Showing results for tags 'hoist'.

-

Hi all, I'm struggling to manage my deceased Father's debts as the executor. I'm left with a complete mess of paperwork. There is a little bit of money left in the estate but I'm unwilling to pay up to debt collection agencies unless I know its legit having read some of the threads on here. Santander responded to my SAR request and I've traced back a debt of £2131.92 that was with Hoist, and has been sent to Philips and Cohen since he died - they've not contacted me. However I see the original debt for £3000 dates back to 1999, but the Santander info stops in 2008, 10 years ago - how can I find out what happened in between and if he ever paid anything - I assume if he didn't its now out of statutory 6 years? Any advice gratefully received as I'm currently chasing MBNA and GE money and its all v stressful! Letter/info scanned and uploaded. Thanks very much. scan0042.pdf scan0043.pdf scan0044.pdf

-

Hi, Im trying to unravel my late father's very complicated finances, as I'm his executor. I found a letter from Hoist Finance dated from last year stating they own the account, with an outstanding balance of £2131.92. When I phoned to say he'd died they told me it would be passed to 'Philips and Cohen' - this was mid-January and I've heard nothing (luckily). Having read these forums I then wrote to MBNA requesting all his account data but they replied stating the 'GDPR only applies to personal data relating to a living individual'. is this true?There's also a letter relating to another MBNA debt from Link Financial, so they have sold the two on. I need to know how old these are etc. Letters scanned and attached. The reason I'm confused is I've also written to Santander (using the same template letter) and have received all the loan info so they obviously have different rules! - I'm not willing to settle anything unless I know how old these debts are and what they relate to. We couldn't find any paperwork at my Father's house. Any advice as what to do next - I did send certified copy of probate certificate with my requests. Many thanks for reading! scan0041.pdf scan0040.pdf

-

Evening all, Since around May this year I've received a shocking amount of post related to alleged debts against my name, I binned most thinking the sc@mmers would get bored... tonight I've just had somebody knock at my door saying he was from Robinson Way debt collectors, I played dumb and said we were not who he was looking for (with a mouth full of tea and my youngest on hip). He said he'd have my addressed removed from the system, I know he wont, I also received a call from them a number of weeks back... where they got my number I'll never know. Now... when I was 19'ish (wrong side of 30 now) I did run up some debts, paid the majority off but moved up and down the country alot with college/uni etc and not heard anything since, in 2010 I bought my own house, with only myself on the mortgage, never been denied a credit card/loan and not heard of anything for YEARS. I've googled the companies in the subject which has led me here... I have three seperate account numbers 'owing' three separate amounts.. .strangely the lowest amount one has had the most mail, some dated the day after the previous letter was dated?!?!? having read alot of the links google has supplied from here, there's alot of dead links to letters i should be sending to ask said companies to prove the debt is mine... .I'm sure the forum gets alot of these requests, and I do apologise. also, I've checked my statutory credit file with 3 agencies and none of them have a record of these alleged debts. Had I been prepared for this visit I could have handled it better and found out whats going on but, i didn't - and i don't want my wife having to deal with these people - whilst he was non threatening/abusing/confrontational - its not what I want. attached 3 letters with all barcodes/details deleted. any and all help appreciated and will update as and when...

