Showing results for tags 'motormile'.

-

Hi I have had an ongoing battle with Lantern (motormile) trying to chase for an alleged Lending Stream Debt. I have provided them with a statement from Lending Stream showing a £0 balance outstanding which they have ignored and i am now receiving threat emails from Wilkin Chapman's "Lantern Team" saying they can't discuss by email due to data protection. I have sent them the same statement i have sent to Lantern and i'm certainly not calling them. Is there a templated response to an email? This is what they sent me "Good morning Thank you for your e-mail, we can confirm that for Data Protection reasons we are unable to discuss details of the account by e-mail without verification that you are the account holder. Please contact us on 01472 253965 or please respond confirming your full name, the first line of your address, postcode and your date of birth for confirmation. We apologise for any inconvenience caused and look forward to hearing from you within seven days. Yours faithfully"

- 4 replies

-

- chapman

- harrassment

- (and 7 more)

-

Hello, ive had a claim from mmf for an alleged debt to lending stream, ive sent the cca and cpr requests and logged into mcol to prepare my defence, which I think is due in next two days?? details as follows. Name of the Claimant ? motormile finance Date of issue – 16/10/2017 What is the claim for – 1.The defendant owes the claimant £217.50 under a regulated loan agreement with lending stream ltd, dated 23/07/2013 and which was assigned to the claimant on 23/12/2014 and notice of which was given to the defendant on the 23/12/2014 (debt). 2.despite formal demand for payment of the debt the defendant has failed to pay and the claimant claims £217.50 and further claims interest thereon pursuant to section 69 of the county court act 184 limited to one year to the date hereof at the rate of 8% per annum, amounting to £17.40 What is the value of the claim? £309.90 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? payday loan/ lending stream When did you enter into the original agreement before or after 2007? after according to claim, 2013. Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. mmf Were you aware the account had been assigned – did you receive a Notice of Assignment? no Did you receive a Default Notice from the original creditor? no not that I recall Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? no not that I recall Why did you cease payments? alledged date is 2013? What was the date of your last payment? 2013 Was there a dispute with the original creditor that remains unresolved? no, don't recall Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? I may have done as this is the year my husband and I split up so really am unsure. my defence?? Particulars of Claim 1.The claimant claims payment of the overdue balance due from the Defendant under a contract between the defendant and lending stream? Motormile finance? 2. The defendant did not pay the instalments as they fell due & the agreement was terminated. 3. And apparently its been assigned to the claimant, for the sum of £234.90 with possible court costs = total £309.90 Defence The Defendant/s contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 1.Paragraph 1 is noted I have in the past had a contractual relationship with lending stream, however the claimant fails to reference any agreement number on which it claim relies upon and fails to comply with CPR 16.4. I have requested the claimant verify the exact details of this claim by way of a CPR 31.14. The claimant has refused to provide me with a copy of the agreement, stating they are not obligated to do so by virtue of the consumer credit Act 1974. To date, no statement of the alleged account has been received. The claimant has failed to provide any evidence of agreement/contract/breach as requested by CPR 31.14 and a Section 78 request. 2.The Claimant alleges that I the Defendant did not pay the instalments as they fell due. The claimant is put to strict proof to evidence such breach by way of a Default Notice pursuant to CCA1974 section 87 (1) 3. Paragraph 3 is denied. I am unaware of any legal assignment or Notice of Assignment allegedly served pursuant to the Law of Property Act and Section 82A of the consumer credit Act 1974. The Claimant has yet to provide a copy of the Notice of Assignment its claim relies upon. Therefore the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreement/contract; and (b) show how the Defendant has reached the amount claimed for; and © show how the Claimant has the legal right, either under statute or equity to issue a claim. 5. As per Civil Procedure Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer credit Act 1974. 6. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the money claimed. do I also add this new part now for this claim? The Claimant has not complied with paragraph 3 of the PAPDC (Pre Action Protocol) Failed to serve a letter of claim pre claim pursuant to PAPDC changes of the 1st October 2017.It is respectfully requested that the court take this into consideration pursuant to 7.1 PAPDC. thank you for any help and id appreciate if someone could let me know if this defence is ok to submit today? thankyou again

- 14 replies

-

- ccj

- ledningstream

-

(and 1 more)

Tagged with:

