Showing results for tags 'request'.

-

Hello, im after some advice if possible. CAG has been helpful to read but im now stuck. Following redundancy I got into a bit of credit card debt, im now in a position to try and resolve the debt but don't know where I stand. One of the credit card debts is now with Idem servicing. I sent the a CCA request and they replied stating they had no agreement, should one be found they would send it. Foolishly maybe, I offered a full and final settlement offer just to move on. They rejected the offer and sent a credit card agreement (13 days after they said they didn't have one). They say the agreement was signed in 2001, however the address on the agreement is the address I moved to in 2008, so a different address I was at in 2001, secondly the credit limit states 1500£, with an APR of 27.9%, I cant prove it but the original credit limit was 950£ and the APR 15.9%, it only went up to 27.9% when I closed my current account at the Halifax and moved to Barclays around 2005/6, I remember that because at the time as I was annoyed to put it mildly - Just to add the credit card was with the Halifax. Idems letter keeps referring to LLoyds Banking Group are they linked to Halifax? The agreement also says bank charges were 12£, again I remember paying 35£ when one of my first payments was a few days late. Some pages of the agreement are blue, some white and all different fonts. Idem claim they own the debt, but terms in the agreement only state they can transfer the debt, but another clause in the terms says only We or You (meaning Halifax or me I assume) can enforce any part of the agreement. The agreement also state that interest will not be charged on defaulted accounts, however Halifax continued to apply interest when in the debt management plan and the account had been defaulted. Where the signature is supposed to be for me is blank, and the agreement contains no dates. Can anyone advise where I stand with this agreement. I can scan in later if it helps? It all just seems dodgy to me, and incorrect for the terms I remember. The debt is also 5481£ which is significantly higher than I recall ( I did bury my head in the sand for a few years, I had no money and no way of dealing with the debts, contributions were made through a dmp, it has been defaulted but the 6 years has now passed) The agreement just isn't correct from what I can see, but if anyone could advise further, it would be greatly appreciated? Chris

-

Sent a CCA request and this was the response, what do you recommend i do next? They have said they didn't send me the notification letters as they didn't have a confirmed address? the address is the same as the one on the CCA that they have sent these letters to? HFC, CCA request response.pdf

-

I asked for a copy of a CCA agreement from Drysdens / Max Recovery recently. A letter dated March 2016 stated that they were unable to fulfill my request. A letter today from Drysden attached a "copy of the credit agreement conditions". It has none of my details on, nor my signature. The letter says " our client considers the debt due and owing" What do I do now?