-

Name of the Claimant Hoist Finance UK Holdings 2 LI Date of issue 30 NOV 2018 Particulars of Claim 1.This claim is for the sum of £1678.00 in respect of monies owing pursuant to an overdraft facility under bank account no XXXXXX The debt was legally assigned by Hoist Portfolio Holding 2 Ltd (EX SANTANDER UK PLC) to the Claimant and notice has been served. 2.The Defendant has failed to repay overdrawn sums owing under the terms and conditions of the bank account. 3.The Claimant claims 1. The sum of £1678.00 2. Costs Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ?I don't believe so What is the total value of the claim?£1863.00 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Bank Account Overdraft When did you enter into the original agreement before or after April 2007 ?I think it was after 2007 Is the debt showing on your credit reference files (Experian/Equifax /Etc...) ?No Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt Purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? I don't remember receiving one Did you receive a Default Notice from the original creditor? I don't remember Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Not that I can recall Why did you cease payments?couldn't afford payments due to low income What was the date of your last payment?Don't remember, nothing for at least 5-6 years Was there a dispute with the original creditor that remains unresolved? I don't believe so Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan?I'm sure I would have mentioned financial struggles and tried to but can't say this for a fact. ……….. Hello everyone, have just received a claim form from Hoist Finance regarding an old overdraft debt with Santander. If memory serves me well this debt is at least 8 years old, maybe more. This has come at a horrible time as I'm currently being assessed by my GP for suffering with depression and anxiety. I'm a University student and have already had some of my modules postponed for this. Not sure if any of that matters but figured I'd inform you guys of the full story. Haven't worked in a year but I'm on a zero hour contract and I'm still technically employed with the company (Could get work in the next two weeks if I ask for the hours). would love some help battling this, thank you.

-

Hi Guys, A friend has just received a letter today from Hoist Portfolio regarding an application for a Charging Order on his property. This is regarding an old Barclaycard debt for approx 7K which was sold on to a DCA. At the time I was helping him him with it and the DCA failed to produce a enforceable CCA (Barclaycard circa 2001). He then put the account into dispute. Now, he claims that he knows nothing about the CCJ , so we checked his credit file and yes he has one from 2 years ago. If he had seen the claim form he would of defended as I was helping him with it. Oddly enough the claim form states land at back of property, not the house - he just has a normal small garden. Property is in equity and jointly owned by him and his wife Thanks in advance for your help guys

- 11 replies

-

- barclaycard

- hoist

-

(and 1 more)

Tagged with:

-

Hi Fellas, Can anyone give me a link to the "Get lost, prove it" letter? Had a letter threatening court action, and while I have seen the last few off once papers arrived, I thought it best to try and get ahead of this one for her. Thanks

-

Hi I've just received a 'Letter Of Claim' from Howard Cohen & Co. Solicitors stating their client as "HPH2 LTD (Ex Tesco Personal Finance PLC)" also referenced in the letter as "Hoist Portfolio Holding 2 Ltd" regarding it's 'intention to issue proceedings in the County Court'. It also says "Despite our client or it's agents, Robinson Way Limited..." I believe my first course of action is to issue a CCA Request to the debt collector / client? The problem is that I cant find a UK address for Hoist Portfolio Holding 2 LTD but have found a Jersey address. The UK arm appears to be Hoist Finance who in turn own Robinson Way. Which of these companies should I write to with the CCA request? It's in relation to an amount of c.£5,500 on a credit card agreement allegedly signed in April 2008 Thanks

-

Evening All - Newbie here. As per the attachment, I have received the sealed CCCF from Hoist Portfolio on Friday (2 days after CCCF issued). I've not received any prior documentation from this company and to be honest I'm wondering what to do. I suffer from mental health issue's which have left me on bordering being admitted for my own safety a few months back however with help from my local Community Mental Health team, I've been making progress but this is chucking me back to a place I don't want to go. I know that I need to defend and get the AOS out on Monday via recorded delivery but from that, I haven't got an idea what to do next. May I kindly ask for some help. Many Thanks M.H.M

-

Hi, A couple of years ago, I left the UK and started a new life abroad. I have some debts with banks etc, and have informed all of them of my new address. However, it seems when I was preparing to leave, I inadvertently cancelled a direct debit for a credit card. I have no recollection of this but I expect this is due to the medication I may have been on at the time. I haven't heard anything from this company for a long time and admittedly, neglected to forward my new address - I hadn't used this card in a long time! My house in the UK has now been sold (although it was in negative equity and therefore we didn't make anything on it) and a friend has gathered all of the mail from there for me. It seems that during the course of my absence, I have accrued a CCJ and now have been threatened with Bailiffs through Hoist. This bailiff action was dated at the beginning of June. I have only just found this information out! I want to pay this debt and create resolution, and naturally, the property that I was registered at is no longer mine. Is it too late to prevent any further action at this point? And, how likely is it that I can make a repayment plan? The debt is for around £2100 Other than this, I'm totally up to date with all of my payments! Thanks all!