-

Hi all, Looking for some advise. As the title says got court action from Motormile on behalf of Cash Genie. Submitted my defence quite awhile back on the 25th august and have heard NOTHING at all. The claim history when logging in stands as below Claim History Your acknowledgment of service was received on 14/08/2017 at 01:07:10 Your defence was submitted on 24/08/2017 at 21:44:09 Your defence was received on 25/08/2017 at 08:02:45 Just wondered what happens now? Did / Do they have a timeframe they have to adhere by before it gets thrown out? Just looking for advise as i haven't got a clue. Many thanks

-

Name of the Claimant ? motormile finanace u ltd Date of issue – 22 nov 2017. What is the claim for – 1. the defendent owes the claimant £200 under a regulated loan agreement with ariste holding ltd t/s cash genie dated 16/06/14 and which was assigned to the claimant on 27/04/2016 and notice of which was given to the defendant on the 27/04/2016 (debt) 2.Despite formal demand for payment of the debt the defendent has failed to pay 3.and the claimant claims £200 and further claims interest thereon persuant to the section 69 of the county court act 1984 limited to one year to the date hereof at the rate of 8.00% per annum amounting to £16 What is the value of the claim? £300 rounded figure Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? PDL When did you enter into the original agreement before or after 2007? after Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. - debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? no Did you receive a Default Notice from the original creditor? no Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? no Why did you cease payments? no knowledge of debt What was the date of your last payment? not applicable Was there a dispute with the original creditor that remains unresolved? Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? no, first I knew of the debt was a letter from Moriarty law 2 weeks ago.. I sent them the prove letter via email to their official email address and got no response Hi, I received a county court claims form this morning for an alleged payday loan debt... The OC was Cash Genie, the claimant Motormile Finance and the solicitors are Moriarty Law.... .I did take out a couple of payday loans back in 2013, but have no genuine knowledge of this one..... ....I received an LBA (or what I thought is one) from Moriarty Law a couple of weeks ago, I emailed them the 'no knowledge of debt/prove it' letters but received no response from them until the claim for arrived this morning. .....I'll acknowledge later on today and will be defending all

-

Hi, am receiving emails and letters from Motormile Finance with regards to a QQ payday loan. Just looking for some help on how to deal with them. I have heard some debts come under the CCA and if they cannot come up with a contract then they cannot pursue? iS this correct? Any advice much appreciated.

-

Hiya, Not posted on here for quite some time but looking for some advice in how to deal/respond to Motormile Finance. I have today received 4 emails (differing amounts from PTP loans when I was struggling and lost my job) threatening legal assessment by Moriatary Law unless I contact them with 7 days. The last contact I had with MMF was in June 2014 when I sent the template doorstep collection letter then sent the below one. I believe all the debts could be statue barred now (as think they were 2010 but going to double check) and have been working hard to clear my credit file of my other priority debts (credit cards, utility arrears etc) rather than concentrating on the payday loan people and almost back to normal so could really do without anymore black marks on it. Does anyone have any further advice/guidance that maybe useful? Thanks in advance.... I do not acknowledge any debt to you or any other company or organisation that you claim to be representing. I am writing in response to the numerous emails I have received from your company that is practically bordering on harassment even though I have responded to each one individually but then been replied to by your companies generic response. I would question are you not receiving them, if so would suggest you monitor your company email policy more carefully. I request the following from your company : An original copy of the credit agreement you are alleging I owe and statement of account you are alleging All correspondence to be sent to be by post through Royal Mail only Full comments on your company’s breach of the data protection act by giving details of the alleged debt over email without relevant permission Reasons why you believe interest can be added to the alleged debt Reasons why you believe a default can be added to my credit file over this alleged debt Please take further note that I do not wish to make any appointment for a home visit and that I revoke licence under English common law for you or your representatives to visit me at my property and, if you do so, you will be liable to damages for a tort of trespass and action will be taken, including but not limited to, police attendance.

