Showing results for tags 'agreement'.

-

Hi seeking some advice if possible , i read some of your posts regarding Lowells and i sent a request for a copy of the original credit agreement using the template supplied on site. I received a letter sometime back saying they would request it from the credit card company and that would take 40 days !!, as of today 14/12/16 i received a recorded delivery letter with an enclosed copy of a so called original agreement , this agreement has no date on it , no agreement number on it no signature on it and the address is spelt wrong it looks like they have just typed it up and sent it off This can't possibly be an original copy can it ? the original was taken out in 2012 they also attached some copy of statements which do have the address spelt correctly .

-

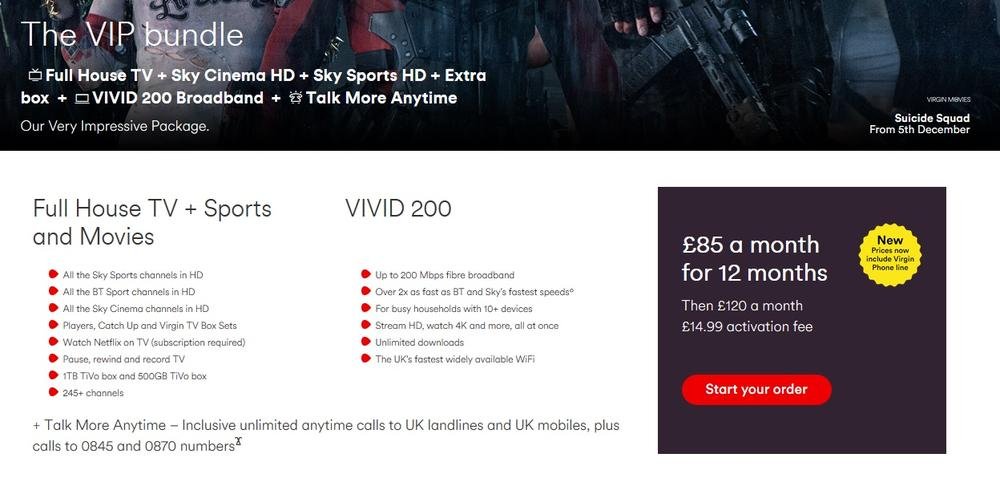

Hey guys cutting this very short for you. I was out of contract and decided to go to Sky unless i could negotiate a deal with VM. So i rang them up and everything they offered as an existing customer was way higher than Sky so i said i would think about it. I was ready to go with Sky so rang VM to disconnect. Talking with them i managed to wangle an excellent deal!! They matched the top bundle with an exchange vbox for 500gb tivo in other room for £89.73 see link below.I said that i should get a good deal similar to this as i was out of contract and they would lose me as a customer otherwise so I jumped at it and confirmed price and 12 month contract twice. ( i was stung years back. ) I got an email saying my bill was £153 + so today i ring to complain and get told that £153 was the price end of! Then after much explaining and to and fro they mysteriously found what i had told them but the 2nd tivo cost extra plus it was a 9 month contract?!?!?! I complained and they sent it to a manager who said take it or leave it. I then said i want the recording of the initial deal and they said it would take 40 days and it would be hit or miss if they even recorded it. They also said i had 4 days cool down period left which they refused to extend until i got the recording PLUS they kept insisting that i was told it was extra etc etc and that i agreed to a 9 month contract not a 12. So i said OK take the lot out!!! As you will see by the link that the VIP pack which i was given says 12 months contract. http://www.virginmedia.com/shop/bundles/vip.html OK, then i was put through to disconnect and i told my story and hey presto i could have the bundle including the extra tivo box but only for 9 months then it would go up BUT if i ring shortly before the 9 month period i will then be offered a new or extended contract virtually the same as i have at near the same price ...... i was told that they do it all the time? I managed tom record this conversation lol. The deal i got was excellent but i am adamant that i only agreed for 12 months and got verbal confirmation twice! No way would i agree to something that would end up twice as expensive for 3 months!! Is there anything i can do to get them to stick to their deal? Yes i know i can renew etc and even with a recording what happens if they have made a note and then shaft me at 9 months and not allow me to renegotiate the same package for the same price?? Can i get them to enforce the initial verbal agreement (sadly never thought to record that)? I have lost out too because i was getting a free 43" 4K tv with sky but is out of offer now : (

-

Hi, long time since I have been on so hope I have put this in the correct place. I am taking two large loans from a friend and family, to clear some business issues, both of which need to be secured on my property. Lawyers are asking ridiculous sums for agreements and posting the charges. A full legal charge appears to be too complicated and time consuming for my needs so I am proposing equitable charges which should suffice. My question is, what forms do I need to submit to the land registry and can this be backed by a simple loan agreement between lender and borrower? Would there be templates on the site for loan agreement and charge as I cannot seem to find them myself? The loan agreement I can find online if necessary, it is the charge details that I do not have. Many thanks for any input. r