-

Hi all I've received a letter of claim from Howard Cohen acting on behalf of Hoist portfolio Ltd. The debt relates to a former Barclaycard that started in June 2008 and later defaulted in in Dec 2013 (according to my noddle credit file). I was self employed at the time and quickly became over indebted at the time. The default amount is £12,500 and last payment made was March 2013. I've uploaded a redacted letter of claim I received recently. I received a very similar letter in Dec last year which I ignored and did not hear anything until now - the same request letter. If I respond should I send a CCA letter request to the solicitors? I have until 13th August to respond. Thank you all in advance. Ben Hoist Portfolio Ltd - Letter of Claim REDACTED copy.pdf

-

Hi, New member here. I've just received a letter from Barclaycard, stating that they've transferred my account to Robinson Way. I have already been paying my debt to a company called Link Financial which Barclaycard had originally transferred my debt to. I have now emailed Robinson Way to tell them my debt is already assigned to Link Financial. I have been happily paying Link Financial each month for over a year without any issues. What would be the next step?

-

Hi, any help would be greatly appreciated. I have just received a Notice of Assignment from Hoist Finance U Holdings 2 Limited. It is regarding Capital One (original creditor). The balance is £830.74. It says they have been appointed to manage all matters related to the account etc. Where do I start please? SAR to Capital One? Regards D

-

What is the difference between Hoist Finance UK Holdings 2 Limited and Hoist Finance UK? I have already a repayment plan set up via Robinson Way but got letter of it transferring from Hoist Finance UK to Hoist Finance UK Holdings 2 Limited (I dont know the difference???)

-

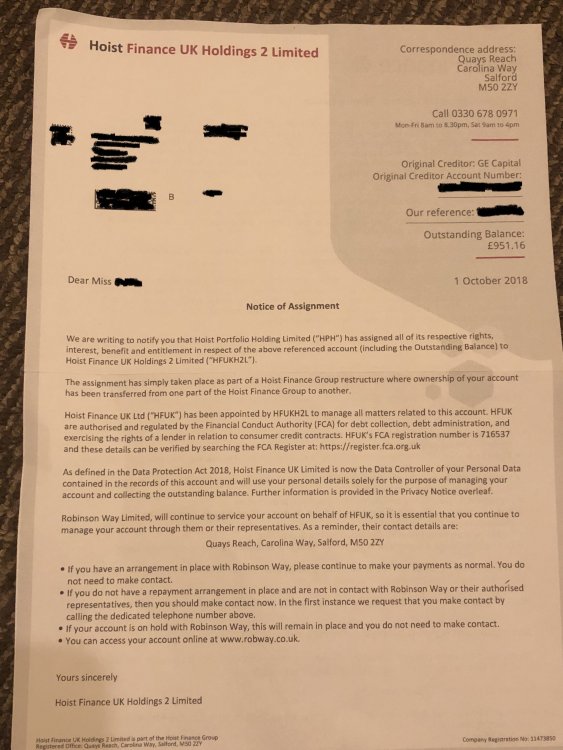

My Wife received a letter from Hoist Financial UK Holdings 2 Ltd concerning an alleged debt that my wife has with GE Capital. I have attached a copy of the letter and there are a few points I would like advice on in terms of how to proceed. 1. My wife has got no recollection of the debt in question, although she did say she once had a debt relief order, this order is coming up to 20+ years ago. 2. The letter was addressed to her in her maiden name (we have been married for 5 years and in a relationship for 6 years) and in all the time we have been together she has never had any letters from Hoist or Robinson Way who are mentioned in said letter. Should we write to them asking for proof of alleged debt, or should we just ignore the letter as it is likely to be a phishing exercise. Also should we report said companies to the ICO for being in breach of DPA as their information is very out of date as they wrote to her using her maiden name. Many thanks

