Showing results for tags 'cca'.

-

Hi, I had a letter off RW last November chasing me for a B/Card CC for £1300 (opened in 2002) last payment to BC in Summer 2017. I requested CCA off RW and they responded 2/1/19 with "couldn't find it and debt now unenforceable, but they would be in touch with regards to setting up a payment plan". Today have received a letter off them with a copy of BC CCA, but not signed by me, looks very much a generic T&C? and wanting details of my Inc & Exp. Can you tell me how I should proceed please.

-

Hi thanks to a member on here telling me to CCA Barclaycard I am looking for help. What makes it unenforceable I keep looking and some people say they have to produce original paperwork, others say they can send a revised one, being taken out in 1999 does it need to show my signature? Any help would be more than appreciated. X

- 44 replies

-

- 1999

- barclaycard

-

(and 3 more)

Tagged with:

-

Hello All I have a Welcome Finance CCA which for one reason or another has been bought by MKRR. I CCA'd them last September, and they have sent me a copy of the front page of the agreement with no T&Cs, but the thing that is puzzling me is the figures stated on the agreement. They are as follows: Total amount of credit = 2945.43 Payment over 65 months APR = 20.80% AIR = 19.6% Total charge for credit = 1805.93 Monthly Payment = 73.07 Made up of Acceptance fee = 75.00 Interest Charge = 1728.93 All well and good, and I am no accountant, but I have work this out on several online loan calculators and got the same amount on each of them, which is different to that on the CCA. They are: Total amount of credit = 2945.43 Payment over 65 months AIR = 19.6% Monthly Payment 73.88 Total Repayable = 4802.43 There is also no total repayable on the credit agreement. My question is, is this CCA enforceable? I was under the impression that the figures given should be correct. Please help Total charge for cretid = 1857.00

- 44 replies

-

- cca

- enforceable

-

(and 4 more)

Tagged with:

-

Hi I was wondering if anyone can offer some advice. My partner took out a Northern Rock loan at the end of 2005 for £25,000, with agreed payment of around £37400 over 120 months. As an aside it just shows how badly NR were engaged in unethical lending as she was only on £11k a year at the time. She made 39 of those payments totalling just under £12200, and additionally she made around £470 in over payments to a grand total of £12670. After being diagnosed with a long term illness, she lost her job and then found it difficult to repay the loan. She organised token payments beginning April 2009, and paid an additional £50 before the debt was written off at just under £24700 at the end of November the same year. She continued to make token payments until the end of July 2013 at which point she could no longer afford to do so, so she stopped. The debt appears to have been sold on to Cabot in October of the same year (2013) for just under £1400 according to the full transaction statement they have returned, but there is no Notice Of Assignment documentation. She started receiving letters from Cabot in June 2018, and she wrote asking for a copy of her CCA. They have complied within the time limit with a full copy (doesn't appear to be reconstituted), including full transaction statements, and they are threatening CCJ action unless payment for the outstanding balance of the loan is made under agreed terms. Like mentioned however, there was no Notice Of Assignment documentation to say how the debt was transferred to them. My partner is very stressed by all this (especially due to the nature of her illness) as she has a very limited income from part time work (being unable to work full time), and I pay the rent and all bills so my money is stretched also. By the way, no debts appear on her credit file, so we are worried that Cabot can also mess with that now. Anyway, does anyone have advice on next steps to take? My partner is looking into a (Debt Relief Order) DRO as a possible solution. Does anyone have experience with these? Any advice would be greatly appreciated. Thank you.

-

Hi I've just received a 'Letter Of Claim' from Howard Cohen & Co. Solicitors stating their client as "HPH2 LTD (Ex Tesco Personal Finance PLC)" also referenced in the letter as "Hoist Portfolio Holding 2 Ltd" regarding it's 'intention to issue proceedings in the County Court'. It also says "Despite our client or it's agents, Robinson Way Limited..." I believe my first course of action is to issue a CCA Request to the debt collector / client? The problem is that I cant find a UK address for Hoist Portfolio Holding 2 LTD but have found a Jersey address. The UK arm appears to be Hoist Finance who in turn own Robinson Way. Which of these companies should I write to with the CCA request? It's in relation to an amount of c.£5,500 on a credit card agreement allegedly signed in April 2008 Thanks

