Showing results for tags 'refused'.

-

I don't know if this is a question, a warning or a rant but having just experienced the worst car journey of my life, I am feeling pretty traumatised and having flashbacks of the nightmare I had yesterday. These are just the highlights. I was driving from North Perthshire to Lancashire and just as I was south of Glasgow, the car jolted and my car's amber engine light came on along with a red light with a message saying ENGINE SYSTEM ERROR. I pulled onto the hard shoulder, switched the engine off and then restarted. Everything seemed fine for about five minutes and then it happened again. The car's revs were capped at 2,000rpm and due to the road and driving conditions, this meant that there were long stretches of incline that I could only achieve 20mph. I have 'Silver' breakdown cover with Eversure/PEX (for reference only, I have included the details below) I phoned them and explained my situation but the operator refused to offer any assistance saying that my policy did not cover warning light issues. I tried to explain that it was not a just a warning light, there was an error light. I was told that so long as my vehicle could move, I had not broken down. I asked to speak to a manager and was passed to a supervisor and got the same story. Eventually, I got to speak to a manager but he just said the same although he did offer to send a truck to remove the car from the motorway for £100 but said that it would probably take an hour and a half before they arrived. I refused this because I was so outraged that I was being denied assistance and I had no way of paying it. I was told that it was standard within the breakdown industry not to cover warning light issues and kept telling me to read my policy documents (as if I had access to them right then - they were e-mailed to me and were on my laptop). Again, I tried to explain that it was an error light, not a warning light. In the heat of the moment, I said something which later realised was not true, I said that this was the first time I had ever needed breakdown assistance with any company and was disgusted that on the first occasion that I needed it, I was being refused. However, I later remembered that I had an old camper many years ago for which I needed assistance (with either the RAC or AA - I don't remember), once for a broken fan belt (the battery light had come on), once for a burst radiator and once for a detached exhaust, none of which, by their criteria, would qualify for assistance - I could have driven until the battery was flat, I could have kept filling the radiator with water and I could have carried on driving making a racket with no silencer. The upshot was that as far as they were concerned, there was no reason that I could not continue my journey, even if it meant limping along at 20mph with trucks driving three feet behind me flashing at me. Consequently, I had no choice but to drive up the hard shoulder until I reached the next exit which was Abingdon Services where I tried to think what to do. I was 190 miles from my destination. I figured that I could maybe take the back roads but no matter how I tried to configure CoPilot on my phone (strictly avoid motorways), it continued to present a route which took me onto the motorway. Eventually, I changed the satnav vehicle to bicycle and it got the message. I hadn't really got a clue where I was or where I was going. I drove about thirty winding miles along ancient bumpy, pot-holed roads linking villages and hamlets imagining the carts which passed a hundred years before me with my car juddering away thinking that I was in a nightmare that would not end. I then found an A road and after some time hit Carlisle at rush hour so it took almost an hour to get from the north to the south and heading to Penrith. Still having to stop to let the understandably impatient past and then stopped for half an hour to let the traffic calm down. In the outskirts of Penrith, at one point, the satnav told me to turn right but before I even considered it, immediately to my right, the road I was supposed to take was blocked by this: I just found the photo on a local news site. I had thought that my memory had exaggerated it. Still at the mercy of the satnav to avoid the motorway, I realised I was heading into the Lake District and followed it blindly until I saw a sign for Kirkstone Pass which, for anybody who does not know, is 1:5 in parts (20%) and by this time it was pitch black. The prospect of retracing my route was too much so I attacked Kirkstone Pass ascending in first gear at about 5mph. After a while, I then came to a turn which seemed a bit wild but did as I was instructed which led to a track crossing a dual carriageay. I followed this for a mile or so until I came to a farmyard with a locked gate. At this point, I reverted to car mode and I had no option but to go back and join the dual carriageway on which I just kept pulling over to let traffic past. Each time I pulled over, I switched the engine off and restarted it which gave me a few minutes of grace before the error came on and I suddenly had no power again. After struggling through Kendal and trying to get onto the A6 but found myself on the M6. Thankfully, by this time, the traffic was fairly light and although there were still lorries who seemed to enjoy driving right up my backside when there were two clear lanes to overtake, I eventually reached my destination. It usually takes just under five hours but I was in the driving seat for eleven. Everybody I have spoken to is outraged that the breakdown company refused to help including the mechanic who is now hopefully fixing my car. The policy document does state under things which are not covered, 'Assistance whereby your vehicle dashboard warning lights are activated, however your vehicle has not broken down and is not immobilised'. As a former aircraft mechanic, I consider amber lights to be warning lights, red lights are faults. The LCD display said ENGINE SYSTEM ERROR, which is not a warning, it is saying that something is wrong. Every web page I have looked at today says that red dashboard lights tend to mean that the car requires immediate attention. Red means stop in every language, doesn't it? I'd be curious to know what other people think. When I get home, I intend to look into getting this clarified and make a formal complaint. Information from the insurance certificate: Section 1: Basic Cover Roadside Assistance 30 minutes Local Recovery Up to 25 miles National Recovery Transport to home or destination Section 3: Silver Cover Offers the following in addition to Basic Cover Benefits: Onward Travel i) Alternative transport ii) Overnight accommodation (£75 per person, £250 in total) iii) Replacement vehicle (£100) Home Start At or within 1 mile of home address Callout Limit 6 callouts Claim Limit Max £2,500 total claims per year

