Showing results for tags 'collectors'.

-

Has anyone dealt with debt collectors and had success in reducing the interest / charges removed to pay for the actual debt. If you have I could really do with some help as have some bad old debts that just keep resurfacing and now need to face up to them and arrange to settle to become debt free. Any help would be really appreciated.

- 4 replies

-

- collectors

- debts

-

(and 2 more)

Tagged with:

-

Hi all, both myself and OH have got ourselves in debt and are receiving threatograms from various DCA's. We could borrow from a relative and pay these off but would rather not pay a DCA. Could someone be kind enough to check this CCA doc my hubby received from Moorcraft? It's a Halifax Loan which was taken over by Moorcraft. He has tried contacting Halifax but they have told him to deal directly with these people. Moorcraft has placed his account on hold for 14 days. Any advice would be very welcome. Thanks as always scan 1.pdf

-

Hi - I have also received two sets of letters from ZZPS, relating to parking notices issued at Brighton University on behalf of Ethical Parking in October and November 2015! Whilst I remember receiving the notices and not really doing anything about them (I've checked back over old bank statements to see if I paid them - and I didn't), I have not received any correspondence since then. Same address and same car as the date of the original PCNs. The only thing I think that has happened is that these letters have been sent to me since I recently parked in the university car park again on a weekend when it is free for a particular event. I assume the cameras picked up the registration plate and it has triggered some kind of recall at 'Ethical'. I received one set of letters at the end of April 2018, and ignored them. I've now received two more. ZZPS are claiming that if I do not pay within 14 days they will pass this to QDR Solicitors. Both letters demand £130. Do you think it worth ignoring them still - there is no mention of a fine but of an 'outstanding debt'? NB: During the time of the original PCNs, I was a student at Brighton University with a valid parking pass. The two incidents relate to my apparently being parked in one parking area which I wasn't entitled to, and the other to being 'parked in roadway'. The latter relates to my squeezing my car into a space in the car park which wasn't intended as a parking space, but as there was no other available and I'd seen others do the same, I decided to park there. It's odd that they've suddenly decided to pursue this but I wonder if they are purging their database of unpaid PCNs or they hold them until a certain point then escalate it? This is my first post on this forum, so apologies if I've hijacked any one else's but thought if might be worth adding to this, as it seems like ZZPS may be purging their database of unpaid notices and perhaps just seeing what they can get. OR is there a shelf-life on unpaid PCNs and subsequent debt collection before it has to be escalated? (doubting that last point somewhat).

- 15 replies

-

- collectors

- ethical

-

(and 1 more)

Tagged with:

-

we received a letter from this gang and we are unsure if it may well be SB whats the first step in getting out a CCA to someone i am supposing we don't speak with them direct thanks in advance rway re BC Egg card.pdf

-

I received a letter in January this year from 1st credit, I replied with a request for CCA. They have now after 4 months written & said that M&S have now the original debt back & Ist Credit will not communicate further (I thought these companies buy the debt,then sell on etc) By same post there was a letter from Intrum, again I will ask for an original copy of the credit agreement. Then a really curt letter from Rostons solicitors, re another small debt. This letter states that I MAY NOT ask for the original agreement. These debts came about when my husband became so ill that I had to retire from full time employment, he is also in receipt of enhanced PIP. These debts have been sold/re sold resulting in letters from various debt agencies claiming to own the debts. Is this correct that I can no longer request a CCA? also please can you advise me if it is only because the debts are into their 6th (or more) year that I have all this activity? Many thanks

- 7 replies

-

- activity

- collectors

-

(and 1 more)

Tagged with:

-

Hi, I was a victim of identity fraud in around June 2012. "Someone at the time took out loans in my name with quick quid and lending stream". It was a lot of hassle at the time ( I went through the police action fraud, recived a crime number and after a month or so I signed a couple of letters from both companies and the matter was cleaned up. I also opted at that time to put extra restrictions on anyone else trying to fraudulently take out any more loans in my name. "Let me just say that I have never ever applied or taken out any loan in my life other that a mortgage for our home that is now fully paid off". back in June 2017 I started receiving letters from MMF motormile finance now Lantern, stating that I owed them £250 for another loan from what turns out to be taken at around the same time as the other loans in 2012! I phoned them straight away and explained what had happened. But all this did was for them to send demanding letters on a weekly basis! I forwarded the police action fraud crime number from 2012 thinking that that would be the end of the matter. But all they do is keep sending me more demanding letters. Are these people above the law or what! They keep asking for very personal details e.g bank statements from 2012, my national insurance number, payslips, photo id from a passport or driving licence. I'm sure it would be reckless to send such sensitive information to a bad debt collecting company! (Do they cover their costs by selling on this very useful and very accurate information to third parties?) It would be very lucrative if they did as they would have all the information to take out a loan in my name!! What's going to happen in another few years, Am I going to get demanding letters form another bad debt company?? As much I want to clear my name I am very sceptical about about how they would use that information. I lay awake at night worrying myself to death, I am frightened about what they might do. I have been to Citizens advice bureau who just say go to police action fraud! its bonkers. If a company doesn't accept a police action fraud number and the evidence from the time of the identity fraud then they are surly acting above the law!

-

Hello I would like some help please. I was a member of virgin gym, I cancelled my membership in March 2017. In April/May the gym became David Lloyd Gyms. I was contacted by David Lloyd in September to say I had 3 months gym membership fees overdue. I told them I cancelled my gym membership in March. They then passed me on to a debt collecting company called ACE. They kept calling me and told me the amount I owed had increased. I told them I cancelled my membership in March. They said they would investigate. After 8 weeks or so, ACE called me again to say they had proof I had used the gym in July and that If I paid 1 months membership fees and their costs on top then the debt would be cleared otherwise they were going to get a CCJ against my name as I am a homeowner this could affect my mortgage etc. I panicked and paid them the money even though I struggled to get it together. The amount including their fees was £125 I've had the feeling that I have been conned ever since. Could someone please tell me how or if I could try to reclaim that money as I am 100% sure that I cancelled my membership and should not have had to pay anything. I am going to contact Virgin Gym to confirm if they have any records of when I cancelled my membership. ! If they do, can I request it in writing? Would I then just contact ACE with this evidence and ask for my money back? Or do I need to contact somebody else? Whats the procedure? If I should write a letter could someone help drafting it? The debt company said they had proof I used the gym in July but I didnt as I have never been back there since it changed to David Lloyd. Can I request them to send me this proof and if so how? Am I able to do any of this or will the fact that I already paid them mean its too late? I know I should have done all this before but at the time I knew nothing about this, never dealt with a debt collector before and panicked. Since then I have spoken to few friends and work colleagues who have given me advice on the steps to take mentioned above. My english is not great I have asked my friend to type this. I hope someone here can help me and guide me in how to reclaim my money because I know they have conned me. Thank you.

