Disco Dave

Registered UsersChange your profile picture

-

Posts

14 -

Joined

-

Last visited

Reputation

1 Neutral-

Hi Guys Don't know if this is right area but, here we go..... Firstly thanks for all the helpful posts £60,000 of unsecured debt in default and 6 years down the line a clean credit history...... A friend has an issue he needs advice over:- Some time ago his limited company got into trouble. He was supplying the banking sector and when the banks crashed his customer base disappeared overnight, he mistakenly paid off his creditors leaving a overdraft of around £20,000. The bank could see he was in trouble and asked for a second charge on his property when his partner refused HSBC called him in and sold him a managed loan to pay off the overdraft. He maintained payments till last year form his own pocket as the business wasn't trading in any way. The current balance is around £4,000. His new accountant looking at the situation suggested desolving the company and this was done, at this time he wrote to the bank explaining the situation and notifying them of financial hardship, since then all they have done is tried to bully him into payment. He believes the original loan to have been mis-sold as affordability checks would have clearly shown he had no income (after all this was why he had been called into his branch), also the loan wasn't offered it was thrust at his as a no option situation. We have been through the financial ombudsman route but because the company doesn't exists as a legal entity they can look at this!!:mad2::mad2: What everybody missed was a Joint and several agreement, that he doesn't recall signing let alone having explained. This was signed by another Director and himself, he doesn't know the whereabouts of the other director having fallen out several years ago. The bank have now placed it to a debt collection agency who are attempting recovery of this business debt under the terms of the joint and several agreement. We have done a SAR and they do have the J&S although HSBC have admitted that they can't at this time produce the original loan agreement. My Questions.... 1/ As this is a business debt, are they able to mark his personal credit file? 2/ it is my guess that the J&S although legal is a civil matter and a court ruling (judgment) is required before his personal credit file can be marked? 3/ Is there any useable defence against the J&S? 4/ Being that he has personally re-paid 75% of this loan from personal funds could he tell them to get the rest from the other director who signed the J&S? 5/ Can we use the lack of loan agreement to default HSBC and stop recovery in the same way as we would for a CCA? 6/ Could any of his personal assets be at risk, without this going to court? Thanks guys, i know you will come through Regards Dave

-

GMAC Mortgage Delay tactics and claiming charges too old

Disco Dave replied to theonetrickpony's topic in Mortgage companies

I was told I had to have basically a ppi policy costing a lump sum of around £3000 that was added to the capital when I took out my Mortgage with Gmac. it was around 9 years ago and I cant find any paperwork. Am I to late if not can someone tell me the contact details for gmac -

Hi Guys Once again thanks for your help, in 18 months i have gone from seriously considering Bankruptcy to a normal life. OK so my creditors have now stopped chasing payment of my debt, having presumably accepted that they are either getting nowhere or that I’m just not going to pay without a valid CCA.... THANKS TO YOU ALL However I’m now receiving only a yearly statement in respect of the accounts, this means that despite my default notices they are still processing my data, is there anything i should or can do? Regards Dave

-

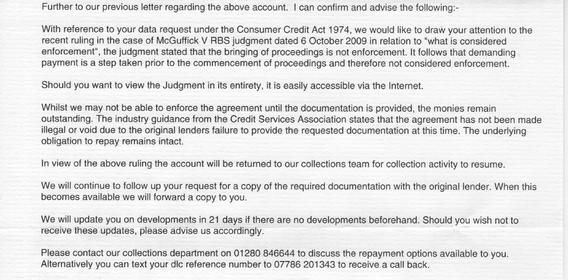

Hopfully this is readable http://i44.tinypic.com/2wfpik0.jpg http://i42.tinypic.com/mt08yv.jpg http://i44.tinypic.com/29ftefs.jpg I look forward to your help and advice

-

Hi Guys On the 8th of March Fairfax Solicitors were served with the standard CCA letter. Last week I finally received the attached letter stating that “Under new regulations” they are only required to provide me “with the terms and conditions” I was “originally presented with and signed”. As you can see they have supplied a copy of the application form, this has VERY limited information surely this cant represent a legally enforceable document? What should I do now?

-

Hi jdes26 no there are no charges in the princaple sum, however all i've been paying for the last year is the intrest charges. But im still back to the same problem, IS AN OVERDRAFT REGULATED BY A CCA? thanks Dave

-

the £5700 is an overdraft.

-

Thanks Jdes26 Ive already asked them and they say they have no record of a loan, i dont know what to do as you say "bank goes my credit file" but if this sould have a CCA and they cant supply one than i could negocate a settlement figure

-

Had a Visit about 3 weeks ago from a Bailiff chasing $2500 worth of council tax from a failed IVA. I had previously witten, in responce to their first letter asking for details of the account as they hadnt made it clear what they were chaseing, but they chose not to reply. Becouse of this my wife sent the bailiff off with a flee in his ear telling him to return when he had the paperwork to support his claim. He did however stick a bit of paper through the door stating that he was intitled to return with the police and force entry!!! IS THIS THE CASE??? Help Dave

-

Just got a letter asking why payments have stopped and telling me that i have exceeded my OD limit. What do i do, can i request the CCA or is this not relavant? Thanks Dave

-

Several years ago I was offered and accepted an overdraft of £5700 on my current account, I don’t recall signing any paperwork at any stage regarding this borrowing, and in fact I am sure it was all done over the phone. Although I stopped using this account 2 years ago I have been maintaining payments to cover the interest only, so the balance has remained the same. Suspecting I could challenge the legality of this borrowing I recently requested the CCA. They have written back stating they cant find any record of a loan. Is an overdraft covered by the CCA and can I challenge it in any way. Thanks Dave

