Showing results for tags 'cca'.

-

In early 2000, we moved to Canada from the UK, At the time we owed ~13000 pounds to Lloyds on a credit card. Until around 2013 we struggled to pay the minimum balance, by this time it was transfered to APEX. In May we asked for a CCA and paid the fee. APEX acknowledged the request in writing and informed us they had asked lloyds for the information. The account was placed on hold. We still have not received that information As of today Lloyds have informed us they have sold the debt to 1st Credit. My many questions are as follows 1) Should we ask 1st Credit for the CCA? 2) As the CCA has not been complied with what should we do ? 2) If they are unable to produce it what is likely to happen ? 3) If this drags on for six years what happens then ? 4) Is it worthwhile offering a full and final settlement and what would be a reasonable percentage ? 5) Is this debt enforceable / transferable to Canada 6) Can I ask 1st Credit to contact us only by post 7) What is likely to happen if we ignore this request Thanks in advance

-

Can anyone provide the most up to date address for CCA & SAR for HALIFAX CREDIT CARD Not sure if the addresses i`ve found are up to date Many thanks in advance

-

Hi All, Lowell have approached me with an account for which I supposedly owe money. The alleged debt is from 2011 and is a Provident Home Credit loan for about £800. I lived at the address in question at the time, but I have no recollection of taking this loan. Lowell told me that payments were made onto the account for a few months and then stopped. I told them that I neither accept nor deny having taken the credit, and that I would like to see the a copy of the credit agreement and a statement of accounts to date. I told them that I would then be able to confirm whether this is something I have overlooked, or if it is indeed false/fraudulent. Lowell sent me a later saying: "Due to the amount of time that has passed, the credit agreement and statement of accounts are no longer available for this account." But they also go on to say that I still owe the money and still need to pay?! Where do I stand with this? Advice is much appreciated. Thanks!

-

Hi All, I had started a CCA process with Idem servicing with the OL being Citi Financial. I took out the loan in 2007 and have had a minimum payment going out. All payments have been stopped whilst my CCA request is in process. Idem promptly replied within the set time of 12+2 days with many copies of the signed contract with Citi financial, i just want to make sure that what they have sent is enforceable, if so should i resume my payments and send a F&F offer to them. I have uploaded the documents that were sent to me.

-

I am trying to get my finances in order and have been reading up on forums about those who have had successes dealing with DCAs, but unfortunately my accounts don’t seem to make sense. I have four default accounts on my credit file, showing a D sign every single month on my account, but I have three payments from DCA going out of my account two I know why I am paying but PRA I don’t know what its for, and the two bank account overdrafts I have defaults for I don’t know what is happening with them and what to do. Should i send out CCA letters to all creditors including barclays and natwest? On my credit file are these four defaulted accounts Lender Idem Capital Securities Current Balance £1,868 I am paying this via direct debit reduced monthly installment at the moment, this has been passed from Agilent to Moorgate and now to Idem and I it was so long ago now I cant even remember who the original company was who I took a loan out with. Lender NWB Current Accounts Current Balance £1,691 It says I am paying £5 per month but I cannot see any standing order or direct debit going out of my account for £5 per month, so I have no idea what is going on with this account. Both Barclays & Natwest overdrafts have been passed over to DCA I am sure of it, but I am unclear on who they are or what is going on with these accounts. What shall I do? Do I chase up with the actual banks to see what information they can pull up (send SARS) Lender Barclays Bank plc Current Balance £1,590 Similar to my Natwest account, I do not have anything on my bank account showing I am paying them, yet it shows I am paying £18 per month, once again I do not know how to handle this and whether I have a DCA I am paying, I haven’t received any letters for a while and I don’t have a clue what I should do. Lender MKDP LLP Account Type Credit Card Current Balance £264 Finally I have a PRA Group direct debit set up for £8.86 per month but yet again I don’t know what debt this is for now, as it seems to have been set up some time back, with moving and getting married last year I lost a lot of paper work and I cant remember what DCA is for what account and why now. DCA payments: Idem Robinsons Way this is on my credit file under MKDP (are they the same company?)But there is nothing on my credit file saying I am dealing with Robinsons Way PRA Group £8.86 No clue whatsoever why I am paying this and for what account.

