Showing results for tags 'reston'.

-

Hi All What section would i post the following Yes i am one of many that suffered in the crash and thought some stuff would go away but yesterdays post brought me a letter from Reston Solicitors as well as a letter from Arrowe Global telling me my account had been transferred to a new agency, and that court proceeding will go ahead after the 12th Sept 18 The debt is from MBNA - Credit Card Date of agreement 28th Feb 2001 States Orginal Account No Date of Issue to Arrowe Global 29th November 2012 Outstanding amount £14425.26 From what i recall i did pay £1 per month for some time but cannot recall how long for or when i stopped the payment but i assume approx 3 years ago, i lost everything in the crash my business, house etc and have just started to get on a level playing field, and since this letter has arrived i felt sick and did not sleep very well at all with worry. My main questions for advice is should i respond to Restons and ask for CCA information ? or should i wait and see if they issue court proceedings after 12th September (their deadline) Any help advice would be truly appreciated Chris

-

Cabot/reston claimform - sainsbury Credit card 'debt'

Dire1 posted a topic in Financial Legal Issues

Hello everyone, I received a court claim dated 04 August 2016 for the sum of £1994.53. It is a claim put in by Restons on behalf of Cabot. Details of debt Original creditor: Sainsburys Type of dent : credit card Account opened: 7 July 2003 Terminated: 22 April 2009 Date of assignment: 27 November 2012 Last payment: 23 November 2011 Restons sent me a letter dated 15 July 2016 advising till 29 July to respond or they'll request CCJ. Sadly by the time I had access to the letter at my address that deadline had passed. I started getting calls from Cabot at all times of the day since last year but I didn't know who they were so I didn't respond. I do not recollect getting the notice of assignment from them. I am so terrified, what do I need to do now? Do I send a cca request to Cabot, I have seen the template on here. What are my deadline dates for responding to the claim court? Having a CCJ in place could harm my employment. Thank you. Please note I have read other threads, but not seen any that directly applies to my situation. -

Hi, Can anyone help please? To cut a long story short, I have a letter of Notice of discontinuance (N279) from back in 2015 from Restons. It states The claimant discontinues all of this claim, however over the last few weeks I have started receiving requests for payment for this alleged debt from Cabot. (I know Restons are Cabots solicitors) Do I continue to ignore these letters or send them a copy of the discontinuance and request they stop harassing me? Thanks

- 13 replies

-

- cabot

- discontinuance

-

(and 1 more)

Tagged with:

-

Name of the Claimant - Arrow Global Limited Date of issue –* 05 Sept 2016 What is the claim for – 1.The Claimant claims payment of the overdue balance from the Defendant (s) under a contract between the defendant(s) and Marks and spencer Financial Services PLC dates on or about Mar 20th 2004 and assigned to the Claimant on Oct 08 2013 What is the value of the claim £2900 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account?* credit Card When did you enter into the original agreement before or after 2007? Before 2004 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt Purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes can't recall when... Did you receive a Default Notice from the original creditor? Yes Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Maybe! Why did you cease payments? 2003/4 What was the date of your last payment? 2003/4 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes, explained that I was made redundant, I called them and they didn't care so I ignore them! Hi All, I received a letter last week ( Claim Form on the 8th of Sept) from the COUNTY COURT BUSINESS CENTRE. And am looking for some help, I've not responded yet but know that its urgent that I do.. . I've been looking at the other threads but it all a too much to try, I'm hoping to get some advice as to see if I can defend this, any help or next course of actions would be most helpful... a little background, I was made redundant and had no money, simple as, stop paying, when some cash came in a few years back I recall sending an offer which was refused, can't remember when, can't really track it either, it would've been most likely 2 years ago.. Is there any chance that I can get this status barred or thrown out of court which would result in me negotiation with Arrow? Wishing you all the very best and thanks for reading...

-

Hi there, I have an old Halifax credit card that defaulted 5 years ago. I have been paying a reduced amount each month on a SO. Halifax closed the account and Cabot, who took over the debt in September 2015 have been sending me letters, which I've ignored as it's being paid each month. They have now passed my account to Restons. A search shows a wealth of posts on how they like to go down the CCJ route. As of yet, I haven't heard from Restons. It was only 3 days ago that Cabot wrote to me advising. My question, can i actually defend the CCJ if court papers come through? Or is my fate sealed. I'm not adverse to paying the debt, though this was due to fall off my credit file early next year. A CJJ would be terrible for us. Any advice would be great.

