Showing results for tags 'ref'.

-

Name of the Claimant ? JC International Acquisition LLC Date of issue 20/09/2017 The particulars of claim state: 1,the claimants claim is for the balance due under an agreement with talk talk limited dated 26/02/2013 which was assigned to the claimant on 31/03/2015 and notice of which was given to the defendant on the 31/03/2015 and which is now all due and payable. 2. the defendant agreed to pay monthly instalments under account number ....but has failed to do so. and the claimant claims the sum of £194.33. 3. the claimant also claims interest thereon pursuant to s.69 county court act 1984 limited to one year to the date hereof at the rate of 8.00% per annum amounting to £15.54 Total amount including fee's is £284.87 I have never agreed to make monthly instalments as I am 99% sure I have never spoken to them regarding this debt and I have definately never responded to any letters. What is the value of the claim? £284.87 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Talk Talk Internet When did you enter into the original agreement before or after 2007? After but not sure when Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. JC International Acquisition/Moriarty/Talk Talk? Were you aware the account had been assigned – did you receive a Notice of Assignment? Not that I can remember Did you receive a Default Notice from the original creditor? I dont think so, but can not be 100% sure Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Unsure Why did you cease payments? Dreadful service, broken promises and extremely rude customer services What was the date of your last payment? 2013 i guess Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management I remember telling them that I wanted to finish because I was unhappy with the dreadful service and if it wasnt rectified I would swap to sky who I have been with and am still with to this day So any advice gratefully received on how to deal with this matter The issue date of the claim was 20/09/2017 and I received it on unknown (as i have issues dealing with paperwork and opening mail) but soon after the issue date I am sure. I am sorry but only realised this evening I need to have my defence in by tomorrow at 4pm...... .. I was sure I had 28days after acknowledging service ( Your acknowledgment of service was received on 09/10/2017 at 08:02:21) but now realise after a panic that it is only 14days Thank you in advance for any advice you have, I am looking now for opther threads to see what I can put as a defence. Sorry Hi I recently received a claim form from the County Court Business Centre in Northampton, by Moriarty Law on behalf of JC International Acquisition for a Talk Talk debt. I have seen a similar problems on here to mine but I am not 100% sure what to do next! Is this the kinda defence I want to be submitting, obviously editing point number 2. I now know that immediately after acknowledging service I SHOULD or done a thing called CPR 31.14 to the solicitors............... so how should I go about approaching this now? 1. The Defendant contends that the particulars of claim are vague and generic in nature.The claimant's’ particulars of claims disclose no legal cause of action as the claimant's statement of case is insufficiently particularised and does not comply or even attempt to comply with CPR part 16.2 The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 2.The claim is denied. I am unaware of what debt the claimant refers to.I have requested information pertaining to the claimants claim by way of a CPR 31.14 request sent on 06.10.2017 and wich the claimant received it on the 09.10.2017 The claimant has failed to respond. 3.The claim is denied the Claimant has not served a Notice of Assignment pursuant to the law of property act 1925 and the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreement; and (b) Show and evidence the nature of any breach;and © show how the Defendant has reached the amount claimed for; and (d) show how the Claimant has the legal right, either under statute or equity to issue a claim; 4.Notwithstanding the above should the alleged amount claimed include an early termination charge(s) amounting to the entire balance of the remaining contract. OFCOM guidance states that any Early Termination Charge that is made up of the entire balance if the remaining contract is unlikely to be fair as it fails to take into account the fact that the provider no longer has to provide and pay for their service. 5. As per Civil Procedureicon Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. 6. On the alternative, as the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer crediticon Act 1974. 7. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief. Should I send this CPR request off to Moriarty today by Special delivery? CPR Template removed If I dont get a response (which is understable because I have left the matter so late), I will go ahead and just file this as my defense (Send the above CPR 31.14 off tomorrow) and hope for the very best 1. The Defendant contends that the particulars of claim are vague and generic in nature.The claimant's’ particulars of claims disclose no legal cause of action as the claimant's statement of case is insufficiently particularised and does not comply or even attempt to comply with CPR part 16.2 The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 2.The claim is denied. I am unaware of what debt the claimant refers to. I have requested information pertaining to the claimants claim by way of a CPR 31.14 request sent. 3.The claim is denied the Claimant has not served a Notice of Assignment pursuant to the law of property act 1925 and the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreement; and (b) Show and evidence the nature of any breach;and © show how the Defendant has reached the amount claimed for; and (d) show how the Claimant has the legal right, either under statute or equity to issue a claim; 4.Notwithstanding the above should the alleged amount claimed include an early termination charge(s) amounting to the entire balance of the remaining contract. OFCOM guidance states that any Early Termination Charge that is made up of the entire balance if the remaining contract is unlikely to be fair as it fails to take into account the fact that the provider no longer has to provide and pay for their service. 5. As per Civil Procedureicon Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. 6. On the alternative, as the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer crediticon Act 1974. 7. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief.