-

Hi I recently got measured up by a rep from Pay Weekly Carpets. It was a good idea at the time but now after receiving a tax rebate and my brother in law hearing about the price I was quoted, he advises me can point me towards much more affordable sources of the flooring I want fitting and he'll put it down for me. The credit agreement I signed says the £40 deposit is non-refundable. I accept that I probably won't get anywhere with that. What does concern me is that the document has the standard heading of; Hire Agreement regulated by the Consumer Credit Act 1974. But in the key information section there is a line under the heading of cancellation rights that says; "You have no right to cancel this agreement under the consumer credit act 1974, the timeshare act 1992 or the financial services (distance marketing) regulations 2004. I and the rep signed it on 3/11/16. I've just read the Which consumer page on credit agreements and it says I have the right to cancel within a 14 day cooling off period? Can anyone confirm for me that is the case so when I do cancel and they try to argue the toss with me I can say to them there's nothing they can do? One thing that bothers me if they do get nasty is they now have my debit card details so I'm guessing I'd need to cancel my debit card to stop them taking payments, even though I haven't actually signed a separate CPA agreement.

-

I've actually put the whole question in the title. I am repaying a debt which went to court mediation and I signed a Tomlin agreement. Over a year later the DCA sold it to another DCA. For about a year the new DCA accepted my payments but are now writing/ attempting to phone/ wanting me to phone them, and saying there is not an agreement in place. I have written a letter of complaint, and am waiting their reply. But what is the LEGAL situation of my Tomlin agreement and the new DCA? Thank you

- 6 replies

-

- agreement

- county court

- (and 6 more)

-

Dont want to reopen a can of worms but we do have an interesting twist on the lender not signing the agreement which is going to court in December.

- 21 replies

-

- agreement

- lancashire

-

(and 3 more)

Tagged with:

-

Hi, Please if possible can someone give me some advise? I have worked for a retail clothing company since March 2013. Up until 6th July 2015 I had a standard 'sales agent' contract. After this date I signed a Consultancy Agreement with a small list of retail customers which I was authorised to to provide 'Services to the Company'. For these accounts I earned a fix 6% commission rate on all paid invoices. Any other customers that I influenced sales for the company I also got paid for at the same rate. In my contract it states that the Commercial Agents Regulations act/regulations 19193 do not apply to this contract. On July 14th 2016 I was given 4 weeks notice of termination with the new MD stating that all business in my region will going forward be handled internally. I have been told that all business concluded by 14th August and paid by Christmas will be commissionable. Can someone please advise if I have any claims as to business on accounts that I have worked on for 3+ years should be commisionable after the 4 week notice period? It is very frustrating as many of my accounts will be placing 2017 orders in October this year and I will receive nothing for my previous development work. Really appreciate if anyone can advise? Thanks

- 1 reply

-

- agreement

- consultancy

-

(and 2 more)

Tagged with:

-

I recently applied for credit with a loan provider. I was accepted for the requested amount and was provided a loan agreement to electronically sign, complete with terms and all the necessary information. I signed it and it was signed on behalf of the provider, which was emailed to me as a PDF. Now, the provider is requesting bank statements and ID verification, and have cancelled the original loan from my account. Is the loan provider legally obliged to continue with the agreement they originally signed or are they even capable of backing out? Thanks in advance, Michael.

- 5 replies

-

- 118118

- 118118money

-

(and 4 more)

Tagged with:

-

Hi, Can anyone explain legal term in Assured Shorthold Tenancy agreement'...execusion of this agreement..' Rent in advance was paid on execusion of this agreement and then mothly afterwards. The agent twists this part. Thanks,

-

Hi. My first post here. I had a browse on the perfect home site and checked out the price of something I'm interested in. I came to the part where it mentions about id, and at this point I decided not to bother as I mainly operate paperless. an hour or so passes by and I receive a call from them saying they noticed I hadn't purchased anything to which I explain the paperless problem. The polite lady began explaining that I can take pics of my digital proofs and upload them to the site and do it that way. I decided fill out an application, made my first payment, and was told someone will call to sort out identity. Long story short, feel lied to, have read the horror stories and no longer wish to proceed. Where exactly do I stand with regards to calling up the local shop and saying nope, have changed my mind. Thanks in advance.

