Showing results for tags 'instructed'.

-

So I need some advice. Long story short, I was working for a small lettings agent. I was given a company car however the owner told me to take out personal car insurance, stating that he would pay the monthly direct debit. This was the case and I was working their for a couple of months until unforntualy I had an accident in the car making it a write off. I then had to claim on the insurance, the car was paid out, after that the owner decided he didn't want me to work their anymore. I then lost my job, the owner canceled the direct debit for the insurance which then, in turn, caused Direct Line to cancel the insurance. I then, however, started receiving letters from Direct line insurance stating that I owed the £1809.71 for the rest of the insurance premium as per the terms and conditions. I ignored these letters for months, however, I am now receiving letters from Moorcroft Debt recovery LTD who have been instructed by Direct Line insurance to collect this £1809.71. I need some advice asap, I am currently not in a situation where I can pay off this debt and to be honest I don't really want to.

-

1. Date of infringement: 11/06/2016 2. Date of NTK: never received due to change of address 3. Final reminder received 10/08/2016 (first letter seen), BW Legal letter combined with Excel parking passed to BW Legal letter: 26th September. 4. No mention of Schedule 4 of the Protections of Freedoms Act 2012. 5. No photographic evidence given by Excel. 6. Excel Parking Services Ltd. now instructed BW Legal 7. My sister parked my car at Peel Centre, Stockport on a stormy/rainy day, not seeing the signs or any ticket machines with her hood up. She made purchases at H&M and left. 8. Excel is a member of the IPC 9. Letters received include a 'Final Reminder Notice' on 10/08/2016. Next letter received in the same envelope 'your account has been passed to our legal team' saying the outstanding balance is £154. Other letter - BWLegal have been instructed by Excel in relation to the Balance Due for the PCN. After not receiving any initial correspondance due to a change of address and upon moving house post has been delayed and lost frequently, I have not responded to any of these letters. I have now received this letter from Excel and BW Legal combined. Letters are still going to old address but currently on mail redirect so receiving them later than normal. Not sure what to do next, I've read on multiple sites to ignore, appeal or pay up. Any help would be great.