-

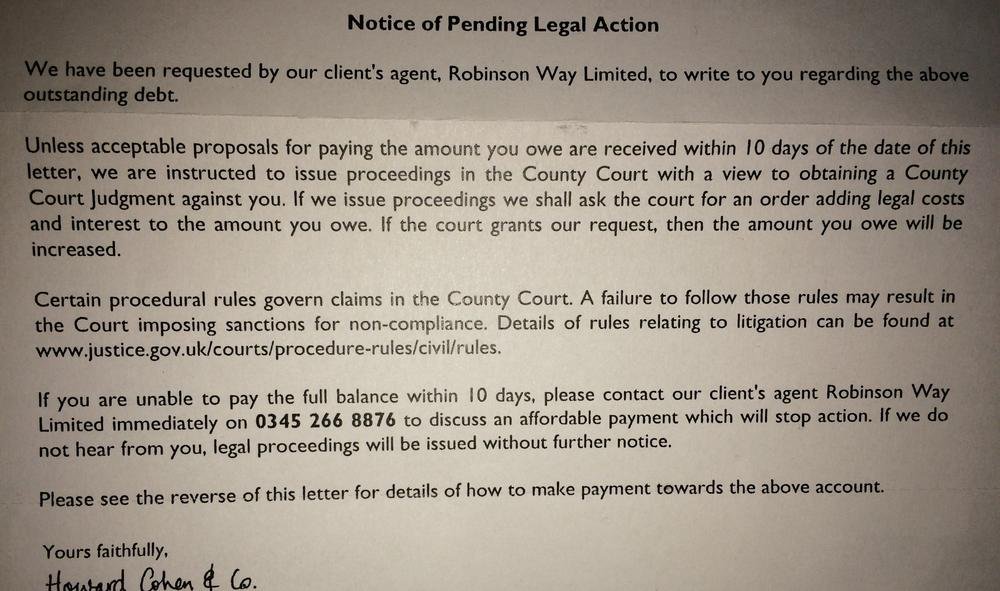

I'm usually happy to ignore letters from debt collectors but this one seems to be more definitive in its terminology. Do you think I should I make the CCA request to Robinson Way? I've never contacted them before. TIA!

-

Sorry if this is the wrong place, can you please move it for me admin if I am wrong. I suspect my DCA (Lowell) cant provide a CCA. I submitted my defence online already regarding a debt for £800 as I don't remember the debt and nobody can tell me if they have or haven't got a copy of the CCA. My defence is that without a CCA the debt is not enforceable. If my DCA go to a hearing is it essential that I turn up to the court in person or can I send a statement or letter. This is worrying me sick because I don't know what to do. I am unemployed with 3 children and I don't drive. Also I have been sent a letter from Bryan Carter on behalf of Lowell that they would like to proceed and have offered "negotiation and mediation. I rang them today and they suggested a Tomlin order. Forms need to be sent back to Northampton court by 17th December. Feeling out of my depth and don't want to make the wrong decision. Thank you in advance.

