Showing results for tags 'central'.

-

Paid off a secured loan with this bunch around 5 years ago. They are now requesting payment of interest, late payment charges etc. Any good letter available to tell them where to get off would be much appreciated? Thanks!

-

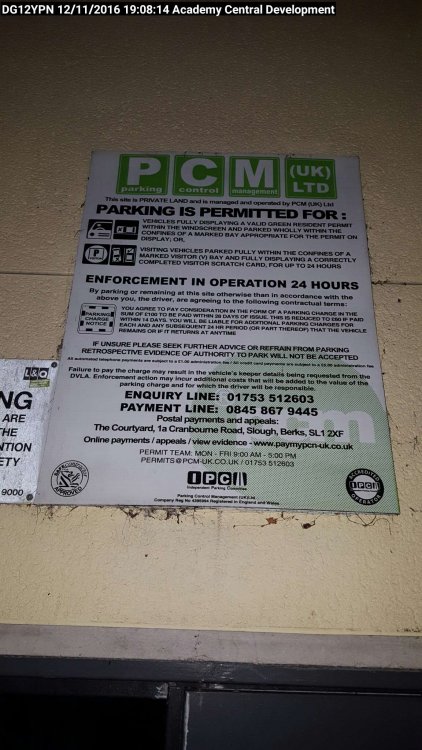

Hi all, need some urgent help please, have been asked to post here by suggestion. Noticed CCJ issued on my credit report prior to applying for mortgage. Found out that it is for PCN issued on 12/11/16 by PCM UK LTD in Academy Central Development. Passed onto Gladstones and onto DCBL. I recall this moment where I parked near my friends apartment and was not aware of signs or did I know I needed to pay. I did not update my DVLA or V5 until recently which is very stupid of me. I moved out of my apartment on 01/12/16 to temporary accommodation. 01/03/17 I moved into my permanent apartment, all utilities etc set up since move in day. Never went back to collect mail at my old address. Default Judgement passed on 16/06/17. I have no trail of any letters at all to date. DCBL are requesting I pay debt of £353.53 and they can mark the file as satisfied. However, to me this is same as having CCJ and this is not an option I will accept. I genuinly was not aware of this situation otherwise I would have resolved if I knew about it. I can prove via my statement that I had money to pay PCN. Below is the information that I have collected :- 1. Court Case reference number 2. PCM UK - PCN reference number 3. DCBL reference number and amount owned (£353.53) 4. Gladstones reference number 5. Images of vehicle from evidence & sign (attached) Out of panic I have directly called DCBL, Gladstones & PCM asking how I can settle, not sure if this was right thing to do. What are my options and next steps to have it removed off my file completely? I do not want it to sit on my file for 6 years, even with satisfactory? I need to resolve this as soon as possible as I have made a house offer and now cannot get a mortgage. Look forward to your advice and any help is very appreciated! Best wishes Mindaugas

-

Hi am after some advice. About three years ago My wife and I were struggling on just my wage and running up quite a few small debts. We foolishly took out two secure loans of 12 and 14k. We have been paying these regulary. When it all started going t*ts up with the banking industry they raised the interest rate. We carried on as before but last week we received a letter saying they would probably be forced to raise the rate again as they were only a small company and borrowing was becoming increasingly expensive for them. As well as that they included a business card of a home finance company which they said might be able to help us out. It seems they are trying to force us to borrow else were and pay them off. Also can they just increase their rates when everyone else are dropping theirs. Thanks for any help

-

Hi We had a new central heating system, hot water cylinder and radiators fitted. Total cost was £14.5k We paid £2k before installation and £10k via a government loan, and have been paying the rest in instalments. Theres around £1k left. Part of the package was a check up inspection after installation. We had issues quickly. The heating worked fine and it gives hot water, but intermittently the hot water stops. We often cant run a bath. After about 2inches of water in the bath the water just stops, won't then come out of any of the taps in the house for 30 to 60 minutes. They didn't come to do the post installation check as promised and I emailed repeatedly about coming out. They didnt until 11 months after installation. They ran the bath and this time it filled, they said its probably a washer, and have refused to come back. I have chased them over and over to sort it out but they wont come out. They have chased me aggressively and threateningly for full payment. They now say how can I expect them to service it until I pay in full, and that by missing last payment I have broken my promise to pay. I'm not confident I'll ever see them again if I pay, and we'll be left never being able to run a bath. It's been a problem from the start and I have all my emails complaining to them. I have photos and videos of the tap stopping. It's a sort of stalemate and I'm not sure what to do next. I'd be grateful for any advice. Thx

