Showing results for tags 'marlin'.

-

Hi, I have been paying off an old debt to original creditor at £10/month for the past 9yrs. I recently got a letter from Nolans Solicitors telling me that Marlin have appointed them to request payment of the full amount which is over £9k, a way load more than original debt. I have noticed the original debt is no longer on my credit file I have still kept paying the £10/month to the original debtor. Can anyone advise what I should do? It was taken out about 12yrs ago. Thanks

-

Hi, I am looking for some advice please. I checked my credit file today and saw a CCJ has been registered against me in October 2017. My credit file was 100% clean in September 2017, no debt or defaults were showing at all. I am currently living in temporary accommodation due to a fire at my main residence I went to see if there was any mail that I missed. I found a letter from the county court business centre, sent in September saying that as I have not replied to a claim a judgement has been granted. The letter quotes CPR 23.8© and that the court will deal with the application to lift the stay without hearing. The accompanying paper work shows that Marlin claim that proceedings were issued on 26/05/2015 and that I failed to respond. I have lived at my current address for over 10 years and I have received no correspondence from Marlin regarding a debt or any claim form. I do not recognise the amount either. History The only debt I am aware of is an egg card from 2008 when I got in to some financial difficulty. The amount from memory was about half of what the CCJ is for (£5k). I have not had any correspondence from anyone regarding this debt since before 2010 and certainly not made any payments. As of September 2017 my credit score was perfect with no outstanding amounts or defaults. I know I can apply to have the CCJ set aside, the only reasons I have at the moment is that I did not receive the claim form, I have not heard anything from Marlin and that I do not recognise the debt amount. The delay between receiving the letter from the court on the 7th of September and now is that the letter came while I was away and in my absence we also had a house fire and lost access to the building. After seeing the default today I gained access and found the letter. Do I apply to set aside first or contact Marlin to ask for details of the debt? I am in a precarious situation because we (wife and children) are currently homeless due to the fire and I am trying to arrange a tenancy. I don't think I will pass a credit check as it stands. If I have missed any key information then please let me know.

-

I have just received a letter from Mortimer Clarke stating that they act on behalf of their client Marlin Europe II Limited asking for details of my financial circumstances for a debt that they say a county court claim was issued on April 2014. It also has a claim number at the top of the letter and if I don't respond they will lift the stay and request Judgement. I have never had any claim form for this debt and I have logged on to MCOL and there is nothing on there with that claim number. I also went on to my credit file and it says the debt they are talking about is with Cabot for a different amount. I'm not sure what to do.

-

Having received funds to pay my charging order, Marlin owe me the outstanding amount but are refusing to pay claiming they do not have enough details about me to do so. I have provided everything I can and feel as though they are trying to get as much info as possible not just what is required. Should I now issue a claim as I have spent weeks sending them more and more info?

-

Hi all, I'm being chased by Cabot / Marlin for an old credit card debt (originally an egg card). The amount is in excess of £3500 however I know for a fact that the debt is statue barred because I fell into arrears with all of my creditors in 2008/2009 after being made redundant and haven't made any payments since then. I had six credit cards back then with total debts of £30k+ and managed to get rid of five of them down the CCA route. One took me to court and eventually conceded on a technical point and two were eventually statute barred due to the time it took the DCAs to get their act together. All that remains is Cabot / Marlin. I sent them the standard statue barred template a few days ago and they responded two days later with a letter insisting that the account cannot be statute barred because the statement of account shows payments as recently as 2014. This is news to me because as I said I know that I haven't ever given them any money and haven't acknowledged any debts since 2008/2009. They included a "copy" of the statement account showing numerous payments from 2011 - 2014. This document has to be fake in an attempt to make it look like the debt is still active. The original account number doesn't match my original credit card and the opening balance is the same as the closing balance?! I'm wondering if anyone has any advice on how to proceed? My feeling is that I will need legal advice and take them to court to get this cleared off my record once and for all. Documents attached. Thanks in advance. davie_falkirk

-

After defaulting on an £18,000 unsecured Northern Rock loan they obtained a CCJ in Bradford Crown Court in July 2009. They then registered a charge on my share of our home with the Land Registry. In October 2009 I was declared bankrupt and included this loan in the bankruptcy. I have made no payments or made contact with Northern Rock or Marlin Europe since then. I was advised that the debt had transferred to Marlin Europe and they are now chasing me for payment. I have received a "notice of application for attachment of earnings order" that looks like it has come from the court but I suspect is another scare tactic from their solicitors, Mortimer Clarke. What is my best course of action? Do I need to complete the form that asks for income and expenditure details? I do not understand how an unsecured loan, sold as that and with the interest rate set accordingly can somehow become secured on my property. Does my bankruptcy not cancel this out? I would welcome any advice as the notice threatens up to 14 days in jail for not replying.