-

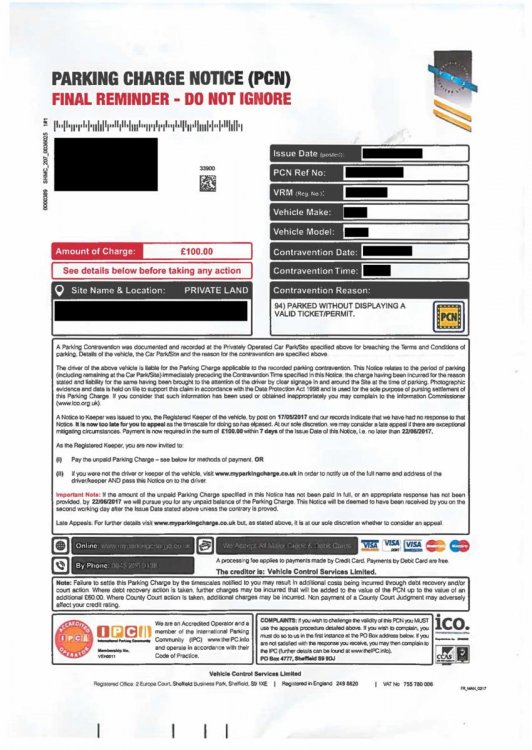

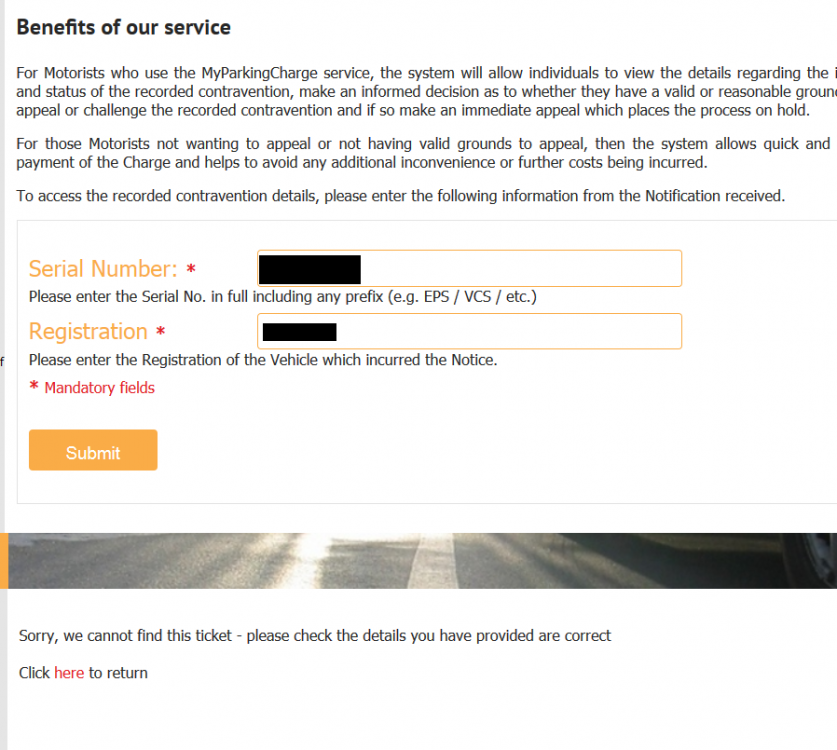

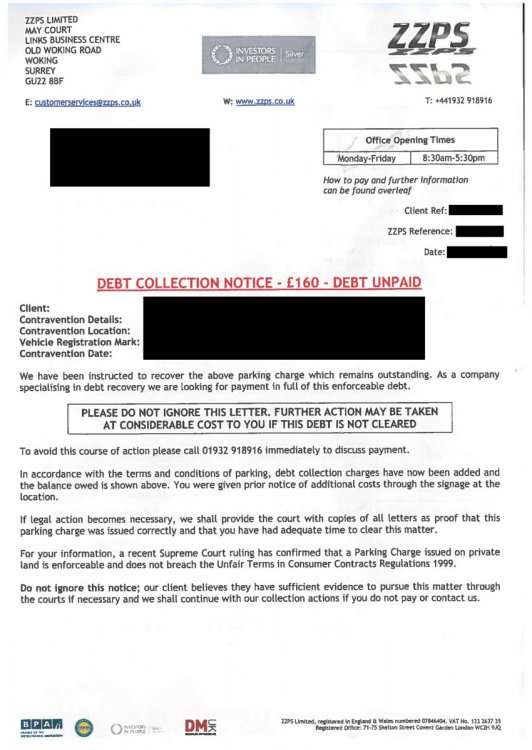

Hi all, First time here so please let me know if anything in this post should be changed. Backstory: I was in Bulgaria on business in June/July and had no knowledge of my PCN before leaving (turns out my mate moved my car out of his drive into the parking area for a couple hours where I received this PCN). Upon arriving home I find two letters, one being a final reminder sent mid June by VCS and then a debt collection notice sent by ZZPS in mid July. As I was out of the country and couldn't access my mail, I had no idea any of this was happening in my absence and had no chance to appeal the ticket in the allotted 28 days. The ticket was for £100, to be reduced to £60 if paid within two weeks and is now at £160 due to the debt collection agency add on. I haven't received any other letters regarding this claim. What I've tried: I have tried to go through the various appeals process, but when searching my ticket ref on the provided websites (namely myparkingcharge.co.uk as noted at the bottom of the VCS letter and the IPC website itself) it comes back with nothing, meaning that I couldn't have appealed it regardless. I even tried POPLA, and they can't find the ticket either. After contacting an ombudsman, they suggested to complain through the companies. VCS said that it was to go through ZZPS as they now were in charge of the debt , ZZPS replied as follows: "We must inform you that you have now passed the time frame in which an appeal can be made as appeals can only be made within 28 days of the Parking Charge Notice being issued, our client maintains that all correspondence received has been actioned accordingly and that the correct procedure has been followed. The balance of £160.00 remains payable on our systems, please refer to the back of our letter for the payment options available to you. In the absence of payment this matter will be referred to solicitors to resolve and further fees may be incurred." What do I do? If none of the appeals agencies even agree that the reference number matches any ticket, has a ticket even been issued against me? The collectors are refusing to provide evidence. I am not exactly inclined to pay this "debt" until the relevant parties prove their claim. Any advice would be appreciated as I feel like I'm about to get strong armed out of £160 Attached are the letters received, along with the website response when I search the reference. Personal info along with refs blacked out for obvious reasons.

- 10 replies

-

- collectors

- come

- (and 10 more)

-