-

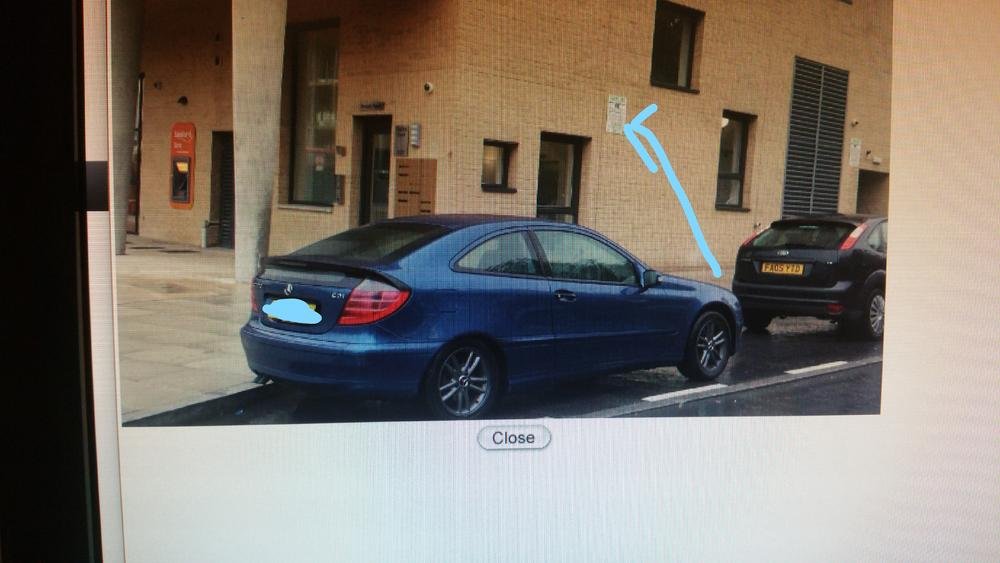

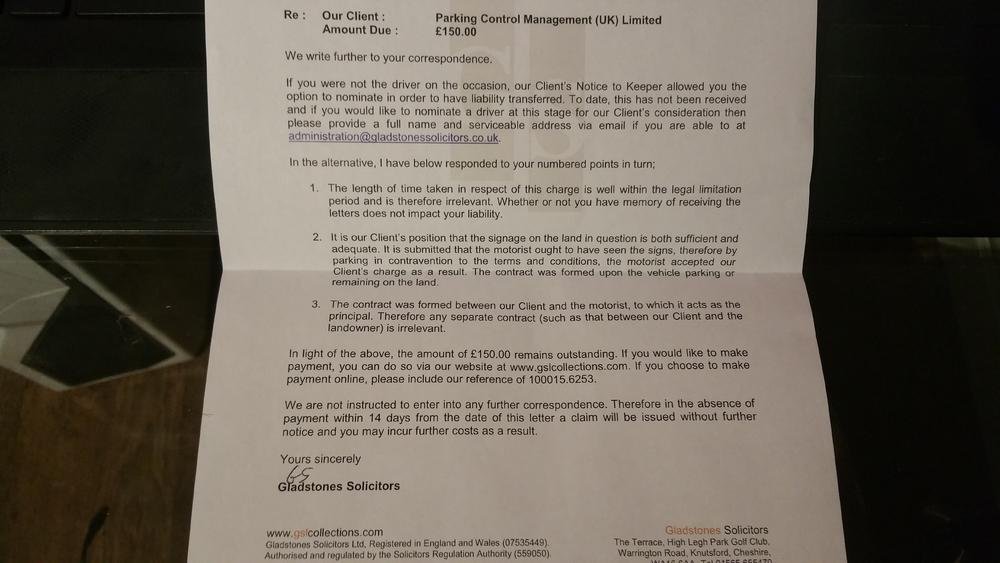

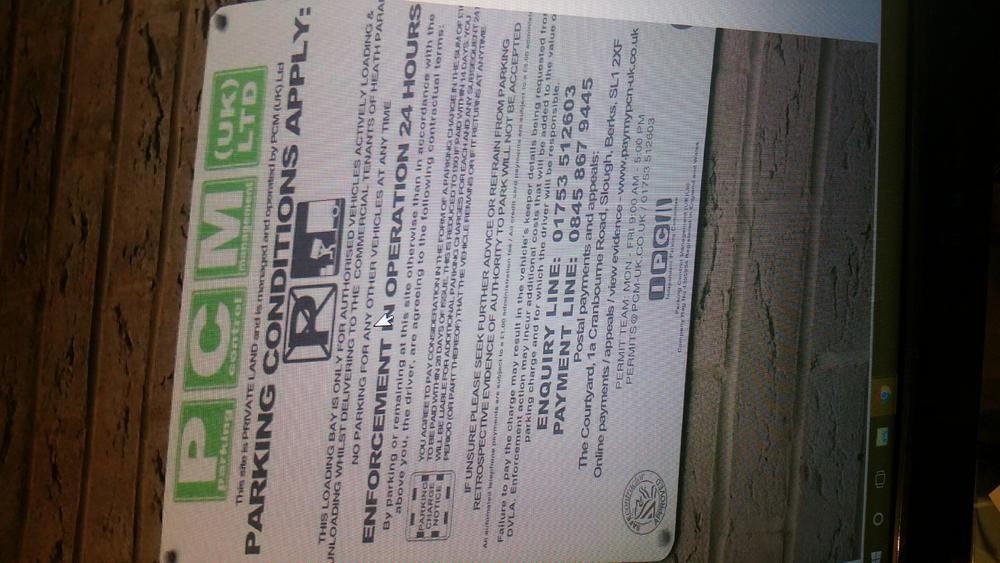

Hello everyone, thank you in advance for any help and guidance you can give, it is very much appreciated. Following receipt of a Letter before claim from Gladstones Solicitors I have responded to them disputing the claim, following a quick back and forth, I have received another letter from them stating that "they are not instructed to enter into any further correpondence...if payment is not made within 14 days - a claim will be issued without further notice" The initial parking charge notice was issued to me by post, although i have no recollection of receiving this as the alleged contravention was in September 2015, I then received the letter before claim in December 2016. 1) Details of the letter before claim are as follows: * Client - Parking Control Management (UK) Ltd. * Charge amount - £150 * Date of charge - 09/2015 * Location - Heath Parade NW9 then the usual comments about paying it 2) My initial reply to this letter is attached as parking letter 1 (after a few days research) 3) I then received the usual threat that they'd take me to court in response, not commenting on any of the points i made in the first reply - i will attach this once i find it as gladstone 1 4) i then sent another reply again making note of my points - this is attached as parking letter 2 5) Today i have received another letter disputing my points made in parking letter 2, stating that they will not discuss it with me anymore and that i should pay within 14 days or a claim will be made - this is attached as gladstone 2 Please could any of you lovely people provide me with some guidance as to how to proceed, My main argument is that the signage is inadequate and that no contract was formed, I have attached photos of the signage (photo 1) and the location of the car in relation to the sign on a wet day (photo 3) [another viewpoint is available] (Sorry for the quality, unfortunately cannot save the evidence as) A massive thank you to all that spend the time to read this, Kind regards, A rather annoyed "keeper" Parking ticket letter 1.pdf Parking ticket letter 2.pdf

- 16 replies

-

- correspondence

- enter

-

(and 4 more)

Tagged with:

-

Hi i have had a similar experience with a child minder She took me via MCOL to a county court over a debt the claim was struck out but now she has instructed bailiffs.(correction -a dca - DX) What I need to know is if the claim was struck out how come she can instruct bailiffs , has she broken any laws in doing so and can i now counter claim?

-