-

The amount that CFO were claiming was £940 - Motormile are now claiming £32.67. I probably will pay this to bring the matter to a close. OUR REFERENCE: M4591793 CURRENT OUTSTANDING BALANCE: £32.67 Welcome to Motormile Finance UK Limited (MMF). Dear xxxxxxxxxxxxxxxxxxxxx We write to inform you the CFO Lending Limited was placed into administration on the 6th of April 2017. Paul Boyle and David Clements of Harrisons Business Recovery and Insolvency Limited, were appointed joint administrators and your CFO account 223644 has now been sold to Motormile Finance UK Limited (MMF). Click here to download your goodbye letter from CFO Lending, please note you will need to enter your date of birth. Whilst the conditions of your account will not change we are pleased to advise that, upon purchasing your account, we have removed any remaining interest, fees and charges from the original agreement. The balance noted above is therefore now your original loan amount less any payment you have already made to CFO Lending. We have allocated a new reference number (shown above). If you have more than one account with us, the customer reference number should now be used in all future correspondence or contact with us for all of your accounts. Please find a breakdown of the accounts you hold with us below: Original Lender Name Reference Amount Outstanding CFO Lending 223644 £32.67 The transfer assigns all of CFO's rights as the owner to Motormile Finance UK Limited. Your legal rights will not be affected by this transfer and future contact should be made directly to MMF. The effect of the legal assignment is that MMF now own the debt and perform all obligations as stated in your agreement, this includes the collection of any outstanding balance. We wish to ensure the smooth transition of your account to us and using our expertise, our intention is to understand your current financial position and agree a suitable repayment plan that is affordable based on your circumstances. You can securely manage your account online by visiting and follow our simple registration process. Alternatively, you can complete a payment mandate here and return to or to discuss your payment options please contact us on 0113 887 6876. If for any reason you believe any of the information we hold for you is incorrect, you should let us know immediately. Your statement of account will follow shortly, we look forward to hearing from you within the next 7 days. Yours sincerely Motormile Finance UK Limited (MMF) Please note: if you choose to communicate with MMF by email, unless otherwise advised by you, we will accept this as your consent to use your personal details to contact you by electronic means (email) with information about your account(s) which may include collections activity, negotiations and other services and products. We are authorised and regulated by the Financial Conduct Authority in respect of consumer credit regulated agreements. MMF is the trading name of Motormile Finance UK Limited, a company registered in England and Wales with company number 06637307. Our registered office is Protection House, 83 Bradford Road, Leeds LS28 6AT. EmailID:[3055189]

-

Hope you guy's can help...as a long time follower i need some assistance! Received a claim from Northampton in May and defended using these forums. usual from MMF saying we are going to defend and CC saying this is now a defended claim etc Late June received a letter from court saying we acknowledge your defence and copy served on claimant and that they have 28 days to respond otherwise stayed. Now i was waiting to hear back from court re mediation etc ..heard nothing. Today though received a letter from county court. ..general form of judgement or order saying i have been sent a notice of proposed track and allocation which specified a date to complete and return. I haven't received this form. It gives me 7 days to comply otherwise i'm stuffed. I was doing well but need some help now!!!

-

Name of the Claimant - Motormile Finance Date of issue – 28/04/2017 Date to acknowledge - 16/05/2017 Date to defence - by 4pm 30/05/2017 What is the claim for? 1.the defendant owes the claimant £100.00 under a regulated loan agreement with ariste holding ltd t/a cash genie dated 30/05/2014 and which was assigned to the claimant on 27/04/2016 and notice of which was given to the defendant on the 27/04/2016 (debt). 2.despite formal demand for the payment of the debt the defendant has failed to pay and the claimant claims £100.00 and further claims interest theron pursuant to section 69 of the county court act 1984 limited to one year to the date hereof at the rate of 8.00% per annum amounting to £8.00 What is the value of the claim? £183.00 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Payday loan When did you enter into the original agreement before or after 2007? After 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim? Motormile Finance Were you aware the account had been assigned – did you receive a Notice of Assignment? Not that she remembers. Did you receive a Default Notice from the original creditor? Not that she remembers. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Not that she remembers. Why did you cease payments? Couldn't afford the repayment What was the date of your last payment? No payments ever made. Was there a dispute with the original creditor that remains unresolved? No. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No I am assume its another case of Acknowledge service and send out a CPR and CCA? Ahoy, Well, after fending off two Lowell cases this year already she has now had one for Motormile Finance. Not a good year for her. I wonder what has made them all come out of the woodwork and try shenanigans. She claims to have no recollection of this particular debt although she had a few payday loans and I know the same companies trade under various different names said she had a letter or two from MMF and it made no mention of the original creditor. I looked into this one (Cash Genie) and see they ceased trading 3 months before this debt was assigned and there are a lot of debtors making claims against them and getting refunds from them (the website for them listed how to claim). I struggle to see how anyone with a degree in Law can have such bad grammar and presentation when it comes to these claims or if its done by random spods how they can allow them to do so in their name.