- 27 replies

-

- county court

- international

-

(and 3 more)

Tagged with:

-

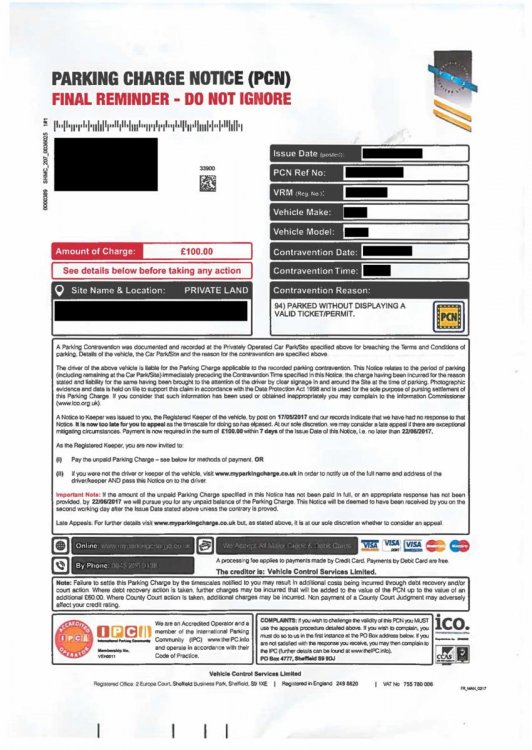

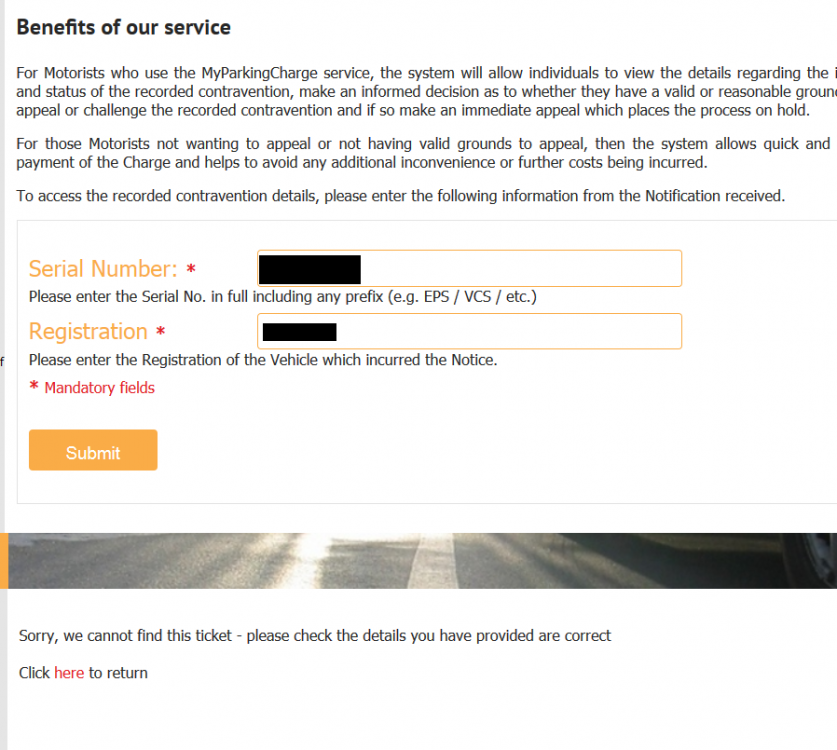

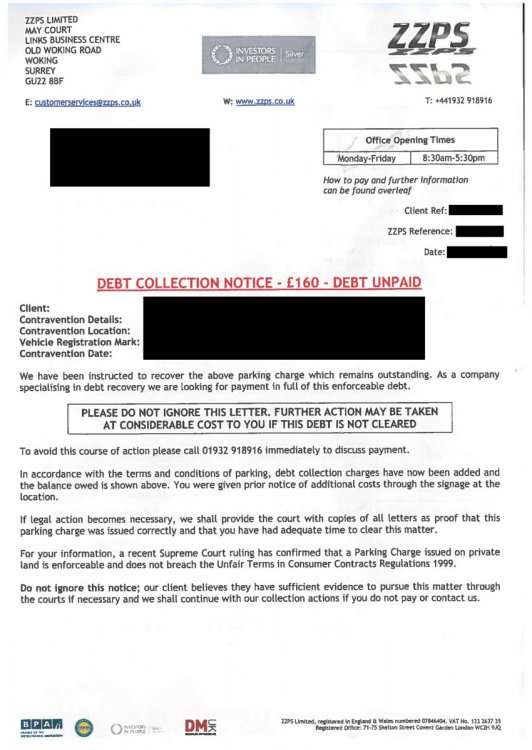

Hi all, First time here so please let me know if anything in this post should be changed. Backstory: I was in Bulgaria on business in June/July and had no knowledge of my PCN before leaving (turns out my mate moved my car out of his drive into the parking area for a couple hours where I received this PCN). Upon arriving home I find two letters, one being a final reminder sent mid June by VCS and then a debt collection notice sent by ZZPS in mid July. As I was out of the country and couldn't access my mail, I had no idea any of this was happening in my absence and had no chance to appeal the ticket in the allotted 28 days. The ticket was for £100, to be reduced to £60 if paid within two weeks and is now at £160 due to the debt collection agency add on. I haven't received any other letters regarding this claim. What I've tried: I have tried to go through the various appeals process, but when searching my ticket ref on the provided websites (namely myparkingcharge.co.uk as noted at the bottom of the VCS letter and the IPC website itself) it comes back with nothing, meaning that I couldn't have appealed it regardless. I even tried POPLA, and they can't find the ticket either. After contacting an ombudsman, they suggested to complain through the companies. VCS said that it was to go through ZZPS as they now were in charge of the debt , ZZPS replied as follows: "We must inform you that you have now passed the time frame in which an appeal can be made as appeals can only be made within 28 days of the Parking Charge Notice being issued, our client maintains that all correspondence received has been actioned accordingly and that the correct procedure has been followed. The balance of £160.00 remains payable on our systems, please refer to the back of our letter for the payment options available to you. In the absence of payment this matter will be referred to solicitors to resolve and further fees may be incurred." What do I do? If none of the appeals agencies even agree that the reference number matches any ticket, has a ticket even been issued against me? The collectors are refusing to provide evidence. I am not exactly inclined to pay this "debt" until the relevant parties prove their claim. Any advice would be appreciated as I feel like I'm about to get strong armed out of £160 Attached are the letters received, along with the website response when I search the reference. Personal info along with refs blacked out for obvious reasons.