-

Hi there, First post on here but have followed the stories of many previously - what a fabulous source of info, reassurance and advice. I hope my story will offer the same. In Dec 2015 we received a County Court Claim Form from Reston's re an alleged old credit card debt. The agreed debt had been paid off two years earlier with a DMP but there was a query re applied interest and late payment fees. Reston's continued to pursue, we continued to ignore them but behind the scenes followed the advice on here around SARs etc, preparing statements, evidence and generally getting our affairs in order. Reston's focus was on threatening us they would be asking the Judge to strike out our defence. 1st court date (Oct 2016). Reston's sent a Head of Chambers barrister to represent them, we represented ourselves. Reston's aim a few days before was to ask the judge to strike out our defence and award against us, however on the day they decided to ask the Judge for an adjournment as new evidence had been provided to them a day before (it hadnt). The judge took a dim view of the fact they had been messing around for around 12 months but allowed them another 8 weeks. 2nd court date (Feb 2017). We (along with an advocate) arrived at the Court, Reston's did not. They had contacted the court the afternoon before to ask for a further adjournment (the Judge agreed and we waited another 8 weeks) During this time we saw a solicitor who wrote to Reston's to assure them we were more than willing to fight the case and would push for a full hearing. Reston's replied to them in April stating that they were confident of their case and would again ask the judge to strike out our defence. 3rd court date was due to be last week, however Reston's sent a communication to the solicitors one day before withdrawing proceedings. So, it's all finished. I think the morale of the tale is to not be scared. Whichever tactic you choose in dealing with them they will twist it. Reston's told us that by ignoring them we were going against the Civil Procedure Rules and the Judge could rule against us purely for that, others who have engaged with them have been tied up in knots. What does seem apparent though is that they talk the talk but are into easy wins and not up for a fight. So, go get 'em tiger and all the very best wishes to anyone going through it all xx

- 4 replies

-

- county court

- reston

-

(and 1 more)

Tagged with:

-

My father made 4 separate CCA requests for 4 different debts being pursued by Cabot. For each of them he has received the attached response which states that they are unable to provide the info for the moment and will continue to pursue the original lender for the information. They say the account will 'remain on hold' but are 'still obliged to repay the outstanding balance'. We wish to settle this matter and are willing to make a percentage payment to clear the debt. I am tempted to write back a letter as in this post http://www.consumeractiongroup.co.uk/forum/debt-collection-industry/266261-calder-financial-offer-clear-2.html#post3017541 . What does everyone think is the best way to settle these debts without prolonging the matter too much (my father is dealing with 17 creditors at the moment!)? cabot.pdf

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

-

Hi All, I purchased a Netgear Ready NAS for aprox £300 for our company for a upcoming project. By the time it came to use it I tested it to make sure the transfer speed are what was stated and they weren't so it wasn't any use. I emailed them 15 days after purchasing letting them know this and they said as long as everything was returned as new they would accept a return, so I replied saying this was the case. The item didn't come sealed so even if I hadn't of opened it there is no way of proving it either way. They then emailed back saying it would be subject to a restocking fee of 30% and I have argued the fact it isn't stated in their terms and conditions surely they can't force that from us after buying the item. Is there anything I can do before just giving into this restocking fee ? Link to their business terms and conditions - https://www.ballicom.co.uk/help/faq#terms-and-conditions-business-purchase Thanks