- 5 replies

-

- agreement

- cancelling

-

(and 1 more)

Tagged with:

-

I have just seen a RBS agreement from 1992!! At the top it does'nt have the usual bumf of 'this is a Credit agreement regulated under the consumer credit Act 1974' (or similar) I thought this was a must! What legal implications does it have? There are other faults but I can't remember what not having the above means. Its not mine so I can't post it up. Kind Regards jack

-

hi i have a question for you all will try to make it simple your advice will be much appreciated i have a tenancy agreement signed on the back page by owner/ landlord on the first page it has the name let's say arthur biggs of renttoday ltd not signed accelerated process procedure applied for but agent arthur biggs has signed all court papers not the landlord/ owner will this make the order invalid many thanks also the ltd company mentioned on the agreement dissolved compulsory strike off several years ago companies house

-

Beneficial interest on HP Agreements. I have tried to simplify this definitions in order to keep them in context with the current discussion regarding, if a vehicles on HP can legally be taken under control. The intention on this thread is not to discuss any success or failings of cases which have gone to court, it is just to examine terms which are unfamiliar to many on the Bailiff forum. It will be necessary to introduce some more terms, which should assist understanding within context. These are: “Property on goods” and “possession in goods”. Property in goods denotes ownership. A landlord has property in goods in a rental agreement for instance. This also applies to the creditor in a HP agreement. “Possession in goods” applies to the hirer in the above case. This is where he takes possession of goods for a period of years on in perpetuity under a lease. This also applies to the hirer under a HP agreement where his legal possession is prescribed by the terms of the HP agreement Interest in goods. An interest in goods occurs when someone who is not their owner, has rights in regard to a part of their value. There are numerous types of interest in goods, legal interest, equitable interest, beneficial interest, etc. All are covered by the above definition but they denote different ways the interest is held or recoverable.

- 401 replies

-

- agreement

- beneficial

-

(and 3 more)

Tagged with:

-

Hi guys, In need of some advice and guidance regarding a credit agreement with littlewooods. In March this year our Television broke and so I sought a replacement. As it happened Littlewoods had some offers on their range of TVs and combined with a new customer discount tis made for a good deal on the TV I was looking for. Combined with their 12 month pay later 0% this seemed a great way to get the TV quick and set the money aside to pay for it at Christmas when I had a bonus due. Upon ordering the TV the representative on the phone struggled to get the order through, first the code wouldn't work, then something else, the the wrong finance plan, the wrong item but Finlay I was able to pay £250 deposit and place the order. The rep assured me the code would be added to the order, the mistakes he'd made ordering it twice rectified and not to worry. TV arrived as promised, just the one, everyone happy.........until the statement arrives the following month. Not only had the discount not been applied but the finance plan was over 3 months, not the 12 at 0%. These two things are what swayed me to buying the TV in the first place. Without, I'd have been better off going elsewhere. I called them, after about an hour of being passed from one place to another I was finally assured not to worry, told to ignore the statement and minimum payment and that following one would be correct and show what I'd actually signed up for. Not only did this following statement not show this, but the amount had increased and a default and missed payment charged added. This has continued each month. Me spending £50 or so and hours on the phone to them with promises of someone will surely call me back, it will be put right and not to worry. Not only have I never received a call back but the statement amount continues to increase despite their acknowledgement it is incorrect and their mistake. It may only be a trivial amount of a few hundred pounds but that is a lot of money to me and something I have to work every hard for. With the time off work on the phone and the cost of calls it adds up to more than I should owe them! Where do I stand on getting these expenses back and sorting this out as 4 months on and it still continues. Its pretty stressful and worrying and I shouldn't have to be spending days on the phone in then little time I get with my family running up expenses chasing a problem they freely admit is there mistake inn the first place. What to do? All help and advice appreciated.

-

Not sure which forum to post this in. I signed an estate agent agreement this week and have since had a friend who wants to rent my house with a view to buying it in the future. The agreement I signed is as follows: typr of agreement - sole selling period - 20 weeks then 14 days notice to terminate and I see that I also signed a waiver of my cancellation rights. Do I have to keep it on the market for 20 weeks even though I don't want to sell it now? Many thanks.

-

Your right to end a hire purchase or conditional sale agreement You can end (terminate) a hire purchase or conditional sale agreement in writing and return the goods at any time. This can be useful if you can no longer afford the payments or you don't need the goods any more. You will have to pay all the instalments due up to the time you end the agreement. If your payments come to less than half of the total price of the goods, you may still have some money to pay as the lender is entitled to this amount under the agreement. If you have already paid more than half of the price when you end the agreement, you can't get a refund but you usually won't have to pay any more. If you are not sure whether you still owe anything, check the original credit agreement which should show the total price of the goods and the amount you must pay if you end the agreement. The credit agreement is the legal document you signed when you bought the goods. Lenders sometimes say you must pay the whole amount owed under the agreement this is sometimes wrong. hope this helps:-D Citizens Advice

