Showing results for tags 'loans'.

-

I have a loan with Satsuma loans for £300. They are a part of provident I wish to say that "Hats Off" to Satsuma Through no fault of my own I ended up on ESA Benefit and could not make the repayments. I phoned them up and they could not do enough to help. Absolutely no charges whatsoever, I am paying them back though expensive at £10.00 a week, but just about finished now. Guaranteed no default status with the credit reference agencies and up do date credit markers with the credit agencies. In this case it was good to talk for both the creditor and borrower

- 8 replies

-

- compliment

- loans

-

(and 1 more)

Tagged with:

-

Hi, First time poster because I'm having a problem with the SLC! Sorry, this is going to be long... I had a student loan each year of my 4 year undergrad Masters from 2003-2007. I graduated with something like £21,000 of debt and immediately started repaying through PAYE with my job. I was in the UK for 4 years after graduating and then did some travelling starting October 2011. During the travelling, the SLC was in touch with my family who told them I was travelling (and therefore I wasn't earning). With hindsight, I wish I had used my savings on paying off my student loan in full rather than going travelling. : '( In 2014 I settled down in Canada and I've been working there with a visa and got in touch with the SLC via the overseas income assessment forms and have been making monthly payments via direct debits from my UK bank (I send the money to my UK bank from my Canadian bank). As of today, I have £13,040 outstanding on my loan. As an aside, during my time in Canada and my annual assessments, I was having issues with the SLC where they would give me 30 days from the date of the letter to update them on my income and provide proof. Usually I would get this letter 2-3 weeks after the date on the letter, partly because Canada Post is slow but mostly because they were sat on the letters for ages (based on postmarks). That would leave me to scramble with getting a letter from my employer and sending it back to the UK, which takes 7-10 days so my letter to them often arrived late. I even wrote them a letter explaining that if they're going to set a 30 day deadline to someone overseas, they should send that letter immediately! as of October 2016 I'm unemployed. I quit my job in the oil and gas industry due to health problems caused by working crazy hours for the preceding two years. I'm back in the UK because I wasn't able to support myself in Canada (lost my savings in the downturn) and I live with my parents for free. I contacted the SLC and told them I was no longer working. The woman I spoke to was lovely and sent out some new income assessment forms in early November. They asked for proof my parents were supporting me via regular bank payments, which they're not doing since it's not a regular payment to my account and instead they just cover my expenses. I called the SLC again to find out what proof I should submit. During this call, I had a 'disagreement' with their phone operator who started questioning me about how the SLC knows I'm going to stay in the UK, how they know I'm actually unemployed, how they know I'm 'not just on vacation,' etc. I can't prove an intention! I submitted the info recommended, specifically bank statements (UK and Canada) that show I'm exceptionally poor right now, a letter from my former employer with my final date, a letter from my father stating that they're supporting me by paying for everything and letting me live with them rent- and bill-free, and the SLC forms they sent. I gave them everything I could to prove what I was saying, which is more than they were asking for! I also sent it with proof of delivery because of the number of times in the past that they claimed to not have received something I sent (a likely story) and have downloaded this proof of delivery. I sent these forms on December 8, 2016, the delay being caused because I was waiting for the letter from my former employer. Also, by this stage I had made two repayments totalling £148 during my unemployment. I was advised to cancel the direct debit so I did. Fast forward to today I received a letter from the SLC with big red letters saying, 'You need to read this letter and take action to avoid penalties and charges.' They're asking for the exact same info I sent them on December 8. Obviously I'm going to call on Monday to find out what on earth the problem is. Has anyone been through this with this sort of threatening letter?