-

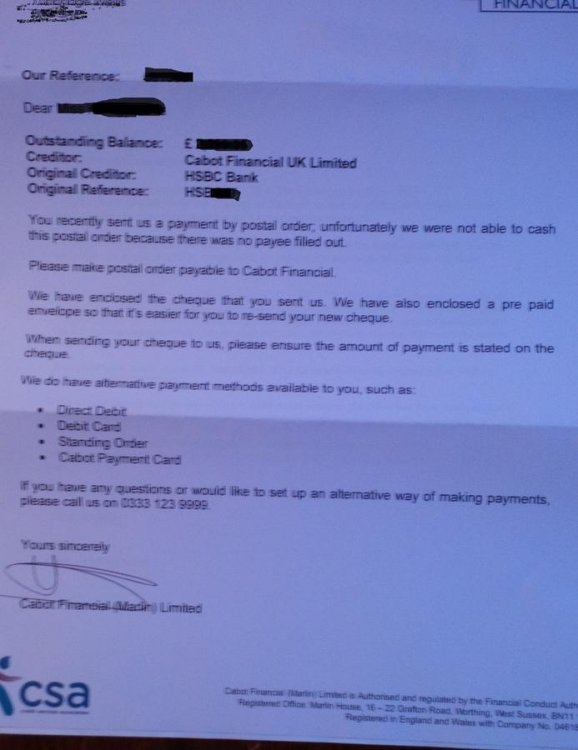

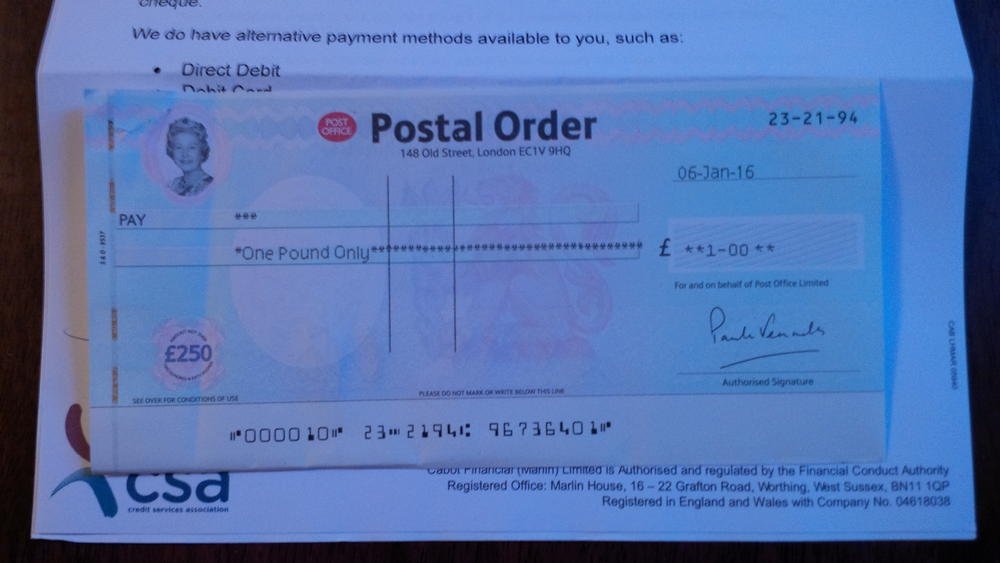

Hello everyone, Credit Card-HSBC Bank, currently with Cabot/ Marlin Account Start Date: 01/2007 Opening balance:£2700 Default balance: £2700 Date of default: 06/2010 I think this probably was an online application.. After defaulted in 2010 Metropolitan Collection Service Limited contacted me and demanded high monthly payments while I was in the hospital- everyday calls etc. .. In the end reduced payments were agreed. I was paying them reduced payments (£10 or £20 I don’t remember exactly) on monthly basis until 2013. They agreed in writing in 2013 a monthly £1 payment : Commencing Date 29/06/13 Finishing date 28/08/2096! A few months after the agreement I was contacted by Marlin (Cabot Financial) advising me to start paying them the £1 monthly and providing me with their details. Noddle currently shows owing of £2400. I was contacted by Marlin over the phone recently for a review -I explained that my financial situation is even worse than it was in 2013. They were fine-still happy to receive the £1 .They also mentioned that a full and final settlement can be arranged at 65% discount but they would consider a lower offer if I go to them with one- they said. I sent them a CCA request on 08/01/16 and a change of address letter. They have received my letters on the 9th. Today I received the following letter (file of the letter attached) advising me that unfortunately they were unable to cash the postal order because there was no payee filled out. Please see the attached letter from Cabot. Apologies for the poor quality of the file- I think it is readable. ..but if it is not let me know an I will try again. They also returned my original CCA request letter and the change of address letter??? So I guess I should return these to them. They have written on my CCA request letter with pen: 'ops req £1' and also attached the sticker for sign for service from the post office (I sent the letter recorded)... I have also attached the file of the postal order. Please tell me what is wrong with the postal order? I asked for a postal order and in the post office they told me that the best is to buy a crossed one if I am going to send it to a company, so I agreed!? I did not ask them to put a name on the postal order... Although I left the postal order completely blank at the back- Cabot has written on it my Ref number and something like a signature next to the ref. number??!!!! Please advise on the above? Very much appreciated! Uploaded PDF files -post 3 .