-

Hello I'm looking for some advice please with reference to the below:- Name of the Claimant ? Capquest Date of issue: 18/11/2016 > Defence filed for SB 06/12/2016 What is the claim for: 1.The claimant claims payment of the overdue balance due from the defendant under a contract between the defendant and [Retailer] dated on Mar 13 2002 and assigned to the claimant on Feb 12 2010. Default balance £1867.74 31/10/2016. What is the value of the claim: £2052.74 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account: Cat Debt / Store Card When did you enter into the original agreement before or after 2007: Before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim: Capquest Were you aware the account had been assigned – did you receive a Notice of Assignment: Unsure, have recently received letters from Capquest Did you receive a Default Notice from the original creditor: Unsure, possibly as it was a long time ago. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year: I don't believe so. Why did you cease payments? Financial difficulties & personal problems What was the date of your last payment? Late 2008 to the OC, 2012 to Capquest [i think]. Was there a dispute with the original creditor that remains unresolved? I stopped making payments and the debt has now been sold on. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Please see below. I received the claim form last month, did some homework [although perhaps not thorough enough] and believed that this was SB. I registered on MCOL, submitted my defense for SB as to the best of my knowledge I believed it was. However, my memory isn't what it used to be unfortunately and things are currently very unsettled at work so I'm not thinking straight. I received a letter from the court saying that the defence had been forwarded to Capquest, then I received a letter yesterday from Capquest stating that they believed it wasn't SB because their client last receievd a payment from me in August 2012, therefore I should withdraw my defence as I've not provided the last payment date, I do not appear to be disputing the the balance, and I'm invitied to withdraw my defence in the next 14 days and complete and return the admission form. I tried to sleep on this last night and ended up searching an old email account and found a communication I sent to Capquest in early 2012 disputing what was showing on my credit file. I must have been making regular payments for just over 12 months, yet this was not reflected on my credit file and I must have emailed them to ask them to correct this. As per my email I must have believed the balance was just over £1000 yet it was showing way over £2000 which I'm guessing is not what we had agreed as part of the payment plan, hence my email to them. I've scoured this mailbox but cannot find a reply from them. I know that later that year I was made redundant twice in a very short space of time [last in, first out] and that will be why I didn't keep up with payment plan as I was out of work for a while but then took a substantial pay cut just to get back into work. There is no mention of Capquest or the retailer on Noodle. I'm now at a loss and I don't want to make the situation any worse. I honestly believed it was SB but have since discovered that it isn't and feel terrible for making that mistake. I haven't submitted any CCA, CPR, SAR, etc. I'm just looking for some sound advice please.

-

Hi, I wonder if anyone has had any dealings with Viking collection services working on behalf of Santander? I am currently sorting out DMP's with all my creditors as a result of a drop in income. Most have accepted it, one has just ignored it, one just keeps sending duplicate letters every so often, bmy Asda card that is owned by santander have now passed it on to vikings who are demanding full payment of the outstanding balance. I wrote to santander a few times telling them my situation and what i could afford and i have been paying that. I have now sent another letter explaining this to Viking. My experience is telling me that Viking is in fact just another part of Santander. Am i right in thinking this and does anyone know what they are like to deal with, will they take me to court sooner rather than later? Is this just a scare mongering letter to make me pay up? Any advice on how to deal with this company would be much appreciated. Many Thanks Gem77

-

Hi Can you again, please offer some legal assistance. I have a ongoing claim in another thread but thought it might be easier starting a new one as this is not my debt.. but a close friend's I have filled in the form below This is for a credit card and a Current account from LLoyds. Does that mean 2 separate documents need to be sent out for the CCA and the CPR 31.14? Thank you Name of the Claimant ?cabot Date of issue – 16 0ct 2015 What is the claim for – 1.The claimants claim payment of the overdue balances (set out below) which the defendant(s) have failed to pay as required under contracts with the following particulars. Acc no 4462xxxxxxxxxxxx (credit card) Acc no 77xxxxxxxxxxxx (current account), between the Defendants(s) and Lloyds TSB dated on or about Mar o1 2002 and Jan 03 1997 respectively. The contracts were assigned to the claimant on Oct 01 2012 and Feb 11 2013 respectively. Particulars – a/c 4462xxxxxxxxxxxx a/c no 77xxxxxxxxxxxx DATE ITEM VALUE 11/08/2015 Default Balance £12249.34 01/08/2015 Default Balance £2428.15 Post Refri Cr NIL Total £14677.49 What is the value of the claim? 14,677.69 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit card and current account (combined) When did you enter into the original agreement before or after 2007? Before 2007 Has the claim been issued by the original creditor or was the account assigned (CABOT) Were you aware the account had been assigned – did you receive a Notice of Assignment? Unsure as it has been a long time Did you receive a Default Notice from the original creditor? Unsure if this was ever received Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Don’t recall receiving this Why did you cease payments? Financial issues stemming from job loss What was the date of your last payment? Approximately 1 year ago Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes attempted debt management but couldn’t sustain it