- 14 replies

-

- assistance

- breakdown

- (and 4 more)

-

Like thousands (100's of thousands?) of other disabled people, I have had my mandatory PIP application refused. I had previously been receiving DLA (middle care, full mobility) for 6 years. On the decision, I was awarded 0 points for all parts. The comments made were either from an assessment for someone else, or were downright lies. I will now have my car, my lifeline to the outside world, taken off me on 13th November. I will only be receiving ESA now, but as the PIP decision says that I am capable of work, I know its only a matter of time before it is taken off me as well. I am totally unable to walk much further than the end of my garden path or driveway. I live off a main road and there is a steep hill from my home to the entrance to our street, making it impossible to use public transport. My wife works, which leaves me at home all day on my own. I have limited use of my left arm and no grip in my left hand. As I need to use a stick to get around, I cannot carry dishes, cups, pots etc. I also suffer from forgetfulness and have left the gas cooker on on several occasions in the past so I can't even prepare a bowl of soup or a cup of tea. I rang and asked for a reconsideration. I went through the different parts with the girl I was connected to, giving her the correct details on what had happened at the assessment. She asked me to get medical evidence from my GP to support the reconsideration, as thinks hadn't been asked for at the time of the application. I can't get an appointment with my GP to discuss this until 15th November. One of the worst aspects of this is that I can't even feel angry, as the antidepressants I take leave me unable to express feelings. what happens next? Has anyone on here from Northern Ireland had to go through this? What sort of waiting time is there for a reconsideration and, ultimately, appeal tribunal?

-

Hi I've ordered a leather apple watch strap from WSC - THE WATCH STRAP CO. The strap was faulty and I returned it back to them within a few days of receiving it and requested a refund. However they refuse a refund and only offer a replacement or a credit. They claim their terms of conditions clearly state that. I am pretty sure that I have a right to a full refund but I am not sure which is the applicable legislation. Is it the Consumer Rights Act or the Distance Selling Regulations? Where can I find the relevant sections? They also have a sticker on the straps that says that you can only return the item when the seal is not broken. I know this is valid for CDs, DVDs or software but I believe this is not applicable to watch straps. I spent an hour with them on the phone but they would not agree to a refund only stating their terms of conditions - which I think are void but I need the right paragraphs when I write a letter to them. Can anyone help me with the applicable legislation? How would you proceed? I am thinking of initially using resolver.co.uk

-

Hi everyone, I'm new one here and sorry for my mistakes, english isn't my first language ))) The question is about PPI claim. I moved to UK in 2010 and opened my bank account in Lloyds bank. Because of I didn't speak in English very well the lady in bank sold me Silver account and I didn't know I can have a free one. I knew only this year (2018) in April and I did complain through Resolver and than escalated to Ombudsman. Today I received the answer with refuse. They write it's too late because of it's more than 6 years from opening account date and I should receive the letter with AES (annual eligibility statement) in 2014. How do you think can I fight for my PPI money back or not? thanks

-

I have a 10 year old mortgage that was sold by Compas Finance Broker (which I paid extortionate fees added to the mortgage) that was with GE money and has now been sold to Kensington. I went through a divorce just over 5 years ago and the mortgage was in joint names, in March last year I rang GE and asked for a transfer of equity as I now have my fiance living with me and things move on, during the phone call I went through the income and expenditure and GE cleared me for the T.O.E and sent out the forms. Due to delay of completing the forms due to family health problems the mortgage has been sold on to Kensington, to persue this again I rang Kensington but was told that they didnt do T.O.E's, I had a little rant and dug out the introduction pack id received from them. In the pack it states under terms and conditions that 'there are no changes to your mortgage conditions arising from the transfer' and they also included a Tariff of Fees on kensington headed paper which clearly state 'Change in Circumstances - Transfer of equity £100.00 charge' I put in writting my request for a T.O.E and sent it to kensington to get their official stance. A week later I received a letter acknowledging my complaint ???? they sent out a leaflet that outlined their Complaints procedure that clearly stated that they only accept complaints in writing ???? no complaint had been sent, only a request for the T.O.E I sent back a letter pointing out that I hadnt sent a letter of complaint only a request for the |T.O.E, I received a response 'that they can confirm that the option to remove a borrower from the mortgage account is not available'. Now the problem is that GE went through the Income and expenditure and sent me the forms for the transfer but yet kensington state there there is no option on the mortgage to transfer.. Despite them sending me the list of fees that include transfer and no changes to the origional contract with GE. I have SAR'd GE and have proof that they went through the I&E and sent me the forms and the terms and conditions of the mortgage are very vague and brief. can this be considered a breach of contract?? Also I state that it was 10 years since the sale of the mortgage but can the broker fees been reclaimed so far back that Compas finance broker recommended we take out this mortgage and not recommending a particular mortgage for your consideration (long shot I know regarding the limitation act) Hadituptohere

