Showing results for tags 'wrong'.

-

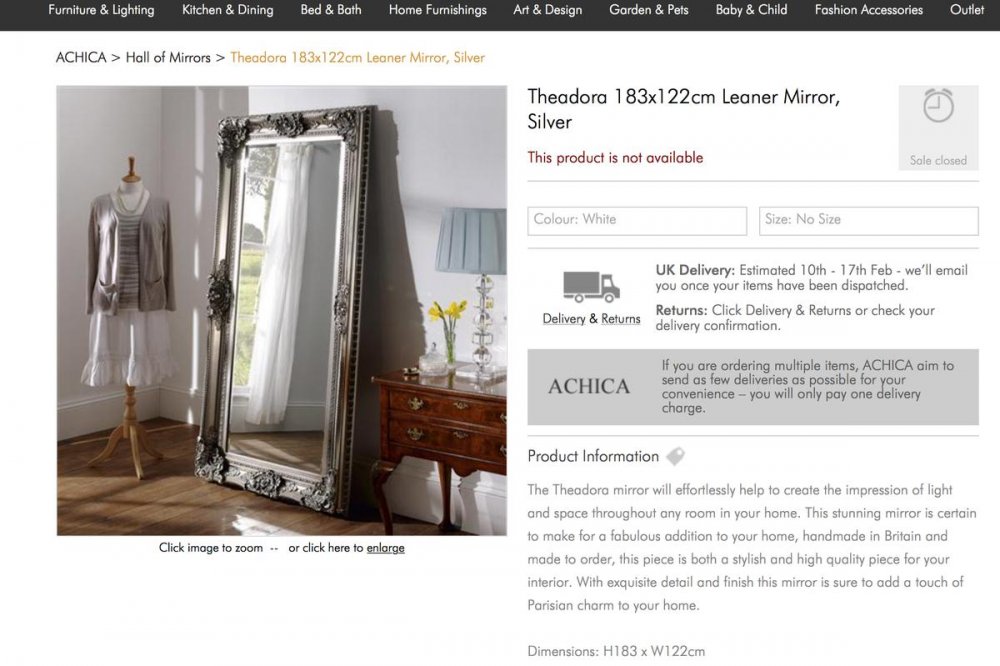

I ordered Theadora 183x122cm Leaner Mirror, Silver As per the order and as advertised the mirror's dimensions should be 122cm wide and 183cm tall A mirror was delivered, however it is only 90cms wide (including the frame). I selected this mirror and this retailer specifically due to the dimensions and the price. Its not as sold and I believe it's actually a different product thats been delivered. Date of Purchase: 4 Jan 2017 Date of delivery 9-2-2017 Cost of mirror £199.00 Achica do not offer a contact number. I have had one voice interaction with their customer service, other than that it's all been email correspondence. They have not offered a root cause for sending the wrong mirror. Achica's initial response was for me to provide a date for them to collect the mirror and I would be refunded 10 working days after its in their distribution centre. I asked them to give me the option of keeping the smaller mirror and be compensated. I said I'd decide based on the response. Achica reverted and offered a £20 achica voucher. I have declined this compensation offer Achica also advised that they cannot provide the mirror I ordered as it's out of stock. However, they are advertising it currently and the website states they have 5 in stock! Their response to this challenge has been to state that this is a different promotion with the supplier. I could really do with some help understanding what my rights and options are here, any contributions are gratefully accepted. The mirror was a gift for my partner and ultimately she wants the mirror we ordered. If theres any further info I can provide, let me know!

-

Hi, could someone please advise. My friends recently had to use the services of a funeral director and with all the added stress of the funeral and the situation, she did not notice at first that the funeral directors had put the invoice in her brothers name and not hers.she called them and they said that they would change it. She needed the invoice in her name as she is claiming some help from the social fund. To cut a long story short, the funeral directors told her after that that they could not change the name on the invoice because it is fraud. It was their error in the first place. I am sure that this is not true and they could raise a credit for the original invoice and re-invoice in the correct name. Can anyone shed any light. Many thanks

