Showing results for tags 'made'.

-

Hi guys! This is my first ever post on here and I'm in desperate need of help. I was employed as an apprentice from June 2015 working towards my NVQ Level 2 in Customer Service. Originally, my NVQ was supposed to end in October 2016 but as my employer refused to let me work towards it (I was told that absolutely everything else in the office took priority over my NVQ work) the end date was extended by my NVQ assessor to October 2017. When my end date was extended, my NVQ assessor informed me that the minimum wage I was entitled to would have increased in June 2016 (after completing my first year of employment) and that my employer had been paying me below this amount for the past 4 months. My assessor told me that they would pass this information on to my manager and confirmed that they had done so via email. Four weeks passed with no mention of this at work at all. My NVQ assessor came into the office to help me get started on the next part of my course. At the end of the day, they asked me if anything had been said about my wage increasing and the money that I was owed. I confirmed that nothing had been mentioned. She went and had a word with my manager and came back and told me that my employer knows that they need to back pay me and that they were going to deal with it shortly. Two days later, my manager asked me to go to a one-to-one meeting where they confirmed that I was going to be back paid the amount of money that I was owed but that, due to a move-around in our department, my position no longer existed and that I would be out of a job this time next week. I was told that there were no problems with my performance, only that my role didn't exist anymore. A reshaping of our department had never been discussed, nor was I ever told that my role might not be there in the future. I was also only given 6 days notice when my contract said that I was entitled to a minimum of 3 weeks. Also, no-one else in the company has lost their job as a result of the reshuffle: I am the only person to have been negatively affected by this. I called ACAS and they told me to write down everything that I think my employer did wrong in a letter and then send it to my employer. The lady on the phone then said to wait 14 days and try to begin the early conciliation process. She told me that it sounded like what my employer did to me was illegal and I've gone through loads of other articles online posted by Law Firms which all seem to suggest that this I have been made redundant unfairly. I was just wondering what other people make of this? Has my employer acted wrongly and am I right in looking to escalate this? I'm really distressed due to the time of year where this has happened and I just want to make sure that I'm doing the right thing. Thank you all so much! Any help is greatly appreciated.

- 17 replies

-

- apprentice

- asking

- (and 4 more)

-

Please would someone kindly offer me some advice. I bought a flat in a converted house about 9 years ago. I have never lived in it as I married shortly afterwards but I rented the flat to an older gentleman who has lived there since, for about 9 years now. When I bought the flat I was responsible for maintaining my part of the building as there was no management company in place, so I took out buildings insurance for my flat. There are five other flats in the buildings. All the other residents are owner occupiers. About two years ago, one of the residents contacted my husband to say they were thinking of banding together to purchase the freehold so that the maintenance of the building would be secured and the cost shared. They first needed to track down the freeholder. We said we would be interested. Please keep us informed. One of the residents contacted my husband about 18 months ago to say they had two residents interested so far but would keep us informed. To my horror, I received a solicitors letter a few weeks ago stating that I owed over a thousand pounds in service charges for this year till March 2016. It transpires that the other occupants have formed a management committee and had banded together to become the freeholders. I replied to the solicitors stating that the last I heard was the discussion stage and I had not received notification of the forming of a committee or that the other residents had purchased the freehold. They did not want to know. They said that if I did not pay immediately they would take me to court and I could lose the flat. I reluctantly paid the thousand pounds requested by the solicitors for the service charges, as they said I could lose the flat if I did not pay immediately, money that I had put aside for Christmas, but despite my payment they have now sent a claim form stating that I still owe the service charges and have added on another two and a half thousand pounds in legal fees. Can anyone please help, I cant sleep at night. The claim form came last Friday and it says I have 14 days to reply. Any help at all would be greatly appreciated, Thank you

