Showing results for tags 'provident'.

-

Hello, i have been helping a friend out who has Provident loans. He has had for years, so I gather. He has always worked but over the last year in particular is drowning with the debt, whilst paying what he can. Like a idiot last summer he even took 2 loans out with Satsuma to get through - and since defaulted on these. Provident hasn't been defaulted to date. I wrote off to Provident for him and complained about irresponsible lending as he's sure loans were paid off by taking new loans in most cases. After a couple of days a letter came back dismissing he's claim and saying since 2006 he had 42 loans although they say since 20 were looked at and as most were over 3 years there's nothing to investigate.They also said they would send a full SAR. I can't find a lot online regarding Provident irresponsible lending and wondering if its worth now complaining to the Ombudsman.

-

Hi all, This time last year my gran passed away. We have discovered this week after finally clearing out everything in the premises (extreme hoarder) that she was a customer of that lovely company we know as Provident. From the mountains of paper work I've looked through, I have found 23 legible statements first one with a date of March 2008 and last one December 2014 - The oldest of the paperwork (extremely water-damaged) have the provident logo's and date Nov 1999. We have counted every one of these and there's 121 (inc the 23 legible) - which works out at roughly 3-4 loans per year from '99! (statements seem to be 6mths each) From the 23 I can read the total value paid back £32k - they average approx £800 each one & have an APR 245% (or around that mark). (Agreements dated before 2013 £20k was paid back) and each time one was taken out there was a repayment within 14days. My Gran, left no will - and my mom acted as executioner(?) though nothing official (except for Hospital letters stating her as N.O.K). She was in receipt of disability / benefits/ pension for years - I'm 40 and I remember going to the post office with her to cash her giro when I was alot younger.. She never held a bank account - did'nt believe in them. the only time she had an account of some sort was when the DWP started to pay into a post office account. I'm aware that Provident are one of the many being investigated for IRL & I've seen other threads where people have refunded PPI on behalf of a deceased relative. My question are - and might seem stupid considering the length of time I've been on here (and successes I've had) 1) Where do I start - do I send a GDPR / SAR request to Provident - (is there any specific wording/template for a deceased relative). 2) Provident will probably only hold 6yrs of info, but what about the year's prior to 2013 where I have statements? 3) Is there a specific IRL template (for a deceased relative) 4) We only have a the death cert. no other paperwork - will this suffice or are we unable to go after them for IRL? It has come as a great shock to see these, and to know that she'd had multiple loans running at the same time with benefit as only source of income. What made it worse is she said she was putting money away for her funeral and family - but my mother had to take out a loan (with a reputable bank) to pay for all the funeral costs & money owed to DWP in over payments. Thanks in advance for your help.