-

Hello all, Wednesday 14th September 2016 On Wednesday 14th September 2016, I arranged for http://www.powerflush365.co.uk to carry out a power flush of my central heating system, (no heating just hot water), the work duly carried out, on completion of work, time to pay him for the service I requested an invoice for proof of work carried out. He said that he was going to email me the invoice and some sort of certificate for insurance purposes, I then gave him my email address, he wrote it his diary so I handed over the agreed sum and he left. After he left, I realised that I had given him the wrong email address, so I sent a text with the alternate email address and also sent an email message to info@powerflush365 explaining with the alternate email address. He has left me with my system is not working (no heating or hot water) as he explained to me that I had to purchase a new plate to plate heat exchanger as the power flush did not clear the metal particles inside it, he also promised to return and fit the new heat exchanger at a reasonable price, all I had to do is inform him when it arrives and arrange a day to fit it. Thursday 15th September 2016 So far I have no response from Powerflush, either from the text or email, I have not tried to phone him yes as he took my mobile number and keyed it into his mobile. 09:00 called Powerflush – went to voice-mail. My question is: Am I legally entitled to an invoice proof of work carried out and proof of payment?

-

Hi all i would like some advice on my next course of action. In Sep 2006 i took out a second mortgage for £16k with central trust and the payments are £237 per month over 10 years. Between approx 2008-2010 i was off sick for a while and then in-between jobs and this resulted in me falling behind with all the bills. I would sometime pay late by a few weeks and sometimes miss a month and catch up the month after. This happened until January 2011 when i paid my arrears off and have never missed a payment since. During the missed payment times i was never more than 3 months in arrears. I am doing very well now with a good job and no debt. As this loan finishes in sep next year i telephoned them to ask for a settlement figure as i have some savings now i wanted to pay it off early (couldnt wait to get rid of this company with their excessive charges), to my horror they have said when i have paid the loan up in sep there is going to be an extra £3900 to pay in charges.. ....he then said don't worry though as when the loans finished they can sort an arrangement out to pay the charges off....FUMING! It turns out the charges they hit you with every month (late payments, bounced direct debits etc) are added to the end of the loan.. this is quite bad but to make things worse they charge you whats called simple interest every month on the charges, which has resulted in me being charge approx £16 every month in simple interest. I did see the simple interest on the statements but just presumed it was the loan interest. I don't think they have been clear on this at all, i have looked back at a few statements and they don't give you a balance on the charges or even warn you that i am paying interest on the charges. So i had a quick google and it seems this company is always at it so i decided to ring them again. I told them i was disgusted by this and want to make a complaint, i said i don't feel it acceptable that they should profit from me being in financial hardship. i took a loan out, paid them interest as agreed and the loan is nearly finished, even though i was a pain in the arse for 2 years it did not cost them nearly £4000 to send me a few letters. They asked what i would like to happen to resolve my complaint and i said all the charges back and deduct them off the balance off the loan at which point i will pay off my balance with my debit card. They said they will look into it and get a manager to get back to me. At this point i thought i was being fobbed off so i phoned FOS and explained, they said they would log my complaint and send them a letter asking them to look into it and send me a final response (just to jeer them up a bit and to show them I'm serious). As he was asking for the details f the company it appears Central trust have changed name many times so he wanted the correct company details i phoned CT back (while fos was on the other line) it was the same CT operator who answered my call, i explained fos was on the other line and he wanted their licence number to send a letter to head office, the operator gave it to me and totally changed his tune. He said the manager has looked at it and has progressed it straight to the head complaints team, he said they have 8 weeks to respond but would usually do it in 4 weeks. Got my complaint ref from FOS this morning and confirmation a letter has also been sent to CT. FOS say when i get the final response if I'm happy then have a nice life and if not to send it to them and they will deal with it. 1/ Do you think i have a good case for these charges. 2/ Shall i pay the loan off minus the charges for now or just leave it collecting the direct debit as normal. 3/ After doing some research on here some people have no faith in FOS, if i don't get anywhere with CT shall i just issue a CCJ claim against CT and don't bother waiting for the FOS to get involved. 4/ At the moment i don't know the split between charges and interest, i just know its approx £3900, can i force them to send me a statement revealing this. Thanks in advance and sorry for the long post, I'm getting annoyed again just typing it.

