Showing results for tags 'further'.

-

Hi all, Just a bit of a background, I called Blackhorse on the 23rd December 2018 to check whether I had any PPI on loans that I took out many years ago. The first and most relevant was taken out in 1987 as I recently found out from them. They found I had three within 87 and 91. They didn’t indicate or tell me whether or not there was PPI on any of my agreements and instead sent out a complaint form and explain to them why I was misold any of the policies attached to each loan. I had no paperwork at the time of calling. A week later I sent back the form and gave the reasons why each were misold. Before doing this I called Blackhorse again and requested a copy each credit agreement agreement they hold on file which they said ok but still fill out the form and send it back which I did. 2 weeks after sending of the form, instead of receiving credit agreements, I was sent each loans running Statements from the opening payments right up until the last. 2 do not show an indication of PPI. But the largest and earliest loan clearly stated PPI £1637.11 included in a total amount of £15,387.78 to repay back. This is on the first page of the statement. Ive keep asking them to comfirm and they keep saying that there is a strong indication and a final response would be provided The Final response date I was given was 18th February. But I received a letter today stating they need at least another 8 weeks to fully respond to the complaint. It’s quite frustrating that they are not providing a final response. I understand there busy and that’s why they have such sufficient time provided to them under their regulations. The reason they have provided for this responses is that they are busy and it hasn’t gone to the relevant departments yet. It funny because I’ve spoken to 3 different people so far during the weeks that have gone by and they have each stated completely contradictory stages as to where the complaint currently is positioned. 2 weeks ago someone told me it’s half way, a week later someone said it’s not even been seen yet by the case handlers and now they have decided to extend for another 8 weeks. I don’t know what to believe. I’ve mentioned to them that I’m going through hardship at the moment as I’m now disabled and require funds for a needed private operation and the money would come in very handy at the right time. Is this common practice or is there something more to it? Would it be wise to take the complaint to the ombudsman? What’s the best thing to do going forward? Given that there is records of each loan, whats the hold up? Could they be passing liability onto someone else, and would have they not of done that already to address the matter ASAP? Any advice or experience anyone has with dealing with Blackhorse PPI dpt is very welcome and I look forward to receiving everyone’s responses on how to best get a reasonable response in a reasonable time. Thank you

- 12 replies

-

- blackhorse

- extended

-

(and 3 more)

Tagged with:

-

Hi everyone, any help would be highly appreciated Back in 2010 I arrived in the UK to study, me and my friends rented a flat in Brighton and I signed with TalkTalk for a broadband plan (1Year). The account was under my name and it was paying it from my personal bank account. End of 2011 I finished my studies and went back to my country, but before I do that I contacted Talktalk and told them that I am leaving and that my room mates will be paying from for this plan from now. (Kindly change the account holder to them and hereby I inform you that I am not longer responsible of this) "for sure there is no proof of this as it was a phone call" Time passed then in 2017 April I returned to the UK with my family to start my new job. Surprisingly I received a letter from Lowell demanding me to pay an outstanding amount of 240GBP for an old account related to TalkTalk. I ignored the letter as I sincerely forgot that I ever had a TalkTalk account! on the end of 2017 I relocated to the northern side of London the somehow they got my new address (I am guessing through the bank as I still use my old account since I was a student) and demanded me again for the same thing so I gave them a call and asked what is this about, they then explained that this account still under my name and it has an outstanding amount since Dec 2013. I asked what account was paying for all these payments since 2012 they explained that it was someone's else account (My room mate). I then explained that I left at the end of Sep 2011 and since then I was away, I have all necessary stamps of exits and entries on my account which validate that I was out of the UK for the past 7 years. They took all these notes from me and were very polite with me, then asked me to wait for a month or too for feedback. Today I received a letter saying that TalkTalk said the following: TalkTalk has advised us that they received change of ownership forms on 09/11/2011; however this could not be completed due to arrears on the account. They state that they received further card payments from a third party, but the name on the account was never changed Lowell then continues the letter saying that I need to pay this and that they will place this account on hold for 30 days for me to review in case they missed anything. Can anyone explain to me what is the best root to take next? As it is obviously not my responsibly to pay especially that i was not informed that the owner ship change did not happen? Bare in mind that my credit report has a note on it from TalkTalk since 2011 apparently which prevented me from taking any credit plan with any type of business in the UK since i got back and i am not quiet sure about the impact on my credit score after this issue is sorted. Kind Regards