-

Hi all , I have a defaulted barclaycard account which was sold to MKRR recently, ouststanding balance about £4500. I have been passed from one dca to another over the number of years that i have had this account set up payment plans then things have happened so they havent been stuck to, it then goes quiet for a few months and then seems to get passed to different dca i have received 3 letters to date first 2 were to inform me that barclaycard have assigned and transferred my account to MKDP LLP etc the third one i received today from MKRR asking me to contact them to set up payment plan quite a nicley worded letter and very non-threatening actually ! Having read all the posts on MKRR im slighlty curious about exploring the possible loopholes that might be avaliable to me not really sure about what is the first letter to send to them and quite nervous about what is the impact of going down this route if it is unsuccessful

- 53 replies

-

- barclaycard

- hoist

- (and 6 more)

-

Credit Card-MBNA -Account start date 05/2006, defaulted -06/2010 at £6550. Noddle currently shows that I owe : £5250. I found a letter dated 01/09/2010 from Experto Credite advising me that Varde Investments(Ireland) Limited has bought the interest of MBNA Europe Banks Limited and they are legal owner of my account. ‘Under the terms of assignment Experto Credite Ltd has been appointed by Varde to recover any and all outstanding sums.’ I paid Experto Credite £20 on monthly basis until Aktiv Capital contacted me to inform me that they have taken over my account. They agreed to the £1 monthly payment in 2013 (which was agreed with Experto Credite already I think) and since then I have been paying it. I noticed just recently that on my Noddle report instead of Activ Capital, PRA Group UK has taken place as a lender.The last letter I received before I moved away in 2013 was from Aktiv Kapital ltd. I have been paying them £1 for more than 2 years. Now I want to update them about my new address and request CCA but they are no longer Aktiv Kapital ltd. They are PRA ltd. They probably sent me a letter to notify me at my old address... Their bank details are still the same so my £1 has been going to them and they update my Credit record file regularly. I called the Aktiv Kapital telephone number from the letter I last received in 2013 but PRA answered. I did not introduce myself - just asked them to who to write and they explained to write to PRA in Scotland not to Aktiv Kapital in Bromley. Who should I address the letter to: PRA or Aktiv Kapital or both? What do you think? My address: Their address: Aktiv Kapital(UK)Ltd/ PRA ltd 2 The Cross Kilmarnock Scotland KA1 1LR Date: Dear Sir or Madam, .................. or My address: Their address: Aktiv Kapital Ltd 2 The Cross Kilmarnock Scotland KA1 1LR Date: Dear Sir or Madam, .....................

-

Hi all, I'm new to this so unsure how to get this into the correct forum? any help is appreciated. To cut a long story short, 2 alleged Halifax debts were sold to Cabot in 2012 and I have had nothing but problems from the start with them. in Sept 2014 I sent 2 CCA requests for the alleged debts and got the standard response from them and these accounts were on 'Hold', however in Jan '15 I received a letter from Cabot stating that they were no longer going to pursue ONE of these debts. I have heard nothing about the other one since, I have since sent a letter to Halifax to see if they actually have a copy of the original CCA (dating back to May 2005) but their response was for me to send for a SAR and I needed to put my signature on the letter to prevent fraud?? (I have not done this). Should I send a follow up letter to Cabot asking what is happening or should I 'just let sleeping dogs lie' any suggestions on next course of action?

-

Hi, I have asked Robinson Way for a CCA request. But can I just clarify something please. The card was a Barclaycard which defaulted, sold to MKDPP who sold to Hoist/Robinson Way. The card was taken out in August 1993. As part of the CCA should I be sent a copy of a "true signed agreement" or can they send me a reconstituted one. I am not sure which one applies to my card or if in fact they could send either. Any help would be greatly appreciated. Also, is there legislation to say which one I should receive, if so what is that legislation. Many thanks

-

Hello, This is something I'm losing my sleep over. I've struggling for the last six months with the HMRC to obtain a full and detailed employment history going back to 16 years ago. I need this, because I need to send a request for permanent residency and I've lost some documentation. I first wrote to the HMRC last November and they replied almost immediately but only sending my national insurance contributions record. Then I wrote again in December, pointing out that I needed a breakdown of my employers instead. They replied in February, again sending the same ni record. So I called the hmrc helpline and the operator suggested that I wrote a request under the Data Protection Act, which I did immediately. I called the HMRC again in April and they told me that, due to the length of the period, it might take up to 375 days. However on their website they state: Now it's more than 3 months and yet no answer has come. Incidentally, re-reading the letter I sent, I have realised I had omitted my national insurance number. Terrible mistake, however I had included so much data that they could identify me without delays. What do do now? I'll call the HMRC tomorrow and if it goes nowhere, I'll write a second letter. Is there anything else I can do? This thing has been eating me for the last six months. Thank you