-

In 2007 i guaranteed a limited company's hire agreement said on the face of the document to be none regulated. Total payable with interest was £26,903. The finance company are now suing me under the guarantee There is a dispute about how long the guarantee was for But that is not why i am on here posting The Company claims the Agreement was signed at a dealership - whereas it certainly was not. Im just trying to find out if they are saying that because for it to be a genuine none regulated agreement the agreement needed to be signed on trade premises. As it wasn't, does that change things and if so how? Might it give me more of a defence Might it mean the agreement is instead regulated If so, is that fatal to the claim or does it just give me more options - like rights to cancel, which seems academic, some 7 years later.. Wonder if anybody out there can please help. Thanks in advance.

-

Hi folks can anyone give advice please, I have cover with this company and my boiler is due a service, first time it was arranged for a Saturday morning between 08.00 and 12.00 they called at 11.0 to say they could not attend as they had a a very high volume of emergency call out's and they take priority over service jobs, ok fair enough. Then they kept phoning to remind me my service was overdue??, it was arranged again for today and they would be here between 08.00 and 12.00 and guess what, they called to say they had a very high volume of, blah blah blah. So reading through their T&C, as i now want to cancel, as they don't seem to have enough engineers to cover the customers they have on there books, but it say's if I cancel then I could be liable for the cost of 12 month cover just renewed in November, but if they cant provide me with the cover they promise to give then surely they are in breach of contract, and they should compensate me for having to take time off work etc. Any advice welcome thanks.

-

Well, to say I am absolutely livid would be an understatement! i've had CHC with e.on for a number of months. The initial inspection was fine apparently, and also last week someone came to fix a fault, said it was fixed and gave the boiler a pass. Lo and behold with in a few hours it broke again, no heat or hot water. Another plumber or whatever you want to call the shower of sharks came out today to repair the boiler. He took the cover off and with one look said he couldn't do the repair as it was a pre-existing fault that had been superglued. if this is the case, why was it not picked up on the previous two visits! We wouldn't know how to get the cover off for a start so it's nothing we've done. if the fault was that obvious how the hell did it pass on two visits! once could possibly be forgivable, but 2!? I've asked them to cancel the policy and refund my payments or repair the boiler, will see what they come back with. Anyone else had a similar problem and any ideas of what recourse I have - apparently they're not covered by the ombudsman??

-

Shocking service. Been told my wife who is 8 months pregnant with her first child has to go without hot water or heating for 4 days until someone can come and have a look. Apparently we/she is not a priority, and duty manager too busy to speak to us. Stick with what you know folks !

-

Mortgage Arrears and Simple Interest - Is it fair? Took out a secured loan for £10,000 6 years ago. After initial application was accepted we were offered an extra £6000 which we agreed to. At the time I was concerned that we had been issued with two loan separate loan agreements - I wasnt happy with this and voiced this to the loan advisor and was basically reassured that this was just an administration technicality and would not make any difference. He even sent me argos vouchers as a sweetner. 12 months later my husband left me and our business collapsed leaving myself and 30 of our staff redudant. I was absolutely financially destitute. He financially abandoned me and ever since I have been fighting one legal battle after another, keeping the wolves from the doors. I have single handedly paid off all our joint debts. 5 years later and I have made the necessary 72 repayments but I am left with a balance of just over £4k. This includes interest, charges and simple interest. What I need to establish is it it all fair. Loan payments where late from December 2007 to May 2008 by around 2/3 weeks. I was charged £50.00 collection charges on each loan. From May 2008 - June 2009 I could not make any payments whatsover.House was put on the market as I saw this as my only option. £50 charge on each loan per month was applied. June 2009 agreement was reached, I reinstated payments and started to pay off the arrears. Continued to apply charges, but agreed to reverse them if I maintained the agreement. April 2010, cleared the arrears. Asked about the charges and they advised I could pay them off at the end of the loan. Im now at the end of the loan and still owe just over £4k. They have reinstated the charges made from June 2009 - 2010 but no more. I have several questions: Was it fair to charge me on each loan account - I was paying £100 per month in charges? Surely there is no more work involved in chasing payment for two accounts as oppose to one account? Was the amount that they charged me a fair amount - it seems very high? Also because I have had so much information off them (in one month I had 10 pieces of correspondence) I have overlooked that they have also been charging simple interest on the charges! As a result, I didnt realise that by leaving these charges until the end of the loan period, I was still being charged interest on them. I was treated appauiling by this company, I was never shown any sympathy, in fact I almost felt bullied by their "callers" and felt that they "harrassed" me at an extremely difficult time. I responded to every call they made - I gave them every bit of information I could, but unfortuantely for a long period I could pay them no money and therefore did everything I could to sell the house. When circumstances changed for the better I offered them the maximum I could afford which included paying the full monthly payments plus a further payment towards the arrears . I was advise that it was not enough and that the arrears would have to be paid within in minimum period of 12 months. They therefore took me to court for repossesion. Thankfully it was not granted and was adjourned on the terms I had previously offere them. Despite this however there are legal fees also on my statement, which could have been avoided had they accepted my proposal. Any advice would be greatly appreciated.