Dear All First of all, thank God for Forums like this and people who care enought to devote precious time to assist others in debt. A Debt collection firm, issued a claim, the progress of which was halted by a CCA request. It has finally come back, after a year following request, with what appears to be a copy of a signed agreement and t&cs and statement of account. Amount seeking is over £3,150. Can't claim time barred, owing to previous payments. They say they can proceed to seeking judgment unless payment arrangement is set up. They trade under three very very similar names. The claim was issued under a name the authorisation of which by the Regulator has now lapsed. Should I give in and set up arrangement? Can I apply to dismiss their claim? Should I request copy & details of assignment or ownership of the debt? Can they come back and reissue a claim under one of their authorised names? Please tell me what option I have. Very grateful

- 16 replies

-

- cca

- challenging

-

(and 5 more)

Tagged with:

-

Hi all, My dad has received a letter from Wescot demanding payment for £313. Apparently they are working on behalf of Natwest retail finance. My dad had an account with Natwest which they themselves closed approx 4 years ago. As far as he is aware all monies were paid and account was closed. After 4 years we receive a letter demanding £313? There has been no previous correspondence regarding this alleged debt. We have been to Natwest but they wont help us. I emailed Wescot asking for more information regarding this alleged debt. They replied asking for my dads DOB and previous address for "security reasons" . What do you think i should do? We have no knowledge of this debt. Tnx all!

-

Hi all Wondered if anyone could help or offer some advice as I am in quite a stressful situation at the moment and this forum has been very helpful in the past. I was recently involved in an accident on the 5th April 2017, I am technically at fault as I went into the rear of someone at around 15-20mph, put Pedestrians went to cross a zebra crossing and the car on approach slammed his brakes early in realization of this and that forced the car in front of me to slam his and I was unable to break in time leading me to go into the back of this vehicle. Aside from me asking if we can handle the incident privately he still decided to claim through insurance after agreeing with my verbally to handle it privately. My insurance (Insure Your Motor) has an excess of 3k, they will not ask me for whatever the estimation is below that and ask me to pay as I am at fault most likely... I am worried as I simply cannot afford any of these payments in my current situation and just wanted to find out what the following steps were. Do they get debt collectors to try and retrieve this... Is there any way feasibly right that I can somehow not have to pay such a ridiculous excess or is there any way I'd be able to get my way out of the debt collectors at a later stage? I had no other choice but to go with these insurers with 3k Compulsory excess as every other price at the time was above the £300 figure a month and this one was £247 monthly. Any help or advice would be appreciated Apologies for the essay Kind Regards

- 170 replies

-

- collectors

- excess

-

(and 3 more)

Tagged with:

-

Hi Please can I have your advice. I registered a business with hmrc, due to one thing and another I never actually started this business, didn't trade 1p. Long story short, I've moved address and now I'm being chased by debt collectors for money relating to this! I wasn't aware I owed because I didn't trade but because I told them after tax submission date I now owe NI and fees Pastdue want £221.10 in NI Advantis want £2656.95 for non payment of tax. Now, I understand you can't swerve the taxman or his henchmen but I'm in no position to pay anything but £5. My situation is I'm now a single mum, no support, can't work as no childcare and parents too old/ill to help. As I've literally started from scratch I had to borrow to move and buy furniture, I'm paying my known/current debt off but it literally leaves me to manage a shoestring budget for myself and my 18 month old. I really do want to sort this as im also trying to build my credit rating for the future, so when I can go back to work I can make a better life for us. My problem is I'm scared of contacting them and this opening the floodgates for them to pressure me to pay more than I can afford. I can only afford £5 a month. How can I go about agreeing such a small repayment with them? Can I send them a standard letter setting out my budget/situation. Would citizens advice help? I'm getting very worried as they're sending harsh letters and I really don't want a ccj. Thanks

-

Hi all just wondering about the doorstep collectors using their own cars and if standard insurance will be enough or will they need something like hire/reward policy. sorry if this has been asked before.

- 3 replies

-

- collectors

- doorstep

-

(and 1 more)

Tagged with:

-

Hi I lived in Norway for 6 months last year and have just received an email from a Norwegian debt collectors stating that I owe £1100 for unpaid electricity bills. I had no idea these bills existed so didnt pay them and hadnt previously been contacted whatsoever. I was in Norway on a tourist Visa so I wasn't registered there, all they have is my name and email address. I dont even think they know im English or where I'm from. Do you think I should contact them and explain the situation or just ignore? What are the possible outcomes? Thanks

- 7 replies

-

- collectors

- contacted

-

(and 2 more)

Tagged with:

-

i wonder can anyone help me? i had notice of court action from lowells debt agency for an alleged debt of capitol one dating to 2012. this happened around mid september ..i subsequently complied with the court procedure but have asked for proof of debt plus a cca. . i seem to have received . . a statement of the account.. from capitol one... but nothing else.. here is what they say has been enclosed... it says "statement and notice of assigment received from client. agreement and default notice been requested... ..with respect to Deed of assignment . this is an agreement between our client and the original creditor containing confidential information. .. and you are not entitled to the information contained in it".... As stated, i requested a cca ... and now. . the court want me to mediate with these people.. but as i say ... i wrote stating .. only on the requested documents being produced... what should i do?

-

Hello, I am in pretty desperate need of advice! I rented a unit to use as a photography studio around 18 month ago. When I looked at the unit, there were a few leaks, which the landlord said he would repair, but never did. I carried on paying rent, but not using the unit as a studio, more of a storage space, as the leaks prevented me from having my equipment set up. Fast forward to December (my dad was incredibly ill and passed away in the August of last year, so all of the unit leaking and not being able to use it went right to the back of my mind) the landlord gave me a polite reminder that my rent is due. I, again, politely reminded him that the unit leaks and nothing has been done about the leaks since I'd been there. He apologised and told me that I wouldn't be paying any rent until he'd repaired the leaks. I then spoke to the landlord in July, him asking what was happening etc. and whereabouts the leaks are etc. so he could get them fixed. I explained that I don't use it etc. and most of my work involves me working away (or I use my garage as a small studio) and I wouldn't be back until mid August. I then start getting messages from the landlord saying that I'm owing the full missing months of rent, from the last time I paid in December. I received a letter the other day from a debt collector company saying that I owe the landlord £4248, which is the 10 months rent (£400/m) plus a late payment fee. The guy was friendly enough and I explained the entire situation and he appreciated that I as clearly not trying to rip them off etc. He said that as it's a commercial property, the fact the landlord told me not to pay until he'd fixed the leaks was completely irrelevant unfortunately. The unit still leaks next to the 3-phase 415V main fuseboard, so as far as I'm concerned, it's a death trap and I could never have clients into the building etc. He said that even though the landlord had said that (not paying rent etc.), I was still responsible and if anything, should have had the roof repaired and taken it out of the rent. Where do I stand? The chap I spoke to said the amount may be negotiable, but to be frank, I feel that I shouldn't have been paying full rent for the period that I was, let alone for the period that he told me not to pay through. I fully appreciate that although the guy I spoke to was very friendly etc., but is obviously working for the landlord and not myself, so there is going to be an issue of him biasing towards their interests and not my own. There's just no way I could afford to pay that figure, it's hard enough working as a freelance photographer at the best of times, let alone paying rent on a unit that's been unusable since I got it. Where do I stand? If anybody has anything impartial to say, that'd be great and thanks in advance. Sorry for long post.