-

Hi I would like to were I stand about requesting my landlords details? The reason for this is about two months ago they tried to fit prepayment meters in the property, which I refused to let the engineer to do. I live in a shared house, we pay one sum for rent and all bills expect TV license. We have a sheared kitchen, utility room and bath room. I rang my local council for information regarding this and was told we should be a HMO (house of multiple occupancy) and the house is not registered as one. The council are now requesting me to let them do an inspection? so I called them about it and got fobbed off, so I requested my landlords details as no one has it in the house. I have sent numerous emails, calls and texts and had not received any reply. So I sent this to them on the 13.04.2016 and no reply. Any help would be very appropriated. Strongdumplin I am the tenant of the above property. Under section 1 of the Landlord and Tenant Act 1985, I hereby request you to provide me with a written statement of the landlord’s name and address within the period of 21 days beginning with the day on which you receive this request. You should be aware that a person who, without reasonable excuse, fails to comply with this request commits a summary offence and is liable on conviction to a fine not exceeding level 4 on the standard scale, which currently stands at £2,500. I look forward to receiving your prompt reply. Yours sincerely.

-

Hello, I wonder if anyone can help me. I bought 2 items from an ebay seller listed as a business seller. Firstly there was a problem with postage, 2nd item was supposed to be £1.00 postage and was charged full. Wrote a friendly email, no reply, left a friendly phone message and asked if I should go through paypal or if they could sort it. It was sorted the next day. OK, the items are not suitable, I collected from the post office last saturday, seller has a 14 day return policy and insists on a form being filled out via access to an ebay account. No ebay account. Have written 3 polite emails requesting the return, left 2 polite phone messages indicitating said emails are awaiting response. Meanwhile checked the new rules for distance selling, Consumer Contract Regulations. This says that the form requested is to make cancelling easier but does not affect the return of goods. As I used ebay as a guest I can't access the form the seller insists on and have made a request by email 3 times now and twice by phone. So as I understand it I have fulfilled my obligation to alert the seller within the 14 days (day 1 actually) that I want to return the items for a refund. No word from the seller. Any idea how I might proceed with this now to ensure the seller gives me a refund. I am trying to keep things cordial but I am anxious to get the items back and have the money returned to my account. Help much appreciated.

-

Hello there! First time post for me so apologies if I miss something! I received a letter from Robinson Way for an alleged barclaycard debt, of which I sent a CCA request enclosing the £1, which they banked. I received a letter saying that they would request the details from their client and it would be on hold until they received the details. Subsequently I've now received a letter saying: "Further to your recent request for a copy agreement on the above account, we are unable to obtain this form the original creditor as this request must be formally made to us in writing. Please accept our apologies for any inconvenience caused by us not informing you of this requirement at the time of your initial request. If you still require the agreement please submit your request in writing to us at the address above and we will process it as quickly as possible. Please note that the £1.00 fee normally required for a CCA request will be waived on this occasion. In the meantime, we have placed your account on a 30 day delay to allow you enough time to submit a written request. If we do not hear back from you within this time we will assume you no longer require this information and your account activity will resume." I sent the CCA request with the enclosed payment to the same address on the letter?! It is now 17 days since the date of my original CCA request. I'm not sure which way to respond to this - any help would be greatly appreciated. Many thanks!