-

Hi Guy’s Firstly thanks for being there for me I feel empowered knowing your are there even if only as a source of stock letters. I am challenging a City Financial credit card account on the basis that i don’t remember ever signing a CCA, I seem to remember the entire application was undertaken on the phone. I requested that Hillesden Securities supply a copy of the CCA for my city credit card on the 22nd of October (signed for on the 23rd). This was acknowledged in several letters since stating that they were waiting on City Financial. The latest update however seems to have changed track, could someone have a look at the atached and advise. What should I do next? Thanks Dave

-

A right mess Hi All Looking for some advice as my IVA has now been failed and I don’t know where to go next. In Nov 2007 I entered into a IVA covering £50,000 + of debt. The basis of this agreement was that following 12 nominal payments of £150 being my judged available spare income, I would then introduce £23,000 by way of a re-mortgage on my property. No one knew of course that the world would go into recession, house prices would crash and mortgages would be like rocking horse droppings. How a year can change things! When the lump sum was due the administrator contacted me asking me to make the arrangements. I duly contacted my mortgage adviser who informed me that my loan to value ratio was at its maximum with my current lender and that a request for a further advance wouldn’t be successful and even if an offer was forthcoming it wouldn’t be for anything like the £23,000 I was looking for. He also told me that self cert mortgages just weren’t available any more and certainly not with my credit record. So I did the one thing that got me into this mess in the first place, STUCK MY HEAD IN THE SAND for several months till my administrator contacted me again. At this time I let him in on the problem his reaction was to tell me that if I was unable to discharge my responsibilities he would have to fail my IVA, he suggested a visit to the local CAB. Whilst I was waiting for my appointment I actually read the IVA document for the first time and discovered several errors, this proved to be the most enlightening part of the hole two hour sham, I knew more about my situation than the woman I was talking too, she failed to fully and properly answer any of my questions! However reading the IVA document caused me to request I variation to the IVA agreement and forwarded a proposal using the figures in my original IVA that would offer my creditors a 12.5p in the pound return against a bankruptcy return of 3.5p in the pound, my administrator refused to propose this on the basis that in his experience creditors would no except a return less than 19p in the pound. He has now refunded all the payments I made over and above the 12 required by the IVA and issued a certificate to fail the IVA and a final statement. This was toward the end of September. So far the only creditor who has contacted me is Hillesdon securities re. City Finical (credit Card £14,747), I have requested the CCA in an effort to stall. Most of the debt is un-secured on credit cards, internet loans, benefit over-payments and overdrafts, so could be challengeable. BUT Would I gain anything or is bankruptcy the only option? The thing that worries me about Bankruptcy is the house? Wife with 50% ownership and two kids (13 & 9), value for fast sale £180,000 sit and wait £200,000, with a mortgage of £156,000. At best my share is worth £12,000 this would be unaffordable for us to buy back from the receiver. My income is made up from my full time employment as a shop assistant £12,000PA and profit from running a mobile Disco is currently around £3,000PA, the disco kit is worth at best £3,000 including the van. Would the disco equipment be considered an asset by the receiver or would it be classed a tool of the trade and therefore be safe? Is there any way I can legally protect the disco equipment, a partnership maybe? Any ideas as to what I should do?????? Help Dave

-

Hi All This is my first post of many (£50,000 + of debt all unsecured) as I finally take control of my finances I will need your help and support. Current amount being claimed by SRJ Debt recovery £690.60 £300+ data charges disputed. History I was a Vodafone customer from 2004 I think till March 2008. During this time I renewed my contract yearly to obtain the latest handsets. My tariff included all the calls I had ever needed and had a fixed price bolt-on that covered all my data charges. I had used the roaming service before and although the bills had been high (£300 +) they had always been paid in the past. Problem In Feb 2008 I went on a diving holiday in Tenerife, just prior to my holiday I telephoned customer services to make sure roaming was still active and to check the costs, no reference was made during this call to data charges. When I got to Tenerife I received the normal text message welcoming me to Spain and informing me of the costs for phone calls and text messages. The holiday went off without issue I made and received calls and texts and my phone behaved normally, giving no indication of the bill that was being run up silently in the background. The first I knew of a problem was when I received a call from Vodafone accounts informing me that I had gone over my credit limit and needed to make an immediate payment. When I quizzed the girl it turned out that there were in excess of £350 worth of data charges whilst I had been away on holiday, I told her that I hadn’t used the net whilst I was in Spain and she finally agreed to start an investigation and placed my account on hold for 7 days. We finally found out that my phone had been checking for email every half hour (although none were ever received) and the charges were totally down to this. This was a service that I had setup on my phone 10 months or so earlier and was only ever used in case of emergency and had always been included in my package with no additional charges so i had totally forgotten anout it. I immediately disputed these charges on the basis that the costs hadn’t been notified in advance and that all data charges had always been included in my normal monthly payment and also that I had no knowledge that the charges were being incurred. I pointed out that I had received a text that clearly detailed the cost of calls and texts but made no mention of data charges, had they been detailed in advance this may have caused me to check that the data side of the phone had been disabled. We have been in deadlock ever since, I have requested a copy of the contract and the terms of the data bolt-on but all they have sent me is some copy invoices. Can they enforce this debt without a copy of the contract or CCA? I could do with stalling them for a few months till I make a informed decision about my overall financial position. But SRJ are threatening the county court or Sheriff’s court action . Anybody got any thoughts that may help? Regards Dave

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.