-

Hi, I am looking for advice regarding a claim form I received on March 17th. I have acknowledged the claim and opted to defend all, details of the claim below with comments further below. Claimant - motormile finance Adresss for sending docs - Moriarty Law Particulars : The defendant owes the claimant £728.40 under a regulated loan agreement with Northway Broker Ltd dated 29/05/12 and which was assigned to the claimant on 06/04/2014 and notice of which was given to the defendant on the 06/05/2014. Despite formal demand for the payment of the debt the defendant has failed to pay and the claimant claims £728.40 and further claims interest Theron pursuant to section 69 of the county court act 1984 limited to one year to the date hereof at the rate of 8% per annum amounting to £58.27 Total plus court fees etc. £916.67 I did have PDL issues a few years back but none of the companies mentioned above ring any bells with me at all. I have had letters from Moriarty Law over the past few months which I disregarded as I'd never heard of them or the debt they were claiming for. Advice on further steps would be appreciated? I have also read on other forums that motormile finance had regulations jumping all over them for bad practices? Thanks for reading, Jellybean

-

Morning All I have just got back from a business trip (been away 6 weeks). On opening my post I have come across a Claim Form (Northampton Court) filed by Moriarty for the Claimant (Motormile). Debt is for 859.33 plus interest (928.07) plus court fee (60.00) plus legal rep's costs (70.00) - total 1058.07. Can someone please help as to how I should respond because I believe as this was issued on 15 August I have very little time to do anything about it. I had been getting letters from Motormile and then Moriarty for a while but have ignored all. Worried!!!!

-

Hello - I am new and clueless so thank you to this site and to any who respond for any help. I have received a letter after several previous horrible threats from the same stating that they have initiated a court claim. Assuming they are telling the truth and the claim arrives soon is there anything I should do now or should I wait to make a post when it arrives? Many thanks

- 99 replies

-

- county court

- law

-

(and 3 more)

Tagged with:

-

I have received a letter today from MMF, which states the following: Dear (me) Outstanding Balance £xxxx As you now have more than one account with us you have been allocated a new customer number which you should use in all future correspondence with us for all your accounts. This will remain as your reference for all dealings with MMF giving us, and you, a single customer view of your MMF accounts. You will find the breakdown of your accounts enclosed. (it's four payday loans) To remind you, we will not ask you to pay more than you can afford, we will remain flexible and only set a repayment plan that is in line with your financial circumstances. 4 steps to an easy repayment plan: 1. Work out how much you can afford 2. Think about the frequency of your paymentns and your preferred method of payment from the options on the back of the letter 3. Contact us on 0113 887 6876 to speak to one of our experienced agents to set your payment plan or 4. Complete the enclosed payment mandate form then return to [email protected] along with you completed income and expenditure form (it isn't enclosed) or alternatively return them in the enclsosed envelpoe (nor is this) You may even be eligible for a discount to assist in clearing these accounts sooner and still be able to spread the repayments. If you are experiencing financial difficulties don't let this stop you, as we have a specialist team equipped to understand and deal with your circumastances. Please note we have highlighted (they haven't) that one of your accounts has exceeded the Statute of Limitations period which mean the period for court action has lapsed however this account still remains payable. Please could you advise what I do now? None of the four payday loans is on any of my credit files, and they are all, to my knowledge, from at least five years ago. The last dealing I had with MMF was a spate of aggressive and threatening texts and calls to my mobile telling me they were turning up at my workplace TODAY if I didn't pay them - they didn't, of course, and I now have a new phone that means I can block numbers so this is the first I've heard in at least two years. Ignore? Or send some kind of response? Thank you in advance!