-

Hello all, I normally just look at these sites but after seeing the helpful replies I thought why not. In Nov 2014 I had missed two payments on a card, and I was aware by this time that hiding did no good, I called Capital One to explain I was starting a new job and it would be maybe 1-2 months until I could get the balance back within it limit (which I did). I was then sitting on £227.57 on a £200 limit due to charges and interest. The advisor said sure, we can setup a payment plan, but no mention of the different types. I got an expenditure form and filled it in. On the form there were two options longer and shorter (max six months) in section 8. The £10 per month I agreed to pay was double the interest on the account if within it's balance (I think 28%) I thought well, they are giving me the option I will take the longer one, not realizing it had consequences. Oh boy what a mistake. This option defaulted the account immediately. I never received the letter they said they sent about stating this so it went untoticed until around a few months ago when I did a credit check. I contacted the financial Ombudsman who said they decided in the companies favour. I have since replied stating a few facts they got wrong and are now reassessing. The thing I feel is wrong that nowhere on the form I filled in explains the two options or their consequences. I had a look on the consumer report and wondered if it applied? I had a look on the consumer act and seen the below which I don't feel applied to the agreement form I filled out. 55Disclosure of information. (1)Regulations may require specified information to be disclosed in the prescribed manner to the debtor or hirer before a regulated agreement is made. [F155APre-contractual explanations etc Before a regulated consumer credit agreement, other than an excluded agreement, is made, the creditor must— (a)provide the debtor with an adequate explanation of the matters referred to in subsection (2) in order to place him in a position enabling him to assess whether the agreement is adapted to his needs and his financial situation, (2)The matters referred to in subsection (1)(a) are— ©the features of the agreement which may operate in a manner which would have a significant adverse effect on the debtor in a way which the debtor is unlikely to foresee, Any advice? I seen a post somewhere else that said anything detailing to time and action should be more profound in size/bold/undlerlined. In the defult letter, i never got its all the same size. I think they also kept the older higher amount on the default notice. za1.pdf za2.pdf

-

Hi Everyone Im hoping for some help on this please. I took out finance december 2015 on a vehicle, immediately fell into difficulties in January and had the car repossessed. I was in complete communication with the finance company, met the transporter to recover the car and kept talking with them throughout. They explained that there may be a shortfall from the resale of the vehicle which i appreciated I heard nothing for a month or so, but expecting there to be some shortfall emailed the company to find out what happened next . I then had a letter sent to my address from their solicitors saying a CCJ had been registered and that I had to reply to the CCJ that would be sent. Next thing I received was a CCJ had been awarded to the claimant asking for £392 a month to cover the balance of almost £8k - when only £9k was borrowed, the car was returned in immaculate condition and was resold almost immediately for over £8k (internet search showed this) I found out that despite having my correct address, the ccj was sent to my previous address. Where do i stand in having to pay back almost 90% of the finance despite no longer having the vehicle? And where do i stand that I have never had the oppurtunity to represent myself in court to explain that the vehicle was returned due to the fact that the finance company explained the shortfall would only be small and manageable? Thanks in advance

- 16 replies

-

- amount

- attentding

-

(and 7 more)

Tagged with:

-

The following statement was released a few days ago by the Government. This is in response to a Daily Mail campaign earlier this year regarding individuals who have found themselves unable to get a mortgage or credit because of the existence of a judgment against them that they were unaware of (usually because all correspondence had been sent to a previous address). Depending on the outcome, this consultation could have far reaching consequences for bailiff enforcement. Currently, in relation to council tax arrears, a local authority are permitted to issue a summons to the 'last known' address. In relation to an unpaid penalty charge notice, correspondence must be addressed to the address held by DVLA at the time of the contravention.

-

Not sure if this is the right section. My Mother-in-Law has been receiving both parking notices and speeding fines at her address for someone else, who lives just down the road and for what ever reason, isn't interested in having DVLA change the details and said she made a mistake when originally registering the car. My MIL is a very unwell person, suffers greatly from mental health issues and parking notices with threats of bailiffs etc is enough to keep her up at night, and risk of harm to herself. She doesn't drive, and doesn't own a vehicle etc. Many of the notices are over a few weeks old now because sadly she hides things like this that scare her and has just told my partner today. Can anyone recommend what we should do? Is there a department we should call at the DVLA to report this, and will we also need to contact the companies sending letters through asking them to review their records? The parking notices are from Parking Eye, and I don't know who the speeding notice is from, but it is doing 84mph in a 60mph zone, so I expect that will be pursued. We are not aware of a log book or any insurance documents coming through to the MIL's address, but because of her mental state, for all we know she could have returned them, buried them, or worse, handed them over to the neighbour. Help appreciated.

