Showing results for tags 'universal'.

-

Cannot seem to find the answer anywhere so was hoping someone may be able to advise onhow I may deal with this when the time comes? Think in the four months I have been on Universal Credit I have had a full payment just the once due to having a couple of part time employers with varied offers of work and hours whilst I look again for full time. Back in October/November I received two Tax Rebates, one higher than the other. This was a tad surprising so I rang the Tax Office to see if this was correct and was informed that one was definitely correct but the advisor seemed a bit confused about the other and couldn’t say for sure. He said my two options were to place the second rebate to one side until they sorted it out in April 19 or I could use it but may have to pay it back in April if it was paid in error. My problem was is that Universal Credit takes tax rebates as earnings it affected my paymentsand I got a big fat zero that month UC wise therefore having to use the rebate to live on. Ironically the Council “do not” take tax rebates as earnings so it didn’t count against my Council Tax benefit which was a blessing of sorts but obviously if I am in the same financial situation in April and this rebate has to be paid back I am going to be in difficulty. If that is the case and it was paid to me in error can I claim for any backdated payment of Universal Credit for that particular month? My thoughts behind this are that I was obviously paid nothing UC wise that month due to the rebate being classed as earnings but if the rebate has to be paid back then it was earnings I technically did not have, receive, earn, if you get my drift!!!! Ie – If I hadn’t been paid that rebate I would have received full UC for that month and I wouldn’t potentially be having to pay anything back in April to HMRC? Of course it may be that it is a legit payment and I won’thave to pay it back but I won’t know until April. All a bit of a disaster, I have no idea why HMRC couldn’t work this out correctly back in October… . Thank you.

-

I'm not sure if this is the correct place to put this on so Mods, please feel free to move. I lost my permanent job late in 2016. Being older (almost 60 at the time), I've found, like many others in my age group that it's almost impossible to find a job. I was asked at the Jobcentre if there was anything I could do to become self-employed. I am a good pianist and had been working towards getting my Diploma after an exam break of 40 years, thinking ahead to when I retire. I am one of the women caught in the 50s trap, no husband and a son who's still recovering from a recent kidney transplant. Life is not easy for us Anyway, I got approval from the NEA to start a teaching business. To date I have not had a lot of interest despite advertising, my website, leafleting doors and anywhere else I can push my business. Just two adult students since I launched on 3rd January 2018 and I didn't get them until October. It seems the NEA and the Jobcentre don't communicate very well. The Jobcentre has taken my start up day from the 18th November 2017. The NEA says I started trading on the 3rd January 2018 which is the date I launched the website and my business. I now get £0 in Universal Credit, the reason being they are using the Minimum Income Floor of £1092 per month which is based on best case scenario estimation. I thought, fine, I don't get a penny from them but what I didn't get told is that my rent (council) wouldn't be paid either. This MIF is a hypothetical figure. Even from when I put in the business plan I have had to drop my prices to £10 for half hour and £19 for a full hour. This week I will earn £10 as one of my students can't come for personal reasons. You can imagine my shock to find out the last payment the council received was on the 11th December 2018. I am now in serious danger of losing my home and my son and myself being thrown out into the street. I am 62 years old and my son is, as said earlier, still recovering from a kidney transplant which has not gone particularly smoothly. I am really at my wits end. Something I thought would put us on the path to a better and more stable future has turned into a nightmare and I've done nothing wrong. I was given a hard choice by the Jobcentre. Either give up my business which I've worked hard to promote and prove I've done that (how do you kill a website - I've already paid for the website and domain for a year, that doesn't end until December this year) and let down my two students, one of whom is very good and practising for her Grade 1 exam later this year or claim UC and completely kill the business. Not knowing that my rent was not going to be paid, I chose to keep on my business as I know it is the type of thing that will take time to build. A year (in my case less) is not a long time. The Jobcentre has now closed my UC claim but I have until May to reinstate it. I have gone without, don't go out or do things other people do. I have been trying to get a job, either part or full time to help things out but get turned down constantly, usually by the agencies who come up with one excuse or another not to put me forward for jobs, the latest excuse being I haven't worked in an office for a year! 45 years experience as a secretary, often working at Managing Director level doesn't count. I met last week with a representative from the NEA who didn't really seem to know why the MIF is playing such a big part in this or even why it's stopping me getting UC to top up my earnings. One can work 16 hours without losing UC or if working 30 hours, similar to the old Working Tax Credits which even applies to self-employed people. These are the people promoting this ghastly scheme and if they don't know how are the rest of us supposed to know? I spoke with the benefits office (their call centre in Scotland) on Friday. Lady there said I would have to get a Mandatory Reconsideration but that could take weeks and may not even be successful. I just tried to reinstate the UC claim - supposedly a one click operation. No, it isn't. Question upon question regarding employment if you work for a employer but absolutely nothing related to being self-employed (I have not completed these questions as they were ambiguous). The Jobcentre advisor I had (or have) is a very nice person but came across as not knowing that much about the NEA scheme (which is run by Pinnacle People). I feel I have been lied to and misled and I'm sure I'm not the only one. From what I've gathered so far, it would seem that if I had started up my piano business on my own, without the NEA scheme I could have declared it to the Jobcentre as casual earnings and they would have simply deducted what I earned from my UC payment. Why there is such a difference between this and being self-employed via the NEA Scheme just doesn't make sense. I hope someone sees this or knows of someone who has gone through this that can point me in the right direction. I'm sorry this post is so long but I really am at my wits end to the point it's making me quite ill.