-

I received a Penalty letter of £100 from NHSBSA all because my dentist registration lady misled me into believing that I was entitled to free dental treatment. I have gone through Stage 1 & 2 complaints procedure to no avail. Now, they have said I can go on to the Ombudsman if I am still not happy. My argument is - I was told I was entitled to free dental because I showed the lady my NHS Medical Exemption Card and asked if being diabetic, was I entitled to free dental as well? The lady said yes I was and asked me to sign the FP17FR form. I signed but didn't tick any box of date it because I didn't see any relevant boxes that applied to be. I thought she was the expert right? I haven't been to a dentist in 10 years. the next time I went was 9 months later, the same thing happened - I got the form to sign and I did but once again, I didn't tick or date the form. A few weeks later, I got a shock in the post - a penalty of £100 plus the dental charges of £56.30. phoned up and asked them what it was about - they told me I falsely claimed free dental. said I had a Medex card - they said that was not inclusive of free dental. said the dental lady said I was entitled - they said I signed the form and ticked the box and dated it. I went back to the dentist and asked why they gave me the wrong info - the owner told me I was responsible for signing the form When I asked to see the forms, I saw that the first form I signed had no tick and no date - but the second form someone in the dental surgery had actually ticked and dated the form - the handwriting was different. Then to illustrate my point - the owner and I both noticed that the first form was still unsigned and undated - and it was submitted to NHS which had rejected the payment because of that so that was why the NHSBSA didn't/haven't penalised me for that "false claim" yet. I asked for copies of the forms but the owner refused to give them to me - she said she will only give it to NHS if they asked for them. After my complaints to NHS, they spoke to the owner's husband (also an owner) and he said I was welcome to get copies of the forms. I went to get them - imagine my surprise when I saw that now, both forms had been ticked and dated - obviously the first one by someone in the dental surgery and probably resubmitted to NHS for their claim. How devious is that? After being told by me that I had been fined - they didn't ask me to pay for the dental fees for the first treatment - and instead preferred to tick and date the form and resubmit it to NHS! So now, I am left wondering, if I agree to pay £100 penalty for the second form, will it be a matter of time before the first from gets flagged up and I get another penalty? Has anyone gone on to the Ombudsman or even to court to fight their case?

-

Hi - I've recently received three letters from Lowell headed 'Pre Legal Assessment' that goes on to say they are deciding whether to pass my account(s) to their legal team. Has anyone seen these before and should I do anything? I wasn't sure if I should send the Prove it letter or CCA request. They are for CCs and a store card. I have moved since the debts defaulted and they are around 5 years old. I have a scan of the letter with personal info obfuscated if anyone would like to take a look to make sure? I know the legislation for LBAs changed recently, so wasn't sure if they are allowed to send me a court claim next or it would be better to wait for an actual LBA. Thanks for any advice.

- 37 replies

-

- assessment

- big

-

(and 5 more)

Tagged with:

-

Just had a visit from Marstons Bailiff, over a speeding fine for my partner. Once we received the letter we filled out a Star dec and sent it off. When he arrived he stated a few things. 1. Stat dec was irrelevant as it hadent been infront of a judge. 2. That he was calling a locksmith @ £100 an hour. 3. That their system says to continue with the warrent. OK I called the court, and the stat dec has been accepted and Marstons has been informed. Called Marstons who state that their system is not uptodate but refuse to call off bailiff. Speak to bailiff who says more bs and that he is again calling locksmith. I try and explain that the stat dec is valid and the court has accepted it. He says that the stat dec is not valid until I have been infront of a judge and kept asking me for a "date". Called the court again and spoke to the same woman and passed phone to bailiff, who started having an argument with the bailiff, she told him to back down as their was no warrant. Told her over the phone that he doesnt take orders from her and hung up. Spoke me to again and told me that he doesnt accept her word and will again be calling locksmith. After finding out the court has accepted the Stat dec I called marstons and said, I dont care if your system is not uptodate, that is not my problem, and that I have advised that the stat dec has been accepted. He was still outside and his final words were "Just going to my van to wait for locksmith" Now he has gone, had a good look round and cant see him. I want to take this further and make a complaint about this, I have read about taking it to the police and making a witness statement under Threats to Cause Criminal Damage, which is contrary to Section 2, Criminal Damage Act 1971. Can anyone point me in right direction please.