-

Hi, I'm usually pretty confident with dealing with debt collectors and things like this but this one has got me scratching my head a little and so I'm just looking for a little bit of advice from people that know far more about these things than I do. I signed up with our local gym in June of last year. It's a council owned gym but they outsource their membership management to a company called Debit Finance Collections (DFC). Our membership is actually a Consumer Credit Agreement provided by DFC which runs for 12 months and ends in June. Everything was going well until I went to the gym in January and they declined my membership card saying that my account had been suspended. Embarrassed and confused I went home to telephone DFC and I was informed that I had cancelled my direct debit. I told them I hadn't and offered to pay them over the phone there and then. They declined this and told me to just set up a new DD which I did. I again got knocked back at the gym as once again my account had supposedly been suspended. I contacted DFC who once again said that I had cancelled my DD. After a few days of me arguing that I hadn't and them arguing that I had, I received a letter from them threatening me with solicitors if I didn't pay what I owed. I have written to them and emailed them numerous times practically begging them to take the money out of my bank. Despite communicating with them for several weeks, DFC wrote to me saying how disappointed they are that I am choosing to ignore their letters and saying that they have no choice now but to enforce the agreement in full. They are demanding over £300 which covers the period of January upto June. Due to all this happening, and not wanting to miss out on keeping up my weight loss, I joined Pure Gym in February to keep me going until this was resolved. Due to their behaviour I did a little bit of research into DFC and discovered that they no longer possess a Consumer Credit Licence. It was cancelled in October. I contacted them about this and they said that they are no longer pursuing the original agreement as a consumer credit agreement and are simply pursuing it as an outstanding debt. This has gotten me confused. Are they allowed do that? Surely if I sign a CCA for 12 months then it has to be treated as such for the entire period? Secondly, the gym that I was signed up with has never held a consumer credit licence, so should they be acting as a broker? I read that them filling in the consumer credit application form for me and sending it off to DFC constitutes being a broker for which they need to be licensed. I'll be honest, at this point, I'm just looking for a way out of this now. I'm happy with Pure Gym and I've had nothing but stress for the last 3 months with DFC. Again, I apologise for the length of this post but I just wanted to give you as much information as possible. If anybody can offer a bit of advice regarding this then I'd be very grateful. Thanks, Paul

-

Hi I have several debts that have been passed to Lowell's. I've had the usual letters from them requesting payment etc. Some of the balances though, seem a lot higher than i remember so have written to Lowell's the standard letter requesting CCA. The letter was dated 15th January 2016. I have had a couple of replies which read as follows: "you have requested documentation under sections 77/78 of the Consumer Credit Act 1974 for this former/B]XXXX account. We have asked XXXX to provide us with the requested documentation and will send this to you as soon as possible. We aim to provide this to you within 12 working days. In the meantime this account is on hold and we will not contact you to request payment. If we have not heard anything from XXXX after 40 days we will send you an update." I received the following letter as a follow up to the above one: "We refer to your recent request under sections 77/78 of the consumer Credit Act 1974 for a copy of the documentation for this former XXXX account. We have requested a copy of the documentation but have not received this yet. Your account will remain on hold while we await the requested information from XXXX." My questions are: 1. In both letters they refer to the account as a "former" account. Does this mean the debt now belongs to Lowell completely or are they simply acting as an Agent? 2. I want to do a follow up letter to Lowell's about all the accounts but am unsure of the time scales within which they have to supply the requested information. I've tried looking this up but keep getting conflicting information. Am I correct in thinking that the first deadline is 12 days plus 2 (is this working days or just continuous days?)? They also mention a further 40 days time limit. From the research I've done I've only come across 30 days but again don't know if this is working days or not. Could someone please clarify the time limits and from which date each time limit should commence? 3. Finally could someone advise on a follow up letter or a template letter that i can use? The original letter I sent made no acknowledgement to the debts. Hope someone can help.

-

I applied to Littlewoods Catalogue via an application form way back in the 1990's. Although I have just a small debt of £160, this is now included in an IVA. The IVA has been enforced since June 2012; I've had no contact with Littlewoods since the IVA was granted. I wish to seek under I believe a section 75 request to see if there is any actual credit agreement with the catalogue company. The debt is still listed with Littlewoods and does not appear to have been sold on. Can anyone please provide me with template letters? Thank you.