-

Hi All, Firstly, apologies if something like this has already been discussed. I have seen similar posts but I think my predicament is slightly different...it's a long story but I hope that some of you will take the time to read it and have some advice for me... So, some years ago, in my clearly very naive and gullible early 20s, I met my ex husband. We got married in 2010 when I was 23, less so because we thought it was the best thing to do, more so for 'financial reasons'. About 6 months before we got married, my ex had started to have some money problems and I noticed some unauthorised transactions on my credit card totally about £800. The transactions came under Victor Chandler and I reported them to my bank's fraud department. On learning that I had done this, my ex decided to tell me that I needed to withdraw my claim to the fraud department as it was to do with him and he could get into a lot of trouble! (He's in the RAF and works in the armoury...I believe being in debt and having gambling problems would be something that's frowned upon in his position...). He explained that he had used a online gambling site to 'transfer money' as he needed it to help his mum... the story was more elaborate and seemed to make more sense at the time.. .anyway I was young and stupid and decided to give him the benefit of the doubt and believe him. I suspected he had a gambling problem, but every time he'd spin me a story and I stupidly tried to believe him. As things progressed, I buried my head in the sand and we got married and as soon as that happened, everything went from suspicious to disaster... The guy had all my bank details, all my personal details... he memorised my bank account numbers and card numbers off by heart! He'd put on a girls voice and call up my bank pretending to be me and all sorts. He took over my accounts completely and in a bid to stop me from finding things out he'd stop me going online by tampering with the phone lines, etc. One day I found he'd taped a small piece of clear tape over the phone plug so I could check my bank online or call them! My life and my finances got to the point where I was working full time and each payday, as soon as I had been paid, literally within an hour all my available funds would be gone. My bank statements from the period which I was with him are just full of transactions of money (mostly) going out and coming in from various online gambling websites. . Despite my feelings deep down and my instincts telling me everything was wrong, I tried whatever I could to just stick it through and hoped he would change and everything would eventually go away! I mean, he went to such lengths to prove to me that things were being sorted...! By May 2013 I finally decided that I was not going to take it anymore. I wasn't going to let him continue to ruin my life and I left him. We separated in May 2013. I moved back to Hong Kong for 8 months to get away from him and stayed with my parents. During this time, my ex husband and I still had some contact as I was still having major issues with my bank and I was desperate for him to sort it out so that, even if I couldn't get any of my hard earned money back at least the black hole of debt would stop getting deeper! Eventually, he told me that a solicitor had managed to get some money back for us, but it was being paid into my account via a payday loan company. As I was out of the country and wasn't up for speaking to him much I didn't pay too much attention to this. Some money did appear in my account from a payday loan company, but the money soon disappeared again. I thought it was just the same old same old. It wasn't until some time in 2015 when I had returned to the UK and got officially divorced from him that I found out that the money that went into my account was in fact a payday loan that he had taken out in MY name. And here in my predicament lies.. .the loan was taken out online, so he used all my details and signed electronically and the money did indeed go into an account that belonged to me. The money then left my bank account going to various gambling websites, and I'm taking a wild guess that all of those accounts to all of those gambling sites were probably in my name as well. This is a debt that I don't feel I'm responsible for at all after all the punishment and the financial ruin he's left me in. In the time I was with him I lost ALL my wages plus some money my parents had gifted me in the hopes we'd settle down and have a decent deposit to put on a house. All in all, I would hazard a guess at losing somewhere between £60-70k in the time I was with him. Not to mention his own salary on top of that! But, now I think I'm stuck with this loan of around £1200. I am now being hounded by the PRA group who have bought the debt off QuickQuid and are sending me letters saying that I need to pay them. I can see on my credit record there is a default against my name under the PRA group for this unpaid debt. It's causing me a lot of stress now as I have finally settled again, with a most amazing man and we are expecting our first child together and would like to purchase our first home but my finances are making me very uneasy. In all this time, I have never contacted the police as I did what I could to try to come to a civil separation from him. I didn't want to get him in trouble as I wasn't sure if it would affect his job and whatever ill feelings I had toward him I tried to stay fair and settle things with as little trouble as possible. Seems though, that the only person suffering is me! Is it too late to take this to the police now? Have I left it too long? My ex husband, to name the things he's done.. .gambled our entire marriage, made up solicitors and created fraudulent email trails. He's taken money from me that should have gone into my bank and brought me home a 'receipt' of paying it in to my account then turned a story about how the money went into the 'wrong account'. He's taken out numerous loans in my name. Opened up accounts to gambling websites in my name. He moved into military married quarters after we were separated using a marriage certificate that was no longer valid, ran up trespass charges for a late march out and slapped me with a bill of nearly £1500! He'd steal my purse... I've never lost my purse in my entire life.. .in the 3 years we were married I managed to lose it THREE times AND every time it's miraculously turned up back on camp.. .minus the couple hundred pounds emergency cash I had in it! He cheated on me. He's even lied to me now about his current girlfriend being sexually assaulted and suffering panic attacks because of it. ..and his poor girlfriend. ..he steals money from her kids...! I apologise for all the excess info and I understand it's all a bit jumbled. I just find it extremely difficult to put what he did to me in words but felt that some background on all the things he got up to might help me get some advice... Thanks.