-

Hello Was hoping for some insight or advice on my situation. I've just checked my credit report and have found two sets of "beneficiary trace enquiries" made by Erudio Customer Management Ltd. The first ones were in mid-march against my current and previous address. Then again two months later in May, also against my current and previous address. I have read up and found out Erudio bought the old style students loans. I do have two of these. One from 1997 and then another for 1999 which has been treated as a separate account by the SLC, but must be linked as the only reason I got the '99 one was because I had started on the old system. The last correspondence about these loans was in 2013 when I applied to defer them in the March, which was confirmed in April 2013 by the SLC. This correspondence was to my old address. Then I have an annual statement from SLC dated September 2013 sent to my current address. I have not had any contact with Erudio so hadn't realised my loans had been sold. I've looked into what a beneficiary trace enquiry means and have read on the internet that it is used to trace people who have moved address without informing their creditors, however the last statement from the SLC was sent to my current address so don't know why they would need to do this, as I have kept the SLC up to date with my contact details. Also I am confused as to why they haven't made contact with me after carrying out these checks if they were searching for me. In normal circumstances I would just sit tight and wait for them to contact me but I am in the process of buying a house and am worried if this will affect it. I have checked all my credits reports and cannot find anything other than these searches. However I am scared in case between exchange and completion they put a default on my credit file, the mortgage offer gets withdrawn and we lose the deposit on the house. I have also read that they do 'backdoor' CCJs, so that's now another worry if they only have my last address could they be putting a CCJ on their without me knowing. Is there anyway I could find out about this if they were, other than waiting to see it appear on my credit report? I have a good report at the moment so would be gutted if they knackered that up for me. Not sure what is the best option. I don't want to contact them and offer to start paying as I fear extra outgoings I didn't know about when I completed my mortgage application might make them withdraw the offer. But then I don't want a default or a CCJ to suddenly turn up and have it withdrawn then, especially if its after exchange and my partner loses all their deposit money as well. Any advice on what would be the best approach, or what Erudio are likely to do next after carrying out these searches would be much appreciated. Thanks for taking time to read this.

- 21 replies

-

- action

- beneficiary

- (and 9 more)

-

Why is why Jeremy Hunt, the health secretary selling a profitable and effective company his Department of Health owns, Which save the NHS and UK Taxpayers £70 MILLION pounds a year? "On the government’s own estimates NHSP saves the taxpayer around £70m a year by organising last-minute or replacement staffing for NHS trusts" "NHSP supplies staff cheaper than those obtained through private agencies which Simon Stevens, the chief executive of NHS England, has castigated for charging “rip-off” rates." "It is thought ministers hope to realise about £50m for a 75% stake in the firm" "Madders is also concerned that if the DH finalises the sale by the end of August, when parliament is not sitting, MPs would be denied proper oversight of the deal. “This deal is being pushed through behind closed doors”, he says in his letter." https://www.theguardian.com/society/2017/jul/27/labour-demands-inquiry-into-privatisation-of-nhs-owned-recruiter?subid=19389892&CMP=EMCNEWEML6619I2 Staffline tables bid for NHS nurses agency amid privatisation row "The current NHS Professionals sale process - codenamed Project Florence - is only the latest attempt to part-privatise the staffing agency, following an aborted previous effort." http://news.sky.com/story/staffline-tables-bid-for-nhs-nurses-agency-amid-privatisation-row-10885313 NHS staffing agency moves towards privatisation "Philip Dunne, minister of state for health, in November said the partial sale was required to bring in “substantial investment” to improve and expand the service" - which currently SAVES the NHS £70 MILLION a year

-

[/HMRC are claiming that a "further information" box was ticked but there was no further information included on a child tax credit form from five years ago when my daughter was attending college and now want the payments back. I know for a fact I hadn't ticked this box as there wasn't any additional information. Could I please have suggestions as to how to deal with this?

