAIMANT CLAIMS 1. The sum of £4800. 2. Stautory interest pursuant to Section 69 of the County Courts Act 1984 at a rate of 8% per annum from X/X/14 to X/X/17 1000 and thereafter at a daily rate of 1.05 until judgment or sooner payment. What is the value of the claim? £6300 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit card. When did you enter into the original agreement before or after 2007? Before. Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim? PRA Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes, think so. Did you receive a Default Notice from the original creditor? Not sure but likely. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Yes probably. Why did you cease payments? Low income, family stress. What was the date of your last payment? Sometime in 2016. I set up a debt management plan to pay off debts, not successfully. Was there a dispute with the original creditor that remains unresolved? No. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan?? Yes. ..... Having looked through the threads here I can see that I am not unique in this regard. I know this debt is enforceable if PRA has the original agreement though I don't know if they do have this or not. I also realise that I have until Friday to respond to the claim. Any help is much appreciated.

-

Hello ,had a letter today from PRA saying I owed £3,900 I telephoned them and asked what is this about was told it was from a car finance debt from 2011 and not at the address I been living at for 13 years. I asked to see copies of credit agreement which the response was they did not have. after the telephone call ended and asked family I remembered having finance for a car in 2004 and that was the only one I had. Can they still chase me for that debt and why are they saying the debt is from 2011 ?

-

Hi all, new to the sight, and indeed, to debt. Had a look around here this morning, and I'm quite frankly overwhelmed by all that is concerned with debt and debt resolution, so please, bear with my ignorance! I'll try to keep this as concise as possible also. Full time employed home owner/mortgage, one active credit card with my bank which I over pay on religiously (£2k balance) so no issues there. No HP/credit, and no defaulted utilities. Wife left Dec 2015 (not divorced yet), I remain in the house and the mortgage is in my name. I'm also a lone parent to 2 boys, 6yrs and 9yrs. In Jan 2016 I got a letter from PRA stating 'my' account had defaulted on 'my' debt (from MBNA credit card) of £10278.34 and advising me I had previously to that point been paying £80pm against the amount. I had no knowledge of this until the letter landed on my mat. As you can imagine... It's come to light that my estranged wife had, over a number of years, been using one of my cards without my knowledge. The first I knew of this debt was the letter from PRA. At the time I was left financially devastated, and have spent the past 20 odd months getting back on an even keel (hence the £2k balance on my current credit card). As such, during this time, I kicked this £10278 debt 'into the long grass' as it was not my priority. Wife also owes other debt held by PRA and a number of other debt companies, and has 'bumped' many of these payday loan companies. I get regular mail in her name from people chasing her for debt. Quite the girl. I have received several more letters from PRA (last one Aug 17th 2017) advising me the matter is with their litigation/investigation/collections team, and an offer of a 'one off' discount allowing me to pay only £9250.51. They've also predictably been phoning me (assuming estranged wife gave them my number...), and also phoned daily by what has been described to me as a 'hunter' for PRA to establish if I am resident at my address. None of these calls I have answered. I am expecting a doorstep knock, as this 'hunter' is only 20 miles away. I was at the point last week of phoning them and saying, "I can give you £100pm...." but thought better of it. As I am seething that the debt I did not accrue is in my name, but yes technically it is my debt. I have no way of disproving this. I spoke to a solicitor last year who advised they could likely establish the debt was not accrued by me, but it would probably cost me £10k in their fees. As it stands then, wife had been paying £80pm to Activ Kapitol (the only thing she did concede), and stopped paying when she left in Dec 2015 (they should have knowledge her paying it over the years as it would have to come out of her account). Obviously, the status of the debt is 'defaulted'. I've paid nothing to it as I wasn't able to during this period. The only thing I have done (last week) was fill in the assessment form on PRA's website. Gin has a lot to answer for... What's my situation? What's likely to happen next? Will I end up in court/CCJ? Do I have to pay this? Should I just pay this and get on with my life? Again, please appreciate I'm all new to this. And yeah, I know, ignorance of the debt is no defence. Many thanks, Jason.