- 4 replies

-

- agreement

- conditional

- (and 5 more)

-

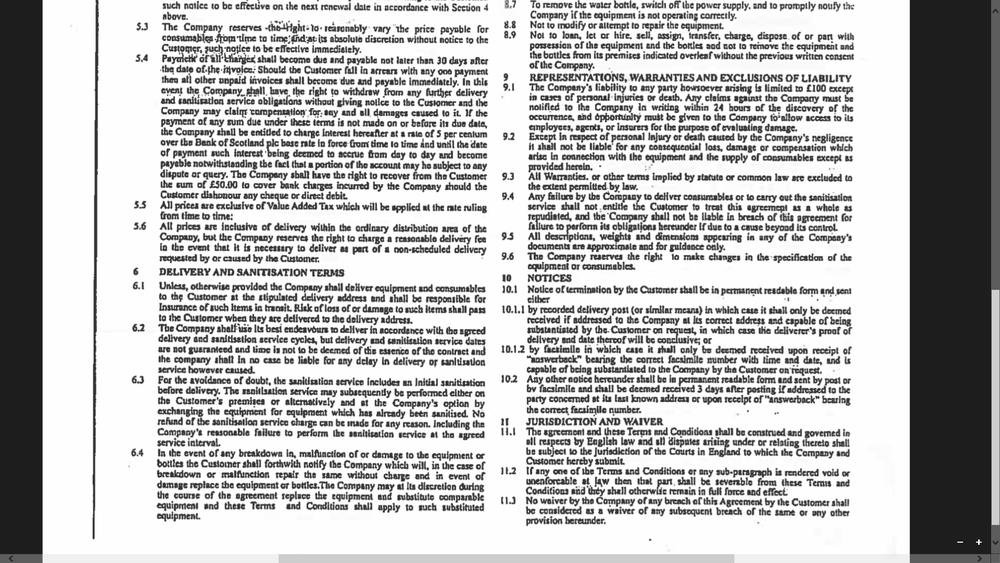

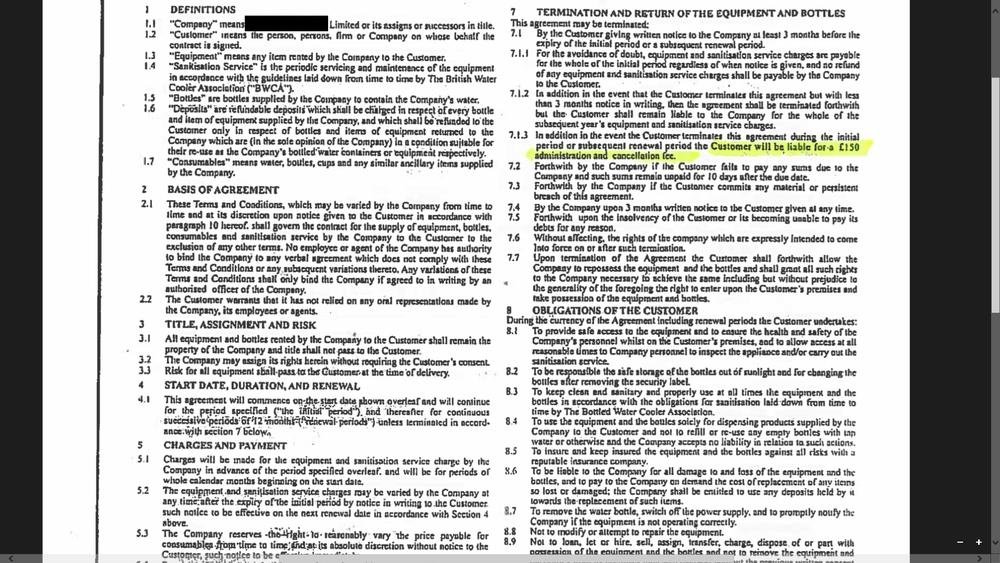

So, long story short, we caught the Water bottle provider (for office water) filling his pockets with mints from the meeting room. He was only supposed to, and trusted with, being in there to change the water bottles over. we dont want this little thief in the building any longer we called to terminate the water contract - they have stated a) they dont give two hoots about their staff and b) they wont cancel the water order, will, come to premises and take the goods and continue to bill us c) "bring it on, we have lawyers" No apology, nothing. here is the agreement enclosed that we signed, yes we can give three months notice as its dated 2014. what rights do I have - without court, bearing in mind its a civil agreement not a criminal one - yet my issue is technically criminal (ok its only mints but the principle is there). we threatend the fact we may call the police about this and for them to just take their stuff and go - but he proceeded to take that as blackmail! We just dont want them in the building ever again nor do we want to pay them a penny more! They are also member sof: http://safecontractor.com/ and http://bwca.org.uk/