-

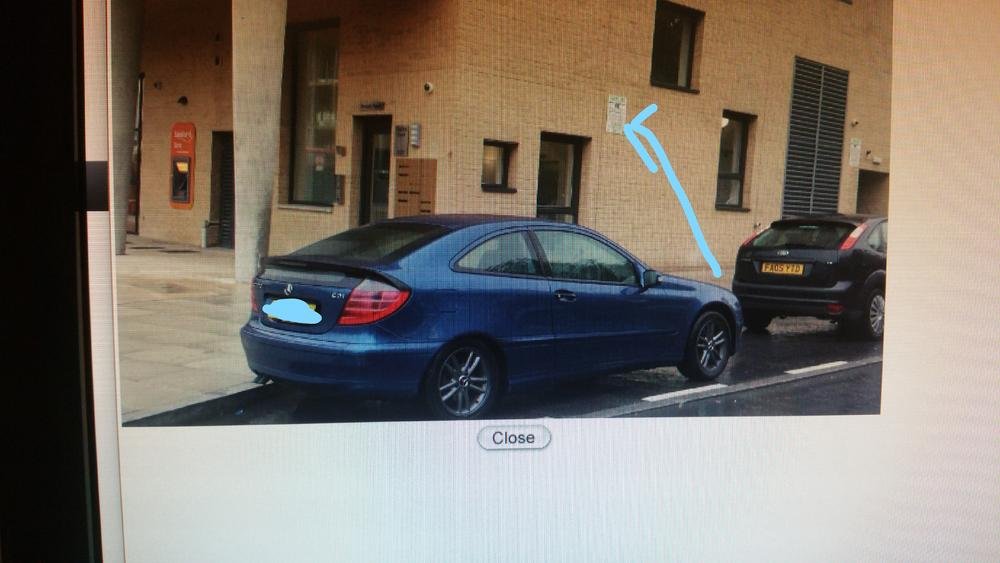

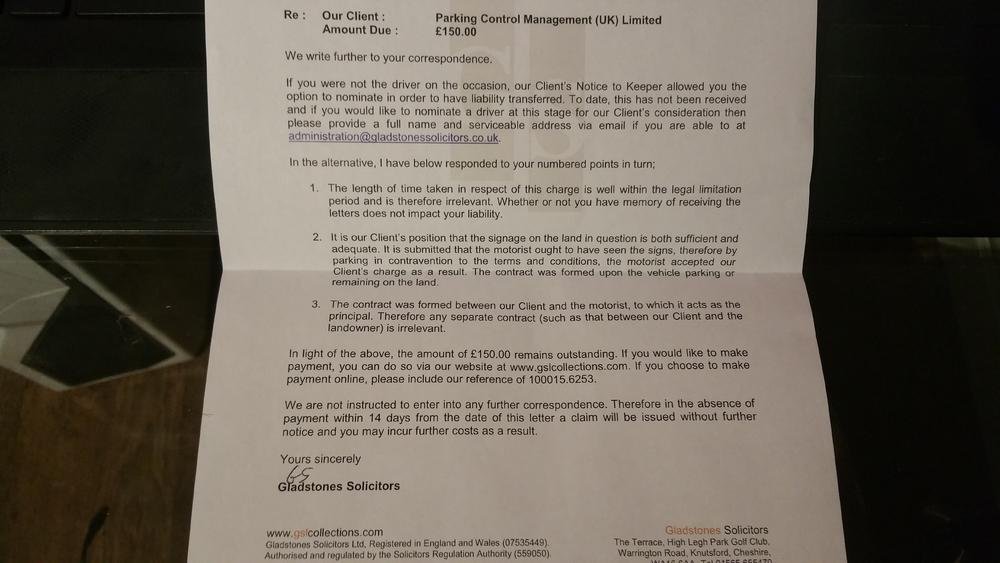

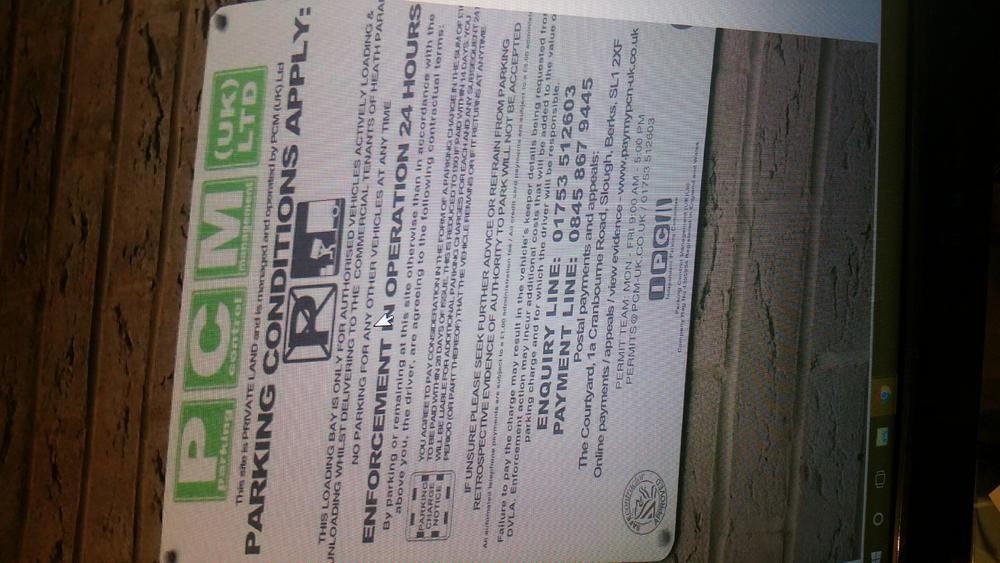

Hello everyone, thank you in advance for any help and guidance you can give, it is very much appreciated. Following receipt of a Letter before claim from Gladstones Solicitors I have responded to them disputing the claim, following a quick back and forth, I have received another letter from them stating that "they are not instructed to enter into any further correpondence...if payment is not made within 14 days - a claim will be issued without further notice" The initial parking charge notice was issued to me by post, although i have no recollection of receiving this as the alleged contravention was in September 2015, I then received the letter before claim in December 2016. 1) Details of the letter before claim are as follows: * Client - Parking Control Management (UK) Ltd. * Charge amount - £150 * Date of charge - 09/2015 * Location - Heath Parade NW9 then the usual comments about paying it 2) My initial reply to this letter is attached as parking letter 1 (after a few days research) 3) I then received the usual threat that they'd take me to court in response, not commenting on any of the points i made in the first reply - i will attach this once i find it as gladstone 1 4) i then sent another reply again making note of my points - this is attached as parking letter 2 5) Today i have received another letter disputing my points made in parking letter 2, stating that they will not discuss it with me anymore and that i should pay within 14 days or a claim will be made - this is attached as gladstone 2 Please could any of you lovely people provide me with some guidance as to how to proceed, My main argument is that the signage is inadequate and that no contract was formed, I have attached photos of the signage (photo 1) and the location of the car in relation to the sign on a wet day (photo 3) [another viewpoint is available] (Sorry for the quality, unfortunately cannot save the evidence as) A massive thank you to all that spend the time to read this, Kind regards, A rather annoyed "keeper" Parking ticket letter 1.pdf Parking ticket letter 2.pdf

