Showing results for tags 'extortionate'.

-

Hi all, I am new to this forum, so please bare with me as I get hang of how it all works. My story dates back to 2006, when I took out a secured loan with Blemain/Together finance for £25k. This was to pay additional bills and to do some repairs on my property. I brought the property in 2003. This was the first time I took out a loan, I had no real knowledge of the best type of loan to choose, which is why I did the loan through a broker, who pass my application to a third party Loan Options, who recommended Blemain finance. They were both paid a commission at the start of the loan and that was deducted from the loan amount. Blemain also added £2000 in charges for handling my application, so at the start of the loan I was already £4000 in debt. My understanding from the start was this was a loan, but over the years it is now referred to as a mortgage, with added legal clauses such as remunerations. None of this information was made clear to me at any stage of my application. There is no way I would taken this loan if I knew the interest rate would be so high. I am now paying more to this loan then my actual mortgage. In the last 11 years Blemain has added charges to this loan for building insurance, Telephone calls, Letters, Arrears and court fees. Yes they have taken me to court on 2 occasion to reprocess my property. Each time adding extra charges to the loan amount. I have recently had a audit done on the amount I have already paid Blemain and it totals to over £39k, I still have 4 years left to pay off this loan. I have been in financial hardship since taking out this loan, with very little to live on. I have been to solicitors, law centers, etc, none them has been successful. I can’t afford the monthly charges of this loan any more, I am compelled to sell the home I lived in for over 33 years. I recently asked Blemain for a redemption figure and they have quoted £46k to pay off this loan early. I am horrified that they can charge such extortionate interest for a loan I took out 11 years ago. If I pay the £46k redemption figure It would total £85k for a £25k loan. How is this possible:???: I would appreciate any advise or guidance from the forum. Thank you! Bdoubleu

- 16 replies

-

- blemain

- extortionate

-

(and 1 more)

Tagged with:

-

Hi all I have applied for all my information from Swift Advances, but I think the broker does not trade anymore, so will have to go to FCSC for PPI reclaim I think?. I am not sure how to go about the spreadsheet that is talked about. ...is there a step by step guide, and a copy of the spread sheet? I want to try to reclaim extortionate charges from Swift.

- 19 replies

-

- advances

- extortionate

-

(and 1 more)

Tagged with:

-

Hello Thank you in advance for any advice on my situation. Between 2009 and 2013 I was registered as self employed, in the earlier couple of years i was going through a stressful personal break up was having problems with work because of depression, also spending my money to go to court of access to my daughter. At the time I was couch surfing and frankly forgot all about tax returns. The HMRC fined me in total £4,524 over this period which I can't afford to pay. I find these charges extortionate, is this even legal for a start? All i did was not send in a piece of paper and now i am in this huge amount of debt? The last thing on my mind at that time of my life was filing a tax return especially when i had literally done no work or earned anything at the time - I certainly couldnt afford an accountant. Since then i started a limited company in 2012 which is still operating now and all tax returns are up to date for myself and my company, done via an accountant. All the old self employment returns have also been done and the self employment terminated as i am employed on PAYE by my own company. The HMRC have passed the debt to CCS collect. I wrote to the HMRC to try and appeal these extortionate charges based on what I have said above, but rather than responding to my appeal they just ignored it and wrote back to me with the figure I requested in the same letter. CCS already seem unreasonable in their initial letters, stating they want an "acceptable payment offer" - in my opinion acceptable is what I can afford, if this is £1 every week then that's what they should get. Am i correct in thinking that I should respond to CCS in writing rather than on the phone so i have written records of everything? And is it also right that they have to accept what I offer them on a monthly basis? I am thinking of £50 per month, which having a family of five to support is more than reasonable. I am writing back to HMRC today to request they actually respond to my letter properly rather than being totally ignorant. Finally, how on earth can a company, the HMRC, just make up these charges? They are just a company after all aren't they, and it's a ridiculous amount just because they didn't receive a piece of paper! Thanks

