Showing results for tags 'initial'.

-

Good evening, I have received a letter from MET Parking Services starting that a fine is now overdue, the problem is, no initial letter was sent. They are demanding payment within 14 days, what is the best way forward. I go to Stansted a lot and I'm not 100% sure the charge is genuine as it was from a few months ago. Date of incident is the first week of November and this is the first letter I have received regarding this (today).

-

Hi, I joined a local gym on an offer that stated 3 months at £9.99. I went regularly for a month and a bit but the parking was shambolic and they had about 5 spaces and the rest was on street parking in a busy area and eventually i got bored of hunting for spaces to go to the gym. I eventually tracked down the portal and it had barely any information on it and no way to cancel. Having been on a Harlands membership before or so i thought with Simply Gym i did what i had been told by them and cancelled the membership. After the last payment should have gone out i received a text and email stating that i owed the £9.99 and a £25 admin fee. I emailed back saying there was no option to cancel the membership so i cancelled the direct debit. I received no response for over a month. I then asked for confirmation confirming this was a minimum term. I then emailed back and confirmed i was happy to pay the remainder of the contract but not the admin fees so just the £9.99 I received another email today adding more admin fee's onto this taking the cost up to £59.99. I rang them today to state i had not had a response from my previous offer and they have not emailed back and now added another charge. I got no where as you would expect. Should i just pay up or should i ignore it? Thanks in advance.

- 13 replies

-

- cancellation

- harlands

-

(and 2 more)

Tagged with:

-

I had a court decree for a credit card (approx £6000) I used for expenses in a business that went bust It did not get paid back in approx 2006, Just checked my credit files with all agencies and nothing showing up, must be more than 6 years ago. I get letters from a solicitor every few months asking for a payment or they will enforce the decree. I have never responded to any of them as I have no income, no assets and no means to pay, Over the last 6 years they have sent debt collectors/tracers to my home 4 times and all have been told the same thing re my circumstances and if they wish to bankrupt me then go ahead and do it. The question that I have is how long does a Scottish decree remain live and enforceable. If they could enforce it what can they do and what am I actually obliged to tell them. Many Thanks David From Hawick

-

I've recently found out that my partner of a year has unsecured debts amounting to around £8k. He is, apparently, in the initial stages of negotiating a DMP with stepchange, based on his income alone. As we now live together and are expecting an (unplanned) child, I am concerned about the impact this will have on us as a couple. I have asked that he track down the paperwork in the hope / expectation that we would be better or equally able to manage this ourselves. He is quite adamant that a DMP is the best way to go. From my limited understanding, it seems like it would be hanging over our heads for a long time to come - the duration of the plan + 6 years from its completion. I am new to all this, so any advice / informed opinions on the following questions would be very much appreciated: 1. Have I got that right, that a DMP will make life financially difficult for its duration AND for six years afterwards? 2. It is inevitable that we will need to move from our current home, which is a private rented tenancy in my name, within the year. We would be looking at a joint tenancy, similarly in the private rented sector. Which situation (DMP or self managed payments of all these creditors) would likely be looked on most favourably by landlords? 3. It is possible that within a few years, we would (otherwise) be in a position to apply for a mortgage, with some family help. Same question as above. 4. Given that these debts were accrued before we even knew each other, to what extent does our now being a 'household' impact on the payments creditors can demand? Would that be different with / without the step change DMP? For now, we are not named together on any official documents / bills or similar. This isn't something we've consciously avoided, we are only recently moved in together. I imagine this will become unavoidable once we have a child? Would I be well advised to avoid our becoming linked on paper, what's the legal / moral standpoint on that and what should I (not) be doing? I don't even really know what questions I should be asking at this stage, so if there's something I haven't thought of, information on that would be appreciated too. Thanks in advance to anyone who can help