- 2 replies

-

- attachment

- charge

- (and 6 more)

-

M&S debt (preference account) - CCA Feb 2009 which produced an unenforceable application form, no terms et c - M&S were advised with no acknowledgment of debt from last activity in Feb 2009. Defaulted by M&S Oct 2009, which fell off my credit record Oct 2015. Debt was sold on by M&S in 2012 to Marlin, whom via Restons issued a court claim dated 2 December 2015, for the full amount. Sum is a little over £5k and is the same amount that the account was defaulted for back in 2009. I received the papers on 4 December 2015, I immediately acknowledged via MCOS, AOS submitted 4 Dec 2015 stating I intended to fully defend the claim. I intend to defend on basis the claim is statue barred - but need some help from you guys on how to construct and phrase my defence. Any and all comments and help greatly appreciated. Abby x

- 6 replies

-

- barred

- county court

-

(and 3 more)

Tagged with:

-

Hi Caggers, I hope you can help . . . thought I was over this lot . . . I had an egg card many moons ago along with other CC's sadly when my printing company hit the wall in roughly 2008 things of course took a turn for the worst. I managed to pay off capital, spoke to barclayshark who said, you're not in arrears so we can't do anything . . . yet . . . i also paid off MBNA and pg's with the bank. I spent almost £30k paying off those and of course there was no more cash left and no income for agreements. Clearly BC and Egg don't listen and thanks to help on here I managed to put those companies back in their boxes and for years I had nothing but the usual threatening letters from various DC's . . . and then came the Talk Talk Hack and the free Noddle credit check and this is where I noticed that my Credit Rating which in April 'ish on experian and the other one was in the green (which i was amazed at) I noticed I was a 1 out of 5 on Noddle?? clicking through I see a CCJ for over £4k and i've now found out it is Marlin and the old Egg debt . . . So what's the next step for me please? I guess contacting the local County Court to get the ruling Set Aside but what after that? I'd appreciate all the help I can get . . I was so chuffed to get a green credit rating earlier this year and now i'm being dragged back into the red again . . .

-

My friend had a loan with HFC, Marble loans in 2004. A few years ago she sent a CCA request to them but never heard anymore from them. They have been selling the debt on to various DCA over the years now they have got heavy and Restons are involved. They have said they are going to apply a Charging Order to her property. She does not have the original paperwork of the original cca request. They sent a letter before Christmas saying she had until the 22nd December to reply to their request and then they will take her to court. Not sure if things have changed now and you can still request cca or if I need proof of original letter? Should she send a SAR to HFC or Marbles Loan with a hope there is a copy of the original cca request or maybe send a new cca request?