-

Hi, I would like to announce a success for you to mark as won thanks to the help I received here if that's ok. I received a County Court claim and came to this site. I had a look around and saw that it was easy to defend the claim myself so I didn't want to start a thread and increase the already high workload of the good people advising on here. Firstly can I just say to anyone who is reading this that is in the same position, don't despair and as the advisers always say " READ OTHER THREADS " anyways here's my my story: A claim was issued against me on 09/05/2018 I found other threads similar to mine My defence was submitted on 20/05/2018 at 22:26:33 My defence was received on 21/05/2018 at 08:02:28 DQ sent to me on 04/06/2018 DQ filed by claimant on 11/06/2018 Again I came on this site and read other threads. General Directions order was made on 30/06/2018 I filed a DQ on 01/07/2018 My claim was transferred to xxxxxxxxxx on 31/07/2018 Ok now this is where I got a little scared and started thinking that if they are carrying on with the claim they must think they have a good chance of winning. Back to the threads and it seems I'm not the only defendant to think this at this stage, but after reading more advice and doing lots of swatting I got my confidence back. This is the point at which many defendants cave in and the DCAs know that. Ok onwards and upwards. 16th August 2018 I received this letter. District Judge xxxxxxxxxx has considered the statements of case and directions questionnaire filed and allocated the claim to small claims track. Unless the claimant does by 4pm on the sixth of September pay the court the trail Fedor £170.00 or file a properly completed application ( i.e one which provides all required information in the manner requested) for help with fees, then the claim will be struck out with effect from xxth September 2018 without further order and unless the court orders otherwise, you will be liable for the costs the defendant has incurred. 1. Claimant to send Court and defendant all documents it relies upon by xth September 2018 and bring ORIGINALS to hearing. Included in documents shall be: I) Copy of all agreements relied upon Il) Copy of the account and sums claimed including details of all fees/changes claimed or included in the sum claimed. III) Evidence of assignment of debt that claimant relies upon IV) Any written statements of witnesses 2. Defendant to send the claimant and court all documents and statements he relies upon in response to the Claimants evidence by 4pm xxth September 2018 Now as you can probably guess I was quite happy and the claimant was probably quite unhappy. Now the claimant must have thought that: 1. I was really stupid or 2. I hadn't received a copy of the letter. First they sent me a letter offering me 25% discount and they would not proceed, then a letter offering me 50% discount and they would not proceed and then, you guessed it, another letter offering me 75% discount. Obviously I ignored them all, the clock for them was ticking. On this xth September 2018 I received this letter from Howard Cohen & co. Solicitors: We write further to the County Court claim that was issued against you on 9/5/18. Following the issue of the claim against you, our client has instructed us to discontinue the claim with the court. Please therefore find enclosed by way of service upon you a Notice of Discontinuance. We will also be notifying the Court that the claim has been discontinued accordingly. Please be advised that our client has now permanently closed your account and no further action is required on your part. If you wish to discuss any aspect of this matter please contact our clients collection agents, Robinson Way on 0345 266 8876 ( no thanks, I'm fine thank you) Well anyways, thanks to all that helped, I couldn't have done it without you. I'll have to go through my notes and come back to thank you all personally. So again, whoever is reading this, don't be scared, read through other threads and try and help yourself, you won't understand what you're doing or why your doing it if you expect the advisers to hold your hand every step of the journey. The DCAs (Mafia), their solicitors (henchmen) are nothing but bullies who deserve a bloodied nose, get your boxing gloves on and come out fighting. *****WON******* Could someone also send a link so that I can donate.

