Showing results for tags 'mmf'.

-

Name of the Claimant ? MMF Date of issue – 12th April 2018 What is the claim for – The defendant owes the claimant £587.43 under a regulated agreement with uncle buck LLP 29/4/2013 and which was assigned to the claimant on 22/11/2013 and notice of which was given to the defendant on 22/11/2013 (debt). Despite the formal demand for payment of the debt the defendant has failed to pay and the claimant claims £587.43 and further claims the interest thereon pursuant to section 69 of the country court act 1984 limited to one year to the date hereof at the rate of 8% per annum amounting to £46.99 What is the value of the claim? £764.42 Is the claim for - payday loan When did you enter into the original agreement before or after 2007? after Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim? mmf Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes Did you receive a Default Notice from the original creditor? Possibly yes Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Not sure probably Why did you cease payments? could no longer afford payments What was the date of your last payment? 2013 Was there a dispute with the original creditor that remains unresolved? no Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? no Good Evening all. The above is what you ask for. I have spent a long time over the past few weeks/month reading other threads & posts & I believe I have proceeded correctly so far without bothering anyone. I have added pdf all the correspondence between myself & MMF Lantern & Moriarty Law. TIMELINE LETTER 21/7/17 MORIARTY LAW been instructed by MMF : Ignored LETTER 7/8/2017 MORIARTY LAW "FINAL DEMAND BEFORE PROCEEDINGS" : Ignored LETTER 4/1/2018 MORIARTY LAW "LETTER OF CLAIM" : Ignored LETTER 22/1/2018 MORIARTY LAW "FINAL DEMAND BEFORE PROCEEDINGS" : Ignored LETTER 12/4/2018 MORIARTY LAW "COUNTY COURT CLAIM ISSUED" A claim was issued against you on 12/04/2018 Your acknowledgment of service was submitted on 13/04/2018 at 17:30:56 Your acknowledgment of service was received on 16/04/2018 at 01:04:33 I sent a CCA Request to MMF on 17/4/2018 signed for received by them 18/4/2018 CPR 31:14 request to Moriarty Law on 17/4/2018 signed for received by them 18/4/2018 LETTER 20/4/2018 LANTERN postal order returned LETTER 20/4/2018 LANTERN two copies of agreements for other payday loans irrelevant to this claim LETTER 12/4/2018 MORIARTY LAW copies of STATEMENT OF ACCOUNT & NOTICE OF ASSIGNMENT LETTER 12/4/2018 MORIARTY LAW copy of agreement & electronic signature I am @ the stage of submitting my defence & I believe the due date is tomorrow 14/5/2018 by 4pm. The below is my defence : 1. The Defendant contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 2. The Claimant claims £587.43 is owed under a regulated loan agreement with Uncle Buck Finance LLP. I did not recall the precise details or agreement and have sought verification from the claimant and the claimants solicitor by way of a Section 77 and CPR 31.14 request who are yet to comply. 3. The Claimants statement regarding the assignation of the debt is denied. I am unaware of any legal assignment or Notice of Assignment allegedly served on ************ from either the Claimant or Uncle Buck Finance LLP. 4. It is therefore denied with regards to the Defendant owing any monies to the Claimant and the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreement; and (b) show and evidence any cause of action and service of a Default Notice © show how the Defendant has reached the amount claimed for; and (d) show how the Claimant has the legal right, either under statute or equity to issue a claim; 5. On receipt of this claim I requested, by way of a CPR 31.14 request and a section 77 request, copies of the documents referred to within the Claimant's particulars in order to establish what the claim is for. To date the Claimant solicitors, Moriarty Law, have failed to fully comply with this request. The claimant in an attempt to comply with my section 77 request has sent me two copies of agreements which are not connected to this claim. 6. As per Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. 7. On the alternative, as the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82 A of the consumer credit Act 1974. 8. By reasons of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief. So please I am asking & observations made: 1. As I have received the copies of the statement of account & notice of assignment, copy of agreement & electronic signature I presume I will have to change the above defence slightly or shall I just submit anyway on mcol & let Moriarty presume I haven't received docs after all not signed for by me???? 2. Have I got my dates correct for submitting.....I hope so!!!?? 3. No default notice received by Moriarty is that good for me? . 4. Two copies of agreements for other payday loans irrelevant to this claim from Lantern Thank you in advance for any help received & I will continue to update this post to help me record what I have done, so you can advise & others can hopefully gain vital info Thanks Again lizmlbundle.pdf