- 58 replies

-

- equity

- kensington

-

(and 3 more)

Tagged with:

-

Hi, I am hoping to get some advice on this thread. Myself, my 2 children, my sister her 2 children and my mum all stayed at parkdean (Shurdale). it was supposed to be 4 nights but was only there for 2. We were in a 3 bedroom van. The first night we had no sleep due to the caravan behind us. The caravan behind was full of teenagers (No adult supervision). They were swearing shouting and screaming till 2am. We tried to call security repeatedly but could not get through. Myself and my sister went out to ask them to keep the noise down twice, but this did not help matters. The next morning, we visited reception to let them know what had happened, they said they would investigate, we went about our day. I popped back into reception on our way back to the caravan to make sure the matter was dealt with and we wouldn’t have a repeat of the night before. I was assured this would not happen. We got back to the caravan where we started to make dinner when suddenly a few loud bangs were heard. I then realised that things were being thrown at the caravan. My mum and sister went straight to reception to tell the staff what had happened. They came to the caravan where the staff witnessed a fire extinguisher just outside the caravan which must have been what was thrown. We did not feel safe and would have all driven home there and then except we had shared a bottle of wine so did not want to drive in case we were over the limit. They agreed to move us to a different caravan but only had a two-bedroom available, we decided to suffer a tight squeeze and I said it would be fine as long as a travel cot was brought for us to use, we were promised this would be fine and the security guard would bring it for us. We got to the 2 bedroom caravan about 6pm and I did notice there was some ant powder around the bathroom. Not ideal but I understand ants can sometimes be a problem. I continued to contact security until 9.30pm for the travel cot, He finally said he couldn’t find one so instead I asked for extra duvets and pillows and was going to try and make a safe place for my sister’s baby to sleep. I slept in the living on the pull-out bed with my 2 children 8 and 4 years old. I was woken up a 3am with ants crawling all over me I then spent the rest of the early hours of the morning on ant watch stopping any ants from crawling over my children. It was vile! The floor was moving! I have video evidence on this. My mum and sister woke up at 6am and we made our way home immediately. Reception did not open till 9 and we weren’t waiting around in the caravan till then. 9am I rang the reception desk at parkdean and asked to speak to the manager. I explained what had happened and he promised we would get a full refund. I wasn’t expecting anything less. I checked my bank account 3 weeks later and the money had not been refunded. I rang the reception again and was told by the same manager that we wouldn’t be getting the refund as we had damaged the caravan. Honestly, I was gobsmacked! I asked what damage and for proof that I have never been given. I asked why no one had contacted me to tell me this and he had no answer. I rang customer services and started a new complaint. went through the whole story again, I was told I would hear from them in 7-10 days. After 10 days rang them back and was told the case had been resolved and closed. No one had contacted us to tell us our refund had been refused, the staff at shurdale just closed the case. I was told that they would reopen the case as I wasn’t happy with the decision. I waited another 10 days and received a letter in the post from Shurdales general manager again they stated they wouldn’t refund. No justification given! sorry for the long story but I want to now hit them with a letter before action and I have no idea where to start? Can anyone help me? Thanks

-

Hi guys, I bought a used car last week that was described as a 'superb example' with absolutely no mechanical issues. The same day, on the way home from the garage, the engine was misfiring. It was diagnosed by a mechanic two days later and a report written. I agreed to return the car for repair having initially been refused a refund - a 100 mile journey. 20 miles into the journey the car was misfiring constantly - vibrating/shuddering. It did not feel safe to drive. I called the dealer and stated that I would like to return the car for a full refund, as we have suffered enough additional expense and stress. He refused and told me that he would not accept the car and that I was not to bring it to his garage. The car is on my drive and has not been used since being diagnosed with the fault 2 days after purchase. A letter in advance of action was sent two days ago with no reply. My question is this, do I have to physically return the car within the 30 day period? Or is it enough to have put it in writing that I am rejecting the car? Thanks in advance, J.