- 10 replies

-

- collectors

- come

- (and 10 more)

-

New here, been reading some posts, but so much info, getting confused.. Well over 10 years ago, had 3 Credit Cards, 2 were with Barclaycard directly, another via another company, but at some point Barclaycard took that card over also... In the last 5 years at least have had a payment plan with Barclaycard with all 3 accounts, as I could no longer afford the monthly amounts along with interest, in Dec 2016 Barclaycard passed 2 of the accounts over to Link Financial, paying one at £50.00 a month the other at £100.00 which is what I was paying Barclaycard In June this year Barclaycard passed the last one to a Hoist Portfolio Holding Limited, who in turn immediately passed it to Moorcroft Debt Recovery Limited I own £1866.75, was paying this at £53.00 every month to Barclaycard, they now sending Letters asking for payment/flexible approach etc What upsets me about all this, I've never missed a payment with Barclaycard, may be a date but doubled it with the next one, my bank account goes from Black one week to Red the next.. So have no spare cash to play around with, Barclaycard was getting their money back, just not quickly. Now have payment details with Moorcroft via account details, web page etc, not yet contacted them, but don't what to fall behind with them just to incur interest etc, so making the amount owed even more & will then take me even longer to pay off.. Can anyone please help me, not sure what to do...

- 18 replies

-

- barclaycard

- cca

- (and 8 more)

-

Hi Recently come of age 65 and applied for my pension. No problem all ok. However upon getting my pension it would appear i cant have Carers Allowance and this will be stopped . Is this right as i still care for my wife on a daily basis. How can this be right as i feel a pension is not a benefit but cash i have paid in to the system . Your comments invited :mad2:

-

@vodafoneuk Help Vodafone refund problem ref #11860062

EmmaE posted a topic in Telecoms - mobile or fixed

Hi I placed an order with Vodafone online on 18th October for an iPhone 6s and paid £69:99 for the handset upfront then realised that I didn't require the order anymore so spoke to someone on live chat on 19th which I have the transcript for who told me that the best thing to do was refuse the delivery at the door and it would be sent back to Vodafone. My delivery arrived on 20th Oct by DPD and as instructed I refused delivery at the door, I then gave them sometime to return the phone to Vodafone and for Vodafone to refund me the £69:99. On the 2nd November I chased up the order return again via live chat which I also have the transcript for and I was given a ref code and told my refund would be with me by 3-5 days. As the 9th was a Monday I expected the refund by Friday at the latest. It has not materialised and judging by the threads online on various forums it seems that using the CAG and speaking to Lee is my only hope of getting my £69.99 back. I'm keeping my fingers crossed he can help and have put my ref code in my thread title so he can find it. -

Hi, I'm hoping someone can help. I have a business account with Vodafone and we have recently tried to move two numbers over to two different contracts that have longer expiry dates. We were initially told this couldn't be done, so decided we would probably get the PAC codes and move the numbers to a different network. Obviously in the process of trying to get the PAC codes we got through to the retention team and they immediately said that they could transfer the contracts without a problem. They told us that all that would happen is that the numbers would be moved to PAYG and then moved onto the new contracts. Within minutes of this conversation, the two numbers lost signal and appeared to be disconnected. On phoning VF back we were then told it may take up to 24 hours to restore the number. 24 hours later and we were told a different story and that it would take a further 24 hours to restore the numbers. Another 24 hours passed and we have were then passed around various departments with no further progress. Yesterday we were told everything would be back up and running within 6 hours... still nothing. Today, at long last one of the numbers has been restored, unfortunately my number hasn't and I'm now being told it could take up to 30 DAYS to 'find' my number. I am failing to understand how a number can be lost in the first place, let alone go missing for 30 days. This is business and personal number (which I have had personally for over 10 years) and I am missing important calls from clients and potential customers, not to mention family and friends. Any help would be appreciated I am not getting anywhere with call centres. I have sent a request to the web team based on instructions in the forum. Thanks, Richard

-

Good morning, I have an ongoing dispute with Vodafone, they are not budging, and I would like some advice if possible. Last autumn (2014) I had some financial difficulties, so I contacted Vodafone to say that I was struggling. The advisor offered to set up a £30 a month payment plan to bring the account back in order, which at the time was greatly appreciated. At the end of the month I contacted them again to make the first payment and was told that the information was on the notes, but the advisor did not process the payment plan, and now it is too late to make payment as the debt was with a collection company. I tried to pay vodafone for 3-4 weeks, but they refused to take payment as the debt was no longer with them. I complained about this and was told by a manager that they would request the account back from the collection company as I should have had a payment plan in place. The collection company declined the request. In December 2014, a default was applied to my account. I complained about this again, and a different manager told me that I should pay the collection company in full and vodafone would refund the £10 difference (which they did) and that the default would be removed from my file (It never got removed). Since then I have been told on several occasions that this can be seen on my notes and they will get the default removed. This has never happened. Now the credit team are stating that the default was correctly applied and nothing can be done. I'm ready to give up to be honest, but need some advice on whether or not there is any point in continuing this fight. Cheers Russ