- 18 replies

-

- agreement

- county court

- (and 5 more)

-

Hello, Sorry, I really tried to keep the description as short as possible: On 03/03/2016 we called some conservatory companies in Devon and finally made appointments with two of them for the next day for a viewing. In the afternoon we sent them a floor plan with detailed measurements and other information about what exactly we wanted. BTW We had even searched the web for reviews about the companies and found nothing negative - just one positive review. On 04/03 an employee of the first company arrived in good time, and we noticed he had the document (which we had emailed the day before) printed out and ready for discussion! Because the negotiated price was acceptable (£8,060), and because he confirmed that they could complete the conservatory within a month, we decided to enter into a contract immediately. In the contract was stated: "Installation date: 18/03/16, 09.00" As advance payment 1/4 = £2,015 had been agreed: On 04/03 we paid £2,015 by bank transfer. On the same day another employee arrived to carry out a survey (as specified in the contract). He examined the house, took measurements and discussed with us and wrote down the exact positions for the doors, opening windows, roof connection etc.. We mentioned that we had already paid the advance, and he said the required parts would be ordered IMMEDIATELY! 17/03: Since we hadn't heard anything from the company, we sent an email and asked if they had received our advance payment and also asked them to confirm that the works would start on the next day as provided in the contract. No answer. On 18/03 we waited at home the whole morning, but in vain. No one came. No information. We called them after lunch: the secretary said she would talk to the builder responsible for the groundworks. On the same day we were informed that the builder would begin on 22/03, 9.00am. On 22/03 no one came, but the builder called us to tell us he would come one day later, 23/03, 1.00pm. On 23/03 he came, examined the ground, and asked us additional questions regarding the groundworks. Since it is a hillside situation, he recommended insistently to build an additional retaining wall (the rain would wash the garden down to the conservatory), cost around £2,000 (making it much more expensive than other offers we had received before signing the contract with this company). He seemed to be a skilled and competent builder, and to avoid further delays, we agreed in principle and asked to calculate the exact additional costs and inform us asap. We asked when the groundworks will begin finally, but he could not give us a concrete date. On 24/03 we sent another email to the company to declare in writing what had happened so far. We wrote that because early installation was VERY IMPORTANT to us, we were happy that they could offer us that early installation date (18/03). This was the MAIN REASON we decided in favour of their company, cancelled another appointment we had later on 04/03, signed the contract, and immediately paid the advance - just to avoid any delay. We asked them to inform us immediately in writing about when the works would begin and what exactly the extra costs for the additional work (retaining wall) would be. 29/03: Since they hadn't answered, we sent another email in the morning. We reminded them that during our initial discussion on 04/03, before signing the contract, it had been confirmed that the project could be carried out within a month, so we already made plans for the time after the installation. We stated again, that we really needed the additional space, provided by the conservatory, as soon as possible. 30/03: Since there was no reply, we sent another email, stating that it's urgent. Then the secretary called us and said she would send us an email regarding the starting date. 01/04: Again, nothing happened. We sent another email: we asked what had happened in the meantime and why there were further delays. We reminded them that we were waiting for 9 days now to get an answer regarding the costs for the additional works. 06/04: After many many attempt we finally got the manager on the phone. He told us that the groundworks will be carried out "next week". We were very relieved about that. He said he would call us back to tell us the exact date. He didn't. 07/04: We sent another email in the evening: We wrote that we tried to call him several times during the day, but in vain. Furthermore we reminded him, that we would also need to know what would be the costs*for the additional works. 08/04: The secretary called and informed us that a skip will be delivered on 13/04. We asked again, if they would already know what the additional costs would be. She just answered "not much". On 13/04, as announced, a ridiculously small skip arrived, and one worker, without any machines, dug out some earth and moved it into the skip. A day went by, but this method was not suitable to make progress. On 14/04 the employee who visited us on 04/03 for signing the contract came again to let us sign an additional contract about £2,000 for the extra works, and we were asked to pay this in advance, because more work needs to be done, so they would need more money in advance for material and the builder: On 14/04 we paid £2,000 by bank transfer. On the same day or a few days later, a larger skip had been delivered, the required machines and an excavator arrived, and intense working finally began. Great! (we thought) On 28/04 a lot of work had already been accomplished, The manager visited us and tried to persuade us to accept that the project would cost another £1,600 (!!) more. He admitted it had taken a bit (!) longer, but he had selected "quality workers" in order to get the job done as good as possible. (Later it turned out that this builder and his men had been commissioned by him for the first time - he never knew them before!) We reminded him that we have a contract plus the additional costs of the second contract, and that we can't pay more than was agreed in these two contracts (all together £10,160). He accepted our objection, but asked us politely to pay another £2,000 in advance + £100 which we had agreed with the builder for a minor modification of the retaining wall, so that he could speed up the remaining works: On 28/04 we paid £2,100 by bank transfer. Until 05/05 (with some interruptions of several days) the builder had completed the