-

Hi Looking for some last minute advice with this claim, when i started to tackle this back in 2016 i was taking advice from another forum and now know that the CPR18 was the wrong approach. The debt is for a credit card that was taken out in 2013, the total debt is £654.68, £784.68 with the court fees. My first communication from Hoist Portfolio was 2 weeks before the court paperwork arrived. I am appearing in court on Friday to try and defend this claim. I received a claim form from the court on the 18 Feb 2016. On the 22 Feb i sent a CCA request and a CPR18. On the 14 March i submitted my defence having received non of the information i had requested via the CPR18 and CCA request. On the 4 May i received the directions questionnaire which i selected mediation, the claimant also chose mediation. On the 24 May i received an appointment for the mediation to take place followed by an email questionnaire which i completed and had to say no to the question that asked do you have enough information about the claim to enter negotiations, unfortunately because i didn't have any of the information i had requested and i answered no this then meant mediation was no longer an option. I then heard nothing more about this claim until i received a copy of a court order dated 3 November 2017 sent to the claimant asking them to provide all the information within 21 days that i had already asked them to provide in the CPR18 request and not received. The claimant then had until the 10 January 2018 to pay a fee or the case would have been struck out. The claimant has provided what i believe to be all the information requested by the court and the hearing is on Friday. I have uploaded what they have sent me. I am not sure where to start with this, i dont know if its relevant but the account number that is menationed in the witness statement is different to what is on all the other documents but the card number is correct. Documents provided Witness Statment Terms & Conditions/Re-constituted Agreement Statement of account (not uploaded) Copy of Claimants predecessors system Notice of assignment Robinson Way letter Why when the defendant requests the information the claimant doesn't provide it, a year can pass by with hearing nothing, the courts request the information and they provide it straight away?? I know this is all very last minute but any advice would be much appreciated. Many thanks Macker16 claimant ws.pdf

-

Hi guys I'd like your thoughts on this. I have a Barclaycard / ex-Egg account - that defaulted back in 2012. In middle of last year it was sold to Hoist and then Robinson Way came chasing. It's a familiar story. Last payment on this was February 2012 (default was Nov. 2012), so I'm thinking "you sods!". I sent CCA request which has taken them months to comply with (I have all the time in the world!). I finally received a recon from them this week, with an I&E sheet attached and 30 days complete it (keeps clock ticking ). Reading between the lines, I don't think they have a clue when this agreement commenced, but nor do I, to be honest. There isn't a date specified anywhere. On the bottom of the Egg recon it states "04_2006", but this only appears to be a copy of T&Cs, so probably isn't a compliant recon anyway. They certainly don't appear to have a copy of the original agreement, so from that perspective, I'm hoping this account is from pre-April 2007. All I know is that it's from around that time and could well be 2006, or could be a year later. With the six year anniversary of the last payment coming up next week, I'm hoping that I'll also have the SB option in my locker too. I'd prefer to eat up another few months though before I would feel confident having to rely on this should they issue a claim. I don't know if it affects anything, but I did enter into conversation with one of these Dor-2-Dor callers a few months after the last payment - they called to the house and caught me on the hop. How would you recommend I respond to the recon they sent me? I'm ideally looking to string them along for a little while longer if possible, although they might even keep sending begging letters for a few months without any form of prompting anyway. Cheers! Sham

- 18 replies

-

- barclaycard

- egg

-

(and 2 more)

Tagged with:

-

Hey all, this just resurfaced after over 3 years-how do i respond to this? Letter of claim We act for HOIST PORTFOLIO HOLDING 2 LIMITED and write to inform you of its intention to issue proceedings in the county court fot the above outstanding amount (£2609)that you have failed to repay. Details of debt: This debt originates from a written agreement betwen the original creditor (lloyds credit card) and you. The agreement was subsequently terminated when its terms were not complied with. Our client later purchase this account and it was legally assigned on 08/09/2015. The notice of assignment has previously been provided to you. (never got it). There have been no interest or administartive fees/charges applied to your account since we aquired it. You should note this letter is being sent in accordance with the pre-action protocol for debt claims of the civil procedure rules. The court rules comfirm the actions either party must take before a matter goes to court. We should point out that paragraph 7 sets out its expectations for you and our client in how to comply with the protocol. Despite our clients of it's agents Robinson way limited attempts to engage with you to agree a suitablle payment plan, the above amount remains unpaid. It then goes on to tell me i need to complete the enclosed information sheet, reply form and income and expenditure form, and tells me i am required to make payment within 30 days and if i don't respond, a claim will be issued in the county court without further notice. What do i do here? I have no information on this, do i have to complete their form? is that admitting liability for the debt? can I send a CCA? Please help

-

Hi I received a claim from Howard Cohen on behalf of Hoist Portfolio regarding a old HSBC overdraft. I am now quite far into defending the claim after having read lots of forums! I have sent a CPR 31.14 request to Hoist Portfolio and submitted a defence. I am now at the stage where I have sent back the DQ and agreed to mediation and waiting to hear back. I have received nothing from Hoist portfolio as of yet and was hoping they would have discontinued the claim by now but no such luck. I'm really worried as I read somewhere that they can stump up the documents at anytime literally a day before going to court or on the day of court and I really wanted to avoid ending up in court. Do they actually do this and how is this fair? Any help/thoughts would be greatly appreciated.