-

Have been ignoring my 6 Payday loans and 4 other debts for several months now, the other companies don't appear to have put disproportionate amount of interest on to the debt but my Toothfairy loan has gone from the original amount of £300 up to £1438 since I took the loan out in late July and I get this email from them every 5 days: We are writing to give you formal notice that ToothFairy Finance Ltd - ToothFairy Pay Day Loan has legally assigned the rights of the above debt to Marshall Hoares Bailiffs. This means that Marshall Hoares Bailiffs Limited now legally own this debt. YOU WILL HAVE OR WILL SHORTLY RECEIVE A HOME VISIT We intend to pursue you fully for all outstanding sums (GBP 1438) including any fees we incur collec ting this debt. Payment in full must be received no later than 17:00 to avoid further door collection fees being added to your file. DO NOT IGNORE OR THIS WILL COST YOU MORE Debt GBP 1408 Missed Payment Fee 1 (day 29) GBP 10 Missed Payment Fee 2 (day 43) GBP 10 Missed Payment Fee 3 (day 57) GBP 10 Repayments todate GBP 0 Total GBP 1438 TAKE NOTICE: You should accept this letter as formal notification that unless payment is received within 4 days then your account will be fast-tracked and considered for the following: Consequences of inaction: 1. Court Judgement legal action will be automatically started in the County Court for recovery of the full amount outstanding. Any such proceedings will include additional claims for legal costs and interest which will increase the amount you will be required to pay. 2. Warrant of execution will be app lied for to enable us to seize goods at your addresses and or an attachment of your earnings. 3. Register of Judgements any judgement will be entered in a public register, the Register of Judgements, Orders and Fines Credit Reference Agencies, who will supply them to credit grantors and others seeking information on you financial reputation. This will make it very difficult for you to get credit. 4. Credit reference ToothFairy Finance Ltd have already advised the Credit Reference Agencies of your DEFAULT. This may seriously affect your ability to obtain credit in the future. Once the balance is paid in full, only then will the default be shown as “Default Satisfied”. To AVOID A HOME VISIT or further action you should PAY IMMEDIATELY 1. online using a card by visiting: www.marshallhoares.com OR 2. at bank either over the counter at the bank or by electronic transfer to: Barclays Ba nk Account Number: 93462382 Sort Code: 20-50-94 This debt will not go away and should not be ignored You can contact us on 08433811111 to discuss your outstandig debt. Yours Faithfully Anti - Fraud Marshall Hoares Bailiffs Telephone: 0843 381 1111 The content of this email should not be considered as an acceptance of any offer unless we previously review and expressly approve in writing your terms and conditions relating to the subject matter of this email. The information in this email is private and confidential. If you are not the intended recipient(s) or have otherwise received this email in error, please delete the email and inform the sender as soon as possible. This email may not be disclosed, used or copied by anyone other than the intended recipient(s). Any opinions, statem ents or comments contained in this email are not necessarily those of Marshall Hoares Bailiffs Limited. If you wish clarification of any matter, please request confirmation in writing. Marshall Hoares Bailiffs Limited. Registered Company No.: 6871092 Consumer Credit License: 631168 We take precautions to minimise the risk of this email containing a software virus but you should use virus checking software. How should I even begin to deal with this lot as from looking in this section of the forum they don't look very easy to deal with

- 21 replies

-

- advanced

- assignment

-

(and 7 more)

Tagged with:

-

Hi all, need a bit of advice please as to how to proceed realistically if you dont mind, here goes - A family member ( yes, honestly) has just bit the bullet and come clean to her other half regarding all the debt she is in. Luckily shes done it before it had any impact on their priority debts ( mortgage, utilities etc). They are all Payday Loans and are relatively recent ( some recently renewed). Heres the state of play at the moment - Inventive - £163 per month. Pounds to Pocket - £154 per month. Sunny - £275 per month. Very - £70 per month. - on top of these, she also has a Wonga loan with a balance of £1307 thats costing her £400 per month to "roll over". So as you can see, shes currently paying around £1000 a month to these firms and its got to breaking point. Two of them are paid by Direct Debit which Ive already got her to cancel through Internet Banking, the other three ( including Wonga) are by monthly Debit card payment. Ive told her to go to the bank this coming Monday and report the card as lost, this should generate a new card but with a different security code thereby stopping the other companies taking any money. Im sure I dont need to tell you that her other half has literally hit the roof, and understandably so, but he knows Ive been through dealing with debt some years ago when I divorced and has asked me for help. There is no question that he wants to repay these loans, but at an affordable rate, so I have a couple of questions for you. After all his priority debts, there is around £300 a month spare cash. Hes happy to offer each company £25 a month until the debts are cleared. Do you think this is reasonable? Also, do you think any of these firms will freeze the interest and if not, is there anything we can do about this? At the rate of £25 a month it will take a little over 4 years to clear the greatest debt (Wonga), is this also reasonable? (that is if they freeze the interest). Everything will be done in writing and by Recorded Delivery so if I do get any agreements, at least Ive got a paper record! So people, I could do with some more experienced input and will keep this thread updated for anyone else in this situation. Thanks in advance all.