-

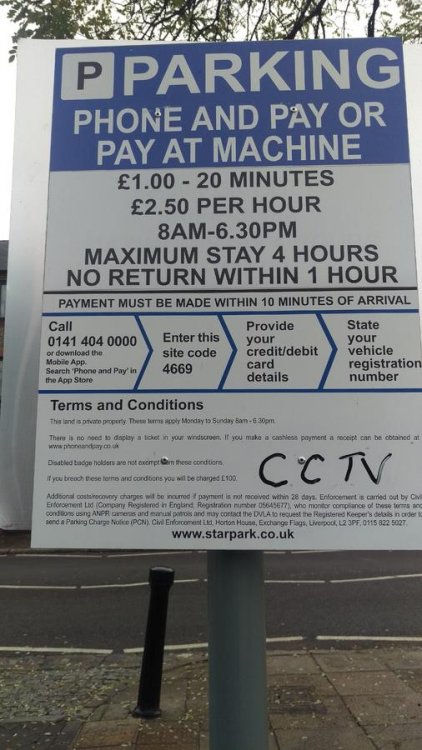

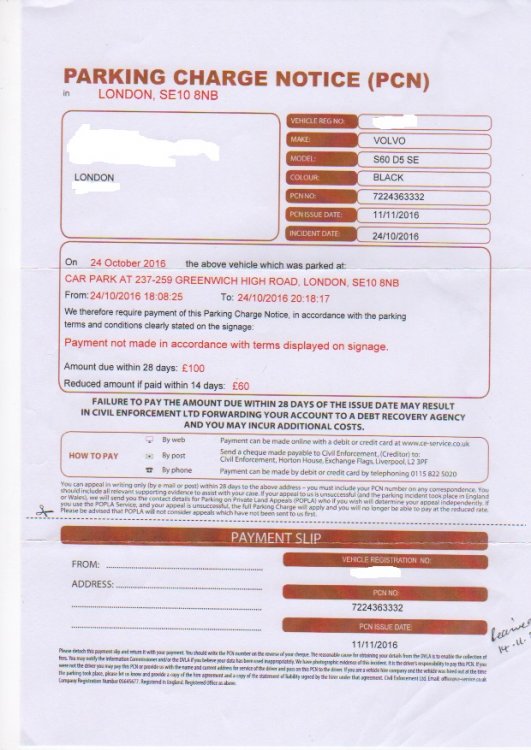

You've helped me once before (post4830039) with a 'parking charge notice'. I don't think I actually need help this time, but wanted to post on this site for general awareness in case there's a pattern in how this firm operates. I parked in a car park where controls are effective 08:00-18:30. The PCN shows I entered the car park at 18:08:25. I purchased a ticket (which I still have) at 18:12, paying £2 for 20 minutes as I didn't have anything smaller. The ticket I purchased shows the expiry time as 18:32 (ie, 2 minutes after parking controls ceased to be effective). Today I received a PCN from CEL citing 'Payment not made in accordance with the terms displayed on the signage'. I've gone back and checked the sign and I can't see any term that I failed to comply with: - I paid the fee - the ticket was purchased within 10 minutes of entering the car park - I didn't exceed the maximum stay Although I said I don't think I need help on this, any offered would be appreciated especially if you spot something I've missed. Otherwise I will email CEL advising the above facts and that if they don't withdraw the charge they must stipulate exactly which term or terms they believe I contravened, with the effective date of the charge being the date they reply. Incidentally, I only received notification of the supposed offence 3 weeks later and it's pure luck that I still have the ticket. What does anyone do in the situation where no parking notice was issued at the time and the ticket has been discarded? It seems pretty outrageous to me that these parking cowboys have the law on their side in cases like this...

- 9 replies

-

- accordance

- civil

-

(and 6 more)

Tagged with:

-

I have lived in a block of 10 flats for 10 years, there is a residents management company of which I am a director along with the other 9 owners. I have just been told that at an AGM 11 years ago it was agreed (documented in the minutes) that parking is restricted to certain times of the day in a specific place and that as I parked there at night I must not do it again. There is nothing in the lease about parking anywhere at any time but my concern really is that I didn't know that I would have to abide by some majority decision made 11 years ago of which I knew nothing, also there could potentially be more decisions made that I know nothing of and don’t agree with. I understood that I had to abide by the lease which was discussed by the Solicitor, and I was not presented with any minutes of meetings when I purchased the flat. My questions are: do I have to abide by decisions, made by previous owners, of which there is no mention in the lease? and also, can they just make rulings by taking a vote, and we all have to abide by the majority decision – is that legally binding to each of us? I am concerned that I am being bullied to suit the needs of the Company Secretary.