-

My wife used a car park at fistral beach in Newquay, she accidentally put a letter J instead of G when she entered her reg number, but there was no way of amending the mistake she carried on anyway. We have now had a fine sent saying we never paid, even though there were only about 2-3 cars in the car park. They can see by their records that it was a one digit mistake but they want their money. We did appeal, but they say they are correct in issuing a ticket even though the parking fee was paid. Any ideas?

-

I recently ordered a bag from the store online and posted it back to them. I had ordered something similar a while ago from the same store online. Both items black backpacks and the same rubbish to be honest, but I think I may have sent the wrong one back. They have received my return from what my tracking number tells me, but they've not processed it yet. I was wondering what could happen or if they'll get me in trouble for this.

-

Our Nine year old son Receives DLA High rate care and low rate Mobility from the DWP. His mobility condition has changed and he is being referred for Surgery on his Achilles tendons by his Paediatrician, so I informed the DWP. The DWP wrote to our GP who we never see and asked for a report on him,she phoned me and asked some very basic questions and submitted a report that totally contradicts the Paediatrician. I have spoken to the DWP and was read the Doctors report and it is total rubbish, the Doctor who we have never seen has said our son can literally walk and run like a normal child. I have asked for a Mandatory Reconsideration, and asked that any information they need should be obtained from the Paediatrician not our GP. Can someone point me to where I can request all the details about our Son from the DWP, so I can confront our GP with her report.

- 8 replies

-

- dwp

- information

-

(and 2 more)

Tagged with:

-

Hi, On 27/4/18 I was stopped by a Police traffic car as the car I had just bought and was driving was untaxed. I had no idea the rules had changed, it was insured in my name and the police officer let me continue on the basis that I taxed the car imeadiately, which I did. I've received a letter dated 19/9/16 from DVLA saying that I was stopped in an untaxed car and have to pay an out of court settlement of £376 by 6/10/16. The letter has the wrong registration number (similar, but wrong) and an incorrect spelling of my surname. Do any of these details mean could avoid paying/stop the offence/payment? It seems a long time from the offence to the commencement of their action. Also feels harsh that the police officer said just to get it taxed. Thanks for any help locostmike

-

A letter from Capital Resolve ( on behalf of TK MAXX) arrived, not addressed to me. When first moved here I regularly received letters and visits from bailiffs and police for people who are using my address fraudulently. In the past, I sometimes sent the correspondence back to the sender, a few I ignored, sometimes I called the various companies, and more than once had to explain to whoever came knocking on the door etc. However, after a particularly bad experience in the past with an enforcer from Marston (I posted here about it and got help!), I am cautious about just sending back closed envelopes or calling the company, giving my name etc . How can I nip this in the bud? Cristina

-

Hi all I've been employed by the same company since April 15 I recently moved and thought I must change my address with the pension company so tried logging in online I kept getting a message saying my details were incorrect so I called the helpline and discovered my Payroll dept had given them the wrong NI number (1 digit is wrong) I then checked my payslips and yes, it's wrong on there too I've informed my payroll dept but do I need to do anything else? Thanks

-

Hello everyone, I've had a County Court claim form sentfrom Northampton CC. The claimant is Cabot Financial (UK) Ltd acting via Restons Solicitors and quoting an Opus credit card reference. Putting those names into Google brought me straight here so I hope someone can give me some advice. I had a Capital One credit card a long while ago and assume that the £5k odd debt has been passed around, I've also had a number of letters and calls from Cabot which I have ignored over the years. I'm aware that if you make no contact with a lender for six years the debt becomes statute barred and my time is up next May so I've been keeping quiet for a while. This is probably why they're getting heavy now. My question is over the name on the claim. They have addressed me incorrectly so does this make legal proceedings unenforceable? It's as if my full name (as on the creditcard) is Fred Steven Bloggs but through a clerical error on the debt collection forms they've renamed me Freds Bloggs. It's a small error but surely legal paperwork should be correct. What do you think I should do now? Sendit back as the defendant is not known at this address, admitliability but negotiate a small pay off or just ignore it . They will know as well as I do that they have to do something in the next six months if they're going to get anything repaid but I'm not sure if aresponse will wipe out my five and a half years of ignoring them. Any advice will be gratefully received. Desparate Des.