-

I have just checked my credit file today - having not checked it for months as ive not needed to and found a default in july 2016 placed on there by Mototmile Finance!! I was shocked. After some investigative work I now know it was a cash genie loan from 2012, which defaulted in 2012!! There is no mention of cash genie on my credit report at all. There used to be but it was removed last year, i'm not sure why but might have been when they went into liquidation?? So i thought that was the matter over......and now Motormile have put a fresh default on there?? I know they are currently carrying out a redress (discovered after some research online) but how do i know if this will qualify and the default be removed?? Or should I write to them and go about this some other way?? Legally they cant add on a 2016 dated default surely?? I am livid to say the least. We are about to look into mortgages as first time buyers and have painstaking saved up a deposit and this could now cause major problems obtaining one....or basically we will get flat out no's.

-

A debt collection firm has agreed to write-off £414m worth of claims after the Financial Conduct Authority (FCA) found systematic failures in the company's systems and controls. Motormile Finance, which also trades as MMF, will write off debts that it had purchased from third parties owed by more than 500,000 customers. Motormile, which also trades as MMF, MMF Debt Purchase and MMF UK, describes itself as “one of the leading debt purchase companies in the UK,” and specialises in buying up old payday loans and other debts, and then attempting to recover this money. According to consumer website forums, the company has bought payday loans from a number of lenders including Cash Genie, Peachy, Mr Lender, Lending Stream, Swift Sterling, WageDayAdvance and PoundsTillPayday.co.uk. It is also understood to have bought car finance loans. The FCA said that after buying debts, the company failed to carry out the necessary “due diligence” to make sure the sums of money that were said to be owed were correct. It added: “This in turn led to unfair and unsuitable customer contact for recovery of those sums.” A redress programme has now been set up, affecting more than 500,000 people. The vast majority – who typically received a letter or email saying that the debt had been passed to Motormile – will see their debts written off. Typically the debt will run into several hundred pounds per person. In cases where the affected customers had started making payments to Motormile, it will be repaid to them. A total of £154,000 is being repaid to 2,148 people, which averages about £72 per person. https://www.theguardian.com/business/2016/nov/02/over-half-a-million-in-uk-have-their-debt-written-off-over-unfair-practices The company has set up a dedicated page on its website providing further information.

-

Hello, I am looking for some advice. I applied for a mortgage in December after receiving a Decision in Principle earlier this year. I was disappointed for the application to be declined based on my credit file. I got a copy and noticed that a default from 2012 with Motormile had been moved to 2016, which is likely to be why the mortgage was declined as other than that my credit file is clear. I contacted Motormile who admitted to their administration error and said they would update my file in 4 weeks. After 4 weeks it wasn't updated so I chased again and they confirmed it would be done within 2 weeks. After 6 weeks it was finally updated. 2 days later I was about to submit my mortgage application again, went on to quickly check my credit report again and noticed the default has been updated again with a 2016 date! While all of this has been going on the seller has been getting quite upset (rightly so) and at this stage it looks like the house purchase will fall through because I can't secure the mortgage. I know if this default is updated I will get the mortgage though. does anyone have any advice on getting Motormile to fix this again and update the CRA's immediately, is it even possible? I have reported it to the ICO but I don't have time to wait on them investigating. Previously I raised notices of correction with the CRA's but they all came back to say they were not updating their records, even though I have correspondence from Motormile saying the date on my credit file is incorrect. Thanks in advance!

- 3 replies

-

- credit reference agencies

- credit score

- (and 6 more)

-

Hello to all you helpful souls @ CAG, I am hoping for some advice...... A couple of years ago I took out a payday loan with MRLENDER @ £700ish. I found myself in financial difficulty and was not able to repay. I tried to talk to MRLENDER but they were not interested in my circumstances and just insisted on full payment or interest/charges would be added etc. This annoyed the hell out of me!! Therefore I just ignored them. I have now received a letter from MORIARTY LAW (dated 09/12/16), stating; Amount Due: £1312.50 Original Lender: PDL Finance t/a Mr Lender We have been instructed by Motormile Finance UK Ltd (MMF) in relation to recovery of the above debt. The debt must now be settled within the next 14 days by either payment in full or an initial payment and an acceptable repayment plan. In the event we do not hear from you within the next fourteen days we have been instructed to issue proceedings without further reference to yourself. To ensure you are fully aware of the consequences of legal proceedings being issued against you we have detailed below the costs, fees and interest that the court will add to your account should this action be taken. Court fees: £70 Solicitor costs: £80 Interest: £105 The issue of proceedings and any consequent judgment in our clients favour would therefore result in your debt increasing to £1567.50. I have not been informed by Mr Lender / Motormile that this has been passed on/sold to Moriarty Law. I do work full time, however I am in receipt of child tax credits and don't have the money to pay this off in full...should I try to arrange a payment plan? Is Mr Lender in any way liable due to poor affordability checks in the first place, or is this all on me solely? Thanks in advance for any and all replies. Dave.