-

Nat West Directors Personal Guarantee - request for advice

bubblesmum posted a topic in NatWest Bank

Dear All, In June 2014, my partner and I arranged an overdraft with our business bank (Nat West) as match funding for a government loan scheme. We were asked to sign a personal directors guarantee and, at the same moment in time, signed the waiver to legal advice form in the bank's office. Sadly, our business has now been declared insolvent and the bank are now calling in the personal guarantee for £20k. Originally, we did not believe we had signed a guranatee but the bank have now come up with the evidence (although that was never originally forwarded to us so we had no copy until now). We have also never received a copy of the overdraft agreement signed in June 14 although we have one signed September 14 with a pp signature from the bank. We were also asked to sign a debenture (again, we have no signed copy) and also a postponement of directors loan account which we definitely didn't sign as they were still chasing us for that in February last year and I know we never signed this. I recently wrote to the bank asking for copies of ALL signed security documents and they only sent me the PG and waiver. I have written to them again today asking for the other security documents. Nether my partner nor I are ones to shirk our responsibilities but I would like to come to an arrangement/agreement with the bank to either pay a lesser amount or a small monthly payment. I have already lost 200k personally from the business failure and hoped that was the end of it. I have phoned several companies who state they deal with these types of issues but not one has come back to me. My question is How is it best to start the process of negotiation with Nat West and what should I say initially? And is it feasible that the guarantee could somehow be unenforceable? I should say that I had another company (Credit4 - beware!) took me to court re another directors personal guarantee for the same failed company and got a ccj and a charging order against a property I owned. i have had to sell that property (my main income) to satisfy their debt and have a small sum left over which I really want to keep to buy somewhere else to live now. Another £20k will add to my losses even more and will dent that small sum. I can't get a mortgage now due to this ccj, even though it is settled, hence why I need to keep as much as I can to buy somewhere to live without a mortgage. My partner now has a new job but has to live away as its not local. We cant afford to buy anything where he is working. Feeling really fed up and just wondered if anyone had some sensible advice on how to get a settlement agreed. Or to know someone who can help at a reasonable cost. A little light at the end of this dark tunnel would be so nice. Thank you in advance to anyone who responds to my request -

I am trying to get my finances in order and have been reading up on forums about those who have had successes dealing with DCAs, but unfortunately my accounts don’t seem to make sense. I have four default accounts on my credit file, showing a D sign every single month on my account, but I have three payments from DCA going out of my account two I know why I am paying but PRA I don’t know what its for, and the two bank account overdrafts I have defaults for I don’t know what is happening with them and what to do. Should i send out CCA letters to all creditors including barclays and natwest? On my credit file are these four defaulted accounts Lender Idem Capital Securities Current Balance £1,868 I am paying this via direct debit reduced monthly installment at the moment, this has been passed from Agilent to Moorgate and now to Idem and I it was so long ago now I cant even remember who the original company was who I took a loan out with. Lender NWB Current Accounts Current Balance £1,691 It says I am paying £5 per month but I cannot see any standing order or direct debit going out of my account for £5 per month, so I have no idea what is going on with this account. Both Barclays & Natwest overdrafts have been passed over to DCA I am sure of it, but I am unclear on who they are or what is going on with these accounts. What shall I do? Do I chase up with the actual banks to see what information they can pull up (send SARS) Lender Barclays Bank plc Current Balance £1,590 Similar to my Natwest account, I do not have anything on my bank account showing I am paying them, yet it shows I am paying £18 per month, once again I do not know how to handle this and whether I have a DCA I am paying, I haven’t received any letters for a while and I don’t have a clue what I should do. Lender MKDP LLP Account Type Credit Card Current Balance £264 Finally I have a PRA Group direct debit set up for £8.86 per month but yet again I don’t know what debt this is for now, as it seems to have been set up some time back, with moving and getting married last year I lost a lot of paper work and I cant remember what DCA is for what account and why now. DCA payments: Idem Robinsons Way this is on my credit file under MKDP (are they the same company?)But there is nothing on my credit file saying I am dealing with Robinsons Way PRA Group £8.86 No clue whatsoever why I am paying this and for what account.

-

Having received court paperwork from hoist portfolio holding for a old HSBC overdraft And loan all merged into one account. Sent hoist solicitors a CPR request After hearing nothing submitted a holding defence I now have notice of proposed allocation to small claims track Do I need to tick no to small claims track being appropriate as they have failed with CPR request Can only find conflicting information looking online about what to put:boxing:

- 6 replies

-

- allocation

- claims

- (and 5 more)