-

Hello Friends, I made a sale to a person I found on internet. I had SMS and chat communication where we agreed on price. We first agreed on payment through Paypal and I sent the invoice but the receiver said she did not receive the invoice. I was in hurry and as I had packed the item and booked a courier, I proposed that I send the item and receiver send the money direct to my bank account and she agreed to this on message. I made mistake of trusting the receiver and sending the parcel. I have had communication till last day wherein I gave her the courier tracking number. She Thanked me over SMS. After that there has been complete silence. No SMS, no picking up phone and no reply to my chat communication. What are my options to recover money? If I raise this with MCOL, will the judge decide on balance of probability? I have evidence to show delivery by courier service and her complete silence after the day of delivery and her active communication before day of delivery. Please advise. I was naive to have believed her.

-

Hi all. Very briefly, my friend worked for an employer last year who paid him by bank transfer and never gave him a pay slip. My friend resigned at Christmas and since then has sent letters to the employer asking for payment for 2 days worked, 2 days bank holiday pay and 2 days holiday pay. He has since asked me to help him make a claim against his ex-employer. Evidence-wise, we have this: Original advert in local paper Bank Statements showing 7 bank transfers made to my friend's bank account starting on 11.9.2015 and ending 18.12.2015 totalling £4718 Copies of letter and email sent to employer Proof of receipt of letter. He is owed money for the last 2 days he worked (21&22 December 2015), 2 days holiday pay and 2 days bank holiday pay. He works this out as £9 x 8 hours x 6 days=£432 Is this the correct amount or do we work out the Tax and NI he would have had deducted? (although his employer, apparently, never paid his NI or Tax) My question is, do you think that we have enough evidence to proceed? And, if so, is an LBA the next move, detailing the above information? Thank you in advance, B

-

Hi all, I had no idea that with my Barclays account I had PPi. Barclays contacted me a few years ago and i got the odd thing in the post from them, it always referred to the fact that 'IF' i had ppi, tbh i really didn't think i did. The most recent form they sent me was so long! With so many questions I could not possibly remember the answers. This company contacted me and said they could see if they could do it for me and that they would do all the hard work, but then they sent me exactly the same questions, I called them and explained this is why i signed with them because i thought they were going to do all this and the guy just tried to help with the answers. Shortly after this I get a refund from Barclays for £3700 approx. AMAZING! BUT they have sent me a bill for £1400. I'm annoyed because all i needed to do was fill in the form like i did for this company and send it back to Barclays, like they asked me to a while ago, now i have to pay this company £1400, so much money, for just this form... Is there anything i can do? I have been dealing with Barclays directly for a while on this and just hit a brick wall when the form came through with lots of questions that i couldn't remember the answer to.

-

Hi, someone can help ! Over the weekend I put in an offer to rent a property, and was given a date as to when i could move in providing referencing went through ok etc etc. The problem now is that my boss, who is my referrer, is now on holiday and wont be able to sign anything until he is back. I need to move out and into a new place before he is back. Perhaps naively, I actually thought that they would simply call or email him and ask to confirm any details that I put down, he is contactable this way, but wont be able to print and sign anything off before he gets back. Which leaves me in a bit of a pickle. I can move my stuff out and and move somewhere else, but once ive moved somewhere else I wont be able to (or want to for that matter) move my belongings again. The lettings company charged me £400 pretty much immediately, and i am wondering if i am within my right to ask for a refund. I didnt sign anything when i sent over the £400. No checks have been made as yet, i found this all out just now as ive received the landlord hub referencing form. thanks in advance

- 3 replies

-

- application

- checks

-

(and 3 more)

Tagged with:

