-

Posts

169 -

Joined

-

Last visited

-

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

Thanks for the info @Peterbard good to know, it seems this account, the way it's been handled has been a complete shambles from the get-go. Now with ICO. The fact that the DCA were chasing an amount which wasn't even correct, even instructing solicitors (pre court letter) for the incorrect account is just laughable. Updates to follow! -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

I suppose that is the issue. This account over 7 years old now, the requests for info from Ferr~ didn't include that and, well, I have no physical paperwork. Nightmare. They also haven't confirmed the original default date, but like I said a while back, I recall this being removed from my file in Dec2019, but have next to no proof next battle. -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

Hi, Folks, apologies, work work work. My complaint is logged with the ICO - thinking this may take a while to process. Hopefully they understand what's going on. Also uploaded copies of DCA (CRS) withdraw from debt, the 'absolute joke of a CCA/SAR' which was sent and 2 other pieces of evidence. I guess it's in their hands now, and, I can only thank you chaps here for the on-going words of wisdom, really really appreciated. -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

Hey, chaps! Just a quick update with this. Having wrote and contacted Ferratum, inc. CRS who as chasing for this. So, not too long ago, I was curious as to what data both companies held, so I did a SAR etc, to which I received a file which was a totally unknow/un-openable format, and even more to my dismay, they simply sent a screenshot of what appears to be their system, which were simply added as a JPEG. However, quick recap - 'loan taken in April 2013, I recall it defaulted and was removed Dec 2019 - this debt then later re-appeared on my credit record, late Jan/early Feb 2020. CRS have now closed my account as they have confirmed this is statue barred - they wont be in contact any more - and I have this in writing. However, no contract/replies from FERR. Credit file continues to be updated monthly. I did raise a dispute too with TransUnion, however today they have come back and advised that FERR have not issued a default and I must contact them (in progress). I did also attach the SAR/detials FERR provided me, and also the confirmation from CRS. This account/debt is now coming to 7 years old, does anyone have any ounce of a clue how to proceed? Few hours on here/google today and unable to find a similar story. #Apologies for the essay Rob -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

From what I remember, this was removed from my credit file in Dec 2013 and Ferratum re-added it in Jan 2020 after updating the balance. I was hoping to get them to confirm the date so I have a little more ammunition. Alternatively, having checked (unsuccessfully) is there a template letter of kind I can send which I can forward noting they're not able to re-add records after 6 years? Looks like I'm finally moving places, TY for help! -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

Cheeky update (below). I just need to battle Ferratum now to remove the new overdue balance. I know the original default date was in 2013 (Dec), am I able to request the original default date via SAR? - For the life of me, unable to find any information. response: "I can only apologize for this and accept the debt is indeed statue barred. I have closed the account on our system and referred it back to Ferratum. We will not pursue you any further for this debt, please could you let me know if you are happy with the outcome. Regards," -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

It gets better, I'm just about to now raise a complaint with the ICO regarding this now - as I've given them enough time. I've wrote to both CRS and Ferratum with no reply. Yesterday I have now received a letter on behalf of CRS from 'AJJB Law' demanding payment before court action within 14 days (letter dates 9th, arrived yesterday - thanks)... best of all, they're still quoting the incorrect balance of £336.40. Uploading both confirmation of Ferratum's balance to £190, CRS email and this letter to the ICO - wonder what they'll have to say! -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

I thought I replied to this, D'oh! Thanks, I'll take a look into that, it does sound like the accounts been very poorly handled. -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

That's the one, yep! I remember it being removed from my file in dec 2019, then bam, it's back feb 20. I did a SAR on Ferratum, but everything they sent is basically screenshots of the account started, no default date. A right pickle this! -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

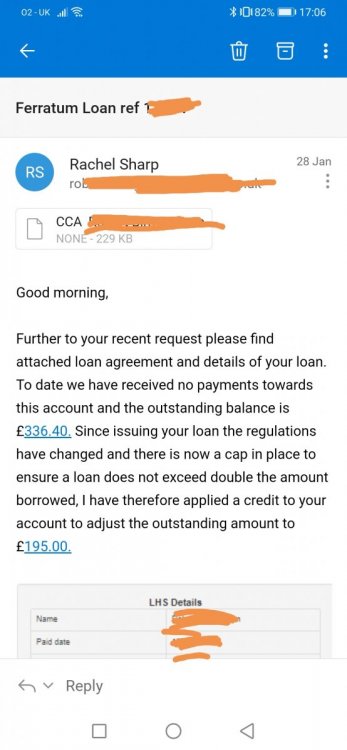

Hey, chaps, just an update on the one. Contacted Ferratum (in writing) as they're noted on credit file as the lender, contact made arfter they updated the balance to £195. To date, nothing back at all, no letter or emails But funnily enough, the balance has been updated to £195 from £336 (also updated on my credit file). However... And here's the fun part, CRS are still emailing (usual pay now or else) and asking for the full balance of £336. Bearing in mind this was updated in Feb! Ferratum have even been kind enough to update my credit file too. Any thought how to move forward? Any suggestions will be greaaaaately appreciated right now. (P.s. not sure if the attached is allowed), hopefully. Rob -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

Thank you both, I'll get something drafted and hopefully sort this out, thank.you -

Birmo0803 changed their profile photo

-

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

I had DMP for multi-loans etc a while back, but I missed adding this one to the DMP, I've never actually made a payment or acknowledged this debt (I only started getting comms late last year, email first then letters (apparent solicitors), this credit was opened in 2013, defaulted Dec 2013, it was removed early Dec '19. Now however (attached), this has now re-appeared, as they have updated the balance. A strange one indeed!! (Also note: the attacement wont even open , adobe... Standard). -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

Hi there, I did set a DMP but I unfortunately missed this one (they were coming out of my ears) this was initally removed from my record in Dec 2019, as I noted a huge increase in credit score prompting me to check it. But then, all of a sudden (attached). You can see it was updated 2020, when they reduced the balance from £360 to £190 - drafting a letter as I speak. P.s. hope attaching below is OK -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

Thank you! It I've been mulling this over since Jan which has nailed my credit file. I'll do exactly what you say, thanks for the assist just to check (been looking all day), is there any kind of standardised letter or even, template available or should I write to F- Ta Rob -

Statue Barred? Ferratum

Birmo0803 replied to Birmo0803's topic in PayDay loans and Short Term loans - General

Thanks! I've raised a dispute with TransUnion - oddly enough, it now looks like a new debt and i can't actually now see the original default marker - I have a strange feeling this one is going to be a bit of a pain!

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...