- 9 replies

-

- allowance

- enterprise

-

(and 2 more)

Tagged with:

-

In July my wife left me at the time I was receiving ESA (support group), Severe Disability premium, DLA, tax credits & LHA. I informed DWP of the change in my circumstances and was advised that I didn't need to contact any of the government agencies as my change in circumstances information would be passed automatically. This was a godsend at the time as I suffer from numerous physical and mental issues. Today I have heard from HMRC saying that I may receive a fine of £300 for not informing them of my change of circumstances. I was also informed that in September my area became full UC so I will be forced onto Universal Credit without any migration protection, is this true? is there anything I can do?

-

Hi, I've searched and searched for an answer to this and can't find it. I'm hoping someone will be able to help. Under JSA if you won an employment tribunal you had to pay back any JSA received from the award. But if you settled 'out of court' you didn't have to pay back the JSA from the settlement amount. Does the same apply to UC? Or would a settlement 'out of court' be classed as earnings? Thank you.

- 2 replies

-

- employment

- tribunals

-

(and 1 more)

Tagged with:

-

Hi Please can someone explain to me how UC works? I lost my monthly paid job 4 weeks ago and immediately started a claim. The online calculators said I'd get about £850 for 4 weeks. I've just now been told my payment for the last 4 weeks will be zero after deduction of my final salary payment. What? So anyone who loses their job will effectively get no benefit for the first 4 weeks of the claim? I have actually got another job starting in a couple weeks time, and it will be paid weekly. DWP explained that I may get UC for the next four weeks even though I am back in work. I've done some calculations based on how much pay I expect to get in the next four weeks and I reckon I will eventually get about £360 UC for 6 weeks out of work! Now I have unfortunately had to claim JSA before and I would've got the full 6 weeks JSA + HB under the old system. Can someone explain what is happening now??? Weird.

-

Hi all just need some clarification as I have read so many different stories. Will people in the long term esa support group transfer over to universal credit it or be left alone? Regards to all

-

Hello, Can anyone give me some guidance please? I need to provide my figures for the month online for Universal Credit. The only thing is i don't know where to enter them and they were due yesterday but i cannot get an answer anywhere. I just need to know,as this is the first time,where and how do i do this? Thanks

-

Hello everyone I am after a bit of help with universal credit. I have been out of work for a while due to mental health issues (depression and social anxiety). I am 46 and It has been a bit of a bolt out of the blue for me because I have been in work since I was 16 and had never suffered with these kind of issues before. I have been claiming universal credit for 18 months now and was placed in the LCWRA group. I feel I have now come out the other side and have been actively looking for work. I have now been offered a job but it would mean relocating to another area. I am happy with this and find the move exciting. However, my query is this. While I am happy that I am able to go back to work what would happen if the symptoms returned? If I found after a couple of months I couldn't cope and was forced to leave the job what would be the situation with universal credit? Would I, in effect, be starting a new claim in a new area and need a new assessment if applying for LCWRA again. Or would I just automatically go back on to my current benefits? If I understand it right, once I start work you don't automatically stop UC, you just don't receive anything while you are above a certain threshold. So, if after a couple of months I had to leave my job so never received any money for the subsequent qualifying period, do I just start receiving UC again? Obviously hoping none of this will apply but just trying to think ahead. Thoughts would be appreciated. Thanks