-

Hi, Just wondering how can you be traced where you live in the UK?

- 18 replies

-

- collectors

- find

-

(and 2 more)

Tagged with:

-

First of all, thankyou for being here. Your advice to others about RLP really supported me during the past year. About a year ago I was accused of shoplifting in Tesco while using the shop and scan for my household shopping. I didn't intend to steal but I accept that things were in my trolley that I hadn't scanned or paid for, and my only excuse is that I was having extreme anxiety and depression problems at the time, and my mind used to wander, esp while shopping. I was detained in the back for 2 hours while they waited for the police, eventually they were told the police were not interested, and I was told to sign this RLP form which I refused to do. I was banned from the store for 6 months. We phoned Tesco the next day and were told that they were not pursuing the matter, I got some medication sorted out, and am now much much better. I now shop online and have never set foot near Tesco again. About a month later I received my first letter from RLP. I found this forum and followed the advice to ignore, so I did. I got about 4 letters then nothing this past 6 months or so. Have now received a letter from a debt collection agency "Capital Resolve" asking for £171.48. They seem to be legit from their website. They have named as their client "RLP on behalf of Tesco". What do I do? They want a response by 5th July.

- 9 replies

-

- collectors

- onto

-

(and 2 more)

Tagged with:

-

Hi, I am new on here but hope that you may be able to help me. I have uploaded the letters that I have received from Robinson Way, the said debt goes back to 2005, I was making payments but all stopped in 2008. I have not heard anything neither from Tesco Personal Finance or any other agencies up until now. Can you advise me on how to deal with this? Thanks in advance.

-

Hi All, In October 2013, I moved into a shared property in Norwich as a student sharing with 3 other guys. I organised/paid the bills and they all paid me. In August 2014, we moved out of the property. We had paid monthly to First Utility and had overpaid on our final bill. I had to chase First Utility and eventually they refunded me £350 (not sure to the penny as was a few years ago and I don't have the bank account anymore). However, during this chasing, I was told that I also had a £400 (ish) credit on my account and would refund this as a cheque. I did think this was strange, however, didn't keep a close tab on the bills and presumed this was right as they had taken the previous refund into account. Both refunds eventually processed and in my bank account. Move forward 16 months, in December 2015 I started receiving texts from First Utility telling me my bill was 400 days overdue. I ignored these texts, but tweeted them asking for them to stop texting me seeing as the account had been closed and finalised. I then got a call from a Complaints handler who told me that the second refund was in error and that I now owe them this money back. After repeating to her that I will not be paying this back, as it's been over 12 months and this is their fault, I was then told it would be passed onto a debt collection agency. Yesterday I received a text from CRS Debt Collectors telling me that they had been instructed by First Utility to resolve an outstanding matter, and to contact them with the reference number. Obviously I have not contacted them, but now am not sure where to go to... Luckily, First Utility do not have my current address and therefore I believe the chance of CRS turning up on my doorstep is minimal. And I know that they have no legal powers and to send them away. So in summary... - First Utility refunded me 2 different amounts (why they were different we won't know), one after the other. - First Utility are now trying to claw back the second refund even though it was their fault. - First Utility have my phone number and e-mail address, however, have not tried to contact me between August 2014 and November 2015 about this overpayment. - I am refusing to pay this back. - CRS have now been instructed to collect this from me. What do I do??? I would send them a letter but I am loathed to give out my current address.

