Showing results for tags 'stayed'.

-

Hi, I'm new to the forum, but have been a long time lurker. First of all apologies for how long winded this is, but I hope I include all the relevant information. Alleged card debt from card taken out in 1998. Alleged debt approx £5k. Card sold to IDEM Capital Securities August 2012 Alleged Card default August 2013. Idem Capital Securities assigned alleged debt to Arrow Global November 2015 About three years ago I received multiple claims for alleged credit card debts, and with the help of this forum managed to get one claim dropped and ended, one victory in court and a few claims stayed, so thanks for the help there! Anyway, one of them doesn't appear to have gone away, and Shoosmiths appear to be applying to Northampton County Court to get a stay lifted and have my previous defence struck out pursuant to CPR 3.4 and obtain summary judgement pursuant to CPR 24.2 they claim I have no grounds for defending the claim. This was my original defence: So my defence was submitted, along with two other defences on the same date. Nothing further was received from Shoosmiths or the courts, and the claims were stayed. I should have asked to have them struck out, but I wasn't fully aware of the procedures, and couldn't afford to pay anything to the courts. So roll on two years and three months, and Shoosmiths start writing to me again, saying they did not receive my original CCA request or CPR18 letter in 2016 (funny how two more were received, and returned, and they were all sent in the same recorded delivery envelope!) They now claim they have provided all of the relevant information, and I still dispute this. Their alleged agreement is an application form for a card around the time I had allegedly taken out a few credit cards. Their "terms and conditions" is a reconstituted partial list, it even says for items X,Y,Z refer to your terms and conditions! They then have another set of terms including MBNA web address details, the web address didn't exist in 1998! Their letters also refer to one credit card number, then it changes to a new card number that they have assigned, which to me just points to multiple pieces of incorrect or fabricated information. I chose to ignore all of this further correspondence, as the claim was stayed. Then earlier this week, they have sent a further copy of this "information" along with a covering letter to me as follows: This covering letter includes a copy of their N244 Application Notice to lift the stay and all previously submitted information. Again, apologies for the long winded post, but I ask, how should I either try to stop this dead, or again defend? I am actually happy to attend court if it comes to that. I read on one of the other threads that this could be submitted. Would I be able to use it as a reply, as it has taken them over two years to get incorrect information that they think they can use in court? If anyone can reply, I'd like to say thanks now, and I will be extremely grateful. Will come back with the results.

-

Hi, I parked in a loading bay for what felt like no more than 15 minutes and received a parking ticket. See images attached. I couldn't see any signs that clearly displayed the time allowed or the terms and conditions. Is this legal? Please let me know if you need any information and thank you CAG in advanced!

- 14 replies

-

- allowed

- enforcement

-

(and 6 more)

Tagged with:

-

Hi, hope someone can help. This is in regards of a 'stayed' case from August 2016 Via the County Court Business Centre. Cabot/Restons At the time I requested documents those being: 1. Agreement/Contract 2. Default Notice 3. Assignment These never arrived within the period of 12 days, then a further 30 days. I went on to deliver my defence and ultimately the case was 'Stayed' Present day: I have just received a photocopy of a credit agreement with spreadsheet statements from Cabot who now which to 'discuss the options available for this account.' My initial concern is the photocopy of the agreement, in that it has clearly had something stuck over part of the section 'YOUR SIGNATURE REQUIRED' with what clearly looks like a faxed signature of who ever was signing off on the agreement, although I am unsure if this is normal practice? Also the spreadsheet is very basic with no opening balance/closing balance or written indication to the amount of initial credit and whether this was increased/decreased over time during the period of the agreement? Per my original request during court proceedings they have not supplied 'Default Notice', 'Assignment', although I'm sure this would be a request I would make again should the 'Stay' get lifted and it goes back to court. Any help in this matter would be most appreciated. Thank you.