-

hi yesterday a car was driving like a nutter behind my wifes car with the young kids in it, she slowed down to let him pass and just as she done it he mounted the grass verge on the left and drove into the left front wing causing a dent, he shouted out of the window and drove off. my 16 year old daughter got the make and reg of the car which was a dark blue Vauxhall insignia, when we reported this to the police they said it must have had fake plates on as the car should have been a white Vauxhall insignia. this seems funny as the wife says it was blue and at 1pm in the afternoon I think she can see clearly. they said they cant do anything as its may be the wrong car? could he have changed the colour, it was a 12 plate car also. any help would be great thank you.

-

In January this year I received a letter from a company called Sigma Red informing me that they had passed my account with premier man to Lowells. Which was interesting because it was the first time I was aware of having an account with premier man! So I sent the standard letter to Lowells saying prove you have the right person or bog off. On 9th July I received a letter from Lowells with a photocopy of an unsigned credit agreement with this company, the name including the middle initial is the same as mine but the address is somewhere in South London that I have never lived at. The supposed debt is for £268.34. So, either there has been a cock up and there is someone out there with exactly the same name and initial as me (highly unlikely) and they think I'm going to pay their debt for them, or somebody has stolen my identity and some kind of fraud has taken place. I am not sure what the best way to proceed is. Should I just tell them to bog off again or will they just think I am avoiding paying and take proceedings further. Your advice would be much appreciated. I should add finally that the account was apparently opened on 9/7/2011 which happens to be around the same time that I did actually buy some trousers for my partner from the said Premier Man, they were paid for in full at the time, and they were so horrible I vowed never to buy anything else from them!

-

Hi all, I was wondering if someone could please share some knowledge on this. Also please be kind A friend told me about this forum I checked my credit file and found that an old loan (which I am still paying off) has appeared. This was originally a Credit Union loan, which was closed in April 2012 and then transferred to a Debt Collection Agency. Since this has occurred I made a small amount of payments and finally agreed to £20 once I got a decent job. I actually was planning on paying this off this month, ironically enough! However, the Union has defaulted me for the last 5 years on the loan and have the wrong information on this e.g. it says I pay £64 a month and the debt has been going down. This is incorrect (as there is only £300 left, not £600!) and also how would I default if it was going down? So here is my questions: • If the original creditor closed the account in April 2012, can they now all of a sudden put this on my credit file? If so, is there a limit to the time they can put this on? After 5 years this seems ridiculous. • If the debt was transferred to an agency, should they not be the ones reporting on this? • I assume if I contact them they will correct this as per the April 2012 closure? If so, I can live with this…. But, I’m not want to continue to rage for another 6 years for the mistakes of my past to go away This is quiet upsetting as I went to apply for a mortgage today, but was denied. I’ve worked really hard since I’ve been a student to pay off debt and pay bills on time. I was finally seeing the light at the end of the tunnel, even to the point my one and only default fell of last month and I hit the 843 mark on my score (even though scores are rubbish anyway, still nice to see). Please help Thanks in advance.

- 16 replies

-

- information

- reporting

-

(and 1 more)

Tagged with:

-

Here is yet another case where a vulnerable adult was given a lot of grief for a CT debt. The defendant handled it the wrong way and this saw them in Court! But both the EA and LA got it wrong again!!! But as you will read they sorted it out far too late as normal... 'Paul Inns, defending, told Welshpool Magistrates Court Dockerill was of good character with no previous convictions. He informed magistrates his client suffered with Asperger’s and officers turned up banging on the door at 6am, refusing to show any ID. Dockerill attempted to find information showing he had paid the bills, before the situation escalated. The next day, he was on the phone to the council when officers returned to seize items. However he passed the phone to officers, who agreed a mistake had been made by the county council, and the matter was dealt with. Mr Inns added there was no intention to cause violence and Dockerill, who was fully co-operative, acknowledges he should have dealt with things differently. Magistrates made Dockerill subject to a six month conditional discharge and ordered him to pay £40 costs and a £15 victim surcharge'. Main story from here >> http://www.newsnorthwales.co.uk/news/162868/berriew-man-threatened-bailiffs-with-hatchet-and-hammer.aspx Lead story from Scoop So with this in mind and the many threads regarding vulnerable debtors where and when will people start to try to understand that is not so simple and that this needs sorting out before something really awful happens to an EA?

