Showing results for tags 'cca'.

-

Today my gf has had back two letters, one from Mint & the other from Natwest after requests for CCA (mint) and SAR request with Natwest. Mint have stated the following: Does this mean I would also be unable to request SAR from Mint & reclaim PPI charges? As for Natwest, they have asked her to sign a form, provide evidence of identification "certified by a member of staff at any branch or a solicitor!" & "As the purpose of your request is unclear, we require some further information from you to help clarify what you are looking for" Are they for real? She'd have to take a day off work to be able to goto the bank just to get the ID authorised. I used the template letter from here & quoted 4 Credit Card account numbers and an insurance policy number.

-

Good Evening, I have been on a DMP for over 10 years. Total debts still exceed 40k with most that were credit card debts (from the mid to late nineties) now with various DCA's such a RW, Westcott, Caboot et al. RW have recently started to get more proactive in trying to get me to increase payments and I am seriously doubting the point of continuing to pay. I have been reading about "cash cowing" and requesting CCA's for the debts, any reason that I should not be encouraged to do down this route? Thanks.

-

I have finally heard back from CapQuest regarding the CCA Request issued in January, they have provided a signed copy of the CCA together with a statement of account from prior to taking over, which causes some questions, primarily the balance has not reduced from the time I went on to the DMP. They have also failed to send any further documentation (such as a deed of assignment) which I requesting in my letter. Please would someone advise what my next steps should be? I am able to post a copy of the CCA & statement on here if that will help?

-

I have sent Halifax a CCA request several times over the past year, which they seem to be ignoring! This card was taken out in the late 1980's I'm guessing they are having difficulties retrieving any documentation. I have spoken to the Financial Ombudsman and they say they cannot force a company to produce documentation they do not have. If I raise a complaint with them they can only ask the same way I have. They have not sold the account, they have passed it on to a DCA to manage the account who are now demanding a massive increase in the monthly payments. Without the contract I do not now what my rights are. So, what should I do next? Thanks in anticipation sidley

-

Hi All, Just finished writing my CCA request for HSBC (C/O MK Rapid Recoveries) - so fingers crossed that I get something back. I'll post my progress back here. All the best