-

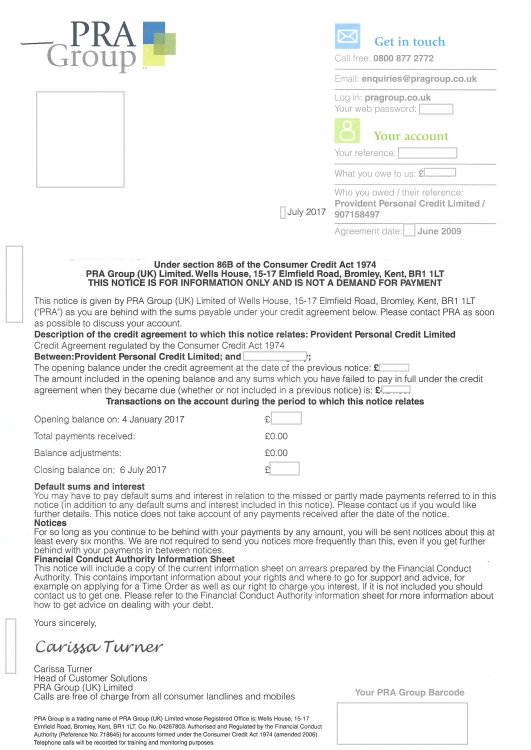

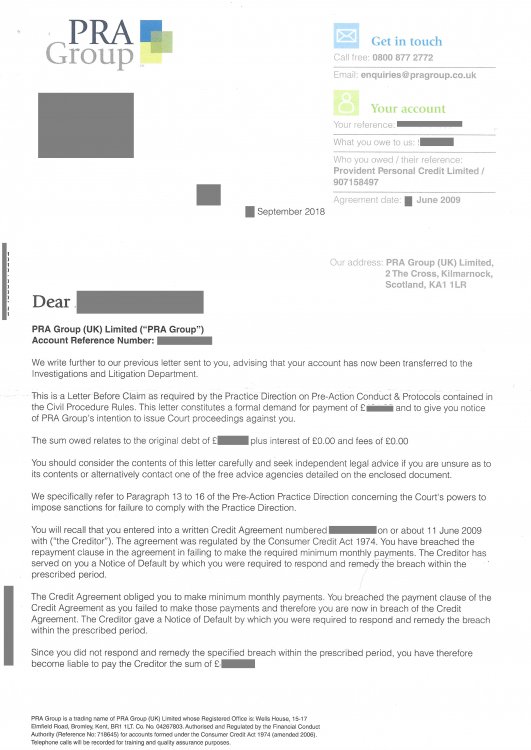

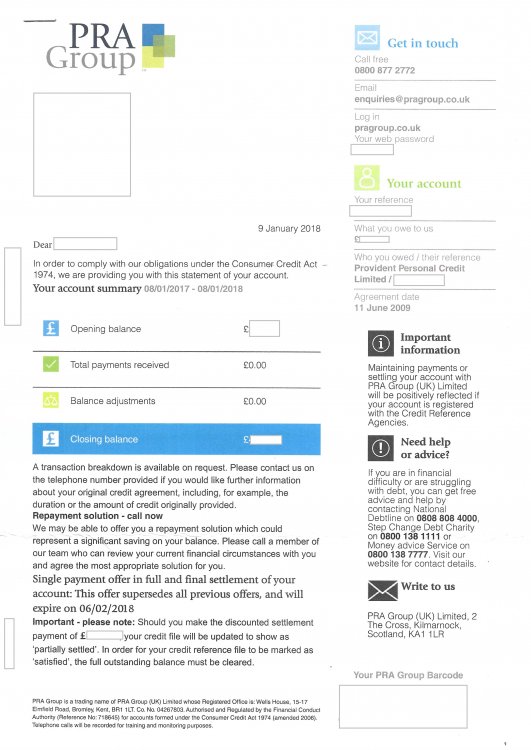

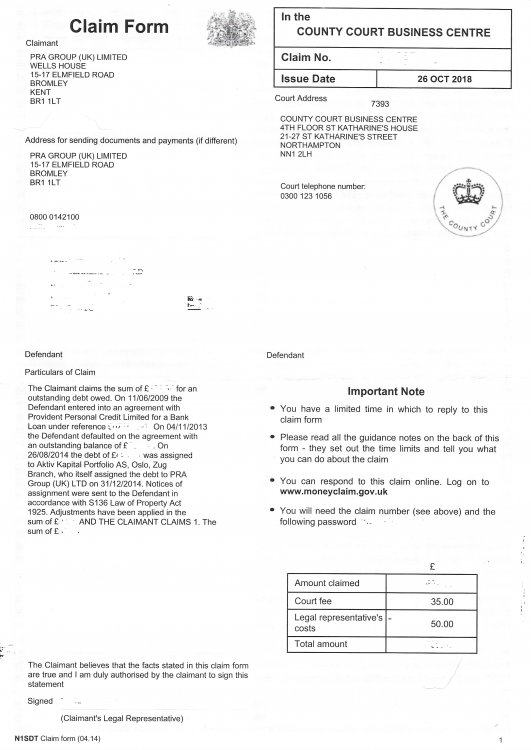

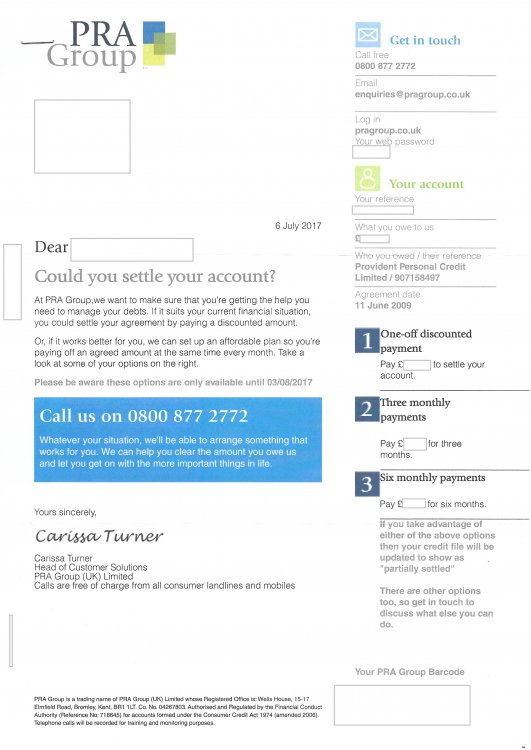

Name of the Claimant ?PRA Group (UK) Limited Date of issue – top right hand corner of the claim form – this in order to establish the time line you need to adhere to. 26/10/2018 Date of issue XX + 19 days ( 5 day for service + 14 days to acknowledge) = XX + 14 days to submit defence = XX (33 days in total) - 28/11/2018 ^^^^^ NOTE : WHEN CALCULATING THE TIMELINE - PLEASE REMEMBER THAT THE DATE ON THE CLAIMFORM IS ONE IN THE COUNT [example: Issue date 01.03.2014 + 19 days (5 days for service + 14 days to acknowledge) = 19.03.2014 + 14 days to submit defence = 02.04.2014] = 33 days in total Particulars of Claim What is the claim for – the reason they have issued the claim? Please type out their particulars of claim in full (verbatim) less any identifiable data and round the amounts up/down. The Claimant claims the sum of £425 for an outstanding debt owed. On 11/06/09 the Defendant entered into an agreement with Provident Personal Credit Limited for a Bank Loan under reference *********. On 4/11/2013 the Defendant defaulted on the agreement with an outstanding balance of £430. On 26/08/2014 the debt of £420 was assigned to Aktiv Kapital Portfolio AS, Oslo, Zug Branch, who itself assigned the debt to PRA Group (UK) LTD on 31/12/2014. Notices of assignment were sent to the Defendant in accordance with S136 Law of Property Act 1925. Adjustments have been made in the sum of £0.40 AND THE CLAIMANT CLAIMS 1. The sum of £425 Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ? 2 identical letters were sent claiming to be "Letter before Claim as required by the Practice Direction on Pre-Action Conduct & Protocols contained in the Civil Procedure Rules" The first of these letters was dated March 2018 & the second in September 2018. What is the total value of the claim? £510, incl court fees & legal fees Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Doorstep loan - not a Bank Loan as claimed in the POC When did you enter into the original agreement before or after April 2007 ? 