- 16 replies

-

- correspondence

- enter

-

(and 4 more)

Tagged with:

-

Hello everyone at the CAG forum, this is my first post here. I'm hoping to get some advice with Marston / Collectica after a bailiff visit today. I wasn't home but they left a hand delivered Final Notice. Let me give some more information; I have a Further Steps Notice from London Collection and Compliance Centre dated 18th November, amount owed £580. I did not open and read this letter until yesterday. Around two weeks ago I received a Notice of Enforcement Distress Warrant from Her Majesty's Courts & Tribunals Service, it stated the debt was £580 but now £660. I did open and read this letter, I thought it was due to a recent CCJ from an unsecured Vanquis debt from over 3 years ago. Based on this thought, I believed this was just a normal scare tactic letter taken to the next level (bearing in mind at this point in time I had not opened or read the Further Steps Notice letter) with the belief that this was from an unsecured debt I also believed that if anything they would just send a standard bailiff to which I could just politely refuse to open to door and ask to leave, having no vehicle or property outside that they could take. The due date of this Distress warrant was 16/02/2017, 14 days after the issue date. Today (well yesterday now) 17th Feb, I arrived home to find the bailiff Final Notice letter, with an added fee of £235. At this point I decided to reread the last letter I received, the Distress Warrant. This is where I started to worry and have doubts that this was actually the debt from Vanquis. I had a look around and found some unopened letters, one of them was the Further Steps Notice. Upon reading this I soon realized it was unlikely that this was the Vanquis debt. Reading about deductions from my salary (I work myself so don't think they could apply this?), but more worrying 'issuing a warrant for your arrest' surely Vanquis can't get a warrant for my arrest issued due to unpaid debt with them? This must have come from the Magistrate's court? I got thinking, last year (I'm not sure exactly when, but now I'm guessing around April or just after) I received a council tax letter out of the blue saying I owed £200 or £300 for unpaid council tax. I live at my Mums house, and for over 15 years the council tax has be debited from her bank every month. I mentioned to her that I received a council tax bill in my name and she said it has always been in her name there must be a mistake, she said she will talk to them about it. She has always paid the council tax and never missed a payment, it comes out of her account automatically. We both thought it was strange a letter arrived in my name, she was adamant it should still be in her name and they must have sent it in error. Unfortunately she forgot to call them to speak about it, I think due to the fact she was sure it was just an error and still in her name, also a very close family member became very ill and sadly passed away late last year. I also forgot about it and did not remind her at anytime about it. Since receiving that letter I have never received another letter from the council or anyone regarding any council tax bills/debts. After all this thinking I call her and ask if she ever spoke to the council about the letter in my name and she doesn't remember it, and ys its in her name always has been. I ask if she can check her bank statements to make sure because I can't figure out what this debt is for, it can only possibly be due to this. She calls me back and is unhappy, the council stopped taking payments from her around April last year. Now I am pretty sure this must be due to unpaid council tax, even though I haven't received any other letters, I know that unpaid council tax can go through the Magistrate's court and a warrant for arrest issued if it came to it, also that these bailiffs could actually enter my home. After doing some research online I have read of people receiving the same letters but due to DVLA fines where someone has used their name and DOB. Now I am not sure if it is council tax or something worse? In the morning I plan to call bailiff on the mobile phone number he left on the Final Notice and ask him who the debt is from and hopefully find out if it is due to council tax or something else. Also no one will be home now until Tuesday or Wednesday and I will let the bailiff know this and that as soon I get back we can sort the issue out. Does he have to tell me who the debt is from, and is there anyway he can come back and enter the house whilst no one is home? Obviously we are going to call the council first thing Monday to sort out the council tax problem, we have no problem paying the back taxes that we owe, and have only realized tonight that they stopped taking payment last year. If this is due to council tax, is there anyway we could contest the added fines/payments? Neither of us received any other letters regarding council tax since the one last year in my name, no other arrears or court letters until the Further Steps Notice. If it turns out it is due to DVLA or something else what would be my next steps? I have not received any parking tickets or traffic offences other than a parking ticket on 10th October from Civil Enforcement LTD which I contested and they sent me a Confirmation of Cancellation letter confirming it had been cancelled. If its council tax there is no issue paying, I can afford to pay it but I would rather not pay the excess as I did not receive any other letters about it. In this case should I try to contest first then pay the council or courts directly, or pay the bailiff inc the excess and try to contest after? I am now worried the bailiff will not tell me who the creditor is but just try to get me to pay, then I will have to wait until Monday to contact the council or courts to find out. Thanks for reading and any advice anyone can give.

