Showing results for tags 'update'.

-

Hello, ive just done a system update on my samsung s7 edge did all the usual download, install, now it wont turn back on, tried the reboot procedure but nothing just a blank screen with a flashing blue light top left. Rang customer services and it is still under warranty, then they asked any visible damage, i said a small hairline crack on screen this cancels the warranty, even though the mobile phone worked perfectly for 12 months. Its the update that shut the phone down not the barely visible crack.

-

Name on my NI Card, is not in full as on my Passport I was given the NI card with a short version of my name. Anyway I've have applied for a job, where I need to show my NI card (which are no longer produced) or NI Record, which I believe is no online, can I go online to the HRMC site register and update my NI record, so my name is now in full as per my Passport? Its not a name change, but update to my full name as on Passport

-

Hi All, In 2014 - there was a clarification from the Information Commissioners Office - on whether the domestic customers were allowed to record calls with utility companies. The article states that the ICO - said this was permissible: http://www.thisismoney.co.uk/money/saving/article-2683569/How-watertight-records-calls-online-chats-case-s-dispute-later.html Now that we are in 2018 - and with all the new legislation that is being passed: Can we get a crystal clear update about what we are allowed / not allowed to do? This should cover - if/how/when we can use our copy in the pursuit of settling a dispute. I think exploring this topic will help many of my fellow community members - as it is one of the very few ways consumers can demonstrate their honesty. My sincere thanks to any, willing to help map this out.

-

ANY ADVICE PLEASE received parking ticket sept 2012 from vcs liverpool didn't admit liability ignored all letters from bwlegal , looks like they have now passed it to dcbl firm from can't pay take it away 6 years later any advice pls I've requested all evidence and proof of contract of landowner, anyone else received a letter

-

Last week a very important judgment was released in the High Court in relation to Part 85 'Third Party' claims. Given the importance of the subject, Master McCloud issued a draft decision, and invited the High Court Enforcement industry to provide comments and suggestions, based upon their experience in the area. The reason why the Master was asked to make the judgment is outlined in details in the following post. In this respect, I have referred to the recent news article from The Sheriffs Office.

- 3 replies

-

- claims

- county court

- (and 4 more)

-

Update on the future of DWP jobcentres READ MORE HERE: https://www.gov.uk/government/news/update-on-the-future-of-dwp-jobcentres

-

Update on the future of DWP jobcentres READ MORE HERE: https://www.gov.uk/government/news/update-on-the-future-of-dwp-jobcentres

-

Hi I could someone please help. I have someone that I used to help with their benefits ESA, etc. Unfortunately I had to leave area for over a year and could no longer aid them. I recently returned and as the person in question is extremely isolated due to their issues, they need my help again. Thing is because I was their only ‘port of call’ they have made their situation far more complex. They forgot/ failed didn't have the capacity to inform HB of their new address. Luckily the scope of the room id address approximately soon after I left to a similar property i.e. single room. And the rent and the housing benefit is exactly the same. But last week it would seem that it has been stopped. We are not 100% sure yet as we cannot phone until tomorrow but evidently the rent should have gone in on Friday but hasn’t. They suffer from severe agoraphobia and similar and are completely disorganized etc. Before I left the area I did all the paperwork for them. If it has been stopped what is the procedure and what can we do to get it updated etc. Would HB have written to him (at his old address) to update details and because he didn't reply stopped it? Should we phone up and explain the situation? It’s not like the person in question has stolen any money, as the rent (same amount exactly) has been paid to the new landlord each week) His medical records prove his temperament etc. which the dwp have. I’m assuming HB as least would be sympathetic to this? The amount that is being paid is the exact same amount that would have been if re-assumed to the new address? he had no-one to act on his behalf, until now. Its a nightmare that could have been avoided had he some kind of support network. Can someone explain the best approach etc.? I’m quite happy to write a statement that I was the single person that always acted as their advocate and that without me etc. they were helpless/ useless etc. I believe that a next door neighbor acted on behalf with the move but failed to help him inform/ fill in new HB paperwork etc. And evidently because the new landlord doesn’t accept dss (he felt it impossible to sort out the situation himself and instead just kept paying the rent to the landlord) Can someone offer advice sympathetically (these forums can be harsh sometimes) thank you very much.