-

Hi there, A year ago I took out a product with Buy as you view. I have had no problems and have paid religiously by DD every week. This week I returned from holiday to a letter saying the DD had been cancelled (my fault I was cancelling several DDs at once online before i went away). this means that the payments have mounted up to £89 owed. Due to the holiday and not realising they hadn't gone out I rang Buy as you view to advise them I could meet the back log in payments on my next payday but would continue to pay the weekly amount every Friday until then so I don't owe more. they said to do this I had to arrange for the area manager to come out (which I did for next Thursday) to reset my direct debit up rather than by phone. this evening having got home from a long day, feeling unwell and with a small child in the house and one on the way a Buy as you view rep bangs on my door. I didn't answer as I hadn't been expecting him; we had made an appointment for next week. It states on the website they can only visit by appointment. Can anybody advise me where I stand on this please? Do I have to let them in at all? Can I make the payments by phone. What has put me off answering and dealing with them in person is now that they have come round uninvited when I have specifically set an appointment. I tried to ring them but was on hold for 56 minutes then told phone lines have closed Best wishes and thanks in advance Emma

- 11 replies

-

- appointment

- buy

- (and 6 more)

-

Hi, Hope someone can give some advice or ideas on how to proceed. We bought an ex-farm last summer directly from the council. The property was advertised with a covenant on the attached paddock but not on the barns. We got an email to say we could run our business from the barns and didn't question anything else until we signed the contract - which the solicitor didn't give us time to look through and just said it was all boring stuff and no need to read through - end of the day, wants to go home?? Didn't think twice as we thought we had all the info. Fast forward to November and the Land Registry paperwork comes through with details of covenants on all the barns and outbuildings, which we knew nothing about! I know we should have been firmer and looked through the contract but we trusted the solicitor and thought the sales particulars given by the estate agent was complete. We've spoken to neighbours who have had a similar issue and have been told by the council that they want 5k to remove the covenants! Can we argue that we were not made aware that the covenant was still in place at time of signing and our solicitor never made us aware, and that the covenants were never on the sales particulars? The solicitor claims that the email from the council saying we can run the business from the barn is enough, but if we want to convert one of the barns into a holiday home in future, will we be stuffed? Solicitor is shying away from the issue and I could do with some advice on who to approach and how to proceed the get this sorted with as little cost as possible. Thanks.

-

Good morning all! Basically after a bit of advice. The company that i work in has been taken over and we all got TUPE'd over and after reorganisation of the company I am going to be made redundant in the near future. Being disabled I am only fit enough to work about 22 hours a week and I get enhanced rate in both the Mobility and Care components of PIP (as well as Disabled tax credit which will end soon after I am made redundant). I presumed after being made redundant I would be able to go on JSA whilst I found another part time job. But then I discovered that like most areas single claimants are now being told to claim for Universal Credit. However having looked into UC (and testing the waters by applyiing online) I see I can not apply for it because I am on PIP. So what benefit am I meant to apply for?

-

This may seem odd but I have just received a payment into my bank account from Fredrickson International. 10 years ago we lost almost everything we had to a business fraud. In the intervening period, we have rebuilt credit and established a new business. However, at the worst time, Fredrickson were one of the hardest and nastiest companies to deal with. I have never, to my knowledge paid them anything or given them my new account details so am mystified that a payment should suddenly appear in my account. I told my bank I do not want this money but they told me there is nothing they can do. Is this a part of some new harassment tactic? Does the payment establish some kind of business arrangement with Frederickson? The idea of going back to that nightmare time is very worrying. If anyone has any information/ thoughts as to what might be occurring, I would be grateful to hear from you. Thanks.