-

Evening, I am seeking some thoughts from more learned individuals. I received a Claim Form end of Dec 2017 for an old WF debt and subsequently entered my defence on MCOL. This was on the 5 January. Since then I have received nothing further to my formal requests for additional information surrounding claim aside from two chaser letters from Cabot's solicitors detailing their 'client wish to settle out of court' and then '14 days to negotiate settlement otherwise instructions from Cabot to lift stay'. Called the court today and was advised that Cabot / their solicitors had attempted to amend the particulars of the claims on the 11 February but this was denied as they did not pay the fee. Their last letter to me dated 5 March is as above on the 14 days. I'm tempted to actually have the claim struck out as the claim remains stayed open ended. Has this happened to anyone before ? Thanks

-

Post for a friend Letter from Mortimer Clarke concerning a CCJ issued in July 2017. Please fill out this I&E form within 14 days otherwise instructed to life the stay and request payment of £50 per month. No CCJ on credit report. Requested copy of CCJ. Defaulted back in March 2011. 1st letter knowing about CCJ. My question is does sending stat dec as never received the CCJ paperwork and couldent defend claim, where does it reset it to? Does it take all the way back to 2011 so debt would be SBd now or to the original court date in 2013 and debt not Sbd?

-

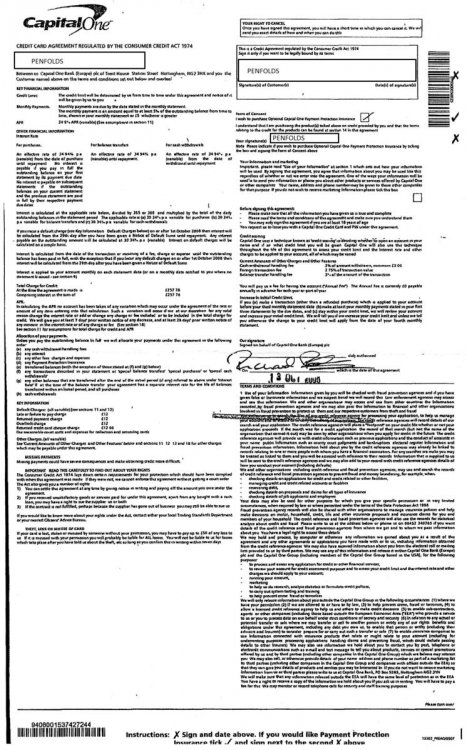

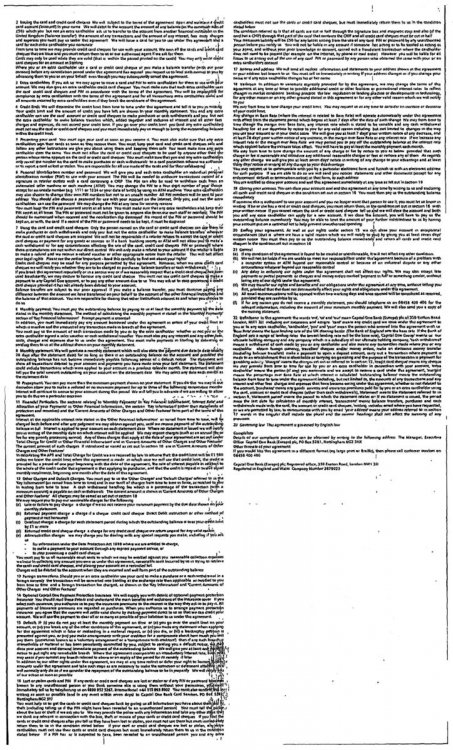

Hi All, I have recently defended a claim by Shoosmiths on behalf of Capquest for a Cpaital One credit card taken out in Oct 2008, the last payment made was in Jan 2012. The claim was stayed at the end of Jan 2017 after filing a defence. Before filing the defence Capquest was sent a CCA request, a copy was also sent to Shoosmiths with a CPR31.14 request, which Shoosmiths remain in breach of. However today Capquest has sent a response to the CCA request (attached). They have also sent somebody elses application for a Barclays Sky Card which includes their name, address, DOB, household income, home, mobile and work telephone numbers and applicants signature. Any advice greatly appreciated, please advise if defence or CPR 31.14 request needs uploading. Thanks Penfolds