-

Barclays- SAR and CCA? Dear Cagers, As mentioned in another post I have 4+ debts which I desperately want to sort out ASAP. I want to start with Barclays and I will rely on your amazing help I have seen you have given to other desperate people. Please be aware that I am very inexperienced in dealing with creditors, DCA etc... The situation: Barclays current account: Opened 11-12 years ago. I use this account to transfer £4 each month from another account to be able to pay my debts -£1 to each of 4 debtors. This is including paying £1 each month to my Barclays unsecured loan (£1 payment agreed in 2013 via CDCS)... My account is in ‘working’ condition but I can see online that my address, telephone number and e-mail are marked as unknown –I guess they have found out that I don’t live at the last address provided to them. My e-mail and the telephone number have not been changed though but they have deleted them from ‘my details’ file... Barclaycard- Credit card: CLOSED by Barclaycard years ago (opened around 2004-2005,closed-unknown when and why). Never had any late payments etc.. . I have overpaid £10 to the card and never received them back. No documentation with me to prove that but I am sure about the above. Barclays Unsecured loan: Information on Noddle about my unsecured loan: Barclays Bank Plc Account start date: ‘Summer’ 2007 Opening balance £ 20,000 Regular payment £ 385 Repayment frequency :Monthly Date of default: ‘Summer’ 2010 Default balance : £14,000 Currently owning : under £13,000 Originally taken in 2007 for £20K as far as I remember to be repaid in 4 years-maybe 5 years!?. I was supposed to pay £385 a month. I paid £385 a month for over 2 years until November 2009. I applied for the loan online through my current bank account online page and I remember that the money was transferred very quickly to my Barclays current account. I don’t have any paperwork of terms & conditions or signed agreement. I am not sure if I was provided with any anyway. Maybe I just ticked these as ‘read’ online without reading them to be honest. The loan was spent on an unsuccessful business. In October 2009 I became very ill and had to leave the country for treatment. I did not pay anything to them for around 6 months while abroad in hospital. I returned to England in June 2010. I discussed with them my situation (conversations over the phone) and was paying them reduced payments (as much as I can) but they did not agree to reduced payments and did not care and kept adding fines and fees. I don’t remember receiving anything in writing from them-most of the conversations were happening over the phone, any correspondence I might have had is lost. I received a letter from CDCS (Central Debt Collection Services- Parent Company: Barclays Plc. Information about them here : http://www.humberdebt.co.uk/help-with-central-debt-collection-services-debt-debt-management-and-debt-advice/ ) in 2013 agreeing to my £1 monthly payment offered to them. Prior to that I was paying them higher amounts. After that I never received anything from them, then I moved address and never contacted to update address as I did not have a permanent place of stay. Please give me advice what to do? I guess once I provide them with an address they may issue CCJ (non registered yet on Noddle)... I remember taking the loan but I have not got any documentation etc.. . and have not got a clue how much fines , interest and charges they have added to my unsecured loan. ..Is the right thing to request SAR and CCA to Barclays? I think that it is necessary to recover all the information (statements, charges, interest, ppi and other insurance, applications, correspondence for loan, credit card and current account, telephone conversations) before discussing any repayment or settlements with them? Will SAR provide me with statements for my current account as I will need these for proof of payments for different debts as well? https://www.apply.barclays.co.uk/forms/subject-access-request?execution=e1s1 Do you suggest to apply via post or using their online system above? Do you think that the best is to close my Barclays current account first and then start communicating about the unsecured loan with them? Is it true that once I have requested SAR and/or CCA there is a big chance interest and fines to apply to my account again and to be asked to pay more than the token monthly payment? Your help is much appreciated.

-

It has often been said on here that a claimant cannot claim the above interest if the action is brought under the remit of the CCA. Well section 69 certainly does not say that. Now I know people will say yes but look here The County Courts (Interest on Judgment Debts) Order 1991 This appears however to relate to section 74 of the 1984 act not 69 am I missing something here???

