sickofbullies

Registered UsersChange your profile picture

-

Posts

25 -

Joined

-

Last visited

Reputation

1 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

I've been in and out of hospital since then and being the only person I know this has happened too I'd given up. With FSCS opening the doors to welcome PPI claims people I know have had a SAR and same behaviour evident. I brought this up as I know at least another 5 people this has happened too. This is with the same branch. Therefore It's not just a one off with me but a pattern of fraudulent behaviours and practices within the branch.

-

Hi, As we all know their practices they've opened a second loan at another branch. My first loan was cleared and a second taken out. The loan agreement for the older first loan is in the SAR but not loan agreement for number 2 is their. They've even sent a letter to my old house knowing I wouldnt receive it. I've spoken to the current managers of welcome and they say this is due to age of files however using the SAR i can prove they fraudulently set up this second loan at my old adderess with them knowing I no longer lived there. (I'd imagine so i never received any paperwork) It was also not opened in the local branch but one 20 miles away. They've also recorded all my debit card details (unencrypted) in their notes system. I kept having to change my debit card as I was having monies fraudulently spent on my account during that time frame (13 cards in 18 monts) With this proof is it worth legal action on any of those points?

-

Black Horse PPI & over payment reclaiming

sickofbullies replied to sickofbullies's topic in Black Horse

I? had personal finance agreement for a purchase with black horse. I ran into difficulty and missed lots of payments. After 3 years of missed payments they eventually sold it on to a debt management company. IAfter sorting out my credit (I had lots debts) I ended up clearing in full single lump sum payment with the debt company however I went for a mortgage (for which I had an agreement in principal) however they refused to honour the mortgage as the Black horse debt was still showing Due. In a rush I paid Black horse agaoin to get approved. When I was reclaiming the PPI for that agreement I got a copy of my bank statement from Halifax. You can clearly see I've paid off two sums of money for almost the same amount (pennies in it) within 2 months of each other. On the account statement from Black Horse it has some strange figures concerning the £500 and odds. At one point its transfered and written off, then it's been paid by me. I contacted the debt management company and they can confirm the payment from me to them but after 6 years have no such paperwork. They did confirm they did (and still do) purchase debt from Blackhorse. Black horse were extremely un-coperative. One of their staff started to see things from my angle and was told by his manager to "Leave things above his pay grade" Any advice? -

So Halifax allowed an account of mines with no overdraft to have 3 years (1 payment a month) of continuous payment authority payments to be taken. As you can imagine for the first year they lumped their twice monthly charges on then for some reason they stopped with the charges but allowed the continuous payment to contiunue. As i didn't use the account, i regarded it as dormant, when I realised what was happening I went into the branch, explained I never authorised this, I also stated I had no overdraft so how was this allowed to happen. I was told they couldn't do anything about the CPA and that was that. Any advice would be appreciated

-

I did agree the payment plan and have stuck to it. It's taken 188 months for the disupte over the actuall bill to come close to a resolution however they've trashed my credit file with 18 months of 6 payment behind markers. The initial issue is I contacted them via letter after I moved out the property with final meter readings, new contact address and a request for a final bill. I would then have arranged a payment plan however after 6 months I hadn't received anything and a debt management company contacted me. I then spoke to BG directly and arrange a £15 a month plan however the Debt management company are still chasing me, the payments haven't been updated on my credit file and I still haven't got an accurate final bill (They have issued estimated readings for 6 months after i moved out the property) They have until the 12th of this month to complete the complaints procedure then it's to be escalated. I just wondered what my options were, and what their obligations were. I was sure that with other finance means they had to issue a statement of the account every 12 months.

-

Hi, I have been paying off a British Gas account for the past 18 months. I've a dispute going on with regards the amount as they've billed me for an additional 6 months useage despite supplying meter readings when I left the property. They've acknowledged their error and I am currently waiting on resolution. Ialso issued them with a DSAR which has just gone over 40 days so the LBA is in the post today. The values on my Credit File in no way represent the true owed amounts nor have they registered the 18 months of payments I have made. It simply says I am 6 payments behind and have been that way for the past 2 years. Despite the bills being wrong I have no issue with regards me owing a sum to them hence arranging a payment plan however fo the past 18 months I have not received any statement of my account. Are they required to issue me a statement every 12 months to see the status of the account and the amount still owed? Any advice would be appreciated.

-

Well, I thought i'd update this thread. After sending a LBA for non compliance of DSAR I was contacted by Vodafone Customer relations a few days later who then took it upon themselves to seriously review my case. I've just received the posted confirmation from Vodafone that the negative markers will be completely removed from my Credit Record and that I've received a full credit for the outstanding balance of £1358 (Caused by them terminating my contracts and charging me early termination fee) Thanks for the advice.