-

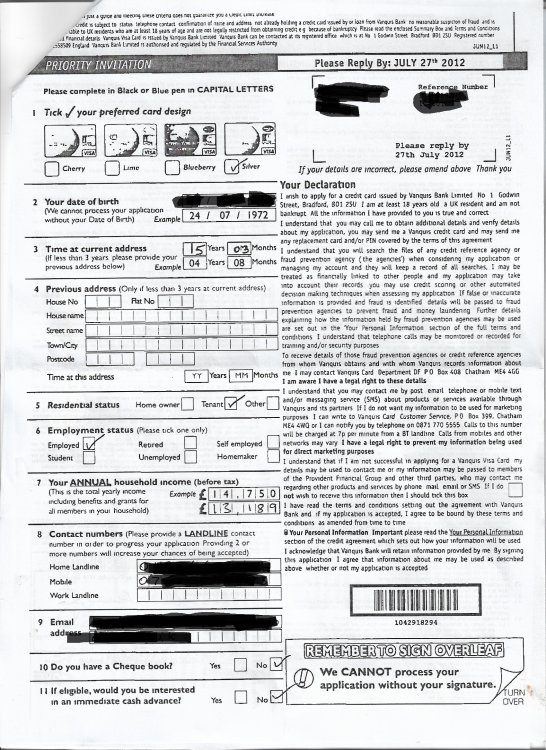

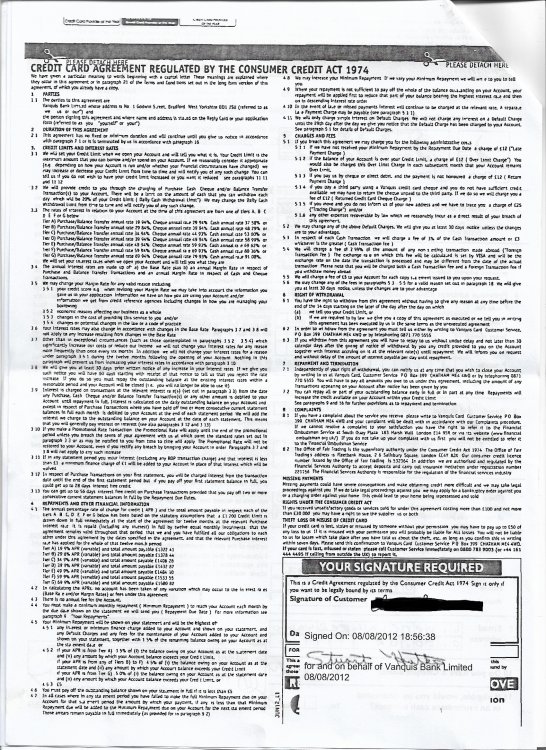

Good morning all, Please could anyone advise if this is an enforceable CCA - received from Lowells for a Vanquis credit card. They've added a sticker with a company reps signature over the date with my signature, which is oddly located - I always sign squarely in the centre of any box. Plus are the elements all correct as I have looked but just not sure. Many thanks in advance.

-

Hello I had a large number of improperly executed credit card agreements which I had been paying for 20 years. After advice from CAG I decided not to make the remaining payments and they are all now statute barred. Due to the length of the time I had the cards their will have been PPI payments made but... 1) Some credit cards were paid in full before I got into financial difficulty many years ago which I don't have records for. 2) Some accepted full and final settlement payments to clear the account, 3) Some accepted a final payment and marked as partially satisfied 4) Some would not negotiate and I had no money left so they were not paid anything Which of the above can I reclaim PPI for Thanks

-

hello there I received the following from idem Sorry for not naming my attachment , I am new to this technology. Are these documents enforceable? Any thoughts and opinions would be appreciated. convert-jpg-to-pdf.net_2018-03-05_13-25-40.pdf

-

Please help , Ive had a Halifax card since late 2004. In early 2007 the account number was changed ( I imagine I may have lost my card and been sent a new one ) or am I being naïve ? Over the next several years my credit limit kept on increasing without me requesting it. It was raised 11 times from the original £2750 till in spring 2014 it stood at £13950 Towards the end of that year Halifax told me that my interest rate was to be hiked up but explained that if I didn't agree to this I was entitled to close the account and pay it off as was previously the case. At this time I was struggling financially and the card was maxed out, so, as the minimum payment was already proving to be a burden I chose to close the account. Since then and up to today Ive never missed a payment and have paid a total of £8000 but have accrued £5450 in interest. So Im still £11400 in debt to them. Last month they kindly reminded me that "just paying minimum payments " is likely to be expensive for me but worryingly they quoted a new FCA DIRECTIVE which says I am in "Persistent debt". I came across your wonderful site and read up and decided to request a copy of my agreement. my request was made using the most recent account number ie from 2007 and what was sent doesn't seem to be an agreement..please help rather worryingly ten minutes after posting my question I got a call on my mobile from 07889902214 and a taped message telling me about a govt scheme to write off debt! Ive NEVER EVER had such a call in the past EVER so something fishys going on!