-

Hi Ims21 did a fantastic job with FosRunningPPI v102.xls based on PS10/12. Does Ims21 or anybody else have any plans to do an update based on PS17/03? I ask as I am in protracted discussions with FOS over a claim and its worth, and they are discounting my calculations using FosRunningPPI. Their statement to me is below: "....It is not our job to audit the Banks calculation, there are periods of missing data and assumptions have been made, we feel this is fair when the business and the consumer don’t have full records. We check to see if the offer is fair and this offer is within our within our tolerances. I have asked you to supply credit card statement show the discrepancies in interest rates used, I've yet to see them. Your calculations differ from RBS' and your calculations are not in line with our guidelines..." Are they lying to me? The CAG warned that the FOS is totally committed to limiting any redress the Bank needs to pay, and I am very much seeing this first hand! I ask the above question as i really need to hit them with some nailed on maths which is beyond my skillset.. Thanks in advance

- 2 replies

-

- fosrunningppi

- ps10

-

(and 3 more)

Tagged with:

-

Hi I need some advice please. Recently I replied to a direct mailshot from a Manchester-based PPI claim company called Consumer Claim Line. I had had a credit card some 20 years or so ago (Capital One card) and I wanted to find out if I had paid PPI on the payments. I returned the paperwork and thought to take advantage of their advertised "no claim no fee" offer to get this investigated. A few weeks later received a reply saying that their preliminary findings were positive and that I should sign the enclosed form authorising them to investigate my claim further. With this same reply paperwork enclosed was another form asking me to list any banks that I may have had accounts with in the past and they would look into these accounts too. I signed the authorisation forms for the Capital One account and sent back the other form listing the Clydesdale bank although details of this and the Capital One account I was not able to furnish as I had no paperwork and no recollection of any details. They said that details weren't important as they had ways of tracing accounts. A fortnight later I received correspondence from this company stating that their investigations showed that the Capital One account had previously been looked into (sometime in 2009 or 2010) and since I had not informed them of this they were invoicing me for a Cancellation penalty fee of £360 for wasting their time. Along with this invoice were two additional "letters of authority" for two Clydesdale bank loans (taken out sometime in the 1990's (I think) which they wanted me to sign and return to them. I telephoned them to explain that my claim on the Capital One account was made in good faith and that I had no recollection of having this investigated before (I have good medical reasons for general memory impairment which I explained to them) I asked them to therefore cancel this penalty fee they were demanding. I also stated that as a consequence of the outcome of this first experience I didn't want to return the forms for the Clydesdale bank investigation as because of my memory impairment I could not guarantee that this case had not also been investigated in the past. I had no recollection of this being the case but then again the same applied to the Capital One case. The supervisor whom I was explaining this to was not sympathetic to my position in fact he adopted a rather aggressive and threatening stance, threatening court action on non-payment of the penalty fee saying that for every subsequent reminder-letter they sent me an additional £20 would be added to the cancellation fee invoice . He further threatened that if I didn't send back the second set of "letters of authority" (for the Clydesdale bank loans) duly signed by myself a further £360 (each) of cancellation fees would be invoiced to me for payment. A few days later I received out of the blue a phone call form the company (from the same supervisor) saying that they have reconsidered and that if I go to my doctor and get him to write a letter confirming that my medical condition and strong medication I have taken (over a period of over 20 years) have indeed led to among other things severe memory impairment. I duly went to my GP and he wrote out a letter confirming what I had said, and I sent this doctor's letter in to the company. A week or so later I received another phone call (again from the same supervisor as before) and he now said that he would not accept my doctor's letter as he had met people before with the same condition that I suffered from and he didn't believe that it could cause memory impairment. In other words he completely disregards a doctor's medical opinion on a patient he has been treating for 25 years in favour of his own unqualified prejudiced and generalised opinion of the condition I suffer from (the condition is in fact Severe Clinical Depression). The decision stood he said and I now owe them 3 x £360 fees plus £20 further penalty on the first case ... a total of £1100. Can they do this ? Is there anything I can do about this ? If nothing else maybe this post will warn others of this companies practices. Regards, Jackthehat