- 8 replies

-

- account

- fredrickson

-

(and 2 more)

Tagged with:

-

Hi There I have followed a number of the threads on this forum, and hope you will forgive me posting this. I am just absolutely terrified about my current situation and the legal implications (if any). I would highly value any help members could provide. My situation: I was on a six figure salary with my previous employer who, a few days ago, informed me that they would be closing with immediate effect. Unfortunately, I have just gone and taken out a couple of loans (about five weeks ago) to help fund a new car and decorate my mum's house for her 80th birthday, and have accrued a fair bit on my credit cards to pay for a silver wedding anniversary cruise for the wife and I. The best part of my salary for the past few years has been spent funding our two children through university overseas. I've been offered a replacement role in Australia, but on a much lower salary (about £40,000 equivalent) and without any accommodation arranged. I already hold a permanent resident visa - as my wife is Australian and we lived out there for a few years. (Returned in 2014, and I have my right to return still active). We will be able to move across to Australia to take up the job, but I know I will be completely unable to properly service my debts (which are roughly £100,000). I am primarily terrified that I will be prosecuted for fraud (although I, in all truth, believed there would be no change to my circumstances when I took out the loans -- as these were only taken out a few weeks ago). I can make full repayments for the next few months before we move; however, I am going to need every penny from my salary to keep us going in Australia for the first little while. I am pensive about offering my debtors a nominal £1 per month payment in good faith until I get established over there. I do not want to run from these debts; however, I also do not want to face prison if the lenders think I committed fraud. We have no mortgage, the house is in my wife's name and I have never contributed towards the house payments: so I think it is safe from repossession, in case things go wrong out in Australia? Basically. Help. Am I going to have an international warrant for my arrest put out because of perceived fraud!? I know this probably sounds ridiculous to some, and I hope you can clarify where I stand. I've got myself in a right bloody mess here.

-

Hello there! First time post for me so apologies if I miss something! I received a letter from Robinson Way for an alleged barclaycard debt, of which I sent a CCA request enclosing the £1, which they banked. I received a letter saying that they would request the details from their client and it would be on hold until they received the details. Subsequently I've now received a letter saying: "Further to your recent request for a copy agreement on the above account, we are unable to obtain this form the original creditor as this request must be formally made to us in writing. Please accept our apologies for any inconvenience caused by us not informing you of this requirement at the time of your initial request. If you still require the agreement please submit your request in writing to us at the address above and we will process it as quickly as possible. Please note that the £1.00 fee normally required for a CCA request will be waived on this occasion. In the meantime, we have placed your account on a 30 day delay to allow you enough time to submit a written request. If we do not hear back from you within this time we will assume you no longer require this information and your account activity will resume." I sent the CCA request with the enclosed payment to the same address on the letter?! It is now 17 days since the date of my original CCA request. I'm not sure which way to respond to this - any help would be greatly appreciated. Many thanks!

-

Hi all, I'm lousy at writing descriptive titles, so apologies in advance I plan to remortgage my home in April of this year, and want to collate proof of income from both self employment and benefits/tax credits paid to me over the last 3 years. Is possible to write to the HMRC and DWP to get a list of all benefits paid into my bank account for the past 3 years? So I can use that as proof of a secondary income?

-

Hi, I purchased a period return ticket from Oxford to Manchester last week. I didn't have a problem on the way up, but I had an issue with using the return ticket on my back. I don't remember which stop it was after but, somewhere between Manchester and Birmingham New Street, the guard came through and stamped the return half of my ticket. When I reached Birmingham New Street, a new guard replaced the previous one. When he came through to check the tickets, he told me that I had already used my ticket and I could only use it once. I explained to him that the ticket had been stamped by the other guard, who he had replaced, on the same train, but he didn't believe me. He told me that I would have to purchase another ticket. As he was threatening to get the police involved and being intimidating, I begrudgingly paid up. Is it possible to get my money back for this ticket? I shouldn't have had to purchase it. Unfortunately the second guard confiscated both halves of my ticket, so I have no proof that I already had a ticket.