-

I have recently (well still in the process of assessment) had to go on Universal Credit due to moving into an area where they have rolled it out in the past two months. I was on Income related ESA in the support group and was told when reporting my change of address that I would have to claim the new benefit. As mentioned I am still in the 4 weeks and 1 week assessment phase. The property I have moved into is incredibly small and it is affecting my condition due to feeling claustrophobic, consequently I am considering moving house again out of the area to another region where UC isn’t even running yet. Can anyone advise as to what happens if on UC and you wish to move please!. Even though I have only lived there 4 weeks my HA will require a months notice but the prospective HA will require rent payment at sign up. There is no mention of a benefit overlap of 4 weeks anywhere on UC (unlike the old Housing benefit system which had this four week overlap provision, were in effect both councils pay rent for up to a month). Can anyone advise on this housing issue please?. As a side note, I had a similar problem with the currently flat, I signed for it an the 10th July and obviously couldn’t move on viewing it, I moved in on 24th July and immediately claimed UC (no other option) the UC said they wouldn’t be paying rent from the sign up date only from UC claim commencement date. No mention of a benefit overlap what so ever, has anyone encountered this and got somewhere with them as I’m hitting brick walls

-

Hi all I'm in desperate need of advice. I have some mental health issues please bear with me. I had a debt relief order approved, however I was somewhere that if you have student debt it has to be declared even though it is excluded from the DRO. I log into my student loans account to see how much I owe. Looking through the old correspondence online i spot a problem with student loans and benefits. I moved back to my home town last year as was kicked out by ex partner and was homeless staying in various sofas. Months beforehand i was considering doing a masters degree but wasn't sure. In the end I went and enrolled and received £1500 student loan. A few days later I realised I was homeless, mental health deteriorating and in debt. I was in no position to continue so I withdrew before classes even begun. I thought they would be in touch about repayment but no. in the meantime the money is eaten up by my debts\buying food to eat then throw up and I had totally forgotten about it as my health had gone downhill, I d isn't know if I would have anywhere to live. Once I moved problems in my new place sorting out the debt, . I went to the CAB who said explain everything to the jobcentre so I made an appointment for a few days time. I know I have to pay back the money but what else is likely to happen? The period the loan would cover (although I was only enrolled a few days) would mean paying back 5 months U C (No housing element at that time). It's no excuse but the past year it's been one th ing after the other and I haven't been coping mentally (I'm in the work prep group). I want to try and focus on dealing with my bulimia depression and anxiety but can't until this is sorted. Also, this prompted me to look back through my whole journal online. When I first claimed U c they asked about previous earning s and ex partners earnings. I misread it and ticked we got less than £430 a month. They asked about ex partner as I live d with him for 3 months (only claimed benefits once he kicked me out( surely that doesn't matter as I wasn't living o r with him when I put in the claim? do I mention this also? For 9 of the previous 12 months before I put in the claim i was a student and living alone, then for 3 months i lived with ex partner, and worked for 3 weeks before I had to leave due to bad mental health and being kicked out. Which brings me to my final query. I ticked that I wasnt expecting any more wages from previous employer. 4 days after I submit my claim online I got a final wage of £400, but was paid during the first 7 days of my claim, and online those waiting days were not included in the assessment period. Do I need to declare that too? I've never been in trouble in my life and oversights like this is unlike me But this last year has been the worst of my life. I'm desperate but have to put on brave face. I am having CBT for the eating disorder but how can I begin to recover with all this going on? I know I'll be a year late in declaring these changes but hopefully because i n not just leaving it hoping they won't find out will work in my favour? That I want to sort out the repayment? When I got my flat me misunderstand invest I'd had to resulted in my payment being delayed, so hopefully they will see in not making this up. I 'm barely functioning. If anyone has any advice please i would be so grateful:help:

-

Hi The company i used to work for has closed down, I do not have a P45 to claim benefits and I am unable to contact them by phone or in person. The company no longer exists, theres another shop there instead which has opened up. I only have payslips from December 2017 which is another company i used to work for (and I was paid cash-in-hand). These small busineses did not give us payslips but only when we needed one and asked for it they would supply it. Will I able to get universal credit if i dont have a P45 or payslips ? What will happen now ?

-

Not sure if this has been mentioned yet but just been on the Universal Job match website and saw this : Universal Jobmatch will be replaced by the Find a job service on 14 May 2018. Important: If you have an existing Universal Jobmatch account it will not move to the new service. Save any information you want to keep, like your CV, cover letters and application history by 17 June 2018.