-

Hi guys, I have been following similar threads on this forum and have found much useful information regarding defending a claim from Restons and Cabot Financial vs myself I had an old CC account which is most definitely Statute bared and used this as my defence when Restons entered a claim via Northampton County Court Business Centre. (Although they claim that I had made 2 x payments of £3.15 both on the same day in April 2013) !!! A typical Restons stunt from reading similar threads!.. It has now passed the 28 day stage since they were informed of my SB defence and I have phoned the courts to confirm that the claim is now stayed which it is. Obviously I would like to put this matter to bed at the earliest opportunity. My question is.. Do I just leave it as is with the prospect of Restons dragging it back up in the future or do I apply to have the case struck out with form N244 and pay the £100 fee. Your help on this matter would be much appreciated.

-

hi i am posting this on behalf of my wife .. she has a debt owed to mbna for £2600 we hadnt heard anything on this for 5 years but as its 11 months off statue barred its popped its head up.. have a cca here to send off just unsure who gets it the debt was owned by dlc but a recent letter says they was placing the account with Cabot Financial (europe) and their next step would be to pass the account to restons solictors had no letter off cabot but a nice one turned up off restons threatening a ccj .. .from what i read here their pretty true to their word. .so was hoping a cca might slow them down. the restons letter stats all future correspondence and payments should be done through them so do i send a the cca to them to dlc or to cabot thankyou on behalf of my better half

-

Hi all I've received a rather threatening letter from Restons Solicitors, I'm hoping you can assist me with my problem. Resotns solicitors been instructed by their Client Hillesden securities limited. I have received an n30 Judgement for claimant Resotns solicitors been. I believe it relates to a car finance agreement I had with Black Horse back in 2000 the Car price was £12000 to be paid over a period of 48 month. After few month later in year 2000 due to financial problem I wasn’t able to keep my payment of the monthly instalment to Black Horse. Black Horse decided to take back the vehicle and sell it at an auction for £5000. Black Horse put a default on my credit file (I do not know if that CCJ or not) but I wasn’t able to take any credit for six years and they started to charge me £20.00 a month until year 2010. Black Horse sold the debt to Hillesden securities limited with some advice from the Citizen advice centre I start paying them £1.00 a month as a token payment. In year 2012 for unknown reason I stopped the standing order by mistake. I didn’t receive any correspondents from Hillesden securities limited from year 2012 until November 2015 I received the court letter from there form Restons solicitors. They are demanding £1540 I wrote back to them asking to make a token payment of £1.00 but they didn’t reply back to me and when I phoned them they denied my offer letter. I received N1SDT from the court and they asked me to pay the £1725 court fee included. I offered the court £1.00 every month for six month until my financial status improved but they refused the offer and now I have N30 from the court asking me to pay instalment of £226 a month which I will not be able to afford. I do not know what action to take as I don’t own a property; I am currently in a renting accommodation and already have family financial problems. Do I consider this as a statute barred? I need your help guys.

- 67 replies

-

hi I am pretty new to this and need some advice, I have received a court letter from Northampton court, I replied to the court online to defend claim in full, I am being taken to court by restons solictors on behalf of arrow global, they claim I own them £742, over last weeks I have sent restons requests for information using your cpr request letters , so far they have given me nothing , in every letter I have denied any knowledge of this alleged debt, as I have not a clue what there talking about so far restons have given me nothing , the last letter they have just sent me under a cpr 18 request, states by restons they fail to see how the information I requested under a cpr18 is reasonably necessary or proportionate, and how provision of the documents I requested will assist you in preparing your case, they then went onto say on a voluntary basis we can confirm this debt is owed to shop direct, (littlewoods extra catalogue) opened in oct 2004 and last payment shows on account on march 2008, i am some what mad with restons as how can i defend myself when 1 i have no clue or information for this alleged debt, and they refuse to provide any documents to prove this, my credit file contains no information, so i am pretty much working blind and i am sorry i have until the 25th nov to submit my defence, and i lost as what to place as a defence, and prior to the court paper s turning up i had received no letters , from either global or restons i would be grateful for any assistance

-

Hi, had a phone call from these people today it came up as international (never answered the call) but on checking we found that it is a DCA. Never ever heard of them and certainly have no debts with them.