- 15 replies

-

- â£400

- collectors

-

(and 2 more)

Tagged with:

-

Hi, My mother called me last night, she had a phone call from a collection agency that's she's been dealing with, and paying. She makes payments online, and it wouldn't let her, instead saying she had to call. The guy on the line said they couldn't take any money without getting full details of her finances. She refused, saying it's none of their business. They say they can't take any money, as by law they need to get these full financial details. She again refused. The guy said it was to make sure that she is not paying more than she can afford. she retorted with "are you a ~@~ idiot? do you think i'd be giving you it if i couldn't afford it?" Her question to me, was is this a legal requirement? I said i was 90% sure they were at it, and that a letter of complaint about this both to the agency, and the regulator, should be the next step. I've advised her to answer everything they say on the phone with "this is what I'm giving you, take it or leave it" just to make sure of the 10% unsureness, can anyone confirm that this is in fact not a legal requirement? Thanks,

-

Hi, I'm posting here because first utility supplied my old house (I have since moved). They made an admin error on the final bill, and ended up sending me 2 cheques for the final balance (their mistake not mine). They sent me a few emails saying "you owe us money for your SUPPLY (not true, it was their error) please login and pay". when i logged in, their website told me "you are no longer a customer so cannot pay us anything". The value in dispute is £70. I did give my forwarding address but I'm guessing they've lost it. I have a disability which prevents me using the phone, so I had no other means of getting in touch with them to explain their error and make payment, so I decided not to bother. First utility threatened me with a prepayment meter (they clearly didn't check that it was a final bill, I've moved so they can't legally fit a prepayment meter). Then the debt collectors. All the debt collectors do is text me, trying to get me to call them by saying we can negotiate a reduction in the balance etc. I block all the texts as i receive them. My question is how long you all think they'll keep going, or if I should keep fighting, given that I did try to login and pay firstutility, and that it was nothing to do with a supply, and it was their admin error. Many thanks in advance for helping me with this

- 3 replies

-

- collectors

- crs

-

(and 1 more)

Tagged with:

-

Hi everyone, I'd be grateful for any advice you can offer: Plusnet offered terrible service so I reported them to CISAS. CISAS ruled that a) plusnet had to pay us £250, b) get our services working and c) if we decided to leave were not to charge us for any outstanding contract charges. We did decide to leave and in Dec 2015 I received an email informing me I needed to pay a final bill including outstanding contract charges. I responded asking for an itemised bill by post, and pointed out that they were instructed to not charge me for outstanding contract charges. I never received a response to this email, nor an itemised bill. I had prior to December been 'locked out' of my Plusnet online account so I had no means of checking the bill. Early Jan 16 I received another email from Plusnet- again, informing me I needed to pay a final bill including outstanding contract charges. I forwarded the initial email I had sent in December, again asking for the same information. Last week I received a letter from a debt collection agency on behalf of Plusnet. Plusnet have proved themselves to be utterly vile; they know I have a disabled son who suffers from anxiety and they - for many months - would instruct engineers to just turn up without any notice, even though I informed them of the problems this causes, and CISAS ruled in our favour over this issue. I have emailed CISAS with this information but wondered if there was anything else I should be doing and would be grateful for any advice. Thank you.

- 1 reply

-

- cisas

- collectors

- (and 4 more)