- 6 replies

-

- collectica

- distress

- (and 4 more)

-

Hi All, I could really do with some expert help here! A Bailiff visited me on 29/11/16 to collect money for an issue that i had no prior knowledge of. The bailiff told me it was for driving without insurance (something i have never done and can prove), and that is all the information i have. I want to do a section 14 statutory declaration, but have no information about the court hearing / date / court etc. How do i find this out without contacting the bailiff? I dont want them to find out im trying to stop them, and put further effort into recovering the money!! The only information i have on the final notice is a reference number and the client which is HMCTS London NW. Any ideas?

-

I have a charge order placed on my house by Bristol & Wessex Water for £1800. They recently sent me a letter stating that if I don't pay the full amount they will be taking legal action and apply for an order for sale. I then will be sent an order to vacate my property within 28 days. My house is owned outright with no mortgage and currently valued around £200K. I am living on a small private pension with no chance of paying back the debt. I went to the CAB who told me that I will end up homeless and living on the streets as there is no social housing available for single men. The Water company placed a CCJ on my credit record so it's impossible for me to borrow money to pay back the debt and keep my house. I could never understand why there were homeless people on the streets, but I do now. I will be joining them soon. What an idiot I was buying a house. If I had a council house I would have nothing to worry about and a safe roof over my head. I know a chap near here who lives in a housing association bungalow. He owes banks £73k and will not end up homeless. Comments welcome.

- 197 replies

-

- 6years

- attachment

- (and 19 more)

-

This is f....g rediculous. They mess up my calculation...let it run for years and then give me a 2 year backdated attachment of earnings. for over 800 pcm. (for one child). I had to leave my job....I got a much lower paid job and they were taking 350 for maintenance and arrears. I get another low paid job...they then accepted 250 for arrears only as the regular payments had stopped. I get another job and try to contact via email and web enquiry. No reply. Suddenly...without warning. £425 per month out of my bank account. I cant even afford my rent or electricity. And this is without travel to work costs or food. What the hell do I do.

-

Although this was first published back in December '15 I haven't seen any more on this story has anyone else? 'Ministers plan to give local councils responsibility for a £5bn benefit paid to older people who need help with daily living in one of the biggest shifts of resources within the welfare state for 25 years. The move, expected to be signalled as early as Thursday, when councils in England get news of their grant allocation for next year, has also raised fears that the benefit – called attendance allowance (AA) – could be restricted or capped. At present, AA is paid to 1.5 million people aged 65 or over in the UK, regardless of their personal means. It is seen as a vital support for hundreds of thousands who live independently but might otherwise need to go into residential care'. 'Caroline Abrahams, charity director of Age UK, said: “Attendance allowance fulfils a real need. We would be very worried if it [were] to go to fewer people as a result of any transfer.” Story from here >> http://www.theguardian.com/society/2015/dec/17/5bn-social-care-shifts-local-government-attendance-allowance and it showed up in the RSS feeds again today...

-

I started claiming in December and from 23-12-15 I wa given an 82 sanction (dismissal from work) and 2 weeks ago I had a back to work appointment but couldn't attend due to me having a doctors appointment at the roughly same time. I called up universal credit and there was a problem getting me a new appointment so they said my local job centre would call me with s new app intent which they didn't (didn't bother me I understand they're busy) I didn't get a call so called up this morning and was given a new appointment for this Thursday morning with the same advisor that spoke to me like **** previous appointment I attended (it's on another thread I posted about the advisor speaking to me like ****) and it clashes with something personal (family) and + I do t want to attend with her again (he said on the phone only sh is available. So my question is with me already being sanctioned unroll pretty much April could I still cancel this on q phone call on the morning before it? I'm interested in getting back in to work but I am not sitting in front of her again, I would rather wait for my usual advisor who he isn't available for a few weeks I was told, would be cancelling Thursday affect my sanction further or is it ov been sanctioned anyway so it would be ok? Thanks in advance : )

-

I am hoping that you well-versed guys can help me. My wife and I were married in Italy in May 2015. However, the outbound flight (07/05/2015) from Manchester was delayed for around 3 hours, then ultimately cancelled due to a fire at the destination airport (Roma Fiumicino). We were given a full refund (around £175) and the Jet2 staff were amazing in trying to help us find alternative flights. Eventually we found the last two seats on a RyanAir flight leaving the next morning from Gatwick. We hired a car (£30 +£25 fuel), a hotel (£90) and the flights (£490). I also incurred around £15 in telephone costs. I telephoned the travel insurer immediately on finding out about the cancellation, as per the terms and conditions. Upon returning to the UK we were refused any sort of compensation due to the extraordinary nature of the cancellation. I sent a forceful reply citing their lack of meaning description regarding the 'extraordinary conditions' section of their terms and conditions. Eventually, they paid up £140 as a gesture of good will under a delayed flight rather than a cancellation. However, they would not pay out on the extra costs we had to fork out just to get out of the country. It is these that were most costly and I would like to get the money back. Any thoughts?