-

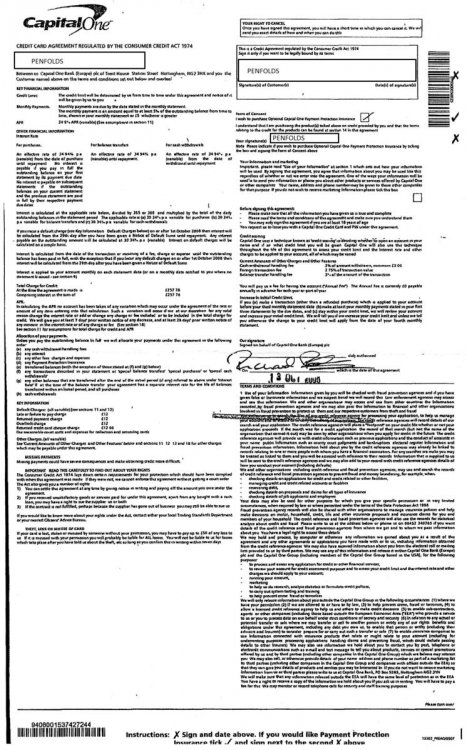

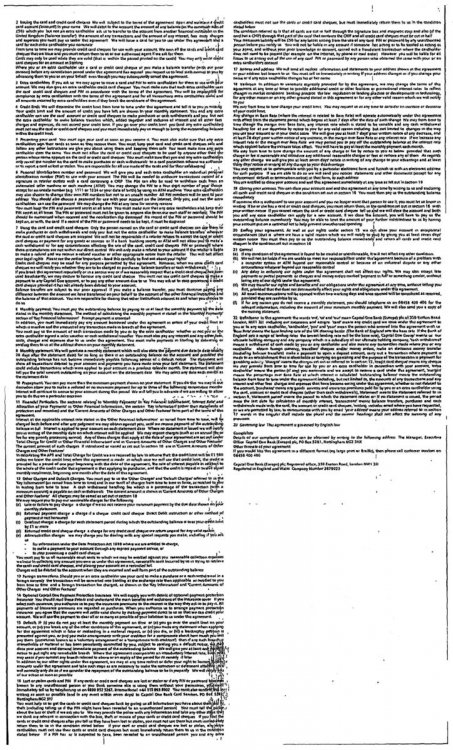

Hi All, I have recently defended a claim by Shoosmiths on behalf of Capquest for a Cpaital One credit card taken out in Oct 2008, the last payment made was in Jan 2012. The claim was stayed at the end of Jan 2017 after filing a defence. Before filing the defence Capquest was sent a CCA request, a copy was also sent to Shoosmiths with a CPR31.14 request, which Shoosmiths remain in breach of. However today Capquest has sent a response to the CCA request (attached). They have also sent somebody elses application for a Barclays Sky Card which includes their name, address, DOB, household income, home, mobile and work telephone numbers and applicants signature. Any advice greatly appreciated, please advise if defence or CPR 31.14 request needs uploading. Thanks Penfolds

-

Hello, I defaulted on a credit card in 2011. The debt has since been passed on to a DCA who applied for a CCJ. I requested a CCA and was sent a reconstituted CCA, default notice and notice of assignment a day before my court date. The case was adjourned as a result of this. I admitted the debt in court and it has been noted by the judge. Upon reviewing the information sent the last payment on the credit card seems to be November 2010. I have sent an SAR request to try and confirm this. The CCJ claim was made in August 2016. If the last payment was November 2010 is this debt now statute barred or does the CCJ claim being filed in August put it on hold? Even if it is statute barred does the fact I've admitted the debt in court make me liable? Thanks in advance to anyone who can help.

-

This is not for myself but for a friend. She's been paying a loan for £5000 from lloyds for a year then she lost her job etc . To cut a long story short it's been bounced around with a few debt collection agencies and now it's with Cabot. She's asked for a CCA and been told that's it's nothing to do with her as it's been to court it's between Lloyds and CABOT . Surely she's entitled to a CCA?

-

Hoist/Cohen Claimform - cahoot Flexible Loan 'debt'

Musicam posted a topic in Financial Legal Issues

Please help, I'm not sure how to handle this claim and don't want to get it wrong! Name of the Claimant ? Hoist Portfolio Holding 2 Ltd Date of issue – 30th Aug 2016 Date to submit defence = - by 4pm Friday 30/9/2016 What is the claim for – 1.The claim is for the sum of £13718 in the respect of monies owing pursuant to The Consumer Credit Act 1974 (CCA) under account no xxxxxx-xxxxxxxx. The debt was legally assigned from Santander UK PLC to the claimant and notice has been served. 2.The defendant has failed to make contractual payments under the terms of the agreement. A default notice has been served upon the defenadant pursuant to Section 87(1) CCA. 3.The Claimant Claims: 1. The sum of £13718 2. Interest pursuant to s69 of the County Court Act 1984 at a rate of 8.00 percent from the 13/8/16 to the date hereof 12 days is the sum of £36.08 3. Daily interest at the rate of £3.01 4. Costs What is the value of the claim? £13718 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? cahoot Flexible Loan When did you enter into the original agreement before or after 2007? 20/05/2002 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. HPH2 Were you aware the account had been assigned – did you receive a Notice of Assignment? No Did you receive a Default Notice from the original creditor? Yes Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Yes Why did you cease payments? Had a Debt Managemant Plan set up with Payplan from February 2010 of which Santander had agreed to being paid £66.27 per month However, they refused repeatedly to freeze the interest unlike the other creditors in the DMP. This was adding around £200 per month in interest in January 2011 I stopped paying the DMP as it seemed pointless as it would never reduce the debt. The original debt was £10804 at the start of the DMP but 11 months later was £13718 due to them being completely unreasonable. What was the date of your last payment? December 2010 Was there a dispute with the original creditor that remains unresolved? Only with regards the interest whilst in a debt management plan Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes, as described above. Payplan had requested all creditors freeze interest and all agreed except Santander. Many Thanks. Brief background: In early 2010 after trying to keep a failing business going I was left with various credit card and a flexible loan debts and the combined monthly repayments became unbearable. I entered into a debt management plan through Payplan paying £324 per month to 6 creditors. By January 2011 the business could no longer trade as I lost my premises and then a few months later lost the house. I considered bankruptcy for the first few years but could never manage to raise the fee (about £750 at the time), then as time passed and I lived in various places the letters became sporadic and it was easier to ignore the few that came. I've had plenty threatening court action from all the usual DCA's and nothing happened until now. I was looking forward to another 4 months hoping it would be statute barred but Hoist have other ideas! I've tried to get an idea by reading all the forums but was wondering if I can do a CCA request for a flexible loan? Also, when checking the FCA register the DCA's licenses don't seem to be active - is this relevant and can it be used? FCA license for Howard Cohen (Cohen Cramer Ltd) Current Status: Lapsed , Permissions Inactive 31/10/2015 FCA license for Hoist Portfolio Holding 2 Ltd Current Status: Cancelled , Permissions Inactive 30/09/2015 I have registered with MCOL and done the acknowledgement on the 8th Sept 2016 and stated I wish to defend the whole claim, problem is I don't know the best way to do it. Any help would be greatly appreciated. Forgot to add, the solicitor on the claim form is Howard Cohen & Co, Leeds -