-

Hi guys. Can I say what a great site this is for dealign with debt companies like weescot for example. I had to register and have a good look on here due to an issue I had with them but once I found out about administration of justice act, protection of harrassment and so forth and I quoted that to them then for now at least my troubles are over...........But will I be contacted by another company? I will explain the situation. Last september I decided to join 3 mobile. Went to toe local 3 mobile shop and picked the phone/price plan I wanted. Now when I signed up in store I was given a little card with possible add on plans for my mobile. I asked should all of these be OK with my price plan on ym phone and I was told.......yep no bother. We wouldn't give you the card if it weren't. That was OK. About the middle of september time I wanted to exercise my right and change a part of my price plan. I wanted to add on a £5 unlimited internet on my phone. I phoned up and (after at least 6 attempts to speak to somebody non indian who could actually understand what I wanted in the first place) I asked about the add on and got told in no uncertain terms Nope. Just an abrupt no you can't get it added to your phone. I was quite shocked at how rude 3 mobile we're to me on the phone and I hung up and so I decided to make a complaint to the CEO'S office only to get a letter a few days later direct from their office to be told my account was closed and we want £455. I wasn't rude or anything. I decided to email instead as I wasn't phoning back due to the rudeness I had already had ad my handwriting isn't great so it would be hard for me to write a letter of complaint. I insisted I would agree a price plan......even sent at least 3 recorded letters (printed) each one of them was ignored. Just before christmas though I got a lovely letter from wescot threatning me with court action for £455.89. I said to them that I was challenging this due to many factors but to keep the peace I eventually decided to arrange some sort of £20 payment plan.....but I wanted official confirmation from them what the debt was for and wescot said they would get back to me with official letters from 3 mobile. That never materialised despite how many times I asked. Wescot then decided that they would star hounding me and hounding me with letters. Was virtually every day a different letter some for payment plans.........some with paymenty slips.......some threatning me again. I eventually got fed up with wescot and their constant letters and more or less told them that if this didn't stop I was going to the police and would threaten to sue them for continued harrassment. Eventually today though I got a email back saying that they had closed the account. I've paid £20 which means I would owe £435. Now what is likely to happen? Would 3 mobile try and pass that on to another company or whatever? Also if another collector gets involved would it be a good idea to advise them of the problems I had with the phone company in the first place and more or less say to them outright that if they start harrassing me like wescot did then I will take it further with them? Sorry if this doesn't make much sense but I am a little shaky. Nevres have been slightly rattled with all of this carry on.

-

Hi all, Bit of a long one! I left my store managers position in February due to a few issues in my personal life (caring for relatives). Since then I've been living off what I had saved from previous paychecks etc. I'm 23 and never been on JSA or the like before, and now my personal issues have cleared in the last 4 weeks or so I've been job hunting again. This is the first time I've had a gap on my CV in 7 years. I'm now at a point where I need the JSA to survive and transport to interviews etc and they've asked me to bring a bank statement and mortgage documents. I have a couple of questions: 1) I'm not going to be using the JSA for gambling, however my bank statement will and does indicate fairly regular outgoing deposits for B365. As recently as a few days ago. Will this be an issue? (I know it won't be an income issue, as I haven't withdrawn any winnings into my bank account or have any. My current balance is £15 in the bank!). 2) The mortgage details. This is actually my late mothers mortgage that me and a brother pay. The letters and documents just have ''The personal reps of _____'' on them. What usually happens is my brother pays for it with DD (he doesn't live at this address) and I transfer him the money for the mortgage, gas and electric each month. Therefore, I don't actually have proof of the mortgage going out as a DD on my account, but I felt this was the most viable option to choose when signing up between Rent, Mortgage, Own or Rent & Own. Will I have any issues here? Thanks!