- 74 replies

-

- —

- confirmation

- (and 12 more)

-

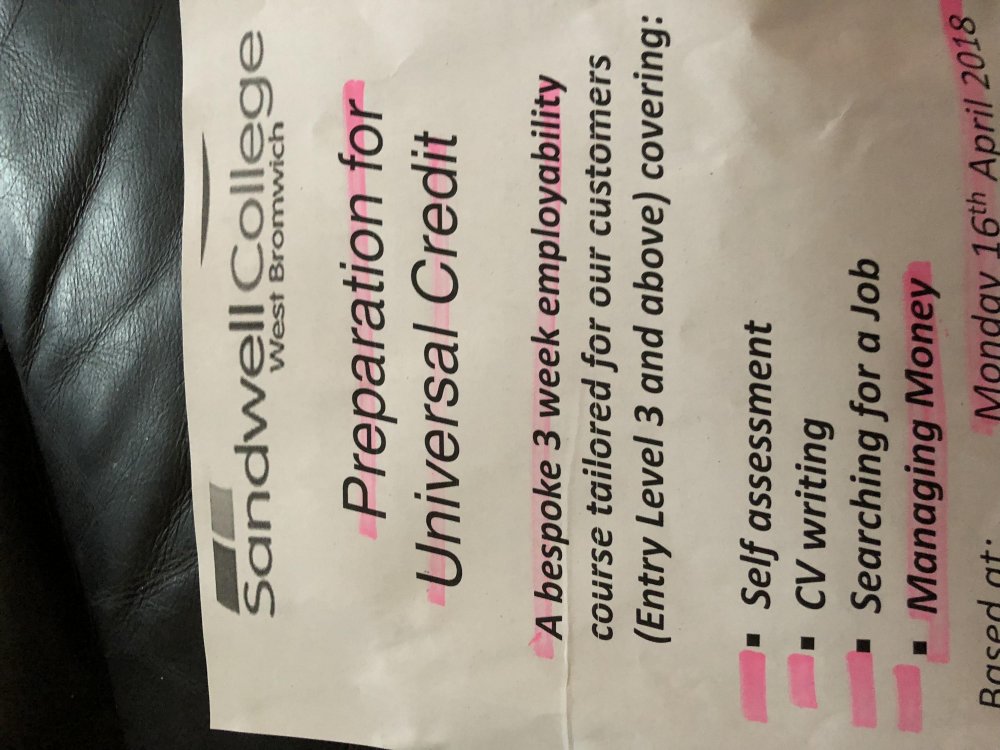

Hi everyone Went to sign on today for my Jobseeker’s Allowance and everyone was given one these piece of paper about a 3 week course to switch to UC,anyone else had one of these or know what’s its about,work coach said it’s mandatory,is this true? Thanks

-

my UC payment was due, logged on to check all was ok like I do every month. They're paying me £24. I usually get around £700. They've said it's a system error and they can't give me a timeline just probably after Christmas I'll get it. I'm due it in 2 days. I have no food gas electric or money. Civic centre can't help me, disability means I can't go out right now so can't get to a food bank. And to top it off I was just finishing paying my overdraft back I got to clear rent debt from the initial 6 weeks of no payment. Now my bank said if it's not paid when I was due to be paid my account will be closed and there's nothing I can do about it. I've sold everything I have. (It's in cex to pick the money up tomorrow they had to test it all) so I've made about £150 but I can't even pay rent now. UC said it's a Computer error and they don't know when it'll be fixed, just not for a while. Social worker couldn't help me, support worker couldn't, both said they have 0 access to funds at the minute and told me to beg family . I don't have any family. I haven't done anything wrong it's UCS fault. What the heck do I do, it's absolutely freezing I haven't eaten in a couple days and I can't afford to take my medication. (Has to be taken in specific drinks I have to pay for which is £100+ a month ATLEAST, very rare issue) And the £150, I have to give bank £100 or my account will close I only really have £50 now. Sorry unsure how to edit but just to add due to medical condition I have to follow a STRICT no gluten no meat no dairy 10g of fat a day diet , if I don't I'll be very ill so foodbsnks are pretty out of the question anyway :/

-

Just looking for some advice, recently I asked my work coach at my Job Centre if the worst comes and I do face a sanction in the future while I am on Universal Credit, will my housing element be affected as well, and he said yes, is this true? I thought housing element won't be affected while on a sanction, or his he wrong? I just hope I don't end up on UC for too long, I am aiming to get into work ASAP.