-

Hi, my name is Vanessa. Can please anyone give me some guidance regarding this problem that I'm going through? Please see the full story below: Last year I went to London and parked my car. I didn't have any change with me, so used the application "Pay by Phone" to pay for the whole morning car park. 12£. When I got back to the car, I had a penalty notice on the windscreen. I came home and I was sure that I had paid for it, so I appealed for it online. I thought this "paybyphone" app was something new and that the officer maybe didn't check my car plate online. I asked if you could please check their online records because I did pay for it. I'd a reply from Lambeth council saying that there was nothing on their online records and so they were rejecting my appeal. I should then wait for a formal appeal, the Notice to Owner. I checked my online records and realised that unfortunately I made a mistake on one letter of my plate, that's why they couldn't find it online. Instead of an "A", I put an "S" which is exactly the letter next to the A. My screen is broken and with the light from the sun, I didn't realise my mistake until I saw the receipt. I was waiting the notice to the owner, but I never got it. Instead, I received a letter from the Bailiffs saying that I owe them nearly 800£. I couldn't believe...I read a lot online and phoned the Traffic Enforcement Court and was advised to fill in TE7 and TE9. First thing they asked me was my address and I realised that they had my old address in their records. I filled in the TE7 and TE9, send it to the TEC and they send that to Lambeth Council. The court told me that the Bailiffs would be put on hold while the process was being investigated. I received a letter from Lambeth Council rejecting my TE7 and TE9. They said that I reply to them the first time, by writting, when I was appealing informally. After that, my address was requested to the DVLA and several notices were sent to my address and I never replied to any... Unfortunately when I moved I forgot to change my address, so obviously all the letters went to the wrong address. I phoned Lambeth Council and asked if they keep a record of the letters that were sent to me. The confirmed it. I asked to see a copy of the Notice to the Owner that was sent but the Council said "you have no right to see the letters, we send them to you once and that's it. You appealed to the Court, we as a Council also have the right to appeal against it. We have to wait for the judge to decide"... This weekend I've got a call from the Bailiffs asking me why I haven't paid yet. I told them that I filled in all the forms to the court and that I was told that the Bailiffs would be on hold. The Bailiff told me that they had no notification and that I have until Wednesday to pay everything... She also said that not changing my address with the DVLA was an offence and so I had to pay for the full bill. This started with a simple mistake made in one letter of the car plate when paying the car parking and it got so wrong and completely out of control with Bailiffs requesting me nearly 800£ to pay within days. I'm sorry is such a long text. I am so lost and stressed and I don't know where to go from here... Any suggestions or anyone that has been through the same situation please? Many thanks, Vanessa

- 28 replies

-

- declaration

- lambeth

- (and 8 more)

-

My son has a Mk 4 VW R32 ,( Fast Golf ) and as well as being a long term project in keeping it standard and in tip top condition ,it is also a money pit , but he loves the car . His latest project came about because of a leak from the sun roof ,. The leak caused staining and other damage to the head lining ,so having replaced seals to the sunroof , using the cars VIN number he ordered a new headlining , which was special order from the factory The replacement head lining material is not a match to the rest of the interior trim ,” A” posts “B” posts and sunroof inner panel etc , VWs answer is that there may have been a specification change to the head lining , and could not guarantee that if he ordered the rest of the interior trim it would match the finish of the headlining . Here is the crunch ,due special order , VW will not accept return , even though there is a mismatch with existing interior trim . There was NO indication on the official VW parts list the dealer used to order the headlining to indicate that there was a change in specification or material type ,so at present my son has shelled almost £400 for a useless part . Not fit for purpose ? or any other reason we can persuade VW to accept return. It is a awkward situation as my son has ( up to now ) a good relationship with the dealership , having bought many parts to keep his pride and joy looking its best .

-

Was called today by I.C.B..... Definitely something to do with motor insurance.. I went through 'security' and when they asked for my address I refused but give the my name and DOB... They said I have not passed security and hung up.. ha! I called Premium Credit who work with Adrian Flux to take credit payments said it is nothign to do with them (that's who I am insured by). So what do I do here? I realy don't care about my credit score because it's to pants is the whole scoring system anyway... But yeah would like to know what's up with these cowboys.

-

Hello, and thanks for reading this. I am in a strange situation of trying to open a bank account, even a basic one. At the moment I use a credit union and it works brilliantly. Unfortunately, they are restricted to a maximum of £20K. In a few months , I am due an inheritance and I need somewhere to put it. Both the Co-op and Barclays have refused, despite saying yes at first, and sending account details. Today they have rescinded their offer. Now there are some defaults on my credit file. Two are current from Anglia Water, which have a note of dispute about them. The others are old, roughly 6 years and due to drop off the file next year. There is no fraud alerts, no CCJ's, everything else is clean. In the past 4 years I have 3 loans from my credit union and have never missed one payment on them. In fact I have a sizeable nest egg that I have saved up. None of this was taken into account, only that I have defaults, and that they must be accurate because the creditor says so, and we all know they don't make mistakes. do I challenge the defaults via the Information Commissioners Office. Cabot tried to sue me over a 5 year old credit card which I fought them off with help from this site. They have gone quiet, but I am wondering if it is worth suing them for filing an inaccurate and unproveable credit report. The Co-op bank may offer me an account if I write and explain things. I did that with Barclays, but to no avail. They treated me very shabbily with broken appointments, not informing me of refusing the account after they sent the details. The alternative is a simple savings account to deposit this inheritance into. I use the credit union for my everyday banking. The account must accept cheques in $dollars, as it is from an American friend who has died and left me some money. Any help will be greatly appreciated and I will return the favour for others who may be having trouble with debt collectors and banks.