Hello, Thought I could do with some advice, which I have an idea anyway but would like to make sure from the people with more knowledge on this. So, couple years back maybe around 2013ish signed up to the new Gym in Liverpool pre-opening, offered the £9.99 12 month contract. All is fine fine until around October/November when I wrote a letter informing them I have now moved and wished to cancel giving 1 months' notice. They then took another payment out which I sent a further letter asking why a payment was taken but no response. cancelled DD after that so no further payments could be taken. I did have proof of receipts but unfortunately after moving they seem to have been lost in transit. Forward on a month received a text saying I missed my payment and contact the gym, which I did and informed them I have moved, asked for copies to be sent by email and so I did but no reply. Then CRS got involved and despite telling them I've moved they failed to ask for my new address and despite having my email and mobile number decided to send letters to the old address - their excuse was that they dont make phone calls:!: They also seemed to have ignored every response I made, even forwarding them copies of the letters. they've quoted me £243.xx for fees which they have so far yet to substantiate. I presume from reading some of the threads here it relates to admin charges amongst other things? I was informed that they did a trace, which failed and then decided to do a further two traces, which also failed?! (could have done a check on my credit file to find my new address). Now I have a letter from Spratt Endicott requesting payment within the next 7 days. Not sure how they have managed to rack up charges from £9.99 to £243 though?! I'm quite happy to fight this right through to court but for the sake of my time I am also happy to pay a tenner to get rid of them. Your comments would be helpful Rob

- 26 replies

-

- endicott

- instructed

-

(and 2 more)

Tagged with:

-

So, got home this evening to be told by my wife the council have instructed Bailiffs for unpaid council tax. The background to this is we were claiming housing and council tax benefit from 2010-2013. The council decided we weren't entitled to what they had paid us for the period 2011-13 last year, even though we supplied them with evidence of income each year we claimed and they approved our claim. So, they demanded £25k from us in unpaid council tax and benefits paid. This is in dispute, we were on our arses and entitled IMHO and I sent them over 100 pages of evidence to this effect around August last year. We have, as yet, heard nothing about this. We were contacted about the outstanding council tax last Oct and I rang the council and explained it was in dispute. They explained that the benefits is a separate issue but they would put the matter on hold until such time as it was resolved, we have heard nothing since. Today, my wife thought maybe she should ring the council to find out what was happening. She was directed to ring another number which turned out to be the Bailiffs. They have reviewed our income and expenditure form, which I sent to the council, which showed we could afford £100 a month, but they insist on £300 a month, no less. We have been charged over £1000 for the privilege of having this referred to the Bailiffs. Any help/advice massively appreciated!! The council is Dorset County Council