-

MMF - false reporting on credit file

dorabellaboo posted a topic in Motormile Finance UK Ltd/Lantern

This is an interesting one.... I have an outstanding default from MMF (now lantern – ROFL) for a payday loan last paid in feb 2012 (the loan was paid 10 fold over this was the point i said no more). The default was registered in May so its just due to be dropped off my credit file and statute barred, so I thought it prudent to down load a copy to keep on file. To be honest I haven’t really paid much attention to this one as i had bigger dragons to slay but on printing out the report I have noticed a discrepancy in the reporting with a payment of £1 showing , then disappearing, then showing in Jan , feb and march 2016 J F M A M J J A S O N D 2016 138 139 138 :-x138 138 138 138 138 138 138 138 138 2015 139 139 139 139 139 139 139 139 139 139 139 I have learnt a lot of lessons along the way so I am a meticulous record keeper at NO POINT Have I contacted them about this debt, put in a cca request or made any payments. This is blatant false reporting and also means at first glance that i have paid towards the debt, thereby acknowledging it which means it is not statute barred. I know I should let sleeping dogs lie as they have yet to action this but part of me wants to take action as it is just WRONG - is there anything I can do such as reporting them to the ICO. They are bottom feeders and use tricks like this to make so many peoples lives so miserable - i want to fight back. -

helping a friend out she's being taken to court about a old cfo loan now mmf now lantern we filed to say we fighting it and asked for all the info you need like credit agreement etc . No response off them defence needs to be in asap. But not sure on this what we need to put any help be great thanks . P.s no payment ever been made it's around 4yrs old and also when first took loan out they just increased and increased without a payment in return she also lied about working but never checked.

- 38 replies

-

- case

- county court

-

(and 2 more)

Tagged with:

-

Lantern DRS Limited (Formerly MMF) Date of issue – 11 JUN 2018. Date of issue 11 + 19 days ( 5 day for service + 14 days to acknowledge) = 29 Jun 2018 + 14 days to submit defence = 13 Jul 2018 (33 days in total) Particulars of Claim What is the claim for – the reason they have issued the claim? 1.the defendant owes the claimant £550.00 under a regulated loan agreement with cfo lending ltd dated 02/08/2013 which was assigned to the claimant on 25/08/2017 and notice of which was given to the defendant on the 25/08/2017 (debt). 2.despite the formal depend for payment of the debt the defendant has failed to pay and the claimant claims £550.00 and further claims interest thereon pursuant to section 69 of the county court act 1984 limited to one year to the date hereof at the rate 8.00% per annum amounting to £44.00 Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol)? NO What is the value of the claim? £594 + COURT FEE £60 + LEGAL FEE £70 = £724 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? PAY DAY LOAN When did you enter into the original agreement before or after April 2007? AFTER Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. DEBT PURCHASER Were you aware the account had been assigned – did you receive a Notice of Assignment? NO Did you receive a Default Notice from the original creditor? NO Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year? NO Why did you cease payments? Unknown Debt, I had a number of pay day loans around 2012/13/14 and as far as I was aware they had all been paid off in full. This has never shown up on any credit report as a missed payment or default. What was the date of your last payment? UNKNOWN Was there a dispute with the original creditor that remains unresolved? CFO WENT INTO ADMINISTRATION Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? NO Hi Guys, I have had a court claim letter through the post. I have been onto the MCOL site and completed the AOS steps. I have also just written out the CPR request and CCA request that will go in the post Recorded Delivery tomorrow. As mentioned above I am not aware that I owe any monies to CFO lending as I paid all my loans as far as I am aware. I also vaguely remember my account getting a redress from CFO in the tune of £650+ which is more than what they are claiming I owe. Any help would be much appreciated

-

hi received a court claim from mmf(lantern) dated 3.9.18 to do with a pounds to pocket loan poc it says in respect of a regulated credit agreement between the defendant and quick quid payday loans should the poc not state pounds to pocket itself . .thanks

-

Hi I have had an ongoing battle with Lantern (motormile) trying to chase for an alleged Lending Stream Debt. I have provided them with a statement from Lending Stream showing a £0 balance outstanding which they have ignored and i am now receiving threat emails from Wilkin Chapman's "Lantern Team" saying they can't discuss by email due to data protection. I have sent them the same statement i have sent to Lantern and i'm certainly not calling them. Is there a templated response to an email? This is what they sent me "Good morning Thank you for your e-mail, we can confirm that for Data Protection reasons we are unable to discuss details of the account by e-mail without verification that you are the account holder. Please contact us on 01472 253965 or please respond confirming your full name, the first line of your address, postcode and your date of birth for confirmation. We apologise for any inconvenience caused and look forward to hearing from you within seven days. Yours faithfully"