- 15 replies

-

- compliance

- data

- (and 6 more)

-

I did do a formal complaint and this was their reply: SAR REF: DP/16/352 RECEIVED: 18/03/2016 OBVIOUS COMPLAINT: Yes SUMMARY CUSTOMER NAME: Mr XXXXXXXXXX ACCOUNT: xxxxxxx ADDRESS MATCH ON ACCOUNT: Yes CHECKBOXES COMPLETED, SAR ABLE TO PROCEED: Yes SAR REQUIRED AFTER COMPLAINT COMPLETION: Yes COMPLAINT SUMMARY OF COMPLAINT: ¿ The customer has an outstanding balance on the account. ¿ This has been referred to a debt collection agency and the customer is disputing this. INVESTIGATION: ¿ The customer had two numbers on the account. ¿ The number ending 345 was taken out on the xx March 2013 and the number ending 840 was taken out on the xx April 2013 ¿ The outstanding balance on the account is £1258.12 ¿ The last payment we received from the customer was June 2013 for £75.49. ¿ Both numbers were cancelled due to the collections path on the 25 October 2013 and the customer was charged an ETF for both numbers. £493.08 was charged for the number ending 345 and £475.25 was charged for the number ending 840. ¿ 19 September, the customer called to update the address and to set up payments it shows in the notes. ¿ 21 Jan 2014- The customer raised a complaint with customer relations and stated that around two months after taking out the contract the customer was in a bad car crash and was hospitalized up until just before Christmas. ¿ The customer was advised that because the debt had been passed to CCM Prime we would be unable to take this back from them and the customer would need to pay the outstanding balance to them. ¿ At this point when the complaint was raised it may have been possible to take back the debt and offer the customer help with the balance which is what we should have done at the time. ¿ 22 March 2014, the customer raised an additional complaint with customer relations for the same issue and he was advised the same thing. ¿ On the 22 march An email was sent to the customer to confirm that we cannot offer any assistance and he would need to refer to the debt collection agency. PROPOSED RESOLUTION: ¿ Due to the debt being over two years old, we could not pull this back from the debt collection agency as this would have been sold to them. ¿ The customer has asked to correspond via email only. ¿ I have discussed the case with TM Simon Mellor and due to there being no adequate resolution for the customer, I will note mail the customer and the SAR will be processed. CONTACT ATTEMPTS DATE: NA TIME: NA NUMBER CALLED: NA OUTCOME: NA NEXT STEPS DATE OF NEXT STEP: NA ACTION REQUIRED: SAR to be processed they have even admitted "At this point when the complaint was raised it may have been possible to take back the debt and offer the customer help with the balance which is what we should have done at the time" Also having been advised to contact CCM prime for the past 2 years, the company do not exist as an entity called CCM Prime?

- 15 replies

-

- compliance

- data

- (and 6 more)

-

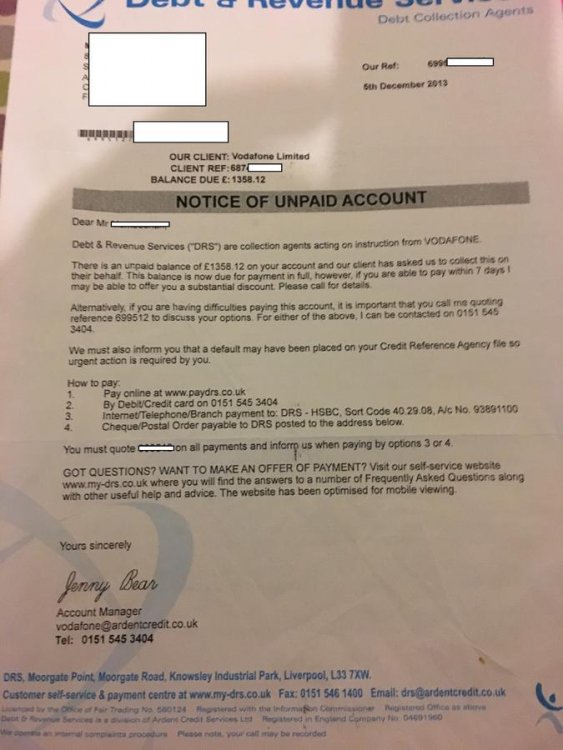

It just keeps getting better... While they are trying to fob me off to the DCA, they have told me the DCA name in question is CCM Prime however the default above which was sent to the wrong address is actually for DRS, a subsiduary of Ardent Credit Services Ltd. If you google CCM Prime there is no mention of this fictional DCA. Since I did a companies house search no companies knows as CCM Prime were listed I then had a look at at Ardent Credit Services Ltd on companies house https://beta.companieshouse.gov.uk/company/04691960 They happened to be called COMMERCIAL CREDIT MANAGEMENT LIMITED prior to their name change however this is still a vast difference from CCM Prime. Also upon checking my credit file the debt is still assigned to Vodafone without change. Does anyone know a good example of a LBA template to use?