-

Hi, I've recently had a letter from robinson way, offering to close my account and to record partially satisfied. Ideally I'd like the default completely removed. I'd like to know if this is even possible, or is it a waste of my time trying to negotiate this with them? Thanks!

-

Hi I am looking for some advice, I have been in contact with Erudio as due to my T&cs in my student loans my loans were due to be cancelled in july 2014. They are now more than two years later claiming I was in arrears at that time and I need to pay more than £4K. I had applied for deferment at the time from SLC they had rejected the deferment I disputed this as in all previous years my tax allowable pension and childcare vouchers were allowed in the calculation and Gross Pay was used to calculate the deferment . I heard nothing back for two years save some statements, a few months ago this from Erudio. I have explained the situation to them several times by letter and email. Now they are calling my home number every day which I don't answer and have repeatedly asked for them to contact by email or letter only so there is a paper trail. I have additionally contacted the financial ombudsman. Does anyone have any advice on how to approach this Thanks

-

I had 2 unpaid old loans with the speedcredit "group" of loan companies which of course went under a few years ago, I didn't hear anything until a few months ago from a company called "United Kash" who said they owned both the loans but have now passed one of the loans onto another company called "Capital Resolve." I have heard very little from Capital Resolve but United Kash have been sending letters / emails & texts (probably phone calls too but I don''t answer unknown numbers.) I have been ignoring all of these forms of harassment, now last week they sent me a text ONLY saying they were going to send a "debt recovery officer" to my house within 10 days unless I get in contact with them which I also chose to ignore, however they have now sent me another text saying that the "debt recovery officer" is going to visit my house this week which has got me a little worried?? The thing is that I still live with my parents and they do know about the previous debts etc but I don't want anyone randomly turning up to the house, so I need advice on what to do. the debt were both £400 which of course with the way the previous owners worked they soon ballooned up into the 1000's, they have sent several payment demands stating that they want £800(not sure where they got that figure from) but they are happy to accept £600. I believe the debts are around half way to statue barred too. So, I need advice on what to do.

-

Apologies if this is sat in the wrong section. My son applied to Amigo loans in order to purchase a new car, He asked me if I would step in as a guarantor which after some consideration I agreed. I know many of you will say I signed it and that's just the way it is. I accept the position at the time. However what has troubled me since is as follows. My son borrowed a substantial amount of monies however he defaulted the first month, the second month and so on.. through to month five. I have paid every month to date as a guarantor. I have raised a complaint based on the due diligence and the affordability of the original loan applicant and furthermore the proof of affordability from me. I provided no proof of affordability although my credit file is perfect so I would expect ay loan application to be approved on my signature. However what concerns me is the following - My son who has now defaulted the loan every month, and also ignored me completely. I raised a complaint and challenged the proof of affordability. It has been confirmed in writing and by an authorised telephone recording the following.. My son has a poor credit file with defaults going back 4 and 5 years ago, poor credit rating full stop. It was confirmed Amigo loans did not look at Bank statements, but only looked at wage slips.. only took on-board the income and only discussed the expenditure but never had to prove this expenditure. I have borrowed monies from many various private and commercials over the years and the loops that I have to jump through are many providing bank statements both commercial and private etc to demonstrate affordability. yet Amigo loans admitted today that they never got physical proof of affordability and a month after pay out they received bank statements at my request and the statements demonstrate affordability and the statement were shocking. My question and getting to the point is were is my protection as a guarantor? How can any finance house lend monies based on income and no physical proof of expenditure especially with so many defaults on his credit file. This demonstrates that responsible lending is Clearly very distant from Amigo loans mind-set and they are just out to nail the Guarantor. Charging a 49.9 APR claiming it is because of risk, I have asked what risk? they take no action against the defaulted loan applicant unless the Guarantor stops paying. then they take action against both... I know I have myself and my unconditional love to blame but surely proof of affordability is key to how these people lend money in the first place. I have now had a final response and now submitted to the ombudsman too. Thoughts please. Thank you

-

I was sick with panic when Link Financial rung me regarding a 97 Student Loan. I have found the correct Statute Barred template and sent it Special delivery to PO Box 141 Caerphilly, CF839BX I have tracked it and its status is only delivered and not yet collected. I am concerned about this. Should I also fax and email? Is there a better address to send it to - how long should I wait? I really appreciate your help on this one to alleviate the worry. many THanks, Clear 33 --------------------------------