- 43 replies

-

- action

- county court

- (and 8 more)

-

Hi there, First post here but long been an observer. Had an account with Lending Stream which due to financial difficulty defaulted in April 2011. Motormile finance purchased the debt from Lending Stream in 2013, and I entered dialogue with Motormile as soon as I received correspondence from them. I requested a full statement of account and a copy of the default notice, as no default notice was received from Lending Stream. After hearing nothing back for over 2 months, I chased Motormile who reluctantly admitted they were unable to obtain this information from Lending Stream. The balance (including a high proportion of default fees, late payment fees etc) was £782, Motormile offered to settle for £250. I agreed this on the condition that the default notice would be removed, as they were unable to show a statement of account or a default notice had been sent, and Barry from Motormile called me a couple of days later to confirm he'd spoken with Lending Stream and they'd removed the default. I paid in full via card £250 over the phone after receiving email confirmation from Motormile the default was being removed (see below). "Email: Good Afternoon Mr *, I can confirm that we have previous received confirmation from Lending Stream that they would update your credit file for the data they have shared. I understand from our early conversation that this has now been updated accordingly. Should you have any further concerns regarding this, please contact me again. As requested, I shall arrange for our collections department to contact you to settle the account. Regards, Barry Customer Relations Manager Motormile Finance UK Ltd (MMF)" After being declined for credit, I checked my credit file in June 2015 to find that the default had been reappeared on the credit file, this time from Motormile Finance. I queried this with Motormile immediately. I was promised a response to my complaint within 14 days. Over a month passed (chased every week), blaming Lending Stream. Once I pointed out on multiple occasions that the default was from Motormile and not lending stream I received a response saying my compaint was being investigated and I would receive a response within 28 days. Sure enough, a month later, I received this response: "Dear Mr *. Thank you for your recent correspondence. We understand your concerns to be that: · We have requested the removal of the default from your credit file previously, however this has recently re-appeared. · You have applied for a mortgage and the default applied by MMF is having a detrimental effect to your application. We have investigated your complaint thoroughly and have provided a response to each concern individually below: We have requested the removal of the default from your credit file previously, however this has recently re-appeared. We have reviewed all correspondence on your account and have found that you have previously discussed your credit file with us in December 2013. We would firstly like to make you aware that MMF did not record any data with the credit reference agencies at this period and as such, never agreed to remove any information on your credit file. Your correspondence with us in December 2013 was in regards to data that was shared on your credit file by Lending Stream. In December 2013, we explained that as MMF has purchased the account, we are legally obligated to take over any information on your credit file. We are obligated to do this to provide an accurate reflection on a consumers credit history. The default that was originally applied by Lending Stream should have been removed in August 2013 and updated to show that the account had been sold. As a resolution to your concerns in December 2013, Lending Stream confirmed to us that they had updated your credit file accordingly. You have applied for a mortgage and the default applied by MMF is having a detrimental effect to your application. We are sorry to hear that you feel this default is affecting your chances to obtain a mortgage. We are obligated to report factual and up to date information on your credit file to provide an accurate reflection of your credit history. Lending Stream have confirmed to us that a notice of default was sent your postal address (*) on 11 April 2011 and the account defaulted on 25 April 2011. We have provided you with a copy of this documentation for your records. As you were provided with a notice of default, we are unable to remove the information as the data is factually correct. We hope this response has brought the matter to an acceptable resolution and the action taken is to your satisfaction. However, this is our final response, if you remain unhappy with the response I have attached a link to the leaflet about the Financial Ombudsman Service (FOS). Should you choose to contact them, you will need to do so within six months from the date of this email, enclosing a copy of the final response, which they will need for their investigation. If you would like a copy of this response by post including the leaflet please let me know by return email. FOS Leaflet: - Kind Regards, Pat Lee Customer Relations Officer Motormile Finance UK Ltd (MMF)" The default reappeared in February 2015. Originally this showed as a fresh default on this date, dropping off in February 2021, but they have updated this to the actual date of the debt, dropping off in April 2017. Removal of this default was essentially a term of me settling the debt (I refused to pay without this being part of the agreement), at at no point was there an indication it could reappear. On discussing this with Barry I was assured that this couldn't reappear, completely contradictory to the claim in the response stating I was made aware of motormile legally obliged to taking over my credit data. Motormile had 2 months to supply details of the default notice and statement of account back in 2013, so now sending me a copy of the default notice after complaining in 2015, which was never received, seems ridiculous to me. I issued a data access request last week of which I am awaiting an acknowledgement of receipt. Where do I stand here? Do I have grounds to have this removed? Motorfile seem firm on their stance, if I have a case would be happy to proceed with the court or FCO complaint, whichever I am more likely to obtain the outcome of removal. I have applied for a mortgage on a dream home, most likely to come back as a decline next week solely due to this default. Any advice would be much appreciated Many thanks for your time - Lewis