-

Hey Caggers, I am after some advise ref a vehicle that we purchased from ACF Car Finance in December 2011. Since we have had the car there appears to have been an lot of things that have actually gone wrong with the car ranging from a new clutch, new gear box, new suspension, new central locking, failed coil pack, misfiring cylinders and knackered suspension to list the ones that come to mind as I write this post. Since we had had the car, we have followed the recommended service arrangement and had a full service every 12 months and really have looked after the car. With having so many issues, one of the garages we went to for repairs did comment on faults of this nature being common with a vehicle that has been neglected and asked if we were sure of the cars service history before we actually purchased it. When we looking at the service book it was pretty clean that the stamps for various services were actually made up, the same pen, same handwriting etc. and none of the boxes were tickets. We have even spoken to Vauxhall to verify the service history and they have said that there is not record of any 2 of the 3 services on the book which were apparently completed at a Vauxhall dealer. We raised this with ACF who said that it was not their policy to check the service history of cars they purchased as they carry out their own check to ensure that vehicles are fit for purpose. Now, what's brought the need to create this post on is that we have just been on the receiving end of a major gearbox and clutch failure on the car, a repair that is set to cost me £1622 to fix a car that is worth just over £2200. We still have 2 years left on the finance however the garage has informed us that they don't believe the vehicle will last the full duration of the finance due to the level of faults we are experiencing. Do I have any ground to ask for the finance to be suspected or the vehicle to be returned to ACF ? the cost of the current repair is approx 70% of the car current value and I fear the next big issue will be pretty much game over. The issue of the fictional service history must have some weight ? Is there anything that can be done to help me get out from in-between this rock & hard place? Thanks Scott

- 29 replies

-

- advised

- corporation

-

(and 2 more)

Tagged with:

-

Hi all, I have been look around taking in all the information, but I could really do with some help/advise. I am currently on a DMP with step change (4-5 years). CCCS now StepChange have & were life savers, but I now feel advice contradict what I have read on theses and other forums I send off CCA request letters to some of my creditors. Long story short Capquest 1st reply stated they were waiting for HSBC, 2nd letter stated that HSBC could not provide CCA paperwork therefore the debt was unenforceable, but I was expected to continue to pay. 12+2+30 days has now pasted. I contacted StepChange as I do want my DMP payment to go towards this debt. StepChange said this was not possible and that I have to contact HSBC myself the gain clarification.. .They would not remove this debt from DMP either. the CapQuest debt is 9k outstanding already paid 4k, all other debt amount to roughly 3k. The debt is also so old if does not show on credit report. What should I do? - End DMP /stop payments to Capquest - Go it alone - Contact other creditors and pay direct (some are at f&f offer stage) Any help pointers would be great Many thanks Also forgot to ask , can I just ignore CapQuest now or is it good practice to send the failed CCA letter???

-

I have a number of outstanding debts that have been prt of a dmp for the last 3 year. I was horrified to discover I have paid in £4300 and £1800+ has been taken in fees by immediate financial. Although 3 items have been settled at a reduced rate. I got into debt 4 years ago when I separated from my ex husband and he left me with 3 children, no financial assistance and I was only working prt time. my dad has offered to help me with this (he got £5000 from my gran when she passed) and try to pay things off myself with a lump sum part settlement. I contacted the people I knew I owed and sent a standard letter. Lowell have come back to me with 3 accounts they hold. I know about 2 and don't dispute them - the 3rd is not on any credit file I have checked them all apparently for shop direct - and there is one missing for £300 that on my crf it advises the debt is with Lowell but I'm not sure who it was originally for. The debt I'm not sure of was an old catalogue last used in 2010. Lowell said this balance is £5500 a which is way more than I ever had on it. I cannot check as it isn't on any crf so I'm not really sure what to do? Any assistance would be gratefully appreciated.