-

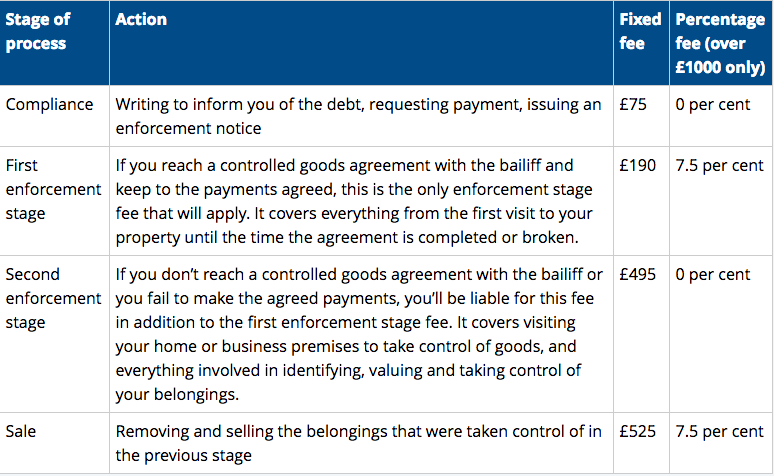

Hi all, I would really appreciate some advice. My business partner and I run a small business, and cashflow is very delicate. Some time ago we got in some money trouble and an invoice was sold to a debt recovery company. We managed to pay it off (or so we thought), but unfortunately my business partner is a bit scatternbrained with numbers, and paid the incorrect amount. The total outstanding debt was £5,723.96. My business partner sent them a transfer of £5,700, accidentally leaving off the £23.96. My business partner had some fees he wanted to dispute - The debt recovery company then sent a follow up email saying all prior fees are legitimate, and that "I have checked your account and can see we are still awaiting a payment of £23.96. I am assured this will be paid in due course, and this case can then be closed.". My business partner forgot to respond to the email (stupid, I know), and three weeks later (yesterday) they send a hired thug to our place of business, while customers were there, demanding the £23.96 plus a £1111.87 enforcement charge. He said that unless we paid that to him on the spot, he would confiscate goods that he valued to the sum of £8000. The £5,723.96 sum had a high court writ, which comes with a cap on fees of this nature that can be charged, as illustrated by the table below: The bailiff claimed to be able to charge for both stage two and three whether or not he actually had to carry out stage three. I pointed out that I was perfectly willing to pay the debt and the enforcement fee on the spot, which meant that he did not have the right to charge a "sale" enforcement fee, but he refused to drop it, saying I either pay exactly what he is demanding, or he starts ripping equipment out of the walls there and then. I had no choice but to pay the entire sum, and did so. There is no doubt in my mind that this is illegal and extortion, and in fact the bailiff himself used the very word "extortionate" when explaining the situation he was putting us in. My question to you is which regulatory body can I bring this to the attention of, are there any court cases setting a precedent in these situations, and are there guidelines that prevent bailiffs from charging huge bills for debts as low as £23? Even the £495 bill is entirely unfair, and clearly taking advantage of an admin error made by a small business. The law was not written to allow them to do this, and it puts our business at risk. Any advice on putting this right would be massively appreciated. Thanks a lot.

-

Hi Everyone Im hoping for some help on this please. I took out finance december 2015 on a vehicle, immediately fell into difficulties in January and had the car repossessed. I was in complete communication with the finance company, met the transporter to recover the car and kept talking with them throughout. They explained that there may be a shortfall from the resale of the vehicle which i appreciated I heard nothing for a month or so, but expecting there to be some shortfall emailed the company to find out what happened next . I then had a letter sent to my address from their solicitors saying a CCJ had been registered and that I had to reply to the CCJ that would be sent. Next thing I received was a CCJ had been awarded to the claimant asking for £392 a month to cover the balance of almost £8k - when only £9k was borrowed, the car was returned in immaculate condition and was resold almost immediately for over £8k (internet search showed this) I found out that despite having my correct address, the ccj was sent to my previous address. Where do i stand in having to pay back almost 90% of the finance despite no longer having the vehicle? And where do i stand that I have never had the oppurtunity to represent myself in court to explain that the vehicle was returned due to the fact that the finance company explained the shortfall would only be small and manageable? Thanks in advance