-

Hi Guys Im new to this I received a court notice from mortimer clarke on behalf of cabot in 2015 regards a cc I filed my defence and sent them the requet for proof of my cca which they did not send me the court stayed the claim and now 2 years later they have appealed to remove the stay with the court ive just received court papers sending the claim to small claims track and mortimer clarke has asked the court to complete this without a hearing any help would be much appreciated

-

Hi hoping someone can help/advise, I received a CCJ for the amount of £2802.71 for a credit card. England based. I can't pay this and on the form it does not tell me how I can pay this off in instalments. I have lots of debt which I am dealing with but this one slipped through, my fault totally. Any advice on how I should proceed would be much appreciated. Many thanks.

-

http://www.mirror.co.uk/news/uk-news/nurse-walked-out-care-home-10166243 The Nurse was giving evidence at a Coroner's hearing into the the deaths of the 3 men. The tale told was quite shocking and I was surprised that the coroner reckons that neglect was not a contributory factor into their deaths !. I think I would rather go to Switzerland and take my own life than end up in a care home. I guess you cant tar them all with the same brush, but even those where residents pay very high fees are coming under scrutiny !

-

Hi, I am hoping for a little advice Lowells issued a claim against me for the sum of £5200 I confirmed the claim and sent defence in I also requested copies from them of default notice, statements of accounts, credit agreement (post 2007) and also that they legally owned the debt. I received nothing and the claim was stayed. A few days ago I received a statement of accounts and credit agreement and although the covering letter says the default notice is enclosed is was not there, the covering letter basically threatens me to contact them or they will apply for a default judgement to be made against me. After going through the statement I see that out of the total amount owed there is over 3k in interest charges and over 200 in ordinary charges. also there are numerous entries on the statement for accidental death plan for £5.95, in the adjustments part there is also things added such as $400 for TRANS EX TERMS They urge me to contact them and the questions I have is should I and try and negotiate because of the interest charges and other charges and also things like death benefit charges, I mean how many do you need? Should I do this before they potentially lift the stay, Can I argue about these interest charges at all? Or should I write to them and offer them payment to stop any action but acknowledge that I only owe part of the debt?. I cant upload any docs as I dont have the means to but the credit agreement was on 4/12/2007 unsigned but on statement of accounts it says account opened 25/11/2008

-

Hello CAG I hope you can help me. Due to unemployment I fell behind my overdraft payments and HSBC closed the current account in 2013 and sold to Cabot. In October 2015 Restons made a county court claim for a HSBC overdraft debt for £1900 including court fees for an overdraft on behalf of Cabot. I defended this claim based on the lack of documentation from Restons/Cabot and to date no documents have been supplied by Restons. The claim has been stayed just over a year now and I was wondering if I should leave it stayed or get the court to strike it out?

-

Hi guys, I have been following similar threads on this forum and have found much useful information regarding defending a claim from Restons and Cabot Financial vs myself I had an old CC account which is most definitely Statute bared and used this as my defence when Restons entered a claim via Northampton County Court Business Centre. (Although they claim that I had made 2 x payments of £3.15 both on the same day in April 2013) !!! A typical Restons stunt from reading similar threads!.. It has now passed the 28 day stage since they were informed of my SB defence and I have phoned the courts to confirm that the claim is now stayed which it is. Obviously I would like to put this matter to bed at the earliest opportunity. My question is.. Do I just leave it as is with the prospect of Restons dragging it back up in the future or do I apply to have the case struck out with form N244 and pay the £100 fee. Your help on this matter would be much appreciated.