-

Hello all In a past life, I fell into the PayDay loan trap and when push came to shove couldn't afford to repay them. I was brave and went onto my credit report today and found that I have three PayDay loan related defaults, as follows: Motormile Finance Uk Limited £160 Account start date **/10/2010 Opening balance £ 205 Repayment frequency Monthly Date of default **/12/2010 Default balance £ 205 Motormile Finance Uk Limited £ 545 Account start date **/10/2010 Opening balance £ 884 Repayment frequency Monthly Date of default **/11/2010 Default balance £ 878 Instant Cash Loans T/A Payday Uk £ 361 Account start date **/10/2010 Opening balance £ 361 Regular payment £ £ 361 Repayment frequency Monthly Date of default **/04/2011 Default balance £ 361 I notice the Motormile ones have drastically differing amounts - applied charges I assume? I'd very much like to get stuff back on track in respect of my credit rating, and would appreciate advice on the best way to sort it out with the creditors. Many thanks in advance Mr Fish

-

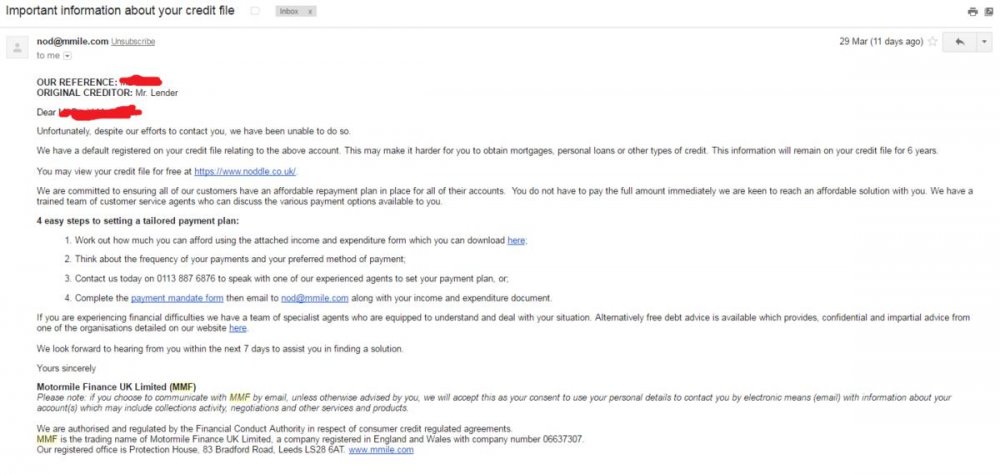

Hi there, Firstly, thanks for all your resources on this website, it has been very informative. I wanted to ask a question as I wasn't really sure how to proceed with Motormile Finance in my particular situation. So the long story short is: I received a letter the other day from Motormile, chasing debt from an old Payday loan going back to early 2013. As the letter was threatening with default action (see "Attachment 1"), I was curious as to why there were no other letters coming through with warnings. I checked my e-mail and it turns out there's countless e-mails in my spam from Motormile from late 2013 onwards. The e-mails are all the usual ones described in this forum: initial discount offers on the debt, then about a year and half of doorstep agent threats, and the most recent one was an e-mail about a default, sent 11 days ago. This e-mail is attached as "Attachment 2". Due to getting this letter and checking those e-mails, I have decided to check my credit rating on various credit checking sites to see where things were at (including Equifax). As shown in "Attachment 3", the last thing every recorded anywhere on my credit history for Mr Lender was on January 2014 as "Settled" and I appear to have no defaults with them - at some point they must have just sold my outstanding balance over to Motormile. My question is: If the original lender has never defaulted me (surprisingly), can Motormile go ahead and create that default on their behalf. From what I have read on here, Motormile can not update the dates of existing defaults - But I'm not sure whether or not they can create a default if the original lender never created one? Note: In the attached e-mail they say they have a "default registered against you" (which isn't true, at least yet) and in the letter they say they will default me later this month if a resolution isn't met. P.S: I know I really should have dealt with this debt back in the day instead of letting the problem "vanish". I guess I am very apprehensive about getting in touch with Motormile and paying off this large debt from many years ago, back when I was stupid and desperate enough to take out a payday loan. Thanks in advance for all advice on how to move forward!

- 3 replies

-

- attachments

- motormile

-

(and 1 more)

Tagged with:

-