-

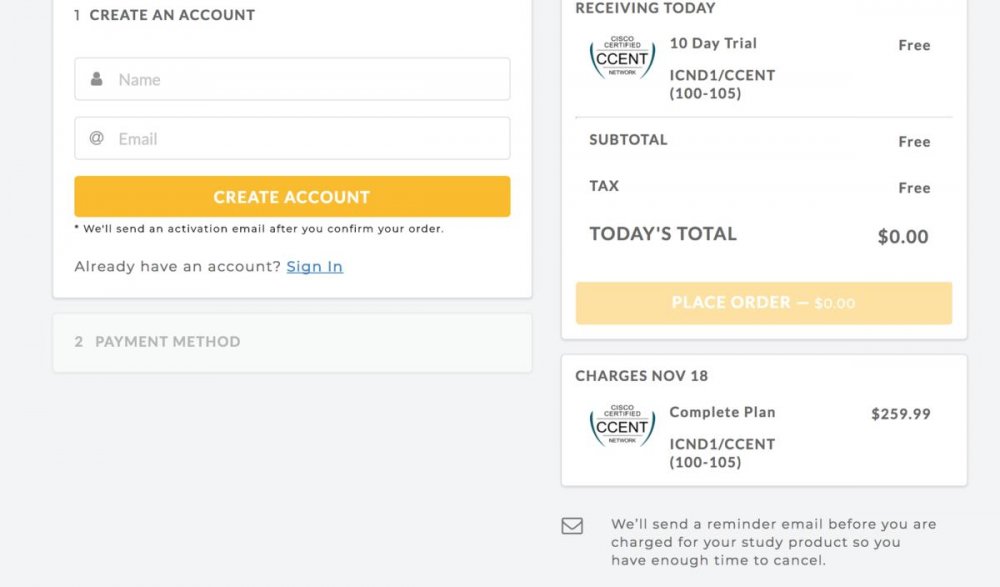

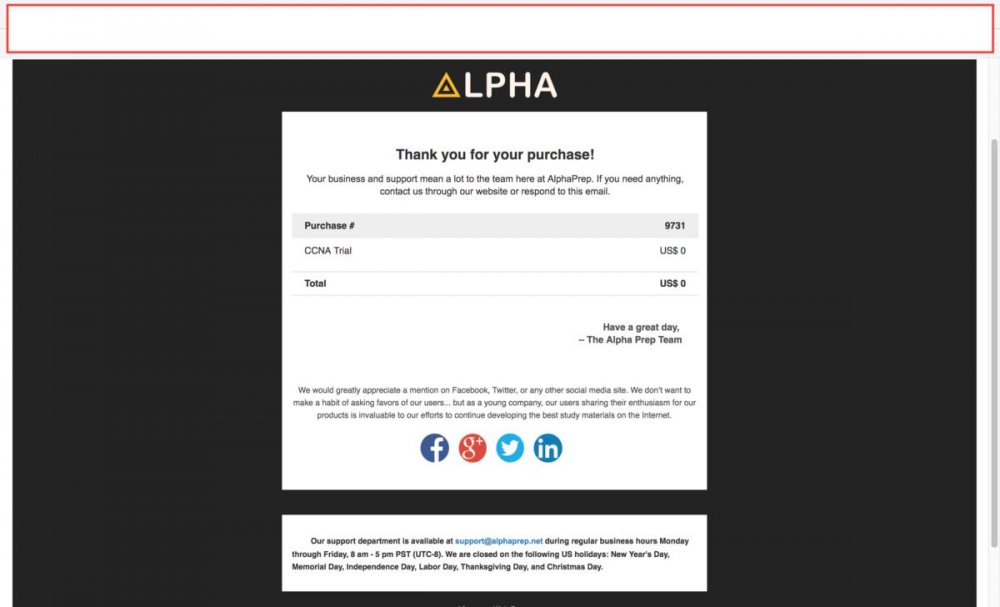

Hi all. I'm hoping someone can help me with the below please? I signed up for a trial on a website called alphaprep.net for their CCNA courses on 27th October, tried the service and didn't want to continue beyond the trial. The website informed me upon signup that they would send me an email to remind me to cancel before the trial period was up (see attached screen shot from their website). They didn't do this and then subsequently charged me $259.99 without any other notice. I have since e-mailed them to request a refund and cancellation but they informed me that they won't provide this. Can anyone give me any help on what i should do here? Should i just go to my bank and ask them to chargeback the amount? Just another note to add... I was just reviewing the original email receipt for the trial and it doesn't state anything about cancelling at all. ]