2009 Is the debt showing on your credit reference files (Experian/Equifax /Etc...) ? Yes Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Original creditor Were you aware the account had been assigned – did you receive a Notice of Assignment? No memory of such but as sent back to OC, prob not applicable Did you receive a Default Notice from the original creditor? No letters marked Default Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Had to give up work to become full time carer for disabled wife. What was the date of your last payment? Not sure Was there a dispute with the original creditor that remains unresolved? No but seeing as OC has already obtained CCJ's for 2 other loan a/c's, it seems particularly odd that they have come for such a small amount & after such a long time. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management planicon? No What you need to do now. Answer the questions above If you have not already done so – send a CCA Request to the claimant for a copy of your agreement Posted 30/10/18 ======================================================= Hi, a dear friend has asked me to help him as he got court papers this morning & he's in a panic. He doesn't have access to computer or scanner so everything will be uploaded/discussed via myself. Since 2017, the only paperwork received has been: 1. Account summary, dated January 2018 and letter marked "not a demand for payment" 2. LBC dated March 2018 incl account summary 3. Letter marked "Not a demand for payment" incl letter offering to accept reduced sum in full payment 3. LBC again dated September 2018 incl account summary 4. N1 claim There is no paperwork saved before Jan 2017 so a CPR 31.14 request for the original agreement, assignment & reassignment letters as well as the default notice will be posted tomorrow. His only income is Income Support and Carer's allowance & he already has 3 CCJ's of which 2 are to PRA re Provident which they secured in Feb 2017. He pays each of them at £5 per month. In view of the fact that their paperwork doesn't appear to be in order, I wondered if he had a chance of successfully defending the claim. Your opinions would be helpful. I have uploaded all the documentation. Interestingly, every piece of paperwork has his correct address on it apart from the September LBC & the actual N1 claim ! Ok, so it's only the last letter of the postcode they got wrong but it strikes me as odd that it's been right up until now - my cynicism alarm bells rang when I noticed it, lol