-

Hi all, I have had a torrid couple of months with a floor restoration company who are now taking me to court to reclaim money they feel they are owed. I have recieved the claim and returned the response pack with a robust defense. Yesterday I received a letter of notification to the small claims track and a request that I fill in the Small Claims Directions Questionnaire. I am quite stressed about the whole thing and nervous about court...not because I don't think I have a defence just because that's how the act of going to court makes me feel. So any advice you can give me is very much appreciated. Here are the relevant bits: I have a standard 3 bed 1930s semi detached. The wall had been knocked through between the dining room and the kitchen. The next job was to sort the floor out. Here's a picture of the floor : The job was to lift the boards from the lounge to make the necessary repair work in the kitchen/diner and replacing the boards from the lounge with chipboard (as this was going to be under a carpet). The floor guy came to quote the job up and said it would take two days for £850 + materials of around £120. When he was at the house he saw the screed where the old fireplace was however there was still laminate flooring covering the old kitchen floor. He went on a cruise in the caribbean and sent 3 young lads round. The young lads were surprised to find that the original floorboards didn't extend into the small, flat roof kitchen extension. There was chipboard here instead. The whole area measured around one square metre: On day two he phoned me up from the cruise ship asking for anther £480 for another days work to complete the job. He said this was due to the delays caused by the chipboard in the kitchen, that he had assumed the original floorboards were under the laminate flooring when he came to quote. I wanted the job done as I could not use the entire downstairs of my house and there was a big hole in my lounge floor. I offered to meet him half way and pay and extra £240. He got very angry and shouty and later that day sent me a text saying he'd take me to court if I didn't pay up and that he'd instructed his team to leave the job. I sent him a few emails explaining my side but he didn't reply claiming that he couldn't get emails on the cruise ship. I waited a month and then got another company in to finish the job. They charged me £600 to not only finish the job but re-fit the floorboards over the old fireplace which had been screwed in using 6 inch screws and were loose. I paid the original company £980 - £600. Now we're going to court. If anyone can assuage my fears about going to court to defend this please do Thank you.

-

Hi all, I know there are a lot of us out there trying to get things sorted with old PDL debts that we have, and in many cases we seek the help of FOS. However I had a PDL from trustedquid back in early 2014 for £150 which I defaulted. there was no way on this earth that FOS would write if off so I contact them directly and today we have agreed an arrangement where I will only repay the original loan over a period of 5 months upon reciept of the first payment they will remove any reference to the loan on my credit files. It was tricky to get this agreement as they would be worried about me not paying anything once the debt was removed, but when I reminded them that they can re-instate the debt at any point the agreement was made. I know some of you will say stupid boy but I feel this is the best that could have come of it. Thought I'd share this with others out there looking to tidy up their credit files as this could be another option for you.

-

Hi I was drawn to an offer of two pairs of glasses for the price of one at our local optican so I took up the offer. Normally my employer pays for my test but this offer seemed good. The experience was okay until I was asked by a counter person to answer some medical questions about my parents. She asked if my parents had Glaucoma and Diabetes. I said I thought my father had Glaucoma and Diabetes. He did have diabetes. She then said I can now have a free test. I was willing to pay there and then, though she insisted that I qualify for a free test. She asked me to sign a form for the free test. I bought the glasses and have to go back next Week. Whist in the shopping centre, I asked my elderly Mother if she could recall Glaucoma in the family. She could not remember. So I went back to the opticians ( 30 mins later ) and explained to the same lady. She then replied that I had already signed the form and could be prosecuted for making a false claim. I was shocked !!! I then insisted that I pay for the test to remove any uncertainty so I paid. However, her attitude was awful. Even when I said that I hoped to save some money by getting a free test but could not ask dad because he had died. She replied, that is too bad. I feel like a criminal even though I offered and did pay the fee in the end. Her attitude was awful and now I fear the NHS will be after me next for making a false claim. I sensed she had it in for me, the now paying customer. I thought I would share this as an experience because even the customer can be intimidated. Thanks, Stella Update.... just checked with my Brother. Apparently my Dad did have Glaucoma and was taking eye drops to help.