- 4 replies

-

- chapman

- harrassment

- (and 7 more)

-

Hello guys. I need some help. I received this email below from lantern. I have received emails from them over the years about this same debt but I do not know which payday loan debt this is in relation to as it doesn't even say. I'm thinking maybe pounds to pocket. I'm pretty sure this is in relation to paydays loans I took out in 2012. I need some advice because my credit rating is shot and I need to try and get it back into the green. My question is; 1) Should I finally make contact with them and ask them what this debt is in relation to? What should I say? 2) Would this debt be statute barred? Is something statute barred from your last payment to the company or from when they put a default on your file + 6 years today date? I've checked my credit report and there doesn't seem to be any defaults which match this sum. I took out a few payday loans between march 2012 and july 2012. There might be an odd one in 2013. 3) Are lantern serious about taking me to court? My last known address was 10yrs ago and my current address isn't listed on my credit report so if they did take me to court the court papers would go to my old address and I would never get them. Having a CCJ against me would cause me alot of problems in my career, so I really don't want that. 4) Should I just carry on ignoring them? 5) I probably shouldn't have gotten this payday loan and I know they can be written off with some companies. I could probably make some monthly payment towards it every month if need be as I got myself into this mess but am looking at all my options. Should I contact them about it being written off? Any other advice on what action I should take? Al help appreciated, thank you. CURRENT OUTSTANDING BALANCE: £1400.11 Dear xxxxx Our efforts to contact you are becoming exhausted as we have made several attempts to offer you a repayment solution and even a discount. In light of this we are preparing your account for one of the following possible actions: Legal Assessment – your account may be sent to our Legal partners who will assess your account to determine if legal action is suitable. If they consider this to be the most appropriate action we will inform you of the next steps. You should be aware that there may be additional costs in the event that legal action is taken. Assignment of your account to our field agents, Resolvecall who will visit you at home to arrive at a solution Assignment of your account to one of our external debt recovery partners, BPO Collections Ltd or Tenron Credit Management Ltd. We consider the above to be a last resort, and hope they will not prove necessary, but without speaking to you we are running out of options. You still have time to set a plan with us if you contact us within the next 7 days. Please click for a payment mandate should you choose to pay by direct debit or standing order for your completion. Just to remind you, you can now manage your account online by visiting If you prefer you can email us at or call us on: 0113 887 6876 to speak to one of our agents. The details needed to set your plan are: Date of 1st instalment Amount of instalment Frequency of payments Preferred method of payment Please ensure that your priority bills are up to date for example rent / mortgage, utility bills, council tax to make sure your payment is affordable. Information pertaining to this account may be registered with credit referencing agencies, this information may then be used by future lenders, landlords and employers and may affect your ability to secure credit in the future. Yours sincerely Lantern

- 13 replies

-

- action

- county court

-

(and 3 more)

Tagged with:

-

Hi, I was a victim of identity fraud in around June 2012. "Someone at the time took out loans in my name with quick quid and lending stream". It was a lot of hassle at the time ( I went through the police action fraud, recived a crime number and after a month or so I signed a couple of letters from both companies and the matter was cleaned up. I also opted at that time to put extra restrictions on anyone else trying to fraudulently take out any more loans in my name. "Let me just say that I have never ever applied or taken out any loan in my life other that a mortgage for our home that is now fully paid off". back in June 2017 I started receiving letters from MMF motormile finance now Lantern, stating that I owed them £250 for another loan from what turns out to be taken at around the same time as the other loans in 2012! I phoned them straight away and explained what had happened. But all this did was for them to send demanding letters on a weekly basis! I forwarded the police action fraud crime number from 2012 thinking that that would be the end of the matter. But all they do is keep sending me more demanding letters. Are these people above the law or what! They keep asking for very personal details e.g bank statements from 2012, my national insurance number, payslips, photo id from a passport or driving licence. I'm sure it would be reckless to send such sensitive information to a bad debt collecting company! (Do they cover their costs by selling on this very useful and very accurate information to third parties?) It would be very lucrative if they did as they would have all the information to take out a loan in my name!! What's going to happen in another few years, Am I going to get demanding letters form another bad debt company?? As much I want to clear my name I am very sceptical about about how they would use that information. I lay awake at night worrying myself to death, I am frightened about what they might do. I have been to Citizens advice bureau who just say go to police action fraud! its bonkers. If a company doesn't accept a police action fraud number and the evidence from the time of the identity fraud then they are surly acting above the law!