-

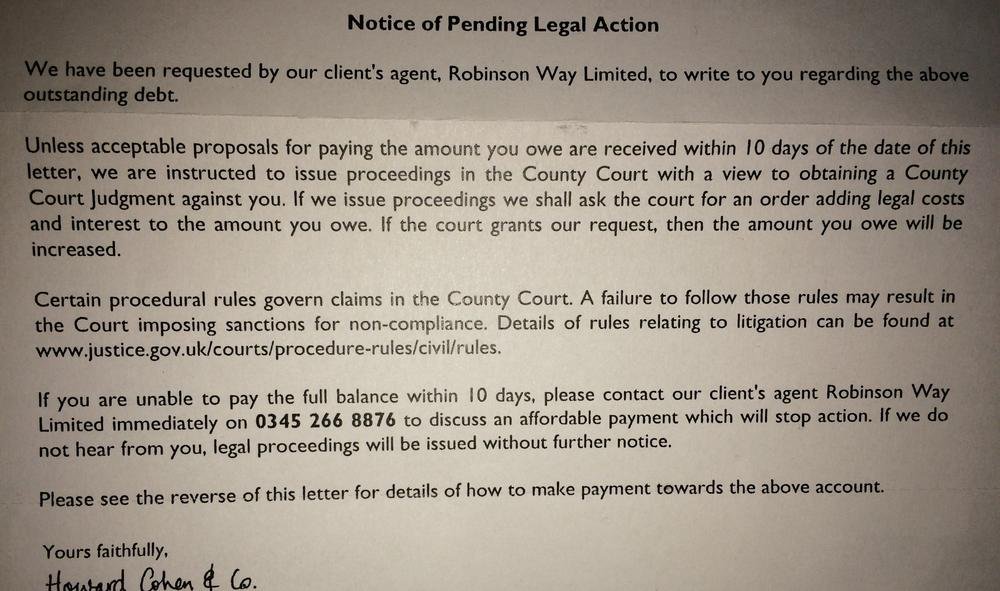

I'm usually happy to ignore letters from debt collectors but this one seems to be more definitive in its terminology. Do you think I should I make the CCA request to Robinson Way? I've never contacted them before. TIA!

-

Hi Guys Long winded but will cut it down best I can, will start with the numbers loan 1 July 98 for £3000 PPI single policy of £443 added to loan (paid 46/60 payments) £144 of ppi refinanced by loan 3 loan 2 Dec 98 for £1400 PPI single policy of £198 added to loan (paid 39/48 payments) £50 of ppi refinanced by loan 3 loan 3 April 02 for £5000 PPI single policy of £1174 added to loan (paid 13/60 payments) £980 of ppi refinanced by loan 4 loan 4 may 03 for £7500 PPI single policy of £1762 added to loan (paid 11/60 payments) £1500 of ppi refinanced by loan 5 loan 5 may 03 for £11000 PPI single policy of £2383 added to loan (paid 12/60 payments) £2032 of ppi refinanced by loan 6 loan 6 may 08 for £10000 PPI NO PPI added to loan still paying Now we had a decision letter from Lloyd's stating they upheld all of the complaints offering refund of the ppi part of the loan that was paid in installments plus interest, which worked out about £7,700 according to their workings out, I had it in my head from working it out that it should have been nearer 10k but at first glance of their workings it looked OK but I still couldn't get it out of my head that something was wrong. It then clicked that they had calculated all their figures ONLY on the installments made and had completely ignored the bits that were left on refinancing which by itself without adding interest is about £4700, this amount is still being paid off on loan 6. I phoned them as the offer letter tells me to do and explained why I felt it was wrong, the guy said that I am not entitled to that bit back as the loan was refinanced, I argued and tried to speak to a manager but was brickwalled, he insisted I was wrong and that the payment of £7700 was going to be sent, I told him at this point that I DO NOT ACCEPT the offer, and under no circumstances are they to consider the matter closed, I even got him to repeat it back to me several time, as they supposedly record the calls. what I would like to know is am I wrong, am I not able to reclaim the bits that were refinanced by the new loans, or are Lloyd's trying it on Many Thanks

- 9 replies

-

- lloyds bank

- premium

- (and 6 more)

-

Sorry if this is the wrong place, can you please move it for me admin if I am wrong. I suspect my DCA (Lowell) cant provide a CCA. I submitted my defence online already regarding a debt for £800 as I don't remember the debt and nobody can tell me if they have or haven't got a copy of the CCA. My defence is that without a CCA the debt is not enforceable. If my DCA go to a hearing is it essential that I turn up to the court in person or can I send a statement or letter. This is worrying me sick because I don't know what to do. I am unemployed with 3 children and I don't drive. Also I have been sent a letter from Bryan Carter on behalf of Lowell that they would like to proceed and have offered "negotiation and mediation. I rang them today and they suggested a Tomlin order. Forms need to be sent back to Northampton court by 17th December. Feeling out of my depth and don't want to make the wrong decision. Thank you in advance.