-

Hi All I bought a 2nd hand Nissan X trail on 13th January from a local dealership. On 6th February I reported to the dealer that the car was making a loud noise from under the bonnet and that the engine management light had come on. We agreed to send it to my local Nissan dealership for them to run a diagnostic check. They diagnosed the fault code as an EGR fault and said that the noise could be coming from a worn turbo. They advised replacing the turbo and intercooler. After speaking with the dealership I bought the car from, I returned the car to them to investigate and they diagnosed a worn turbo which they took over 2 weeks to replace. They acknowledged the EGR fault, but did nothing to rectify it as the engine management light had gone out. Upon receiving the car following the new turbo, the noise was still there. I reported this again only to be told its to be expected with a car of this age and mileage. Over the past 3 weeks the noise has gotten worse and the engine management light has come on again. I have had 2 garages look at the car for me in the last few days and both say that the gear box is shot and that the EGR fault is still there and the EGR valve needs replacing. I have written to the dealership rejecting the car under the Consumer Rights Act 2015, but after speaking to them this afternoon I fear that they are just going to ignore me and try to fob me off. He is all ready talking about trying again to fix it. Do I have to accept this? or is there anything I can do to force the refund?

-

Hi, received a cheque from Halifax for CC PPI from 2001-2011. Total premium paid was £2900 and they z have paid me £2200 interest. Im guessing this is simple interest when I should have argued for compound interest? Is it too late for me to pursue this any further as I have not signed anything they just sent me the cheque? I'm guessing I have missed out on a good few grand because of this as the card always had a big balance:|

-

I'm emailing in respect of Temp work problem.I have registered with an agency to work on during the weekends. I joined the agency in May and I have been working for the agency ever since.I did not singed a contract with them and all I did I sent them my Security licence ,NI,British passport ,proof of address and bank details. Everything was fine I used to receive my pay slips and get paid on Fridays.The agency hire me to work for a company to cover luxury shops and night clubs and bars in London. on the 25th of August around 22:30,I was working in a bar in London, I got a call from from the company that hire the agency and asked me to go to work on an other site.,I said to them ,that was too late and there was no agreement between me and the agency to stand by and mobilize so,I did not go .The lady who was on the phone told me that I was not get paid. for refusing to go . I phoned the person in charge on the following day and I told him what append.He told me that I was his employee and get paid by him NOT the hiring company, and if that company wanted me to be stand by they must tell at 20:00 to get myself ready.He asked to work normal on Saturday ,26th and Sunday,27 as agreed.On Saturday,26th around 22:00 I missed a call from the company that hired the agency because my phone was charging and I found a message asked me again to go work somewhere else.I found the message a round midnight and replied saying sorry the call was missed and message wasn't read because the phone was charging. I had to get paid on Friday,the 1st of September ,but I was not,I phoned and texted the person in charge ,but no answer .I emailed the agency they ignored my message. I would to mention that no holidays were paid since I joined the agency and NO contract was singed but, I have got the pay slips. I look forward to hearing from you soon.

-

I hope this is in the correct sub forum Last week I sent a statute Barred letter to Restons Solicitors for an debt that falls under the statute Barred law for an alleged debt to Capital which seems to have been sold to Cabot Financial I did not sign this letter I have recieved a county court claim from Northampton to which i have acnowleged for the same as well the day i sent this letter A copy of the letter was also sent to Cabot This morning i have received a reply from Restons more or less saying that i have sent them a "Draft" letter which purports to come from me which is unsigned and until i sign it to prove who i am they will not Acknowlege reciept nor provide any response! Should I sign the letter and send it back ? Can they ignore my Statute Barred Letter? Ive read storied about DCA making false copies of documents with peoples signatures Thanks in advance