-

Name of the Claimant ? MMF Date of issue – 28th March 2018 What is the claim for – The defendant owes the claimant £385 under a regulated agreement with cash on go limited t/a peachy dated 27/11/2012 and which was assigned to the claimant on 07/01/2014 and notice of which was given to the defendant on 07/01/2014 (debt). Despite the formal demand for payment of the debt the defendant has failed to pay and the claimant claims £385 and further claims the interest thereon pursuant to section 69 of the country court act 1984 limited to one year to the date hereof at the rate of 8% per annum amounting to £30.80 What is the value of the claim? 500.80 Is the claim for - payday loan When did you enter into the original agreement before or after 2007? after Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. mmf Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes Did you receive a Default Notice from the original creditor? Possibly Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Not sure Why did you cease payments? could no longer afford payments What was the date of your last payment? DEC 2012 Was there a dispute with the original creditor that remains unresolved? no Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? no

-

Help please. I have defended a claim from Moriarty Law acting on behalf of Motormile Finance (MMF) received late last year. They say this is for a fixed sum loan with Lending stream. I wont go into all of the details so far, just want advice what to do next? I did all the usual requested CCA, did not receive, failed mediation and was passed to my local county court. My local court sent a form last month ordering The claimant shall by 2/3/18 file and serve upon defendant in compliance with sect 76 & 79 0f 1974 CCA all relevant info & documents. In default, the claim be and is herby struck out. I received a letter from Moriarty dated the 1/3/18 on the 2/3/18 I will not repeat what was received in the letter word for word but give you an oversight of what it entails. If you need more info please let me know, thanks. It starts by referring to the order from the court, then goes on to refer to the agreement I had entered the amounts and failure to pay etc etc Then says section 76 does not apply to an agreement that has ended as indeed is the position in your case Then says sect 79 does not relate as is for consumer hire agreements Confirms they have sent copy to court by way of filing Ask me to acknowledge receipt and enclosures. The documents they have indexed by page, document and date are Fixed sum loan agreement from LS dated 20/8/12 Notice of assignment dated 20/2/14 then 3 letters from claimants solicitor to defendant dated 25/8/17, 11/9/17 & 19/10/17 I have already picked a few flaws with this info, but need to know do I reply to them or wait to hear from local county court. Thanks in advance

- 7 replies

-

- action

- county court

- (and 4 more)

-

Just reading this forum for some help I recieved a letter from Moriarty Law about an old pay day loan stating I owe about £200. I had several pay day loans, rolling the over etc and I must have paid far more than that in interest alone. (I had a period about 5/6 years ago when i got out of control with pay day loans and most of them were settled. Wonga even wiped off my debt as they said they had made errors in their porcess) I am adding a forum post as this letter comes at a terrible time from me, I have spent the last month in hospital with my father who has been recovering from cancer and 5 operations that has left him in intesive care. (Hopefully he can pull through but I digress) I wanted to just check my actions and keep a note of what I am doing do I don't end up with a backdoor CCJ. So..... - CCA being sent to Moriarty Law with Postal Order and letter stating my address. - If they send one back I have seen mention of an irreponsible lending complaint, so I'll read up on that. Thanks for the great information, I haven't been able to conentrate and this was so clear and easy to follow.