-

Hi I have had some emails from CRS regarding a debt which was with lifeboat loans but now owned by starline capital limited as they bought the loan book from lifeboat loans when they went into liquidation. The email I have had from CRS informing me of the amount I owe is the first communication of any kind regarding this since taken the loan out several years ago. CRS were chasing £1200 pounds. I spoke to CRS a month ago to dispute this amount as the original loan was for £300 pounds I think asked CRS for the default notice as I have never had one and also a statement of account and a true copy of the terms of conditions. today I call CRS to find that they are no longer going to deal with the account due to the dispute. So I am guessing that CRS have had no response to my request and have given up or know there is proof. What can I do going forward as I cannot find any details of starline capital limited and CRS say all their communication is done via an electronic system and have no contact details for them and suggested I google search them. Any help would be appreciated as I want to dispute this amount and get them off my back.

-

Cutting a long story very short, bought a car in May 2016 for a few hundred pounds, have received a letter from Loans 2go saying vehicle was subject to security by the owner previous to the one we bought from and to contact L2Go. Called them this morning and asked to see copy of BOS and authorisation over the vehicle, they said they would release their clam for over three times what we bought the vehicle for. :-x the amount requested is laughably high, the vehicle would be worth maybe £200 at auction, the person on the other end of the line said we have 10 days to respond Obviously courts are closed for the weekend. Advice please Have reported the matter to the police as a pontential fraud

-

Hi All, Apologies if this isn't the right place to post this but it was the most suitable heading I could find. In April 2012 I took out a £5000 loan from Amigo with a 60 month term, I know the interest rate is ridiculous and anyone would be stupid to actually use these people but I needed the money and at the time this was my only option. I worked out yesterday that I had 10 months left of the loan and around £2200 left in payments to make but when I checked the statement the balance was £3095 (before they add any interest on for the next 10 months). So I called them this morning to ask what happens to the £900ish that would be left, if they didn't add any more interest. The guy on the end of the phone kindly advised me that I have 20 payments left and I'd made 50 - so 70 payments for a 60 month loan... When I asked him to explain he said it was because of a couple of things: 1. they paid the loan out on the 16th April 2012 and the first payment was made on the 1st June 2012 (this was the date they advised me the first payment was due) 2. I've changed the payment date twice, first from the 1st of the month to the 22nd and later from the 22nd to the 28th. I haven't missed any payments, just extended the payment to 3 weeks later and then a further week. With point 1 he said the first payment should have been made within 30 days of the loan payout to 'protect the terms of the agreement' but as I pointed out to him, I didn't ask for this to be the first payment date - they told me that was when the first payment was due On point 2 he told me that changing the payment date would affect the total loan duration and therefore may cost more in interest - I get that - I moved the loan payment by 28 days so instead of the final payment being the 1st May 2017 it would now be 28th May 2017 These two things apparently add 10 months to the term of my loan at a cost of 217 a month (£2170 for a 28 day payment change) How can this be and what can I do about this? As far as I'm concerned I had a 60 month agreement with fixed payments and the interest rate was variable - how can they just add 10 months onto the agreement and force me into paying so much extra. As if the £8000 interest on the original £5000 wasn't bad enough Help me please

-

Hi all, my daughter has received an Interim Charging Order for a £2700 debt incurred by her sister, jointly named on the paperwork. She has no knowledge of this, and also, Lightfoots appear to have obtained this order by using Land Registry search and she has received absolutely no other communication. She has no CCJ's showing on her credit report, but we have found other defaulted loans she knows nothing about. However, TFS isn't one of them. She is paying her mortage on a house with negative equity, having been left in the lurch by her former partner, so the mortage is still in joint names as far as I am aware. The covering letter gives her 28 days to respond, what should she do please