-

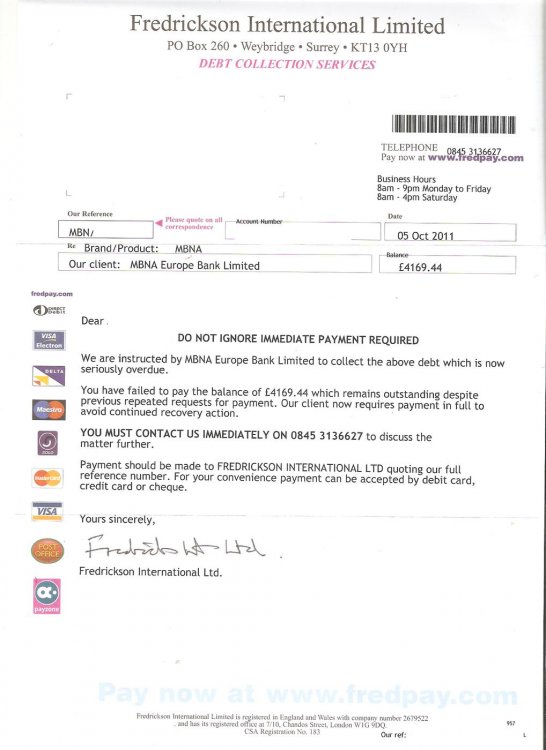

I have a debt with MBNA for £3000+ I was paying £65 per month and had got it down from about £8k over the years. The people who regularly pester me decided £65 was suddenly not enough when it actual fact it had become too much. So I sent them a CCA request and they sent back a copy of my initial application form. Same with Barclays, only Barclays just sent a piece of paper with my old address on from 12 years ago and a big wadge of terms and conditions. No signatures or anything really. I know things have changed since the Taylor case, but still, it didn't seem like enough, so I sent them both letters (from templates on here) saying it was inadequate and that the accounts were in dispute. that's when both of them sent letters - MBNA's was from Fredrickson and Barclays was from Mercers. Can someone enlighten me as to what to do next? I feel a bit stuck. Barclays, throughout all of this, call me between five and ten times a day, in spite of me asking them to just write. Thanks in advance

-

Hi All, This is my first post on this forum, I have been reading it for 1-2 days now and the info here is simply amazing! I have various issues but the most pressing is a Court Case with MBNA and Preston Solicitors. I heard they are the nasty ones! I was living in the UK till January but due to my health and being unemployed, I had to move back to my country of origin, in the middle of Europe (sorry for being secrecy, just do not want people to find me this way) I have a CC debt of 25k from MBNA what I could not pay due to job loss and health issues. I tried to negotiate with debt collectors, offered 30% but turned down and referred it to Prestons, they went to Court right away. I have defended the claim (filed online in December) and then they requested to transfer the case to my local Court close to London, (where I used to live). I was already abroad that time and did not get the mail about the transfer and the hearing so could not attend. On the hearing they have struck out my defence and now I have 2 weeks to file something otherwise I guess it is CCJ. Not sure really, never been to this situation before. This is the letter I got from the Court 1, the said defence of 10/12/2011 is Struck Out pursuant to CPR 3.4 (2)(a). 2, Unless the Defendant files and serves a defence which is the opinion of the District Judge discloses reasonable grounds for defending the claim by 4pm by 30th March, the Claimant may thereafter enter judgement in default for the amount claimed, interest and fixed costs 3, The court has made this order of its own initiative. You are entitled to apply to have this order set aside, varied or stayed but must do within 7 days from the day on which this order is server upon you or such other perios as may be directed above. The credit card was opened on 14th 09 2006! I was reading aroundand it seems it is good if the CC was opened prior 2007 but could not find why? What you guys think, what options do I have to avoid CCJ? If necessary, I could make a payment for final settleemnt in the region of 5-6k, not really much, do you think there is still scope to negotiate or offer this? Thanks John

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.