-

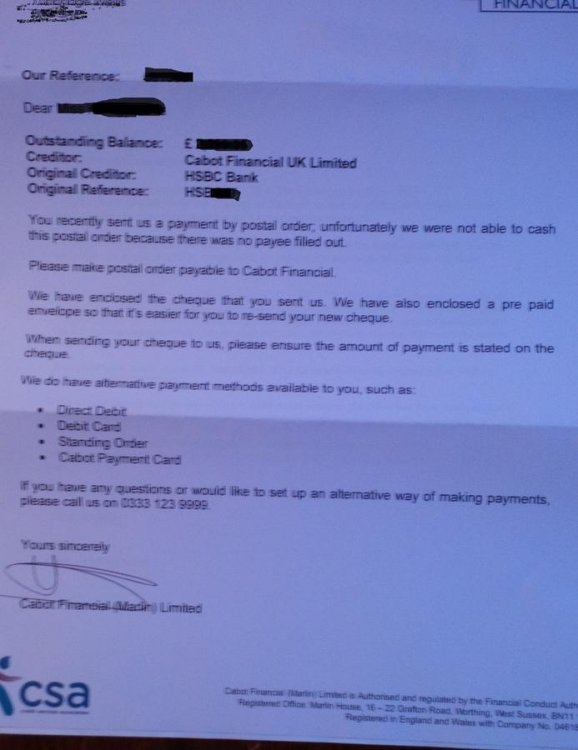

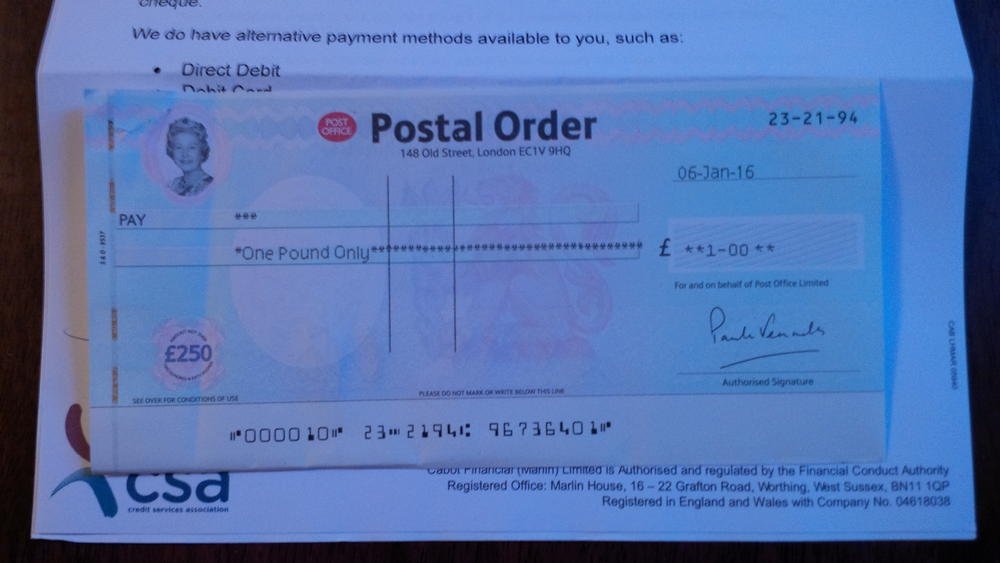

Hello everyone, Credit Card-HSBC Bank, currently with Cabot/ Marlin Account Start Date: 01/2007 Opening balance:£2700 Default balance: £2700 Date of default: 06/2010 I think this probably was an online application.. After defaulted in 2010 Metropolitan Collection Service Limited contacted me and demanded high monthly payments while I was in the hospital- everyday calls etc. .. In the end reduced payments were agreed. I was paying them reduced payments (£10 or £20 I don’t remember exactly) on monthly basis until 2013. They agreed in writing in 2013 a monthly £1 payment : Commencing Date 29/06/13 Finishing date 28/08/2096! A few months after the agreement I was contacted by Marlin (Cabot Financial) advising me to start paying them the £1 monthly and providing me with their details. Noddle currently shows owing of £2400. I was contacted by Marlin over the phone recently for a review -I explained that my financial situation is even worse than it was in 2013. They were fine-still happy to receive the £1 .They also mentioned that a full and final settlement can be arranged at 65% discount but they would consider a lower offer if I go to them with one- they said. I sent them a CCA request on 08/01/16 and a change of address letter. They have received my letters on the 9th. Today I received the following letter (file of the letter attached) advising me that unfortunately they were unable to cash the postal order because there was no payee filled out. Please see the attached letter from Cabot. Apologies for the poor quality of the file- I think it is readable. ..but if it is not let me know an I will try again. They also returned my original CCA request letter and the change of address letter??? So I guess I should return these to them. They have written on my CCA request letter with pen: 'ops req £1' and also attached the sticker for sign for service from the post office (I sent the letter recorded)... I have also attached the file of the postal order. Please tell me what is wrong with the postal order? I asked for a postal order and in the post office they told me that the best is to buy a crossed one if I am going to send it to a company, so I agreed!? I did not ask them to put a name on the postal order... Although I left the postal order completely blank at the back- Cabot has written on it my Ref number and something like a signature next to the ref. number??!!!! Please advise on the above? Very much appreciated! Uploaded PDF files -post 3 .