-

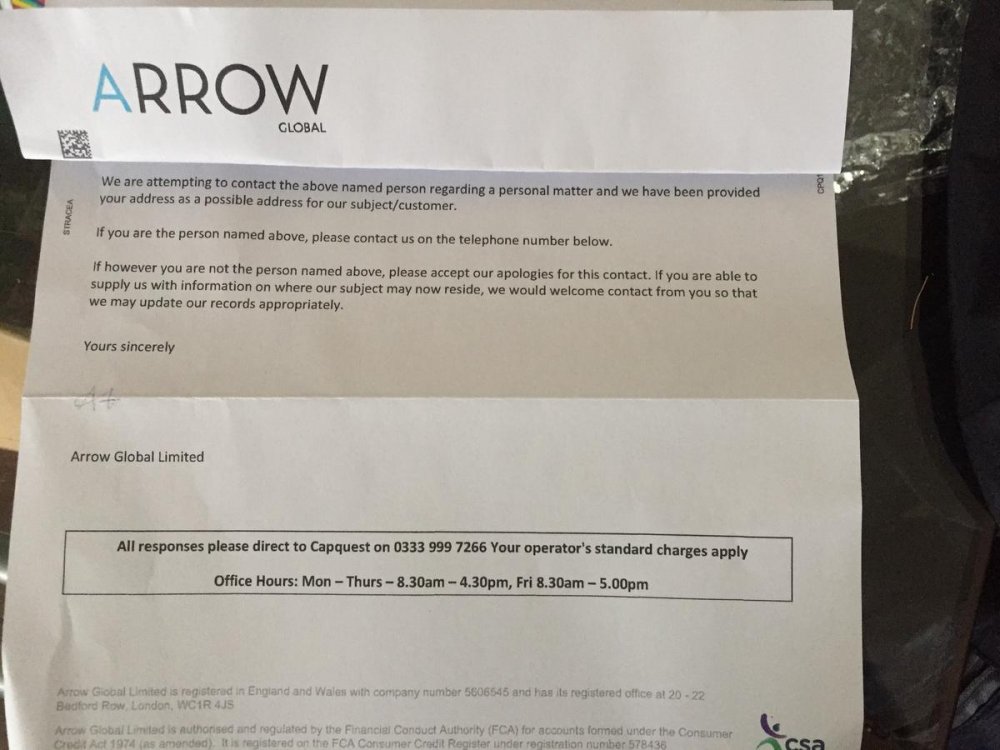

Hi, So the other half received an initial letter from Arrow Global today saying that they are trying to contact him about a personal matter aka trying to recover a debt. After reading other posts myself and the OH are in two minds whether to ring them as most have said to deal with them in writing. However without phoning them we can not access how much debt they are trying to collect and from what company they are collecting on behalf for. Any help on this would be great!

-

Hello, I had JSA for about four months total of £840 (approx). I knew at the start that I had around £28,000 in savings in a separate account. The savings are for university. full cost of course and living for three years. This was my plan. I was off work for 7 months with depression, still receiving an income. I went and signed on and received one week (£71) and never went back. I was off work at this time. I had an argument with HR at work who were complaining about me not being there. I told them that I quit and didnt want to go back. I assumed that I resigned there and then. I went and signed on, then a week or so later I got a call from my union rep who told me that I hadnt resigned, he spoke to them about my problems and I could come back. He told me that they were giving redundancy soon. I returned, a few months later I got redundancy. Fell a little more into depression. I had over £10,000 in my account. I transferred £5900 to ISA and then signed on. I took a few weeks, then quit. Then I went back again and got a few weeks more. This was a few years ago. I got a letter the other day asking for more information as inland revenue flagged up that I had more money in my account when I made a claim. They are asking for my financial situation of that time. I ncluding statements covering two years. I looked at my statements online and saw that the money transfer was maybe a week or two before applying for JSA. I am worried that I will go to prison for this. I am going to send the statements with the letter and answer the questions honestly. I have read about how they will try to prepare a prosecution if they could prove that I knowingly didn't tell them of my finances. It will look that way on the statement. I don't know what is going to happen. Could this lead to prison? I haven't told my parents, I am 35 and still live at home. I haven't been able to get a diagnosis for aspergers but believe that I have it. I am still struggling with depression. A result of my aspergers is that I really struggle to get on with people, I have had some very bad experiences at work and I am terrified of returning to that sort of situation. I have had threats of physical assault and have had fights with people. My things have been damaged/vandalised. I dont know what I can do, any help or advice would be appreciated. I have made a self-referal to talking change. My uni course is going down hill, I dont think I will be able to go onto year two. That is if I am not in prison. So much failure. Does anybody have any advice, I could really use some right now! Thank you

- 52 replies

-

- benefit

- confirming

-

(and 7 more)