-

Hey guys, was wondering if you could give me some advice on whether I've handled a used car situation, as after putting it off as much as possible, I've been given no other choice but to take a car dealer to court 8th December, me and my girlfriend traded in her Corsa for £400, for a Polo plus £500 cash (£900) total. The dealer checked her car, and had access to it for about 4-5 hours. I test drove one car, which broke down straight away, then test drove a similar but more expensive one, but only at 30mph up and down the local road. I refused the £50 Mot offered (Had 4 months left), as I have a very trustworthy garage that I wanted to take it to. As soon as money changed hands, the car cut out when I drove it out, to which the dealer said it was just because the car was parked on a slope and it's just the petrol and would be fine after putting some petrol in it. despite driving 15 mins back to my home, and putting in £10 petrol, the car kept cutting out, whenever going over speed bumps the car would make awful scraping sounds. when I took it to my garage they said there were two minor problems and an oil leak from the sump pan. They said the dealer illegally sold me the car, and that they would have to fix these problems straight away. Dealer argued the case, but eventually accepted that they needed fixing, and booked me into his local garage. 5 days later i took it to his garage, and when the work was done the mechanic denied that he was even told to look at the sump pan, and that he wouldn't look at that until the dealer gave the go ahead (he did fix the 2 minor problems again, contacted dealer, who reluctantly said he would book it in, to which was another 5 days away. When car was taken to garage, he kept it for a few days, and finally rang us to pick it up, but it was still cutting out while driving. due to it being Christmas, it took just under 2 weeks to get it checked by my garage (5th January) to which they said that it wasn't fixed, and that I need to take it back. Again contacted seller who arranged it for the 9th (a day after a month of having the car). On the day I was unwell and my girlfriend didnt feel safe driving the car, I text to cancel, but then the dealer started ignoring us. I tried ringing but no avail. i gave it a few days and then text him again to say that I wasn't happy with the car and would like a full refund. No response. spoke to citizens advice, who said send him a recorded letter. Which I did. But again no response, i text him saying if i dont hear back I will take it to court. Thats when he finally responded saying that it's my fault for buying a used car, and that he won't be giving me a refund and that I can take him to court but to let him know in advance. There's been a lot of back and forth between me and him, but the only thing he's willing to offer is £400 refund as he says the Corsa I traded in had a Head Gasket problem and it's cost him £480 to fix, even though I was not aware of this problem, and he had ample time to check and reject the trade in on the day. He's also listed the car without saying that he's fixed it, but is saying he's fixed pads and discs, which he never mentioned to me. I offered that he could have the Corsa for free, but the minimum I would've taken was my £500 cash back, to which he declined. Now I've applied for small claims court and am claiming over £1200 as I've had to keep the car insured and taxed to keep it on the road as I have no where else to store it I was debating whether to claim for traveling costs, as the car was bought to travel to football matches but I've had to get multiple coaches and trains on the day Do I have a good chance of winning?

-

Hello I was put at risk of redundancy , the letter said they would consider volunteers but no guarantee, was intending to leave later in the year i volunteered . had a one to one with the director and said i was interested , have worked there for over 10 years so the payout was considerable and would help with my new venture . The request was refused. There are 2 positions and 4 people , have un offically been told one of the roles is mine even though i said dont want it, was un offically told they want me to take the job as if i dont they will be forced to give it to one of the people they want to get rid of . have a very good relationship with the director who said if i stay until all the dust settles he will try let me leave before the 3 months notice is up maybe 2-3 weeks early but this wont help me much . The whole thing stinks tbh why offer someone a job who has told you they're intending to leave , also i will have to put in my notice during the 45 day redundancy consultancy period and not sure how that would work . i have not spoken to HR yet as this will cause issues but im seriously considering going to Hr . Need some advice please asap . Thanks

-

Hello everyone, I have applied for current accounts with Natwest and RBS which have both been denied (even though I was originally accepted) I want to know why they have refused me as my credit file is in good condition, no defaults etc so do I need to send an SAR? if so, is there a specific template? Any help or advice would be appreciated.

-

If a staff member bought a item from a store they work at and that it turned out to be faulty, can they still return it without a receipt? Or can the managers refuse because staff simply arnt allowed a refund or exchange without a reciept as we have access to stockroom?

-

Hi, I have read a few posts with people having trouble with Capital one not refunding PPI, but the ones with the same scenario as us are from a few years ago.. My husband took out a credit card with Capital one in 2007. on the form he did not tick the PPI box, We have a copy of this which they kindly (!) sent us with the rejection letter. They say that when he phoned to activate the card the member of staff offered it then and he accepted. Now obviously we dont remember him being asked this. He was working in the same place as he is now which pays good sick and redundancy pay so we dont think he would have said yes to PPI. Is it worth writing to ask for proof or better just to SAR Capital one for all documentation/transcript of telephone call? If anyone has had the same problem, can you advise the outcome for you? Thank you.

-

I rang the GP surgery due to having problems with the online booking system, this particular bad mannered receptionist talked down to me in a demeaming manner, telling me to use the online booking system at 7.45am in the morning. I tell her the online booking system is showing the next 3 weeks as not available to book an appointment and question her why? Her response to use it 7.45am in the morning or ring for an appointment at 8am. I tell her I can't because I'm travelling to work that time, she responds thats the only option and she gets more and more agressive during the call, like she's on a power trip. I tell her I'm making a complaint. I ring back after a few days, its the same receptionist, she takes my details (d.o.b), I ask to speak to the Practice Manager, she tells me 'We don't escalate calls to the practice manager. you have to put it into writing'. She keeps on repeating this over and over. I feel I'm getting no where and she's looking for a verbal confrotation after realising its me who and she asks "is it about the complaint against me?" I say no, but she asks "so whats the complaint about about you want to tell the practice manager or is it about not getting your appopintment within the 3 day time limit (I was given it 3 weeks later!!!) She asks "is it about the complaint against me? or about your appointment in 3 weeks time" I tell her its neither, but she keeps interrogating me over and over. Her tone of voice is aggressive, she talking loudly and I can hear her colleagues in the background. She tells me "I can't give you the practice manangers details, put the complaint in writing" and she's questioning me time and time about what issue is about (she's trying to find out why I want to speak to the practice manager, so she can pre-empt and try to cover her tracks before the practice manager receives the complaint. I can hear her colleagues in the background and tell her, she's breaking confidentiality/privacy by talking loud about my matter in from of her colleagues (she's buzzing of the power trip in front of her colleagues". She tells me I'm breaking confidentiality by talking to her in the presence of my family because she can hear them in the background!!! She tells me the call is recorded and we are not getting anywhere and she will end the call. I say her attitude towards me is bad, she's not professional and she's now talking over me, interrupting me constantly, then she slams the phone down. My health is not good at the moment and this effected my health....what can I do now to put her strong complaint in and get this receptionist dismissed because of above and she's openly discussed my issue with her colleagues and she went through my notes when she took the call, trying to find out if she could find out why I wanted to speak to the practice manager. Please help.