- 4 replies

-

- airport

- cancellation

-

(and 6 more)

Tagged with:

-

I was caught shoplifting some earrings from Topshop yesterday by the LP officer. I know what I did was totally wrong and I am completely and utterly ashamed of myself. I feel dreadful and I deserve the scare they gave me. They approached me outside the shop and asked me to come with them to the holding room. When there, I admitted I had taken a pair of earrings and gave them back. The LP officer kept asking me about a gold necklace that I knew I hadn't taken so I took all my stuff out and showed them I didn't have it. I was in a real state of shock and fear and had (honestly or maybe just in fear) forgotten I had taken another pair of earrings which he had thought was a necklace. They did not get the police involved or mention the police at all. They took my photo, name, and address from my driving license and gave me an exclusion order from any of the shops in the Arcadia group. I then paid for the earrings and was escorted out. The thing I am mostly concerned about is, would they (having dealt with it in house and by giving a ban to me) bother reviewing the CCTV tapes regarding the earrings I did not give back? And then pursue further action based on that evidence? The items were only about £5 if that makes any difference. I am so so worried about this. I have never stolen before and feel totally disgusted with my behaviour. Any help would be so so appreciated. Edit - I gave back one pair of earrings and paid for them. The other pair were in my pocket the whole time so I didn't give them back but the LP officer certainly suspected/knew I had taken something else. I was panicking so much I think I just completely forgot about the other pair. It's the fact that I didn't hand these over and think it will be on CCTV that worries me about further action.

-

@npowerhelp Npower bill dispute since 2007

finaldj posted a topic in Utilities - Gas, Electricity, Water

Me and my partner have been fighting Npower since the start of 2007 and it is still ongoing. When I met my partner 2 1/2 years ago she had a token meter and one day I went to put one of her tokens in to find that she had a debt on the meter of around £860 being taken at £3.02 a week. She was unaware that there was a debt that high on the meter and told me that it should have only been around £64 from when she changed from a credit to a token meter but thought it had been paid off through the meter a long time ago. We opened up a complaint well what a song and dance that has been. customer service have not been any help. one tells me one thing and they can do this and that while another says they can't. mid 2004 credit meter was changed to a token meter with a debt on an old bill found of £64. however once the complaint was opened Npower said they need to look at the meter e.g. take it out and put in a key one as they said old one maybe broken. We then find out the meter wasn't looked at and looking further into the account the debt is actually £1680 of which they can on the old meter only put a debt on of £999 as thats all it will allow on one go. this has gone on now since 2007 to the point we spoke to a manager on the phone for an hour and she said well you must owe it. Before speaking to her 1st April gets our quartly statement december 7 to march 10 bill was £1448.99 on the 3rd of april gets a letter saying that the debt of £1500 will be taken at £10 a week and added to the token key in a few days. We as manager why it has gone up £51 and she said it could be emergency credit. but it cant be right that from 10th march to april 3rd that it would be £51 She went onto say that a warrent of exacution was sent out to force a token meter in march 2006, however my partner phoned up june 2006 to ask why there was a warrent (this was logged on computer) when she already had a meter and they came march 2006 to change the something on the meter and gave her a new card. The manager said there was a new card around that time but we would have to send that old one back in to prove our case. partner said that the old card was sent back to them in 2006 as they requested in writing to send it back which they still do now because when we went onto this new key meter they wanted our old card sending back to them. She told us to put everything in writing explain everything and the back dated statements we had been asking for over the course of 2 years for 2004-2006 and mention this managers name so they know we spoke to her. Now the other day we were told we still owe the debt they are not looking into it anymore now and if we want the back dated statements from 2004-mid 2006 they are £35 each statement which would cost us around £350 Is this right can they actually charge £35 per statement I thought under the data protection act (subject access request) We are allowed for a small fee to have copies of whatever information companies hold on you for a fee of around £10?? She went onto say that they dont have to prove we owe the money we have to prove to them we dont how the hell can I do that when they wont release the information as we haven't got electric statements dating that far back. What Npower have tried to say is that we had a credit meter in from 2004-2006 and never paid them (hence the warrent of execution to force one in march 2006) although there was already on here. They haven't answered the question if we didn't pay electric for 2 years you would have cut us off.- 40 replies

-

- complaints

- further

-

(and 3 more)

Tagged with:

-

Hello, I just received this through the post. I honestly have no idea what it for but looking at the amount it seems old. Can someone advise what I do next.