-

Hi, Need some advice. I sent Vanquis a DSAR request over 4 months ago. I enclosed a £10 cheque which was duly cashed however they failed to provide me with any of the reqested documents (CCA, Terms & Conditions, Default Notices, Deed of assignment etc) I received a 3 page letter consisting of a demand for a further £1 for CCA and a 2 page document consisting of an abreviated table of transactions (I believe this is supposed to constitute a statement) Can someone confirm to me whether the £10 paid for the sar superceeds the requirement for an additional £1 for the cca. My understanding was the £10 sar fee covers ALL docs & data. Thanks

-

Name of the Claimant ? HSBC Date of issue Dec 2014 What is the claim for – the reason they have issued the claim? The Claimant's claim is for the balance outstanding under a credit card agreement dated 30/09/2002 and numbered [my cc number] regulated by the consumer credit Act 1974. The Defendant has failed to make payment by the Statutory Default Notice served by the Claimant dated 10/11/2010 AND the Claimant claims 1. £2559.39 2. Interest pursuant to Section 69 of the county court Act 1984 at a rate of 8.000% per annum from the date hereof at a daily rate of £0.56 to the date of Judgement or sooner payment. Amount claimed: 2559.00 Court fee: 105.00 Solicitor's costs: 80.00 Total amount: 2744.00 What is the value of the claim? £2,500 + costs Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit card When did you enter into the original agreement before or after 2007? September 2002, allegedly Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Original creditor (HSBC) Were you aware the account had been assigned – did you receive a Notice of Assignment? Not sure, it might have been assigned to Metropolitan... Have to check that though. Did you receive a Default Notice from the original creditor? I did, in 2010. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? I don't think I have, at least not every year. Why did you cease payments? HSBC started harassing me with letters - used to get them at least 2 times every month. Never responded to these though. What was the date of your last payment? September 2014 Was there a dispute with the original creditor that remains unresolved? Don't think so. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? I've made an offer to HSBC back in 2010 to pay them a nominal amount of £1 due to being unemployed for 4 years. They've accepted that then. Brief history of the claim (answers to the questionnaire follow below): 1. In Dec/2014 I've received a claim from HSBC for my CC debt (around £2,500) 2. Responded to the claim filing an acknowledgement of service and sending CPR31.14 request to HSBC. Received acknowledgement from HSBC's solicitors, but nothing else. 3. By 17/Dec/2014 no documents provided, filed N244 form with Northampton court to strike out the claim. 4. Order granted on 31/Dec/2014, however it stated that HSBC needed to comply with that order the week before (24/Dec). 5. HSBC appealed on the grounds that the order was impossible to comply with so needs to be struck out and also provided me with a "reconstituted" version of the agreement and the default notice. 6. Case transferred to my local court for 1 hour hearing. 7. On that hearing (at the beginning of this month), the judge accepted HSBC's arguments and ordered for the original order by NCC to be struck out. He, however, also ordered HSBC to provide witness statement why they cannot supply me with copy of the documents I requested under CPR31.14 and need to provide a reconstituted version of these. In the same order, the judgement says that, provided HSBC respond to this request, I am required to file a defence by the end of this month (in 10 days’ time). HSBC responded with a witness statement and I am now required to file a defence. This is where I am at. A lot of questions, but the main issue for me is to file a defence - how can I get a defence based on "reconstituted" version of the CCA, also given that I have no recollection of ever signing such agreement (the credit card in question, as far as I remember, was given to me by HSBC when I applied with them for a current account and I was told at the time that HSBC offers such credit cards as "standard" - never asked for a credit card specifically). Another important fact to note is that the CCA, allegedly entered into, is dated in September 2002. There is also a matter of costs - I am of the understanding that if the case is allocated under the small claims track, the most costs I am going to pay if I lose the case, would be around £280, but I am hearing conflicting opinions that HSBC can ask me to pay their full costs t hat could be 1000s of pounds worth. Is that really the case? Ideally, I am on the lookout for good solicitors out there (I am willing to pay, of course) to review my papers/correspondence, advice and draft my defence, then, if it comes to that, to represent me in court. Help very much appreciated, many thanks. Questionnaire answers:

-

Hello Can I firstly just say what a gold mine of information this site is. Its very comforting to read all the advice and be able to apply it to my own position and feel I am achieving something. I have a small mountain of alledged debt but have been managing it down with your help. I cope by giving priority to dealing with debt which is "sold on", hence my post. A while ago now I CCA requested 2 credit card (Barclaycard & Halifax) debts "sold" to Cabot Both have eventually come back with reconstituted and unsigned documents. I'm pretty sure these are both pre 2006. I get regular letters from Cabot ranging from "please get in touch" to "we are going to approach a local collection agency" I am not paying anything currently. I'm a bit unsure what to do next. Should I contact them and ask them to supply a signature or desist? Thanks for any help Victor

-

hi guys i had an issue with a dca about four years ago which was halted by a cca requested helpfully obtained from this site the debt has been sold on to several other dca,s, who although i can head them off with further cca requests, they keep registering the debt on my credit file is there anything i can do to prevent this happening in future? cheers Mark

-

First post, so hoping I've followed all the recommendations. Would appreciate some advice following a recent SAR request I sent to NatWest. Used the template from the CAG library to send a SAR to NatWest and they've called today to ask exactly what I was looking for. Not very good at being forceful on the phone, so rather than saying "everything I asked for in writing", I explained I needed transactions and credit agreements. They are supposed to send me a list of transactions for all of my accounts that I will then comb through for any reclaimable charges and supply me details of the department that may be able to locate my agreements. They are also sending back the £10 fee. I have the following defaulted from Natwest (all have fallen off my credit report in the last 2 years). Fell into problems in 2009 and have been making token payements on and off since: a non SB unsecured loan (post April 2007) - £16k outstanding Overdraft - £304 outstanding Credit Card (pre April 2007) - £3k outstanding Just wondering if I should have demanded more or if transactions and an attempt to find my agreements is a good start. Have just started to tidy up the mess from numerous debts. Natwest is the most complicated, largest amount I owe and surprisingly haven't chased, just send statements. They have used DCA in the past but seem to still own the debts Can anyone advise. Thanks

-

Hi all, Here is the response from DCA from a complaint I made to them. In the letter i received from them they say that this is their "Final Response" to the complaint. And that the documents sent to me satisfy their legal obligations under the CCA 1974 etc. I have removed all personal information from it and the big white patch you can see over where a "signature" was -who knows impossible to tell due to the quality - looks like a big white sticker with some sort of bar code on it. Date on application form 1997. The t and c's are the wrong shape and size to have fitted anywhere on the application form and nowhere does it connect with the application form (ie serial number or anything else) The bits i can read, if I squint hard enough and go cross-eyed, have nothing about interest rates or penalties. And yes the scan is as bad as the original sent to me. My question is does this satisfy the request and would a court accept them? If, of course, it goes that far. Thank you in anticipation.

-

I am curious how this case has been dealt with see here >> http://www.bailii.org/ew/cases/EWHC/QB/2012/2402.html My questions in this Judgment are at para: 10-17 in the above link... Especially para: 17 your thoughts please... As this is driving me mad atm. Can anyone please give thoughts.. PS not sure where to post this thread, sorry.. MM

-

My Wife has a very old debt through Barclays that was sold to P&J years ago. Just recently they have started a lot of stick waving, getting their in house solicitors Foulds to threaten her with a CCJ if she didn't pay the outstanding amount with seven days. we sent them a CCA request. Today they have returned the Postal Order saying that they do not have a copy of the CCA at their office and it may take some time to retrieve the original documentation from Barclays. I know Barclays have an uncanny knack of obtaining old micro film ( the last one we got via Link was a credit application and totally ineligible ) What is her next move ? Are P&J in breach of her CCA request ? Should she continue to pay them ?