-

She appealed to Smart with the same mitigating circumstance and they told her to pay. A complaint to the principle who hired the [problem] gets the charge cancelled.... http://www.itv.com/news/meridian/2015-09-23/mother-fined-70-because-she-stayed-in-asda-car-park-after-doing-her-shopping-to-breastfeed-baby-daughter/?ref=yfp

-

Thanks for taking the time to read this, I'd be really grateful for any advice please. I had two accounts which were sold to Cabot, they wrote to me in July 14 and then issued a MCOL case ten days later via Restons claiming £7,138. I part accepted the claim but said that the figures were completely wrong and I only admit to £1,000 of the claim. My response was received in time by the processing centre and I then heard nothing until March 2015 when I received a letter from Restons advising that their client was still trying to get together the paperwork. I then got a letter at the start of July 2015, again from Restons advising that they were intending to accept my offer and needed a full income and expenditure to be returned IMMEDIATELY!! I wrote back to them and said if they meant my £1,000 offer I would pay that in return for them stopping all action and confirming in writing that this was in full and final of both accounts. I heard nothing so phoned them and they are adamant that they can't consider my one off payment without a full income and expenditure - silly. I have contacted the central court who confirmed the case has become automatically stayed as more than 6months X days has passed since the original claim was submitted and Restons only action was to file for automatic judgement (sorry if that is not the right term) three days after my part acceptance was returned, otherwise the court has heard nothing from them. My questions are therefore 1) As the case is stayed should I bother with the income and expenditure or just chance the fact that they won't do the necessary paperwork and cost to get it unstayed (given that they couldn't get the paperwork in time first time)? 2) Should I pursue them with my offer or just leave them now to reply if they want 3) Should I apply for a set aside and if so what are the risks of letting them open the case again? Sorry for the long winded explanation, hope you can help.

-

I have received a letter saying "If we do not hear from you by X we have instructions to issue legal proceedings against you in county court to recover the full balance outstanding. PLease be aware that, if it is necessary to issue legal proceedings, there will be additional costs incurred for which you may be held liable" Should I call them, if not what would you suggest as my next action? Think this is around 6 months from SB. Thank you

- 24 replies

-

- county court

- solicitor

-

(and 1 more)

Tagged with:

-

I recently attended a court hearing to get a writ stayed as it was enforced by a company who claimed to have purchased the debt July 15, however as they are not recognised on the original claim the judge told them they have no legal stake on the ccj. I am aware the claimant was used in name only and the 3rd party have been involved from the start. I would like if possible to know what action if any can I do to stop them now applying to court to have the claimant details changed. As i have a claim for illegal eviction, unlawful entry of property, removal if property to submit against claimant i do not want the ccj to change details. They are aware I have this claim to submit. for info; claimant never once attended court claimant still wont respond to any correspondence i send the deed of assignment was alledgedly done in July 15 and sent to me in Sept 15 No notice sent from claimant to confirm debt sold - even after I have written to the claimant to confirm. payments sent to claimant that the 3rd is now asking for proof of so they can consider whether to reduce the balance. threatening interest when no interest awarded on claim.