-

Thank you to all who contributed to this forum. I have worked my way through as many post as I can, and it has helped me to calm down since getting cautioned by an inspector on the tube. It was very distressing for me and really affected my day to day activities for the first 48 hours or so. The letter that I had been expecting came today and one thing that struck me was how it does not ask me to comment on the incident. It merely asked me to fill out the form on the reverse side. It reads: 1. If you deny committing an offence, please explain why. Please note, xxx fare evasion offences are ones of strict liability. This means that a mistake or accident is not a defence. The fact you were on a ttt service without a valid ticket or pass is normally sufficient for a conviction. 2. If you accept committing an offence, please provide any exceptional reasons, including evidence, as to why ttt should not proceed with a prosecution. The whole episode was quite distressing when the inspector came. I wasn't expecting anything wrong and quite happily produced my card. Earlier that morning, I couldn't find my normal oyster card (which has a photo) and having emptied my bag, dug up another oyster card, I then picked up a friend's card (not photocard) on the table by mistake (which I realised only on hindsight) , which had a young person railcard loaded on it. However it strangely contained also another discount, but we do not know what it was (because my friend had asked me before what discounts are available). In any case, when asked about the discounts on the card, I panicked because it was only then I realised I took the wrong card and I acted as if the card was my own, and told them there's a young person railcard and possibly another thing. The inspector then asked if I had any photo ID to prove the second discount, but I didn't even know what discount was on it I was even asked by a different inspector how much I paid for that card. So they suspected me of fare evasion because of the second discount and then interviewed me under caution, and I told them everything I knew about that card, but I acted as if the card belonged to me (I still don't know why I did that). I am an international and so I'm very worried about losing my visa. My normal oyster should contain details of my travel history and the frequency of topping up, but I'm now not even sure if I have accidentally picked up my friend's oyster card by mistake on the days I could not find my normal oyster card (I don't travel on the tube every day). My friend says he doesn't think the card is registered as he doesn't have any log in details to check that card. The fact is that the card I used that day was invalid so I can't choose option 1. But what should I write?

- 17 replies

-

- blue

- discounted

-

(and 3 more)

Tagged with:

-

Hi everyone Myself, brother and sister recently parked outside a parking facility for apartments at 12:07 on Monday 30/05/2016. We came back to the car at 13:34 to see a PCN from Salford City Council on the window. I took pictures so I could give more detail to were she was parked to see if she really has to pay. Please let me know if anything can be done. http://docdro.id/1ED7Zpn Thanks Andrew

-

The dreaded ESA 50 arrived yesterday, so onward for the battle, endless photocopying and reams of explanations. Can someone remind me where to find the "help" guides for filling out the form, for both mental and physical disability as I have both, please? Thanks in advance.

- 70 replies

-

- assessment

- centre

- (and 7 more)

-

http://www.bbc.co.uk/news/health-36345768 It seems that the advice to eat low fat was wrong and could make your health worse. I have for awhile now, moved to eating standard fat products and not the low/reduced fat items. I have noticed that i have lost weight, when consuming about the same volume of food. The French are apparently much healthier and they have never been convinced of the low fat diet some have been recommending.

-

Hi, I have received a claim from the small claims court. The claim relates to an Estate I was the administrator for. The claimant is not a beneficiary of the Estate but an agent for some of the beneficiaries. However, the name of a beneficiary is not stated on the claim form as I suspect the Agent has not been retained by any beneficiary to make this claim. Should I just reject this claim as it is not made by a beneficiary. The value of the claim is about £150 and I would be reasonably confident of winning the case but absolutely not 100% as it relates to expenses incurred in administering the Estate. It would be down to the court in their interpretation. Your comments would be much appreciated.