- 15 replies

-

- payments

- possession

- (and 6 more)

-

Hi long story short. ive been made redundant. I do not plan on being jobless for long but in the interim regarding universal credit, im currently renting a room, question being,would it be problematic for the landlord?

-

Does anyone know when the government going to provide the free phone number for UC like they promised? I am still hearing about people being on hold for 20-30 mins or more and then getting cut off when they finally get through! Also why can we not claim back these wasted on hold phone calls? Or even travel expenses for repeated trips to the JC to repeatedly provide all the info they ask for then fail to record it correctly? So claimants have to repeat the trip to the JC to yet again provide the same info? I am hearing about some people having to go multiple times to provide the same info, one even went 12 times!

-

After a long absence from benefits I'll be starting a new claim for Universal Credit in the next few days. Just a brief history: I was on the old Work Programme with Ingeus for the full 2 years - towards the end I was placed on the ESA assessment phase having been on JSA only and didn't have to attend the office anymore... Shortly after I ended the claim to pursue a new opportunity and that's where I've been for over a year and a bit. Now having to go back to relying on benefits is a difficult thought and I have no idea what's changed. I have no clue if my local office is still open, I know most claims are now dealt with by phone only... I think that's right? I've heard DWP offices are closing down all over the country so what does this mean for a claimant and how do they check your doing all you can to find work? Can anyone fill me in on what's changed and what'll happen when I sign up... very nervous about it as I never actually thought I'd go back into the system... I was on antidepressants before and looking for job didn't help much with my mental health. Having not worried about work strictly speaking for over a year I am quite anxious regarding all these changes and what it could mean for my family.

- 11 replies

-

- any

- appreciated

- (and 6 more)

-

hi guys hoping someone can shed some light on this. applied for universal credits 14/12/16, handing in fit notes ever since etc been waiting since to have WCA and i called to ask what was happening with that on friday UC said my work group had changed to no work related activity and i wouldn't have to attended the appointment they scheduled for me, that for me is a weight off my shoulders since i have agoraphobia being forced to go to the job centre every month always ends up with me in a state crying because i don't want to be outside. anyway, the advisor couldn't work out why now that my group has changed, that there wasn't any payment issued since i've been waiting since Dec 2016. Case manager was meant to call me back friday by 6pm, which never happened. i've had problems with him before, meant to contact me before 6pm the day i called, this was nearly 5 weeks ago and i'm still waiting. anyway, rambling on here. i just want to know really peoples experiences once their work group changed, how long did it take to receive their back payment. My work group changed on the 16th so it seems like its taking longer than it should. im just worried because even though my group has changed, theyve told me that i don't need to go to anymore appointments yet another advisor that i spoke to said i still have to go. if i don't go, i dont get paid and then i dont have any money for myself and my kids to live on. hope someone can put my mind at ease since i'm getting stressed out which isn't helping my current condition. thanks guys

-

I've been reading around this forum before posting but I can't find an answer. I think I may be in an unusual position, so any advice specific to me would be great. I need to leave my job next week. Let's just leave it as a 'personality clash' (Manager is a , I'm not! lol) I've found a new job starting 1st November. Great! BUT, I went to the job centre on Friday and my area is trialing UC, and so the first payment I'd get is in 7 weeks from when I leave my job. Obviously I'll be working by then, but won't be paid till 1st December. I have no savings, but have paid a bucketload of tax over the last 25 years and something called 'National Insurance' to 'insure' me against being in a situation like this. But now I'm in need for the first time in about a decade I'm whole outta luck apparently!!! I've suffered with anxiety and depression my whole life but realised that life is better if I connect with other people through work rather than give in to my malaise - even if sometimes that work has been beneath me just to keep self-respect. Anything is better than just locking myself away in a darkened room and spending more hours on a computer than a full-time job would be sat alone at a computer trying to convince the JCP "I'm really sick, I can't even work at a computer, I need ESA", etc, all that bad-back . But I'm tempted to claim if ESA pays faster than the 7 weeks I've been quoted for UC. I only need what's my right having paid in, and only need it for a month to tide me over. Any ideas how best way to go? I'm going to hand in my week's notice tomorrow morning either way.