Hi, I have a problem with Motormile finance, they have trashed my credit file with a default. They have registered it in June this year without sending out a default notice or any letters. I don't even know what the debt is for. says on Experian £350 account started November 2013. I have no records that show what it is, Experian claim its a pay day loan. Experian are going to contact MMF that I dispute it. Should I SAR them or is there a CPR request that would be more appropriate. My credit file has been looking up recently and this serves a blow to it. Baggies

-

Hi, I have posted here before and have had the best help from everyone here and am now wondering if I could get just a little more. Motormile Finance have added 2 defaults to my credit file, both for payday loans, I have only just realised as I haven't been checking my credit file on a regular basis recently. 1 of the accounts was supposedly Default in 04/2012 but has only been on my report for 4 months and the other was supposedly Default in 10/2009 but has only been on my report for 3 months? The plan was to issue a CCA request, do I need to issue a CCA request for each one? Also, does anyone have anything else they can shed any light on about these people and how I should go about handling them?

-

Hi I am in the process of clearing most of my debts since leaving step change in august. However, I can't seem to get on with these. I borrowed 300 from Mr lender 18 months ago. I have maid payments of 70 pounds to them via step change and then they gave the debt to MMF. They have been horrible and I paid them 15 pounds in October to stop them hassling me. Anyway, I have sent several letters of complaint to Mr lender and also the guy that owns it but nothing. MMF want 654 pounds off me. I see from my credit file that Mr lender is marked as settled. There is nothing on there belonging to MMF. I sent a cca and got an unsigned copy of an electronic agreement. Shall I just ignore MMF and pay Mr lender the original amount plus one month interest etc or ignore them completely. Since leaving step change i have paid off over 1700 pounds and got over 6500 written off. I now owe less than 8k for the first time in 11 years. Thanks to all of you.

-

Hi All, Well now debt free regarding Payday lenders however still having an issue with Motormile clowns, i had a loan which was owned by gothia who entered a default on my credit file on 05/04/2010 and marked settled on 14/07/2013 £1004.00 However Motormile have also entered a default for the same debt as follows default date 30/04/2010 £1,774.00 ( started on 1/3/2010 £1,004.00 ) they have also listed a default for an old minicredit debt which was also repaid Started on 23/10/2012 current balance £528.00 Default on 30/11/2012 £390.00 I have wrote and wrote and wrote, i have reported them to OFT but now completely cheesed off, i have not had contact from MM for over a year now yet they still refuse to amend my credit report. What action can i take now or just wait until the 6 year hits andd they drop off my report. Are Motormile still trading ?????? any help would be great :mad2:

- 3 replies

-

- information

- motormile

-

(and 2 more)

Tagged with:

-

Motormile Finance Uk Limited £ 390 01/01/2015 Default Name Mr xxxx xxx Address Date of birth xx/xx/xxxx4 Account type Student Loan Account number ***xxx Account start date 16/06/2009 Opening balance £ 390 Repayment frequency Monthly Date of default 01/12/2012 Default balance £ 390 Now i know this was an old payday loan from 2009. Notice they have defaulted it from when Motor Mile purchased the account 1/12/2012. This should be off my credit file in a few months but for that default date. They also have it down as a "Student Loan" Suggestions please people as this is the only nasty left on my credit file now

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.