Tagged with:

-

Hi guys. This is my first post here and so be gentle !! Last week I received a demand letter from Debt Recovery Plus (DRP) stating they are writing to me of behalf of their creditor (G24 Ltd). It states they are writing to me due to no response received to their previous correspondence and are demanding I pay £160 parking charge ! The thing is, this is the first I've heard of the parking charge/fine (dated 5th Nov 2015). There has been no correspondence received. I have also revisited the site (England) to inspect the disclaimer sign, which states the fine is £100, or £40 if paid within 14 days. Naturally, I rang DRP and explained I have had no previous correspondence and as such was completely oblivious to the parking fine. He then said "Well you're now outside the 28 day appeals window" !!. I then questioned him as to how I can appeal a situation I had no knowledge it existed !! To which he had no answer, obviously. At this point I also had no evidence of the offence I had allegedly commited so I asked for this, which they emailed me at the weekend (two images of my car parked outside the lined bays). I replied to the email thanking them for the evidence but also stating that I will not be paying £160 because I received no initial paperwork and was not given the opportunity to settle the matter at the reduced rate. I then received a reply which I will copy below, which says they still want the £160.... Start of letter........ Thank you for youremail regarding the above Parking Charge Notice (PCN). The time to challenge the charge has now expired and therefore access to the Independent Appeals Service (if applicable) is no longer available. However, in order to resolve this matter, I will offer the following comments as to why this PCN was correctly issued and is still payable. My findings The site in question is subject to terms and conditions, which are stated on signs throughout the area. Those signs state that all vehicles must be parked in authorised areas. On the date in question, the vehicle was parked in an unauthorised area and a PCN was correctly and legitimately issued as a result. Correspondence Please note that a PCN was sent to the vehicle’s registered address for notification purposes. If there has been a problem regarding the delivery of this document, this is a matter to raise with your postal service. Under The Interpretations Act 1978: Where an Act authorises or requires any document to be served by post (whether the expression “serve” or the expression “give” or “send” or any other expression is used) then, unless the contrary intention appears, the service is deemed to be effected by properly addressing, pre-paying and posting a letter containing the document and, unless the contrary is proved, to have been effected at the time at which the letter would be delivered in the ordinary course of post. Your obligation to notify the DVLA of a change of circumstance Regarding your details, I must stress that it is your obligation to ensure any of your details held at the DVLA are correct. If a delay in communication has resulted from a failure to do so, our company cannot be held accountable. What you need to do now Please ensure that £160.00 is paid by 24th March 2016. Payment can be made online or by phone. Go to 'link removed' or phone 0208 234 6775. You can find full details of how to pay on the reverse of the letter(s) sent. What will happen if you do not pay what you owe If the amount is not paid by the date shown above, we will recommend to our client that court action be taken by them to recover the outstanding balance. What if you do not agree Although any correspondence that does not provide further evidence will be noted and retained, I cannot guarantee that we will reply to it. End of letter...... Surely they cannot force me to pay £160 when they cannot prove I received the initial PCN ? It also rages me that they say if I haven't received the initial PCN, then I need to contact my local postal service ! They're the sender, it's not my duty to ensure delivery and how can I query unsolicited mail ? Any help/comments guys would be much appreciated. Kind regards

-

Hi, new member here I had a big issue with Lloyds due to a number of transactions that I didnt recognise. Lloyds however didnt do anything to resolve the problem therefore I submitted my case to the Financial Ombudsman last week. I wanted to ask how long did it take you before they acknowledged and logged your case? Its been 5 days now, and the 2 representatives I spoke to seem to given me 2 different answers. One of which saying logging your complaint takes 48 hours, while the other told me itll take up to 2 weeks. On average how long has it taken the ombudsman to log your case.