groundworks and brickwalls, however there is still some work left for him to do, which he can't do before the other conservatory parts will be built up. That is the reason why material, some debris and the last skip (which has already ruined the lawn in front of the house in the meantime) had been left here at the construction site. (BTW: It turned out that the ground is solid ROCK, so the wall wouldn't have been required - according to horticultural advice it could also have been fixed with cheap retaining wire netting!) On 06/05 the manager called us and asked us to pay another £2,000. He said he had to pay bills for many skips, pay the builder and buy further material. Again, he said this would speed up the completion. Because it was already more than a month after the expected completion date, and we really wanted this project to be finished as soon as possible, we accepted his request: On 06/05 we paid £2,000 by bank transfer. On 09/05 the employee who took measurements on 04/03 came once again for more detailed measurements. On the same day we sent an email and asked if the works would continue the next day. No answer. On 11/05 we tried to reach someone of the company on their various phone numbers. We could only reach the employee who visited us for signing the contracts. We asked him when the works would continue. He said in about a week. Later we could also reach the manager via phone, and he claimed that the groundwork would require 2 weeks to stabilise! According to this we would have to wait until 23/05. (Later the builder confirmed that this isn't true at all!) On 23/05, we stayed at home and waited for the work to continue - again, in vain. We tried to reach the manager via phone, but in vain. Again, we could only reach the employee who visited us for signing the contracts. He assured he would contact the manager and call us back. He never did. On 24/05, again, we stayed at home and waited - again, in vain. We tried to reach anyone by phone. Since no one answered, we sent another email. No answer. On 25/05 we could reach the employee who took measurements. He informed the manager who finally let his secretary call us back. She said, the problem would be that the "roof takes longer to arrive"; estimated day of arrival: 31/05. On 26/05 the builder visited us privately on his own initiative and informed us that he hadn't received any money from the manager, though it was him who did all the work until 05/05. He warned us NOT TO PAY any more money in advance (what we hadn't done anyway). He said, the remaining work could be done within three days. It would NOT have been required to wait to let the groundwork stabilise! For many days we tried to contact the manager, but we had only been cajoled and put off by a new, young employee whom we had never known before. On 07/06 we reached the manager by phone! He said he would call us back soon or confirm via email to guarantee that the works will be completed from 14/06. On 08/06 in the morning he called and offered to complete the conservatory from 21/06 (about another two weeks later!). Since we still wanted to get the earlier date (14/06), we sent another email reminding him what he had said the day before. We also tried to call him again, but there was just his answering machine! We sent another email in the late evening and asked for a confirmation for 14//06 again. On 09/06 we could reach him by phone in the morning. What he had suggested, he had also confirmed by email in the morning: "Further to our telephone conversation this morning, I have been speaking to our manufacturers about a possible earlier delivery for your conservatory roof. As I explained in the telephone conversation, they will need a payment upfront to prioritise the roof which could lead to a delivery to us on the 13/06. We will need to payment of £1500 for the roof to get this prioritised and allow us to complete the conservatory sooner. I also would like to confirm that I have offered you a discount [£500] on the total left outstanding which I have taken off the contract." We answered via email, that we had believed him that the 3 additional payments he had already asked for (£2,000 + £2,100 + £2,000) would speed up the conservatory works, and we had always paid! Nevertheless the project had been delayed by months, which caused many serious problems and financial loss for our family. At this point we couldn't take an additional financial risk. We suggested to arrange the delivery of the roof (direct to us) and the payment direct with the manufacturer. We wrote we would also pay the rest (£2,045 minus price of roof) after completion and that we won't make use of the offered £500 discount. When we came back home we noticed that the manager had tried to call us back (caller ID), but he hadn't left a message. We sent him another email, that we had noticed that he wanted to call us, and that we wouldn't want further phone calls, but a WRITTEN answer in this case. We waited the rest of the day for his reply, but again in vain. We sent another friendly email later in the evening and asked him to answer. On 10/06 we waited until the evening and then wrote another email: Because he hadn't replied to our suggestion regarding the payment of the roof, we decided to accept his previous offer (which he made via phone on 08/06) to complete the conservatory from 21/06. Because in this case a prioritised delivery of the roof*wouldn't be required, we would pay the remaining £2,045 after completion. We asked him to confirm this in writing until 14/06. He didn't reply. On 14/06 we sent him a "Reminder with fixing of a period of time" As time limit for completing the remaining works we allowed 2 MORE WEEKS, until 28/06 (included). We had sent this as emails and as RM Signed for letter. On 06/07 the letter came back (undeliverable and not collected from the PO). In the meantime we found two extremely negative reviews on Google about him - unfortunately posted after we had signed the initial contract. The other customers got their work done, but with immense delays, and without obtaining promised discounts. We know we made mistakes: We waited too long. We paid too much in advance. Nevertheless, what can we do to get this solved? Offer him a bit more money? (Sometimes paying a bit more is better than fighting longer.) Go to a solicitor? Trading standards? We really need a fast solution now. Our nerves are on edge... Many thanks!