-

It is the summer of 2015, August to be precise. My wife and I have just ordered a top of the range Schreiber kitchen - £24,000 worth of all singing and dancing fittings from Homebase ( now Bunnings UK ) It was going to be a large contract and we were going to be out of the country whilst the work took place, hence we gratefully accepted Homebase`s offer to project manage the delivery of goods and installation. While we had the cash to pay for the whole thing upfront, we deliberately opted for the 12 month deferred interest free loan arrangement as this would enable us to "sign off" the work to our satisfaction before the loan was activated. So far so good. The small print on the Terms and Conditions of the loan- as laid down in the Consumer Credit Act 1974 - stated that; "After we have accepted and signed this agreement and you have received the goods or services, we will pay the loan amount to the retailer". Well, the kitchen fit s a disaster. Long delays, notifications to ourselves in Florida !! on our mobile phones of goods being delivered and, worst of all, the top end larder units which had swung our decision to go for the kitchen in the first place didn't actually exist ! Trying to co ordinate the snagging from the USA was a nightmare and when we returned home in early December 2015, the kitchen was still without the units which had to be specially manufactured in Italy. We had a succession of top level meetings with senior staff at Homebase ( up to and including Divisional and Regional Managers and the attention f the then CEO ) The final meeting with 4 Homebase personnel took place on 4th December 2015. On 7th December 2015, we received an e mail from Barclays Partnership Finance congratulating us on our purchase and notifying us that our loan agreement had been activated ! Surprised ? You bet we were ! Having to fight with Homebase to get the kitchen finished was bad enough but having the one bargaining chip I possessed being taken away was even worse. Cutting a very long, painful and tedious story short, our kitchen was finally finished and compensation agreed with Homebase on 1st July 2016. The explanation was that the sign off system is computer generated ( isn`t it always ? ) and that receipt of delivery notes - plus an allowance of time for the fitting process - triggers the loan activation. Fine, except the average time for activation bore no resemblance to the date on which my loan was activated. Basically, even though Homebase knew we were heavily into dispute over the kitchen delivery and fitting, someone, somewhere decided that it was tie they got their money. I took issue with both companies but mostly with Barclays because, at the end of the day, I had NOT received all the goods and I had most certainly NOT therefore received all of the services at the time they decided to activate the agreement. Going through Barclays byzantine complaints process ( around 15 letters from them and 8 from myself plus countless hours on the phone ) got me to the point where Barclays told me that they could activate the loan at any time and that I should read the terms and conditions more carefully. Nice. EXCEPT, they are and were wrong ( see the third paragraph above ) They can only activate the loan once the goods or services have been supplied. Finally, they acknowledged that their own wording and my interpretation of it were correct. At which point, they simply re interpreted the rules - or rather, invented a new one - by saying the following ( excuse the grammar, it is Barclays own exact words ) :- "As you had received some of your goods, we are allowed to release the funds to the retailer. As Homebase requested this and because some of your goods had been delivered, we were effectively allowed to do so which meant that your loan with us went live" Problem is that this wrinkle is NOT spelled out in the terms and conditions and was not made clear to me at the time signed the contract. I am awaiting a response to my request for Barclays to point out to me exactly where it says they can do this and to date ( one month on ) I have yet to receive a reply. Spoke yesterday with an employee who said that the person I had written or someone in her team would be responding to me. Still waiting. O yes, I did point out that I had left at least three messages on the lady`s ansaphone. Guess what he told me ? They are so busy dealing with all other aspects of customers complaints that it is their policy NOT to respond telephone messages or call back if you leave one ? Apparently all you can do is request a call back when you eventually speak to someone. Other buyers beware. If you are contemplating such a purchase, ensure that you demand a satisfaction sign off for the delivery of goods AND the fitting services otherwise Barclays will simply pay YOUR money to the retailer without any recourse to you the customer. If and when I hear from them next, I shall be asking for a deadlock letter and then it`s off to the Ombudsman we shall go. Wish me luck, share any similar experiences please and watch this space. "Activation"

-

http://www.fca.org.uk/news/cheque-centre-stops-selling-single-repayment-payday-loans-fca-tougher-consumer-protection One down. Many more to go

-

How do these work exactly. I have a loan with Mobile money but they don't have the log book as they gave me the loan when I first had the car and had sent off for the log book. As I am now in financial difficulties with them, how can they seize the car without the book? Also, could I still sell the car and then pay them back rather than them seizing it and selling it cheap?

-

I have started having a sort through old paperwork from the last 20 years, imagine my surprise about the gems one finds. My first loan was with Barclays in 1996 for £1795.44 and PPI was added, I was self employed at the time. The next loan was with Barclays in 1997 for £7273.40 and used to pay the previous balance off.... PPI added....I was still self employed Then had an egg loan in 2000 for £5831 which was used to pay off the previous balance( PPI added). The next egg loan was in 2002 for £15241.66 which was used to pay off the previous balance( PPI added). PPI settlement from egg on this back in 2012 for 6.5k. The next loan was a Barclay loan in 2005 for £23331.36 and paid previous balance off and trip to AUS. no PPI on this one. Renewed Mortgage and paid of previous Loan 2006 Chelt & G. So at this moment is it worth firing off a claim for the first 2 Barclays loans ? Egg is obviously done and dusted in settlement. The next area that I have now noticed on the 23k Barclays loan, Is that the bank copy and my copy of agreements are different. Also on both, Apr is shown as 7.9% that doesn't add up right to the payments 48 x £486.07= 7.767 % not 7.9 or am I looking at this wrong? If the document has the wrong calculations what options are there ? Tigs

