Showing results for tags 'illegible'.

-

Hello anyone out there who knows what's what re CCAs and DCAs etc - will cut short a long story, an original creditor defaulted me 2/3 years ago on a credit card debt, on assigning the account to a DCA, registered amount owing at £0. DCA wrote demanding payment of original debt and I replied giving reason I believed debt to be unenforceable - DCA replied saying would look into this and usually required 4 months to do so. At end of 4 months, I noticed DCA had 'updated' the default, with original amount said to be due, without notifying me, this being some 5/6 weeks ago - still have had no reply from DCA - is this in accordance with any of the various terms of credit card acts etc? - or should I have been written to prior to default being updated - I did read somewhere you could only be defaulted once per debt- More than grateful for any comments on this - thanks in advance.

- 59 replies

-

Hi, first post on something I need a little help on please. I receieved a court claim about a credit card I took out 14 years ago but I had kept no records of it. I did a CPR and CCA request to get some documentation. What they sent through was a copy of the application form. All my details were legible within the white boxes of the form, strangely legible when compared to the rest of the form, but the surrounding areas with their information is illegible and very grey and pixalated. You can make out my signature, but not the date. They also sent me some terms and conditions as a separate photocopy. Am I right in thinking that pre 2007 it has to contain proof that the t's & c's were signed by me for it to be enforceable? I came across an old post in the forum about a similar issue and I'll quote it below, but does this apply too:

- 4 replies

-

- 2003

- application

-

(and 1 more)

Tagged with:

-

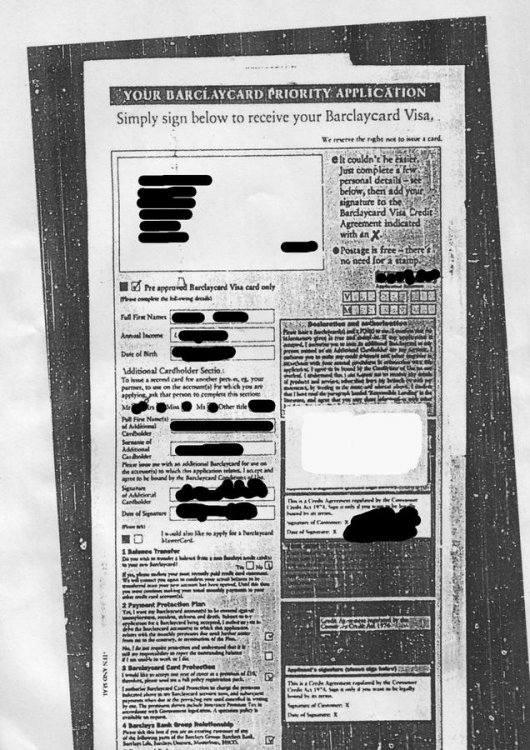

Hi all, Here is the response from DCA from a complaint I made to them. In the letter i received from them they say that this is their "Final Response" to the complaint. And that the documents sent to me satisfy their legal obligations under the CCA 1974 etc. I have removed all personal information from it and the big white patch you can see over where a "signature" was -who knows impossible to tell due to the quality - looks like a big white sticker with some sort of bar code on it. Date on application form 1997. The t and c's are the wrong shape and size to have fitted anywhere on the application form and nowhere does it connect with the application form (ie serial number or anything else) The bits i can read, if I squint hard enough and go cross-eyed, have nothing about interest rates or penalties. And yes the scan is as bad as the original sent to me. My question is does this satisfy the request and would a court accept them? If, of course, it goes that far. Thank you in anticipation.

-

I have had a letter today, after a phone call before the letter arrived from Fredrickson International DCA asking for payment on a MBNA credit card. I don't recognise the number and am very suspicious so I will be requesting a copy of my argreement etc asap. However they have also sent me a default notice which is odd because this is the first I have heard from them. Apparently MBNA assigned the debt to them on 2/8/06 which is news to me. Can they do this?

-

Hello, I have received an N1 claim form from a building firm I am in dispute with over work they did for me (there was no contract or quote or any verbal agreement of the sum involved) - the N1 form is a photocopy which has been stamped by NCC/CCMCC but the photocopy is so faint that I cannot read the POC on the reverse. Presumably this did not come through MCOL. Who do I contact to get a legible copy and will that affect the time I have to put in the Acknowledgement of Service?

-

I have a question about original agreements. Most of the questions about lack of legibility are about section 78 requests, because they are poor copies. What is the legal position about agreements ( prior to April 2007 ) where the prescribed terms are there but they are barely legible due to the tiny font used ?

-

Hello all, Its been quiet for me the last two years , it all went wrong in early 2009. By the end of 2011 most of my debts were settled and its been very quiet since. I was defaulted on a Co Op cc at the end of May 2009 and then a termination notice at the end of June 2009( they gave enough time I think). However the amounts differ by over £200 on each notice. Q1. Do the amounts quoted on deafault and termination notices need to be the same? Also I have a copy of the CCA that they sent me back in 2009 and in its not legible. Its a very poor photo copy ( micro fiche ? ) and parts are missing where the copier has incorrectly scanned. Some parts can be read with a magnifying glass but some parts are not legible. Q2. Will they be sucessful in obtaining a CCJ against me if they have only provided an illegible CCA? In the recent letter from Lowell they say they have purchased the debt from Co Op , But the Co Op letter says that it has been assigned ( both letters in the same envelope. I will wait until Lowell do something before I take any action , but I wanted to know the answer to the above two questions. I half expect Lowell to try a SD which I should be able to set aside. But as I am not upto date is an illegible CCA and differeing amounts on the default and termination notices enough to protect me in court? Incedentally the amount being claimed now is significantly different from both the termination and deafault notices , is this relevant? Also , I had a heart attack last October and I had Angioplasty ( not looking for sympathy ) can I use this to any advantage. This debt will go statute barred in Feb 2015. Thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.