- 48 replies

-

- central

- extortionate

-

(and 5 more)

Tagged with:

-

i am seeking help from anyone on the forum who may be able to help with this difficult PPI claim against GE Money and Central Capital. we borrowed a total of £183,292 remortgaged in november 2005. during a time of financial dificulties, we applied for the mortgage through Central Capital , and GE money approved the mortgage, the total amount borrowed includes paying off for 2 other mortgages. other charges on the agreement is: central capital £1,995, GE money £25, processing and completion costs £575, telegraphic tramsfer fee, £50. and Central Capital Limited£6197. Further letters from Central capital outlining the PPI details are as follow, Premium £5901.88, Insurance premium tax £295, Total premium £6197.12. it also confrim that at present interest rate the total amount payable for this insurance will be £10,389,60. I still have the PPI insurance certificate ,issued by wessex group, which expires november2010 , and confirm single premium of £6,197. I wrote to Central capital back in 2009, recieved rejection letter from them , tried to contact them by telephone ,but told at the time they were no longer in buisness . I left it took no further action. i contacted both GE money and Central Capital again in May 2012, after realising they were still in buisness with slight name change, GE money first response letter was to denied PPI is added to the mortgage, and stated i may have negotiate this with the Broker,and have recieved x3 standard letters of refusal , and directed to the ombudsman Central Trust claimed that i have exausted my claim , and stated i also will not be able to go to omsbudsman because its past the 6months limit to refer. I then decided to send a final letter of action to both, on 8/1/13, GE MONEY stated they are unable to consider the case any further , and again refer me to FOS. Central Capital -they have already investigated and do not intend to undertake any further actions, they stated that that i am free to go o the courts, and sent me their Soliciters details, they conclude that if i chose court action, they will seek to have the matter struck out as statute barred, in accordance with limitation act 1980. and they will seek to recover any legal cost they incur as a result of such application from me. Ihave recieved full SAR from both. I am currently paying £960 monthly to GE Money , and now owed about £130,000 Any one can advice me what to do next, I am vey inexperience when it gets to the Legal side.

-

hi just won 2 cases of ppi against central trust I took out the loans for a total of £22k in 2007 secured on my home. all was going well until I lost my job in 2009. for the next 12 months I struggled to make my repayments to them and fell into arrears eventually giving up and decided to sell the house. with the housing market at rock bottom in dec 2010 I sold it to a property company for two thirds its value. when I came to settle the loans with central trust I had to pay them just short of £30k which they said was for charges of being in arrears letters and phone calls. I had paid the repayments for 2 years no problem but for 12 months was in arrears I couldn't argue with them over the charges because I needed the deeds for the sale of the house on the £22k I borrowed I paid 370.00 per month for 2 years and what ever I could in arrears sorry for being long winded but could enyone let me know if I could claim back some of these charges

-

I am after some advice on PPI on a loan. I made an approach to question the sale of PPI to the loan company Central Trust in 2008 some time after the loan was paid off and then subsequently referred the claim to the FOS in 2009 when Central Trust rejected the claim. The FOS also rejected the claim as they say Central Trust was not under their jurisdiction as the loan was taken out prior to 14th January 2005. Despite this and the time elapsed I still think that I have a really solid case for a claim that the PPI was miss-sold. Is the ruling of the FOS final or do I have another option? Have rules changed that would permit me to make another approach to Central Trust or the FOS? Any advice would be greatly appreciated.