Early last year my husband received a county court summons for £11,500 for a credit card debt sold on to a DCA. He replied and defended the action on the basis of the limited information on the summons and that he was awaiting a reply to the CCA letter sent to them on the day the summons was received. He never received a copy of the CCA, just a letter from them saying the debt was no longer enforceable and they could not proceed any further through the courts, but would he please call them to discuss a repayment plan. They also promised to forward the copy of the CCA. That was over a year ago and we are still haven’t received the CCA, but what he did not advise them was the debt would not really be statute barred until last October , three months after their letter. Move forward to now, and I have received a letter from the same DCA and they are chasing a debt for £8.250 for a card of mine. This will become statute barred in the middle of August when it will be 6 years since the last payment. I received a letter from them dated 6 April but not received until 12 April, saying if I did not contact them within 14 days they would commence legal action. My understanding of statute barred debts is they expire six years after the last payment or admission of the debt and the creditor has until this time to obtain judgement. Is this correct and can the DCA request to the courts an extension this period for the time it takes to transfer to a local court and to a hearing? The default for this will expire soon and I am l keen to keep as clean a record as possible after eight years of financial misery. I appreciate I am morally wrong but this DCA will have purchased the debt for peanuts,

- 169 replies

-

- –questions

- answer

- (and 17 more)

-

Hi I am new to the forum but have been looking at similar posts etc to try and get my head around my situation etc. This site is incredible and has given me the confidence to fight my alleged debts. I entered a DMP in 2004 as got into financial difficulty due to numerous factors. all the debts were obviously taken out prior to this probably late 1990s or early 2000s at the latest. I have dumped the DMP as 12 years on nothing seems to have changed. Was originally told that I would be debt free in 6 years but that's another story. I have SAR'd the DMP company. I am sending CCA requests for any credit card/loan debt. Also have a overdraft debt with Lloyds - sending then a SAR. List of debts below any advice greatly accepted. All below defaulted 2004 M and S Loan now Robway £8k Halifax CC now Cabot £4.5k Lloyds CC now PRA Group £4k MBNA CC now Link £4k Barclay Card (EGG) CC now Cabot £3k Barclay Card (Morgan Stanley) now Link £2 Capital One CC now Lowell £2k Lloyds Loan now Cabot £580 Lloyds Loan now Apex £400. Also my DMP provider put my Lloyd's current account/overdraft on the DMP without informing first saying because I had debts with Lloyds on the DMP then I couldnt bank with them - that was in 2007. I am more than capable of handling the CCA requests etc but will probably need some help with checking the agreements when they come back. Also seems like the DCA's are escalating a lot to court these days. Again I will have no issue defending any claim that can be defended with some assistance if possible. Thanks in advance.

-

My wife has an old credit card debt of around £5K. It went into arrears and a DMP (CCCS then self-managed) several years ago. The debt was sold on to a bank who have recently sold it on to a DCA. The DCA can't provide a copy of the CCA - I didn't expect them to be able to - but still want the full balance. They also can't provide any proof of the balance they claim by way of statements. What are the implications of stopping all payment. I know it used to be the case that a debt without a CCA could not be taken to court, but is it right that courts are now more lenient with the creditor if proof of payment history is available? I don't want to name any names at this point, I'm just trying to establish the principles and current experience.