-

Good morning, I originally joined xercise4less in January 14 after a phone call from a sales person. I was reluctant but they talked me round by offering two months for free & £9.99 a month there after. Even though the gym was 18 miles from my home I niaevely agreed to become a member. I didn't/haven't used the facilities once & in February I emailed the operations manager asking to cancel my membership but received no reply. I left it until April and sent another request to cancel via but again didn't get a response. In September I noticed they were still taking the amount so I cancelled by direct debit. Now I am receiving threatening letters saying I owe £69:98 with x2 £25 'admin' charges and the threat of court. I've rang xercise4less but been told the manager isn't available - I've emailed the operations manager again and haven't gotten a response (I see a pattern here) however when I messaged them publicly on Twitter they responded (funny that!) but in their DM they have simply said "Sorry however unfortunately you cannot cancel your membership via email unless you have this agreed by the operations manager - do you have this indicated in your emails" I replied stating that I hadn't received a reply and asked how they could resolve the matter but they have not responded. I'm not sure why an email won't suffice when the only contract I've received was via email and I haven't signed anything from them. In fact the only letters I have received were from Harlands threatening me and charging me x2 £25. Do you have any advice for me - I can't have a CCJ against me because of my employment. They have no responded saying that "unfortunately in this instance you will need to pay the cancellations charges - what is your contact number so a member of the membership team can contact you?" I feel this is completely unfair - howe should I respond.

- 17 replies

-

- admin

- cancellation

-

(and 4 more)

Tagged with:

-

Hi, I sent LOWELL a request for a CCA for an old debt, original account Capital one. back on 7 January 2015 giving them 12+2 days to respond. Received a letter dated 12 January 2015 stating (we are in receipt of your request for a copy of your credit agreement. .. we will advise you further if it will take longer than the prescribed period.). Received a letter dated 22 January 2015 stating ( We have been in touch with Capital One about the copy of your agreement, they have let us know they are trying to retrieve the agreement from their archive) .Received a letter dated 30th January 2015 stating ( We are waiting for your credit agreement). Received a letter dated 24th March 2015 stating (we have ordered statements on your account. As we have requested these from Capital One, it may take some time for them to be returned to us. During this time your account has been placed on hold). Applied for the card November 2007 on-line. Not sure on default date, and can't remember when last payment was probably end 2008. Letter dated 31 July 2014 informs us when the account was assigned to Lowell. Also attached letter dated 8 June 2015 paragraph two (we have confirmed with the original creditor that the outstanding balance is correct)? The statements attached is a little vague. The credit agreement was a rough copy, and difficult to see anything. Many thanks for your time.

-

Hi guys I need some help, i applied for esa on 8th April as i am going through bad anxiety and PTSD. After few days they sent my statement back and ask for doctor's note which i sent on 18th April. On 19th i got sms from Jobcentre that they have all information and they will contact me with the decision. I also received the letter from Jobcentre saying that i am pleased to you that we can pay esa form 8th April you will get £84 a week etc. I rang Jobcentre on 25th April and i was surprised when they said they have not received my sick note and i need to ring on Monday to find out. I rang today and got another surprise when they said you need to send the ESA50 form back then we can release the payment. Can anybody tell me if this is true i am totally confused and upset as i cant fill this ESA50 as its too difficult. I made an appointment with local cab but the date is too far and i dont know what to do. Thanks

- 21 replies

-

Hi, At the momemt I have aroud £1500 with Quick Quick, the original capital borrowed was about £600, the rest is late fees and charges, I am only able to pay the finance charge to extend the loan to be able to live every month, Ive dont this about 10 months in a row now. From this forum, Ive learning I can get them to freeze the debt and pay a solid amount each month to pay of the loan, but am not sure the best of doing it, could some one point me a in direction for a letter sample? I figure I can pay £50 a month to start and once I am trained in my job and getting full pay I can increase the amount later on, would it be possible to get the total amount reduced as well or a I stuck with the current amount? Also I dont know if makes a differences but when I took the loan out I had an IVA does this help in anyway? Thanks for any help and advice in advance.

-

I recieved a letter from FPC stating they have made enquiries for the confirmation of my current address and to contact them immediately. Pretty scary when you first read it! I can only imagine it is from an old network provider that I changed from two years ago because they changed my contract without my permission or any notification thus running up a bill of a few hundred pounds. As a student at this time I had no where near that kind of money to pay out, so canceled the contract and never received anything from the network provider since. Not sure what my rights are, if I ignore this will it go away as they don't have any legal right to take money from me? I'm more concerned that due to the fact the network provider never contacted me via post with a final bill or warnings of payments due that I will have a ridiculous debt to settle as its been two years! From what I've seen online its best not to ring them whatsoever as they have to prove I owe a debt not me having to prove to them that I don't? Any help would be greatly appreciated!!