-

After the news in today's budget and the back tracking on certain UC policies it seems that if it CAN be done then WHY WASN'T IT IN THE FIRST PLACE? Originally, if you transfer from another benefit or a new claimant - NOT A PENNY FOR 6 WEEKS apart from an advance of 50% when claim approved Now: - No 7 day waiting period on new claims - Advance now full amount (not 50%) paid back over 12 months instead of 6 - Previous HB claimants now get 2 weeks grace on HB from their LA when claiming UC So all in all no waiting period and a 2 week HB grace and a cut in time for your first UC payment. Although still not great it is certainly better than before. So the question needs to be asked, and someone in power needs to ask it, WHY WAS THE INITIAL POLICY IN PLACE ALLOWED TO BE PASSED? I am certainly (as a new UC claimant from 2 weeks ago) going to contact my LA and ask the question whether I am entitled to this 2 weeks HB as what is classed as a 'new' claimant given todays budget news? Does it mean from today? last week? a month ago? define 'NEW' I am still £95.41pm worse off under UC than ESA and HB but I would not have been so ill or stressed knowing I had less of a wait and some HB to tide me over plus a full advance. Yes, UC has made claimants ill - I am one of them!

-

Sorry for another thread but I really am in a bit of a mess/state at the moment and really need some help/advice. After sorting out my UC claim I totally forgot about a WTC overpayment I had from last year and forgot HMRC said to simply wait until I heard from them. Well today I got in from town to find a brown envelope from HMRC saying I owed £1,227.31 from when I was employed as an overpayment. I do owe this and am not disputing it. So, I call HMRC and they tell me that they have passed the 'debt' over to DWP (UC) for them to deal with and they could not tell me any more and I should call UC. I call UC and at this moment in time they say they have no notifications of this on their system however it can be updated at any time and that legally they can take up to 40% of my base award as payment towards the overpayment which works out at £127.13pm My UC award is £572.82pm and there is no way I can pay this amount each month for around 10 months with rent and bills to pay. What makes it worse is that the letter to me could cross and a deduction could be made with nothing I can do about it! HMRC said I should ask UC for an income and expenditure sheet to fill in so I asked UC for this and they said they could not do anything yet as nothing was on their system. I am now in between HMRC and DWP and do not know what to do howeber HMRC said I should be able to come to an agreement with DWP. I done an I&E sheet anyway and worked out that I have £13.92pm after all bills are paid which includes rent, utilities, food etc. What do I do now? Wait for the letter from DWP and then contact them to arrange a repayment plan on what I can afford based on my I&E. Do they have to agree to this if I can prove outgoings or can they really attach a larger amount as a repayment against the overpayment? If it is the latter I am 100% screwed and basically homeless or will there be some compassion based on my circumstances? One part of me is saying I should pay the balance in full by credit to DWP by doing a cash transfer to my current account as it is obviously better being in debt with a bank than the DWP and HMRC the other part of me says surely they cannot take what I do not have. I am very worried about this, what should I do?

- 3 replies

-

- credits

- overpayment

-

(and 3 more)

Tagged with:

-

Waiting time before first payment of UC is made down to 5 weeks, that's if no other delaying tactics are used. The 7 day wait after claiming before payment can be applicable in the first place to be abolished. The payment to be applicable from day 1 of claim. A full month's payment to be given if needed in cases of hardship within a week of making the claim to tide the claimant over that first month and a full 12 months to be allowed for repayment of this advance. Housing benefit continues to be paid for the first two weeks of transition periods between other benefits an UC. It does not address the many issues related to UC but it will ease and relieve the initial hardship it causes as it is currently applied. Work & Pensions Secretary to spell out the details of this announcement in Parliament tomorrow (Thursday), including the dates on which those changes come into force.

-

I've read in a few places that people who are paid weekly will earn slightly too much in a 5week month and thus end their UC claim, even though their circumstances haven't changed. This is for those in work. I presume this doesn't affect those in the support group of ESA who don't do any work when they're eventually moved over to UC? I.e. I will get a payment every 4 weeks regardless of how many weeks are in a month, which is the same way PIP is paid currently.

-

Hi, I'm disabled and live with my parents. I claim IR-ESA and PIP, my mum gets Carer's allowance for looking after me my dad is approaching retirement age - he's on contributions based ESA, and receives a private pension from the job he was medically retired from. My question is - when I eventually get moved over to Universal Credit, will my ESA amount be affected by my dad's income? I don't think it should be, as it currently isn't I'm under the impression your parents' income has no effect on your entitlement. Hope someone with better knowledge can help me out!

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.