Throwaway

Registered UsersChange your profile picture

-

Posts

61 -

Joined

-

Last visited

Reputation

1 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Tesco personal loan - cannot afford full payment anymore

Throwaway replied to Throwaway's topic in Tesco Bank

Thanks for the reply dx. I noticed in another thread you mentioned that the poster should send a letter to the original lender stating that they do not want to deal with a DCA because they are abusive and threatening. Shall I proceed to do the same? -

Tesco personal loan - cannot afford full payment anymore

Throwaway replied to Throwaway's topic in Tesco Bank

Hi I hope all is well and wishing everyone a happy new year. I've just received a letter from Tesco stating that the debt has now been ''passed to their DCA Moorcroft..'' and that I should await contact from them within the next few days. Shall I still continue paying Tesco? Or wait and see what moorcroft say? -

1 Date of the infringement 27.01.2020 2 Date on the NTK [this must have been received within 14 days from the 'offence' date] 31/01/2020 3 Date received 05/02/2020 4 Does the NTK mention schedule 4 of The Protections of Freedoms Act 2012? [Y/N?] Y 5 Is there any photographic evidence of the event? Y 6 Have you appealed? [Y/N?] post up your appeal] Have you had a response? [Y/N?] post it up - N 7 Who is the parking company? MET PARKING SERVICES 8. Where exactly [carpark name and town] (841) Great Cambridge Road Retail Park Enfield For either option, does it say which appeals body they operate under. There are two official bodies, the BPA and the IAS. If you are unsure, please check HERE - I'm not 100% sure but they have a complaints section and they mention BPA. Tback Parking Charge Notice.pdf

-

Hi, I received a PCN from MET for overstaying at a carpark. 90 minutes Free stay period. Actual period of stay 110+ minutes. It was a genuine mistake on my behalf I was catching up with a few friends and lost track of time. We were at one of the restaurants at the car park. Do I have a leg to stand on if I appeal? Thanks, T

-

Hi, I forgot to update the thread. We complained saying we didn't receive it to BP on twitter. After a few emails we got a letter saying they're going reduce the pcn to the initial amount.

-

Hey, what avenues would she have? Still struggling with monthly payments and now some solicitors have sent her a letter saying she has 7 days to pay 2months of arrears. otherwise L2G will serve a default notice and look to reclaim the money by legal routes.

-

Yes, all of those were done just before our move too. We were at the old address for 5 weeks after the incident, surely it would've come during that period. EDIT: I am speaking on behalf of my father btw.

-

We moved mid December and have had a redirection service put in place for mail too. I have no idea why we haven't received it.

-

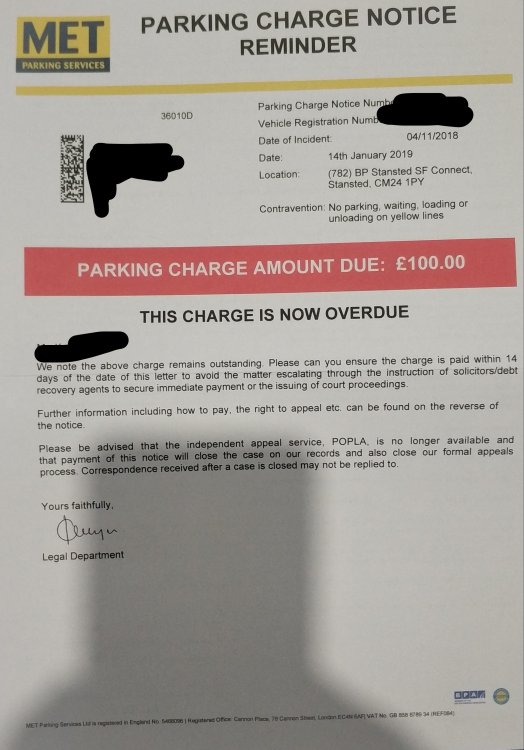

1 Date of the infringement 04/11/2018 2 Date on the NTK [this must have been received within 14 days from the 'offence' date] Not received 3 Date received PARKING CHARGE NOTICE REMINDER Received today 4 Does the NTK mention schedule 4 of The Protections of Freedoms Act 2012? [y/n?] Not received 5 Is there any photographic evidence of the event? Not received 6 Have you appealed? {y/n?] post up your appeal] Have you had a response? [Y/N?] post it up N/N 7 Who is the parking company? MET PARKING SERVICES 8. Where exactly [carpark name and town] BP Stansted SF Connect, CM24 1PY - - - Updated - - - - - - Updated - - - My bad, it doesn't mention 'fine'

-

Good evening, I have received a letter from MET Parking Services starting that a fine is now overdue, the problem is, no initial letter was sent. They are demanding payment within 14 days, what is the best way forward. I go to Stansted a lot and I'm not 100% sure the charge is genuine as it was from a few months ago. Date of incident is the first week of November and this is the first letter I have received regarding this (today).

-

Tesco personal loan - cannot afford full payment anymore

Throwaway replied to Throwaway's topic in Tesco Bank

Hi, I've just received another stating I must pay the whole remaining balance in a week, otherwise they will send it to their recoveries department to work out a payment plan or send my account to a debt collector or put a default on my credit file. I have already agreed a payment plan for 6 months, are these just generic letters or do I need to reply to them? Thank you. -

Tesco personal loan - cannot afford full payment anymore

Throwaway replied to Throwaway's topic in Tesco Bank

Hi, Got it all sorted and paying them on a pro-rata basis for the next few months. They've also sent me a default notice and said the arrears on my account have to be paid within 28 days. Is this just generic? Because they have acknowledged that I will be paying them pro-rata.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.