- 16 replies

-

- amount

- attentding

-

(and 7 more)

Tagged with:

-

Hello I am in dispute with The UW over the erratic and high bills I have been receiving. Since early September I have been emailing the CEO office and trying to sort out what is going on . In the past year my so called smart meter has never been read by anyone other than me and I am not sure how to check it. They send very long wordy emails saying how good they are but do not answer my concerns. Eventually they suggested fitting a test meter. A meter inspector was sent to read my meter and he said that my smart meter was very old and that particular type was unreliable. An appointment was made, confirmed by letter,email and text but no one turned up so I decided to call them. After a long conversation with no explanation another appointment was made for today and guess what - no show. In the mean time I decided to change supplier, after all enough is enough. Initially UW objected but the new supplier says they are taking over both gas and electricity later this month. So after this lengthy pre-amble; should I contact Uw and tell them about the no show or do nothing and see if it swops over to new supplier?

-

Hi All I will not bore you all with the details of my case, lets just say that this forum and advice from certain members have been like "Saving Grace" to me and I feel indebted. I have been granted a "Stay of Execution" for a recent enforced writ to the value of £5,119.15. pending court hearing, which I provided an affidavit with my monthly proposal. Firstly, I would like to ask what to expect from this hearing? Secondly, I have listed a breakdown of fees and wondered if the "more experienced" on these matters would kindly advise whether they feel I am being ripped off. The fee's for visiting to post the N55 seizure notice are as follows:- Judgement Debt £3,750. Judgement costs £100 Execution costs £60 [email protected]% £41.35@ £0.84 per day from 25-02-2014 Sheriff fees £973.16 VAT £194.63 TOTAL £5,119.14 doesn't seem right to me Any further advise most appreciated Momummission

-

This is on behalf of a friend of mine. He owned a Classic Morris car which he insured with Lancaster Insurance at the price of £68 for a full years cover which he paid in full. Now he has sold the car and is getting something more modern. Lancaster Insurance told him that if he takes a new policy for his new car then they would waive the £50 cancellation fee but if he takes cover elsewhere they want £50. He was hoping just to transfer the policy over to another car but Lancaster Insurance quoted him almost £500 but he managed to get a much cheaper quote, almost half price, elsewhere on comparison sites. Now I feel a cancellation fee of £50 is excessive given the price of the policy for a year at £68. They even refuse to refund him for the 4 months which was left to run stating that once the policy has run for 8 months they don't refund anything. They even told him that if he had not sold the car and let the policy run he would only be able to transfer the NCD to another classic car. Can anyone help with this?

- 8 replies

-

- extortionate

- fees

-

(and 2 more)

Tagged with:

-

Hi guys, I ordered some things a while ago from America. I was taxed by the customs as the parcel was valued at over £15. Previously, I had ordered similar items (at an even higher value) from the same company but did not get taxed. On this occasion, I received a card saying I had been taxed and that there was a handling fee of £8. I wasn't expecting to be taxed in the first place let alone the handling fee. It seems ludicrous that there should be such a big charge. I don't mind paying the tax if that is what is owed by law but for Royal Mail to profit because something was ordered from abroad seems absolutely absurd. How can they be losing out, if I'm expected to pick up the item from the depot?!?! Is there any way I could persuade Royal Mail to drop the handling fee? Thanks in advance for any advice.

-

Good Afternoon, I have just moved out of a property which has a £1000 Deposit secured against it. When I moved into the property just over a year ago. I was charged Agency Fees and a Tenancy Agreement fee. Upon moving out I met with a member of the Letting Agent to complete the Inventory Checkout Process. This passed with flying colours and they are looking to return all of the deposit, Minus 21 Days Rent (At my request after I needed to stay at the property for an extra 3 weeks). However they want to charge me £120.00 for a Check Out Fee!! I've had a look around and seem to find conflicting information on whether this charge is reasonable or not. There is such a charge detailed in the tenancy agreement. However from memory it's slightly vague, and £120 for 20 minutes of the LA's time is to me rather unreasonable. ( That or I'm in the wrong job ) Is there anyway I could dispute this charge? Is it enforceable? Or do I pay up like a mug? Thanks for reading caggers

- 20 replies

-

- checkout

- extortionate

-

(and 1 more)

Tagged with:

-

The Government refuses to regulate Payday loan companies. The Government has given the green light to Payday loan companies to carry on charging thousands of percent interest on loans and to bully and threaten those who take out a loan. They have 'refused' to discuss the growing trend and misery caused by this legal rip-off. Jo Swinson, the minister for Employment, Relations and Consumer Affairs said "It makes sense to leave it and wait to see if the companies come up with some voluntary control". What a disgusting statement from some stuck up cow who lives on state money. She said they might have a chat about it next summer.