-

Hello everyone, Credit card- Citi with Cabot Financial Europe. I am paying to Clarity (online payment via their website) which I guess has been employed by Cabot to take the payments of £1 since 2013. Noddle is updated by Cabot on regular basis showing –£1 each month. Information on Noddle: Account start date 07/2007, opening balance £1436, default balance £1436 ,date of default 06/2010. Between 2010 and 2013 I was paying more than £1 a month so the current balance is down to around £590. The last letter I have received from them is a confirmation of arrangement for £1 a month with Clarity. I called Citi years ago to ask them for more information regarding the debt and about Clarity. They could not find anything in my name with their bank and explained they do not have credit card department anymore as they no longer offer any credit cards and as far as they are aware I don’t owe them anything. They could not give me any information about PPI either.. .They never wrote to me to explain that they ‘sold’ my debt as far as I remember. I sent them CCA request as advised by the helpful people here. They have received my change of address letter and the CCA on Friday 8th of January, 2016 - I can confirm that because I sent it Recorded. This morning they called me but I did not answer. T hey left a voice mail asking me to call them back. I did not provide them with my telephone number on the change of address letter or the CCA request (only address but I guess they have my telephone number from previous contact with them back in 2012-2013). Should I call them or ignore? Why are they calling me?! Anybody with similar experience?

-

Hi fellow Caggers i hope someone can help me with this one. i have been sent a credit card application/agreement following a CCA request. but the document's pre typed sections cannot be read as the copy is very poor. if i complaint about this copy will the credit card company send me a recon instead and i have to accept it. Or is it the case that because they can provide a copy of the original no matter how poor that copy is that is the copy they have to use if they need to take me to court should i default?

-

Bit of an odd one. The wife had a letter today from Barclays: The loan they are referring to is a loan she took out 8 years ago to pay for a new car (in fact the car salesman helpfully arrange the finance package, earning himself a nice fat kickback in the process, but the provide was Barclays). This was before I met her (the good old days), and when we got together I encouraged her to use her savings to get it paid off early, rather than continue to pay high interest rates. So I'm wondering why Barclays are now contacting her offering her money (albeit only a fiver). I'm sure it's not out of the goodness of their hearts. Has there been some recent scandal (like with the misselling of PPI) and they are being forced by a regulator to issue refunds?

-

Hi all, I would like some advice please on my partner's Next Directory account which was opened around start of 2007. Payments have been made in full and on time etc over the 10 years, and the account is fully up to date. My partner's CRA records are spotless and we do not want Defaults or any AP markers etc to be recorded. Before Christmas, the account was suspended out of the blue and now the credit limit is tracking down to keep in sync with the current outstanding balance. My partner emailed a complaint of being unable to use the account, and in response received a goodwill payment. The complaint also asked for the credit limit to be reinstated otherwise no choice but to close the account and request a copy of the CCA. The limit was not reinstated. This week, a letter has been received from Next that basically says 'sorry - but we dont have a record of the signed agreement'. The letter also helpfully encloses a new CCA for my partner to sign and return along with various printouts of notice of variations and a screen print out of the outstanding balance on the account. Obviously, we are aware that the account is now unenforceable. However, we dont want any adverse markers to be recorded on the CRAs. Has anybody else been in a similar position, and what options are open to us now? i.e. balance reduction, 0% interest, reclaim interest etc? Alternatively, given that Next do not have permission to process my partner's data, can they be asked to close the account and remove all data from the CRA? thanks in advance...

-

Hi guys, not posted here for a while - he - he. I'm currently in an ongoing dispute with Lowell / Lowell Solicitors and awaiting a copy of a CCA (after default, dang). However, I've just received the attached form. Does it look legit or do you believe it to be another one of their ploys? (sorry about the image, the scanner went ka-plunk). I've seen a few online and they look a little different, I might add the crest and stamp look a little 'faded'. Also, if it was real, would it appear on https://www.moneyclaim.gov.uk/? Thanks, Rob

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.