-

As you will be aware yesterday now Carillion announced it was going into liquidation Service Personnel, Families may be concerned about this which is understandable. CarillionAmey has placed an update on there website 15th January 2018 READ MORE HERE: http://company.carillionamey.co.uk/company-news/15-january-2018-update-from-carillionamey/

- 1 reply

-

- armed

- carillionamey

-

(and 3 more)

Tagged with:

-

Hi, Hope everyone had a good bank holiday. I (and three others!) missed crap signage and got a Contractual Breach Charge from Ethical Parking on my windscreen over the weekend. Just double checking that it is currently still best to do nothing until a notice to keeper arrives (between 28 and 56 days) before I take any action on one of these? Then if it (NTK) arrives on time post photos of it and signage on here for assistance? Just don't want to get it wrong! Thanks!

- 57 replies

-

Apple have issued an urgent iPhone and iPad software update (iOS 9.3.5) that included a patch for a serious security vulnerability. The vast majority of iPhone owners are probably on iOS 9 right now, but you should check and install that version right away The malware in question, which was detailed in a report from Citizen Lab and Lookout security, is a serious compromise that’s never been observed against iOS devices before. But you can guard your devices and your personal data against the latest security threat simply by heading to settings and hitting the update button. http://www.theverge.com/2016/8/25/12651206/apple-iphone-security-threat-update-now