- 2 replies

-

- approves

- extortionate

-

(and 4 more)

Tagged with:

-

Mortgage Arrears and Simple Interest - Is it fair? Took out a secured loan for £10,000 6 years ago. After initial application was accepted we were offered an extra £6000 which we agreed to. At the time I was concerned that we had been issued with two loan separate loan agreements - I wasnt happy with this and voiced this to the loan advisor and was basically reassured that this was just an administration technicality and would not make any difference. He even sent me argos vouchers as a sweetner. 12 months later my husband left me and our business collapsed leaving myself and 30 of our staff redudant. I was absolutely financially destitute. He financially abandoned me and ever since I have been fighting one legal battle after another, keeping the wolves from the doors. I have single handedly paid off all our joint debts. 5 years later and I have made the necessary 72 repayments but I am left with a balance of just over £4k. This includes interest, charges and simple interest. What I need to establish is it it all fair. Loan payments where late from December 2007 to May 2008 by around 2/3 weeks. I was charged £50.00 collection charges on each loan. From May 2008 - June 2009 I could not make any payments whatsover.House was put on the market as I saw this as my only option. £50 charge on each loan per month was applied. June 2009 agreement was reached, I reinstated payments and started to pay off the arrears. Continued to apply charges, but agreed to reverse them if I maintained the agreement. April 2010, cleared the arrears. Asked about the charges and they advised I could pay them off at the end of the loan. Im now at the end of the loan and still owe just over £4k. They have reinstated the charges made from June 2009 - 2010 but no more. I have several questions: Was it fair to charge me on each loan account - I was paying £100 per month in charges? Surely there is no more work involved in chasing payment for two accounts as oppose to one account? Was the amount that they charged me a fair amount - it seems very high? Also because I have had so much information off them (in one month I had 10 pieces of correspondence) I have overlooked that they have also been charging simple interest on the charges! As a result, I didnt realise that by leaving these charges until the end of the loan period, I was still being charged interest on them. I was treated appauiling by this company, I was never shown any sympathy, in fact I almost felt bullied by their "callers" and felt that they "harrassed" me at an extremely difficult time. I responded to every call they made - I gave them every bit of information I could, but unfortuantely for a long period I could pay them no money and therefore did everything I could to sell the house. When circumstances changed for the better I offered them the maximum I could afford which included paying the full monthly payments plus a further payment towards the arrears . I was advise that it was not enough and that the arrears would have to be paid within in minimum period of 12 months. They therefore took me to court for repossesion. Thankfully it was not granted and was adjourned on the terms I had previously offere them. Despite this however there are legal fees also on my statement, which could have been avoided had they accepted my proposal. Any advice would be greatly appreciated.

- 48 replies

-

- central

- extortionate

-

(and 5 more)

Tagged with:

-

Hello everyone, I am new to this forum; thank you for all the information and input. I went to view a property to rent this past week and at the viewing, I expressed interest in renting it. The estate agent informed me to call the office to "stake my claim" to the property and that there would be an admin fee of £250 to draw up the tenancy agreement and to carry out credit checks. She also stated that they, as the estate agents, are actually only in charge of finding a tenant and that once the agreement was signed, our property would be managed by the prestigious estate that actually owns the property. She said that there would be a further admin fee of £150 charged by the estate, but that this amount would be deducted from the first months rent. I already thought that the initial £250 admin fee was a bit excessive as I had expected about £100 for 2 people's credit checks. However, I was so anxious to "stake my claim" as she said, as she put the pressure on and said that this property would be snatched up straight away and it was really ideal for us, so we paid the £250 over the phone and the agent said that this would take the property off the market. However, the property is still being advertised on their website. I thought the addition of another £150 admin fee from a different estate that they let for was especially insulting, but I guess I was mollified by the fact that this would be deducted from the first months rent, as I was told by the estate agent at the time of viewing. However, when I went to the estate agent's office to collect the application forms so that they can carry out their credit checks, the agent in the office handed me the "Advance Payment Form" which detailed the security deposit of £995, the first months rent due on the day of move in £795, the tenancy agreement fee of £250 ( this has already been debited from our bank account) and a further £150 admin fee for the other estate charge for a grand total of £2190 pounds due at the time of move in. However, they did remove the initial £250 from their grand total as this has already been debited, for a total of £1940 due at the time of move in. As I was told that the £150 other admin fee would be debited from the first months rent, I questioned this with the agent. She blithely replied that it would not be DEBITED from the first months rent, rather that it is ADDED to the first months rent. I said that I was given the wrong information and that this would have influenced my decision to rent this property, as the admin fees alone are equal to half a months rent, and we wouldn't be able to claim this money back like a deposit. I asked to see the rental agreement but she removed it from the packet stating that I would have to complete the credit check applications before I could see the rental agreement that I was applying for! I them calmly stated that I felt I was given the wrong information at the time that I paid the initial £250 "admin fee" as I was told that the additional £150 fee would be deducted from the first months rent. I then said I felt I had a right to read the rental agreement to a property I am applying to live at and have already paid the £250 admin fee for. She then pressured me to sign the advance payment form, advising me that I didnt need to consult my husband to pay this upfront and that I didnt need to see the rental agreement. I didnt sign it but asked to take it away with me to review with my husband. She hesitantly made a copy of our "advance payment form" and remarked that the £250 pound paid admin fee was non-refundable, even if they gave us the wrong information, and that I wouldnt be getting my money back whatever happened. She also made a snarky comment about how we still have to do credit checks yet to be deemed as acceptable tenants, as if we didnt earn enough money to live there, which I'm sure we make more than enough of. I know that in Scotland very recently, laws have been passed that have made it illegal to charge tenants fees to be able to rent a property, but sadly similar laws have not yet been passed in the UK yet. I think I would have understood if there was a reasonable charge to move in, such as £100. However, as if the £250 wasn't bad enough, they have now added a £150 further admin fee that they said would be refunded in the form of being deducted out of our first months rent, which they have now added to the first months rent instead. What rights do I have in terms of being given the wrong information at the time of viewing? Also, do I have the right to ask them to itemise just what exactly the £250 pound admin fee and further £150 estate fee is for? What could they possibly need £400 pounds for to check us out as tenants? I just feel that the cost is so extortionate to rent this place, and also that they have deliberately told me wrong information saying that I would be refunded the further £150 estate fee, while instead adding it on. I'm not trying to give them a hard time, and I certainly don't want to back down from renting the property because it is just so ideal for us, but I feel that what they've done borders on illegal, and I feel like I definitely have a right to see our rental/tenancy agreement papers if they are making me fill out our credit checks and have already debited £250 pounds from us. Is it worth sticking my foot down and telling them that they told me the wrong information at the viewing when I dont have any written proof that they said that? Also, I know it might be too late as they have already debited the £250 pound admin fee from us, but I have read on other forums that there is usually a fair amount of negotiating or haggling when it comes to these admin fees that I so naiively didnt know about - is there such thing as after-negotiation? Thank you all in advance for any advice; I really appreciate it.

- 5 replies

-

- agreement

- estateagents

-

(and 3 more)

Tagged with:

-

My son has had a letter from EDF demanding 150.00 or the baliffs are coming 17th December to force entry. They have not read the meter i over 2 years and just provided estimated bills h e has being paying them around £40 per month and now this. I dont know what the correct bill is because it has been left for all this time, I guess it is partly his fault for not being on the ball. He is on benefit and cannot pay them anything untill the 26th when his benefit is due. Don't know what to do when they arrive. Any advice would be appreciated. Regards, Mashmallow

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.