-

HI Caggers! I need your help with this! November last year, I had received my initial FOS assessment in my favour about PPI complaint registered against Barclays. On 18th of February 2013, I received another letter from FOS informing me that Barclays contested the decision for the reasons below: please find letter sent by Barclays to FOS. i never had anyone either on phone or face to face who explained to me anything about the PPI policy. it came through the post & i signed it off to them. Dear Sirs We refer to your assessment in relation to Mr xxxx complaint concerning the sale of payment protection insurance (PPI). Please accept our apologies for the the length of time it has taken to respond to your letter. My understand of your assessment is that you believe the complaint should be upheld because you feel that reviewing the Payment Protection Insurance (PPI) policy element of their Barclaycard is not clear from the evidence available that the policy was optional. We have reviewed the complaint relating to the purchase of their PPI policy and have identified that their application form was completed over the telephone with one of our advisors. We believe that our evidence suggest that the optional nature of the policy was made clear to the customer. We have set out below our reason for this, using both our generic evidence and where applicable customer specific evidence. Sales Process Evidence We note that the Payment Protection Insurance was sold 2003 over the telephone. Attached is a copy of our telephone sales script and attach this in appendix 1. We note the following from this script which indicates the optional nature of the policy: · The customer was required to give positive or negative response when asked if they would like to take out PPL policy; · Following positive selection, we in addition make the customer aware of their right to cancel within the first 30 days without obligation; · Even following a positive response the customer is requested to reconfirm their decision;4 · We also note that at no point customer is informed that the policy is obligatory in order to take a Barclaycard. Following positive selection for PPL, a pre-populated Application Form will be sent to the customer following the conversation. We attach in Appendix 2, 3 copies of Application Forms use during this period. We will have sent our original submission a copy of the application form if we hold on file, howeverdue to age of sale, we may not retain copies. The Application Forms are per-populated for convince the customer’s decision. Sections required, then there was further opportunity for it to declined at this stage. In this instance, acceptance was confirmed by signing and returning this documentation to Barclays. The customer would then the application form to the insurer’s, who would review it and if the application was accepted would forward a certificate of insurance to the customer. The certificate of insurance confirms the full terms and conditions of the cover, including all exclusions and highlighting the right to cancel cover within the first 30 days without obligations. As a result of the sales script used, the process following the initial sales call, and the fact that the customer’s recollection of the complaint does not indicate his script was not used, we believe this is sufficient evidence to demonstrate the optionality of cover. Customer Specific Evidence in addition, we note from our investigation, that the customer has not provided any evidence or any testimony that indicates the customer was unaware optionality of the policy. Conclusion In summary, given the above, we do not agree with your assessment of this complaint and would ask that the point raised is considered. We await response In due course. Thank you in advance for helping me with this

- 9 replies

-

- assessment

- barclaycard

-

(and 3 more)

Tagged with:

-

Hi there, this is my first post. I had a letter from RBS offering me a goodwill payment for PPI of £1760. I accepted and returned the forms. I have two accounts with overdrafts managed by Payplan at about £500 each and a Natwest Credit Card at approx £5000. I no longer bank with Natwest due to the terms of my DMP and my old accounts are managed by Triton credit services. A few days ago, RBS credited £1028 into the overdrafts thus settling them. They paid a further £210 into my old savings account which is now £211 in credit. They have said they will decide what to do with this money in exactly 28 days and no sooner and that they are at liberty to just retain the money and close the account. RBS sent a cheque for £93 as 8% interest but all of this adds up to £1331, which is lower than their original offer. I have tried to contact them but they have said that this claim has been settled and closed. I feel that Triton are holding onto £200 ( which I dont mind going on the credit card), and RBS have conned me out of almost £400. Advice would be greatly appreciated. Thanks, Kevin:|

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.