-

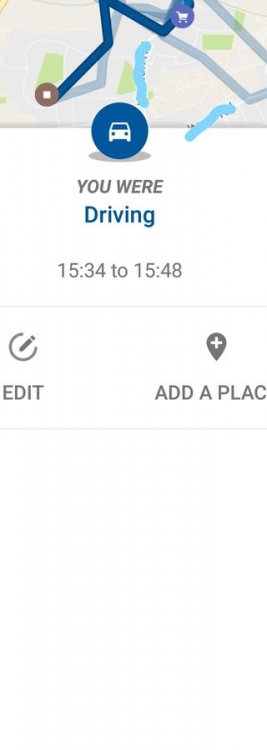

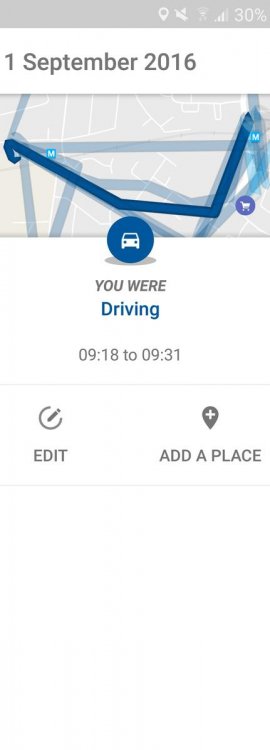

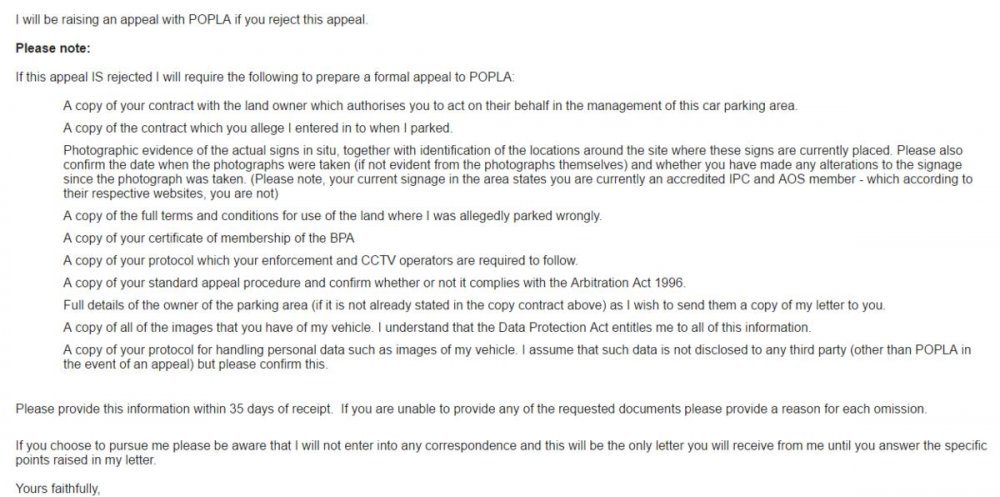

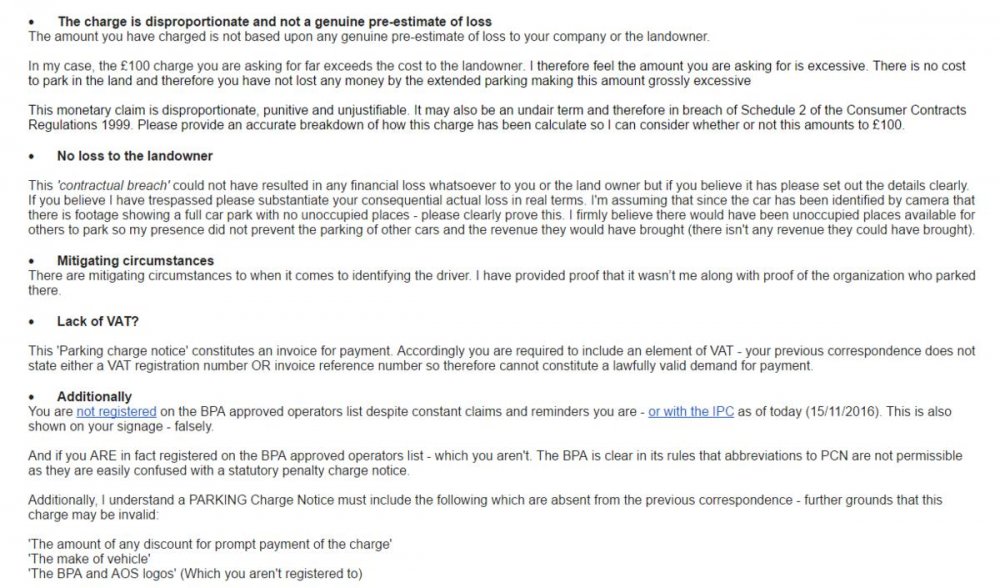

Hi everybody, I've been pointed in this direction by a reddit user for help relating to a Parking Charge Notice. I took my car to my local garage to get an MOT check done on 01/09/2016. The owner then drove the car to the MOT garage and parked it up inside and then returned back to his garage. A few hours later I hadn't received a phone call yet to say it had been completed so I rang up to find out that my car was OK to collect. I then made my way there and collected my car from the (private) parking lot less than 30 meters away from the MOT garage. Fast-forward a week or so and I've received a letter in the post saying my car was broke the allowed parking period in the car park and I need to pay a fine for £100, I replied to the letter stating the address of my local garage and to take it up with them - I then received an email a month later saying that the time period had ran out and I had to pay urgently - I reminded them that I sent a letter in the post some time later I received this response I then replied with this email (1, 2) using a template I was advised to use. I then explained to take this matter up with my local garage and the MOT centre. I then received this. What should my next action be? I'm really not in a position to be able to afford £100 so close to Christmas. My local garage has told me that they can vouch that I wasn't the person who drove the car there/parked it in the space. Any ideas? Thanks in advance EDIT: I now have a signed and stamped note from the doctors saying I was there when this incident took place. I've managed to find my google location history showing the time I dropped the car off at my local garage and when I picked it up from the MOT centre, this is attached. My local garage has said if it goes to court they will provide further evidence that I didn't have the car after 9am until Also included text to girlfriend with date and timestamp. Omitted names etc for confidentiality EDIT 2 - it turns out I cant include links or images, any idea on this first?

-

After many cancellations and a strongly worded letter from my GP and support worker instead of putting me in a group I've got a home visit on thursday and my anxiety and anger is flowing like mad! I don't know how to deal with this interigation in my own home. I have a feeling I'll be that scared of them I will rage as soon as I open the door to them I really don't know how to cope with this on thursday. I've read so many horror stories all over the Internet and I'm frightened that I will be the next person to write the next horror story! I'm just so terrified. I can't face the interigation! What happens if they hit my last nerve and I snap? I can't cope with all this! Please help me, give me advice. I'm generally so scared and so angry about all this! I just wish I didn't have to deal with this crap. I've already got other worries on top of this rubbish PS I have BPD, depression anxiety and other things to be diagnosed by psych