- 17 replies

-

Hi there I have received a claimform for a Santander O/D:- Name of the Claimant ? - Hoist Portfolio Holding 2 Limited Date of issue – 23 April 2015 Date of defence - by 4pm – 25 May 2015 - This is Bank Holiday so should I send by Friday 22/5 ? What is the claim for – The claim is for the sum of 2***.** in respect of monies owing pursuant to an overdraft facility under account number XXXXXX XXXXXXXXXX. The debt was legally assigned by Santander UK Plc to the claimant and notice has been served. The Defendant has failed to repay overdrawn sums owing under the terms and conditions of the bank account. The Claimant claims: The sum of 2***.** Interest pursuant to s69 of the county court Act 1984 at a rate of 8.00 percent from the 7/04/2015 to the date hereof 14 days is the sum of *.** Daily interest at the rate of .54 Costs What is the value of the claim? 2***.** Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Overdraft When did you enter into the original agreement before or after 2007? after 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Hoist portfolio 2 Limited Were you aware the account had been assigned – did you receive a Notice of Assignment? Not sure Did you receive a Default Notice from the original creditor? Yes Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? I have received a Transaction Summaries – doesn’t mention ‘Notice of Default Sums” Why did you cease payments? I lost my job and because I didn’t have enough to cover the overdraft they demanded that I repay the overdraft. What was the date of your last payment? I’m not sure could be around 2009 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Can't remember On receipt of the claim I sent a CPR 31.14 request but to date I have not received any repsonse. My claimform is very generic as per Ladylovesalsa I intend to send the below defence as suggested on that thread :- Particulars of Claim... 1.The claim is for the sum of 2***.** in respect of monies owing pursuant to an overdraft facility under account number XXXXXX XXXXXXXXXX. 2.The debt was legally assigned by Santander UK Plc to the claimant and notice has been served. 3.The Defendant has failed to repay overdrawn sums owing under the terms and conditions of the bank account. The Claimant claims: The sum of 2***.** Interest pursuant to s69 of the county courticon Act 1984 at a rate of 8.00 percent from the 7/04/2015 to the date hereof 14 days is the sum of *.** Daily interest at the rate of .54 Costs Defence The Claimants particulars of the claim are vague and generic in nature accordingly the defendant sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 1. It is admitted with regards to the Defendant once having had banking facilities with the original creditor Santander Bank. However I do not recognise this account. 2. Paragraph 2 is denied.I am not aware or ever receiving any Notice of Assignment pursuant to the Law and Property Act 1925. It is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer credit Act 1974. The Claimant has yet to provide a copy of the Notice of Assignment its claim relies upon. 3. Paragraph 3 is denied. The Original Creditor has never served notice pursuant to 76(1) and 98(1) of the CCA1974 Any alleged amount claimed could only consist in the main of default penalties/charges levied on the account for alleged late, rejected or over limit payments. The court will be aware that these charge types and the recoverability thereof have been judicially declared to be susceptible to assessments of fairness under the Unfair Terms in Consumer Contracts Regulations 1999 The Office of Fair Trading v Abbey National PLC and others (2009). I will contend at trial that such charges are unfair in their entirety. 4. As per Civil Procedure Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. The claimant is also put to strict proof to:- (a) Provide a copy agreement/overdraft facility arrangement along with the Terms and conditions at inception that this claim is based on. (b) Provide a copy of the Notice served under 76(1) and 98(1) of the CCA1974 Demand /Recall Notice and Notice of Assignment. © Provide a breakdown of all excessive charging/fees and show how the Claimant has reached the amount claimed. (d) Show how the Claimant has the legal right, either under statute or equity to issue a claim. (e) Show how they have complied with sections III & IV of Practice Direction - Pre-action Conduct.5. On receipt of this claim I requested documentation by way of a CPR 31.14 request dated April 2015 namely the Agreement and Termination Demand Notice referred to in the claimants Particulars of Claim. The Claimant has failed to comply with this request. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief.

-

Hi, I'm not sure if this is the right forum but I've a question that doesn't seem to be answered and its driving me crazy. I have a debt company chasing me for an old debt, they applied for a CCJ in which I sent a SAR request as my defence. They have now sent the paperwork and it showed the last payment was on the 10/10/08 yet they filed a CCJ claim on the 6/10/14. Is this debt statue barred as no judgement was registered due to the CCJ being stayed as there is no ccj registration against me due to the ccj claim being but on hold until the SAR was received?