-

Quick outline of case first. My girlfriend had a secured second load taken out with Firstplus about 9 years ago in joint names with her and her then husband for his debts (yes she is aware this was not ideal) they then split not long after. She has continued to pay this debt with Firstplus. She then started struggling with the debt £400 per month on top of her Mortgage single parent etc. Case defaulted, got a CCJ and a reposession order now Suspended re-possesion order or something like that. She then started to repay and again began struggling with it so First plus then marked it as defaul and passed the debt to Credit Solutions. They have been tootally unhelpful when she tried to negotiate lower monthly payments stating that this wouldn't even pay the interest and charges so £400 was the minimum she could pay. So a few weeks ago I got her to ring Credit Solutions to ask for a redemption figure. The latest statement from them stated the balance to be £5200. They said they had to go back to First Plus. We then received a letter from "Eversheds LLP" reason for quotations will become clear. Panicking she ran Eversheds as the figure in the letter was just over £13000 stating "this includes our charges up to the redemtion date". So panickinng she rang them (Eversheds) who stated " we do not hold an account for you relating to First Plus and have not dealt with them in over 3 years. So confused she rang First Plus who stated yes this included interest and charges from Eversheds . The reason CS held the balance as £5200 was because the interest and charges had been frozen?? Confusing. She advised that she had been offered a bit of cash from her father and was wanting to make an offer. The Firts Plus agent advised to write in explaining her circumstances and with an incomne and expenditure sheeet and this would go before managers. So we did that, explaining that she has been struggling, detailing stress and problems at home as she has a disabled child too and sent an offer of £3000 for full and final settlement. we hear nothing for just under 2 weeks when yesterday a letter arrives from First Plus saying following your correspondence the debt has been passed to Credit Solutions????? And to contact them. your correspondence has been passed to them also she rang Firstplus stating she had sent a letter offering a full and final settlement as THEy had asked. The agent said that it looked as if proper process had not been followed, explaining it should have gone to a manager etc. Again my gf pointed out the Eversheds, Oh yes that will include their charges again she says. To which my gf advised of the call to Eversheds who had nothing to do with it. The agent than said yes the debt really should not have been handled like this but you will have to contaft CS. This all sounds to me like they have really messed this up and leaves us open for a complaint. Also we do not know if they have passed the letter to CS reegarding the F+F Offer. Does anyone have any advice on what we should do, and if we have decent grounds to get CS to accept the F+F offer? I also think CS will bounce it back to First Plus. All very confusing . Writing this just before leaving work so if it is a little rushed this is why. But we are foaming and just wanting to clear this debt with the £3000 we have sitting waiting for them. Any advice appreciated. Many thanks

-

Tickets for centenary commemorations of the Battle of the Somme have been made available by ballot. Residents of the UK, France and Irish Republic can now apply for free tickets for the ceremony at Thiepval Memorial in France on 1 July 2016. The Somme was one of the bloodiest battles of World War One with more than one million casualties over 141 days. The online ballot will be open until 18 November - the day the battle ended in 1916. READ MORE HERE: http://www.bbc.co.uk/news/uk-34361335 This is the direct link to register for the ballot: http://somme2016.org/en/tickets-somme-centenary/

-

Ok so looking for some advice.. 12 years ago I had finance through black horse. I have not made any payments or contact since 2007. And they gave up except send me a annual statement but this didn't happen every year. There is nothing on my credit report to do with them. I have recently bought a house for the first time and then the other day I received a statement and then a letter asking for payment. This was sent to my old address. I have not acknowledged the letter. Can they still Persue after 8 years of no contact? and is my house safe? The debt was unsecured . What do I do next? Thanks in advance

-

Sat Nav made useless my update

tali posted a topic in Technical Computer/IT/Console/SatNav Questions

I have a tomtom satnav (2007) i went on its site to update it.However , all that happened was that it wiped off all my maps - so basically i have nothing. .They have offered me a 25% discount voucher code to use on their products.So what are my rights ?given that i had a perfectly working Sat nav turned into scrap by the maker? -

I've taken out an insurance policy. a term assurance one over 15 years thinking even if I still live over that we get a payout. I wanted one where I know there would be a definate payout.

-

I stole £200 pounds worth of money from my work. I have an investigative meeting on Tuesday and am at a loss over what to do. I know I am in the wrong and I am aware that the company uses civil recovery to recover any loss from theft. However, will they have me arrested and charged or take me to court. I can't afford even a caution against my name due to my future career. Please help, I haven't slept a wink since I was given the letter and suspended for gross misconduct. Thanks.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.29a0f7dbe62a30ea26d12f2f859bb612.jpg)