-

I insured my car with 1st Central Insurance Group knowing they had an auto renewal policy. 6 weeks before the policy ran out I received a quote from another company over £100 cheaper. I checked all the term and conditions for cancelling and followed them to the letter. I then called the company and they confirmed the policy had be cancelled. I have just received 3 emails confirming direct debit payment details, policy document and renewal confirmation. I now find this is common with them They deny all knowledge of cancellation and take an admin fee to rectify it. Take my advice - avoid this tin pot company like the plague!

-

Can someone settle this for me? My flat gets very cold in winter. It's rented, so I'm not in a position to adapt or modify anything. It's also single-glazed, with a lot of windows. I maintain that it uses less gas to have my central heating on all the time, even when I'm out, but very, very low, so that the heat gradually builds up to a constant temperature, and thus means lower bills in the long run. My girlfriend, on the other hand, insists it's better to have the central heating off at times, especially when we're out, but then whack it up to full when we come back in to a freezing cold flat. She's convinced that this means we use less gas, and is thus cheaper, overall. Who's right? Is either method better than the other, or do they both probably use the same amount of gas?

-

http://www.guardian.co.uk/business/2013/mar/18/eurozone-crisis-cyprus-bailout-savers-markets#block-514731da95cb3037f5c82a1f The only reason banks function is because of trust, this decision is crazy people are going to lose trust in the system if this plan is enforced. It's basic theft. Time to buy gold and bury it in your garden? Only time will tell but if this gets enforced I'd be very wary about keeping savings in the bank.

-

I just wanted to share my recent story regarding eon central heating care. I have bin paying for my care for the last 5 years and before my recent issues have had no problems but then never needing it i wouldnt have would i? Anyway in the middle of december(during the very cold spell) our bollier packed up it was losing pressure and needed re pressurising at least once a week untill it stoped working all together i phoned eon and was given a day in 5 days time, bear in mind we have a child of under 1 in the house(hes one now b-day in jan). This was later improved to 3 days but still along time without heating and hot water and a baby in the house. The enginer came out and couldnt find any faults with the boiler even after me telling him about the pressure isues which to me sugested a leak some where, he said the bolier wasnt working due to a saftey switch that had come into play when the bolier had lost pressure. So he switched the switch and off he went. Fast forwred to thursday 17th jan and during the night all the power goes off (i know this as our baby moniters have an alert to tell us if the power cuts) after scraberling around for a while i manage to isolate it to the boiler, so i ring eon and get sunday 20th between 8am-1pm as there next slot so another 3 days without heating and hot water. So sunday comes and we recive a text to say our time has bin changed to 1pm-8pm. The enginer turns up at 2pm and finds a leak (who would of thought it ) that is causing the power to trip he drys it all out, fixes the leak and where up and running again happy days. Well move on to tuesday night/wednesday morning and im woking agin to find all the electricty off again this time the bolier was my first thought and yet again its tripping the electricty great. So i ring eon again and im given sunday 27th as there next available slot great another 5 days of being frezing and smelly. They said they would phone me back later that morning with a better slot, so 1pm comes with no call back so i give them a call they manage to improve my slot to friday but im still very un happy about this and feel very let down by eon so this is my experiance with eon boiler care just wanted to share so other people no what they will be dealing with when using eon thanks

-

My daughter crashed her car on the 26th May 2012. She swerved to miss a rabbit hit a grass verge which bounced her into th emiddle of the road. She did a 360 turn before crashing through a dry stonewall. She is very lucjy to have got out of the car alive. The car was assessed as a write off and the assessor told her the car was worth £1100. She put in her claim to 1st Central and everything has gone well until now!! Today she received a call from the claims department to say to her that after all the deductions were made there is a payout of £0.00. Out of £1100 there was £250 excess and voluntary excess. £250 inexperienced drivers charge? was not aware of such a charge and finally they have dedcuted the rest as a balance againt the old policy despite my daughter continuing with the insurance. They have said it was due to what she owed on the previous policy? but that policy has not been cancelled it is continuing. She has on numerous occasions asked them for copies of the insurance and they have ignored her. She has no terms or conditions to check any of these things. The insurance company has told her she could view on line - but the policy etc is not available. So how can she check if this iscorrect? she has paid in premiums £520.01 and there would be a balance of £356 still to pay but she added her new car. Can they do this?