-

I paid them for a couple months via Monthly Standing Orders which i set up, this was after the Debt Management Company I used folded, I then stopped paying all of them recently ... I have just received a true copy of my original CCA from Halifax, back dating to 2001, so will now need to sort a repayment offer with them They are the only 1 from 5 to provide thus far, so tbh i still had a great result This is very true, i assumed info from a company like StepChange would be best i would get, not a mention or suggestion of doing CCA's came from them Sometimes their hands are tied to give certain aspects of advice and as I say CAG was a blessing in disguise when i read what people were saying about making CCA requests I have just received a true copy of my original CCA from Halifax, back dating to 2001, so will now need to sort a repayment offer with them, they are the only 1 from 5 to provide thus far, so tbh i have still had a great result ! Better late than never, very true

-

Hello, I am just wondering, I have nearly paid off Restons £1200, And my wife has various ( apex, moorcroft etc ) where she is paying £1 a month If we send a CCA to all of those, and they cannot confirm, how does we write off or stop paying, in my case, how would i get the money back ? Regards Q.

- 15 replies

-

- cca

- collection

-

(and 1 more)

Tagged with:

-

On the 20th September I posted off nine CCA requests all by signed for post. Of these only one company NCO (Amex ) have sent a copy of the CCA which I posted up under the AMEX sub forum. Two have replied and said they have asked the original creditors to supply the CCA and one has returned my request and postal order and asked me to write to the creditor directly. So five have not responded at all, what is my next move ? Is there a template letter I can send ? Mine is outdated as it has a reference to the defunct OFT. Thanks Everett.

-

I took out a Unsecured Personal Loan with Halifax online in December 2011. I was NEVER asked questions like, can you afford the payments, are you employed/unemployed, and I certainly was not asked about my income. This have got so bad I am currently on an IVA - Halifax increased the IVA from 5 years to 6 years forcing me to pay for longer. I am now wondering if bankruptcy is the best option. Do I have a claim that Halifax lent to me irresponsibly without going through my finances first?

- 217 replies

-

- 2007

- adjudicator

-

(and 45 more)

Tagged with:

- 2007

- adjudicator

- agency

- agreement

- agreements

- april

- cca

- collection

- complied

- disappeared

- dispute

- don

- enforceable

- evidence

- financial

- found

- halifax

- harassed

- has

- incorrect

- irresponsible

- lending

- letters

- limited

- moorcrof

- ombudsman

- personal

- recovery

- reply

- response

- rossendales

- say

- section

- service

- shows

- sign

- space

- stance

- still

- stitched

- template

- unaffordable

- unenforceable

- was

- waste

- whats

- write

-

hi has anyone had any experience re a cca request re an overdraft subject to the amended consumer credit act which now requires an agreement for o/d's ie no 'exemption'.

-

Hi, Like many hundreds of other borrowers with Northern Rock Together Mortgages, we have an unsecured loan for an amount in excess of £25k which we took out prior to 2008. The unsecured loan paperwork states that it is covered by the CCA although NRAM are now trying to argue that this is not the case (because the amount exceeds the limit that was covered when we took the loan out). We, like many others, have complained to NRAM to no avail and now approached the Financial Ombudsmen for help. However, everyone so far seems to have been fobbed off in a manner which the cynics amongst us would have good reason to believe that, as a government body, the FOS may have been leaned on to try and sweep this issue under the carpet. (There is an easy-to-find thread on MSE) It seems to me that NRAM and the FOS will have little to argue if borrowers in the same position as ourselves can show either of the following; 1. A Judge declaring that loan executed on regulated paperwork should be treated as being covered by the CCA even if the amount exceeds £25,000 (prior to 2008) 2. Perhaps less so but there does seem to be cases of NRAM taking a borrower with such a loan to a court and using the CCA against the borrower. NRAM clearly can't have it both ways...if they wish to pursue people with loans in excess of £25,000 by citing the CCA then clearly they accept that the loan is covered. I can see from other threads that the member Petebeds appears to have had a Judge rule that his Northern Rock / NRAM loan over £25k should be treated as if it were covered by the CCA since it was executed on regulated paperwork. Also, on the same thread Josie8 suggests that she successfully argued something similar or indeed very relevant to all of this. If this is indeed the case, then the details of those court hearings will prove to be a great asset to those who are so clearly being stiffed by NRAM. If we can keep this thread to people who know exactly what I'm talking about that would really help everyone in the same boat. Hopefully then we can post some good clear advice for everyone and get some proper redress for how we've all been mislead, mis-sold, lied to, cast aside and generally treated like badly Thanks in advance to the site admins who I hope will flag this with the members mentioned above and anyone else who they think may have some constructive input. JHill