-

Name of the Claimant ? Motormile finance uk ltd (MMF) Date of issue – 01 Dec 2017 date to file defence - 03 Jan 2018 What is the claim for – 1.The defendant owes the claimant £292.81 under a regulated loan agreement with Casheuronet LLC T/A quick quid dated 03/09/2013 and which was assigned to the claimant on 01/12/2016 and notice of which was given to the defendant on the 01/12/2016 (Debt). 2. Despite formal demand for payment of the debt the defendant has failed to pay and the claimant claims £292.81 and further claims interest thereon pursuant to the section 69 of the courty court act 1984 limited to one year to the date hereof at the rate of 2.45% per annum amounting to £7.18 What is the value of the claim? £374.99 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Pay day loan When did you enter into the original agreement before or after 2007? After - 03/09/2017 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. MMF - Moriarty Law Were you aware the account had been assigned – did you receive a Notice of Assignment? Not that im aware. Did you receive a Default Notice from the original creditor? Not that Im aware Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Illness, SSP and had to leave work due to becoming disabled. What was the date of your last payment? None made to my knowledge. Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Im sure I made a payment arrangement at the time to pay late but couldnt pay. Hi all, Today I have received a claim from Moriarty law from CCBC, for a payday loan from Quick Quid. This relates to a payday loan I took out in 2013 for £150. Around this time I was ill, in and out of work on SSP so took this loan out as a desperate need for cash. I also had outstanding loans with wonga at the time which have now been written off due to being unaffordable. Also, just logged in to acknowledge claim and i didnt notice at first but the claim is issued to a MS 2ltr16valve..... Ive been a MR for my life up until now .....

-

Hi, so like many over the past few months I'm new to this site and have received a letter from Moriaty Law stating that I owe £877.55 from a loan I took out with Quick Quid back in May 2012. As I'm already paying one debt off with Moriaty I contacted them straight away and questioned it. I probably should have posted about this earlier before taking any action, but here's what's happened so far: I've asked them to provide all/any documentation they can in regards to the load as I genuinely don't remember taking it out. There's a fair chance I did as but I'd like to see proof first. They said it was a fair request and will begin to request the documentation. They then stated that I did, in fact, pay £105.50 off the loan two weeks after taking it out (probably first pay day after getting it). They then said that MMF are willing to accept £700 as a settlement. I've tried to gaina ccess to my old email address used at the time but with no avail. I'm also using a different bank account now so have no way of checking on receiving the load or making the payment. Usually I would just begin to pay the load as I know it's my mess and I have to deal with it, but this one sounds a little suspicious after not hearing about it for years. And I also know what has happened with MMF and read multiple articles stating that £0.5 million has been written off due to unfair practices. Any advice as to what I should do next or when I receive the paperwork would be of great help.

-

Hi all, Looking for some advise. As the title says got court action from Motormile on behalf of Cash Genie. Submitted my defence quite awhile back on the 25th august and have heard NOTHING at all. The claim history when logging in stands as below Claim History Your acknowledgment of service was received on 14/08/2017 at 01:07:10 Your defence was submitted on 24/08/2017 at 21:44:09 Your defence was received on 25/08/2017 at 08:02:45 Just wondered what happens now? Did / Do they have a timeframe they have to adhere by before it gets thrown out? Just looking for advise as i haven't got a clue. Many thanks

-

Hi All, My partner took out a pay day loan agreement with Peachy on 31.10.2013 for £662. She has had sporadic bouts of employment through the following years and the debt was assigned to MMF on 3.01.2014 of which they allege they sent notice. She has been bullied by Moriarty Law and has this very week been sent a letter from them saying she has 14 days to come to an arrangement or they will apply to Northampton for a CCJ. This weekend, she has received the paperwork from Northampton CC. The solicitor has filed for the original debt of £662 plus interest of 52.96 plus their own costs bringing the total to £844.96. Currently she is claiming ESA, although she is trying to start a small business herself and would rather avoid a CCJ, she has no other debt apart from the mortgage and a car loan that is finishing this November. Do I now log on and file an AOS and then have 28 days from then to present a defence? If so, what sort of defence (I am reading through this site as I write)? Would it also be prudent to send a letter disputing the procedures followed by Peachy/MMF for providing the initial loan without taking into account all of her circumstances? I know she buries her head in the sand with these types of things and does not know which way to turn (that's not to say I am a legal expert either!). Many thanks for your help and guidance on this. PB

- 8 replies

-

- county court

- law

-

(and 2 more)

Tagged with:

-

Hi all, I was in the payday loan trap back in 2012. I had loads of payday loans, owing to a gambling addiction. Pleased to say I am clean now and repaid loads of debt. However, I had a £240 'Peachy' Loan and the debt was sold to Motormile Finance and handled by Moriarty Law. They filed a court claim against me, and I made a CCA request. They sent some stuff across, but nothing that I had signed. It went to small claims track, but we never got a mediation arranged. The case was then sent to court, with a date for Monday 20th November. I have been terribly busy with work and had some family issues, and booked today off work to compile some form of defence to take with me on Monday. However, I have just seen that I had to file any documents 14 days before court! I totally did not realise this as not been in this position before. They have said they are not attending court, but placed a case against me. Is there anything at all I can do? This company was supposedly writing off lots of debt for bad practice. I am also certain I could have had this wiped out by the FCA due to their lending behaviour (lending increasing amounts when I could not afford). Any help would be much appreciated. I feel at a loss and feel there is probably no point in even going to court as I will 100% lose now? Just to add, the original loan was £240 and they are claiming £700 now.