-

Hi, I wonder if someone can advise me please. I was issued a Claimform on 13/1 . On 29/1 I filed the acknowledgement of service and I filed my defence on 12/2. I got a letter from the court telling me my defence would be served on MKDP and they have 28 days to respond or the claim becomes stayed. I've heard nothing from the court since and I want to know if the 28 days are working days or calender days? In the meantime I wrote to MKDP and asked them for copies of the signed credit agreement, statements, notice of default, notice of assignment of the debt. They replied saying it could take 8 weeks and sent me a default notice with all personal details blacked out, it could have been sent to anyone! Thanks

- 43 replies

-

- county court

- judgement

-

(and 1 more)

Tagged with:

-

Hi there- to anyone who can help me in a very frustrating situation. I am the defendant of a case brought against me by a company who is representing a creditor - to the sum of aprox £3000 The case details are very vague against me to which there were not specific details at all that i could relate to or remember as i have a few very old debts from over 5 years ago that i have had no correspondence with. Before i submitted my defense I sent several letters to the claimant requesting specific details of the account in question so i could identify what debt the claim related to but the claimant did not respond whatsoever. My defense to the court was that the claim was vague and did not specify any specific details relating to me or even an account number and due to no response by the claimant i asked that the case be throw out. My defense was submitted to the claimant - to which the claimant did not reply within the allotted time frame by the court and so the court automatically STAYED the case. It has now been many weeks later - the case is still Stayed and i have recently/ finally received a letter from the claimant saying that - "They are currently in the process of obtaining their client instruction and shall revert to me in due course" I get the impression that they have bought the debt - submitted an ambiguous claim against me in the hope i would ignore it and they would win by default. But they clearly have not complied from day one. Can someone please advise what i can do now as i believe the court seems to be weighted in there favour. Why cant the court take into account the lack of info in the claim and just simply throw it out ? or do i wait indefinitely until the sword of Damocles comes down months and years later? Please can anyone help? Thank you

- 3 replies

-

- county court

- mcol

-

(and 1 more)

Tagged with:

-

Hi all my question is as follows A family member and partner and passenger parked in the Car park of Iceland sign states no free parking for disabled drivers. Free parking for 2 hours, photo to prove this. Driver overstayed by 30 mins or so. Due to the following A late add to the story, the passenger in the car a (Motability car) is disabled and had an epileptic fit and was unable to get about for nearly an hour after the fit. Hence the late return and getting the PCN. Otherwise they would have left the site within the time limits. PCN issued by ANPR to the RK the company is EXCEL PARKING The RK can not drive PCN issued by post within 7 days (calendar) and clearly states that parking is for ONE hour only free, sign says TWO hours but was still over time regardless. The signs (contract) are on boards at 7 feet high on poles as seen in picture one, I am 6ft 2" tall and the angle to get the sign in full was as displayed in the photograph. in picture one the 2 hours HAS NOT BEEN EDITED AT ALL I have attached a PDF with the redacted PCN with pers removed, please can I draw your attention to page 2 where the "time limit is 1 hour" on the PCN sign says different. Any advice please MM

-

Hi guys, Not sure if this is the right forum but I'll ask anyway. Thanks in advance for reading this. Sigma SPV and their pals HL Solicitors put a money claim through Northampton court (where else?!) on May 2012. Due to the fact the money they are collecting refers to a) A debt over 6 years old (although they took the debt in 2011) b) It is less than £500. c) The credit card company (HSBC) was in breach of credit agreement (I got ripped of by internet merchant) once I put my defence in, they decided to stop perusing the claim, However they have listed a default on my credit history using a bogus amount and default date as soon as they received the defence paperwork from the court. What can I do? Are they able to post the default even though there is an ongoing claim that they decided to stay or drop? Any ideas Thanks for your help

- 3 replies

-

- collector

- county court

-

(and 1 more)

Tagged with:

-

hi, i have just received cc j forms regarding overdraft which i originally contested due to huge amount of charges that were added on, at the time the banks were being investigated and my ccj application was put aside until judge was able to make decision, (as i understand it) I didnt hear anything back, despite the banks apparently winning the case, but left it at that, until last week when i received these papers from another firm a dca who it would seem has bought the debt. I need some advice about how i should defend this if i still can, is this application valid baring in mind the situation with the first application ? thanks

-

http://www.dailymail.co.uk/news/article-2255587/New-Year-celebrations-turn-ugly-cities-country-country-lives-Binge-Britain-reputation.html?ICO=most_read_module

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.