-

Hi I.m new here and need help . Over the yrs me and the wife have had provident loans we have defaulted 3 times on them for thousands over the yrs. They still lent to us mind. Over last few yrs we have never missed a payment but got our self in debt with them. To the point we paying £200 a wk in repayments over long term. We kept renewing loans for more to keep money in our pockets it would last us a fee wks until next renewal to the point that we are at the limit. We did pay it off once to lower payments and renewed straight away then to get more money back but this is how we got to the limit . We paid off with our Christmas no ey borrowed 2 wks later to get our money back but borrowed even more . My wife as aspergers and she hates not paying it especially as we know the agent as live locally. We on benefits which as been stopped at moment due to change over from was to income support not had money for nearly 3wks andooking at another fee wks before it's sorted. We missed last wks payment they been fine with it and going to try and help but can't afford to pay it back at all. My son and daughter been helping is out for so long even my son's boss giving is money to lend . CAB just told us to contact them to make arrangement to lower payment but we been told it looks like we been irresponsible lending and between defaults and constantly renewing for more shows we couldn't really afford them they never looked at our money coming in and cause we needed the money for Christmas we lied what we had coming in I know it's wrong but was desperate.

-

I've lurked here for many months and gained lots of useful advice. Many Thanks. I've joined ready for what may be the next step.... I've taken up the cudgels for my partners who is being harassed by Lowells Pariahs for an old £400 Provident debt she was saddled with by her ex partner. On my advice, she ignored months of Lowell Portfolio threatograms and discount offers to settle, then they wheeled out Lowells Solicitors, whom I imagine to be another minimum wage otherwise unemployable sat at an adjacent desk! I suspect they are cranking up as it appears to become statute barred in September. When they got serious. I CCA'd them on 3 March. They replied on the 11th, putting things on hold, refusing to supply commercially sensitive assignment details and seemingly awarding themselves time over the 12+2 to produce the other. They wrote 29th March enclosing Statement of account which is a poor Excel anyone could have done. Stated they were still waiting original agreement. Reading all useful advice, I now plan to do nothing. Is that correct? Also what can we expect now and how to deal with it. Have they failed the 12+2? Interested to hear. Many thanks.

- 44 replies

-

I have just found out the level of my 69 year old mother's provident loan repayments. At the moment, she would appear to have 4 active loans and a weekly repayment of £110 per week whilst living on a pension. Surely there has to be some sort of irresponsible lending going on here? Most weeks, her fridge is almost running on empty and I'm lending money from time to time to help her pay things like rent, electricity and even to make sure that there is food in the fridge! I knew she had a loan, but I am shocked at the level of it. She cannot afford £400 a month, on a pension either! Is there any steps I can take to get this into a manageable payments?

-

Hi, I was wondering if it would be possible to get some advice please. Late 2011/ early 2012 (sorry I can't remember the exact date) I took a loan out through Providemt for about 300. I paid weekly to the lady collector who arranged the loan and then a new collector started working for them and I continued to pay him weekly (for about 4 weeks) until late mid 2012 when I was moving to a different county. At this point I paid my balance to the collector in cash as was the arrangement and moved away. Over the past few years I would occasionally get a 'debt' letter from Lowells which I queried with them the first time then ignored as I believed it to be just an error. However this morning out of the blue I received a claim form from moneyclaim.giv.uk asking for 464.94 plus 85.00 fees. They haven't put the original date of the loan in the particulars just a date 29/08/2014 which is when they say they took on this 'debt'. I really don't know what to do. I don't see why I should pay twice but as it was five years ago I don't have the provident payment book to prove the collector took the cash. Any advice greatly appreciated.

-

regarding this post: http://www.consumeractiongroup.co.uk/forum/showthread.php?401188-Abbey-National-Endowment-Mortgage-Santander-giving-us-the-runaround AVIVA have demonstrated the kind of shocking customer service that even BT would be ashamed of - This complaint has been running far too long now, AVIVA customer support - Pls explain why this has taken so long. I would like a reply, & an explanation, & an apology. I would never EVER deal with this ridiculous outfit as my Parents did. AVIVA pls deal.