-

I had a letter from Moriarty saying they were acting on behalf of MMF who had *bought* a debt from WDA in 2012. I told them I had made a complaint to FOS re WDA and was waiting an outcome, which I had. Yesterday, I got home to 2 letters one from WDA who said that since some of the payday loans were from 2008-2011 they could not look at the interest and charges on them but did offer a payment of in total £382 as final settlement, which brings me to the 2nd letter from Moriarty who now say they have been in discussion with MMF and they are willing to take a payment of .. yep, £382 to settle the debt from 09/12. They have never registered this debt on any credit files and I know they cant know as its out of the timescale. Do you have any suggestions, if I take the settlement from WDA will I have to pay it straight to Moriarty, surely this proves they are all in cahoots as if we didn't know already. Does anyone have any advice for me please. Thanks

-

Name of the Claimant ? MMF Date of issue – 04/10/17 What is the claim for – 1.The defendant owes the claimant £260 under a regulated agreement with curo transatlantic t/a wagedayadvance dated 28/05/2012 and which was assigned to the claimant on 16/10/2012 and notice of which was given to the defendant on 16/10/2012 (debt). 2.Despite the formal demand for payment of the debt the defendant has failed to pay 3.and the claimant claims £260 and further claims the interest thereon pursuant to section 69 of the country court act 1984 limited to one year to the date hereof at the rate of 8% per annum amounting to £21. What is the value of the claim? 359.32 Is the claim for - Payday loan When did you enter into the original agreement before or after 2007? after Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. mmf Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes, but I couldn't be sure one way or another if notice received Did you receive a Default Notice from the original creditor? Possibly, but I no longer had it Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? I don't believe so Why did you cease payments? could no longer afford payments on my part time wage, then started full time university What was the date of your last payment? 27/07/2012 Was there a dispute with the original creditor that remains unresolved? yes. Unaffordability complaint made and declined. Has been with the ombudsman for several weeks. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? I believe so, I tried to keep up payment on just the interest for a while, but was unable. I have received a claim form from the court in relation to an old payday loan debt with wagedayadvance/mmf I made an affordability complaint and shortly after they decided I didn't have a case, have made a court claim. Before I received the claim, I took the case to the ombudsman, so have ask moriarty law to stay the case until this is complete. Ive attached my statement of account if it helps at all. What else can I do Thank you

-

Hi Guys, I just got this from MMF. CURRENT OUTSTANDING BALANCE: £1777.50 Our efforts to contact you are becoming exhausted as we have made several attempts to offer you a repayment solution and even a discount. In light of this we are preparing your account for one of the following possible actions: Legal Assessment - your account may be sent to our legal partner Moriarty Law, who will assess your account to determine if legal action is suitable. If they consider this to be the most appropriate action, we will inform you of the next steps. You should be aware that there may be additional costs in the event that legal action is taken. Assignment of your account to one of our external debt recovery partners, BPO Collections Ltd, or Themis Recoveries. You still have time to set a plan with us if you contact us within the next 7 days. There are several payment methods available to you, as previously advised we are happy to discuss together the available solutions in line with your circumstances. You can now manage your account online by visiting http://www.mmile.com/myaccount. If you prefer you can email us at [email protected]. The details needed to set your plan are: Date of 1st instalment Payment Amount Frequency of Payments Preferred Payment Method Please ensure that your priority bills are up to date for example rent / mortgage, utility bills, council tax to make sure your payment is affordable. If you are experiencing financial difficulties please be assured that our specialist team will be able to assist you. Information pertaining to this account may be registered with credit referencing agencies, this information may then be used by future lenders, landlords and employers and may affect your ability to secure credit in the future. You can contact us on 0113 887 6876 if you wish to discuss your account(s). We look forward to hearing from you. Yours sincerely Motormile Finance UK Limited (MMF) I've never heard of them or any debts witht them?