-

Sat Nav made useless my update

tali posted a topic in Technical Computer/IT/Console/SatNav Questions

I have a tomtom satnav (2007) i went on its site to update it.However , all that happened was that it wiped off all my maps - so basically i have nothing. .They have offered me a 25% discount voucher code to use on their products.So what are my rights ?given that i had a perfectly working Sat nav turned into scrap by the maker? -

Hi, I moved into a new house in July 2014 which had BG as the gas and electricity supplier. At the beginning of Sept I changed supply to another company. Shortly afterwards I received my final bill which for July and August amounted to £308 for gas and £90 for Electricity. they wanted £400 for 2 months supply in a new build house. I queried this and they stated the meter readings were correct and somebody had been to our property and manually read the meters. long story cut short, they weren't telling the truth after 7 months of wrangling and speaking to 2x DCA, taking my complaint to Centrica and providing a photo of my meter in February (which was still way below there supposed read) they agreed there was a mistake. All good final bill adjusted to £120 for both + £60 compensation and still ended up with a £35.17 refund! Finally the end of the matter or so I thought... In mid April I contacted the bank to take out a loan for £12k. Over the phone they provisionally approved me based on their internal scoring system but declined me based on my credit score. I queried this and was advised to take a copy of my credit report to the branch. I printed off my Experian credit report and met with the adviser to go through the finer details they couldn't see anything array and eventually agreed to lend the money by turning it into a joint application and at a high interest rate (18.9%!). last night I checked my free credit report with Noddle and saw 4 months missed payment on both of my old BG accounts. whilst I was disputing the final bill with them they logged missed payments on both accounts until I settled in April. So two questions I have: 1) Will BG remove these based on the fact they upheld my complaint? 2) Can I pursue BG with regards to the higher interest rate on the loan? as without the missed payment showing I would have had a lower interest rate. Any help will be really appreciated Thanks,

-

Hi Ladies and Gents Yesterday I started a new part time job and ceased with my Self Employed status. I filled out the HMRC for and received confirmation last night they had received it with a confirmation number. Now I tried to get through to HMRC today, after going through the gate keeping questions it requires me to have PAYE reference and payroll number. I don't have a payroll number yet till next week. Can I still give them all the other details they require omitting the payroll number giving them next week. I just wondered if the ceasation of Self Employed would stop my Working Tax element for next weeks payment on a Thursday. Is one section quick enough to inform the other. I am hoping my working tax will not stop or I will not be able to pay my rent on the second of November.

-

For those who don’t know, Microsoft is currently working on it’s first non-patch update for Windows 10, currently codenamed Threshold 2 and was originally supposed to launch sometime in October. But as of recently, it appears that release window may have slipped ever so slightly, as according to my sources, Threshold 2 will now launch in early November instead. This is likely for the best, as it gives Microsoft a little more time to continue developing Threshold 2 and should hopefully result in a better built all round update for consumers when it is finally released. Now another interesting thing to think about is what the update could possibly be called when it does eventually launch. Full Article

-

Hi all A quick update on my final 3 complaints regarding irresponsible lending all with the Financial Ombudsman Wageday Advance - complaint rejected by adjudicator. escalated to an Ombudsman who has disagreed with adjudicator and will give final response this week. Lending Stream - received e-mail from adjudicator upholding my complaint. She has written to lending Stream with her response asking them to refund all interest on all loans. They can refer to an Ombudsman and I think they probably will as they have been awkward throughout the whole process although she has said unless they can come up with more information then the outcome is unlikely to be different. PoundstoPocket - heard from adjudicator, he is hoping to provide a response by the end of this week. Nearly at the end of a long struggle with payday lenders. So far have had refunds from 7 out of 10 lenders and it looks promising for the other 3. Would advise anyone in a similar situation to make a complaint.