- 3 replies

-

- divison

- enforcement

- (and 4 more)

-

Hi quick bit of advice needed please. I agreed a full and final settlement with Bryan Carter solicitors acting for Lowell in Jan this year and paid the agreed amount set out in a Tomlin order. Today i have received a further demand for payment from Lowell on the same account for the difference between the amount claimed and the amount paid under the order. My understanding is the full and final settlement was just that and agreed by both parties in the signed Tomlin order. Is this Lowell trying it on ? Thanks for any advice

-

Hi, I am new to posting but not new to the site. I cam on really for a little bit of advice. I am trying to improve my credit rating. A few years ago it was terrible so I've been paying things off and not applied for anything other than this card. I was declined....however, I then received a form through the post to fill in, one of their "invitations" so I filled it in and a week later I got a call asking for my bank details as part of verification. I then got another call saying that they have trouble verifying people who use my bank and so asked for my driving licence number. I gave this and was then asked to set up a direct debit. After setting that up, I was told I was approved and offered £100 cash advance. I said yes ok I will have that and it was due to go into my account by tomorrow. However, I got a text today saying the £100 has been cancelled and to call them! I called and the lady said they need to see proof of my bank details and that nothing will be sent out to me until they can verify these. They need to see my name, address, account number and sort code. So I have just got the front page of my bank statement showing all of this information and put it into an envelope to send off. Is this usual practice as it seems very strange to me? Will this one piece of paper be enough? They said they only want to verify the details so that surely is plenty. Or is this just messing me around and then I will get declined? I've not heard anyone else say that this has happened to them before. Please respond if you can thanks.

-

I will keep my experience with Thomson holiday as brief as I possibly can. My husband and I booked a week’s holiday for 2 in Lake Garda for w/c 25th June. My sister had flown over from Australia to allow me to go as I look after my 93 year old mum so I wanted this to be a holiday to remember. I paid £2108 for a deluxe room for one week, which according to the hotel when I e mailed them prior to booking was classified as a junior suite on their website. When we arrived at the hotel the minute the receptionist showed us into the room I told her it was not a suite and was unacceptable. She insisted that it was what we had booked and could do nothing about it as our booking was through Thomsons. I argued that a room with a bed, bathroom, two bucket chairs and a small table was not a suite and, taking into consideration the appalling view of an old building with underwear hanging from the windows, I stood my ground and told her it was unacceptable. As the hotel was full I was told that the only solution was to upgrade to a suite (not a junior one!) which would be available the following day at 80 euros a night. I told them this was impossible as we were on a budget and needed the money for any excursions we may wish to go on. At that she said she would contact the Thomson rep. She was lovely but her hands were tied so I asked her to contact her Manager so that a solution could be reached. I never saw the Manager and no solution was offered so reluctantly we stayed in the allocated room for one night and then decided to pay the 480 euros to upgrade the following day. When we arrived home I wrote to Thomson on 7th July detailing my complaint about the room we were offered which they received on 9th July. No reply was forthcoming so I wrote again on 16th August requesting their comments. I received their reply dated 16th September in which they stated:- “after double checking the details in your letter along with the information we have, we believe that the room you were allocated was in fact not a deluxe room as you had booked.” By way of apology they offered me a refund of £192 – being half of the cost of the upgrade – an upgrade that I wouldn’t have needed if I had been allocated the correct room. I was delighted to receive acknowledgement that I was right about the room and replied on 23rd September copying my letter to the hotel and the Managing Director of Thomson. I am afraid I do write lengthy letters but this is the most important part of it:- You may be aware that the definition of fraud is:- Knowingly cheating someone. Also for it to be considered fraud the person being cheated must not have known it was a lie. I believe this is exactly how I was treated. I was allocated a room which I was assured by the Hotel was what I had booked i.e. a deluxe room and, as stated in my first letter, I had no way of contradicting this so reluctantly had to accept their word on the situation. Now that you have confirmed that I was allocated the wrong room, I am writing to inform you that I am sorry but I am not prepared to accept your offer of £192. As I explained in my letter my holiday was severely curtailed due to the fact that I had to pay 480 Euros to upgrade to a suite. Now I have been proved right, I feel I am fully entitled to ask for:- • A full refund of the 480 euros I had to pay for an upgrade. • Recompense for having to sleep in an ordinary room on our first night when I had in fact paid for a suite. • Postage costs currently standing at £7.85. • Recompense for the time I have spent detailing this complaint plus printer costs. • Compensation for being put through this ordeal. I presumed paying £2180 for a weeks holiday in Italy would guarantee me what I was looking for - a stress free holiday. Obviously not – I was not only stressed but ended up having to pay an additional credit card bill when I arrived home. The reply was almost immediate, dated 30th September, where they have stated ‘that they would like to increase the gesture of a refund to 480 euros in order to close this matter for me. This does represent our final offer and is instead of the £192 offered previously.’ After all that my question is should I accept the 480 euros? I don’t want to as I feel I should receive at least some of the recompense I asked for. Is it worth carrying on or should I do as my husband says and take the easy way out and accept it.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.