-

Hi There Wonder if anyone can help please. We were on holiday with the family in Mallorka and whilst in Mallorka tried to book our flights back home to East Mids Airport. Towards the end of the holiday we decided to start looking for various flight options with different airlines and used ryanair, jet2 and thompson websites to compare flight times and prices. Thompson has shown available flight in the day on the 24/08/2014 and we decided to book it and stay a bit longer. Bare in mind we have tried booking Thompson on a few occasions for a couple of days however they were showing flights one minute and then once the page is refreshed they would disappear. We thought it was due to their own holidays not sold last minute they would sell flight seats to general public at a reduced price, but they would disappear because it would have been sold or something. Anyway, we we happy with the flight time and date and proceeded to booking it. Booked and paid. Thompson booking process took only a few minutes - we have paid with the credit card and it didnt even ask for the security letters or numbers. As we were supposed to flight out in 2 days we thought we would check in at the same time and this is when we have realised that the booking was made for the 24/05/2015!!! Somehow , somewhere in the computer world the dates changed during the booking itself. We have selected correct dates in the original search, selected correct time and date for the flight and booked. Confirmation came however for the date in future! We checked and Thompson is non refundable airline. We called credit card company and advised them of the incident. When tried to go back and rebook the correct flight ( Thompson customer service line was permanently engaged) - they were no longer available!! We had to pay for another tickets with Jet2 in the end. Once were came back home we have raised this issue with Thompson - however they did not want to know and not even interested in giving us a credit note or vouchers to change for another date or flight or location. We are raising complaint with the credit card under s75 of CCA1974 Ironic thing is - we cannot fly out of Mallorka on the 24/05/2015 at 12pm as we are getting married here in the UK at 2pm! So its not like we have made a mistake in dates or anything. We are desperate to get the money back or credit towards another flight or a refund as not really interested in Thompson flights at all at the moment. Can anyone help with any suggestions please? thank you in advance

-

Hello All, thank you all for the advice that follows; My car has been photographed at the above station and issued with a PCN in the early evening but that PCN has an incorrect reg on it. I, like many others, just want assurance that the PCN is invalid due to the incorrect details being taken down and not to do anything with the PCN nor write to NCP. I always pay my parking, all the time, including this day pay by phone but I did this just before leaving London some 2 hours after the PCN was issued but by the time I got back to my car the dreaded sticky envelope was on my windscreen. This is a company vehicle which both myself and my wife are allowed to drive. If any more information is needed please let me know. Thank you all once again. NCPSucker

-

Hi Guys Long winded but will cut it down best I can, will start with the numbers loan 1 July 98 for £3000 PPI single policy of £443 added to loan (paid 46/60 payments) £144 of ppi refinanced by loan 3 loan 2 Dec 98 for £1400 PPI single policy of £198 added to loan (paid 39/48 payments) £50 of ppi refinanced by loan 3 loan 3 April 02 for £5000 PPI single policy of £1174 added to loan (paid 13/60 payments) £980 of ppi refinanced by loan 4 loan 4 may 03 for £7500 PPI single policy of £1762 added to loan (paid 11/60 payments) £1500 of ppi refinanced by loan 5 loan 5 may 03 for £11000 PPI single policy of £2383 added to loan (paid 12/60 payments) £2032 of ppi refinanced by loan 6 loan 6 may 08 for £10000 PPI NO PPI added to loan still paying Now we had a decision letter from Lloyd's stating they upheld all of the complaints offering refund of the ppi part of the loan that was paid in installments plus interest, which worked out about £7,700 according to their workings out, I had it in my head from working it out that it should have been nearer 10k but at first glance of their workings it looked OK but I still couldn't get it out of my head that something was wrong. It then clicked that they had calculated all their figures ONLY on the installments made and had completely ignored the bits that were left on refinancing which by itself without adding interest is about £4700, this amount is still being paid off on loan 6. I phoned them as the offer letter tells me to do and explained why I felt it was wrong, the guy said that I am not entitled to that bit back as the loan was refinanced, I argued and tried to speak to a manager but was brickwalled, he insisted I was wrong and that the payment of £7700 was going to be sent, I told him at this point that I DO NOT ACCEPT the offer, and under no circumstances are they to consider the matter closed, I even got him to repeat it back to me several time, as they supposedly record the calls. what I would like to know is am I wrong, am I not able to reclaim the bits that were refinanced by the new loans, or are Lloyd's trying it on Many Thanks

- 9 replies

-

- lloyds bank

- premium

- (and 6 more)

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

3053548.thumb.jpg.6ea05a752ac6bbf38ae4e7be9676053a.jpg)