-

Hi, It's been a long time since I needed to come onto this site but it looks like I'm back again. I need help but really don't know if helps going to be possible now. Ok here is what's going on so far. background info For the last five weeks I have been at my mums house, I'm diagnosed with bipolar and things have been pretty bad. I've been back and forwards to the doctor to get help, their mental health clinic and 9 days ago things hit critical mass and the doctor called in the mental health crisis team who have been visiting me daily and will be for the foreseeable future. I live alone and after a massive problem with new meds given to me by the doctor I moved back to mums for my safety. I'm on yet another set of meds that at least has started to let me focus on things hence being back on here for help. My problem Arriving home I have found two letters, the first a notice of issue of warrant of control. Dated 15th March 2016. It states that I owe Marlin Europe I £804. To be paid by the 29th March 2016. Posted on the 18th March. The second letter was hand delivered I have no idea when and this is a notice of first visit, talking to neighbours there was somebody at my door earlier today but the date on the letter is the 1/4/2016. My daughter went to check the house on Saturday and said she didn't see any mail so I don't think it was delivered on Friday of Saturday. The letter also stated I have until 10am on the 6th of April to pay the amount owed. Now the bit I need help with I haven't to my knowledge had anything to do with Marlin Europe, I have no idea who they are, I also have no idea when all of this was started and have had no paperwork from the courts. I have been through everything I've received since Christmas to check to make sure I haven't missed anything. I really don't know if I have any options or do I just roll over accept it and try to come to some agreement with them, but since my income is esa at the moment they can't have a lot. I would be very grateful for any help, this has come out of the blue

- 28 replies

-

- control

- county court

- (and 5 more)

-

My sister passed away in January and before she died she absolutely assured me she had no debt or credit cards. She said I'd find it easy to deal with her affairs as she owed no money anywhere. There was some money in the estate, but when everything (or so we thought) was paid and settled I wrongly assumed it would be alright to use the money in the estate to pay bills and expenses we'd incurred moving into a flat near her to help care for her. In other words, I was the beneficiary of the estate, being her only relative. She died intestate and there was no need of letters of administration as her bank were happy to pay money in her account directly to me as her next of kin. It was a huge shock when a letter arrived for her 4 months later at her previous address (her partner opened it) from Cabot (Marlin). It seems to be a statement and says she owes £11372.27. We both in a blind panic tried to phone them but they refused to discuss until we send a death certificate. I have sent the death certificate and I assume what comes next is that they will make a claim from the estate. There are no records that I could find at her home of any such transactions, but they say original lender was HFC Bank PLC - Credit Card. It says Agreement date Jan 2000 and says Date Assigned 11th August 2010. I have no way of knowing whether 6 years have passed or whether she has made any payments, no original documents or agreements and no copy of any assignment documentation. I don't know whether the estate can request these? I feel absolutely sick about this as I was only just coming to terms with losing her! I'm assuming the worst and they will have a legitimate claim against the estate and that I will somehow have to find a way to pay the money. Can anyone advise?

-

Damn! Another one has been snapped up. Cabot Have just bought MCS - Mortimer Clarke. They have now bought all of Marlin Group. Worrying! HERE Marlin Group Own Marlin Financial Services Mortimer Clarke Solictors They were subject to the Channel 4 Documentry on Debt Collection Practices through Dispatches.

-

Can anyone help me with letter I got today? Last thing I remember about this Egg debt was when I sent Egg the CCA letters for my contract back in 2009, send both letters since they failed to respond and thought that was the end of it.

-

Please help have till Monday to file defence for egg debt have sent cpr31.14 and have attached reply

- 12 replies

-

- county court

- egg

-

(and 2 more)

Tagged with:

-

In Oct,we received ccj papers for an old debt from egg. The claimant was Marlin and the solicitors was Mortimor clarke. I sent the court paper to the solicitors in Oct with a request contest jurisdiction as we had received no warning from anyone re the debt. Not even a 14day warning letter. We heard nothing until a letter dated 23 January from solicitors saying the ccj had been awarded by default. What do I do now? Should I have sent it to the court? Have I done it wrong, anyone advise? Regards

-

Does anyone know if there is proof that Cabot and Marlin are owned by the same company and the reason for this request is I am currently helping a friend and had a very interesting call with Cabot yesterday (recorded for accuracy and security purposes) The information gleaned was to say the least interesting.

-

Hello. My wife has debts that were originally with Egg and are now being chased by Marlin. She's been paying £20 p.m. and we've had a letter saying the account is up for review and to fill in an income/expenditure form. I don't know whether or not to do this. I've read on here to just write and say I can only afford £x p.m. but is that asking for them to get awkward? Could they issue a Statutory Demand for example?