-

Hi Guys Im trying to be proactive regarding some letters im receiving from Cabot but i cannot find a recent SAR address for MBNA? Does this one look current? I found it on thread dated from 2007, thats my only concern. MBNA Europe Bank Ltd PO Box 1004 Chester Business Park Wrexham Road Chester CH4 9WW

- 22 replies

-

- barclaycard

- mbna

-

(and 2 more)

Tagged with:

-

Hi I have several debts that have been passed to Lowell's. I've had the usual letters from them requesting payment etc. Some of the balances though, seem a lot higher than i remember so have written to Lowell's the standard letter requesting CCA. The letter was dated 15th January 2016. I have had a couple of replies which read as follows: "you have requested documentation under sections 77/78 of the Consumer Credit Act 1974 for this former/B]XXXX account. We have asked XXXX to provide us with the requested documentation and will send this to you as soon as possible. We aim to provide this to you within 12 working days. In the meantime this account is on hold and we will not contact you to request payment. If we have not heard anything from XXXX after 40 days we will send you an update." I received the following letter as a follow up to the above one: "We refer to your recent request under sections 77/78 of the consumer Credit Act 1974 for a copy of the documentation for this former XXXX account. We have requested a copy of the documentation but have not received this yet. Your account will remain on hold while we await the requested information from XXXX." My questions are: 1. In both letters they refer to the account as a "former" account. Does this mean the debt now belongs to Lowell completely or are they simply acting as an Agent? 2. I want to do a follow up letter to Lowell's about all the accounts but am unsure of the time scales within which they have to supply the requested information. I've tried looking this up but keep getting conflicting information. Am I correct in thinking that the first deadline is 12 days plus 2 (is this working days or just continuous days?)? They also mention a further 40 days time limit. From the research I've done I've only come across 30 days but again don't know if this is working days or not. Could someone please clarify the time limits and from which date each time limit should commence? 3. Finally could someone advise on a follow up letter or a template letter that i can use? The original letter I sent made no acknowledgement to the debts. Hope someone can help.

-

HI there i am appealing a mandatory review from the ESA. Is there a form that i can use to ask for all info they have held on record about me? If there is could you post a link as i can't find one. Is there also a charge for this? \thanx in advance

-

hi guys i had an issue with a dca about four years ago which was halted by a cca requested helpfully obtained from this site the debt has been sold on to several other dca,s, who although i can head them off with further cca requests, they keep registering the debt on my credit file is there anything i can do to prevent this happening in future? cheers Mark

-

My Wife has a very old debt through Barclays that was sold to P&J years ago. Just recently they have started a lot of stick waving, getting their in house solicitors Foulds to threaten her with a CCJ if she didn't pay the outstanding amount with seven days. we sent them a CCA request. Today they have returned the Postal Order saying that they do not have a copy of the CCA at their office and it may take some time to retrieve the original documentation from Barclays. I know Barclays have an uncanny knack of obtaining old micro film ( the last one we got via Link was a credit application and totally ineligible ) What is her next move ? Are P&J in breach of her CCA request ? Should she continue to pay them ?

-

Hi I would like to put a SAR in finding out what information my employers hold about me (I work for my local council). In particular interest are some emails which a colleague who left under a compromise agreement sent about me. My employer has email archives dating back ten years so I know they are still available but wasn't sure how to word the request to make sure that these are included. Any ideas Thanks

-

Hiya Guys I have a case with Lowell for just under 16 grand. The details of which are as follows 1. They placed a default on my credit file for this and then I didn't hear from them for 4 years 2. They then started sending letters to my mums (I live in Switz) 3. I sent them a CCA request from my Swiss address. 4. They finally responded to that request after over 6 weeks saying that Barlcays cannot find the account in their archive and they are putting my account on hold. They sent the reply letter to my Swiss address so they have finally got hat through their heads that I dont live in the UK. So I take that to mean there is no paperwork then. Can I based on that get them to remove the default then? Will they ever find the paperwork or is it gone? Why would they buy debts without paperwork? Cheers

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.