- 34 replies

-

- agreements

- apr

- (and 5 more)

-

Hi, I have sent all my payday loan refunds claims off but I just have a few questions. I don't have any bank statements but I have my credit report. I attempted suicide because of my bad debt and I had over 19 payday loans in Sept 2011 so I chucked everything and buried my head in the sand. On my credit report it shows I had every month in 2010 - 2011 3 loans running at the same time every month. I have claims for all my loans in 2011. My quick quid loans I had 33 loans that's roughly over 7 per year. Do you think I have enough to claim back as most of my outgoings in them 3 years were to my parents as they are retired and relied on my rent. in 2009 my dad to a loan to pay all my lenders and so my outgoings increased by £150. Rent: £500 Dad Loan: £150 (After 2009) Mobile: £45 Travel: £250 Food: £200 In 2008 - 2010 I was earning £1010 and in 2010 - 2011 I was earning £1200 per month. For 4 months in 2010 I was on JSA so I only had £280 every 4 weeks. In 2008 - 2009 I had the following loans all at the same time Wonga Quick Quid Poundstillpayday Wageday Advance Payday UK Payday Express Moneybox 247 Mr lender Uncle Buck In 2010 - 2011 Wonga Quick Quid Payday UK Wage day Advance Payday Express Payday Overdraft Monkey Dosh Convers Money Tower Capital Moneybox 247 Mr Lender Poundstillpayday Cash Genie Peachy Loans TxT Loan The Loan Store UK Uncle Buck CFO Lending Poundstoday and I think PoundstoPocket Oakham As I said I don't have any bank statements only my Credit report that was bad anyway. MoneyBox247 have sent me a sheet that show the credit check they did came back with a score of 450! Thanks for any help in advance Happy Easter!!

-

hi all, apologies in advance if posted in wrong place or incorrectly. I had a secure loan with future mortgages and that in turn was sold to engage credit which has been sold to Skye loans. Are they allowed to do this ? and is Skye loans a mortgage company? I cant find much info on them at all. Also I had PPI with Future and want to reclaim but not too sure how to or who to at the moment. Any assistance would be welcome. thanks Highjinks.

-

Hi everyone, j ust after a bit of advice i have run into a few problems with this company, they recently rang the guarantor at their place of work, which i did think was not allowed as they did have two other contact numbers for the person, i did raise a complaint but they said they have done nothing wrong, i am sure they cant do this, also the payments are meant to be 146 a month but they randomly took 66 pounds from the guarantors account without permission which agin as far as i am aware they cant do without permission, can they really do this isnt there a code of practice they have to follow and they cant just do what they want, can they

-

Hi Would like some advice about 2 loans that I took out in 2005 with egg to consolidate credit cards, car purchase etc after getting a mortgage in 2004. Both loans were for just under £25k each and it was more or less implied that if I took out PPI that the loans would be easier to be accepted for and that I would be able to claim if I was not able to work for any reason even though I was self employed. Roll onto end of 2008 where my ex wife and I started having relationship problems and I started struggling to make the repayments but feeling that I had a duty to repay I struggled on trying to keep the repayments up to date even when I could not carry on working at the end of 2009 when I became a single parent. By March/April 2010 I could not make the payments so the loans went into default officially. I spent the next 6 years struggling to bring up my kids as a single parent and have been chased to repay the loans via lots of different debt collection companies but was never in the position to pay anything So now in 2016 the loans have both been removed from my credit report (such a relief as can start rebuilding my credit worthiness). I did receive a questionnaire for both loans from Canada Square Operations in 2013 about my PPI but because of my financial situation I just filed them as I was worried that it was a ploy to get me to pay money to them that I could not afford. It does state in the covering letter that they that the loans where now being administered by Britannica Recoveries but does not say the debt had been sold to them. It also lists the reasons that they think I would be entitled to a refund for and they are for it being implied that by taking PPI I would get the loans and that when self employed I could only claim if I could not work at all. My question is would it be worthwhile sending in the questionnaire now to apply for a refund. Many thanks in advance Allister