-

HI Ive got a letter saying notice of transfer of proceedings on the top left. It states Claimant - HOIST PORTFOLIO HOLDING 2 LTD defendant ME. Then all it says is To all parties This claim has been transferred to the the county court of St.Helens for enforcement. That is it no forms attached, there is no Amount Outstanding on the letter, nothing. I have checked my Credit File today and there are 2 listings on my Financial History. 1 CCJ from Barclays showing as SATISFIED and the other Account is still awaiting to be taken to Court for defaulting on my Mortgage. How do I find out what this letter is about?? Does anyone know why I have got this letter. It is not asking anywhere to respond I am a bit confused if this is the starting of my Mortgage Company taking me to Court??? If so I just expect more documentation & details. Like amounts, dates etc.

-

Hello all at CAG, I've received a second claim from Hoist/ cohens for a credit card. Name of the Claimant ? Hoist Portfolio Holding 2 Ltd Date of issue – 03 Feb 2017 Date to submit defence = - by 4pm Friday 03/03/2017 ? What is the claim for – Particulars of claim: (As Written) The claim is for the sum of £11079.33 in respect of monies owing under an agreement with the account no. xxxxxxxxxxxxxxxx pursuant to the The Consumer Credit Act 1974 (CCA) The debt was legally assigned by MKDP LLP (Ex Barclaycard) to the claimant and notice has been served. The defendant has failed to make contractual payments under the terms of the agreement. A default notice has been served upon the defenadant pursuant to Section 87(1) CCA. The Claimant Claims: 1. The sum of £11079.33 2. Interest pursuant to s69 of the county court Act 1984 at a rate of 8.00 percent from the 27/09/11 to the date hereof 1947 days is the sum of £4727.90 3. Future interest accruing at the daily rate of £2.43 4. Costs What is the value of the claim? £15807.23 (plus court fee £711.33 & Legal Reps Costs £100) Total £16618.56 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit card When did you enter into the original agreement before or after 2007? Approx 2000/ 2001 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt Purchaser (hoist) Were you aware the account had been assigned – did you receive a Notice of Assignment? No Did you receive a Default Notice from the original creditor? Can't be sure Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Business ceased trading and couldn't afford rent let alone DMP payments What was the date of your last payment? January 20th 2011 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? Yes, Payplan DMP set up in Feb 2010 I wondered if I could use the statute barred defence or should I use the no paperwork? I have done the AOS on MCOL, should I send the CPR and CCA requests regardless of defence? Your help is much appreciated.

-

I've been reading through the forums for a while but just am getting a bit nervy now! Im at the stage where after submitting the defence, ive got the Defence questionnaire re the small claims track. Hoist still haven't responded to my requests for info, and ive not had anything back from Cohens either and the requests were sent at the end of April. Before it got to this stage, Id spoken to the litigation department twice requesting correspondence - in the second call, the Hoist person said that they wouldn't be sending me any requested info... Am i correct in thinking that i now tick the mediation box and take it from there? I then explain about the requested information not being provided - assuming it still hasn't by then? Sorry if this has been said loads before, but i just need to know for my own peace of mind!