-

Hello all, I'm new to this forum and need help. I have a court hearing to set aside a store card debt which is of £174.34. The judgement was made against me as I didn't get the claim form , now I have a hearing on Monday. This morning I received a witness statement from Lowell solicitors who are Lowell portfolio 1 ltd's solicitors and they have attached a CCA agreement copy with my signature on it. The contract was taken in November 2006. It is not a full agreement on the page with my signature on it. I'm panicking as I have hearing on Monday, plz can anyone advice on CCA section 127(3-4) is in enforceable on my agreement. Any help would be appreciated, I'm nervous and very scared.

-

Hi guys, Been helping out yet another friend with some advice and as its some time since I advised on here regulary I thought i would get up to speed. My mate took out a Conditional Sale Agreement for a car with one of the subprime car finance companies. He made his first 3 payments of approx £260 Being self employed sometimes money doesn't come in quick enough and he was late with his next payment. They sent him a default notice The arrears consisted of 1 month instalment £48 of charges stated as administration costs He paid the 1 month arrears (but not the admin costs) 1 day late after the deadline. He then came home to a letter put through his door and a contact number. he rang it, it was a man who said he had a repossession order for the car. My mate sent him photos of the payments he had made in the 4 months he had the car and the repo man said he was going to refer it back to his office. In the mean time my mate spoke to me and I looked through his paperwork and noticed that he had overpaid 1 month by £20 . on his behalf I rang the finance company pretending to be him. They told me that the contract had been terminated and he had to either pay a final settlement or the car would be repossessed the next day. I said how much currently is the arrears, £48 they replied. So your repossessing for £48? Yes . Cant he just pay the £48? No its too late, your contracts been terminated , there is nothing you can do about it. i said lets go through the payments and he agreed that there there was an overpayment of £20 they hadn't accounted for . I said so your default amount is incorrect then? He said that doesn't matter, I argued. In the end I said you get us a settlement figure and I will look for your invalid default notice (I hadn't seen it at this point) 30 mins later my mate has a missed call from them, he phones back and offices are closed. 10 mins later they phoned again (this is out of hours) and said "Mr ***** , i wasn't very happy with the whole situation , i have spoken with my manager and am delighted to say he has agreed to reinstate your agreement tomorrow as long as you ring up and pay the £48 arrears and this months payment which becomes due in the next few days" he does all this and its all back on. A month later, he hadn't reinstated his direct debit , so he pays online using their payment portal onvtime. 5 days later he gets a default sums notice- payment not received by DD £18 charge This just raises a few questions for me 1 Can they default him in the first instance for being just 1 payment in arrears? 2 Can they add charges onto the default for £18 admin fees for non payment by DD? 3 Obviously the default was invalid otherwise they wouldn't of panicked and reinstated it, but if the default is on his credit file can we get it removed? 4 Is there a difference between a default sums notice and a default notice? Thanks in advance

-

Hello, I'm looking for a little help if possible. I currently live out of the UK and have Lowell on my case, I contacted them actually as was in a payment plan and stopped it for a few years as was moving etc. Since I contacted them they have been horrific, wished I had just stayed quiet to be honest and I have paid more than my due as interest has been added over the years. I'm now in the mood to challenge. I have asked for proof and this is what they sent. Would anyone in the know look over this credit agreement if possible, I see a signature is missing but anything else and would you think it is enforceable? Many thanks in advance for any help with this.