-

Hi all, I've read a lot of people in a similar circumstance to my own on here, but thought I'd post my case as it progresses. I received a letter from some company called Honours Student Loans (HSL) a few days ago saying that they have 'now located me' and that I owe them £1600 in 'arrears' for a debt of £2500 and they have also applied a 'trace fee' to my 'debt'. From what I've read on here I'm not the only one, although a lot of the cases I've read are quite old now, so not sure if they've changed their tactics at all. Incidentally my original loan was for £1800 and I paid some of that off in bits so god knows where those figures came from. my student loan was from 1997, after which I started to pay it off for about a year, I deferred for a year, I moved and continued to defer, I moved again, informing the student loans company all the time of my address. I stopped hearing from them, no deferrment forms. Long story short I read in the paper that they were about to go bust and thought that the debt had just been anulled. That's probably when HSL bought all their loans. I was 17 odd years ago, last contact was maybe 14 or 15 years ago. Bottom line is that my debt is statute barred (from what I gather on here). I ran a credit report on equifax, I have no CCJ's current or passed, credit rating is good. today I'm sending the statute barred template letter, royal mail signed for. After that I guess I'll hear nothing for a while and then I'll get a reply saying I deliberately withheld my address or something, which is nonsense, (also from what I read on here), then god knows. Is there anything else anyone can think of that I should be doing at this stage? Any tips? Thanks

-

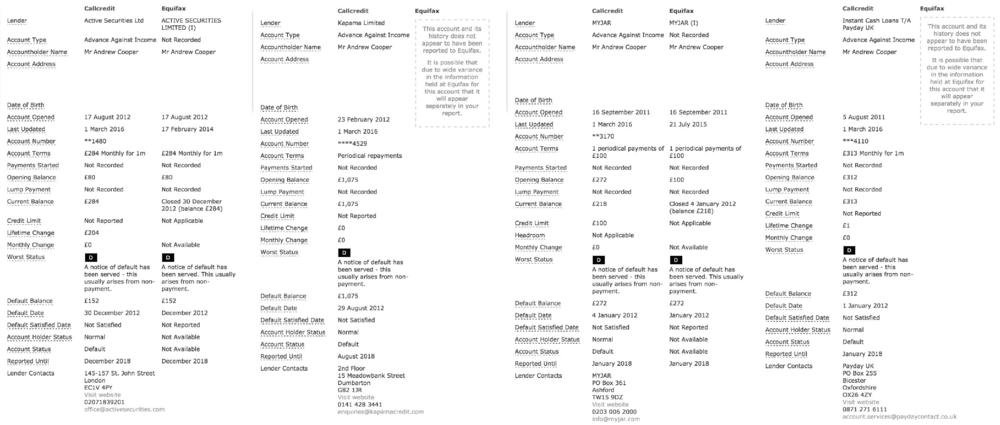

Hi, I was unfortunate, some may say silly to get involved with Pay Day Loan companies over the last few years. I am trying to clean up my credit report and have found four registered on my report. One for over £1000 on what was only a £100 loan. I have attached a copy of the information from my report. Can anyone help me sift through this and advise on the best route. I think the Kapama debt was from Mini Credit who have ceased trading. Just need to know what is the best way forward with these . Many thanks.

-

Hi, Thanks to all those who post such great advice. I am currently in the process of claiming for irresponsible lending. I have had a great number of payday loans due to a gambling problem. I have had an offer from Quickquid via the FOS to repay interest on the last two loans made in October. I am just after some advice as to have far I could reasonably claim back for to see if it is worth shortening the fight. I have outlined the dates and amounts below. I have already had a judgment from the adjudicator that one in August was irresponsibly lent so I am working on the basis that everything after is. Would it be worth try to ask for interest from the loan in April as I had borrowed 3 times already and paid off the March one only to borrow two days later and on my payday no less?? When do you think that the FOS would start presuming that money was being irresponsibly lent? Quickquid Oct 2014 £400 Quickquid Dec 2014 £600 Quickquid Oct £1000 (paid off and then...) Quickquid Oct £1100 Quickquid March £700 Quickquid April £700 (paid off the previous loan and then borrowed 2 days later - on my payday) Satsuma August £500 (The adjudicator has said that this has been irresponsibly lent) Satsuma Feb 2015 £350 Sunny Feb 2015 £700 Sunny May £750 Sunny June £100 Sunny Sep £750 Sunny Oct £350 Payday Express Feb 2015 £400 Payday Express May £400 Uncle Buck July £200 Uncle Buck Oct £300 Lending Stream Sep £250 Lending Stream June £150 Whizz Cash Sep £250 Western Circle Sep £200 Pixie Loans Sep £200 Pixie Loans Oct £300 Piggybank Nov £100 Ferratum Nov £110

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.