-

Hi Caggers Looking for some guidance relating to a old credit card debt which Lowells have purchased. To cut to the chase have put a marker on my credit file etc etc . I have sent the prove it and CCA request , got a letter back to say unable to obtain docs we have decided not to pursue outstanding money ! Ok so far but last paragraph goes on to say as we are required to record true and accurate information on our customers credit file any default will remain in place for six years ! Not happy with this and am going to send return letter stating for it to be removed as firstly it is not under default for the customer but Lowell secondly any reporting will be misleading as it will not show a true reflection of the current condition of the account so do I have a case to have this removed ? Should I just go straight to the ICO ? Thanks

-

hi guys just wondering if someone could take a look at this credit aggreement i have been sent by a dca. the other page is just my name etc and says application on it. they have only sent me the 2 pages and i noticed down the side it says page 3 of 3 and 2 of 3 on the other page. just want to know the enforcibility of it to be honest. its an old catalouge debt.any ideas. it was the result of a cca request. it isnt pre 07 it was taken out in 2010. this is the pdf. this is the second part.this is all they sent. convert-jpg-to.pdf convert-jpg-to.pdf

-

Hi I have 2 debts that were started in approx 2006 one barclaycard PRA group sold to these in 2015 one abbey loan now with Cabot. both been in a dmp since 2010 and I've been paying monthly to a company. I've stopped that now and I pay direct. But what I was wondering is do I send a CCA to the company which have aquired these debts. One is PRA group sold to these in 2015 and the loan is now with Cabot. Cabot is off credit file and PRA group shows are arrangement to pay as Barclays didn't default me early on like abbey

-

Hello All I am assisting a lady with a catalogue card debt as she is struggling to make the (modest) monthly payment. Many years ago she had an account with LaRedoute which went into arrears and she ended up in a £5 per month payment plan with Droyds Debt & Collection Services. She has fallen into arrears with this. I asked her how much she owed and how big was the original debt etc. as it seems to me that this is an ongoing thing without any obvious signs of ending. She has not received any statements and does not know how much she has paid over the years. I therefore used the CAG template CCA request and she has received two letters; The first is from La redoute and the pertinent part is as follows: We have checked our records and have been unable to locate a copy of the signed agreement. a copy will have been sent to you for signature when the account was opened in accordance with our standard process but it may be that you signed it but did not post it back to us. I enclose a copy of the agreement that will have been sent to you when the account was opened which governs the account, subject to any variations subsequently notified, e.g. changes to interest rates. Terms and Conditions are also available on our website and in our catalogues. They also sent a double sided photocopy of very poor quality of what looks like a blank Credit agreement. There is no customer number and no signature or date, and it is for most practical purposes, illegible! The second letter is from Droyds saying they have received her payment of a £1 (which was sent as part of the CCA request). They have credited it to her bill despite the wording of the CCA request stating it was not to be used for anything other than the CCA request) and is demanding the balance of £4. May I request members help to answer the following: 1. Is their response a compliant one? 2. If not, am I right in thinking she can stop paying until such time as they produce a compliant response? 3. Am I right to take the position that no further communication need be made to them at this point? 4. Given the frank admission by LaRedoute that they do not have a signed copy of the Credit Agreement is it actually all over for Redoute as far as this account is concerned? Many thanks for your interest.

- 2 replies

-

- cca

- compliance

-

(and 2 more)

Tagged with:

-

Good afternoon I have today received a response from IDEM after sending them a CCA letter regarding a HSBC credit card They have sent me a reconstituted copy and statement and their letter says that this is all they need to provide and that the debt once again becomes enforceable. There is nothing enclosed that shows my signature. is this now enforceable without the signature and if not what should my next move be Many thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.