-

Hey all Not been on here in while! ok so here goes My wife has got herself into a bit of debt without my knowledge and is now struggling to make payments etc due to us moving home and the expense that has caused so Im starting with Provident She had been paying nearly £60 a week to provident for a £2200 loan it looks it split into 2 different loans £700 Flat rate interest 68.50% APR 191.20% £1500 same interest rates as above this is causing a great deal of grief in the household soo please could anyone help with advise on how to go about tackling this one? Thank You Paul

-

Irresponsible Lending - Provident

flynnsmum123 posted a topic in Provident and associated companies.

Hi guys, hoping you can help. I've sent off my complaint to Provident about irresponsible lending, what i am wondering about is what would be refunded (if successful). From what i have read up on, it would be interest + 8% of that interest. So for example, one of my loans were £1600, over a period of 104 weeks with an interest rate of 181.4%. Using an interest calculator online, it shows the interest on that loan would be £4,409.70 plus 8% of that which is £352.78, totalling £4,762.48. I just want to make sure because that seems an awful lot, considering i had 10+ loans from them over the years and this is just one of those. Apologies if the calculations are wrong, I'm terrible at maths, hopefully someone can shed some light on this.- 2 replies

-

- irresponsible

- lending

-

(and 1 more)

Tagged with:

-

received c/c summons from lowells via n/Hampton indicated that didn't have any knowledge of debt and would defend on line n/Hampton acknowledged . this am a letter from Lowell solicitors Form N 190 already filled in just requiring my sig , they did also state that court would be in touch ive heard it all now or is this the norm. have sec 77 lowels no reply as yet

-

Bit of help/advise needed. during a recent search through the credit file I came across a default registered by Lowell Financial a former Provident debt. following some threads on here first thought was to CCA them CCA'd them on 14.06.17 finally received a copy of a credit agreement and statement of account on 29/07/17. however I am dubious as signature doesn't look like mine, the agent I was dealing with back then was named Joan and never had any contact with the agent named on the credit agreement. also on the statement of account it states I made a payment of 10.00 on 16/05/2013 however I did not make this payment. having checked the default date its 23/01/2012 so suspect they are trying to get around the stat barred rules. can anyone give me an opinion on the attached and also how to go about dealing with this. As 100% the agent signing is not the one I dealt with there was no payment on 2013 and statement looks abit iffy at best img011_LI (2).pdf img012_LI.pdf

-

Hi All Trying to help a friend who is a mental health patient. He had a provident loan and then several times they rolled it over. Never checked he could afford it or asked for proof of income. They know he is on benefits and a mental health patient. Not SB last payment was 29/7/13. Was assigned 13 months, aug 14, later to A Kapital who then assigned it to PRA group end of dec 14. they say he was informed but he cant remember if was. Stopped paying as Agent stopped calling when not getting enough to cover it due to money. He said first he knew was the court papers which he has returned to sender after taking notes

- 118 replies

-

- action

- county court

-

(and 3 more)

Tagged with:

-

Name of the Claimant - Lowell Portfolio I LTD Date of issue – 08/02/2017 Date to acknowledge - 26/02/2017 Date to defence - by 4pm 10/03/2017 What is the claim for? 1) The Defendant entered into a consumer credit act 1974 regulated agreement with Provident personal Credit limited under account reference ********* ('the agreement'). 2) The Defendant failed to maintain the required payments and a default notice was served and not complied with. 3) The Agreement was later assigned to the Claimant on 29/08/2014 and notice given to the Defendant. 4) Despite repeated requests for payment, the sum of £1,***.** remains due and outstanding And the Claimant claims a)the said sum of £1,***.** b) Interest pursuant to s69 County Courts Act 1984 at the rate of 8% per annum from the date of the assignment to the date of issue, accruing at a daily rate of £0.404, but limited to one year, being £147.28 C) Costs What is the value of the claim? £1988.28(for a £900 loan) Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Provident Doorstep loan When did you enter into the original agreement before or after 2007? After 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim? Issued by Debt Purchaser Lowell Were you aware the account had been assigned – did you receive a Notice of Assignment? Unable to tell as she didn't keep letters sent to her, but probably. She recalls letters from Lowell last year but it could be from something else. She has also moved once since this was taken out. Did you receive a Default Notice from the original creditor? Unable to tell as she didn't keep letters sent to her, but probably. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Unable to tell as she didn't keep letters sent to her, but probably. Why did you cease payments? Agent never turned up. What was the date of your last payment? She thinks one payment was made around September 2013 Was there a dispute with the original creditor that remains unresolved? Agent stopped turning up. This was a second loan with them at the time and the agent had turned up for the first one every fortnight for about 6 months. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No, when no-one turned up she just ignored the problem. So, just defended an older one with these guys for her(literally about a week before this was issued) and now another one. At least she was not in floods of tears this time. I am assuming to go down the same route of Acknowledge service and send out a CPR and CCA?