-

Hello Everyone, This is a piece of advise for my mother who is currently going through lots of old paperwork. Back in 1990, she and my grandfather bought a house between them, both named on the mortgage with the Nationwide. Both her income and his pensions (he was 70 at the time) were used to get the mortgage. Both had to have Decreasing Term Mortgage insurance linked to the property in the event of either of them dying as it would clear the mortgage. In 1992 my grandfather died and whilst dealing with his affairs, my mother (and I as a teenager) visited our local NW branch where we were told that the mortgage would be cleared in full due to his death. The amount at the time was circa £20000. This was a Friday afternoon and I clearly remember how relieved my mother was as this was a huge pressure lifted off her mind. Our home was secure. We had been asked to return on the Monday morning following which we did. On arrival my mother was taken aside and apologised to by a senior member of staff. There had been a mistake. Due to my Grandfathers age (72) the insurance would not pay out as he was not covered. The premiums were up to date and like I said the policy was sold less than 2 years previously. Apparently he should never have been sold the insurance policy due to his age at the time of taking out the mortgage. My mother was very upset and the member of staff apologised again stating that due to the mistake, the NW would refund the policy payments made. It was a few hundred pounds and no where near the £20000 she was expecting to be getting paid out that day. And that was that. Back then with no internet and my mum was a lay person, she took what the NW said at face value. She was a long standing customer 15+ years at the time and trusted the staff to know what they were saying - even though they had messed things up big style when selling the policy alongside the mortgage less than two years previous. Ive tried looking online but to little avail as this seems quite a rare instance nowadays. Can anyone advise as to the best way to try and gain some redress with this issue please? I think it was handled appallingly and NW should have swallowed the mistake back then. Thanks.

-

Hi guys i really need your help i have a property which i have rented out through agency. Everything was fine until feb this year. I wanted to sell this house so i gave section 21 noticeon 15th Feb to end agrreememnt in May. this is more then enough notice from my side. since then tennents did not pay the rent. also i wanted to take pictures of the house for sale purpose. i gave 1 week notice to tennents that i will be attending the property with professional photograper. tennents did not communicate with me. so as planned i went to the property with letting agent and photographer. While we were taking photos one man entered the property and claims that he lives here with his wife. he had driving licence registered on same address. There was only 2 ladies registered on tennecy agreement. This man stared to be aggrasive and abusive towards us. We have to call police to get him out of the property. yesterday i had a meeting with my tennet(lady) along with letting agent. She clearly not intrested to pay the rent. She wants me to evict her through court. The tennency was for 2 ladies and 2 kids. But looking at the state of property its seems there are more then 6 ppl live there. so... thats the situation i am in. I would much appriciate your help/advise in this matter. Thanks

-

Hello everyone I hope your all having a good day, I have been sent a few demands for payments in a letter from Lowell portfolio in regards to various debts they have acquired. The letters are threats, demanding for payments and are asking me to phone up and arrange a payment. Today I rang Lowell ( I know, I know) and asked them for over an hour which I have recorded with their knowledge to send me a ''bill'' with a giro slip / cheque / remittance form so I can remedy the accounts they have refused to send me a bill with the remittance / giro form on the bottom. They have said they will send me some sort of acquisition letters and how much I am alleged to owe and their bank details to make payments to, I have no idea if this is the same as a bill but I'm sure its not and after an hour they have point blank refused to send out a ''bill'' so I can remedy via giro credit and said they will only send out an acquisition letter and I can only pay via credit card. I told them that I can not pay a debt without first receiving a bill which in my world would only seem fair and that by refusing my payment offer and refusing my request to send me said bill they have now null and void my debts. They said that they would still come for me for my debts and put the phone down. I'm just wondering what to do now as I haven't got an actual bill to pay the debts just some dodgy threatening letters and they have refused to accept my offer of payment through giro bank credit. I'm just wondering what to do now as I do really want the bill sending to remedy the accounts , do they have to send me a bill or is a demand letter or an acquisition letter classed as a ''Bill''. By refusing my offer of remedy and refusing to send me out a proper bill have they just null and void my debts. Any advise would be greatly appreciated on what to do next as I will not pay via card or debt. Many Thanks BB a4v

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.