-

Hi 10 days ago, I get sent an e-mail from MMF saying my debt is being referred to Moriarty Law. Ummm, OK then. I replied saying, "I have no knowledge, please provide agreement etc". 4 days later, I get e-mailed a copy of an agreement from Wageday Advance. The signature is dated 23 November 2012 and the credit limit is £120 I then asked for statement of account, breakdown of charges and notice of assignment. On 23 March, I get a very simple breakdown saying the loan date is 1 May 2013 and the original loan value was £330 Those two don't match. I asked if this debt was included in the redress scheme arranged between MMF and the FCA and was told it wasn't. On Friday, I asked for the complaints procedure and for all debt collection activities to be halted; I got that today. I will be asking for this debt to be included in the redress scheme and for all current and future collection activities to cease. All I can say is, if you get an e-mail from MMF chasing debt ask for proof and lots of it.

-

Hello all, I have received a county court claim form from Moriarty for an old payday debt from 2011(not quite statute barred yet) I have acknowledged the claim and need help with a defence please. The original loan was from Speed loan finance, I recall making one payment via direct debit but nothing more. I have never received an assignment notice from Speed loan and all I got from mmf was the standard threats and phone calls. Who should I contact to see if they can supply any written proof of this loan? Or should I just admit defeat and pay up? Thanks in advance for your help.

-

Hey CAG, Hopefully someone can help me out with this issue. I just got a court letter issued 27th of June from MMF via Moriarty Law looking for payment from a payday loan taken out in 2011 from wageday advance for just over £400 (The claim was filled with the Northampton County Court). I went online and responded to the claim with an acknowledgement of service, however I can see that I am over the 14 days I had to respond to the initial claim and now I am a little worried that they may have already filled the CCJ. I want to defend the claim as I am 80% sure they took the money out of my account (even though I had no overdraft facility) from LloydsTSB which left me with a debt with the bank. However it's been over 6 years from the initial default with wageday, I've moved a number times since then, and Lloyds and TSB are now two separate entities so it's doubtful I have the proof of this. I am hoping someone on here could help me with what type of response I should issue to the court, or to any of the claimants specifically? I really don't want a CCJ (who does) and I've recently got on top of some really bad debts so this would be a major blow to my credit. If someone could help me out, I'd be eternally grateful. Thanks!

- 54 replies

-

- county court

- issued

- (and 6 more)

-

Hi all, new to the forums but a familiar problem. It appears to be for a loan in 2013. Apparently its going to court 14 days from the date of the letter (29/12/17 dated) leaving me short of time. There is no mention of it on my credit file at all. I do not want to contact either company without first knowing the best way to do so. I also don't want a CCJ. I tried to upload the letter but the function isnt working for me. Any further information required?

- 3 replies

-

- county court

- law

-

(and 3 more)

Tagged with:

-

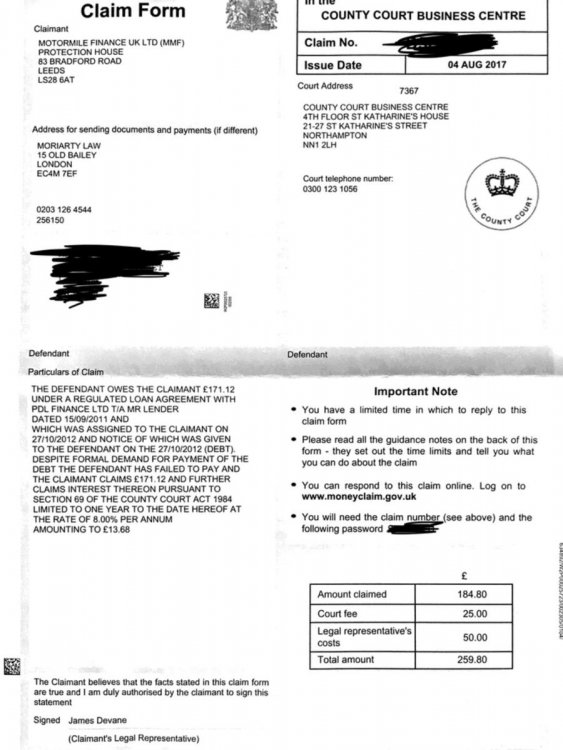

Hi Guys, I had a Mr Lender loan a good while back, for only £184. I believe it was nearly statue barred. (Screenshot of noddle report attached) However, yesterday I received from ‘Moriarty Law’ (also attached) and today a County Court Claim form (this is also attached). I’m unsure how to proceed and would really apreaciate the groups advice. Many thanks.

- 56 replies

-

- arrived

- county court

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.