-

Hey, I haven't posted on here in a long time but I have just received a Claim Form from Lowell Solicitors on behalf of Provident. I used to work in litigation, but that was 7+ years ago (unqualified legal assistant), so whilst I am familiar with small claims and county court processes, I am a little rusty all the same, so I hope to get some information from people in the know... The date of issue is 31/01 I have filed AOS I am calculating the date for the defence to be by 04/03. I have made a CCA request to Lowell Plus I have made a CPR 31.14 request to Lowell Solicitors The part that I need help with if is... I don't really know how to defend my claim. Do I just hope that they cannot find the agreement, unable to provide a legible copy, or there is an issue with the contents etc? If I remember rightly then this loan dates back to 2010/11 - in which case it might be statue barred? I have made a payment to them in almost the same amount of time. I will need a copy of the agreement to see what date is on it. Is there anything else I should do or be aware of? I stopped paying because I was struggling with my mental health; I received a bi-polar diagnosis whilst battling other health issues - so I just lost all touch with reality for a while. Thanks in advance! M

-

Name of the Claimant - Lowell Portfolio I LTD Date of issue – 17/01/2019 Date to acknowledge) = 04/02/17 Date to defence = by 4pm Friday 17/02/17 What is the claim for? 1) The Defendant entered into a consumer credit act 1974 regulated agreement with Provident personal Credit limited under account reference ********* ('the agreement'). 2) The Defendant failed to maintain the required payments and a default notice was served and not complied with. 3) The Agreement was later assigned to the Claimant on 26/06/2015 and notice given to the Defendant. 4) Despite repeated requests for payment, the sum of £2**.** remains due and outstanding And the Claimant claims a)the said sum of £2**.** b) Interest pursuant to s69 County Courts Act 1984 at the rate of 8% per annum from the date of the assignment to the date of issue, accruing at a daily rate of £0.046, but limited to one year, being £16.92 C) Costs What is the value of the claim? £303.42 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Provident Doorstep loan When did you enter into the original agreement before or after 2007? After 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim? Lowell, Were you aware the account had been assigned – did you receive a Notice of Assignment? Unable to tell as she didn't keep letters sent to her, but probably. She recalls letters from Lowell last year but it could be from something else. She has also moved 4 times since this was taken out. Did you receive a Default Notice from the original creditor? Unable to tell as she didn't keep letters sent to her, but probably. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Unable to tell as she didn't keep letters sent to her, but probably. Why did you cease payments? Agent never turned up. What was the date of your last payment? She doesn't think she ever made a payment. Was there a dispute with the original creditor that remains unresolved? Does not turning up to collect count? Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No, when no-one turned up she just ignored the problem. Hi there, Looking for some help for a freind. She has had a claim form arrive this morning for an old Provident account from Lowell. She thinks it may relate to a doorstep arrangement where the agent never turned up to collect but there is no paperwork provided to prove the claim(i thought they had to provide evidence to make a claim). She thinks it dates back to 2009 so well out of the 6 years to chase (is that still a thing). It is also in her old name and the address is incorrect but it arrived anyway (postman is pretty good). She had quite a few debts and any letters that arrive in her old name that have debts info in it she RTS's them(I have told her not to do that again). So, what now? Do I - send a CCA Request to the claimant for a copy of your agreement Send a CPR31.14 request to the solicitor named on the claim form for copies of documents mentioned/implied within the claim form Fill in the return and Dispute the Claim? Or Just Acknowledge service while awaiting the two above responses? Do I have to tell the court I am doing so?

-

I have a number of accounts with provident that I stopped paying about 12 months ago. I was an agent for them for a very short time and took a number of loans out myself (stupid I know). I stopped working for them 2 years ago when I was forced to take out a loan due to me loosing the money I collected when I had to take it into the office to show the collections on a weekly basis. I was so upset by this I stopped working for them in my part time position as an agent. I have had numerous calls which I have ignored but have just got a default letter from vanquish fresh start and really don't know what to do next. They say that I owe over £8000 because of the interest that they put on the loan for the money loss. Can anyone please offer me some advice.