-

I received a letter from PRA Group recently which states:- Dear Mr XXXXXXXXXX PRA Group (UK) Limited ("PRA GROUP") Account Reference Number: XXXXXXXXXX We write further to the above and to inform you that your account has now been transferred to the Investigations and Litigation Department. This is a letter before claim as required by the Practice Direction on Pre-Action Protocols, to give you notice of PRA Group's intention to issue court proceedings against you. You should consider the contents of this letter carefully and seek legal advice or alternatively contact one of the free agencies detailed on the enclosed document. We specifically refer to paragraph 4 of the Practice Direction and set out in that paragraph are the courts powers to impose sanctions for failure to comply with the Practice Direction. You will recall that you entered a written agreement numbered XXXXXXXXXX on or around xx/xx/1998 with MBNA Europe Bank ("the Creditor"). The agreement was regulated by the Consumer Credit Act 1974. The agreement obliged you to make payments, however, in breach of the agreement you failed to make those payments and are now in breach of the agreement. By a notice of default the Creditor required you to remedy the breach within the prescribed period and gave notice that, in default of so doing, you would be liable to pay the monies due and owing. However, you did not remedy the specified breach within the prescribed period and you then became liable to pay the Creditor the sum of £xxxx By an assignment in writing dated xx/xx/2014, the Creditor assigned the debt to PRA Group. Then by notice in writing the Creditor and PRA Group wrote to you to notify you of the assignment. PRA Group has made further written and oral requests for payment of the sums but you have not paid the sum due and owing. If after considering this letter you take the view that you do not owe £xxxx then we look forward to receiving your reasons why you take that view plus supporting documentation. We do not presently envisage that expert evidence will be needed in this claim. This letter should be treated as an invitation to refer this dispute to medeation or some other form of alternative dispute resolution (ADR). In addition this letter triggers certain time limits that effect you:- 1. You are expected to acknowledge and answer this latter before claim by xx/12/2016. 2. You are expected to respond to the invitation to refer this matter to ADR by xx/12/2016. We look forward to receiving your letter in reply, responding to the claims made against you and / or setting out your proposals for settlement / payment. We are prepared to discuss repayment options if this assists you. If we do not hear from you within the above time limits then court proceedings will be issued against you which may increase your liability for interest and costs. If you have any difficulty in complying with the above limits please explain the problem to us as soon as possible and we will consider a reasonable request for extension. Yours sincerely Litigation manager PRA Group (UK) Limited Tonight I have done a CCA request to them which will be sent tomorrow. Is there anything else I need to do or just wait for there reply? Thanks in advance

-

Here's my summarised situation. I'd like any advice on how I should proceed now. Took out a Credit Card with MBNA in 1999 Through their unscrupulous lending, my own stupidity & intermittent mental health issues, I ran up a debt that I couldn't pay off I started to have problems meeting my minimum monthly payments in 2010, and requested a temporary interest freeze when it got really bad (thought this was 2011, but now realise it was probably 2012... further explanation below) to help me to sort our my finances. This request was ignored. After several months I stopped paying anything and prioritised other debts. Eventually defaulted in 2012 I started to get harrassed by Aktiv Kapital Over time have now been chased by PRA, another couple of agents and back to PRA At one stage, not sure when but probably 2012/13 I requested proof of the debt being owed to Aktiv Kapital/PRA?, and didn't receive that proof. At the time I downloaded a template letter to send, but not sure where from, but it included the sentence about not admitting to the debt. Due to not receiving the proof requested I didn't enter into any communication with any of these companies again. PRA continued to harrass me. I wouldn't hear from them for months and would then be bombarded with telephone calls as well as letters. I didn't answer the phone to them or respond to their letters. Over time they have offered a discount on the debt several times In June 2016 they advised by letter that they were considering passing the case to their Scottish Solicitors I received a letter from Brodies LLP in July 2016 stating they had been instructed by PRA to pursue recovery of the debt and threatening court proceedings. I panicked! I was convinced at the time that it had actually been in 2011 that I had last communicated with the original lender and sent a Statute Barred letter. I heard nothing back and when a couple of months passed with no communication I thought I had heard the last from them. On Saturday I received a letter from Brodies again (6 months later) which included a copy of my original Credit Agreement and copies of the final few months of statements of my account with MBNA showing I made a payment in August 2012. This letter states that "To avoid this matter being passed to our Court Action Team, you are required to pay the Debt or contact us to discuss a suitable payment arrangement not later than 2 February 2017" The amount of the debt being chased is £5781.16 Are they allowed to only give 4 working days for me to contact them? Are they allowed to come back to me after 6 months of no communication? Am I entitled to request proof of ownership of the debt by PRA? Should I contact them tomorrow? I am not in a position to pay this amount. Part of me says, I borrowed the money and should accept that it eventually needs to be paid. However, if there are any loopholes I can use to my advantage then I'd like to try to use them, as for the first time in 20 years I have all my other debts under control and can't believe this has come back to haunt me. I've tried to read as much as possible on other threads, but got really confused by some of the terminology being used, so apologies if I should have been able to find my answers elsewhere.

-

Hi, have just found this thread whilst trying to respond to claim forms to PRA group. I am hoping that someone can help. I received a claim form dated 19th December from PRA group for a historical debt with MBNA. I just logged on to the moneyclaim sort this out and am baffled. I had a historical debt and was making regular payments, I hadn't intentionally defaulted from these payments. However PRA group have stated that my payments stopped in June 2016 as the company (experto credite) passed the debt on to PRA group. However looking at the court documents it appears that PRA group had the debt since Dec 2014 so I can't understand why the payments have defaulted. I emailed PRA group requesting a copy of all letters but haven't heard back. Is there anything that I can do? Should I defend the charges and interest charges or just make an offer of payment?

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.