-

Hi all! I have been reading through alot of threads to gain info. We have a problem with a builder, who was supposed to do approx £27k of work on our house. I will keep details sketchy as I don't want to identify ourselves. he was a cowboy, didn't do the work as he was contracted to do (we had no written contract, but the Surveyor had specified what needed to be done and how and the quote referred to "all works as detailed in the surveyor;s report). To cut a long story short, he has had two attempts to fix the roof, and has only made it worse both times, and it is now falling apart instead of renovated. We will have to completely re roof it now as its not viable to try to fix it anymore. There are other jobs that were done and also all wrong for varying reasons. We had taken legal advice, had the original surveyor in twice to assess the property and works and draw up a scotts schedule. The work he has done was considered as £0 value due to not being what was supposed to be done and shoddy work. The damages to our property soar at over £60,000, certified by both the FRICS surveyor and conservation. Including legal expenses and other fees the claim against him will be over £70,000. He has chased us with 3 debt collection companies so far, one whom sent out a Liverpool gangster to deliver a Statuatory demand against us to try to bankrupt us. I have proof of who he was, as for some reason when I explained what the builder had done to our house, he claimed to be a "surveyor" and told me he could survey the damages for us, and wrote his number and name down. When i googled him and found his image and name I found out who he really is. -none of the debt collectors have been told by him its a disputed debt. -The first debt agreed to wait until a certain date to get the scotts schedule and evidence, but before that date came around, the next was pursuing us vigorously. -The second debt collector refused to contact our solicitor despite being told to only converse via him and repeatedly texted us and phoned us saying they were going to bankrupt us. -Our solicitor tried to call them but his calls went unreturned and he had to email them to ask them to desist harrassing us and only converse via him. -Then they sent letters threatening SD against us, and when contacted AGAIN by our solicitor for continuing to ignore the direction to speak via our legal advisor, claimed they never received his "letter", (even though it was an email!) -We forced them to set aside the Statutory demand, by furnishing the evidence and he was dropped like a hot potato by the bulldog debt collectors and that was the last that we heard from anyone for approx 8 months, until we got a letter a few days ago, from yet another. -I have recording software on my phone so made sure i used it when I called this debt collection company. We haven't got the solicitor involved again as yet, as we don't want to part with yet another £500 to get rid of these guys. I had a list of qurestions which i calmly repeated: "has your client told you this is a disputed debt? -has your client told you that you are the third debt collector he has gotten on to us? -has he told you he issued a statutory demand against us which they had to set aside when the evidence was furnished -has he told you we have proof of a £70,000 AGAINST HIM? etc... She said she didn't have a record that he had told them it was a disputed debt but would get the case manager to call us back, which hasn't happened yet. -Also I'll mention the claim of monies owed started at around £15,000, and each time the amount has changed and risen and now he's claiming theres over £25,000 outstanding, which is absolute balshovic! He's just making up amounts and doesn't actually KNOW what the actual amount would have been had he done a satisfactory job. Our solicitor said should we take this to court we must be aware it will cost us at least : -£2500 filing fee with court -£10 - 15,000 of solicitor, barrister and court costs in the year it will take to get to court, and thats before the case is heard. The evidence is overwhelming and I feel we would blow him out of the water should we try the case, but our solicitor is concerned that we will get a win, but get no funds out of him as he doesn't really have company assets the tracing agent could identify, and the company has a £150,000 debt against it. ..The only upside is, he said the banks wouldn't let a builder run up such huge amounts of debt unless they had it secured against something , and we know he has a property worth at least £600,000 in his personal name, so should he not pay, we could seek a winding up order of his company, which couldn't happen until he repaid the banks , and if he didn't have the cash to pay the debt, they would force him to sell his home, so he most likely would then be forced to pay us to avoid losing his home. So we are not sure whether its worth losing yet more money trying to take him to court, but until we take him to court, how do you stop him constantly harrassing us with debt collector after debt collector? I feel he is just trying to be a nuisance and waste our money on solicitor fees endlessly as he knows he has no hope of getting any more money out of us. I called citizens advice bureau, but they said there is nothing they can do as its not a small claims case. Each time he does this, we have to answer to the debt collectors and waste more money-surely there is some way he can be stopped from doing this? He is purposely misleading debt collectors in order to get them to take his case by not disclosing the facts.

- 26 replies

-

I got a MET Parking Fine for spending too long in McDonald's back in June. I rang McDonald's who said they'd sort it. Heard nothing back so rang them again and claimed the conversation never happened. I appealed with POPLA because I felt £100 was excessive for a free car park especially at midnight when my car was the only one in the car park so there were no losses. This was rejected. And now I've just got a letter from the Debt Collectors. Should I just ignore?

- 11 replies

-

- collectors

- mcdonald

-

(and 1 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.