- 19 replies

-

- cca

- reconstituted

-

(and 1 more)

Tagged with:

-

Hi, *deep breath* I am new to the forum so hello everyone, can i say what a great resource of information this place is i have been lurking and reading up the past few weeks and it has helped me massively and made me realise a few things too:) I have been on a DMP for just over 10 years trying to payback a whole load of debt i ran up years ago (i wont go into detail, long story short i was young, naive and the crash in 2008 crippled me when all the discounted mortgage deals got pulled the day before my discounted rate with NR ended), anyway... i have only recently found out about CCA requests and as most of my debts are old and with DCA's i have decided to do some digging... I have sent off a whole bunch ofthe CCA requests today recorded delivery with postal orders for £1 in each. I am wondering what the likely reaction of the companies will be? I am still paying into my DMP and intend to continue doing so for now, are they likely to get uppity at my request and start adding interest and charges again or worse? I am a bit worried about that to be honest. Below is a list of the DCA's and the approx amounts they say i owe, any info about how they are likely to respond or what i should do next would be great guys. Cabot Financial (Europe) Ltd - 4k Cabot Financial (Europe) Ltd - 2.5k Cabot Financial (Europe) Ltd - £700 Clarity Credit Management Solutions Ltd - 1.3k Link Financial Ltd 1.1k Link Financial Ltd - 2.9k Moorcroft - 1.1k Paragon - 1k Paragon - 1.3k Wescot Credit Services - 8k I have looked back and know i have more than paid back what i originally borrowed, this has been going on for nearly 10 years now and i need it to be over i think the bulk of the alleged outstanding amounts will be due to interest charges ect... but i just let the DMP deal with it for years and didnt take much notice..i also moved from CCCS to Payplan a year ago when i was toying with the idea of IVA which i didn't end up doing as wouldn't have been right for my circumstances Any help/advice appreciated. Thanks again for being a great resource for information.

-

I have recently had a CCA response from Robinson Way, regarding an old Burton card account. The CCA they have sent however relates to another older and closed account in my name, as the account numbers are different. Just wondering what the best approach is now. They have resumed collection activities but at present just threatening to send e-mails, letters & phone calls. Is it worth responding at the moment to point out the error or should I just let it run it's course for a while and see where it goes? Any advice would be appricated. Many thanks.

-

Hi, I sent out a CCA request to DLC, who were collecting for an old Egg debt; I have been paying £1 token payments to them every since the account defaulted over 6 years ago, and due to having moved house a couple of times since, have completely lost track of what has happened with this as the standing orders were set up to come out automatically. Last week I received a response to my request from DLC stating "we returned the account to Egg in July 2010, who have since ceased to trade. We assume that your account has been acquired by a third party company and we suggest you contact them". I have no idea who to contact about this now! Any advise as to what I should do next? If Egg have ceased to trade, then where has my £1 a month been going?!! Many thanks AM

- 31 replies

-

- account

- barclaycard

- (and 9 more)

-

Hi, If I have 4 accounts with one DCA, do I need to submit a separate CCA letter per account and a £1 postal order per account or can I just do one CCA requests to them listing all accounts and one postal order? I assume it's the former but wanted to check. Thanks

-

Hi All Last year i fired off CCA request's to the DCA that were handling my accounts. Not one managed to return a copy of the credit agreement, so I ceased payments as instructed on here. two of the DCA's have now 'passed' my account on to sister companies to recover the debt. My question is, do I have to go through the CCA process again to get rid of these guys too? I am also a little concerned that maybe the original DCA has received the original credit agreement and as the time has lapsed they cannot use it, but if they pass it on to a sister company and I CCA them, they then have the credit agreement waiting to reply! Am I being paranoid? Should I just ignore these new DCA letters or CCA them as before? I guess this is normal process until I get the position of Statute Barred? Many thanks for any advice given.

-

A family member had a loan with Northern Rock. She requested a CCA from them but never heard anything from them. Northern Rock was taken over by NRAM and that was 11 years ago. They have now been contacted by NRAM saying about the Northern Rock loan was being passed to Cabot and for them to contact Cabot regarding the loan. Is it best just to ignore the letter and if they do take it to court go for the Statue Barred letter? Thank you for your help.