- 44 replies

-

- barclaycard

- choose

-

(and 3 more)

Tagged with:

-

Hi So far having followed threads on here I've managed to deal with a hoist claim on a card from 2005 for £1800 before court fees on moneyclaim online for £2800. They were supposed to have paid a fee by 15th June otherwise it would be struck out similar to a thread on here by "musicam" I rang the court a few days after said date and they hadn't paid although the lady said there was some leeway in case they had paid by cheque. I rang again yesterday still having heard nothing expecting to be told it was struck out but was informed its going ahead as they have paid the court fee. How they are allowed extra time to do this when I have received a letter stating it would be struck out by 15th June if the fee is not paid I have no idea ?! today I received hoists witness statement. I wonder if it would be ok to send the witness statement "andyorch" provided for "musicam" as the cases seem pretty much the same. In mine they also rely on Carey v HSB and concede what they have is poor quality and illegible. They also have no default notice from the original creditor Barclaycard, only a default notice from mercers dated 18/3/11. Despite the default from mercers being 2011 - The last payment to this card would have been nearly 10 years ago with no contact since - is it too late to add any statue barred defence to this witness statement ? Athe court date is the 2nd week in July. Does my witness statement have to be in 14 days before which makes it pretty much now ? Hoist also made an offer to accept £1508 full and final settlement when they sent their "evidence" which makes me think they don't really want to go to court. Am I ok to go with ? "IN THE ******* county court Claim No. *********** BETWEEN: Claimant Hoist Portfolio Holding 2 Ltd AND Defendant ************ _________________________ ________ WITNESS STATEMENT OF ********** _________________________ ________ I ******, being the Defendant in this case will state as follows; I make this Witness Statement in support of my defence in the claim. The claimants witness statement confirms that it mostly relies on hearsay evidence as confirmed by the drafts person in the opening paragraph.It is my understanding that they must serve notice to any hearsay evidence pursuant to CPR 33.2(1)(B) (notice of intention to rely on hearsay evidence) and Section 2 (1) (A) of the Civil Evidence Act. 1. I understand that the claimant is an Assignee, a buyer of defunct or bad debts who are based in Jersey, which are bought on mass portfolios at a much reduced cost to the amount claimed and which the original creditors have already wrote off as a capital loss and claimed against taxable income as confirmed in the claimants witness statement exhibit by way of the Deed of Assignment As an assignee or creditor as defined in section 189 of the CCA this applies to this new requirement on assignment of rights. This means that when an assignee purchases debts (or otherwise acquires rights under a credit agreement) it also acquires certain obligations to the borrower including the duty to comply with CCA requirements (such as the rules on statements and notices and other post-contractual information). The assignee becomes the creditor under the agreement. This ensures that essential consumer protections under the CCA cannot be circumvented by assigning the debt to a third party. 2. On or around the ******, I received a claims form from the County Court Business Centre, Northampton, for the amount of £****.The claimant contends that the claim is for the sum of £X in respect of monies owing under an alleged agreement with the account no. XXXXXXXXXX pursuant to The consumer credit Act 1974 (CCA).The particulars of claim fail to state when the alleged agreement was entered into but their witness statement states it was 1994 23 years ago. 3. Contained within the claimants particulars the claimant pleads that The defendant has failed to make contractual payments under the terms of the agreement and that a default notice has been served upon the defendant pursuant to S.87(1) CCA. It goes on to evidence a default notice in their exhibits which is provided by Mercers and not the actual creditor Barclaycard themselves.It is therefore contended that the original creditor failed to serve a valid Default Notice pursuant to section 87(1) Service of a notice on the debtor or hirer in accordance with section 88 (a “default notice ”) is necessary before the creditor or owner can become entitled, by reason of any breach by the debtor or hirer of a regulated agreement. Given that Mercers are in fact a Debt Collect Agency they cannot be considered to be the creditor or owner of the regulated agreement. 5. On the xxxxxxxxI made a formal written request by way of a CPR 31.14 to the Claimant solicitors requesting that the Claimant provides copies of all documents mentioned in the statement of case [EXHIBIT A]. 6. On the xxxxxxx I made a formal written request to the Claimant for them to provide me with a copy of my Consumer Credit Agreement as entitled to do so under sections 78 of the Consumer Credit Act 1974 [EXHIBIT C]. The claimant has since disclosed a copy of the application which purports to be the agreement within its witness statement at point 5 exhibit HT1 and admits its very poor quality.It is averred that it is impossible to read and illegible..the court is invited to try and decipher the contents and in particular the prescribed terms pursuant to section 78 CCA1974 and sec 61 (1) c of the CCA1974. The claimant tries to get around the poor quality by trying to rely on Carey v HSBC.Carey V HSBC is irrelevant in this matter and only applies to the giving of information under section 77/78/79 and is not retrospective to agreements entered into pre April 2007.I therefore contend that section 127 (1 and 2) accordingly applies in this case. 7. Furthermore the author of the witness statement at point 6 then tries to introduce a reconstituted version of the agreement (exhibit HT2) which is no more than a set of Terms and Conditions and in no way comply with the prescribed terms of a reconstituted version which they have previously tried to rely on at point 5 of their witness statement. 8. The Claimants pleaded case is that the Defendant entered into an agreement with HSBC under account reference **********. I am uncertain as to which account this refers to. It is accepted that I have had banking products with Barclaycard in the past however I have no recollection the alleged account number the claimant refers to. Therefore the claimant is put to strict proof to disclose a true executed legible agreement on which its claim relies upon and not try to mislead the court. Until such time the claimant can comply and disclose a true executed copy of the agreement they refer to within the particulars of this claim they are not entitled while the default continues, to enforce the agreement pursuant to section 78.6 (a) of the Credit Consumer Act 1974. Statement of Truth I, ********, the Defendant, believe the facts stated within this Witness Statement to be true. Signed: _________________________ _______ Dated: _________________________ _______" Any advice appreciated For Info The original defence provided my myself was "1. The Defendant contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 2. Paragraph 1 is noted I have in the past had a contractual relationship with MKDP LLP (Ex Barclaycard). 3. Paragraph 3 is denied as the Defendant maintains that a default notice pursuant to Section 87(1) CCA was never received. 4. On the 18th January 2017 I made a legal request by way of section 78 request to the Claimant. The Claimant has yet to comply with the requested agreement. I have also requested further information to clarify the claimants claim by way of a CPR 31.14, again the Claimant has yet to comply. Therefore the Claimant is put to strict proof to: a) show how the Defendant has entered into an agreement; and b) show how the Defendant has reached the amount claimed for; and c) show and evidence any breach. 5.As per Civil Procedure Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. 6. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief."