- 21 replies

-

- baliffs

- instructed

-

(and 2 more)

Tagged with:

-

Hi all, my tenant upon moving out hired a carpet cleaner to clean the carpet. The cleaner came a couple of days ago did their job and left, the carpets were still damp after 24hours and not to mention shrunk! The letting agent still has the tenants £1800 deposit and the carpet to replace is around the same amount. 1. Is the tenant able to sue me if the deposit is not returned through small claims? 2. Can I sue the carpet cleaning company as I have suffered Loss/ Damages or does it have to be my tenant whom sues the carpet cleaning company as they paid the fees/ contracted with the carpet cleaners. There is a bit more to the story but that's the main gist of it, in order to keep as succinct as possible. Any help much appreciated

-

Hi all! Sending this on behalf of my partner - She took out a payday loan with QQ she thinks back in a time of crippling debt. She owed a few things out at the time and basically ran away from them when it all became overwhelming. She borrowed £200 in July 2009 and never paid a penny towards it, fast forward 5 years and a letter from BPO Collections has landed on our doorstep this morning, acting on behalf of Motormile Finance and threatening visitors to our door. So first question is - can she request a CCA? Because this was online is it different to a normal loan where you sign something etc. If someone does come to our door, they have no rights to enter our property without our permission do they? I'm fairly certain of that. Only problem is what if some bully turns up while im at work and barges past her. Thanks in advance

- 4 replies

-

- bpo

- instructed

-

(and 1 more)

Tagged with:

-

Hello team, Returning member which needs your kind help again, thank you in advance! Today, I received a phone call and subsequent email from a nice lady from Wilson and Co telling me that they have been instructed to enforce a High Court Write against my Limited Company. None of the documentation, Notice of Claim, Judgement Form, invoices, etc. has ever been received by us. By phone, the nice lady told me that papers were served by recorded delivery to what I confirmed to the lady is our old service address. We moved to a new "virtual office" a few months earlier. (Formally changed via Companies House). We are a web based booking company and have no assets. The business address is a virtual office, we are not there, but any mail (we don't get any really) is forwarded to our home address. They don't have our home address - well I have not given it to them anyway. The debt is for a magazine advert to promote our business. The nice lady has emailed me the details of the Judgment and costs incurred, as follows: Judgment £731 Costs of Execution £111.75 Assessed Solicitors Costs £152.00 HCEO fees: £944.00 I told the nice lady that that I will communicate with her by email, she is happy to do so by email. I confirmed in writing that today is the first time we are hearing about this judgement and writ and that I am amazed at the excessive HCEO fees. The nice lady has been kind enough to tell me the cliam number and and where the judgement was obtained, "County Court Business Centre". Where do I go from here? Can I apply for Set Aside and Stay of Writ? This has got totally out of control and the fees are absurd! Do I contact the creditor, an (advertising/printing house) or do I contact the solicitors which has instructed the High Court Writ against by business or do I continue in email exchange with the nice lady at Wilson and Co.? On a different side-point, I am furious with my ex-accountant who it seems has been "signing for" important letters from the Courts and not informing me. If this is really the case, and the creditor has been sending such letters and claims packs by recorded delivery, then I will be paying my old accountant a visit and making a complaint! At the very least he should be emailing me to say he has what looks to be important letters for me, or even better, he should be refusing to sign for them and they would automatically be sent back to the creditors solicitors, whom would investigate further by either visiting my website or checking Companies House listing for the new service address. I feel like I have a case against my ex-accountant as he has helped balloon this relatively small debt, to a ridiculously large one. Back to what my next move should be? Any help and advice would be most appreciated. Thanks, Jameson

- 44 replies

-

- hceo

- instructed

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.