-

Good afternoon everyone, I sent off a CCA Request to Santander regarding a Debenhams store card, and got the following back. Does this mean they do not have an original copy on file. The card was originally run by GE Money and sold on to Max Recovery after I took out an IVA in 2012, or should I have written to GE Money or Max Recovery. Any help appreciated. img004.pdf img002.pdf img003.pdf

-

sent cca to robin son way regarding following provident personal Loan replied today We have requested the following documents from provident and aim to provided in 12 days In meantime account put on hold and we will not contact you to request payment if we have not heard from provident within 40 days then we will send an update. question I thought if yoo sent a cca they must supply within 12 days

-

Hi long time reader, first time poster. I requested a CCA from Lowells in October of last year relating to a Llyods/TSB credit card debt. The card in question was taken out in April 2004 and fell into default in late 2012. 4 months later they have sent me what appears to be a copy pasted set of terms and conditions and a copy of the last years worth payments to the account. The terms and conditions have an error in the address I was living at when the card was taken out, they've used the postcode for an address I was living at 10 years later, otherwise it's correct. There's also no date for when the agreement was taken out, nor is there a signature (I'm unsure if this is required or not). Would I be right in thinking that a reconstituted CCA is only valid for debts after a certain date? I would be grateful if someone could take a look at the attached PDF to see if what I received meets the requirements of a CCA request and if not, what do I do next? 2017-03-07_12-43.pdf

-

Hi I need some advice about requesting a CCA ive got a ccj more than 4 yrs old I'm being threatened with a warrant of control from restons unless I fill in a expenditure form is there any point in requesting a CCA the original debt is from around 8yrs ago and I've never responded to any letters or paid anything Would like to get some info on this Thanks in advance

-

Hi all, I have no idea if the reconstituted agreement I have received from Link Financial is enforceable. It is a £6k debt with Barclaycard. Please can somebody advise me how to upload this for somebody to check if it is enforceable? Thanks,

-

I have only just discovered this site since having 8 properties taken over by LPA Receivers. I am desparately trying to find out what to do next. I read that I can make an Application to Court to get control of sales. Please is there an expert who can tell me how to word tha application? I am scared of making an awful situation even worse if that is possible!!!

-

Morning all. I have an outsanding credit card with Capital One ( well pre 2007). Been paying nominal amount for 10 years with payplan The debt is still with Capital One - not sold off to any DCA whatsoever. Is there anyway to check the default date on it ? Both on Clearscore and and Experian I have clean CRF. All defaults well and truly dropped off. The reason I am asking , is that I am currently in process of CCA'ing everyone. Capital One is the only debt NOT sold on to fleecers. But cannot remember / have not got any paperwork with a default notice. Pretty sure it was defaulted say 8 years ago - just want to make sure 100% - I now have clean CRF and dont want it damaged for another six years - if and when I stop paying them. This is the only card I have NOT CCA'd at this present time , on this basis. Any help much appreciated. Thanks again.

-

Hi peeps Sainsbury’s / Lloyd’s cca sent back. I won’t scan the rest up ( I don’t think I need too ) it’s just freshly printed reconstituted version. This defaulted back in 2009 Card was WELL before 2007 I guess it’s just Bog roll ? They sent back the cca postal order (£1) Thanks everyone Scan 19 May 18 R.pdf

- 16 replies

-

- cca

- enforceable

-

(and 2 more)

Tagged with:

-

Hi guys Around 2 years ago, I asked Cabot for a CCA request for a loan i had. They said at the time that they couldnt find the documentation so it was not enforceable. Ive recently had a letter form them saying they have now found this CCA agreement and that the debt is now enforceable! Theyve sent me a reconsituted copy but im wondering if this is now a debt i have to pay? If you look at the scan ive added, it looks like the document is missing something, and also surely there would have been more than 1 page of t&c's?? Is there not a time limit that they have to provide me with the CCA or its not enforceable? i ve read they committed an offence but that doesnt really help me in this situation Anyone know if this is now a debt again? i cant find anything similar to this anywhere thanks Scan 1 copy.pdf

-

Hi everyone, I was wondering if anyone could advise on what I should do with regards to the following. Around 12 years ago due to various issues I found myself in debt for about 35K. I went on a DMP which for majority of creditors is still going, paying off regularly the agreed amount. About 4 years ago MBNA stopped taking the payment, I have now discovered that they sold the debt to Arrow Global. Over the past couple of weeks I have received some letters from Shoosmith on behalf of Arrow for the credit card etc. Would anyone be able to advise if I shoudl ask for a CCA on the debt (I genuinely do not know if MBNA was paid in full or not! but I am doubting even my name at the moment panic is back!) . What steps should I take? Any advice is welcome (sorry if the above does not make much sense but after 10 years of paying things back this has brought me back onto "put your head on the sand mode")....

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.