-

I wonder if any one can help please. My son wen to buy a car from Evans Halshaw garage just as he started his new job with not more than £100 in his pocket . was advised that this is enough for the deposit to secure a finance deal. Paid the deposit of £100 on a £12k car and was told to come back and collect it a few days later. When he came back to pick up the car a sales manager went through some basic person information with him and briefly advised that the monthly repayments would be circa £250 pm. tried selling the insurance to which he declined etc ( the usual sales tactics to get you to buy all sorts of warranties and protection). The manager then went away to make a phone call and came back to say he got all approved and once all the documentation is signed he can collect the car today. At this point he then passed the file to an admin person in the garage and asked my son to complete the paper work. At no point any of the figures and charges were discussed with my son. Admin just went through some basic information again and had my son to sign a load of papers. After all was completed he was given the car and drove off with a complimentary 7 days insurance. As it happened my son lost his driving licence to drink driving 4 months later , lost his job and couldnt make any repayments. As I got involved he didnt have copies of the finance agreement. So after missing couple of payments we finally received notices of arrears and managed to speak to Motonovo ( this is when he realised he has taken finance with them). They kept dragging their feet with providing copies of the documents requested and kept sending unsigned copies. Then a few days later when the documents were finally received it was clear that the signature on the finance agreement wasnt my sons and also dated 2 days prior him even being in the garage. Complimentary insurance turns out to be with his wrong age ( they have indicated his 68 which I presume was to reduce their premium and i think this meant he was driving the vehicle uninsured?!). We have raised 2 complaints originally 1) to Evans Halshaw for mis selling the finance and not following FCA rules , falsifying signatures, selling insurance products my son declined ( they still put them on the finance agreement) etc. 2) complaint was made to motonova - paying out on antiimpersonated documents, not following fca rules ref provding documentation, not assessing affordability etc. Needless to say Evans Halshaw never bothered to respond. Motonovo finance played on the fact that they have done nothing wrong. We have gone to the ombudsman and so far it has been rejected twice and they support MOtonovo an we are looking to appeal further. The problem we have now is that the police has been after the vehicle as it was reported stolen by the finance company. They have been rude and threatening with obstruction to justice. Ombudsman are not interested about anything else apart from playing the broken record of he signed the agreement and obviously bought the vehicle and the only reason he doesnt pay now because he lost his licence and his job which is not their problem. My questions are: * Can police reposes the vehicle? or even get involved * can we report motonovo to the police for falsifying signatures? Any one got experience or had similar situation? any advice will be appreciated

- 20 replies

-

- agreement

- documentation

-

(and 3 more)

Tagged with:

-

Hi all, I have send a request and got this agreement back. Can someone please tell me if its enforceable? and if so or not what is the next steps? Is there anywhere a guide on what to look for when its enforceable? Thanks a lot! Halifax agreement Page 1.pdf

- 25 replies

-

- agreement

- enforcable

-

(and 1 more)

Tagged with:

-

Hi Guys Don't know if this is right area but, here we go..... Firstly thanks for all the helpful posts £60,000 of unsecured debt in default and 6 years down the line a clean credit history...... A friend has an issue he needs advice over:- Some time ago his limited company got into trouble. He was supplying the banking sector and when the banks crashed his customer base disappeared overnight, he mistakenly paid off his creditors leaving a overdraft of around £20,000. The bank could see he was in trouble and asked for a second charge on his property when his partner refused HSBC called him in and sold him a managed loan to pay off the overdraft. He maintained payments till last year form his own pocket as the business wasn't trading in any way. The current balance is around £4,000. His new accountant looking at the situation suggested desolving the company and this was done, at this time he wrote to the bank explaining the situation and notifying them of financial hardship, since then all they have done is tried to bully him into payment. He believes the original loan to have been mis-sold as affordability checks would have clearly shown he had no income (after all this was why he had been called into his branch), also the loan wasn't offered it was thrust at his as a no option situation. We have been through the financial ombudsman route but because the company doesn't exists as a legal entity they can look at this!!:mad2::mad2: What everybody missed was a Joint and several agreement, that he doesn't recall signing let alone having explained. This was signed by another Director and himself, he doesn't know the whereabouts of the other director having fallen out several years ago. The bank have now placed it to a debt collection agency who are attempting recovery of this business debt under the terms of the joint and several agreement. We have done a SAR and they do have the J&S although HSBC have admitted that they can't at this time produce the original loan agreement. My Questions.... 1/ As this is a business debt, are they able to mark his personal credit file? 2/ it is my guess that the J&S although legal is a civil matter and a court ruling (judgment) is required before his personal credit file can be marked? 3/ Is there any useable defence against the J&S? 4/ Being that he has personally re-paid 75% of this loan from personal funds could he tell them to get the rest from the other director who signed the J&S? 5/ Can we use the lack of loan agreement to default HSBC and stop recovery in the same way as we would for a CCA? 6/ Could any of his personal assets be at risk, without this going to court? Thanks guys, i know you will come through Regards Dave

-

This week, I received response back from Restons for my Halifax credit card debt, for a case which is already in court. But in their response they provided an approximate date of credit card agreement and said '... Halifax card agreement entered into by the defendant on or around 22 August 2011...' Can they still get a judgement without providing an original date of credit agreement. They provided a reconstituted credit agreement with some dates at the bottom but they do not match with the date they mentioned above.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.