-

Good Morning! Does anyone know how I can stop a door collection agent from Provident attending my home? I missed a payment collection date and was unable to notify the agent as my phone died. The agent then attended my property 4 times that evening knocking loudly from 9pm. Has anyone dealt with Provident before? The whole doorstep collection process for the sake of £100 loan is getting ridiculous. If I can come to an arrangement and deal directly with them that would be ideal. Any advice would be appreciated! Thanks very much. Kind regards P

-

Hi , just a brief question ... my parents , both over 70 and on pension are both gambling every penny and more on the fruit machines ( though as most addicts do they deny it ) and are regularly taking out Provident loans to support this ... I reclaimed nearly £2k in bank charges for them which was gone within the month as well as over £2k of Provident loans ... they have been on the phone to the agent again this morning so no doubt more will follow ! I have told the agent several times that they are gambling the money and she said she wouldn't give them any more - but she has ! and keeps 'paying off' old loans to make new ones ( more interest and charges ! ) Do I write to head office as I told the agent I would if she carried on ? Or write to the ombudsman ? This agent regularly helps them make up excuses for why they need the money - including 'doing up the house' despite being told they no longer have any financial hold on the house and that I do all the maintenance etc.

- 1 reply

-

- irresponisble

- lending

-

(and 1 more)

Tagged with:

-

I have had over £500 worth of loans from what was originally greenwoods but they merged with provident so i'm told. So when my original caller quit after the merger provident sent 5 different callers over a 7 week period and each one i asked to see their identification as anybody would, but each one of them said we don't carry id as it isn't company policy, so i told them no id no payment. They could have been anybody and i don't pay to anybody on my doorstep without id. In recent months i have been recieving letters from lowell threatening court action and bailiffs, and i told them same as i told provident! show me id and i'll pay it but not until, and lowell said they don't have to provide id and my response was in that case i don't have to provide payment. My Question is do they actually have to provide id and am i right in refusing payment?

-

Hi all Need a little help after looking at my credit report i have been trying to clean up my mistakes. I had a old mobile which i fall behind (passed on to lowell) I phoned the company to make payments to where they said i had a outstanding provident loan this was new to me as i said to them i have never had a loan from provident. I ask if they could send me documents of the loan agreement. Its been a few weeks and to day i had a email stating they have investigated my enquiry, but are unable to provide and documents. the email goes on and then ask me to make a payment in full or to call to discuss instalments. im problem is i can honest say i have never had a provident loan and now dont whats best to do. i have also notice that my credit report now is showing this up as of the end of jan with a letter Q (can any one tell me what this means) thanks

-

Wonder if anyone can advise on the problem my partner is having with Lowell. Following is a timeline of events: Partner had problems paying provident and was defaulted on 4/1/2010 but was paying 1pound a month. Debt sold to Lowell on 22/5/2015 Sent for cca on 24/7/2015 Letter from lowells on 3/8/2015 -they have requested credit agreement. Letter from lowells- 4/9/2015- no cca closing account Letter from lowells- 16/9/2015 Copy of signed cca with terms and conditions. October 2015- started repayments again. The problem now is that lowells have put a new default on her credit file even though it had disappeared some months beforehand. Can they do this after the original default was in 2010?. Any help would be very much appreciated.

-

I received a letter sometime ago from lowell (21st October 2014) saying they had acquired a debt from provident regarding a couple of loans i took out a while back, with the letter there was a letter from provident saying they had handed over the debt to lowell. Within the letter from lowell it stated that the breakdown of the amount claimed owed covered 2 different accounts/agreements from 2010 and 2011. I decided to send a CCA request to lowell on the 27th October 2014 In January i received a letter from lowell saying they had closed the case at present as the document they had requested from provident was no longer available due to the length of time since the account was opened. They stated they would not contact me again unless the document was received by them. today i received a letter from lowell with a copy of one of the agreements from 2010 but not for the other agreement from 2011. In the letter they said they would stop collection activity for 30 days whilst they await proposal of repayment just wondering if someone could help and advice me what to do next next. always grateful to all who respond thank you

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.