-

#10905185 Hi Looking for some advice. I previously had an account with vodaphone which I cancelled in January. After cancelling I then stopped the direct debit. I had no correspondence until an email on the 2nd of March from ardent credit services advising of an outstanding balance owing to vodaphone, which in hindsight I appreciate was my fault due to stopping the dd too soon. the amount now owing was around £75.00 but Phillip from ardent credit advised on the 9th that I could make a payment of £60.12 as a full and final settlement to close the account which I did on the 11th of March. I have had no further correspondence from either party but then when applying for credit I was having issues and one currently credit provider then started reducing my limit until eventually suspending the account completely due to information they had from the credit agencies. I then checked my credit file around 3 days ago to find vodaphone had a applied a default of £12.00 to my file in May as well as showing as late payments the two months previous. I contacted ardent credit who confirmed the payment closed the account and have all correspondence with them on email. I NEED this default off urgently Any help appreciated. Marc

-

Hi i have started a claim against Thomson for a delayed f light in 2011. However to continue my claim they are continually asking for a booking reference number, which i dont have . I have even rang them to say i have nt got this reference number, one lady saying that i am unable to make a claim then . ?????? surely not right. Rox

-

Some may want to take a look at this www.lendingmetrics.com Had some dealings with the company today.

-

I have a few student loans taking back from 1997, 98, 99 and 00. I went Bankrupt in 2010 but was told my student loans would not be included in my Bankrupcy. I spoke to SLC and they backed this up. I was still receiving deferment forms from SLC and I kept deferring the payments but have now received a letter from Erudio who say they have now bought the debt. I have now read that certain student loans could be put under Bankrupcy so could be written off. Would these loans have been written off when I was declared bankrupt? Was I miss-informed? Any information would be great

-

Howdy! Entering a Token Payment Plan with StepChange as been avoiding creditors for long years now. Could someone tell me how to find old bank account numbers, old ref numbers to finish off my paperwork for TPP? I haven't kept any old letters etc, and I'd like to avoid ringing creditors at all costs. My credit report doesn't exactly show ref numbers. Is it actually crucial to find them anyway? StepChange said it would greatly help.

-

I live in a flat with another tenant. Our bills our up to date so no worries there. The last two months I have noticed that EON now report the account to Equifax, it is a Green OK. However my concern is that a financial association might pop up. Unfortunately I have a terrible credit rating (working to improve!) and would not want to harm my flat mate by creating a link. Currently there is no financial association on any of the 3 agencies. Is it likely one will be created? We moved in 3 years ago but with the move to utilities reporting I am fearfull of this. Another question, if a financial link is made does it appear on both credit files (is it a two way thing)? So if mine is clear his is clear of an association? Is it possible to put the bills all in my name say to protect him?

-

Long story short. I had a loan for £10,000. I paid back £5k and owe a further £5k. I since 2007 havent paid anything since. It is due to be statue barred on 1st april this year. Never heard anything from anyone until last week when Lowells said they bought the debt. Today I had a letter from Co-Op saying they have sold the debt to Lowells. Thing is, how can i stave off Lowells until 1st april when it become statue barred? The last thing i want is legal action and them to obtain a ccj at this point after paying so much other stuff off etc It is my last bad debt and all my files will be clean after this......

-

Just received my Barclaycard statement which I was 2 days late paying so consequently they have charged me £12 plus £12 over limit fee, I've decided to reclaim the fees sending a copy of the template letter on this site (thank you) problem is I'm not sure how much they actually owe me, I've had the card for about 7 years and have been charged fees quite a few times. Any suggestions as to what I should do, can I send the letter without stating an amount and rely on their 'honesty' (Barclaycard & honesty, doesn't really work does it) I'd be really grateful for any suggestions from the experts , I'm so sick of letting them take my hard earned cash simply because I've been a day or 2 late in paying, have never actually missed a payment, thanks in advance.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.