- 31 replies

-

- complaints

- ombudsman

-

(and 1 more)

Tagged with:

-

Has anyone else had this error? Had this error for a few days and it would not load or update. As always I looked around as many forums on this as I could. I eventually found this >> http://www.windows10forums.com/threads/update-for-windows-10-version-1511-for-x64-based-systems-kb3122947-error-0x80070643.5909/ I followed the guide it worked so now all sorted for the time being. So if anyone else has had this error and wants to sort it then this may help you out.. But you MUST use the elevated command prompt... For the elevated command prompt right click start hit Command Prompt (ADMIN) then paste the code that is in the link above Hit enter wait then it should be done.... Run the windows update to see if the issue is fixed (windows is up to date) last checked xxxxx Copy/paste the command from the PDF

-

Multiple agreements within section 18 consumer credit Act 1974 This is just a view and interpretation of s18 CCA and therefore we would advise anyone reading this bear that in mind Section 18 can be very useful concerning agreements where there is a main loan and payment protection insurance. Firstly lets look at what section 18 says 18.Multiple agreements. —(1) This section applies to an agreement (a “multiple agreement ”) if its terms are such as— (a)To place a part of it within one category of agreement mentioned in this Act, and another part of it within a different category of agreement so mentioned, or within a category of agreement not so mentioned, or (b)To place it, or a part of it, within two or more categories of agreement so mentioned. (2) Where a part of an agreement falls within subsection (1), that part shall be treated for the purposes of this Act as a separate agreement. Ok so what does this mean, well, lets say you borrow £6000 from Nasty Banking Corp, the loan is for you to use as you like and therefore you would have fixed sum credit See s10 (1)(B) CCA, unrestricted use credit See s11 (2) CCA and finally it would be a debtor-creditor agreement as defined within s13 CCA Now if you add PPI to the loan, this changes things slightly, why? If you borrow £6000 from Nasty Banking Corp and then you add a PPI policy for example adding another £1500 of credit you are turning it into a multiple agreement The PPI is fixed sum credit as set out in section 10 CCA but it is not unrestricted use, instead its restricted use credit ( See s11 CCA) as you do not have any say over its use, it is in effect only credit for the purchase of the PPI policy and additionally it is a debtor-creditor-supplier agreement as it would be undoubtedly underwritten by another specialist insurer and not the creditor and therefore it falls within the definition given in section 12 CCA So in effect what we have with the £6000 loan and the £1500 PPI is a multiple agreement with “part of it within one category of agreement mentioned in this Act, and another part of it within a different category of agreement so mentioned, or within a category of agreement not so mentioned” This is because the £6000 is fixed sum, unrestricted use debtor creditor and the £1500 is fixed sum, restricted use Debtor-creditor-supplier Therefore since this type of agreement falls within s18, it means that as defined in s18 (2) CCA that the document is to be treated as 2 separate agreements and each agreement must have its own prescribed terms for each part Therefore each piece of credit must have its own term stating the amount of credit, repayments and all other statutory info, in addition the PPI policy would need to have a term stating the Cash Price of the policy, due to it being a restricted use debtor creditor supplier agreement. In essence there should be the following Loan Amount of Credit £6000 Repayments 60 payments of £XXXXXX Total amount payable £XXXXXXXX APR 16.9% PPI Amount of credit £1500 Repayments 60 payments of £XXXXXXX Total amount payable £ XXXXXXXXX Apr 16.9% Cash price of policy £1500 the agreement may not be set out exactly as above but that is to give you an idea of what it must contain If the agreement fails to correctly set matters out in accordance with s18 then the lender risks falling foul of the form and content requirements of section 60 CCA and could be improperly executed as set out within section 61(1) (a) CCA 1974 thus becoming unenforceable the main thing to remember is that you have two agreement within one document, so there must be a set of prescribed terms for each piece of credit, it is permissible to add the prescribed terms together and then state them as total amounts BUT they must be also stated in their separate parts. Multiple agreements falling within section 18 CCA 1974.pdf Before Printing the PDF TIP If you DO NOT wish to print Page 1 (Cover Page) of the PDF, please ensure to do the following: Ensure you go to your Printer Settings and set it to 'Print from Page 2' (this way Page 1 (Cover Page) should not print out). Note: This will save you Ink & Paper

-

- 1974

- agreements

- (and 6 more)

-

I am currently registered as a single person living at my address and I get the single person discount. My girlfriend moved in January 1st and I need to update my council tax. I want to check if I would get into trouble for not updating this sooner, can they back date it?

- 5 replies

-

- forgot

- girlfriend

-

(and 3 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

3053548.thumb.jpg.6ea05a752ac6bbf38ae4e7be9676053a.jpg)

.thumb.jpg.b57560183b11d2f268a05ddebc499501.jpg)