-

Hi just looking for some advice... on two things Firstly, 9 years ago, i took out a loan with sothern pacific finance brokered by central trust. The original loan amount was £5k, over a five year term. I was told that unless i took out ppi, i would not get the the loan. Reluctantly on my part they added £900 to the loan amount for this. Then, 18 months later, i made a further advance on the loan. This loan was with central trust themselves. They paid the earlier loan off which we had taken out, (inc the £900 ppi). So we ended up with a completely new loan, of £10k, over ten years. And this also included ppi. I actually cancelled the ppi some time later, but i was not told that it was a lump sum, or indeed that it would only cover us for 5 years of the loan term. Also mis sold due to the fact that i receive full pay when off sick. I have tried to reclaim the ppi. Southern pacific no longer exist, and central trust have stated that the loan with them was prior to them being regulated??? What i am trying to determind is should i take this to the FOS? Next problem.. . i contacted central trust re coming to the end of my loan term, and asking for a date when i will have finished paying. We had a period of financial difficulty about six years ago, when my OH lost his job. We did not pay the loan for three months. Central trust we aware of the issues we have, and we came to an arrangement to pay off the three months arrears. They were really accomadating, and we apid the arrears off in full within a short period of time. Imagine my horror when yesterday, i received a letter from central trust telling me that there were 10 x £185.53 payments due on the account, (which i agree with) and also the following... As your loan account has been subject to collection fees and added interest during the term of your loan, we need to come to an arrangement to clear these.... then i turned the page over to see the following.... Current balance - £ 3975.07 Interest asccrued - £47.29 Future charges - £169.05 Total amount payable - £4191.41 The following costs are also included in the settlement figure Collection costs - £1020.00 Legal costs - £543.64 Now i am no mastermind, but this just does not add up.... 10 x 185.53 = 1855.30 collection costs = 1020.00 legal costs = 543.64 TOTAL £3418.94 central trust tell me the balance outstanding, after charges is £3975.07. So, after taking out a loan for £10,000 nine years ago, with ten months left on the term, i have £4191.41 to pay. Thats nearly half of the original loan???? What i want to know is.. . does this look like a case to take to the FOS? I just feel so annoyed that they can do this, the apr on the loan was not high, and we were not advised that these charges would be made on the account. Is there anything i can do, as i just want these cowboys out of my life!!!!

-

Central Trust charge £60.00 per month on an account that is in arrears each month.Is this unfair?Could I claim it back from them?i.e by taking it off the arrears?

-

Hi All Have a secured loan with endeavour personal finance and its got PPI. we dont ever remember taking it out on the loan and at the time were in a major financial crisis so know we would have been aiming to get the lowest repayment per month possible. Called endeavour yesterday to ask about it to be told they never sold it to us a broker did called central capital. I have never heard freom them and dont have any documentation from them either. They only way I seen we had PPI is because we have just had a PPI statement from Endeavour. So I have written to Central capital requesting my credit agreement and also the T&C's and explaining that I didnt even know who they were. What do I do next? Thanks

-

Hi all, Does anyone know who Broker Central Ltd are ? I have been fighting a very long battle with my PPi insurance and the latestest instalment is that Broker Central were the brokers. I have never heard of them and cannot find anything about them. Thanks:-x

-

Hi again friends, I am getting really confused with two of my debts, but refuse to ring the numbers given on these letters... I have two debts outstanding with HSBC, one was a current account overdraft and the other was a credit card. I have been paying these off at a very low rate for quite a while now, one with MKPD and the other with metropolitan. I have had a letter this morning telling me that the debt has been referred for immediate collection with central debt recovery unit. and that I must pay the balance by 18.10.12 I see on the bottom of the letter that this is a "trading style of Metropolitan collection services ltd." Should I carry on ignoring these letters and just keep letting the standing orders go through as usual, or should I contact them. I am getting really worried now as I am getting confused as to who is getting what???

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.