-

Have received another letter from Marlins this time wishing to let me know that since they have had no response from me they have now been instructed to move my alleged debt over to Weightmans for consideration. As it is £19k from a Lloyds loan I am expecting them to go after it heavily. I am trying to head them off and have sent a CPR31.14 to Weightmans this week as at the moment I don't know who to send the CCA request to Weightmans have already gone down the Court route for another debt so I'm expecting them to do the same with one. Is it worth sending an SAR to Lloyds as both my loans with them have ended up with Wightmans or should I wait and see what the sols come back with:?: Any advice greatly received.

-

This is for an old overdraft that may or may not be statute barred but no one will reply to me to tell me! Court papers issued, filed defence asking for all paperwork etc and proof not statute barred, Northampton then asked for some kind of form to be filled out where Restons asked for a three month stay and its now been transferred to local court and I attach what the Judge has asked for. Need some advice on what I do as this arrived yesterday and dated 26th so I guess 5 days service plus 7... .Interesting to see that Judge has a) Referred to mediation and Restons have previously put on their form before transfer that they wont enter into mediation. b) Judge has asked for us to liase, but Restons wont enter into correspondence with me at all c) The court fee is nearly as much as the claim Hopefully this will help, perhaps a mod can delete the two above please as not to confuse issues

-

Hi. I have a debt with Cabot that I have been paying since November last yr. I got a letter from Cabot and Marlin in the same envelope last year saying my debt has been handed to Marlin to administer on BEHALF of Cabot. Needless to say I just continued to pay Cabot direct not Marlin. Now Marlin have got Weightmans LLP involved also who are working on BEHALF of their client which is Marlin who in turn are working on BEHALF of Cabot. Weightmans are accepting my pay terms, however I have been paying Cabot. Sooooo my question is who the hell do I continue paying? Should I write to Marlin and Weightmans stating I am paying Cabot (which they must know anyway). Don't want to get into a long winded battle just want to pay off my debts (having a fair few others too being paid) and I know who I owe to. Should I just refer payments to Weightmans now or is their a valid legal reason to continue paying Cabot as I have been. Thanks kindly.

- 29 replies

-

- cabot

- legalities

-

(and 2 more)

Tagged with:

-

Hi Guys Im looking for some advice. I received a court claim from Northampton county court from Restons on behalf of Marlin. I completed the acknowledgement of service and request evidence from Restons which never came. I completed a defence based on I cant defend without see any evidence. The case is now stayed as reston's have not contacted the court. Reston's have now sent me a statement of account and it would seem the original lender has transferred the debt from a credit card, loan and current account into a seperate account and sold the debt. Restons have also invited me to withdraw my defence as they feel my defence has little chance of success. I'm not sure what steps I should be taking now. Should I now be writing asking for copies of the CCA for the loan and credit card? Any advice would be really appreciated. Many thanks Gnarl

-

Hi, please help. Marlin/Mortimer Solicitors have issued a county court claim against me for a overdraft with Yorkshire Bank at least 8 years old. I`m not sure if the amounts are correct its that old and don`t know how to fight it. HELP NEEDED PLEASE

-

Marlin acquired NR's loan portfolio last year. I am going to send requests into NR for copies of the original paperwork as I smell a rat. I took a personal loan (unsecured) in 2005 and defaulted on this and 3 credit cards in 2009 when I went DMP. The default wasn't recorded by NR, just an ATP until early 2013 when it dropped off of my credit history. I have 4 defaults from 2009 which expire next yr and I will make F&F on these are they are valid (I have CCA's them). I'm worried about the Marlin loan, I am desperate to avoid a CCJ or something I want a plan as to whether continue paying them £60 a month, F&F or test the validity.... Long rambling post (sorry) - my question is do I CCA/SAR or both? And to NR or Marlin?

-

Hi everyone can anyone advise me of my next steps with this problem please, here goes, In 2007 I had a marbles credit card (£250) with a hp purchase from currys think it was one of their pushy things when you took out a hp purchase? in 2008 I had a dispute with Marbles (original creditor) over some late payment charges and stopped my payments (last payment made 2nd Jan 2009) This was then passed to several dca's and a few weeks ago I had a letter fro Marlin Financal saying they were acting for Cabot Financial (current creditor) and were going to issue court proceedings if the debt was not paid in full, I sent for statements of accounts and credit agreement and 1 week ago had them returned, the credit agreement has no signature it is just blank?? And since the last payment balance then was £233 so all the rest is made up with charges. Default was made 2nd Jan 2009. Today had a letter from Marlin say that no payment plan has been offer so now they will take steps to issue court action? Any help will be great Thanks mw

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.bf2f59e5260173230834ce3ad8015900.jpg)