- 42 replies

-

- barclaycard

- hearing

-

(and 2 more)

Tagged with:

-

I've trawled through the threads and got some information, but I could do with something more specific now. The story is fairly long, but perhaps if I ask the questions in the right order, then depending on the answers, much of it might become irrelevant. I got a claim form from Howard Cohen Solicitors, acting on behalf of Hoist Portfolio 2 Holdings Ltd. (I gather both are well known to caggers) for a dubious old bank debt, much of which is fees and statuary interest. They claim to have had the debt legally assigned but have not furnished proof. As a second point, I have mental and physical disabilities (I won't detail here) and have written to the court for an extension of time. They have effectively granted me another 7 days to file a full defence (ie 13th March) and this is now triggering anxiety responses. Quick question: can I do anything straightforward in that time? (if not, I'll go into more detail)

-

HI all have a sepearte thread for another of these hoist have sent me a claim form for a debt for a barclaycard pre 2007 i have already sent a cca request off to hoist which they have repsonded saying they are looking into it and a cpr request to cohen which they have ignored i also sent off a SAR request to barclaycard via the online tool a few weeks back heard nothing and they havent called to take a £10 payment the particulars of the claim are This claim is for the sum of £5410.23 in respect of monies owing under an agreemen with the account number xxxxxx pursuant to the consumer credit act 1974 (CCA) The debt was legally assigned by MKDP LLP (ex barclaycard) to the claimant and notice has been served the defendant has failed to make contractual payments under the terms of the agreement a default notice has been served upon the defendant pursuant to s.87(1) CCA The claimant claims 1. the sum of £5410.23 2.costs just need help with defence i already been a logged onto moneyclaim and did that ready to file the defence which i have another week or so to do i beleive the claim is dated 24 april

- 16 replies

-

- barclaycard

- cohen

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.