- 15 replies

-

- compliance

- data

- (and 6 more)

-

I was in a serious car crash and hospitalised. I got out of hospital in october 2013 and was back in within a matter of weeks. Finally leaving hospital in January 2014 and have been unable to work since. I sent LOADS of correspondance asking about reinstatement etc and they ran all over me, said they issued a default and that was that. As it seems the default they issued was sent to the wrong address! I think I've got a good chance with this going to the small claims court. The terms and conditions state that they have to give me 30 days notice of any increases. There is no date on the increase form, nor is the communication listed in my SAR and I can prove they sent it to my old address Also i had them investigating the complaint for me: this is their response: I have an admission by them that when I contacted initially after coming out of hospital they should have took the debt back and offered me help. Also any bills, demands for payment, default notices and DCA paperwork was sent to the wrong address. I can therefore PROVED i didn't receive the default notice due to their negligence

- 15 replies

-

- compliance

- data

- (and 6 more)

-

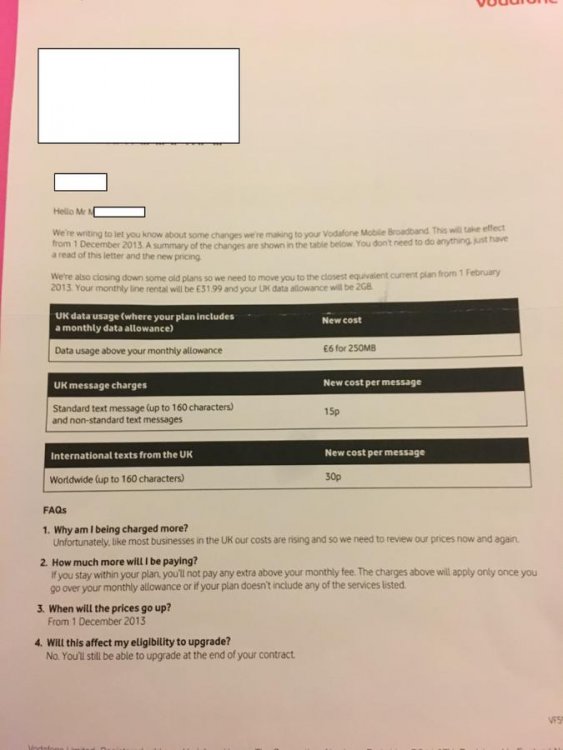

Based on what she has told me thus far, she wouldn't have been able to send me a copy of that document, however in her words "However we do not attach actual copies of these to your account, instead we simply record the fact that a letter was sent" Which hasn't been done. Nor is their a date on said letter an dit's also been sent to my old address yet again? They are required to give me 30 days notice of price increases so this makes me start to ponder what else they've got away with. The price increase quotes the following "If these changes increase your total bill by more than 10% based on your recent usage, you'll have the right to cancel your contract" However I am sure OFCOM ruled against this and allows people to terminate their contract based on any changes to terms and conditions. I'm just trying to confirm this 100%. Th

- 15 replies

-

- compliance

- data

- (and 6 more)

-

It get's even better, having asked for the T&C's of my contract and also Any Changes to T&C's / Pricing Which I believe to be totally unlawful. How can you old me to a contract that you can't produce? And then I asked for details of any pricing changes including copies of any correspondance informing me: To which he reply was: However, in the treasure trove of old mail sent to my old address I found the following:

- 15 replies

-

- compliance

- data

- (and 6 more)

-

Need some advice on dealing with Vodafone. I submitted a SAR request asking for all the usual (Contract Details, Pricing Structure, Allowance, statement.. the works) and eventually received less of a "Data Subject Access Request" but more a summary of screen notes: For instance I called to change my address and this is what they have given me in the SAR Now I agree, it notifys me of an address change, and could be considered screen notes however WHERE IS THE ACTUAL DATA? Changed address to what??? Now I know where I changed the address to as I have a tenancy agreement and could prove that however subsequently the following happens: So I asked for a Signed copy of my default notice from the CS Agent who sent my SAR: Now I was extremely confused because I knew that I 100% hadn't received the note at my new address however until just shortly I had lost all hope then suddenly while speaking to the new owners of my old address, they informed me that they did indeed have a pile of old mail for me in their cupboard: Incase you haven't guessed THIS WAS SENT TO MY OLD ADDRESS DESPITE ME CHANGING IT

- 15 replies

-

- compliance

- data

- (and 6 more)

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.